Question: The following items may appear on a

The following items may appear on a bank statement:

1. Bank correction of an error from posting another customer’s check (disbursement) to the company’s account

2. EFT deposit

3. Loan proceeds

4. NSF check

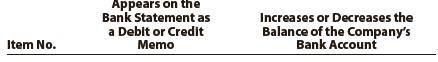

Using the following format, indicate whether each item would appear as a debit or credit memo on the bank statement and whether the item would increase or decrease the balance of the company’s account:

Transcribed Image Text:

Appears on the Bank Statement as a Debit or Credit Memo Increases or Decreases the Balance of the Company's Bank Account Item No.

> Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Jaffe Co. on February 28 by the retail method, presenting details o

> Data on the physical inventory of Katus Products Co. as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the invento

> Pappa’s Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. D

> The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. In Problem 7-1B The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending

> The following is an excerpt from a conversation between Mark Loomis and Krista Huff. Mark is debating whether to buy a stereo system from Tru-Sound Systems, a locally owned electronics store, or Wholesale Stereo, an online electronics company. Mark: Kris

> Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Celebrity Tan Co. on August 31 by the retail method, pres

> The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/

> Data on the physical inventory of Ashwood Products Company as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the i

> Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine t

> The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A. In Problem 7-1A The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period endin

> Beginning inventory, purchases, and sales data for prepaid cell phones for May are as follows: a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of merchandise sold for each sale and the inventory b

> Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form ill

> Beginning inventory, purchases, and sales data for portable game players are as follows: The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of the merchandise sold for each sale and the

> Hardcase Luggage Shop is a small retail establishment located in a large shopping mall. This shop has implemented the following procedures regarding inventory items: a. Because the shop carries mostly high-quality, designer luggage, all inventory items a

> Triple Creek Hardware Store currently uses a periodic inventory system. Kevin Carlton, the owner, is considering the purchase of a computer system that would make it feasible to switch to a perpetual inventory system. Kevin is unhappy with the periodic i

> Based on the following data, estimate the cost of the ending merchandise inventory: Sales …………………………………………………… $1,450,000 Estimated gross profit rate ………………………………. 42% Beginning merchandise inventory ……………. $ 100,000 Purchases (net) ………………………………………… 860

> The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers: Mar. 2. Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/1

> Based on the following data, estimate the cost of the ending merchandise inventory: Sales ………………………………………………… $9,250,000 Estimated gross profit rate ……………………………. 36% Beginning merchandise inventory ………… $ 180,000 Purchases (net) …………………………………… 5,945,000

> The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records: a. Estimate the cost of the merchandise destroyed. b. Briefly describe the situations in which the gross profit method is usef

> On the basis of the following data, estimate the cost of the merchandise inventory at June 30 by the retail method: Cost Retall June 1 Merchandise inventory $ 165,000 $ 275,000 June 1-30 Purchases (net) 2,361,500 3,800,000 June 1-30 Sales 3,550,000

> Kroger, Sprouts Farmers Market, Inc., and Whole Foods Markets, Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for these three companies indicated the f

> The following data (in millions) were taken from recent annual reports of Apple Inc., a manufacturer of personal computers and related products, and Mattel Inc., a manufacturer of toys, including Barbie®, Hot Wheels®, and Disney Cla

> Rustic Furniture Co. is owned and operated by Cam Pfeifer. The following is an excerpt from a conversation between Cam Pfeifer and Mitzi Wheeler, the chief accountant for Rustic Furniture Co. Cam: Mitzi, I’ve got a question about this recent balance shee

> During 20Y5, the accountant discovered that the physical inventory at the end of 20Y4 had been understated by $42,750. Instead of correcting the error, however, the accountant assumed that the error would balance out (correct itself) in 20Y5. Are there a

> Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 20Y8, Fonda Motorcycle Shop incorrectly counted its inventory as $337,500 instead of the correct amount

> Missouri River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y2, Missouri River Supply incorrectly counted its inventory as $233,400 instead of the correct amo

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. Inventory Item Inventory Quantity Cost per Unit Market Value per Unit (Net Realizable Va

> Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. a. In each space that follows, place the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. b. Why woul

> The following selected transactions were completed by Capers Company during October of the current year: Oct. 1. Purchased merchandise from UK Imports Co., $14,448, terms FOB destination, n/30. 3. Purchased merchandise from Hoagie Co., $9,950, terms FOB

> The units of an item available for sale during the year were as follows: There are 2,000 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by

> The units of an item available for sale during the year were as follows: There are 1,200 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by (a) The first-in, first-out meth

> Assume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustra

> Assume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustr

> Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 2019. Suzi is considering a proposal to increase net

> In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financia

> On April 18, 2019, Bontanica Company, a garden retailer, purchased $9,800 of seed, terms 2/10, n/30, from Whitetail Seed Co. Even though the discount period had expired, Shelby Davey subtracted the discount of $196 when he processed the documents for pay

> The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers: July 1. Sold merchandise on account to Landscapes Co., $33,450, terms FOB shippi

