Question: The following list includes a series of

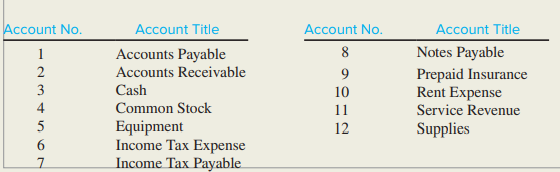

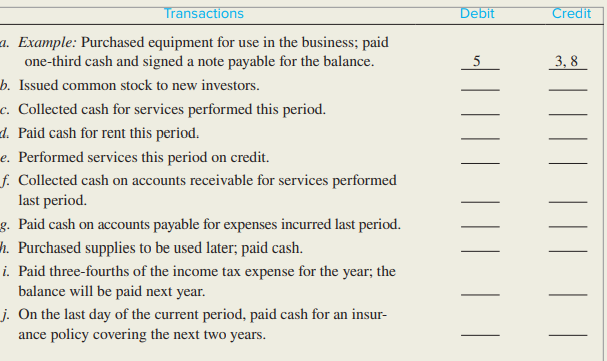

The following list includes a series of accounts for B-ball Corporation, which has been operating for three years. These accounts are listed alphabetically and numbered for identification. Following the accounts is a series of transactions. For each transaction, indicate the account(s) that should be debited and credited by entering the appropriate account number(s) to the right of each transaction. If no journal entry is needed, write none after the transaction. The first transaction is used as an example. TIP: In transaction (h), remember what the expense recognition principle says. TIP: Think of transaction ( i ) as two transactions: (1) incur expenses and liability and (2) pay part of the liability

> Worldwide Company obtained a charter from the state in January that authorized 200,000 shares of common stock, $10 par value. During the first year, the company earned $38,200, declared no dividends, and the following selected transactions occurred in th

> The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2018. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The followi

> Complete the requirements of CP10-6, assuming Southwest Corporation uses simplified effectiveinterest amortization shown in Chapter Supplement 10C. Data from CP10-6: Southwest Corporation issued bonds with the following details: The annual accounting

> Complete the requirements of CP10-6, assuming Southwest Corporation uses effective-interest amortization. Data from CP10-6: Southwest Corporation issued bonds with the following details: The annual accounting period ends December 31. The bonds were is

> Southwest Corporation issued bonds with the following details: The annual accounting period ends December 31. The bonds were issued at 104 on January 1, 2018, when the market interest rate was 8 percent. Assume the company uses straight-line amortizatio

> Brunswick Corporation is a multinational company that manufactures and sells marine and recreational products. A prior annual report contained the following information: Required: If Brunswick recorded a liability for $133.2 million (3 × $

> Sikes Corporation, whose annual accounting period ends on December 31, issued the following bonds: Required: 1. For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2018, financial statements immedia

> Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $43,000 on October 1. The equipment has an estimated residual value of $3,000 and an estimated useful life of five years or 20,

> What are some of the methods for restricting access?

> Riverside Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($130,000), payroll deductions for income tax ($13,000), payro

> Using data from CP10-1, complete the following requirements. Required: 1. Prepare journal entries for each of the transactions through December 20. 2. Prepare any adjusting entries required on December 31. 3. Show how all of the liabilities arising

> Hondor Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2018. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The following sch

> EZ Curb Company completed the following transactions. The annual accounting period ends December 31. Required: 1. For each listed transaction and related adjusting entry, indicate the accounts, amounts, and effects (+ for increase, −

> Palmer Cook Music Productions manages and operates two bands. The company entered into the following transactions during a recent year. Required: 1. Analyze the accounting equation effects and record journal entries for each of the transactions. TIP: G

> During the current year, Martinez Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 2 for $20,000 ca

> At the beginning of the year, Young Company bought three used machines from Vince, Inc. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. B

> Mattel, Inc., and Hasbro are two of the largest and most successful toymakers in the world, in terms of the products they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following inform

> Execusmart Consultants has provided business consulting services for several years. The company has been using the percentage of credit sales method to estimate bad debts but switched at the end of the first quarter this year to the aging of accounts rec

> A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of four years. The company uses double-declining-balance depreciation. Calculate its book value at the end of year 3. Round to the nearest dollar.

> Jung & Newbicalm Advertising (JNA) recently hired a new creative director, Howard Rachell, for its Madison Avenue office in New York. To persuade Howard to move from San Francisco, JNA agreed to advance him $100,000 on April 30, 2018, on a one-year, 10 p

> Why should responsibilities for certain duties, like cash handling and cash recording, be separated? What types of responsibilities should be separated?

