Question: The following information relates to Dell City,

The following information relates to Dell City, whose first fiscal year ended December 31, 2019. Assume Dell has only the long-term debt as specified below and only the funds necessitated by the following information.

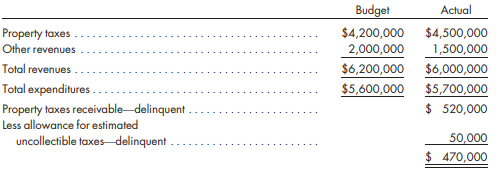

1. General fund:

a. There were no amendments to the budget as originally adopted.

b. No property taxes receivable have been written off, and the allowance for uncollectibles balance is unchanged from the initial entry at the time of the original tax levy.

c. There were no encumbrances outstanding at December 31, 2019.

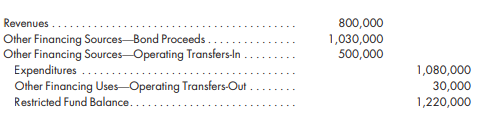

2. Capital projects fund:

a. Finances for Dell’s new civic center were provided by a combination of general fund transfers, a state grant, and an issue of general obligation bonds. Any bond premium on issuance is to be used for the repayment of the bonds at their $1,000,000 par value. At December 31, 2019, the capital projects fund for the civic center had the following closing entries:

b. Also, at December 31, 2019, capital projects fund entries reflected Dell’s intention to honor the $900,000 purchase orders and commitments outstanding for the center.

c. During 2019, total capital projects fund encumbrances exceeded the corresponding expenditures by $52,000. All expenditures were previously encumbered.

d. During 2020, the capital projects fund received no revenues and no other financing sources. The civic center building was completed in early 2020, and the capital projects fund was closed by a transfer of $27,000 to the general fund.

3. Electric utility enterprise fund:

a. Dell issued $4,000,000 revenue bonds at par. These bonds, together with a $500,000 transfer from the general fund, were used to acquire an electric utility. Electric utility revenues are to be the sole source of funds to retire these bonds beginning in the year 2024.

Required

Answer questions 1–15 with a yes (Y) or no (N) in the space provided. Answer questions 16–22 with the correct amount in the space provided.

1. Did recording budgetary accounts at the beginning of 2019 increase the fund balance by $300,000? ____________

2. Should the budgetary accounts for 2019 include an entry for the expected transfer of funds from the general fund to the capital projects fund? ____________

3. Should the $500,000 payment from the general fund, which was used to help establish the electric utility fund, be reported as ‘‘other financing uses—operating transfers-out’’? ____________

4. Did the general fund receive the $30,000 bond premium from the capital projects fund? ____________

5. Should a payment from the general fund for electricity received for normal civic center operations be reported as ‘‘other financing uses—operating transfers-out’’? ____________

6. Does the net property taxes receivable of $470,000 include amounts expected to be collected after March 15, 2020? ____________

7. Would closing budgetary accounts cause the fund balance to increase by $600,000? ____________

8. After closing entries are made, do the budgetary accounts effect the fund balance on the balance sheet? ____________

9. In the general fixed assets account group, should a credit amount be recorded for 2019 in ‘‘Investment in General Fixed Assets—Capital Projects Fund’’? ____________

10. In the general fixed assets account group, should Dell record depreciation on electric utility equipment? ____________

11. Should the capital projects fund be included in Dell’s combined statement of revenues, expenditures, and changes in fund balances? ____________

12. Should the electric utility enterprise fund be included in Dell’s combined governmental funds balance sheet? ____________

13. Should Dell report capital and related financing activities in its statement of cash flows in its debt service fund? ____________

14. Should Dell report capital and related financing activities in its statement of cash flows in its capital projects fund? ____________

15. Should Dell report capital and related financing activities in its statement of cash flows in its electric utility enterprise fund? ____________

16. What amount was recorded in the opening entry for appropriations? ____________

17. What was the total amount debited to Property Taxes Receivable? ____________

18. In the general long-term debt account group, what amount should be reported for bonds payable at December 31, 2019? ____________

19. In the general fixed assets account group, what amount should be recorded for ‘‘Investment in General Fixed Assets—Capital Projects Fund’’ at December 31, 2019? ____________