> The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co., $43,250, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $650 was added to the invoice. 5. Purchased

> On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkin

> Selected transactions for Essex Company during July of the current year are listed in Problem 6-3B. In Problem 6-3B The following were selected from among the transactions completed by Essex Company during July of the current year: July 3. Purchased mer

> Selected transactions for Niles Co. during March of the current year are listed in Problem 6-1B. In Problem 6-1B The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co

> An employee of JHT Holdings, Inc., a trucking company, was responsible for resolving roadway accident claims under $25,000. The employee created fake accident claims and wrote settlement checks of between $5,000 and $25,000 to friends or acquaintances ac

> Halibut Company purchased merchandise on account from a supplier for $18,600, terms 2/10, n/30. Halibut Company returned $5,000 of the merchandise and received full credit. a. If Halibut Company pays the invoice within the discount period, what is the am

> Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Apr. 15. Received $800 from Jean Tooley and wrote off the remainder owed of $1,200 as uncollectible. Aug. 7. Reinstated the account of Jean Too

> Beginning inventory, purchases, and sales for Item Widget are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) The cost of merchandise sold on March 25 and (b) The inventory on March 31.

> Can a business earn a gross profit but incur a net loss? Explain.

> The following three identical units of Item Beta are purchased during June: Assume that one unit is sold on June 27 for $110. Determine the gross profit for June and ending inventory on June 30 using the (a) First-in, first-out (FIFO); (b) Last-in, fir

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Oct. 2. Received $600 from Rachel Elpel and wrote off the remainder owed of $1,350 as uncollectible. Dec. 20. Reinstated the account of

> The following three identical units of Item A are purchased during April: Assume that one unit is sold on April 30 for $118. Determine the gross profit for April and ending inventory on April 30 using the (a) First-in, first-out (FIFO); (b)

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Apr. 15. Received $800 from Jean Tooley and wrote off the remainder owed of $1,200 as uncollectible. Aug. 7. Reinstated the account of J

> During the current year, merchandise is sold for $31,850,000. The cost of the merchandise sold is $24,206,000. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Freight Pald by Seller

> Beginning inventory, purchases, and sales for Item Foxtrot are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) The cost of merchandise sold on March 27 and (b) The inventory on March 31.

> United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger: Advertising Expense . . . . . . . . . . . . . . . . . .

> Identify the errors in the following schedule of the cost of merchandise sold for the year ended May 31, 2018: Cost of merchandise sold: Merchandise Inventory, May 31, 2018 Cost of merchandise purchased: $ 105,000 Purchases ... $1,110,000 Purchases

> Based on the following data, determine the cost of merchandise sold for July: Increase in estimated returns inventory ……………… $ 34,900 Merchandise inventory, July 1 ………….………………….. 190,850 Merchandise inventory, July 31 ………….………………… 160,450 Purchases ……………

> Based on the following data, determine the cost of merchandise sold for November: Increase in estimated returns inventory ……………………… $ 14,500 Merchandise inventory, November 1 …………………………….. 28,000 Merchandise inventory, November 30 …………………………… 31,500 Purc

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: Increase in estimated returns inventory …………………… $ 11,600 Merchandise inventory, May 1, 2018 ……………………….. 380,000 Merchandise inventory, Ap

> Selected transactions for Babcock Company during November of the current year are listed in Problem 6-3A. In Problem 6-3A The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3.

> The following selected transactions were completed by Air Systems Company during January of the current year. Air Systems Company uses the periodic inventory system. Jan. 2. Purchased $18,200 of merchandise on account, FOB shipping point, terms 2/15, n/3

> Selected transactions for Capers Company during October of the current year are listed in Problem 6-1A. In Problem 6-1A The following selected transactions were completed by Capers Company during October of the current year: Oct. 1. Purchased merchandi

> Kroger Co., a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: Total revenue …………………………………………….. $108,465 Total assets at end of year ………………………………. 30,556 Total assets at beginning of ye

> At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Using the aging method, the balance of Allowance for Doubtful Acco

> The Home Depot reported the following data (in millions) in its recent financial statements: a. Determine the asset turnover for The Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn concerning the trend in

> Journalize the following merchandise transactions: a. Sold merchandise on account, $72,500 with terms 2/10, n/30. The cost of the merchandise sold was $43,500. b. Received payment less the discount. c. Issued a credit memo for returned merchandise that w

> On July 31, 2019, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture wholesaler, are as follows: Prepare the July 31, 2019, closing entries for Serbian Interiors Company. $ 530,000 Accumulated Depr.-Build

> Based on the data presented in Exercise 6-25, journalize the closing entries. In Exercise 6-25 On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulate

> Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2019, are presented in Problem 6-5A. In Problem 6-5A The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fis

> Summary operating data for Custom Wire & Tubing Company during the year ended April 30, 2019, are as follows: cost of merchandise sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; an

> Identify the errors in the following income statement: Curbstone Company Income Statement For the Year Ended August 31, 2019 Sales... $8,595,000 Cost of merchandise sold 6,110,000 $2,485,000 Income from operations Expenses: Selling expenses . Admini