> Callaway Golf Company sells on account to golf pro shops and general sporting goods retailers. In its financial statements for the year ended December 31, 2015, Callaway reported the following balances and changes in the Allowance for Doubtful Accounts (

> Red Hat, Inc., is a software development company that recently reported the following amounts (in thousands) in its unadjusted trial balance as of February 29, 2016. Required: 1. Assume Red Hat uses ¼ of 1 percent of revenue to estimate i

> Partial income statements for Murphy & Murphy (M & M) reported the following summarized amounts: After these amounts were reported, M & M’s accountant determined the inventory at the end of Quarter 2 was understated by $3,0

> Using the information in CP7-1, calculate the Cost of Goods Sold and Ending Inventory for Scrappers Supplies assuming it applies the LIFO cost method perpetually at the time of each sale. Compare these amounts to the periodic LIFO calculations in require

> GameStop Corp. is the world’s largest multichannel video game retailer. The company reported the following amounts (in millions) in its annual financial statements at the end of January. Required: 1. Determine the inventory turnover r

> Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary income statement follows:

> Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the f

> Frigid Supplies reported beginning inventory of 200 units, for a total cost of $2,000. The company had the following transactions during the month: Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. 2. P

> A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of 20,000 machine hours. The company uses units-of-production depreciation and ran the machine 3,000 hours in year 1, 8,000 hours in year 2, and 6,000 ho

> Psymon Company, Inc., sells construction equipment. The annual fiscal period ends on December 31. The following adjusted trial balance was created from the general ledger accounts on December 31: Required: 1. Prepare a multistep income statement that w

> Great American Oilchange (GAO) sells a combined oil change service and parts package for $30. A customer who supplies the parts (oil and filter) is charged $20 for only the service, whereas a customer who buys only the oil and filter (for do-it-yourself

> Why is it a good idea to assign each task to only one employee?

> Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $152,070). $275,000 b. Received merchandis

> Use the information in CP6-1 to complete the following requirements. Required: 1. For each of the events (a) through (c), indicate the amount and direction of the effect (+ for increase, − for decrease, and NE for no effect) on Amalga

> The transactions listed below are typical of those involving Amalgamated Textiles and American Fashions. Amalgamated is a wholesale merchandiser and American Fashions is a retail merchandiser. Assume all sales of merchandise from Amalgamated to American

> Superior Cabinets maintains a petty cash fund for minor business expenditures. The petty cash custodian, Mo Smith, describes the events that occurred during the last two months: a. I established the fund by cashing a Superior Cabinets check for $300 mad

> The August bank statement and cash T-account for Martha Company follow: No deposits were in transit and no checks were outstanding at the end of July. Required: 1. Identify and list the deposits in transit at the end of August. TIP: Put a check mark

> The April 30 bank statement for KMaxx Company and the April ledger account for cash are summarized here: No outstanding checks and no deposits in transit were noted in March. However, there are deposits in transit and checks outstanding at the end of Ap

> The following procedures are used by Richardson Light Works. a. When customers pay cash for lighting products, the cash is placed in a cash register and a receipt is issued to the customer. b. At the end of each day, the cash is counted by the cashier

> A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of four years. The company uses straight-line depreciation. Calculate its book value at the end of year 3.

> Golf Academy, Inc., provides private golf lessons. Its unadjusted trial balance at December 31, 2018, follows, along with information about selected accounts. Required: 1. Calculate the (preliminary) unadjusted net income for the year ended December 31

> Indicate the effects (account, amount, and direction) of each adjusting journal entry. Use + for increase, − for decrease, and NE for no effect. Provide an appropriate account name for any revenue and expense effects. TIP: The first tr

> Jordan Company’s annual accounting year ends on December 31. It is now December 31, 2018, and all of the 2018 entries have been made except for the following: a. The company owes interest of $700 on a bank loan. The interest will be paid when the loan i

> What are three categories of employee fraud? Which is most common? Which is associated with the largest losses?

