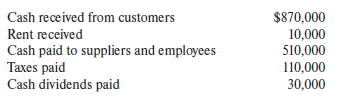

Question: The following information is available from Sand

The following information is available from Sand Corporation’s accounting records for the year ended December 31, 20X1:

Required:

Compute cash flow provided by operations for 20X1.

> Nathan’s Grills, Inc., imports and sells premium-quality gas grills. The company had the following layers in its LIFO inventory at January 1, 20X4, at which time the replacement cost of the inventory was $675 per unit. The replacement c

> KW Steel Corp. uses the LIFO method of inventory valuation. Waretown Steel, KW’s major competitor, instead uses the FIFO method. The following are excerpts from each company’s 20X1 financial statements: Required: 1. C

> Blago Wholesale Company began operations on January 1, 20X1, and uses the average cost method in costing its inventory. Management is contemplating a change to the FIFO method in 20X2 and is interested in determining how such a change will affect net inc

> Selected information concerning the operation of Kern Company for the year ended December 31, 20X1, is available as follows: No work-in-process inventories existed at the beginning or end of 20X1. Required: 1. What would be Kern’s fini

> On January 1, 20X1, Manuel Company’s merchandise inventory was $300,000. During 20X1, Manuel purchased $1,900,000 of merchandise and recorded sales of $2,000,000. The gross profit margin on these sales was 20% of the selling price. Required: What is Man

> Smithfield Farms purchased a combine from John Deere for $175,000 on January 2, 20X1. Smithfield paid $25,000 in cash and signed an installment note calling for five annual payments of $39,569.58 beginning on December 31, 20X1. Deere based the payments o

> On December 31, 20X1, Fenton Company sold equipment to Denver, Inc., accepting a $275,000 non–interest-bearing note receivable due on December 31, 20X4. Denver, Inc., normally pays 12% for its borrowed funds. The equipment is carried in Fenton’s perpetua

> Blue, Inc., sells playground equipment to schools and municipalities. It mails invoices at the end of each month for all goods shipped during that month; credit terms are net 30 days. Sales and accounts receivable data for 20X1, 20X2, and 20X3 follow: R

> Kendall Corporation designs and manufactures sports cars. During the course of its business, Kendall generates substantial receivables from its customers. On July 1, 20X1, to improve its cash flow, Kendall establishes a securitization entity (SE) and (1)

> The following information related to Caterpillar’s inventories is taken from its 2015 annual report. Use this information in answering the questions that follow. There were no LIFO liquidations in 2014 or 2015. 7. Inventories Inventorie

> The following information relates to Zulu Company’s accounts receivable for 20X1: A factor has recently offered to purchase all of Zulu’s outstanding receivables without recourse for 94% of their face amount. Required

> On December 31, 20X1, Vale Company had an unadjusted credit balance of $1,000 in its Allowance for credit losses. Vale analyzes its historical experience related to receivables in specific age categories and estimates the expected credit loss for each ca

> On January 1, 20X1, Wade Crimbring, Inc., a dealer in used manufacturing equipment, sold a CNC milling machine to Fletcher Bros., a new business that plans to fabricate utility trailers. To conserve cash, Fletcher paid for the machine by issuing a $200,0

> The following information is available for Fess Company: Credit sales during 20X1………………………………………………………………………$150,000 Allowance for credit losses at December 31,20X0……………………………………1,450 Accounts receivable deemed worthless and written off during 20X1………….1

> Central Valley Construction (CVC) purchased $80,000 of sheet metal fabricating equipment from Buffalo Supply on January 1, 20X1. CVC paid $15,000 cash and signed a five-year, 10% note for the remaining $65,000 of the purchase price. The note specifies th

> For the month of December 20X1, Ranger Corporation’s records show the following information: Required: Determine the gross sales for the month of December 20X1.

