Question: The merchandise inventory was destroyed by fire

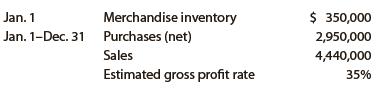

The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records:

a. Estimate the cost of the merchandise destroyed.

b. Briefly describe the situations in which the gross profit method is useful.

Transcribed Image Text:

Jan. 1 Merchandise inventory $ 350,000 Jan. 1-Dec. 31 Purchases (net) 2,950,000 Sales 4,440,000 Estimated gross profit rate 35%

> An accounting clerk for Chesner Co. prepared the following bank reconciliation: a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., using the format shown in the illustrative problem. b. If a balance sheet i

> Using the data presented in Exercise 8-18, journalize the entry or entries that should be made by the company. In Exercise 8-18 The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: 1. Cash balance accordin

> The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: 1. Cash balance according to the company’s records at July 31, $32,110. 2. Cash balance according to the bank statement at July 31, $31,350. 3. Checks ou

> Which of the reconciling items listed in Exercise 8-16 require an entry in the company’s accounts? In Exercise 8-16 1. Bank service charges, $30. 2. Check of a customer returned by bank to company because of insufficient funds, $400. 3. Check for $320 i

> Identify each of the following reconciling items as: (a) An addition to the cash balance according to the bank statement, (b) A deduction from the cash balance according to the bank statement, (c) An addition to the cash balance according to the company’

> Paragon Tech Company, a communications equipment manufacturer, recently fell victim to a fraud scheme developed by one of its employees. To understand the scheme, it is necessary to review Paragon Tech’s procedures for the purchase of services. The purch

> Abbe Co. is a small merchandising company with a manual accounting system. An investigation revealed that in spite of a sufficient bank balance, a significant amount of available cash discounts had been lost because of failure to make timely payments. In

> Sergio Flores works at the drive-through window of Big & Bad Burgers. Occasionally, when a drive-through customer orders, Sergio fills the order and pockets the customer’s money. He does not ring up the order on the cash register. Identify the internal c

> The ticket seller at a movie theater doubles as a ticket taker for a few minutes each day while the ticket taker is on a break. Which control procedure of a business’s system of internal control is violated in this situation?

> Before inventory purchases are recorded, the receiving report should be reconciled to what documents?

> (a) Name and describe the five elements of internal control. (b) Is any one element of internal control more important than another?

> The following selected transactions were completed during April between Swan Company and Bird Company: Apr. 2. Swan Company sold merchandise on account to Bird Company, $32,000, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $330, whi

> Knott Inc. has a petty cash fund of $750. (a) Since the petty cash fund is only $750, should Knott Inc. implement controls over petty cash? (b) What controls, if any, could be used for the petty cash fund?

> What is the purpose of preparing a bank reconciliation?

> Assume that Brooke Miles, accounts payable clerk for West Coast Design Inc., stole $48,350 by paying fictitious invoices for goods that were never received. The clerk set up accounts in the names of the fictitious companies and cashed the checks at a loc

> In teams, select a public company in the merchandising industry that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It i

> Anstead Co. is experiencing a decrease in sales and operating income for the fiscal year ending October 31. Ryan Frazier, controller of Anstead Co., has suggested that all orders received before the end of the fiscal year be shipped by midnight, October

> Sizemo Elektroniks sells semiconductors that are used in games and small toys. The company has been extremely successful in recent years, recording an increase in earnings each of the past six quarters. At the end of the current quarter, Jay Shulz, the c

> The general merchandise retail industry has a number of segments represented by the following companies: Company Name ______________Merchandise Concept Costco Wholesale Corporation ………â

> Target Corp. sells merchandise primarily through its retail stores. On the other hand, Amazon.com uses its e-commerce services, features, and technologies to sell its products through the Internet. Recent balance sheet inventory disclosures for Target an

> Margie Johnson is a staff accountant at ToolEx Company, a manufacturer of tools and equipment. The company is under pressure from investors to increase earnings, and the president of the company expects the accounting department to “make this happen.” Ma

> The following is an excerpt from a conversation between Paula Marlo, the warehouse manager for Musick Foods Wholesale Co., and its accountant, Mike Hayes. Musick Foods operates a large regional warehouse that supplies produce and other grocery products t

> Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Purchases: Sales: April …………â&#

> The following were selected from among the transactions completed by Essex Company during July of the current year: July 3. Purchased merchandise on account from Hamling Co., list price $72,000, trade discount 15%, terms FOB shipping point, 2/10, n/30, w

> The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. In Problem 7-1B The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending

> The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. In Problem 7-1B The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending

> The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Instructions 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory reco

> Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Jaffe Co. on February 28 by the retail method, presenting details o

> Data on the physical inventory of Katus Products Co. as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the invento

> Pappa’s Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. D

> The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. In Problem 7-1B The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending

