Question: The following table provides data on nominal

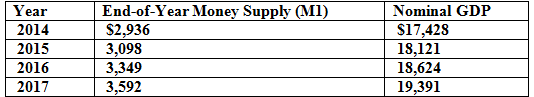

The following table provides data on nominal gross domestic product and the money supply (M1 definition) in recent selected years. Compute velocity for each year. Do you see any trend? How does it compare with the trend that prevailed from about 1996 to about 2006? (See Figure 1(a).)

> Use the concept of opportunity cost to explain why velocity is higher at higher interest rates.

> In March 2008, the Fed helped prevent the bankruptcy of Bear Stearns. However, in September 2008, the Fed and the Treasury let Lehman Brothers go bankrupt. What accounts for the different decisions? (Note: You may want to discuss this question with your

> Suppose exports and imports of a country are given by the following: Calculate net exports at each level of GDP.

> Explain the basic idea behind the TARP legislation. Was that idea carried out in practice?

> Explain how a collapse of the economy’s credit-granting mechanisms might lead to a recession.

> Explain how a collapse in house prices might lead to a recession.

> Explain why a mortgage-backed security becomes riskier when the values of the underlying houses decline. What, as a result, happens to the price of the mortgage-backed security?

> If you were watching house prices rise during the years 2000–2006, how might you have decided whether or not you were witnessing a “bubble”?

> Explain why both business investments and purchases of new homes rise when interest rates decline.

> Once the federal funds rate reached (approximately) zero, which happened in December 2008, what options were still open to the Fed. What did it actually do? (Note: This may be a good question to discuss with your instructor.)

> From September 2007 through December 2008, the Fed believed that interest rates needed to fall and took steps to reduce them, eventually cutting the federal funds rate from 5.25 percent to nearly zero. How did the Fed reduce the federal funds rate? Illus

> Explain why the quantity of bank reserves supplied normally is higher and the quantity of bank reserves demanded normally is lower at higher interest rates.

> Why does a modern industrial economy need a central bank?

> If domestic expenditure (the sum of C + I + G in the economy described in Test Yourself Question 1) is as shown in the following table, construct a 45° line diagram and locate the equilibrium level of GDP.

> If the government takes over a failed bank with liabilities (mostly deposits) of $2 billion, pays off the depositors, and sells the assets for $1.5 billion, where does the missing $500 million come from? Why?

> Excess reserves make a bank less vulnerable to runs. Why, then, don’t bankers like to hold excess reserves? What circumstances might persuade them that it would be advisable to hold excess reserves?

> After 2008-2014, a rash of bank failures occurred in the United States. Explain why these failures did not lead to runs on banks.

> What is fractional reserve banking, and why is it the key to bank profits? (Hint: What opportunities to make profits would banks lose if reserve requirements were 100 percent?) Why does fractional reserve banking give bankers discretion over how large th

> How is “money” defined, both conceptually and in practice? Does the U.S. money supply consist of commodity money, full-bodied paper money, or fiat money?

> If ours were a barter economy, how would you pay your tuition bill? What if your college did not want the goods or services you offered in payment?

> Advocates of lower taxes on capital gains argue that this type of tax cut will raise aggregate supply by spurring business investment. Compare the effects on investment, aggregate supply, and tax revenues of three different ways to cut the capital gains

> Explain why G has the same multiplier as I, but taxes have a different multiplier.

> The federal government spending (relative to the size of the economy) is rising again, after years of comparative “austerity.” How will this development affect GDP in the United Sates if the higher spending leads to a. larger budget deficits? b. less sp

> Why do you think wages tend to be rigid in the downward direction?

> In a certain economy, the multiplier for government purchases is 2 and the multiplier for changes in fixed taxes is 1.5. The government then proposes to raise both spending and taxes by $100 billion. What should happen to equilibrium GDP on the demand si

> Give two different explanations of how the economy can suffer from stagflation.

> Comment on the following statement: “Inflationary and recessionary gaps are nothing to worry about because the economy has a built-in mechanism that cures either type of gap automatically.”