> 1. Why do regulators require banks and insurance companies to maintain minimum levels of investor capital? 2. What impact does this type of regulatory requirement have on the financial statements that banks and insurance companies prepare for shareholder

> In 20X1, Illinois Power & Heat spent $5 million repairing one of its electrical generating stations that was damaged by a tornado. The loss was uninsured. Management has asked the public service commission for approval to treat the $5 million as an asset

> Sunshine Groceries operates a rapidly expanding chain of retail grocery stores. The company has grown from 10 stores in 20X1 to 50 stores in 20X3 and plans to add at least 10 stores each year for the next three years. Top executives at the company can ea

> The quarterly cash flows from operations for two software companies are: Required: 1. Explain why Firm B has more credit risk than Firm A. 2. Suppose that Firm B’s cash flow was $200 higher each quarter (e.g., $336.7 in Q1 of 20X1). Ex

> Presented below are excerpts from the 2018 annual report of Siemens AG, a German company that operates in numerous industries, including technology, power generation, and medical diagnostics. Required: Using the Siemens AG note, identify the similaritie

> In Chapter 17, we will discuss goodwill impairment rules, which determine when goodwill must be written down and by how much. They do so by comparing the estimated fair value of a reporting unit to its carrying value. Required: 1. Suppose Jesse Corporat

> The price/earnings ratios of four companies from the same industry are: Required: What factors might explain the difference in the P/E ratios of these companies?

> The price/earnings ratios of four companies from different industries are: Required: What factors might explain the difference in the P/E ratios of these companies?

> This exercise is built around Kroger’s financial statements from the chapter. Total shareholders’ equity—The Kroger Co. was $5,384 million at February 1, 2014. Required: 1. Kroger earned an ROA of 6.9% in fiscal 2014. What was ROCE that year? 2. ROA at

> The Hershey Co. is famous worldwide for its chocolate confections—the Hershey bar and those delightful Hershey Kisses. Tootsie Roll Industries is equally famous for its chewy Tootsie Roll and those flavorful Tootsie Roll Pops. Selected

> Selected information taken from the accounting records of Vigor Company follows: Required: 1. What was Vigor’s gross profit for 20X1? 2. Suppose that there are 360 business days in the year. What were the number of days sales outstandin

> A comparison of 20X1 to 20X0 performance shows that Neir Company’s inventory turnover increased substantially although sales and inventory amounts were essentially unchanged. Required: Which of the following statements best explains the increased invent

> The following data were taken from the financial records of Glum Corporation for 20X1: Required: How many times was bond interest earned in 20X1?

> Selected data of Islander Company follow: Required: 1. What is the accounts receivable turnover for 20X1? 2. What is the inventory turnover for 20X1?

> Utica Company’s net accounts receivable was $250,000 at December 31, 20X0, and $300,000 at December 31, 20X1. Net cash sales for 20X1 were $100,000. The accounts receivable turnover for 20X1 was 5.0, which was computed from net credit sales for the year.

> Appearing next is information pertaining to Garrels Company’s Allowance for credit losses. Examine this information and answer the following questions. Required: 1. Solve for the unknowns in the preceding schedule. (Hint: Use T-account

> On January 1, 20X1, River Company’s inventory was $400,000. During 20X1, the company purchased $1,900,000 of additional inventory, and on December 31, 20X1, its inventory was $500,000. Required: What was the inventory turnover for 20X1?

> Following are income statements for Hossa Corporation for 20X1 and 20X2. Percentage of sales amounts are also shown for each operating expense item. Hossa’s income tax rate was 22% in 20X1 and 24% in 20X2. Hossa’s mana

> The following information is from the 20X1 annual report of Weber Corporation, a company that supplies manufactured parts to the household appliance industry. Required: 1. Compute Weber Corporation’s return on assets (ROA) for 20X1 usin

> Nagy Corporation reported the following income statement in 20X1, along with a comparable income statement for 20X0, its first year of operations: In its Form 10-K, Nagy also provided a non-GAAP metric, earnings before depreciation and one-time charges,

> Trubisky Corporation acquired a machine on January 1, 20X1, for $3 million and decided to depreciate it over eight years using the double-declining method. The depreciation rate each year, as a percentage of the original cost, was as follows: On January

> The preliminary draft of the balance sheet at the end of the current fiscal year for Eagle Industries follows. The statement will be incorporated into the annual report to stockholders and will present the dollar amounts at the end of both the current an

> Krafty Kris, Inc., discovered the following errors after the 20X1 financial statements were issued: a. A major supplier shipped inventory valued at $8,550 to Krafty Kris on consignment. This merchandise was mistakenly included in the inventory taken by K