20. What was the completed cost of the civic center? ____________

21. How much was the state capital grant for the civic center? ____________

22. In the capital projects fund, what was the amount of the total encumbrances recorded during 2019? ____________

Transcribed Image Text:

Budget Actual $4,200,000 2,000,000 $4,500,000 1,500,000 Property taxes Other revenues Total revenues. $6,200,000 $6,000,000 Total expenditures . $5,700,000 $ 520,000 $5,600,000 Property taxes receivable-delinquent . Less allowance for estimated uncollectible taxesdelinquent 50,000 $ 470,000 Revenues .. 800,000 1,030,000 500,000 Other Financing Sources Bond Proceeds.... Other Financing Sources Operating Transfers-In Expenditures ... Other Financing Uses-Operating Transfers-Out 1,080,000 30,000 1,220,000 Restricted Fund Balance..

> Explain how both the intrinsic value and the time value are measured for a forward contract to sell and for a put option.

> What are the objectives of the International Accounting Standards Committee Foundation, and does the FASB support those objectives?

> Identify several environmental factors that may explain why accounting principles differ among countries.

> Rose Corporation was unable to service its outstanding debts. The company is considered to be experiencing significant financial difficulties. In an attempt to avoid filing for bankruptcy, it took the following measures: a. Patents with book value of $14

> On January 1, 2014, Fabco borrowed $5,000,000 from First Bank of Newburg. The loan had a term of five years with the principal amount due at the end of the fifth year. Interest is at an annual rate of 6% with interest being paid semiannually on June 30 a

> Early in May of last year, Nancy Fable was diagnosed with a terminal illness, and doctors gave her one more year to live. Aside from a prior year $6,000,000 gift to the city of Macon, Georgia, she had not done any other gifting. She made the following gi

> Walter Campbell was a very giving person all of his life. His surviving children speak frequently of his generosity not only toward his deceased wife but also to many beyond his immediate family. Unfortunately, Walter’s will have proved to be more genero

> Spencer Cook died on July 18 of the current year, leaving a gross estate of $8,600,000. Claims to be settled against that estate included funeral, administrative, and medical expenses of $180,000 and other debts of $210,000. Spencer’s wife Sara has a con

> At the time of Robert Granger’s death, his estate consisted of the following assets and liabilities measured at fair market value: Assets Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> James and Susan Wagner have assets with fair market values of $12,700,000 and $4,800,000, respectively. James has been diagnosed with a terminal illness and is expected to pass away within the current year. James wants to minimize his estate taxes, and a

> Champos Corporation is a foreign corporation that was formed on June 30, 2015. On July 1, 2016, Magnum Ventures, a U.S. venture capital firm, paid $700,000 to acquire a 30% interest in the equity of Champos. At the time of the acquisition, Champos had ne

> Using the data in Problem 19-8 and the following additional information, prepare a statement of financial position for Excel Private College. Debit Credit Cash 255,000 625,000 185,000 175,000 300,000 1,450,000 3,025,000 Accounts Receivable (net) Con

> The following events occurred as part of the operations of Kronke Private University for the year 2018 (all amounts are in 000’s): a. To construct a new business building, the university floated at par a $20,000,000, 8% serial bond issued on July 1. Inte

> The statement of financial position of Washbud Private University as of the end of its fiscal year, June 30, 2018, is as follows: The following transactions occurred during the fiscal year ended June 30, 2019 (all numbers are in 000’

> Record the following transactions. Identify each as a contribution, agency, or an exchange transaction, and prepare any appropriate entries. 1. Private University coordinated its annual special event with the opening of the alumni weekend. Tickets to the

> Select the best answer for each of the following multiple-choice items dealing with universities: 1. Abbott Public University’s unrestricted current fund comprised the following: Assets. . . . . . . . . . . . . . . . . . . . . . . . .

