Question: The historical cost accounts of Smith plc

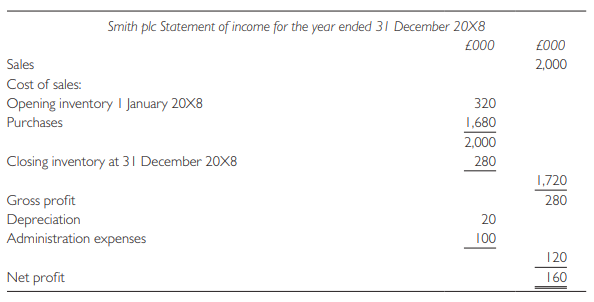

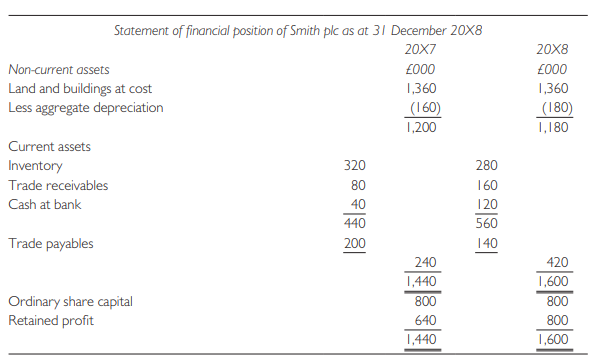

The historical cost accounts of Smith plc are as follows:

Notes

1 Land and buildings were acquired in 20X0 with the buildings component costing £800,000 and depreciated over 40 years.

2 Share capital was issued in 20X0.

3 Closing inventories were acquired in the last quarter of the year.

4 RPI numbers were:

Average for 20X0 ……………………………120

20X7 last quarter …………………………….216

At 31 December 20X7 ………………………220

20X8 last quarter …………………………….232

Average for 20X8 …………………………….228

At 31 December 20X8………………………. 236

Required:

(i) Explain the basic concept of the CPP accounting system.

(ii) Prepare CPP accounts for Smith plc for the year ended 20X8. The following steps will assist in preparing the CPP accounts:

(a) Restate the statement of comprehensive income for the current year in terms of £CPP at the year-end.

(b) Restate the closing statement of financial position in £CPP at year-end, but excluding monetary items, i.e. trade receivables, trade payables, cash at bank.

(c) Restate the opening statement of financial position in £CPP at year-end, but including monetary items, i.e. trade receivables, trade payables and cash at bank, and showing equity as the balancing figure.

(d) Compare the opening and closing equity figures derived in (b) and (c) above to arrive at the total profit/loss for the year in CPP terms. Compare this figure with the CPP profit calculated in (a) above to determine the monetary gain or monetary loss

(e) Reconcile monetary gains/loss in (d) with the increase/decrease in net monetary items during the year expressed in £CPP compared with the increase/decrease expressed in £HC.

Transcribed Image Text:

Smith plc Statement of income for the year ended 31 December 20X8 £000 £000 Sales 2,000 Cost of sales: Opening inventory I January 20X8 320 Purchases 1,680 2,000 Closing inventory at 31 December 20X8 280 1,720 Gross profit Depreciation Administration expenses 280 20 100 120 Net profit 160 Statement of financial position of Smith plc as at 31 December 20X8 20X7 20X8 Non-current assets £000 £000 Land and buildings at cost Less aggregate depreciation 1,360 1,360 (180) 1,180 (160) 1,200 Current assets Inventory 320 280 Trade receivables 80 160 Cash at bank 40 120 440 560 Trade payables 200 140 240 420 1,440 800 1,600 800 Ordinary share capital Retained profit 640 800 1,440 1,600

> The approach in IAS 39 to the impairment of financial assets was flawed because it did not allow financial institutions to recognize the true losses they expected on loans at the time they had made the loans. How does the final version of IFRS 9 address

