Question: The following table describes the number of

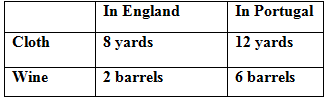

The following table describes the number of yards of cloth and barrels of wine that can be produced with a week’s worth of labor in England and Portugal. Assume that no other inputs are needed.

a. If there is no trade, what is the price of wine in terms of cloth in England?

b. If there is no trade, what is the price of wine in terms of cloth in Portugal?

c. Suppose each country has 1 million weeks of labor available per year. Draw the production possibilities frontier for each country.

d. Which country has an absolute advantage in the production of which good(s)? Which country has a comparative advantage in the production of which good(s)?

e. If the countries start trading with each other, which country will specialize and export which good?

f. What can be said about the price at which trade will take place?

> Suppose real GDP is $10,000 billion and the basic expenditure multiplier is two. If two tax changes are made at the same time: a. fixed taxes are raised by $100 billion b. the income-tax rate is reduced from 20 percent to 18 percent will equilibrium GDP

> Explain why the best educational policies to promote faster growth might be different in the following countries. a. Mozambique b. Brazil c. France

> The previous chapter pointed out that, because faster capital formation comes at a cost (reduced current consumption), it is possible for a country to invest too much. Suppose the government of some country decides that its businesses are investing too m

> Explain the different objectives of (long-run) growth policy versus (short-run) stabilization policy.

> Show why each of the following complaints is based on a misunderstanding about inflation: a. “Inflation must be stopped because it robs workers of their purchasing power.” b. “Inflation makes it impossible for working people to afford many of the things

> In Figure 8, interpret the economic meaning of points A and B. What do the two points have in common? What is the difference in their economic interpretation?

> In Figure 6, determine the values of X and Y at point K and at point E. What do you conclude about the slopes of the lines on which K and E are located?

> Arthur believes that the number of job offers he will get depends on the number of courses in which his grade is B+ or better. He concludes from observation that the following figures are typical: Put these numbers into a graph like Figure 1(a). Measure

> From Figure 5, calculate the slope of the curve at point M.

> Portray the following hypothetical data on a two variable diagram: Measure the slope of the resulting line, and explain what this number means

> In each of these cases, how much saving is there in equilibrium? (Hint: Income not consumed must be saved.) Is saving equal to investment?

> Suppose each of the transactions listed in Test Yourself Question 2 was done by many Americans. Indicate how each would affect the international value of the dollar if exchange rates were floating.

> For each of the following transactions, indicate how it would affect the U.S. balance of payments if exchange rates were fixed: a. You spent the summer traveling in Europe. b. Your uncle in Canada sent you $20 as a birthday present. c. You bought a new H

> Show that if the economy’s aggregate supply curve is vertical, fluctuations in the growth of aggregate demand produce only fluctuations in inflation with no effect on output.

> The following table provides data on nominal gross domestic product and the money supply (M1 definition) in recent selected years. Compute velocity for each year. Do you see any trend? How does it compare with the trend that prevailed from about 1996 to

> How much money by the M1 definition (cash plus checking account balances) do you typically have at any particular moment? Divide this amount into your total income over the past 12 months to obtain your own personal velocity. Are you typical of the natio

> Why do we say that deposits are “liabilities” of banks?

> Explain how your answers to Test Yourself Question 5 would differ if banks decided to hold onto the $5 billion in new reserves as excess reserves.

> Show the balance sheet changes that would take place if the Federal Reserve Bank of New York purchased an office building from Citigroup for a price of $100 million. Compare this effect to the effect of an open-market purchase of securities shown in Tabl

> Use tables such as Tables 2 and 3 to illustrate what happens to bank balance sheets when each of the following transactions occurs: a. You withdraw $100 from your checking account to buy concert tickets. b. Sam finds a $100 bill on the sidewalk and depos

> How would your answer to Test Yourself Question 1 differ if the reserve ratio were 25 percent? If the reserve ratio were 100 percent?

> Which of the following transactions are included in the gross domestic product, and by how much does each raise GDP? a. You buy a new Toyota, made in the United States, paying $25,000. b. You buy a new Toyota, imported from Japan, paying $25,000. c. You

> Suppose banks keep no excess reserves and no individuals or firms hold on to cash. If someone suddenly discovers $12 million in buried treasure and deposits it in a bank, explain what will happen to the money supply if the required reserve ratio is 10 pe

> Consider an economy in which tax collections are always $400 and in which the four components of aggregate demand are as follows: Find the equilibrium of this economy graphically. What is the marginal propensity to consume? What is the multiplier? What

> In an economy with the following aggregate demand and aggregate supply schedules, find the equilibrium levels of real output and the price level. Graph your solution. If full employment comes at $2,800 billion, is there an inflationary or a recessionary

> Suppose that investment spending is always $250, government purchases are $100, net exports are always $50, and consumer spending depends on the price level in the following way: On a piece of graph paper, use these data to construct an aggregate demand

> In which direction will the consumption function shift if the price level rises? Show this on your graph from the previous question.

