Question: The following information related to Caterpillar’s

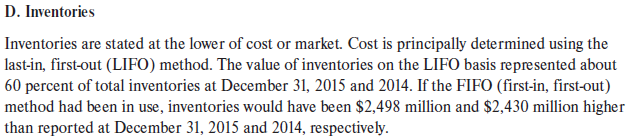

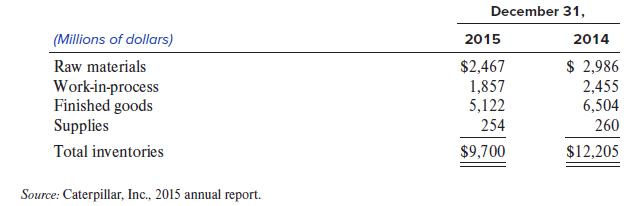

The following information related to Caterpillar’s inventories is taken from its 2015 annual report. Use this information in answering the questions that follow. There were no LIFO liquidations in 2014 or 2015.

7. Inventories

Inventories (principally using the LIFO Method) are comprised of the following:

Required:

1. By how much would pre-tax income for 2015 have differed had Caterpillar used FIFO for all of its inventory?

2. Explain whether Caterpillar’s input prices increased or decreased during 2015.

3. Explain whether Caterpillar owed more or less tax in 2015 because it was on LIFO instead of FIFO. Assume a 35% tax rate.

4. Assume that the U.S. Congress eliminates the use of LIFO. How much tax would Caterpillar owe based on its 2015 inventory if it transitions to FIFO for all of its inventory? Assume a 21% tax rate.

5. Compute how Retained earnings would change if Caterpillar changed to the FIFO method. Base your answer on the 2015 inventory amount and a 21% tax rate.

> Information from the annual report of Hicks Company (a fictional company) to shareholders follows: Required: 1. Suppose that the increase in the preferred stock account was due to the issuance of new preferred shares at par on January 1, 20X2. What journ

> Craig Incorporated (a fictional company) manufactures and sells security systems. Selected information from the company’s 20X3 financial statements show: On December 31, 20X1, Craig Incorporated bought back 1,237,000 shares of common st

> Locate the Form 10-K for the year ended December 31, 2018, for Southwest Airlines Co. You can find it at http://investors.southwest.com/financials/sec-filings. 1. What is Southwest Airlines’ main business? 2. List some of the nonfinancial metrics that S

> In recent years, investors, creditors, governments, and the public have demanded more information from companies about climate change. Required: 1 Why have investors and creditors become interested in business activities related to climate change? 2. Wh

> Locate the 2018 Sustainability Information report for Siemens AG, the German manufacturing conglomerate,athttps://www.siemens.com/investor/pool/en/investor_relations/siemens_sustainability_ information2018.pdf. Required: 1. What are the main areas for w

> As a senior partner at one of the nation’s largest public accounting firms, you serve as chair ofthe firm’s financial reporting policy committee. You are also the firm’s chief spokesperson onfinancial reporting matters that come before the FASB and the S

> Krewatch, Inc., is a vertically integrated manufacturer and retailer of golf clubs and accessories (gloves, shoes, bags, etc.). Krewatch maintains separate financial reporting systems for each of its facilities. The company experienced the following even

> Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 20X1. Additional facts gleaned from notes to Hardrock’s financial statements follow (dollar amounts in thousands): a. Other, ne

> The following information is provided for Kelly Plumbing Supply. Cash received from customers during December 20X1 $387,000 Cash paid to suppliers for inventory during December 20X1 131,000 Cash received from customers includes all $139,000 of the accoun

> Under Hart Company’s accounting system, all insurance premiums paid are debited to prepaid insurance. Hart then makes monthly charges to Insurance expense with credits to prepaid insurance as the insurance coverage period is used up. Additional informati

> Joel Hamilton, D.D.S., keeps his accounting records on the cash basis. During 20X1, he collected $200,000 in fees from his patients. At December 31, 20X0, Dr. Hamilton had accounts receivable of $18,000 and no liability for deferred fee revenue. At Decem

> In November and December 20X1, Gee Company, a newly organized magazine publisher, received $36,000 for 1,000 three-year subscriptions at $12 per year, starting with the January 20X2 issue of the magazine. Required: How much should Gee report in its 20X1

> On January 1, 20X1, Hardy, Inc., purchased certain plant assets under a deferred paymentcontract. The agreement called for making annual payments of $10,000 for five years. The firstpayment is due on January 1, 20X1, and the remaining payments are due on