> Procter Limited, a UK private company has the following financial assets and liabilities in the accounts: (i) An equity investment in Milner plc, a UK listed company. Procter recognises the investment as an ‘available for sale’ investment under IAS 39 Fi

> (a) IAS 16 Property, Plant and Equipment requires that where there has been a permanent diminution in the value of property, plant and equipment, the carrying amount should be written down to the recoverable amount. The phrase ‘recoverable amount’ is def

> At the start of the year Cornish plc entered into a number of financial instruments and is considering how to classify these instruments under IFRS 9. The instruments are as follows (a) Investment in listed 3% government bonds for €2 million. Cornish acq

> Tan plc has the following assets originated on 1 January 2016: (i) A loan receivable generated from lending £100,000 to a customer of the company. The loan carries interest at 7% per annum payable in arrears and is classified at amortized cost. The 12-mo

> Charles plc is applying IAS 32 and IFRS 9 for the first time this year and is uncertain about the application of the standard. Charles plc’s balance sheet is as follows: Note The forward contracts have been revalued to fair value in t

> A company borrows on a floating-rate loan, but wishes to hedge against interest variations so swaps the interest for fixed rate. The swap should be perfectly effective and has zero fair value at inception. Interest rates increase and therefore the swap b

> Baudvin Ltd has an equity investment that cost €1 million on 1 January 2008. The investment is classified as an available-for-sale investment under IAS 39. The value of the investment at each period-end is: 31 December 2008 ……………………………€950,000 31 Decemb

> The following is an extract from the trial balance of Imecet at 31 October 2005: Other relevant information: (i) One million $1 ordinary shares were issued 1 May 2005 at the market price of $1.75 per ordinary share. (ii) The inventory at 31 October 200

> On 1 January 2009 Hazell plc borrows €5 million on terms with interest of 3% fixed for the period to 31 December 2009, going to variable rate thereafter (at inception the variable rate is 6%). The loan is repayable at Hazell plc’s option between 31 Decem

> On 1 April year 1, a deep discount bond was issued by DDB AG. It had a face value of £2.5 million and covered a five-year term. The lenders were granted a discount of 5%. The coupon rate was 10% on the principal sum of £2.5 million, payable annually in a

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 30 September 2008 are being prepared. Your assistant, who has prepared the first draft of the statements, is unsure ab

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 31 March 2009 are being prepared. The board of directors is responsible for all key financial and operating decisions,

> The finance director of Small Machine Parts Ltd is considering the acquisition of a lease of a small workshop in a warehouse complex that is being redeveloped by City Redevelopers Ltd at a steady rate over a number of years. City Redevelopers are grantin

> On 1 April 20W9 Kroner began to lease an office block on a 20-year lease. The useful economic life of the office buildings was estimated at 40 years on 1 April 20W9. The supply of leasehold properties exceeded the demand on 1 April 2009 so as an incentiv

> Suktor is an entity that prepares financial statements to 30 June each year. On 30 April 20X1 the directors decided to discontinue the business of one of Suktor’s operating divisions. They decided to cease production on 31 July 20X1, with a view to dispo

> Easy View Ltd had started business publishing training resource material in ring binder format for use in primary schools. Later it diversified into the hiring out of videos and had opened a chain of video hire shops. With the growing popularity of a mai

> In 20X6 Alpha AS made the decision to close a loss-making department in 20X7. The company proposed to make a provision for the future costs of termination in the 20X6 profit or loss. Its argument was that a liability existed in 20X6 which should be recog

> Plasma Ltd, a manufacturer of electrical goods, guarantees them for 12 months from the date of purchase by the customer. If a fault occurs after the guarantee period but is due to faulty manufacture or design of the product, the company repairs or replac

> On 20 December 20X6 one of Incident plc’s lorries was involved in an accident with a car. The lorry driver was responsible for the accident and the company agreed to pay for the repair to the car. The company put in a claim to its insurers on 17 January

> Olive A/S, incorporated with an authorised capital consisting of one million ordinary shares of €1 each, employs 64 persons, of whom 42 work at the factory and the rest at the head office. The trial balance extracted from its books as at