> On a piece of graph paper, construct a consumption function from the data given here and determine the MPC.

> What are the four main components of aggregate demand? Which is the largest? Which is the smallest?

> Two countries have the production possibilities frontier (PPF) shown in Figure 3. Consumia chooses point C, whereas Investia chooses point I. Which country will have the higher PPF the following year? Why?

> Suppose you agree to lend money to your friend on the day you both enter college at what you both expect to be a zero real rate of interest. Payment is to be made at graduation, with interest at a fixed nominal rate. If inflation proves to be lower durin

> What is the real interest rate paid on a credit card loan bearing 12 percent nominal interest per year, if the rate of inflation is a. zero? b. 4 percent? c. 8 percent? d. 15 percent?

> Below you will find the yearly average values of the Dow Jones Industrial Average, the most popular index of stock market prices, for five different years. The Consumer Price Index for each year (on a base of 1982–1984 = 100) can be fou

> If output rises by 35 percent while hours of work increase by 40 percent, has productivity increased or decreased? By how much?

> Use an aggregate supply-and-demand diagram to study what would happen to an economy in which the aggregate supply curve never moved while the aggregate demand curve shifted outward year after year.

> Which of the following problems are likely to be studied by a microeconomist and which by a macroeconomist? a. The rapid growth of Twitter b. Why unemployment in the United States fell from 2010 to 2018 c. Why Japan’s economy grew faster than the U.S. ec

> Which of the following items are likely to be normal goods for a typical consumer? Which are likely to be inferior goods? a. Expensive perfume b. Paper plates c. Secondhand clothing d. Overseas trips

> Consider two alternatives for Stromboli is 2018. In one case (a) its inhabitants eat 60 million pizzas and build 6,000 pizza ovens. In case (b), the population eats 15million pizzas but builds 18,000 ovens. Which case will lead to a more generous product

> Jasmine’s Snack Shop sells two brands of potato chips. She produces them by buying them from a wholesale supplier. Brand X costs Jasmine $1 per bag, and Brand Y costs her $1.40. Draw Jasmine’s production possibilities frontier if she has $280 budgeted to

> Suppose the supply and demand schedules for bicycles are as they appear in the following table. a. Graph these curves and show the equilibrium price and quantity. b. Now suppose that it becomes unfashionable to ride a bicycle, so that the quantity demand

> Graphically show the production possibilities frontier for the nation of Stromboli, using the data given in the following table. Does the principle of increasing cost hold in Stromboli?

> A person rents a house for $24,000 per year. The house can be purchased for $200,000, and the tenant has this much money in a bank account that pays 4 percent interest per year. Is buying the house a good deal for the tenant? Where does opportunity cost

> Suppose consumption and investment are described by the following: C = 150 + 0.75DI I = 300 + 0.2Y – 50r Here DI is disposable income, Y is GDP, and r, the interest rate, is measured in percentage points. (For example, a 5 percent interest rate is r = 5.

> Referring to Test Yourself Question 1, do the same for an economy in which investment is $250, net exports are zero, government purchases and taxes are both $400, and the consumption function is as follows: C = 250 + 0.5DI

> Explain why X – IM = (S – I) – (G – T). Now multiply both sides of this equation by –1 to get IM – X = (I – S) + (G – T) and remember that the trade deficit, IM – X, is the amount we have to borrow from foreigners to get Borrowing from foreigners = (I –

> Use an aggregate supply-demand diagram to analyze the effects of a currency appreciation.

> We learned in this chapter that successful speculators buy a currency when demand is weak and sell it when demand is strong. Use supply and demand diagrams for two different periods (one with weak demand, the other with strong demand) to show why this ac

> Use supply and demand diagrams to analyze the effect of the following actions on the exchange rate between the dollar and the yen: a. Japan opens its domestic markets to more foreign competition. b. Investors come to believe that values on the Tokyo stoc

> Suppose that the United States and Mexico are the only two countries in the world and that labor is the only productive input. In the United States, a worker can produce 12 bushels of wheat or 2 barrels of oil in a day. In Mexico, a worker can produce 2

> Long-term government bonds now pay approximately 3 percent nominal interest. Would you prefer to trade yours in for an indexed bond that paid a 1 percent real rate of interest? What if the real interest rate offered were zeroed? What if it were negative

> If the Federal Reserve lowers interest rates, what will happen to the government budget deficit? (Hint: What will happen to tax receipts and interest expenses?) If the government wants to offset the effects of the Fed’s actions on aggregate demand, what

> Explain in words why the structural budget might show a surplus while the actual budget is in deficit. Illustrate your answer with a diagram like Figure 6.