> Tack, Inc., reported a Retained earnings balance of $150,000 at December 31, 20X0. In June 20X1, Tack’s internal audit staff discovered two errors that were made in preparing the 20X0 financial statements that are considered material: a. Merchandise cost

> Bettner, Inc., is a calendar-year corporation whose financial statements for 20X0 and 20X1 included errors as follows: Assume that inventory purchases were recorded correctly and that no correcting entries were made at December 31, 20X0, or December 31,

> Jones Corporation switched from the LIFO method of costing inventories to the FIFO method at the beginning of 20X1. The LIFO inventory at the end of 20X0 would have been $80,000 higher using FIFO. Reported retained earnings at the end of 20X0 were $1,750

> Caterpillar Inc. manufactures and sells earth-moving equipment. Presented below is information on its receivables and allowance for credit losses from its 2018 Form 10-K. The “Recorded Investments in Finance Receivablesâ€

> Presented below are excerpts from the 2018 annual report of Marston’s PLC, a UK-based company that operates pubs. Property, plant and equipment • Freehold and leasehold properties are initially stated at cost and subs

> The following information was taken from the 20X1 financial statements of Zurich Corporation, a maker of fine Swiss watches: Required: 1. Calculate Zurich’s cash flow from operating activities for 20X1. 2. Explain the reasons for the di

> The following information was taken from the 20X1 financial statements of Eiger Corporation, a maker of equipment for mountain and rock climbers: Required: 1. Calculate Eiger’s cash flow from operating activities for 20X1. 2. Explain th

> The following information was taken from the 20X1 financial statements of Planet Corporation: Required: Determine the cash collected from customers by Planet Corporation in 20X1.

> Serven Corporation has estimated its accrual-basis revenue and expenses for June 20X1 and would like your help in estimating cash disbursements. Selected data from these estimated amounts are as follows: Sales…………………………………………………………………………………………………$ 700,00

> Dunnsmore Company reported cost of goods sold of $318,450 on its 20X1 income statement. Other information for Dunnsmore is as follows: Required: Prepare a schedule showing the amount of cash Dunnsmore paid to suppliers in 20X1.

> During 20X1, Kew Company, a service organization, had $200,000 in cash sales and $3,000,000 in credit sales. The accounts receivable balances were $400,000 and $485,000 at December 31, 20X0 and 20X1, respectively. Required: What was the amount of Kew Co

> Following is a list of items taken from the December 31, 20X1, balance sheet of Reagan Company (amounts omitted): Required: Using the above information, prepare a classified balance sheet in good form.

> Brower Corporation owns a manufacturing plant in the country of Oust. On December 31, 20X1, the plant had a book value of $5,000,000 and an estimated fair value of $8,000,000. Oust’s government has clearly indicated that it will expropriate the plant dur

> Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1: Its income statement for 20X2 was as follows: Additional information: During 20X2, Holmes had the following transactions: a. Declared and paid a common dividend of $78 mi

> Several executives of Computer Associates International, including former CEO Sanjay Kumar, pleaded guilty to providing fraudulent financial statements. The scheme was built around the backdating of sales contracts to affect the results of quarterly repo

> The following balance sheet, which has some weaknesses in terminology and classification, has been prepared by an inexperienced accountant and submitted to you for review: Required: Prepare a classified balance sheet in proper form. Make any necessary co

> Jerry’s Jellies sells one- and two-year mail-order subscriptions for its jelly-of-the-month business. Subscriptions are collected in advance. An analysis of the recorded sales activity revealed the following: Required: What amount of li

> In 20X1, Ginzel Corporation agreed to provide a client with 20 detailed marketing analyses of its client’s key products for a total fee of $110,000. The fee was computed as $5,000 per report × 20 reports = $100,000, plus $10,000 to extract the necessary

> On November 1, 20X1, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It sells technical support for $30,000. Gerakos allocates

> Glick Corporation offers a 10% volume discount to customers who purchase more than 10,000 units of its yoga mats in a calendar year. The volume discount applies to all units purchased in the year, not just the units above 10,000. Once a customer exceeds

> Pogrund Vacation Properties sells real estate in Florida. Pogrund requires potential buyers who are interested in a property to remit a $10,000 deposit to show good faith before receiving detailed information about a property. The deposit is fully refund