> For more than 30 years, imports have consistently exceeded exports in the U.S. economy. Many people consider this imbalance to be a major problem. Does this chapter give you any hints about why?

> Between 2008 and 2009, real disposable income (in 2009 dollars) declined slightly (by $19 billion), owing to a recession. The decline in real consumption expenditures was far larger: $133 billion. Explain why dividing the two does not give a good estimat

> In 2001 and again in 2003, Congress enacted changes in the tax law designed to promote saving. If such saving incentives had been successful, how would the consumption function have shifted?

> Explain why permanent tax cuts are likely to lead to bigger increases in consumer spending than temporary tax cuts do.

> Look at the scatter diagram in Figure 3. What does it tell you about what was going on in this country in the years 1942 to 1945?

> The marginal propensity to consume (MPC) for the United States as a whole is roughly 0.90. Explain in words what this means. What is your personal MPC at this stage in your life? How might that change by the time you are your parents’ age?

> Explain the difference between investment as the term is used by most people and investment as defined by an economist.

> Discuss some of the pros and cons of increasing development assistance, both from the point of view of the donor country and the point of view of the recipient country.

> Suppose real GDP is $10,000 billion and the basic expenditure multiplier is two. If two tax changes are made at the same time: a. fixed taxes are raised by $100 billion b. the income-tax rate is reduced from 20 percent to 18 percent will equilibrium GDP

> Explain why the best educational policies to promote faster growth might be different in the following countries. a. Mozambique b. Brazil c. France

> The previous chapter pointed out that, because faster capital formation comes at a cost (reduced current consumption), it is possible for a country to invest too much. Suppose the government of some country decides that its businesses are investing too m

> Explain the different objectives of (long-run) growth policy versus (short-run) stabilization policy.

> Show why each of the following complaints is based on a misunderstanding about inflation: a. “Inflation must be stopped because it robs workers of their purchasing power.” b. “Inflation makes it impossible for working people to afford many of the things

> In Figure 8, interpret the economic meaning of points A and B. What do the two points have in common? What is the difference in their economic interpretation?

> In Figure 6, determine the values of X and Y at point K and at point E. What do you conclude about the slopes of the lines on which K and E are located?

> Arthur believes that the number of job offers he will get depends on the number of courses in which his grade is B+ or better. He concludes from observation that the following figures are typical: Put these numbers into a graph like Figure 1(a). Measure

> From Figure 5, calculate the slope of the curve at point M.

> Portray the following hypothetical data on a two variable diagram: Measure the slope of the resulting line, and explain what this number means

> In each of these cases, how much saving is there in equilibrium? (Hint: Income not consumed must be saved.) Is saving equal to investment?

> Suppose each of the transactions listed in Test Yourself Question 2 was done by many Americans. Indicate how each would affect the international value of the dollar if exchange rates were floating.

> For each of the following transactions, indicate how it would affect the U.S. balance of payments if exchange rates were fixed: a. You spent the summer traveling in Europe. b. Your uncle in Canada sent you $20 as a birthday present. c. You bought a new H

> Show that if the economy’s aggregate supply curve is vertical, fluctuations in the growth of aggregate demand produce only fluctuations in inflation with no effect on output.

> How much money by the M1 definition (cash plus checking account balances) do you typically have at any particular moment? Divide this amount into your total income over the past 12 months to obtain your own personal velocity. Are you typical of the natio

> Why do we say that deposits are “liabilities” of banks?

> Explain how your answers to Test Yourself Question 5 would differ if banks decided to hold onto the $5 billion in new reserves as excess reserves.

> Show the balance sheet changes that would take place if the Federal Reserve Bank of New York purchased an office building from Citigroup for a price of $100 million. Compare this effect to the effect of an open-market purchase of securities shown in Tabl

> Use tables such as Tables 2 and 3 to illustrate what happens to bank balance sheets when each of the following transactions occurs: a. You withdraw $100 from your checking account to buy concert tickets. b. Sam finds a $100 bill on the sidewalk and depos

> How would your answer to Test Yourself Question 1 differ if the reserve ratio were 25 percent? If the reserve ratio were 100 percent?