> On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantage

> One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter. Sales $463,400 (b) $1,295,000 (d) Cost of merchandise sold $410,000 $900,000 (a) 83,500 (c) 275

> The following expenses were incurred by a merchandising business during the year. In which expense section of the income statement should each be reported: (a) Selling, (b) Administrative, or (c) Other? 1. Advertising expense 2. Depreciation expense on s

> Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $1,000. b. The amount of cash in the petty cash fund is $315. Issued a check to replenish the fund, based on the following summary of petty cash receip

> For the fiscal year, sales were $191,350,000 and the cost of merchandise sold was $114,800,000. a. What was the amount of gross profit? b. If total operating expenses were $18,250,000, could you determine net income? c. Is Customer Refunds Payable an ass

> Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2019. Zell Company provides customers a refund for any returned or damaged merchandise. At the end of the year, Z

> At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Bad debt expense is estimated at ¾ of 1% of sales. Determine (a) T

> Assume the following data for Oshkosh Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer refunds and allowances b. Estimated customer returns Unadjusted Balances Debit Credit Sales $51

> Paragon Tire Co.’s perpetual inventory records indicate that $2,780,000 of merchandise should be on hand on March 31, 2019. The physical inventory indicates that $2,734,800 of merchandise is actually on hand. Journalize the adjusting entry for the invent

> The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner’s equi

> Journalize the entries to record the following selected transactions: a. Sold $62,800 of merchandise on account, subject to a sales tax of 5%. The cost of the merchandise sold was $37,500. b. Paid $39,650 to the state sales tax department for taxes colle

> The following selected transactions were completed during August between Summit Company and Beartooth Co.: Aug. 1. Summit Company sold merchandise on account to Beartooth Co., $48,000, terms FOB destination, 2/15, n/eom. The cost of the merchandise sold

> Based on the data presented in Exercise 6-14, journalize Balboa Co.’s entries for (a) The purchase, (b) The return of the merchandise for credit, and (c) The payment of the invoice. In Exercise 6-14 Showcase Co., a furniture wholesaler, sells merchandis

> Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $254,500, terms n/30. The cost of the merchandise sold is $152,700. Showcase Co. issues a credit memo for $30,000 for merchandise returned prior to Balboa Co. paying the or

> Beginning inventory, purchases, and sales for Meta-B1 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) The weighted average unit cost after the July 23 purchase, (b) The cost of the merchandise

> Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

> The debits and credits for four related entries for a purchase of $40,000, terms 2/10, n/30, are presented in the following T accounts. Describe each transaction. Cash Accounts Payable (2) 450 (3) 4,900 (1) 39,200 (4) 34,300 (4) 34,300 Merchandise I

> The debits and credits for four related entries for a sale of $15,000, terms 1/10, n/30, are presented in the following T accounts. Describe each transaction. Cash Sales (5) 13,860 (1) 14,850 Accounts Receivable Cost of Merchandise Sold (1) 14,850 (

> The following data were gathered to use in reconciling the bank account of Torres Company: Balance per bank ………………………………………. $12,175 Balance per company records ………………………. 9,480 Bank service charges ………………………………………… 50 Deposit in transit …………………………………………

> After the amount due on a sale of $28,000, terms 2/10, n/eom, is received from a customer within the discount period, the seller consents to the return of the entire shipment for a cash refund. The cost of the merchandise returned was $16,800. (a) What i

> Financial statement data for years ending December 31 for Davenport Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an

> Financial statement data for years ending December 31 for DePuy Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unf

> Journalize the entries for the following transactions: a. Sold merchandise for cash, $116,300. The cost of the merchandise sold was $72,000. b. Sold merchandise on account, $755,000. The cost of the merchandise sold was $400,000. c. Sold merchandise to c

> Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow: a. Determine the asset turnover for 2019 and 2018. b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable trend?

> On December 31, it was estimated that goodwill of $4,000,000 was impaired. In addition, a patent with an estimated useful economic life of 15 years was acquired for $900,000 on August 1. a. Journalize the adjusting entry on December 31 for the impaired g

> What is the meaning of (a) 1/15, n/60; (b) n/30; (c) n/eom?

> Financial statement data for years ending December 31 for Tango Company follow: a. Determine the inventory turnover for 20Y7 and 20Y6. b. Determine the days’ sales in inventory for 20Y7 and 20Y6. Use 365 days and round to one decimal

> Financial statement data for years ending December 31, 2019 and 2018, for Latchkey Company follow: a. Determine the asset turnover for 2019 and 2018. b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable tren

> On December 31, it was estimated that goodwill of $6,000,000 was impaired. In addition, a patent with an estimated useful economic life of 12 years was acquired for $1,500,000 on April 1. a. Journalize the adjusting entry on December 31 for the impaired

> Financial statement data for years ending December 31 for Holland Company follow: a. Determine the inventory turnover for 20Y4 and 20Y3. b. Determine the days’ sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decima