> The following is an excerpt from a conversation between Mark Loomis and Krista Huff. Mark is debating whether to buy a stereo system from Tru-Sound Systems, a locally owned electronics store, or Wholesale Stereo, an online electronics company. Mark: Kris

> Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Celebrity Tan Co. on August 31 by the retail method, pres

> The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/

> Data on the physical inventory of Ashwood Products Company as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the i

> Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine t

> The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A. In Problem 7-1A The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period endin

> Beginning inventory, purchases, and sales data for prepaid cell phones for May are as follows: a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of merchandise sold for each sale and the inventory b

> Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form ill

> Beginning inventory, purchases, and sales data for portable game players are as follows: The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of the merchandise sold for each sale and the

> Hardcase Luggage Shop is a small retail establishment located in a large shopping mall. This shop has implemented the following procedures regarding inventory items: a. Because the shop carries mostly high-quality, designer luggage, all inventory items a

> Triple Creek Hardware Store currently uses a periodic inventory system. Kevin Carlton, the owner, is considering the purchase of a computer system that would make it feasible to switch to a perpetual inventory system. Kevin is unhappy with the periodic i

> Based on the following data, estimate the cost of the ending merchandise inventory: Sales …………………………………………………… $1,450,000 Estimated gross profit rate ………………………………. 42% Beginning merchandise inventory ……………. $ 100,000 Purchases (net) ………………………………………… 860

> The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers: Mar. 2. Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/1

> Based on the following data, estimate the cost of the ending merchandise inventory: Sales ………………………………………………… $9,250,000 Estimated gross profit rate ……………………………. 36% Beginning merchandise inventory ………… $ 180,000 Purchases (net) …………………………………… 5,945,000

> On the basis of the following data, estimate the cost of the merchandise inventory at June 30 by the retail method: Cost Retall June 1 Merchandise inventory $ 165,000 $ 275,000 June 1-30 Purchases (net) 2,361,500 3,800,000 June 1-30 Sales 3,550,000

> Kroger, Sprouts Farmers Market, Inc., and Whole Foods Markets, Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for these three companies indicated the f

> The following data (in millions) were taken from recent annual reports of Apple Inc., a manufacturer of personal computers and related products, and Mattel Inc., a manufacturer of toys, including Barbie®, Hot Wheels®, and Disney Cla

> Rustic Furniture Co. is owned and operated by Cam Pfeifer. The following is an excerpt from a conversation between Cam Pfeifer and Mitzi Wheeler, the chief accountant for Rustic Furniture Co. Cam: Mitzi, I’ve got a question about this recent balance shee

> During 20Y5, the accountant discovered that the physical inventory at the end of 20Y4 had been understated by $42,750. Instead of correcting the error, however, the accountant assumed that the error would balance out (correct itself) in 20Y5. Are there a

> Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 20Y8, Fonda Motorcycle Shop incorrectly counted its inventory as $337,500 instead of the correct amount

> Missouri River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y2, Missouri River Supply incorrectly counted its inventory as $233,400 instead of the correct amo

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. Inventory Item Inventory Quantity Cost per Unit Market Value per Unit (Net Realizable Va

> Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. a. In each space that follows, place the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. b. Why woul

> The following selected transactions were completed by Capers Company during October of the current year: Oct. 1. Purchased merchandise from UK Imports Co., $14,448, terms FOB destination, n/30. 3. Purchased merchandise from Hoagie Co., $9,950, terms FOB

> The units of an item available for sale during the year were as follows: There are 2,000 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by

> The units of an item available for sale during the year were as follows: There are 1,200 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by (a) The first-in, first-out meth

> Assume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustra

> Assume that the business in Exercise 7-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustr

> Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 2019. Suzi is considering a proposal to increase net

> In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financia

> On April 18, 2019, Bontanica Company, a garden retailer, purchased $9,800 of seed, terms 2/10, n/30, from Whitetail Seed Co. Even though the discount period had expired, Shelby Davey subtracted the discount of $196 when he processed the documents for pay

> The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers: July 1. Sold merchandise on account to Landscapes Co., $33,450, terms FOB shippi

> The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co., $43,250, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $650 was added to the invoice. 5. Purchased

> On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkin

> Selected transactions for Essex Company during July of the current year are listed in Problem 6-3B. In Problem 6-3B The following were selected from among the transactions completed by Essex Company during July of the current year: July 3. Purchased mer

> Selected transactions for Niles Co. during March of the current year are listed in Problem 6-1B. In Problem 6-1B The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co

> An employee of JHT Holdings, Inc., a trucking company, was responsible for resolving roadway accident claims under $25,000. The employee created fake accident claims and wrote settlement checks of between $5,000 and $25,000 to friends or acquaintances ac

> Halibut Company purchased merchandise on account from a supplier for $18,600, terms 2/10, n/30. Halibut Company returned $5,000 of the merchandise and received full credit. a. If Halibut Company pays the invoice within the discount period, what is the am

> Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Apr. 15. Received $800 from Jean Tooley and wrote off the remainder owed of $1,200 as uncollectible. Aug. 7. Reinstated the account of Jean Too

> The following items may appear on a bank statement: 1. Bank correction of an error from posting another customer’s check (disbursement) to the company’s account 2. EFT deposit 3. Loan proceeds 4. NSF check Using the fo

> Beginning inventory, purchases, and sales for Item Widget are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) The cost of merchandise sold on March 25 and (b) The inventory on March 31.