> (a) Provisions are particular kinds of liabilities. It therefore follows that provisions should be recognized when the definition of a liability has been met. The key requirement of a liability is a present obligation and thus this requirement is critica

> Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and preference capital has been eroded as seen on the statement of financial position. The fol

> Speedster Ltd commenced trading in 1986 as a wholesaler of lightweight travel accessories. The company was efficient and traded successfully until 2000 when new competitors entered the market selling at lower prices which Speedster could not match. The c

> In the year to 31 December 20X9, Amy bought a new machine and made the following payments in relation to it: Required: (a) State and justify the cost figure which should be used as the basis for depreciation. (b) What does depreciation do, and why is i

> Discuss the advantages to a company of: (a) purchasing and cancelling its own shares; (b) purchasing and holding its own shares in treasury.

> A summary of the statement of financial position of Doxin plc, as at 31 December 20X0, is given below: During 20XI, the company: (i) issued 200,000 ordinary shares of £I each at a premium of I0p per share (a specific issue to redeem prefer

> The following is the statement of financial position of Alpha Ltd as on 30 June 20X8: The following information is relevant: 1 There are contingent liabilities in respect of (i) a guarantee given to bankers to cover a loan of £30,000 made

> The draft statement of financial position of Telin plc at 30 September 20X5 was as follows: Preference shares of the company were originally issued at a premium of 2p per share. The directors of the company decided to redeem these shares at the end of

> Complete Computer Services (CCS) sells computer packages which include supply of a computer which carries the normal warranty against faulty parts plus a two-year assistance package covering problems encountered using any software sold or supplied with t

> Assume that in Question 3 you had also been told that cars without the inclusion of free services are typically sold by other sales outlets for €40,000. Required: Re-do the entries for the sale and the servicing. (Ignore interest as the timing of the se

> Assume the facts as per Question 6 with the following additional costs: There is a five euro cost to add a customer to the phone system and those who buy the phone outright do not default on payments for the phone or the service contract, but those who h

> The following are criticisms made of the IASB’s 2015 exposure draft proposing updates to its Conceptual Framework. 1 The framework does not consider the meaning of the term ‘true and fair view’ despite this being a fundamental characteristic discussed in

> Five G Telephones enters into telephone contracts on the following terms and options: Xyz mobile phones …………………………………..€1,000 Basic Y phones ……………………………………………€200 Basic connection service options: A ……………………………………………..€40 per month B ……………………………….€15

> Assume the same facts as in Question 4(b) but add the presence of a 7.5% value added tax on the sales and a 1% transaction cost paid to the supplier of credit card transactions. Required: (a) Show the entries to record the transactions associated with t

> You have been given the task, by one of the partners of the firm of accountants for which you work, of assisting in the preparation of a trend statement for a client, Mercury. Mercury has been in existence for four years. Figures for the three preceding

> TYV is a manufacturing entity and produces a range of products in several factories. TYV’s trial balance at 30 September 2014 is shown below Notes: (i) On 1 October 2013 two of TYV’s factories, factory A and factory

> Facts: Henry Falk subscribes to an online monthly gardening magazine and selects the option of a three-year subscription from the following options: One issue ……………………………..………..€12 Twelve issues ……………………….……..€120 Twenty-four issues ………………………€200 Thirty

> Penrith European Car Sales plc sells a new car with ‘free’ 5,000 kilometre and 20,000 kilometre services for a combined price of €41,500. The cost of the car from the manufacturer is €30,000. The two services normally cost €400 and €600 to do and are cha

> Strayway PLC sells two planes to Elliott & Elliott Budget Airlines PLC for 5 million euros each payable in two years’ time on presentation of an accepted bill of exchange to be presented through Lloyds Bank. The face value of the bill is €10,000,000. Fur

> Renee Aluminum Products plc enters into an agreement to supply Skyline Window Installers plc with standard window frames at the retail prices at the time less 40%. Renee supplies 300 windows a month at £66 each. However, the agreement provides for price