> The following is a list of accounts and amounts reported for Rollcom, Inc., for the fiscal year ended September 30, 2018. The accounts have normal debit or credit balances Required: 1. Prepare an adjusted trial balance at September 30, 2018. Is the Reta

> Lakewood Tennis Club (LTC) operates an indoor tennis facility. The company charges a $150 annual membership fee plus a member rental rate of $20 per court per hour. LTC’s fiscal year-end is August 31. LTC’s revenue recognition policy is described in its

> Barbara Jones opened Barb’s Book Business on February 1. You have been hired to maintain the company’s financial records. The following transactions occurred in February, the first month of operations. a. Received shareholders’ cash contributions on Feb

> Ryan Olson organized a new company, MeToo, Inc. The company provides networking management services on social network sites. You have been hired to record the following transactions. a. May 1: Issued 1,000 shares of common stock to investors for $30 per

> Performance Plastics Company (PPC) has been operating for three years. The beginning account balances are During the year, the company had the following summarized activities: a. Purchased equipment that cost $21,000; paid $5,000 cash and signed a two-

> For each of the following items, enter the correct letter to show whether the expenditure should be capitalized (C) or expensed (E)

> Athletic Performance Company (APC) was incorporated as a private company. The company’s accounts included the following at July 1: During the month of July, the company had the following activities: a. Issued 2,000 shares of common st

> Ag Bio Tech (ABT) was organized on January 1 by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,000 shares of common stock. To date, they are the only stockholders. During the first month (January), the company had

> 1. Did Fitbit rely more on creditors or stockholders for its financing at October 1, 2016? What is your information source? 2. Was the stockholders’ equity at October 1, 2016, comprised more of contributions made by stockholders direct

> Fitbit, Inc., reported the following information for the nine-month period ended October 1, 2016. Items are listed alphabetically and are in thousands of dollars. Required: Prepare the four basic financial statements for the nine months ended October 1

> Using the information in question 8, determine the amounts and accounts that will be reported on the January31 balance sheet and the income statement for the month ended January 31.

> Refer to CP1-1. Required: 1. Was the company profitable? Which financial statement provides the information to answer this question? 2. Did the company’s dividends exceed its net income? Which financial statement provides the informa

> Assume you are the president of Nuclear Company. At the end of the first year of operations (December 31), the following financial data for the company are available: Required: 1. Prepare an income statement for the year ended December 31. TIP: Begin b

> Bart Company had outstanding 30,000 shares of common stock, par value $10 per share. On January 1, 2018, Homer Company purchased some of these shares at $25 per share. At the end of 2018, Bart Company reported the following: net income, $50,000, and cash

> On each December 31, you plan to transfer $2,000 from your checking account into an investment account. The investment account will earn 4 percent annual interest, which will be added to the account balance at each year-end. The first deposit will be mad

> On January 1, Alan King decided to transfer an amount from his checking account into an investment account that later will provide $80,000 to send his son to college (four years from now). The investment account will earn 8 percent, which will be added t

> What is the difference between Accounts Receivable and Revenue?

> On January 1, you deposited $6,000 in an investment account. The account will earn 10 percent annual compound interest, which will be added to the fund balance at the end of each year. Required: (round to the nearest dollar): 1. What will be the bala

> Procter & Gamble (P&G) manufactures and markets many products you use every day. In 2016, sales for the company were $65,300 (all amounts in millions). The annual report did not report the amount of credit sales, so we will assume tha

> Cintas Corporation is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2016 fiscal year, the company reported sales revenue of $4.9 billion and Cost of Goods Sold of $2.1 billion. Required: Ass

> Double West Suppliers (DWS) reported sales for the year of $300,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Required: 1. Compute the turnover ratios for accounts receivable and inventory (ro

> Match each ratio or percentage with its formula by entering the appropriate letter for each numbreed item

> On December 31, a company makes a $9,000 payment for renting a warehouse in January, February, and March of the following year. Show the accounting equation effects of the transaction on December 31, as well as the adjustments required on January 31, Feb

> Use the information in E13-3 to complete the following requirement. Required: Compute the times interest earned ratios for 2016 and 2015. In your opinion, does Computer Tycoon generate sufficient net income (before taxes and interest) to cover the cos

> Use the information in E13-3 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2015 to 2016 is the beginning of a sustained trend, is Co

> According to the producer price index database maintained by the Bureau of Labor Statistics, the average cost of computer equipment fell 3.8 percent between January and December 2016. Let’s see whether these changes are reflected in the

> Use the information for Chevron Corporation in E13-1 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2014 to 2015 is the beginning of

> American Golf Corporation operates golf courses throughout the country. For each of the following items, enter the correct letter to show whether the cost should be capitalized (C) or expensed (E).