> Which of the following transactions are included in the gross domestic product, and by how much does each raise GDP? a. You buy a new Toyota, made in the United States, paying $25,000. b. You buy a new Toyota, imported from Japan, paying $25,000. c. You

> Suppose banks keep no excess reserves and no individuals or firms hold on to cash. If someone suddenly discovers $12 million in buried treasure and deposits it in a bank, explain what will happen to the money supply if the required reserve ratio is 10 pe

> Consider an economy in which tax collections are always $400 and in which the four components of aggregate demand are as follows: Find the equilibrium of this economy graphically. What is the marginal propensity to consume? What is the multiplier? What

> In an economy with the following aggregate demand and aggregate supply schedules, find the equilibrium levels of real output and the price level. Graph your solution. If full employment comes at $2,800 billion, is there an inflationary or a recessionary

> Suppose that investment spending is always $250, government purchases are $100, net exports are always $50, and consumer spending depends on the price level in the following way: On a piece of graph paper, use these data to construct an aggregate demand

> In which direction will the consumption function shift if the price level rises? Show this on your graph from the previous question.

> On a piece of graph paper, construct a consumption function from the data given here and determine the MPC.

> What are the four main components of aggregate demand? Which is the largest? Which is the smallest?

> Two countries have the production possibilities frontier (PPF) shown in Figure 3. Consumia chooses point C, whereas Investia chooses point I. Which country will have the higher PPF the following year? Why?

> Suppose you agree to lend money to your friend on the day you both enter college at what you both expect to be a zero real rate of interest. Payment is to be made at graduation, with interest at a fixed nominal rate. If inflation proves to be lower durin

> What is the real interest rate paid on a credit card loan bearing 12 percent nominal interest per year, if the rate of inflation is a. zero? b. 4 percent? c. 8 percent? d. 15 percent?

> Below you will find the yearly average values of the Dow Jones Industrial Average, the most popular index of stock market prices, for five different years. The Consumer Price Index for each year (on a base of 1982–1984 = 100) can be fou

> If output rises by 35 percent while hours of work increase by 40 percent, has productivity increased or decreased? By how much?

> Use an aggregate supply-and-demand diagram to study what would happen to an economy in which the aggregate supply curve never moved while the aggregate demand curve shifted outward year after year.

> Which of the following problems are likely to be studied by a microeconomist and which by a macroeconomist? a. The rapid growth of Twitter b. Why unemployment in the United States fell from 2010 to 2018 c. Why Japan’s economy grew faster than the U.S. ec

> Which of the following items are likely to be normal goods for a typical consumer? Which are likely to be inferior goods? a. Expensive perfume b. Paper plates c. Secondhand clothing d. Overseas trips

> Consider two alternatives for Stromboli is 2018. In one case (a) its inhabitants eat 60 million pizzas and build 6,000 pizza ovens. In case (b), the population eats 15million pizzas but builds 18,000 ovens. Which case will lead to a more generous product

> Jasmine’s Snack Shop sells two brands of potato chips. She produces them by buying them from a wholesale supplier. Brand X costs Jasmine $1 per bag, and Brand Y costs her $1.40. Draw Jasmine’s production possibilities frontier if she has $280 budgeted to

> Suppose the supply and demand schedules for bicycles are as they appear in the following table. a. Graph these curves and show the equilibrium price and quantity. b. Now suppose that it becomes unfashionable to ride a bicycle, so that the quantity demand

> Graphically show the production possibilities frontier for the nation of Stromboli, using the data given in the following table. Does the principle of increasing cost hold in Stromboli?

> A person rents a house for $24,000 per year. The house can be purchased for $200,000, and the tenant has this much money in a bank account that pays 4 percent interest per year. Is buying the house a good deal for the tenant? Where does opportunity cost

> Suppose consumption and investment are described by the following: C = 150 + 0.75DI I = 300 + 0.2Y – 50r Here DI is disposable income, Y is GDP, and r, the interest rate, is measured in percentage points. (For example, a 5 percent interest rate is r = 5.