> New Management plc is a pharmaceutical company selling to wholesalers and retail pharmacies. The new CEO was appointed at the start of the financial year and was full of enthusiasm. For the first six months her new ideas created a 10% increase in sales a

> Exess Steel plc specialises in steelmaking and is located in the northwest of the country. Due to an unexpected downturn in demand for its steel products it has excess coking coal. South East Steel Products plc has also been caught by the unexpected econ

> Henry plc is a company which has established a reputation as a company which generates growth in sales from year to year and those growth prospects have been incorporated into share prices. However, the current year has been more difficult and the managi

> Senford PLC entered into a contract to sell 3,000 telephones each with a two-year provider contract. The total cost of the contract was €120 per month payable at the end of the month. The phones were bought for cash from a supplier for €480 each and the

> The FRC in its 2009 publication Louder than Words – Principles and Actions for Making Corporate Reports Less Complex and More Relevant included a call for action to ‘Ensure disclosure requirements are relevant and proportionate to the risks’, stating tha

> Aspirations Ltd commenced trading as wholesale suppliers of office equipment on 1 January 20X1, issuing ordinary shares of £1 each at par in exchange for cash. The shares were fully paid on issue, the number issued being 1,500,000. The follo

> (a) Discuss why IAS 40 Investment Property was produced. (b) Universal Entrepreneurs plc has the following items on its PPE list: (i) £1,000,000 – the right to extract sandstone from a particular quarry. Geologists predict that extraction at the present

> Shower Ltd was incorporated towards the end of 20X2, but it did not start trading until 20X3. Its historical cost statement of financial position at 1 January 20X3 was as follows: A summary of Shower Limited’s bank account for 20X3 is

> The statements of financial position of Parkway plc for 20X7 and 20X8 are given below, together with the income statement for the year ended 30 June 20X8. Notes 1 The freehold land and buildings were purchased on 1 July 20X0. The company policy is to

> The finance director of Toy plc has been asked by a shareholder to explain items that appear in the current cost statement of comprehensive income for the year ended 31.8.20X9 and the statement of financial position as at that date: Required: (a) Expla

> Raiders plc prepares accounts annually to 31 March. The following figures, prepared on a conventional historical cost basis, are included in the company’s accounts to 31 March 20X5. 1 In the income statement: 2 In the statement of fi

> Jason commenced with £135,000 cash. He acquired an established shop on 1 January 20X1. He agreed to pay £130,000 for the fixed and current assets and the goodwill. The replacement cost of the shop premises was £100,

> (a) Describe briefly the theory underlying Hicks’s economic model of income and capital. What are its practical limitations? (b) Spock purchased a Space Invader entertainment machine at the beginning of year 1 for £1,000. He expects to receive at annual

> (a) ‘Measurement in financial statements’, Chapter 6 of the ASB’s Statement of Principles, was published in 1999. Among the theoretical valuation systems considered is value in use, more commonly known as economic value. Required: Describe the Hicksian

> George Longfellow is a financial controller with a listed industrial firm which has a long period of sustained growth. This has necessitated substantial use of external borrowing. During the great financial crisis it has become harder to roll over the lo

> The following is an extract from Accountancy Age, 25 January 2001: A powerful and ‘shadowy’ group of senior partners from the seven largest firms has emerged to move closer to edging control of accounting standards from the world’s accountancy regulators

> On 1 April 20W9 Oliver granted share options to 20 senior executives. The options are due to vest on 31 March 20X2 provided the senior executives remain with the company for the period between 1 April 20W9 and 31 March 20X2. The number of options vesting

> Jemma Burrett is a public practitioner. Four years earlier she had set up a family trust for a major client by the name of Simon Trent. The trust is for the benefit of Simon and his wife Marie. Marie is also a client of the practice and the practice prep

> Kim Lee is a branch accountant in a multinational company Green Cocoa plc responsible for purchasing supplies from a developing country. Kim Lee is authorized to enter into contracts up to $100,000 for any single transaction. Demand in the home market is