> Using data from Problem 19-14 and the following additional information, prepare a reconciliation of change in net assets to net cash provided by operating activities that would accompany Lakeside Hospital’s statement of cash flows for the year ended Dece

> You are provided with a summarized version of the cash account of Lakeside Hospital, a not-for-profit organization for 2018. Required Prepare a statement of cash flows, using the direct method, for the year ended December 31, 2018. Cash Account Deb

> The June 30, 2018, adjusted trial balances of Bayshore Community Health Care Association follow: Required 1. Prepare a statement of activities for the year ended June 30, 2018. 2. Prepare a statement of financial position as of June 30, 2018. Bays

> Select the best answer for each of the following multiple-choice items dealing with health care organizations. 1. Hospital financial resources are required by a bond indenture to be set aside to finance construction of a new pediatrics facility. In which

> Select the best answer for each of the following multiple-choice items dealing with hospitals: 1. In June 2018, Park Hospital purchased medicines from Jove Pharmaceutical Company at a cost of $2,000. However, Jove notified Park that the invoice was being

> On June 30, 2015, the shareholders’ equity of Fabinet, a foreign corporation, was 10,500,000 FC. At that time, Newcore, a U.S. corporation, acquired 40% in Fabinet by paying $3,120,000 when 1 FC was equal to $0.60. Equipment, with a fair market value tha

> Select the best answer for each of the following multiple-choice items. (Nos. 2–10 are AICPA adapted.) 1. Which of the following is required as part of the complete set of financial statements for a private college or university? a. Statement of changes

> We Care, a VHWO, conducts two programs: Adult Services and Education. It has the typical supporting services of management and fund raising. The condensed trial balances after allocable expenses have been assigned are presented as follows: We Care Conde

> Outreach Clinic, a VHWO, conducts two programs: Alcohol and Drug Abuse and Outreach to Teens. It has the typical supporting services of management and fund raising. Expense accounts from the pre allocation trial balances as of December 31, 2019, are as f

> Thirty years ago, a group of civic-minded merchants in Mayfair organized the ‘‘Committee of 100’’ for the purpose of establishing the Mayfair Sports Club, a not-for-profit sports org

> Carleton Agency, a VHWO, conducts two programs: Medical Services and Community Information Services. It had the following transactions during the year ended June 30, 2019, shown on next page. 1. Received the following contributions: Unrestricted pledge

> The following selected events relate to the 2019 activities of Fall Nursing Home, Inc., a not-for-profit agency: a. Gross patient service revenue totaled $2,200,000. The provision for uncollectible accounts was estimated at $92,000. The allowance for con

> Select the best answer for each of the following multiple-choice questions: 1. A VHWO receives a donation that is restricted to its endowment and another donation that is restricted to use in acquiring a child care center. How should these donations be r

> Select the best answer for each of the following multiple-choice items. (Nos. 2–4 are AICPA adapted.) 1. Super Seniors is a not-for-profit organization that provides services to senior citizens. Super employs a full-time staff of 10 people at an annual c

> From the expense accounts information and allocation schedule shown in Problem 18-8, prepare a statement of functional expenses for We Care for the year ended December 31, 2019.

> Select the best answer for each of the following multiple-choice items. Items (1) through (3) are based on the following: The Fox Point Humane Society, a VHWO caring for lost animals, had the following financial inflows and outflows for the year ended De

> Lakey International is a foreign corporation that maintains its books of record in foreign currency (FC), although its functional currency is the U.S. dollar. Lakey originally began operations on July 1, 2012, by issuing no par common stock in the amount

> Assume that a U.S. company has made three purchases of inventory from three different foreign vendors. One of the purchases is denominated in U.S. dollars, and the other two purchases are denominated in foreign currency, FC-A and FC-B, respectively. Furt

> From the following information, prepare a statement of net position for the city of Lucas as of June 30, 2019. Cash and cash equivalents, governmental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 280,000 Cash and cash equivalen

> Using the information from Problem 17-6, illustrate and explain the adjustments necessary to convert to a government-wide statement of activities, assuming all expenditures are for capital assets and other finance sources are the result of issuance of ge

> The pre closing, year-end trial balance for a capital projects fund of the city of Rochester as of December 31, 2019, follows: Required 1. Prepare closing entries as of December 31, 2019. 2. Prepare the year-end statement of revenues, expenditures, and

> Define a financial reporting entity. Give an example of a primary government. Define and give an example of a component unit. Explain the two methods of reporting the primary government and component units in the financial reporting entity and when each

> Based on the following very limited information, indicate whether and how the city should report its related entity. 1. Its school district, although not a legally separate government, is managed by a school board elected by city residents. The system is

> The Urban Development Authority (UDA) was created as a separate legal entity by an act of the state legislature and ‘‘activated’’ by action of the city council to plan and develop the downtown area of the city and to attract new businesses and residents.

