Question: The following is the draft trading and

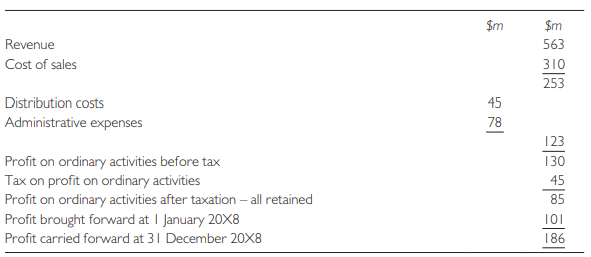

The following is the draft trading and income statement of Parnell Ltd for the year ending 31 December 20X8:

You are given the following additional information, which is reflected in the above statement of comprehensive income only to the extent stated:

1 Distribution costs include a bad debt of $15 million which arose on the insolvency of a major customer. There is no prospect of recovering any of this debt. Bad debts have never been material in the past.

2 The company has traditionally consisted of a manufacturing division and a distribution division. On 31 December 20X8, the entire distribution division was sold for $50 million; its book value at the time of sale was $40 million. The profit on disposal was credited to administrative expenses. (Ignore any related income tax.)

3 During 20X8, the distribution division made sales of $100 million and had a cost of sales of $30 million. There will be no reduction in stated distribution costs or administration expenses as a result of this disposal.

4 The company owns offices which it purchased on 1 January 20X6 for $500 million, comprising $200Â million for land and $300 million for buildings. No depreciation was charged in 20X6 or 20X7, but the company now considers that such a charge should be introduced. The buildings were expected to have a life of 50 years at the date of purchase, and the company uses the straight-line basis for calculating depreciation, assuming a zero residual value. No taxation consequences result from this change.

5 During 20X8, part of the manufacturing division was restructured at a cost of $20 million to take advantage of modern production techniques. The restructuring was not fundamental and will not have a material effect on the nature and focus of the company’s operations. This cost is included under administration expenses in the statement of comprehensive income.

Required:

(a) State how each of the items 1–5 above must be accounted for in order to comply with the requirements of international accounting standards.

(b) Redraft the income statement of Parnell Ltd for 20X8, taking into account the additional information so as to comply, as far as possible, with relevant standard accounting practice. Show clearly any adjustments you make. Notes to the accounts are not required. Where an IAS recommends information to be on the face of the income statement it could be recorded on the face of the statement.

Transcribed Image Text:

$m $m Revenue 563 Cost of sales 310 253 Distribution costs 45 Administrative expenses 78 123 Profit on ordinary activities before tax Tax on profit on ordinary activities Profit on ordinary activities after taxation – all retained 130 45 85 Profit brought forward at I January 20X8 101 Profit carried forward at 31 December 20X8 186

> Aspirations Ltd commenced trading as wholesale suppliers of office equipment on 1 January 20X1, issuing ordinary shares of £1 each at par in exchange for cash. The shares were fully paid on issue, the number issued being 1,500,000. The follo

> (a) Discuss why IAS 40 Investment Property was produced. (b) Universal Entrepreneurs plc has the following items on its PPE list: (i) £1,000,000 – the right to extract sandstone from a particular quarry. Geologists predict that extraction at the present

> Shower Ltd was incorporated towards the end of 20X2, but it did not start trading until 20X3. Its historical cost statement of financial position at 1 January 20X3 was as follows: A summary of Shower Limited’s bank account for 20X3 is

> The historical cost accounts of Smith plc are as follows: Notes 1 Land and buildings were acquired in 20X0 with the buildings component costing £800,000 and depreciated over 40 years. 2 Share capital was issued in 20X0. 3 Closing inventor

> The statements of financial position of Parkway plc for 20X7 and 20X8 are given below, together with the income statement for the year ended 30 June 20X8. Notes 1 The freehold land and buildings were purchased on 1 July 20X0. The company policy is to

> The finance director of Toy plc has been asked by a shareholder to explain items that appear in the current cost statement of comprehensive income for the year ended 31.8.20X9 and the statement of financial position as at that date: Required: (a) Expla

> Raiders plc prepares accounts annually to 31 March. The following figures, prepared on a conventional historical cost basis, are included in the company’s accounts to 31 March 20X5. 1 In the income statement: 2 In the statement of fi

> Jason commenced with £135,000 cash. He acquired an established shop on 1 January 20X1. He agreed to pay £130,000 for the fixed and current assets and the goodwill. The replacement cost of the shop premises was £100,