> Joe Withers is the chief financial officer for Withco plc responsible for negotiating bank loans. It has been the practice to obtain loans from a number of merchant banks. He has recently met Ben Billings who had been on the same undergraduate course som

> You have recently qualified and set up in public practice under the name Patris Zadan. You have been approached to provide accounting services for Joe Hardiman. Joe explains that he has had a lawyer set up six businesses and he asks you to do the books a

> (i) Critically discuss the rationale for allowing businesses in the UK a choice as to which accounting standards to apply, such as IFRS for the Group accounts and FRS 102 for UK subsidiaries. (ii) Critically evaluate the IASB decision to move from a size

> Consider the interest of the tax authorities in financial reporting regulations. Explain why national tax authorities might be concerned about the transition from domestic accounting standards to IFRS in companies’ Annual Reports.

> The financial statements of Saturn plc have been prepared as follows: Further information: (a) Extract from statement of income (b) Operating expenses written off in the year include the following: €000 Amortization of development c

> The following information has been taken from the financial statements for Payne plc (Payne) for the year ended 31 March 2013. * In June 2011, the IASB issued amendments to IAS 1 Presentation of Financial Statements. One of these proposed the adoptio

> Shown below are the summarized final accounts of Martel plc for the last two financial years: Summarized statement of comprehensive income for the year ending 31 December Additional information: 1 The movement in non-current assets during the year en

> The statements of financial position of Radar plc at 30 September were as follows: The following information is available: (i) An impairment review of the investments disclosed that there had been an impairment of $20,000. (ii) The depreciation charge

> Oberon prepares financial statements to 31 March each year. Oberon makes contributions to a defined benefit post-employment benefit plan for its employees. Relevant data is as follows: (a) At 1 April 20X0 the plan obligation was €35 million and the fair

> The following extract is from ‘Comments of Leonard Spacek’, in R.T. Sprouse and M. Moonitz, A Tentative Set of Broad Accounting Principles for Business Enterprises, Accounting Research Study No. 3, AICPA, New York, 1962, reproduced in A. Belkaoui, Accoun

> Marwell plc reported a profit after tax of €14.04m for 20X2 as follows: The statements of financial position and changes in equity showed: (i) Inventories at the year end were €5.94m higher than the previous year. (ii)

> Direct plc provided the following information from its records for the year ended 30 September 20X9: Required: Using the direct method of presentation, prepare the cash flows from the operating activities section of the statement of cash flows for the

> Omega prepares financial statements under International Financial Reporting Standards. In the year ended 31 March 20X7 the following transaction occurred. On 31 December 20X6 the directors decided to dispose of a property that was surplus to requirements

> The following trial balance has been extracted from the books of Hoodurz as at 31 March 2006: The following information is relevant: (i) The trial balance figures include the following amounts for a disposal group that has been classified as â

> Omega prepares financial statements under International Financial Reporting Standards. In the year ended 31 March 20X7 the following transaction occurred: Omega follows the revaluation model when measuring its property, plant and equipment. One of its pr

> Mr Norman set up a new business on 1 January 20X8. He invested €50,000 in the new business on that date. The following information is available. 1 Gross profit was 20% of sales. Monthly sales were as follows: Month ……………………………………Sales € January ……………………

> Sasha Parker is going to set up a new business on 1 January 20X1. She estimates that her first six months in business will be as follows: (i) She will put £150,000 into a bank account for the firm on 1 January 20X1. (ii) On 1 January 20X1 she will buy ma

> Phoenix plc’s trial balance at 30 June 20X7 was as follows: The following information is available: 1 Freehold premises acquired for £1.8 million were revalued in 20X4, recognising a gain of £600,000. These i

> Mr Norman is going to set up a new business in Singapore on 1 January 20X8. He will invest $150,000 in the business on that date and has made the following estimates and policy decisions: 1 Forecast sales (in units) made at a selling price of $50 per uni