> Lemon Corporation and Morley, Inc., have entered into an arrangement whereby Lemon will supply materials and 1,000 hours of its scientists’ time for a project to be undertaken at Morley’s research facility in Austin, TX. Morley will also contribute its s

> On October 1, 20X1, Bulls eye Company sold 250,000 gallons of diesel fuel to Schmidt Co. at $3 per gallon. On November 8, 20X1, 150,000 gallons were delivered; on December 27, 20X1. another 50,000 gallons were delivered; and on January 15, 20X2, the rema

> In 20X1, its first year of operations, Regal Department Store sells $250,000 of gift certificates redeemable for store merchandise that expire one year after their issuance. With a high degree of certainty, Regal believes 10% of the gift certificates wil

> For each of the following independent situations, determine the point at which a contract exists and is subject to application of the five-step revenue recognition model by Amiel Corporation. 1. A regular customer of Amiel’s always places an order on the

> Prior to being acquired by Amazon.com, Whole Foods Market provided that its Compensation Committee would determine a portion of executive bonuses by selecting from a list of 13 performance metrics. For the fiscal year 2014, the Compensation Committee sel

> Ashley Stores, Inc., sells gift cards for use at its stores. The following data pertain to 20X1, 20X2, and 20X3, the company’s first three years of operation: As of December 31, 20X1, Ashley estimates that 1.0% of its gift cards will ne

> Amiel Company reported sales revenue of $20.3 million and expenses of $11.1 million in 20X1, excluding the results of its 80%-owned subsidiary, Talia Company. Talia had $7.0 million of sales revenue and $3.0 million of expenses in 20X1. Ignore income tax

> JDW Corporation reported the following for 20X1: net sales $2,929,500; cost of goods sold $1,786,995; selling and administrative expenses $585,900; unrealized holding loss on available for- sale securities (considered other comprehensive income) $22,000;

> Hentzel Landscaping commenced its business on January 1, 20X1. 1. During its first year of operations, Hentzel purchased supplies in the amount of $12,000 (debited to Supplies inventory), and of this amount, $3,000 were unused as of December 31, 20X1. 2.

> On September 1, 20X1, Revsine Co. approved a plan to dispose of a segment of its business. Revsine expected that the sale would occur on March 31, 20X2, at an estimated pre-tax gain of $375,000. The segment had actual and estimated pre-tax operating prof

> Munnster Corporation’s income statements for the years ended December 31, 20X2 and 20X1, included the following information before adjustments: On January 1, 20X2, Munnster Corporation agreed to sell the assets and product line of one o

> Hoffman Engineering Company is a young and growing producer of pre-stressed concrete manufacturing equipment. You have been retained by the company to advise it in the preparation ofa statement of cash flows. Hoffman uses the direct method in reporting n

> Metro Inc. reported net income of $150,000 for 20X1. Changes occurred in several balancesheet accounts during 20X1 as follows: Required: Determine the reported net cash provided by operating activities for Metro in 20X1.

> Selected financial statements for Ralston Company, a sole proprietorship, are as follows: Additional Information: a. During 20X1, equipment having accumulated depreciation of $4,500 was sold for a $4,000 gain. b. A $3,550 lease payment was made in 20X1,

> Alp Inc. had the following activities during 20X1: • Acquired 2,000 shares of stock in Maybel Inc. for $26,000. • Sold an investment in Rate Motors for $35,000 when the carrying value was $33,000. • Acquired a $50,000, four-year certificate of deposit f

> Margaret Magee has served both as an outside director of MX Manufacturing for the past 10 years and as a member of the company’s compensation committee for the past 5 years. Margaret has been reviewing MX’s 20X1 prelim

> Superfine Company collected the following data in preparing its cash flow statement for theyear ended December 31, 20X1: Required: Determine the following amounts that should be reported in Super fine’s 20X1 statement of cash flows. 1.