> Explain the difference between the budget deficit and the national debt. If the deficit gets turned into a surplus, what happens to the debt?

> Find the equilibrium level of GDP demanded in an economy in which investment is always $300, net exports are always –$50, the government budget is balanced with purchases and taxes both equal to $400, and the consumption function is described by the foll

> The money supply (M) is the sum of bank deposits (D) plus currency in the hands of the public (call that C). Suppose the required reserve ratio is 20 percent and the Fed provides $50 billion in bank reserves (R = $50 billion). a. First assume that people

> Which of the following events would strengthen the argument for the use of discretionary policy, and which would strengthen the argument for rules? a. Structural changes make the economy’s self-correcting mechanism work more quickly and reliably than bef

> During the financial crisis and recovery, stock market prices first fell by about 55 percent and then rose by about 65 percent. Did investors therefore come out ahead? Explain why not.

> Create your own numerical example to illustrate how leverage magnifies returns both on the upside and on the downside.

> If the expected default rate on a particular mortgage-backed security is 4 percent per year, and the corresponding Treasury security carries a 3 percent annual interest rate, what should be the interest rate on the mortgage-backed security? What happens

> Consider an economy in which government purchases, taxes, and net exports are all zero. The consumption function is C = 300 + 0.75Y and investment spending (I) depends on the rate of interest (r) in the following way: I = 1,000 – 100r Find the equilibriu

> Explain how your answers to Test Yourself Question 5 would differ if each of the assumptions changed. Specifically, what sorts of changes in the assumptions would weaken the effects of monetary policy?

> Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions: a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point. b. Each 1 percentage point decline in interest rat

> Treasury bills have a fixed face value (say, $1,000) and pay interest by selling at a discount. For example, if a one-year bill with a $1,000 face value sells today for $950, it will pay $1,000 – $950 = $50 in interest over its life. The interest rate on

> Suppose the Fed purchases $5 billion worth of government bonds from Bill Gates, who banks at the Bank of America in San Francisco. Show the effects on the balance sheets of the Fed, the Bank of America, and Gates. (Hint: Where will the Fed get the $5 bil

> Fredonia has the following consumption function: C = 100 + 0.8DI Firms in Fredonia always invest $700 and net exports are zero, initially. The government budget is balanced with spending and taxes both equal to $500. a. Find the equilibrium level of GDP.

> Which of the following is considered a fixed tax and which a variable tax? a. The gasoline tax b. The corporate income tax c. The estate tax d. The payroll tax

> Suppose there is $120 billion of cash and that half of this cash is held in bank vaults as reserves, all of which are required (that is, banks hold no excess reserves). How large will the money supply be if the required reserve ratio is 10 percent? 121⁄2

> For each of the transactions listed in Test Yourself Question 3, what will be the ultimate effect on the money supply if the required reserve ratio is one-eighth (12.5 percent)? Assume that the oversimplified money multiplier formula applies. Question 3

> Now put yourself in charge of the economy in Test Yourself Question 2, and suppose that full employment comes at a GDP of $1,840. How can you push income up to that level?

> Suppose you are put in charge of fiscal policy for the economy described in Test Yourself Question 1. There is an inflationary gap, and you want to reduce income by $120. What specific actions can you take to achieve this goal?

> Return to the hypothetical economy in Test Yourself Question 1, and now suppose that both taxes and government purchases are increased by $120. Find the new equilibrium under the assumption that consumer spending continues to be exactly three-quarters of

> Consider an economy similar to that in the preceding question in which investment is also $200, government purchases are also $500, net exports are also $30, and the price level is also fixed. But taxes now vary with income, and as a result, the consumpt

> Use an aggregate supply-and-demand diagram to show that multiplier effects are smaller when the aggregate supply curve is steeper. Which case gives rise to more inflation—the steep aggregate supply curve or the flat one? What happens to the multiplier if

> Add the following aggregate supply-and-demand schedules to the example in Test Yourself Question 1 of Chapter 9 to see how inflation affects the multiplier. a. Draw these schedules on a piece of graph paper. b. Notice that the difference between columns

> Suppose a worker receives a wage of $20 per hour. Compute the real wage (money wage deflated by the price index) corresponding to each of the following possible price levels: 85, 95, 100, 110, 120. What do you notice about the relationship between the re

> Use both numerical and graphical methods to find the multiplier effect of the following shift in the consumption function in an economy in which investment is always $220, government purchases are always $100, and net exports are always -$40. (Hint: What

> Imagine an economy in which consumer expenditure is represented by the following equation: C = 50 + 0.75DI Imagine also that investors want to spend $500 at every level of income (I = $500), net exports are zero (X – IM = 0), government purchases are $30