> (a) Describe briefly the theory underlying Hicks’s economic model of income and capital. What are its practical limitations? (b) Spock purchased a Space Invader entertainment machine at the beginning of year 1 for £1,000. He expects to receive at annual

> (a) ‘Measurement in financial statements’, Chapter 6 of the ASB’s Statement of Principles, was published in 1999. Among the theoretical valuation systems considered is value in use, more commonly known as economic value. Required: Describe the Hicksian

> George Longfellow is a financial controller with a listed industrial firm which has a long period of sustained growth. This has necessitated substantial use of external borrowing. During the great financial crisis it has become harder to roll over the lo

> The following is an extract from Accountancy Age, 25 January 2001: A powerful and ‘shadowy’ group of senior partners from the seven largest firms has emerged to move closer to edging control of accounting standards from the world’s accountancy regulators

> On 1 April 20W9 Oliver granted share options to 20 senior executives. The options are due to vest on 31 March 20X2 provided the senior executives remain with the company for the period between 1 April 20W9 and 31 March 20X2. The number of options vesting

> Jemma Burrett is a public practitioner. Four years earlier she had set up a family trust for a major client by the name of Simon Trent. The trust is for the benefit of Simon and his wife Marie. Marie is also a client of the practice and the practice prep

> Kim Lee is a branch accountant in a multinational company Green Cocoa plc responsible for purchasing supplies from a developing country. Kim Lee is authorized to enter into contracts up to $100,000 for any single transaction. Demand in the home market is

> Joe Withers is the chief financial officer for Withco plc responsible for negotiating bank loans. It has been the practice to obtain loans from a number of merchant banks. He has recently met Ben Billings who had been on the same undergraduate course som

> You have recently qualified and set up in public practice under the name Patris Zadan. You have been approached to provide accounting services for Joe Hardiman. Joe explains that he has had a lawyer set up six businesses and he asks you to do the books a

> (i) Critically discuss the rationale for allowing businesses in the UK a choice as to which accounting standards to apply, such as IFRS for the Group accounts and FRS 102 for UK subsidiaries. (ii) Critically evaluate the IASB decision to move from a size

> Consider the interest of the tax authorities in financial reporting regulations. Explain why national tax authorities might be concerned about the transition from domestic accounting standards to IFRS in companies’ Annual Reports.

> The financial statements of Saturn plc have been prepared as follows: Further information: (a) Extract from statement of income (b) Operating expenses written off in the year include the following: €000 Amortization of development c

> The following information has been taken from the financial statements for Payne plc (Payne) for the year ended 31 March 2013. * In June 2011, the IASB issued amendments to IAS 1 Presentation of Financial Statements. One of these proposed the adoptio

> Shown below are the summarized final accounts of Martel plc for the last two financial years: Summarized statement of comprehensive income for the year ending 31 December Additional information: 1 The movement in non-current assets during the year en

> The statements of financial position of Radar plc at 30 September were as follows: The following information is available: (i) An impairment review of the investments disclosed that there had been an impairment of $20,000. (ii) The depreciation charge

> Oberon prepares financial statements to 31 March each year. Oberon makes contributions to a defined benefit post-employment benefit plan for its employees. Relevant data is as follows: (a) At 1 April 20X0 the plan obligation was €35 million and the fair

> The following extract is from ‘Comments of Leonard Spacek’, in R.T. Sprouse and M. Moonitz, A Tentative Set of Broad Accounting Principles for Business Enterprises, Accounting Research Study No. 3, AICPA, New York, 1962, reproduced in A. Belkaoui, Accoun

> Marwell plc reported a profit after tax of €14.04m for 20X2 as follows: The statements of financial position and changes in equity showed: (i) Inventories at the year end were €5.94m higher than the previous year. (ii)

> Direct plc provided the following information from its records for the year ended 30 September 20X9: Required: Using the direct method of presentation, prepare the cash flows from the operating activities section of the statement of cash flows for the

> Omega prepares financial statements under International Financial Reporting Standards. In the year ended 31 March 20X7 the following transaction occurred. On 31 December 20X6 the directors decided to dispose of a property that was surplus to requirements

> The following trial balance has been extracted from the books of Hoodurz as at 31 March 2006: The following information is relevant: (i) The trial balance figures include the following amounts for a disposal group that has been classified as â

> Omega prepares financial statements under International Financial Reporting Standards. In the year ended 31 March 20X7 the following transaction occurred: Omega follows the revaluation model when measuring its property, plant and equipment. One of its pr