> Samson Manufacturing Company, a calendar-year company, purchased a machine for $65,000on January 1, 20X0. At the date of purchase, Samson incurred the following additional costs: The machine’s estimated salvage value was $5,000, and Sam

> Apex Company purchased a tooling machine on January 3, 20W1, for $30,000. The machinewas being depreciated on the straight-line method over an estimated useful life of 20 years, withno salvage value. At the beginning of 20X1, when the machine had been in

> On April 1, 20X1, Mills Company acquired equipment for $125,000. The estimated useful lifeis six years, and the estimated residual value is $5,000. Mills estimates that the equipment canproduce 25,000 units of product. During 20X1 and 20X2, respectively,

> For several years, the Securities and Exchange Commission (SEC) has been considering whether to transition U.S. firms to International Financial Reporting Standards (IFRS) for filing public financial reports. During 2011, Matthew J. Foehr, the vice presi

> Gonzo Co. owns a building in Georgia. The building’s historical cost is $970,000, and $440,000of accumulated depreciation has been recorded to date. During 20X1, Gonzo incurred the following expenses related to the building: Required:

> On July 1, 20X1, Ritz Company signs a contract with Venticello, Inc., to install Ritz’sinventory management software throughout Venticello, Inc. Ritz will begin the installation immediately and expectsto compete the installation in thre

> In January 20X1, Vorst Company purchased a mineral mine for $2,640,000. Removable orewas estimated at 1,200,000 tons. After it has extracted all the ore, Vorst will be required by lawto restore the land to its original condition. The expected present val

> Pearl, Inc., develops and markets computer software. During 20X0, one of Pearl’s engineersbegan developing a new and very innovative software product. On July 1, 20X1, a team of Pearlengineers determined that the software product was te

> In 20X1, Ball Labs incurred the following costs: Required: What was Ball’s total research and development expense in 20X1?

> During 20X1, Orr Company incurred the following costs: Required: How much research and development expense should Orr report in 20X1?

> On January 2, 20X1, Lava, Inc., purchased a patent for a new consumer product for $90,000. At the time of purchase, the patent was valid for 15 years; however, its useful life was estimatedto be only 10 years due to the product’s competitive nature. On D

> On January 1, 20X0, Vick Company purchased a trademark for $400,000, which had an estimated useful life of 16 years. On January 1, 20X4, Vick paid $60,000 for legal fees in a successful defense of the trademark. Required: How much should Vick record as

> Union Company acquired machinery on January 2, 20X1, for $315,000. The machinery’s estimated useful life is 10 years, and the estimated residual value is $15,000. Union estimates thatthe machine will produce 15,000 units of product and that 20,000 direct

> Information from Jacob Perez Company’s records is available as follows for the year ended December 31, 20X1: No work-in-process inventories existed at the beginning or end of 20X1. Required: 1. What would be Perez’s f

> Baines Corporation (a fictional company) manufactures fireplace tools and accessories. It has been prosperous since its incorporation, largely due to a small, exceptionally skilled, and highly motivated managerial staff. Baines has been able to attract a

> Frate Company was formed on January 1, 20X1. The following information is available from Frate’s inventory records for Product Ply: A physical inventory on December 31, 20X1, shows 1,600 units on hand. Required: Prepare schedules to co

> On June 30, 20X1, a tornado damaged Jensen Corporation’s warehouse and factory, completely destroying the work-in-process inventory. Neither the raw materials nor finished goods inventories were damaged. A physical inventory taken after

> Hestor Company’s records indicate the following information: On December 31, 20X1, a physical inventory determined that ending inventory of $600,000 was in the warehouse. Hestor’s gross profit on sales has remained con

> For the year 20X1, Dumas Company’s gross profit was $96,000; the cost of goods manufactured was $340,000; the beginning inventories of goods in process and finished goods were $28,000 and $45,000, respectively; and the ending inventories of goods in proc

> The following information is available for Day Company for 20X1: Required: What is the cost of goods sold for 20X1?