> Under the reporting model required by GASB Statement No. 34, fund statements are required for governmental, proprietary, and fiduciary funds. Government-wide statements include the statement of net position and the statement of activities. Required 1. E

> Go to the Web site featuring the financial statements of Minneapolis, Minnesota, at http://www.ci.minneapolis. mn.us/finance/reports/CAFR/index.htm. Required Provide brief answers to the following: 1. The financial section includes the basic financial s

> Select the best answer to the following multiple-choice questions: 1. In the statement of activities, a. all expenses are subtracted from all revenues to get net income. b. the net program expense (revenue) for major functions and programs of the primary

> Palto County elects not to purchase commercial insurance. Instead, it sets aside resources for potential claims in an internal service ‘‘self-insurance’’ fund. During the year, the fund recognized $4 million for claims filed during the year. Of this amou

> Brico Enterprises, a U.S. corporation, acquired an 80% interest in Bandar Distributors in June 2012 when 1 FC equaled $1.62. Bandar is a foreign corporation whose functional currency is the FC. The condensed pre closing comparative trial balance for Band

> The pre closing, year-end trial balance for a capital projects fund of the city of Clark as of December 31, 2019, follows: Required 1. Prepare closing entries as of December 31, 2019, assuming that all inflows and outflows are designated assigned. 2. P

> The following information pertains to Palmer Township’s construction and financing of a new administration center: Estimated total cost of project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. $9,000,000 Project financin

> Mountain View’s citizens authorized the construction of a new library. As a result of this project, the city had the following transactions during 2018: a. On January 3, 2018, a $600,000 serial bond issue having a stated interest rate of 8% was authorize

> (Nos. 4, 5, and 8 are AICPA adapted.) 1. The following revenues were among those reported by Tosa Township in 2018: Net rental revenue (after depreciation) from a parking garage owned by Tosa . . . . . . $ 40,000 Interest earned on investments held for

> The following information relates to Redwood City during its fiscal year ended December 31, 2019: a. On October 31, 2019, to finance the construction of a city hall annex, Redwood issued 8%, 10-year general obligation bonds at their face value of $600,00

> The village of Fay was recently incorporated and began financial operations on July 1, 2018, the beginning of its fiscal year. The following transactions occurred during this first fiscal year from July 1, 2018, to June 30, 2019: 1. The village council a

> A selected list of transactions for the city of Hope for the fiscal year ending June 30, 2018, follows: 1. The city government authorized a budget with estimated revenues of $4,500,000 and appropriations of $4,450,000. 2. The city’s share of state gasoli

> In compliance with a newly enacted state law, Tilburg County assumed the responsibility of collecting all property taxes levied within its boundaries as of July 1, 2018. The following composite property tax rate per $100 of net assessed valuation was dev

> The following trial balance of the Employees’ Retirement System Fund for Bedrock City was prepared by a clerk who used only balance sheet accounts in recording the events for the fiscal year ended June 30, 2018: Cash . . . . . . . . . . . . . . . . . .

> In the past, Baxter Manufacturing has engaged in a number of foreign currency transactions but has never before attempted to hedge these transactions. Baxter has given you three past events and asked you to illustrate how hedging could have been employed

> In 2018, a city opens a municipal landfill, which it will account for in an enterprise fund. It estimates capacity to be 6 million cubic feet and usable life to be 20 years. To close the landfill, the municipality expects to incur labor, material, and eq

> The city of Cloverville operates a central computer center through an internal service fund. The Computer Internal Service Fund was established by a contribution of $1,000,000 from the general fund on July 1, 2017, at which time a building was acquired a

> Prepare a statement of cash flows for the internal service fund of the city of Boniville from the following information: Cash on hand at the beginning of the year . . . . . . . . . . . . . $ 122 Interest from investments . . . . . . . . . . . . . .