> Mr Norman set up a new business on 1 January 20X8. He invested €50,000 in the new business on that date. The following information is available. 1 Gross profit was 20% of sales. Monthly sales were as follows: Month ……………………………………Sales € January ……………………

> Sasha Parker is going to set up a new business on 1 January 20X1. She estimates that her first six months in business will be as follows: (i) She will put £150,000 into a bank account for the firm on 1 January 20X1. (ii) On 1 January 20X1 she will buy ma

> Phoenix plc’s trial balance at 30 June 20X7 was as follows: The following information is available: 1 Freehold premises acquired for £1.8 million were revalued in 20X4, recognising a gain of £600,000. These i

> Mr Norman is going to set up a new business in Singapore on 1 January 20X8. He will invest $150,000 in the business on that date and has made the following estimates and policy decisions: 1 Forecast sales (in units) made at a selling price of $50 per uni

> Kathryn plc, a listed company, provides a defined benefit pension for its staff, the details of which are given below. As at 30 April 2013, actuaries valued the company’s pension scheme and estimated that the scheme had assets of £10.5 million and obliga

> Sasha Parker is going to set up a new business in Bruges on 1 January 20X1. She estimates that her first six months in business will be as follows: (i) She will put €150,000 into the firm on 1 January 20X1. (ii) On 1 January 20X1 she will buy machinery €

> Gettry Doffit plc is an international company with worldwide turnover of £26 million. The activities of the company include the breaking down and disposal of noxious chemicals at a specialized plant in the remote Scottish countryside. During

> Springtime Ltd is a UK trading company buying and selling as wholesalers fashionable summer clothes. The following balances have been extracted from the books as at 31 March 20X4: Notes: 1 Depreciation is provided at the following annual rates on a str

> David Mark is a sole trader who owns and operates supermarkets in each of three villages near Ousby. He has drafted his own accounts for the year ended 31 May 20X4 for each of the branches. They are as follows: The figures for the year ended 31 May 20X

> The following items have been extracted from the accounts: Required: (a) Prepare a value added statement showing % for each year and % change. (b) Draft a note for inclusion in the annual report commenting on the statement you have prepared. 2005 (

> (a) Prepare a value added statement to be included in the corporate report of Hythe plc for the year ended 31 December 20X6, including the comparatives for 20X5, using the information given below: (b) Although value added statements were recommended by

> Wonder Kid Enterprises Company has produced the following results over the last three years: Management has just issued its annual report for 20XZ and a fair reading of their commentary is that the company has done very well because the trend in profit

> Geoworld Enterprises plc has the following information extracted from its statement of income and payroll systems: Each fulltime employees works double the hours of part time staff. Dividends paid to shareholders …â€&br

> Why is there a prohibition of auditors owning shares in client companies? Is this prohibition reasonable? Discuss.

> How is the relationship between the audit firm and the audit client different for: (a) the provision of statutory audit when the auditor reports to the shareholders; (b) the provision of consultancy services by audit firms?

> C plc wants to reward its directors for their service to the company and has designed a bonus package with two different elements as follows. The directors are informed of the scheme and granted any options on 1 January 20X7. 1 Share options over 300,000

> (a) Describe the value to the audit client of the audit firm providing consultancy services. (b) Why is it undesirable for audit firms to provide consultancy services to audit clients? (c) Why do audit firms want to continue to provide consultancy servic

> The board of White plc is discussing the filling of a vacant position arising from the death of Lord White. A list of possible candidates is as follows: (a) Lord Sperring, who is a well-known company director and who was the managing director of Sperring

> Conglomerate plc was a family company which was so successful that the founding Alexander family could not fully finance its expansion. So the company was floated on the Stock Exchange with the Alexander family holding ‘A’ class shares and the public hol

> Harvey Storm is chief executive of West Wing Savings and Loans. Harvey authorizes a loan to Middleman Properties secured on the land it is about to purchase. Middleman Properties has little money of its own. Middleman Properties subdivides the land and b

> Manufacturing Co. has been negotiating with Fred Paris regarding the sale of some property that represented an old manufacturing site which is now surplus to requirements. Because part of the site was used for manufacturing, it has to be decontaminated b

> Discuss the following issues with regard to financial reporting for risk: (a) How can a company identify and prioritize its key risks? (b) What actions can a company take to manage the risks identified in (a)? (c) How can a company measure risk?

> Briefly state: (i) the case for segmental reporting; (ii) the case against segmental reporting.