> Jessica’s Office Supply, Inc., had 300 calculators on hand at January 1, 20X1, costing $16 each. Purchases and sales of calculators during the month of January were as follows: Jessica does not maintain perpetual inventory records. Acco

> Sperry-New Holland manufactures farm machinery. During 20X1, it incurred a variety of costs, several of which appear on the following list. Nature of Incurred Cost a. Comprehensive liability insurance premium on corporate headquarters b. Depreciation on

> On December 31, 20X1, Fern Company adopted the dollar-value LIFO inventory method. All of Fern’s inventories constitute a single pool. The inventory on December 31, 20X1, using the dollar-value LIFO inventory method was $600,000. Invent

> Acute Company manufactures a single product. On December 31, 20X0, it adopted the dollar- value LIFO inventory method. The inventory on that date using the dollar-value LIFO inventory method was determined to be $300,000. Inventory data for succeeding ye

> The following inventory valuation errors have been discovered for Knox Corporation: •The 20X1 year-end inventory was overstated by $23,000. •The 20X2 year-end inventory was understated by $61,000. •Th

> The following information related to Exxon Mobil’s inventories is taken from its 2017 annual report. Required: 1. By how much would net income for 2017 have differed had Exxon Mobil used FIFO to value those inventory items valued under

> Watsontown Yacht Sales has been selling large power cruisers for 25 years. On January 1, 20X1, the company had $5,950,000 in inventory (based on a FIFO valuation). While the number of yachts in Watsontown Yacht Sales’s inventory remained fairly constant

> Nathan’s Grills, Inc., imports and sells premium-quality gas grills. The company had the following layers in its LIFO inventory at January 1, 20X4, at which time the replacement cost of the inventory was $675 per unit. The replacement c

> KW Steel Corp. uses the LIFO method of inventory valuation. Waretown Steel, KW’s major competitor, instead uses the FIFO method. The following are excerpts from each company’s 20X1 financial statements: Required: 1. C

> Blago Wholesale Company began operations on January 1, 20X1, and uses the average cost method in costing its inventory. Management is contemplating a change to the FIFO method in 20X2 and is interested in determining how such a change will affect net inc

> Selected information concerning the operation of Kern Company for the year ended December 31, 20X1, is available as follows: No work-in-process inventories existed at the beginning or end of 20X1. Required: 1. What would be Kern’s fini

> On January 1, 20X1, Manuel Company’s merchandise inventory was $300,000. During 20X1, Manuel purchased $1,900,000 of merchandise and recorded sales of $2,000,000. The gross profit margin on these sales was 20% of the selling price. Required: What is Man

> Smithfield Farms purchased a combine from John Deere for $175,000 on January 2, 20X1. Smithfield paid $25,000 in cash and signed an installment note calling for five annual payments of $39,569.58 beginning on December 31, 20X1. Deere based the payments o

> On December 31, 20X1, Fenton Company sold equipment to Denver, Inc., accepting a $275,000 non–interest-bearing note receivable due on December 31, 20X4. Denver, Inc., normally pays 12% for its borrowed funds. The equipment is carried in Fenton’s perpetua

> Blue, Inc., sells playground equipment to schools and municipalities. It mails invoices at the end of each month for all goods shipped during that month; credit terms are net 30 days. Sales and accounts receivable data for 20X1, 20X2, and 20X3 follow: R

> Kendall Corporation designs and manufactures sports cars. During the course of its business, Kendall generates substantial receivables from its customers. On July 1, 20X1, to improve its cash flow, Kendall establishes a securitization entity (SE) and (1)

> The following information relates to Zulu Company’s accounts receivable for 20X1: A factor has recently offered to purchase all of Zulu’s outstanding receivables without recourse for 94% of their face amount. Required

> On December 31, 20X1, Vale Company had an unadjusted credit balance of $1,000 in its Allowance for credit losses. Vale analyzes its historical experience related to receivables in specific age categories and estimates the expected credit loss for each ca

> On January 1, 20X1, Wade Crimbring, Inc., a dealer in used manufacturing equipment, sold a CNC milling machine to Fletcher Bros., a new business that plans to fabricate utility trailers. To conserve cash, Fletcher paid for the machine by issuing a $200,0

> The following information is available for Fess Company: Credit sales during 20X1………………………………………………………………………$150,000 Allowance for credit losses at December 31,20X0……………………………………1,450 Accounts receivable deemed worthless and written off during 20X1………….1

> Central Valley Construction (CVC) purchased $80,000 of sheet metal fabricating equipment from Buffalo Supply on January 1, 20X1. CVC paid $15,000 cash and signed a five-year, 10% note for the remaining $65,000 of the purchase price. The note specifies th

> For the month of December 20X1, Ranger Corporation’s records show the following information: Required: Determine the gross sales for the month of December 20X1.