> Can a business earn a gross profit but incur a net loss? Explain.

> The following three identical units of Item Beta are purchased during June: Assume that one unit is sold on June 27 for $110. Determine the gross profit for June and ending inventory on June 30 using the (a) First-in, first-out (FIFO); (b) Last-in, fir

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Oct. 2. Received $600 from Rachel Elpel and wrote off the remainder owed of $1,350 as uncollectible. Dec. 20. Reinstated the account of

> The following three identical units of Item A are purchased during April: Assume that one unit is sold on April 30 for $118. Determine the gross profit for April and ending inventory on April 30 using the (a) First-in, first-out (FIFO); (b)

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Apr. 15. Received $800 from Jean Tooley and wrote off the remainder owed of $1,200 as uncollectible. Aug. 7. Reinstated the account of J

> During the current year, merchandise is sold for $31,850,000. The cost of the merchandise sold is $24,206,000. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Freight Pald by Seller

> Beginning inventory, purchases, and sales for Item Foxtrot are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) The cost of merchandise sold on March 27 and (b) The inventory on March 31.

> United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger: Advertising Expense . . . . . . . . . . . . . . . . . .

> Identify the errors in the following schedule of the cost of merchandise sold for the year ended May 31, 2018: Cost of merchandise sold: Merchandise Inventory, May 31, 2018 Cost of merchandise purchased: $ 105,000 Purchases ... $1,110,000 Purchases

> Based on the following data, determine the cost of merchandise sold for July: Increase in estimated returns inventory ……………… $ 34,900 Merchandise inventory, July 1 ………….………………….. 190,850 Merchandise inventory, July 31 ………….………………… 160,450 Purchases ……………

> Based on the following data, determine the cost of merchandise sold for November: Increase in estimated returns inventory ……………………… $ 14,500 Merchandise inventory, November 1 …………………………….. 28,000 Merchandise inventory, November 30 …………………………… 31,500 Purc

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: Increase in estimated returns inventory …………………… $ 11,600 Merchandise inventory, May 1, 2018 ……………………….. 380,000 Merchandise inventory, Ap

> Selected transactions for Babcock Company during November of the current year are listed in Problem 6-3A. In Problem 6-3A The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3.

> The following selected transactions were completed by Air Systems Company during January of the current year. Air Systems Company uses the periodic inventory system. Jan. 2. Purchased $18,200 of merchandise on account, FOB shipping point, terms 2/15, n/3

> Selected transactions for Capers Company during October of the current year are listed in Problem 6-1A. In Problem 6-1A The following selected transactions were completed by Capers Company during October of the current year: Oct. 1. Purchased merchandi

> Kroger Co., a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: Total revenue …………………………………………….. $108,465 Total assets at end of year ………………………………. 30,556 Total assets at beginning of ye

> At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Using the aging method, the balance of Allowance for Doubtful Acco

> The Home Depot reported the following data (in millions) in its recent financial statements: a. Determine the asset turnover for The Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn concerning the trend in

> Journalize the following merchandise transactions: a. Sold merchandise on account, $72,500 with terms 2/10, n/30. The cost of the merchandise sold was $43,500. b. Received payment less the discount. c. Issued a credit memo for returned merchandise that w

> On July 31, 2019, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture wholesaler, are as follows: Prepare the July 31, 2019, closing entries for Serbian Interiors Company. $ 530,000 Accumulated Depr.-Build

> Based on the data presented in Exercise 6-25, journalize the closing entries. In Exercise 6-25 On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulate

> Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2019, are presented in Problem 6-5A. In Problem 6-5A The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fis

> Summary operating data for Custom Wire & Tubing Company during the year ended April 30, 2019, are as follows: cost of merchandise sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; an

> Identify the errors in the following income statement: Curbstone Company Income Statement For the Year Ended August 31, 2019 Sales... $8,595,000 Cost of merchandise sold 6,110,000 $2,485,000 Income from operations Expenses: Selling expenses . Admini

> On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantage

> One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter. Sales $463,400 (b) $1,295,000 (d) Cost of merchandise sold $410,000 $900,000 (a) 83,500 (c) 275

> The following expenses were incurred by a merchandising business during the year. In which expense section of the income statement should each be reported: (a) Selling, (b) Administrative, or (c) Other? 1. Advertising expense 2. Depreciation expense on s