> Harry is about to start negotiations to purchase a controlling interest in NX, an unquoted limited liability company. The following is the statement of financial position of NX as at 30 June 2006, the end of the company’s most recent fi

> R. Johnson inherited 810,000 £1 ordinary shares in Johnson Products Ltd on the death of his uncle in 20X5. His uncle had been the founder of the company and managing director until his death. The remainder of the issued shares were held in s

> On 1 January 20X1 a company obtained a contract in order to keep its factory in work but had obtained it on a very tight profit margin. Liquidity was a problem and there was no prospect of offering staff a cash bonus. Instead, the company granted its 80

> Growth plc made a cash offer for all of the ordinary shares of Beta Ltd on 30 September 20X9 at £2.75 per share. Beta’s accounts for the year ended 31 March 20X9 showed: Additional information: (i) The half yearly profits

> Sally Gorden seeks your assistance to decide whether she should invest in Ruby plc or Sapphire plc. Both companies are quoted on the London Stock Exchange. Their shares were listed on 20 June 20X4 as Ruby 110p and Sapphire 120p. The performance of these

> The following are the accounts of Bouncy plc, a company that manufactures playground equipment, for the year ended 30 November 20X6. The directors are considering two schemes to raise £6,000,000 in order to repay the debentures and financ

> Quickserve plc is a food wholesale company. Its financial statements for the years ended 31 December 20X8 and 20X9 are as follows: Required: (a) Describe the concerns of the following users and how reading an annual report might help satisfy these con

> Filios Products plc owns a chain of hotels through which it provides three basic services: restaurant facilities, accommodation, and leisure facilities. The latest financial statements contain the following information: The following breakdown is provi

> Belt plc and Braces plc were in the same industry. The following information appeared in their 20X9 accounts: Required: (a) Calculate the following ratios for each company and show the numerical relationship between them: (i) Their rate of return on th

> The statements of financial position, cash flows, income and movements of non-current assets of Dragon plc for the year ended 30 September 20X6 are set out below: (ii) Statement of income (extract) for the year ended 30 September 20X6 (iii) Statement

> The Housing Department of Chaldon District Council has invited tenders for re-roofing 80 houses on an estate. Chaldon Direct Services (CDS) is one of the Council’s direct services organizations and it has submitted a tender for this con

> Chelsea plc has embarked on a program of growth through acquisitions and has identified Kensington Ltd and Wimbledon Ltd as companies in the same industrial sector, as potential targets. Using recent financial statements of both Kensington and Wimbledon

> Liz Collier runs a small delicatessen. Her profits in recent years have remained steady at around £21,000 per annum. This type of business generally earns a uniform rate of net profit on sales of 20%. Recently, Liz has found that this level of profitabil

> The following trial balance was extracted from the books of Old NV on 31 December 20X1. Note of information not taken into the trial balance data: (a) Provide for: (i) An audit fee of €38,000. (ii) Depreciation of plant at 20% straight

> You work for Euroc, a limited liability company, which seeks growth through acquisitions. You are a member of a team that is investigating the possible purchase of Choggerell, a limited liability company that manufactures a product complementary to the p

> Saddam Ltd is considering the possibility of diversifying its operations and has identified three firms in the same industrial sector as potential takeover targets. The following information in respect of the companies has been extracted from their most

> The major shareholder/director of Esrever Ltd has obtained average data for the industry as a whole. He wishes to see what the forecast results and position of Esrever Ltd would be if in the ensuing year its performance were to match the industry average

> Relationships plc You are informed that the non-current assets totaled €350,000, current liabilities €156,000, the opening retained earnings totaled €103,000, the administration expenses totaled €92,680 and that the available ratios were the current rati

> Drucker plc is a public listed wholesaler. Its summarized financial statements for the year ended 31 December 2013 (and 2012 comparatives) are as follows: You are a newly recruited accountant working for Drucker plc. The draft financial statements for

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 31 March 2009 are being prepared. The board of directors is responsible for all key financial and operating decisions,

> Amalgamated Engineering plc makes specialized machinery for several industries. In recent years, the company has faced severe competition from overseas businesses, and its sales volume has hardly changed. The company has recently applied for an increase

> Flash Fashions plc has had a difficult nine months and the management team is discussing strategy for the final quarter. In the last nine months the company has survived by cutting production, reducing staff and reducing overheads wherever possible. Howe

> Delta NV has share capital of €1m in shares of €0.25 each. At 31 May 20X9 shares had a market value of €1.1 each. On 1 June 20X9 the company makes a rights issue of one share for every four held at €0.6 per share. Its profits were €500,000 in 20X9 and €4