> In response to a petition signed by the property owners of Riverdale Subdivision, the city of Pewaukee will oversee the installation of sidewalks, curbs, and gutters in the subdivision, to be accounted for in the city’s capital projects

> Select the best response for each of the following multiple-choice questions. (Nos. 1–8 are AICPA adapted.) 1. In 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residen

> Prepare journal entries to record the following events using the general fund and the general fixed assets account group: a. The general fund vouchered the purchase of trucks for $80,000. The purchase had been encumbered earlier in the year at $75,000. b

> Manchester City maintains a defined benefit pension plan for its employees. In a recent year, the city contributed $15 million to its pension fund. However, its annual pension expense and increase in net pension liability as calculated by its actuary was

> A summary of the general fund transactions for the city of Toma for the year ended December 31, 2019, is as follows: a. A budget was approved, showing estimated revenues of $900,000, appropriations of $875,000, transfers-in of $27,000 from other funds, a

> The general fund trial balance of the city of Oakpark at December 31, 2018, was as follows: The following data pertain to 2019 general fund operations: a. Budget adopted: Revenues and other financing sources: Taxes ....................................

> On July 1, 2018, the beginning of its fiscal year, the trial balance of the general fund of the city of Wentworth was as follows: The following events occurred: a. The budget shows estimated general fund revenues of $400,000 and estimated expenditures

> Regber International is building an addition to one of its overseas manufacturing facilities with all construction costs being paid in foreign currency (FC) as follows: 200,000 FC, 300,000 FC, 400,000 FC, and 100,000 FC on March 1, June 30, August 31, an

> Land City leases a fleet of garbage trucks. The term of the lease is 10 years, approximately the useful life of the equipment. Based on a sales price of $800,000 and an interest rate of 6%, the city agrees to make annual payments of $108,694. Upon the ex

> Select the best answer for each of the following multiple-choice questions. (Nos. 1, 5, and 7–10 are AICPA adapted.) 1. The encumbrances control account of a governmental unit is increased when a voucher payable is a. not recorded and t

> The January 2, 2018, trial balance of Oneida Township follows: The following events occurred during the first six months of 2018: a. The adopted budget showed the following: Estimated expenditures .................... $620,000 Transfers to other funds

> The following selected information was taken from SunValley City’s general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019: Revenues: Property taxes—2019 ........................................

> The city of Clinton was incorporated on January 1, 2014. On December 31, 2019, a careful study of the city’s records revealed the following information regarding long-term debt: a. General obligation bonds in the amount of $1,500,000 were authorized and

> The following schedule of capital assets was obtained from the records of the city of Elmcreek: City of Elmcreek Schedule of General Fixed Assets December 31, 2018 Governmental activities: Land ...........................................................

> Prepare the necessary journal entries to record the following transaction for the city of Small ville during 2017 in the general fund and account groups, and specify the account group used. Entries in the debt service fund and capital projects fund shoul

> Select the best answer for each of the following multiple-choice questions. (Nos. 3 and 7 are AICPA adapted.) 1. What is the underlying reason a governmental unit uses separate funds to account for its transactions? a. Governmental units are so large tha

> Prior to liquidation, the following information relates to the partnership: Partnership trial balance: On June 30, other assets with a book value of $160,000 were sold for $120,000, and all available cash with the exception of $20,000 was used to reduc

> A partnership has decided to liquidate its operations. Prior to beginning the liquidation process, the partnership had cash balances of $12,000 and noncash assets of $210,000. At that time liabilities were $125,000 of which $25,000 represented a note pay

> Jackson, a U.S. company, acquires a variety of raw materials from foreign vendors with amounts payable in foreign currency (FC). The company needs to acquire 20,000 units of raw materials, and the goods are expected to have a price of 100,000 FC. Assume

> At the end of 2015, Klaproth finds himself in a difficult situation. He is a partner in a residential construction company, and the housing market has been adversely impacted by interest rates, mortgage defaults, and a surplus of existing homes for sale.