> An economy has the following consumption function: C = 200 + 0.8DI The government budget is balanced, with government purchases and taxes both fixed at $1,000. Net exports are $100. Investment is $600. Find equilibrium GDP. What is the multiplier for thi

> Keep everything the same as in Test Yourself Question 4 except change investment to I = $1,100. Use the equilibrium condition Y = C + I + G + (X – IM) to find the equilibrium level of GDP on the demand side. (In working out the answer, assume the price l

> Consider an economy in which the consumption function takes the following simple algebraic form: C = 300 + 0.75DI and in which investment (I) is always $900 and net exports are always –$100. Government purchases are fixed at $1,300 and taxes are fixed at

> From the following data, construct an expenditure schedule on a piece of graph paper. Then use the income-expenditure (45° line) diagram to determine the equilibrium level of GDP. Compare your answer with your answer to the previous question.

> From the following data, construct an expenditure schedule on a piece of graph paper. Then use the income-expenditure (45° line) diagram to determine the equilibrium level of GDP. Now suppose investment spending rises to $260, and the price le

> Which of the following acts constitute investment according to the economist’s definition of that term? a. Pfizer builds a new factory in the United States to manufacture pharmaceuticals. b. You buy 100 shares of Pfizer stock. c. A small drugmaker goes b

> Show on a graph how capital formation shifts the production function. Use this graph to show that capital formation increases labor productivity. Explain in words why labor is more productive when the capital stock is larger.

> Which of the following prices would you expect to rise rapidly over long periods of time? Why? a. Cable television rates b. Football tickets c. Internet access d. Household cleaning services e. Driving lessons

> Imagine that new inventions in the computer industry affect the growth rate of productivity as follows: Would such a pattern help explain U.S. productivity performance since the mid-1970s? Why?

> The following table shows real GDP per hour of work in four imaginary countries in the years 2008 and 2018. By what percentage did labor productivity grow in each country? Is it true that productivity growth was highest where the initial level of product

> Below you will find nominal GDP and the GDP deflator (based on 2012 = 100) for the years 1996, 2006, and 2016. a. Compute real GDP for each year. b. Compute the percentage change in nominal and real GDP from 1996 to 2006, and from 2006 to 2016. c. Comput

> Country A and Country B have identical population growth rates of 1 percent per annum, and everyone in each country always works 40 hours per week. Labor productivity grows at a rate of 2 percent in Country A and a rate of 2.5 percent in Country B. What

> Most economists believe that from 2010 to 2017, actual GDP in the United States grew slightly faster than potential GDP. What, then, should have happened to the unemployment rate over those three years? Before that, from 2006 to 2010, actual GDP grew slo

> Two countries start with equal GDPs. The economy of Country A grows at an annual rate of 3 percent, whereas the economy of Country B grows at an annual rate of 4 percent. After 25 years, how much larger is Country B’s economy than Country A’s economy? Wh

> Which of the following transactions are included in gross domestic product, and by how much does each raise GDP? a. Smith pays a carpenter $50,000 to build a garage. b. Smith purchases $10,000 worth of materials and builds himself a garage, which is wort

> The following table summarizes information about the market for principles of economics textbooks: a. What is the market equilibrium price and quantity of textbooks? b. To quell outrage over tuition increases, the college places a $55 limit on the price

> The following are the assumed supply and demand schedules for hamburgers in Collegetown: a. Plot the supply and demand curves and indicate the equilibrium price and quantity. b. What effect would a decrease in the price of beef (a hamburger input) have o

> The demand and supply curves for T-shirts in Touristtown, U.S.A., are given by the following equations: Q = 24,000 − 500P Q = 6,000 + 1,000P where P is measured in dollars and Q is the number of T-shirts sold per year. a. Find the equilibrium price and q

> Consider the market for beef discussed in this chapter (Tables 1 through 3 and Figures 1 and 8). Suppose that the government decides to fight cholesterol by levying a tax of 50 cents per pound on sales of beef. Follow these steps to analyze the effects o

> The two accompanying diagrams show supply and demand curves for two substitute commodities: regular cell phones and smartphones. a. On the right-hand diagram, show what happens when rising raw material prices make it costlier to produce regular cell phon

> What shapes would you expect for the following demand curves? a. A medicine that means life or death for a patient b. French fries in a food court with kiosks offering many types of food

> Now complicate Trivialand in the following ways and answer the same questions. In addition, calculate national income and disposable income. a. The government bought 50 cars, leaving only 150 cars for export. In addition, the government spent $800,000 o

> How are the following demand curves likely to shift in response to the indicated changes? a. The effect of a drought on the demand curve for umbrellas b. The effect of higher popcorn prices on the demand curve for movie tickets c. The effect on the deman