> Karr Inc. reported net income of $300,000 for 20X1. Changes occurred in several balancesheet accounts as follows: Additional Information: a. During 20X1, Karr sold equipment that cost $25,000 and had accumulated depreciationof $12,000, for a gain of $5,

> During 20X1, King Corporation wrote off accounts receivable totaling $25,000 and made sales,all on account, of $710,000. Other information about the company’s sales activities follows: In addition, in February 20X1, King accepted a $6,0

> Lino Company’s worksheet for the preparation of its 20X1 statement of cash flows included the following information: Required: What amount should Lino include as net cash that is provided by operating activities in thestatement of cash

> During 20X1, Xan Inc. had the following activities related to its financial operations: Required: In Xan’s 20X1 statement of cash flows, how much should net cash used in financing activities be?

> On January 1, 20X1, Hitchcock Corporation entered into a five-year interest rate swap agreement. The agreement uses a notional value of $500,000 and calls for the company to receivefixed interest of 9% and to make payments based on a floating interest ra

> On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixedand pay variable on a notional amount of $5,000,000. The contract calls for cash settlement ofthe net interest amount at December 31 of each year. The yield cur

> Maynard Corporation buys 1,000 call options to buy 1,000 shares of Rossman, Inc., commonstock on December 1, 20X1. At the time of the purchase, the option price is $5.00, the Rossman stock price is $30.00, and the exercise price is $32.00. On December 31

> Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenueit will recognize when it sells its gold inventory. The forward represents a perfect cash flowhedge. When Callahan settles the forward, it pays $100,000 to the c

> On January 1, 20X1, East Corporation adopted a defined benefit pension plan. At plan inception, the prior service cost was $60,000. In 20X1, East incurred service cost of $150,000 andamortized $12,000 of prior service cost. On December 31, 20X1, East con

> This case illustrates how the abnormal earnings valuation model described in Appendix 7A of this chapter can be combined with security analysts’ published earnings forecasts and used to spot potentially overvalued stocks. Required: 1. Use the abnormal e

> Dell Company adopted a defined benefit pension plan on January 1, 20X1. Dell amortizes theinitial prior service cost of $1,334,400 over 16 years. It assumes a 7% discount rate and an 8%expected rate of return. The following additional data are available

> The following information pertains to Kane Company’s defined benefit pension plan: Kane has no net actuarial gains or losses in AOCI at January 1, 20X1. Required: In its December 31, 20X1, balance sheet, what amount should Kane report

> The following information pertains to Gali Company’s defined benefit pension plan for 20X1: Required: What was the dollar amount of actual return on Gali Company’s plan assets in 20X1?

> Use the facts given in E15-4. Repeat the requirements assuming that the discount and earningsrate is 11% instead of 8%.

> Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor offarm implements. Abbott plans to retire on her 65th birthday, five years from January 1, 20X1. Her salary at January 1, 20X1, is $48,000 per year, and her projected

> On January 2, 20X1, Loch Company established a defined benefit plan covering all employeesand contributed $1,000,000 to the plan. At December 31, 20X1, Loch determined that the 20X1 service and interest costs totaled $620,000. The expected and the actual

> At December 31, 20X1, Kerr Corporation’s pension plan administrator provided the followinginformation: Required: What amount of the pension liability should be shown on Kerr’s December 31, 20X1, balancesheet?

> At January 1, 20X1, Archer Co.’s PBO is $500,000 and the fair value of its pension plan assetsis $630,000. The average remaining service period of Archer’s employees is 12 years. The AOCI—net actuaria

> At January 1, 20X1, Milo Co.’s projected benefit obligation is $300,000, and the fair value ofits pension plan assets is $340,000. The average remaining service period of Milo’s employeesis 10 years. Milo Co. uses the

> Bonny Corp. has a defined benefit pension plan for its employees who have an average remaining service life of 10 years. The following information is available for 20X1 and 20X2 related tothe pension plan: Bonny Corp. had no beginning balance in its AOCI

> Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive, with low profit margins. The company’s competition includes national, regional, and local supermarkets; oil companies

> Zeff Manufacturing provides the following information about its postretirement health careplan for 20X1: Required: 1. Determine Zeff’s postretirement health care expense in 20X1. 2. Determine the fair value of plan assets at December 3

> Jones Company has a postretirement benefit (health care) plan for its employees. On January 1, 20X1, the balance in the Accumulated postretirement benefit obligation account was $300 million. The assumed discount rate—for purposes of determining postreti