> Murphy and Reinartz have been partners for several years and critical values related to their partnership are as follows: In 2016, the partnership reported net income of $230,000, and each partner received a $100,000 distribution at year-end. After muc

> Jacobs, a client of yours, is a partner in a retail establishment that has been experiencing difficult times. Shortly after deciding to liquidate the partnership, partner Williams offers to buy out the interests of the other partners. Jacobs is trying to

> Midway Construction was a partnership owned by Davis, Murray, and Clay with year-end 2013 capital balances of $50,000, 80,000, and $70,000, respectively. Davis and Murray each received an annual salary of $100,000. Clay was primarily involved in sales an

> After being a partner for over 10 years, Ziegler has decided to sell her interest in a partnership with Grossman and Casper. Prior to the date of the sale and subsequent to the allocation of profits and drawing balances, information concerning the partne

> A partnership has assets of $210,000 and liabilities of $95,000. The capital information for the current partners is as follows: Given the above information, respond to each of the following independent fact situations: 1. Assuming new Partner D acquir

> Carlton, Weber, and Stansbury share profits equally and have capital balances of $120,000, $70,000, and $80,000, respectively, as of December 31, 2014. Effective January 1, 2015, Stansbury has transferred his interest in the partnership to Laidlaw for to

> Rexcam is a partnership owned by Wilson, Watts, and Franklin that manufactures special machine tools used primarily in injection molding applications. The partnership had operated very profitably for the first five years of existence. However, in the las

> Rivera, Sampson, and Elliott are partners in a commercial plumbing business. Rivera and Sampson have also started another contracting company and have cash flow needs, which require periodic distributions from the partnership. In order to deal fairly wit

> At the beginning of the current year, Meyers, Lincoln, and Kopinski formed a partnership to carry on their consulting practice. At that time, net assets of $59,000, $30,000, and $25,000 were contributed to the partnership by Meyers, Lincoln, and Kopinski

> Stark, Inc., placed an order for inventory costing 500,000 FC with a foreign vendor on April 15 when the spot rate was 1 FC = $0.683. Stark received the goods on May 1 when the spot rate was 1 FC = $0.687. Also on May 1, Stark entered into a 90-day forwa

> Jacobs and Levine are partners in a plumbing contracting business. Jacobs was divorced and the divorce stipulation states that his ex-spouse is to receive the following as maintenance for any given year: 1. Monthly maintenance payments of $2,500 througho

> Raymond is a senior partner in a manufacturing firm and is approaching retirement age. In discussing succession planning with the company partners, two alternatives have been presented to Raymond. The first alternative would call for Raymond to receive a

> Sandburg and Williams are the owners of a partnership that manufactures commercial lighting fixtures. Profits are allocated among the partners as follows: Sandburg was divorced as of the beginning of 2015 and as part of the divorce stipulation agreed t

> Rockford, Skeeba, and Tapinski are partners in a business which manufactures specialty railings. Their profit and loss agreement provides for the allocation of profits and losses as follows: 1. Salaries of $50,000, $40,000, and $55,000 for Rockford, Skee

> Raymack Manufacturing, headquartered in Michigan, is a manufacturer of equipment component parts used in a number of industries. The company’s financial statements and related footnotes contain the required segment reporting. The financial statements are

> Tress Corporation is a rapidly growing company that has diversified into a number of different segments. The following partial trial balance, which includes the effect of intercompany transactions, is for the current year ended December 31: Net Sales .

> A U.S. multinational corporation has divided its operations into several operating segments and has provided the following data for each segment: It is important to note that all purchases of goods or services from other segments have been sold to ou

> You are presenting segmental information regarding your company to the finance committee of the board of directors and have been asked the following questions. Provide your response to each of the following questions: Required 1. How is it possible that

> A new client of yours has prepared the following condensed income statement for the second quarter of 2015. Sales revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $280,000 Less: Sales returns and allowances . . . .

> The following schedule was developed for Monroe Corporation to support interim reporting for the year 2014. The following additional 2014 information is available: 1. The statutory tax rate is as follows: 15% on the first $50,000 of taxable income 20%

> A company has acquired two derivatives: an option to buy foreign currency (FC) and a forward contract to buy FC. Both derivatives were acquired on the same day, for the same notional amount and expire on May 31. Relevant information involving the derivat

> Radix, Inc., operates primarily as a distributor of components for gasoline compressors. In the first quarter of 2015, the company reported a gross profit of $248,000 on net sales of $1,360,000. After considering selling, general, and administrative expe