> Company A uses the FIFO method to cost inventory and Company B uses the LIFO method. The two companies are exactly alike except for the difference in inventory costing methods. Costs of inventory items for both companies have been falling steadily in rec

> A company has current assets that total $500,000, has a current ratio of 2.00, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,000 in merchandise on short-term credit for $15,000, (2) decla

> Good Sports, Inc., is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $88,000 and its current ratio was 1.75, and then completed the following transactions: (1) paid $6,000 on accounts payable,

> In its most recent annual report, Sunrise Enterprises reported current assets of $1,090,000 and current liabilities of $602,000. Required: Determine for each of the following transactions whether the current ratio, and each of its two components, for

> Dollar General Corporation operates general merchandise stores that feature quality merchandise at low prices to meet the needs of middle-, low-, and fixed-income families in southern, eastern, and mid we stern states. For the year ended January 29, 201

> The average price of a gallon of gas in 2015 dropped $0.94 (28 percent) from $3.34 in 2014 (to $2.40 in 2015). Let’s see whether these changes are reflected in the income statement of Chevron Corporation for the year ended December 31,

> What is an adjusted trial balance? What is its purpose?

> New Vision Company completed its income statement and balance sheet and provided the following information: Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the indirect method. 2. Of th

> Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet

> Suppose your company reports $160 of net income and $40 of cash dividends paid, and its comparative balance sheet indicates the following. Required: 1. Prepare the operating activities section of the statement of cash flows, using the indirect method.

> Plummer Industries purchased a machine for $43,800 and is depreciating it with the straight-line method over a life of 8 years, using a residual value of $3,000. At the beginning of the sixth year, an extraordinary repair was made costing $7,500, the est

> Suppose your company sells goods for $300, of which $200 is received in cash and $100 is on account. The goods cost your company $125 and were paid for in a previous period. Your company also recorded salaries and wages of $70, of which only $30 has been

> Suppose your company sells services of $150 in exchange for $120 cash and $30 on account. Depreciation of $50 relating to equipment also is recorded. Required: 1. Show the journal entries to record these transactions. 2. Calculate the amount that shou

> Suppose your company sells services for $325 cash this month. Your company also pays $100 in salaries and wages, which includes $15 that was payable at the end of the previous month and $85 for salaries and wages of this month. Required: 1. Show the j

> Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year: • Purchased a long-term investment for cash, $15,000. • Paid cash dividend, $12,000. â&#

> During the period, Teen’s Trends sold some excess equipment at a loss. The following information was collected from the company’s accounting records: No new equipment was bought during the period Required: For the eq

> Cedar Fair operates amusement parks in the United States and Canada. During a recent year, it reported the following (in millions): Equipment costing $120 was purchased during the year. Required: For the equipment that was disposed of during the year

> Refer back to the information given for E12-10, plus the following summarized income statement for Pizza International, Inc. (in millions): Required: 1. Based on this information, compute cash flow from operating activities using the direct method. Ass

> Explain the differences between depreciation expense and accumulated depreciation

> Suppose your company sells services of $180 in exchange for $110 cash and $70 on account. Required: 1. Show the journal entry to record this transaction. 2. Identify the amount that should be reported as net cash flow from operating activities. 3. I

> Refer to the information for New Vision Company in E12-9. Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the direct method. Assume that Accounts Payable relate to Utilities and Office

> Saskatchewan Forestry Company purchased a timber tract for $600,000 and estimates that it will be depleted evenly over its 10-year useful life with no residual value. Show the journal entry that would be recorded if 10 percent of the total timber is cut

> To compare statement of cash flows reporting under the direct and indirect methods, enter check marks to indicate which line items are reported on the statement of cash flows with each method.

> The Walt Disney Company reported the following in its 2016 annual report (in millions): Required: 1. Note that in all three years, net cash provided by operating activities is greater than net income. Given the above information and what you know about

> Gibraltar Industries, Inc., is a manufacturer of steel products for customers such as Home Depot, Lowe’s, Chrysler, Ford, and General Motors. In the year ended December 31, 2016, it reported the following activities: Required: Based o

> Rowe Furniture Corporation is a Virginia-based manufacturer of furniture. In a recent quarter, it reported the following activities: Required: Based on this information, present the cash flows from investing and financing activities sections of the ca

> The following information was reported by three companies. When completing the requirements, assume that any and all purchases on account are for inventory. Required: 1. What amount did each company deduct on the income statement related to inventory?