> The following information relates to Simrin plc for the year ended 31 December 20X0: Simrin plc had 100,000 ordinary shares of £1 each in issue throughout the year. Simrin plc has in issue warrants entitling the holders to subscribe for a

> The computation and publication of earnings per share (EPS) figures by listed companies are governed by IAS 33 Earnings per Share. Notes: 1 Called-up share capital of Nottingham Industries plc: In issue at 1 April 20X5: 16,000,000 ordinary shares of 25

> Beta Ltd had the following changes during 20X1: Required: Calculate the time-weighted average number of shares for the basic earnings per share denominator. Note that adjustments will be required for time, the bonus issue and the bonus element of the r

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 30 September 2008 are being prepared. Your assistant, who has prepared the first draft of the statements, is unsure ab

> The following extract is from Conceptual Framework for Financial Accounting and Reporting: Elements of Financial Statements and Their Measurement, FASB 3, December 1976: The benefits of achieving agreement on a conceptual framework for financial accounti

> Alpha plc had an issued share capital of 2,000,000 ordinary shares at 1 January 20X1. The nominal value was 25p and the market value £1 per share. On 30 September 20X1 the company made a rights issue of 1 for 4 at a price of 80p per share. The post-tax e

> The following Statements of Comprehensive Income relate to Rooster plc (Rooster) and its investee companies, Houseton plc (Houseton) and Kelson plc (Kelson). Kelson is based in New Jersey, USA. It produces, sells and is managed autonomously in the USA. A

> The following information is available for the year ended 31 March 20X6 (values in $m): Present value of scheme liabilities at 1 April 20X5 $1,007; fair value of plan assets at 1 April 20X5 $844; benefits paid $44; contributions paid by employers $16; cu

> Helvatia GmbH is a Swiss company which is a wholly owned subsidiary of Corolli, a UK company. Helvatia GmbH was formed on 1 November 2005 to purchase and manage a property in Zürich in Switzerland. The reporting and functional currency of

> (a) According to IAS 21 The Effects of Changes in Foreign Exchange Rates, how should a company decide what its functional currency is? (b) Until recently Eufonion, a UK limited liability company, reported using the euro (€) as its functi

> On 1 January 20X0 Walpole Ltd acquired 90% of the ordinary shares of a French subsidiary Paris SA. At that date the balance on the retained earnings of Paris SA was €10,000. The non-controlling interest in Paris was measured as a percent

> On 1 January 20X1 Fibre plc acquired 80% of the ordinary shares of a Singaporean company, Fastlink Ltd, for £6m when Fastlink’s retained earnings were $15.5m and the share premium was $0.8m. Fastlink’s fin

> Fry Ltd has the following foreign currency transactions in the year to 31/12/20X0: The exchange rates at the relevant dates were: Required: Calculate the profit or loss to be reported in the financial statements of Fry Ltd at 31/12/20X0. 15/11 Bu

> Arnold plc and Bunny plc agreed to establish a Joint Operation, Carlton, which started trading on 1 January 20X1. Carlton is an unincorporated business, which is financed and managed by Arnold and Bunny. Arnold agreed to provide land at an agreed price o

> This question concerns an associated company making a loss and possible impairment of goodwill. Hyson plc acquired a 30% interest in the ordinary shares of Green plc on 1 January 20X3 when Green’s general reserve was £25,00

> Epsilon acquired 40% of Zeta when Zeta’s retained earnings were $50,000, 25% of Kappa when Kappa’s retained earnings were $40,000, and 25% of Lambda when Lambda’s retained earnings were $50,000. The f

> (a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for the selection of accounting policies and prescribes circumstances in which an entity may change an accounting policy. The standard also deals with accounting

> Set out below are the financial statements of Ant Co., its subsidiary Bug Co. and an associated company Nit Co. for the accounting year-end 31 December 20X9. Ant Co. acquired 80% of the shares in Bug Co. on 1 January 20X7 when the balance on the retai

> The following information (in £m) relates to the defined benefit scheme of Basil plc for the year ended 31 December 20X7: Fair value of plan assets at 1 January 20X7 £3,150 and at 31 December 20X7 £3,386; contributions £26; current service cost £80; bene

> FRS 105 requires that a complete set of financial statements of a micro-entity should include the following: (a) a statement of financial position as at the reporting date with notes included at the foot of the statement; and (b) an income statement for

> Many bank card issuers impose different types of fees; briefly describe three of these fees.

> How is the interest rate typically set on bank credit cards?

> What is the attraction of reward cards?

> What is open account credit? Name several different types of open account credit.