> 1. Why do regulators require banks and insurance companies to maintain minimum levels of investor capital? 2. What impact does this type of regulatory requirement have on the financial statements that banks and insurance companies prepare for shareholder

> In 20X1, Illinois Power & Heat spent $5 million repairing one of its electrical generating stations that was damaged by a tornado. The loss was uninsured. Management has asked the public service commission for approval to treat the $5 million as an asset

> Sunshine Groceries operates a rapidly expanding chain of retail grocery stores. The company has grown from 10 stores in 20X1 to 50 stores in 20X3 and plans to add at least 10 stores each year for the next three years. Top executives at the company can ea

> The quarterly cash flows from operations for two software companies are: Required: 1. Explain why Firm B has more credit risk than Firm A. 2. Suppose that Firm B’s cash flow was $200 higher each quarter (e.g., $336.7 in Q1 of 20X1). Ex

> Presented below are excerpts from the 2018 annual report of Siemens AG, a German company that operates in numerous industries, including technology, power generation, and medical diagnostics. Required: Using the Siemens AG note, identify the similaritie

> In Chapter 17, we will discuss goodwill impairment rules, which determine when goodwill must be written down and by how much. They do so by comparing the estimated fair value of a reporting unit to its carrying value. Required: 1. Suppose Jesse Corporat

> The price/earnings ratios of four companies from the same industry are: Required: What factors might explain the difference in the P/E ratios of these companies?

> The price/earnings ratios of four companies from different industries are: Required: What factors might explain the difference in the P/E ratios of these companies?

> This exercise is built around Kroger’s financial statements from the chapter. Total shareholders’ equity—The Kroger Co. was $5,384 million at February 1, 2014. Required: 1. Kroger earned an ROA of 6.9% in fiscal 2014. What was ROCE that year? 2. ROA at

> The Hershey Co. is famous worldwide for its chocolate confections—the Hershey bar and those delightful Hershey Kisses. Tootsie Roll Industries is equally famous for its chewy Tootsie Roll and those flavorful Tootsie Roll Pops. Selected

> Selected information taken from the accounting records of Vigor Company follows: Required: 1. What was Vigor’s gross profit for 20X1? 2. Suppose that there are 360 business days in the year. What were the number of days sales outstandin

> A comparison of 20X1 to 20X0 performance shows that Neir Company’s inventory turnover increased substantially although sales and inventory amounts were essentially unchanged. Required: Which of the following statements best explains the increased invent

> The following data were taken from the financial records of Glum Corporation for 20X1: Required: How many times was bond interest earned in 20X1?

> Selected data of Islander Company follow: Required: 1. What is the accounts receivable turnover for 20X1? 2. What is the inventory turnover for 20X1?

> Utica Company’s net accounts receivable was $250,000 at December 31, 20X0, and $300,000 at December 31, 20X1. Net cash sales for 20X1 were $100,000. The accounts receivable turnover for 20X1 was 5.0, which was computed from net credit sales for the year.

> Appearing next is information pertaining to Garrels Company’s Allowance for credit losses. Examine this information and answer the following questions. Required: 1. Solve for the unknowns in the preceding schedule. (Hint: Use T-account

> On January 1, 20X1, River Company’s inventory was $400,000. During 20X1, the company purchased $1,900,000 of additional inventory, and on December 31, 20X1, its inventory was $500,000. Required: What was the inventory turnover for 20X1?

> Following are income statements for Hossa Corporation for 20X1 and 20X2. Percentage of sales amounts are also shown for each operating expense item. Hossa’s income tax rate was 22% in 20X1 and 24% in 20X2. Hossa’s mana

> The following information is from the 20X1 annual report of Weber Corporation, a company that supplies manufactured parts to the household appliance industry. Required: 1. Compute Weber Corporation’s return on assets (ROA) for 20X1 usin

> Nagy Corporation reported the following income statement in 20X1, along with a comparable income statement for 20X0, its first year of operations: In its Form 10-K, Nagy also provided a non-GAAP metric, earnings before depreciation and one-time charges,

> Trubisky Corporation acquired a machine on January 1, 20X1, for $3 million and decided to depreciate it over eight years using the double-declining method. The depreciation rate each year, as a percentage of the original cost, was as follows: On January

> The preliminary draft of the balance sheet at the end of the current fiscal year for Eagle Industries follows. The statement will be incorporated into the annual report to stockholders and will present the dollar amounts at the end of both the current an

> Krafty Kris, Inc., discovered the following errors after the 20X1 financial statements were issued: a. A major supplier shipped inventory valued at $8,550 to Krafty Kris on consignment. This merchandise was mistakenly included in the inventory taken by K