> Referring to Test Yourself Question 1, do the same for an economy in which investment is $250, net exports are zero, government purchases and taxes are both $400, and the consumption function is as follows: C = 250 + 0.5DI

> Explain why X – IM = (S – I) – (G – T). Now multiply both sides of this equation by –1 to get IM – X = (I – S) + (G – T) and remember that the trade deficit, IM – X, is the amount we have to borrow from foreigners to get Borrowing from foreigners = (I –

> Use an aggregate supply-demand diagram to analyze the effects of a currency appreciation.

> We learned in this chapter that successful speculators buy a currency when demand is weak and sell it when demand is strong. Use supply and demand diagrams for two different periods (one with weak demand, the other with strong demand) to show why this ac

> Use supply and demand diagrams to analyze the effect of the following actions on the exchange rate between the dollar and the yen: a. Japan opens its domestic markets to more foreign competition. b. Investors come to believe that values on the Tokyo stoc

> Suppose that the United States and Mexico are the only two countries in the world and that labor is the only productive input. In the United States, a worker can produce 12 bushels of wheat or 2 barrels of oil in a day. In Mexico, a worker can produce 2

> The following table describes the number of yards of cloth and barrels of wine that can be produced with a week’s worth of labor in England and Portugal. Assume that no other inputs are needed. a. If there is no trade, what is the price

> Long-term government bonds now pay approximately 3 percent nominal interest. Would you prefer to trade yours in for an indexed bond that paid a 1 percent real rate of interest? What if the real interest rate offered were zeroed? What if it were negative

> If the Federal Reserve lowers interest rates, what will happen to the government budget deficit? (Hint: What will happen to tax receipts and interest expenses?) If the government wants to offset the effects of the Fed’s actions on aggregate demand, what

> Explain in words why the structural budget might show a surplus while the actual budget is in deficit. Illustrate your answer with a diagram like Figure 6.

> Explain the difference between the budget deficit and the national debt. If the deficit gets turned into a surplus, what happens to the debt?

> Find the equilibrium level of GDP demanded in an economy in which investment is always $300, net exports are always –$50, the government budget is balanced with purchases and taxes both equal to $400, and the consumption function is described by the foll

> The money supply (M) is the sum of bank deposits (D) plus currency in the hands of the public (call that C). Suppose the required reserve ratio is 20 percent and the Fed provides $50 billion in bank reserves (R = $50 billion). a. First assume that people

> Which of the following events would strengthen the argument for the use of discretionary policy, and which would strengthen the argument for rules? a. Structural changes make the economy’s self-correcting mechanism work more quickly and reliably than bef

> During the financial crisis and recovery, stock market prices first fell by about 55 percent and then rose by about 65 percent. Did investors therefore come out ahead? Explain why not.

> Create your own numerical example to illustrate how leverage magnifies returns both on the upside and on the downside.

> If the expected default rate on a particular mortgage-backed security is 4 percent per year, and the corresponding Treasury security carries a 3 percent annual interest rate, what should be the interest rate on the mortgage-backed security? What happens

> Consider an economy in which government purchases, taxes, and net exports are all zero. The consumption function is C = 300 + 0.75Y and investment spending (I) depends on the rate of interest (r) in the following way: I = 1,000 – 100r Find the equilibriu

> Explain how your answers to Test Yourself Question 5 would differ if each of the assumptions changed. Specifically, what sorts of changes in the assumptions would weaken the effects of monetary policy?

> Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions: a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point. b. Each 1 percentage point decline in interest rat

> Treasury bills have a fixed face value (say, $1,000) and pay interest by selling at a discount. For example, if a one-year bill with a $1,000 face value sells today for $950, it will pay $1,000 – $950 = $50 in interest over its life. The interest rate on

> Suppose the Fed purchases $5 billion worth of government bonds from Bill Gates, who banks at the Bank of America in San Francisco. Show the effects on the balance sheets of the Fed, the Bank of America, and Gates. (Hint: Where will the Fed get the $5 bil

> Fredonia has the following consumption function: C = 100 + 0.8DI Firms in Fredonia always invest $700 and net exports are zero, initially. The government budget is balanced with spending and taxes both equal to $500. a. Find the equilibrium level of GDP.