> Kathryn plc, a listed company, provides a defined benefit pension for its staff, the details of which are given below. As at 30 April 2013, actuaries valued the company’s pension scheme and estimated that the scheme had assets of £10.5 million and obliga

> Sasha Parker is going to set up a new business in Bruges on 1 January 20X1. She estimates that her first six months in business will be as follows: (i) She will put €150,000 into the firm on 1 January 20X1. (ii) On 1 January 20X1 she will buy machinery €

> Gettry Doffit plc is an international company with worldwide turnover of £26 million. The activities of the company include the breaking down and disposal of noxious chemicals at a specialized plant in the remote Scottish countryside. During

> Springtime Ltd is a UK trading company buying and selling as wholesalers fashionable summer clothes. The following balances have been extracted from the books as at 31 March 20X4: Notes: 1 Depreciation is provided at the following annual rates on a str

> David Mark is a sole trader who owns and operates supermarkets in each of three villages near Ousby. He has drafted his own accounts for the year ended 31 May 20X4 for each of the branches. They are as follows: The figures for the year ended 31 May 20X

> The following items have been extracted from the accounts: Required: (a) Prepare a value added statement showing % for each year and % change. (b) Draft a note for inclusion in the annual report commenting on the statement you have prepared. 2005 (

> (a) Prepare a value added statement to be included in the corporate report of Hythe plc for the year ended 31 December 20X6, including the comparatives for 20X5, using the information given below: (b) Although value added statements were recommended by

> Wonder Kid Enterprises Company has produced the following results over the last three years: Management has just issued its annual report for 20XZ and a fair reading of their commentary is that the company has done very well because the trend in profit

> Geoworld Enterprises plc has the following information extracted from its statement of income and payroll systems: Each fulltime employees works double the hours of part time staff. Dividends paid to shareholders …â€&br

> Why is there a prohibition of auditors owning shares in client companies? Is this prohibition reasonable? Discuss.

> How is the relationship between the audit firm and the audit client different for: (a) the provision of statutory audit when the auditor reports to the shareholders; (b) the provision of consultancy services by audit firms?

> C plc wants to reward its directors for their service to the company and has designed a bonus package with two different elements as follows. The directors are informed of the scheme and granted any options on 1 January 20X7. 1 Share options over 300,000

> (a) Describe the value to the audit client of the audit firm providing consultancy services. (b) Why is it undesirable for audit firms to provide consultancy services to audit clients? (c) Why do audit firms want to continue to provide consultancy servic

> The board of White plc is discussing the filling of a vacant position arising from the death of Lord White. A list of possible candidates is as follows: (a) Lord Sperring, who is a well-known company director and who was the managing director of Sperring

> Conglomerate plc was a family company which was so successful that the founding Alexander family could not fully finance its expansion. So the company was floated on the Stock Exchange with the Alexander family holding ‘A’ class shares and the public hol

> The following is the draft trading and income statement of Parnell Ltd for the year ending 31 December 20X8: You are given the following additional information, which is reflected in the above statement of comprehensive income only to the extent stated

> Harvey Storm is chief executive of West Wing Savings and Loans. Harvey authorizes a loan to Middleman Properties secured on the land it is about to purchase. Middleman Properties has little money of its own. Middleman Properties subdivides the land and b

> Manufacturing Co. has been negotiating with Fred Paris regarding the sale of some property that represented an old manufacturing site which is now surplus to requirements. Because part of the site was used for manufacturing, it has to be decontaminated b

> Discuss the following issues with regard to financial reporting for risk: (a) How can a company identify and prioritize its key risks? (b) What actions can a company take to manage the risks identified in (a)? (c) How can a company measure risk?

> Briefly state: (i) the case for segmental reporting; (ii) the case against segmental reporting.

> Harry is about to start negotiations to purchase a controlling interest in NX, an unquoted limited liability company. The following is the statement of financial position of NX as at 30 June 2006, the end of the company’s most recent fi