> Tack, Inc., reported a Retained earnings balance of $150,000 at December 31, 20X0. In June 20X1, Tack’s internal audit staff discovered two errors that were made in preparing the 20X0 financial statements that are considered material: a. Merchandise cost

> Bettner, Inc., is a calendar-year corporation whose financial statements for 20X0 and 20X1 included errors as follows: Assume that inventory purchases were recorded correctly and that no correcting entries were made at December 31, 20X0, or December 31,

> Jones Corporation switched from the LIFO method of costing inventories to the FIFO method at the beginning of 20X1. The LIFO inventory at the end of 20X0 would have been $80,000 higher using FIFO. Reported retained earnings at the end of 20X0 were $1,750

> Caterpillar Inc. manufactures and sells earth-moving equipment. Presented below is information on its receivables and allowance for credit losses from its 2018 Form 10-K. The “Recorded Investments in Finance Receivablesâ€

> Presented below are excerpts from the 2018 annual report of Marston’s PLC, a UK-based company that operates pubs. Property, plant and equipment • Freehold and leasehold properties are initially stated at cost and subs

> The following information was taken from the 20X1 financial statements of Zurich Corporation, a maker of fine Swiss watches: Required: 1. Calculate Zurich’s cash flow from operating activities for 20X1. 2. Explain the reasons for the di

> The following information was taken from the 20X1 financial statements of Eiger Corporation, a maker of equipment for mountain and rock climbers: Required: 1. Calculate Eiger’s cash flow from operating activities for 20X1. 2. Explain th

> The following information was taken from the 20X1 financial statements of Planet Corporation: Required: Determine the cash collected from customers by Planet Corporation in 20X1.

> Serven Corporation has estimated its accrual-basis revenue and expenses for June 20X1 and would like your help in estimating cash disbursements. Selected data from these estimated amounts are as follows: Sales…………………………………………………………………………………………………$ 700,00

> Dunnsmore Company reported cost of goods sold of $318,450 on its 20X1 income statement. Other information for Dunnsmore is as follows: Required: Prepare a schedule showing the amount of cash Dunnsmore paid to suppliers in 20X1.

> The following information is available from Sand Corporation’s accounting records for the year ended December 31, 20X1: Required: Compute cash flow provided by operations for 20X1.

> During 20X1, Kew Company, a service organization, had $200,000 in cash sales and $3,000,000 in credit sales. The accounts receivable balances were $400,000 and $485,000 at December 31, 20X0 and 20X1, respectively. Required: What was the amount of Kew Co

> Following is a list of items taken from the December 31, 20X1, balance sheet of Reagan Company (amounts omitted): Required: Using the above information, prepare a classified balance sheet in good form.

> Brower Corporation owns a manufacturing plant in the country of Oust. On December 31, 20X1, the plant had a book value of $5,000,000 and an estimated fair value of $8,000,000. Oust’s government has clearly indicated that it will expropriate the plant dur

> Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1: Its income statement for 20X2 was as follows: Additional information: During 20X2, Holmes had the following transactions: a. Declared and paid a common dividend of $78 mi

> Several executives of Computer Associates International, including former CEO Sanjay Kumar, pleaded guilty to providing fraudulent financial statements. The scheme was built around the backdating of sales contracts to affect the results of quarterly repo

> The following balance sheet, which has some weaknesses in terminology and classification, has been prepared by an inexperienced accountant and submitted to you for review: Required: Prepare a classified balance sheet in proper form. Make any necessary co

> Jerry’s Jellies sells one- and two-year mail-order subscriptions for its jelly-of-the-month business. Subscriptions are collected in advance. An analysis of the recorded sales activity revealed the following: Required: What amount of li

> In 20X1, Ginzel Corporation agreed to provide a client with 20 detailed marketing analyses of its client’s key products for a total fee of $110,000. The fee was computed as $5,000 per report × 20 reports = $100,000, plus $10,000 to extract the necessary

> On November 1, 20X1, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It sells technical support for $30,000. Gerakos allocates

> Glick Corporation offers a 10% volume discount to customers who purchase more than 10,000 units of its yoga mats in a calendar year. The volume discount applies to all units purchased in the year, not just the units above 10,000. Once a customer exceeds

> Pogrund Vacation Properties sells real estate in Florida. Pogrund requires potential buyers who are interested in a property to remit a $10,000 deposit to show good faith before receiving detailed information about a property. The deposit is fully refund