Question: The Laser Division of FOX Technologies Inc.

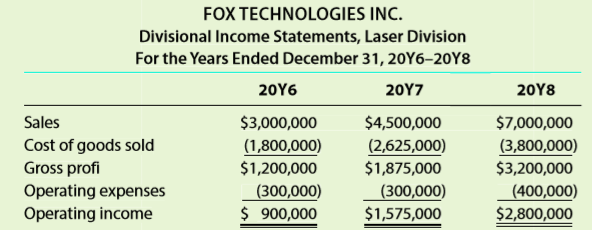

The Laser Division of FOX Technologies Inc. has been experiencing revenue and proï¬t growth during the years 20Y6–20Y8. The divisional income statements are provided below.

Assume that there are no charges from service departments. The vice president of the division, Stacy Harper, is proud of her division’s performance over the last three years. The president of FOX Technologies Inc., Hal Nelson, is discussing the division’s performance with Stacy, as follows:

Stacy: As you can see, we’ve had a successful three years in the Laser Division.

Hal: I’m not too sure.

Stacy: What do you mean? Look at our results. Our operating income has more than tripled, while our proï¬t margins are improving.

Hal: I am looking at your results. However, your income statements fail to include one very important piece of information; namely, the invested assets. You have been investing a great deal of assets into the division. You had $2,000,000 in invested assets in 20Y6, $4,500,000 in 20Y7, and $10,000,000 in 20Y8.

Stacy: You are right. I’ve needed the assets in order to upgrade our technologies and expand our operations. The additional assets are one reason we have been able to grow and improve our proï¬t margins. I don’t see that this is a problem.

Hal: The problem is that we want to maintain a 30% rate of return on invested assets.

1. Determine the profit margins for the Laser Division for 20Y6–20Y8.

2. Compute the investment turnover for the Laser Division for 20Y6–20Y8.

3. Compute the return on investment for the Laser Division for 20Y6–20Y8.

4. Evaluate the division’s performance over the 20Y6–20Y8 time period. Why was Hal concerned about the performance.

Transcribed Image Text:

FOX TECHNOLOGIES INC. Divisional Income Statements, Laser Division For the Years Ended December 31, 20Y6–20Y8 20Υ6 20Y7 20Υ8 $4,500,000 (2,625,000) $1,875,000 $7,000,000 (3,800,000) $3,200,000 Sales $3,000,000 Cost of goods sold (1,800,000) $1,200,000 Gross profi Operating expenses Operating income (300,000) $ 900,000 (300,000) $1,575,000 (400,000) $2,800,000

> A company could sell a building for $650,000 or lease it out for $5,000 per month. What would need to be considered in determining if the lease option would be preferred?

> Explain the meaning of (a) differential revenue, (b) differential cost, and (c) differential income.

> a. What is the objective of just-in-time processing? b. How does just-in-time processing differ from traditional processing?

> a. Differentiate between the clock card and the time ticket. b. Why should the total time reported on an employee’s time tickets for a payroll period be compared with the time reported on the employee’s clock cards for the same period?

> a. Name two principal types of cost accounting systems. b. Which system provides for a separate record of each particular quantity of product that passes through the factory? c. Which system accumulates the costs for each department or process within the

> List three differences in how managerial accounting differs from financial accounting.

> In one group, find a local business, such as a copy shop, that charges for printing, faxing, copying, and scanning documents. In the other group, determine the price of a mid-range printer/copier/scanner/fax machine. Combine this information from the two

> Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed entertainment. Regarding theatrical films, MGM states, “Our feature films are exploited through a series of sequential domestic and international

> World Electronics Inc. invested $16,000,000 to build a plant in a foreign country. The labor and materials used in production are purchased locally. The plant expansion was estimated to produce an internal rate of return of 20% in U.S. dollar terms. Due

> Use the data from E11-12 and assume that break-even sales are $2,798 million. Determine the following for Molson-Coors Brewing Company. Round to one decimal place. 1. Margin of safety expressed as dollar sales. 2. Margin of safety expressed as a percenta

> At a recent staff meeting, the management of Warp Time Technologies Inc. was considering discontinuing its Track Time line of electronic games. The chief financial analyst reported the following current monthly data for the Track Time F

> For a major university, match each cost in the following table with the appropriate activity base. An activity base may only be used more than once. Activity Base a. Number of enrollment applications b. Number of financial aid applications c. Number

> The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases. a. Direct material cost per unit. b. Fees f

> Following is a list of various costs incurred in producing and selling college textbooks. With respect to the production and sale of textbooks, classify each cost as either variable, fixed, or mixed. 1. Art commission of $36,000 paid for use of art on tex

> Five selected transactions for the current month are indicated by letters in the following accounts in a job order cost accounting system: Describe each of the five transactions. Cost of Goods Sold Materials (e) increase (a) decrease Factory Overhe

> A Masters of Accountancy degree at Jalapeno University would cost $15,000 for an additional fifth year of education beyond the bachelor’s degree. Assume that all tuition is paid at the beginning of the year. A student considering this investment must eval

> Reboot Inc. provides computer repair services for the community. Ashley DaCosta’s computer was not working, and she called Reboot for a home repair visit. The Reboot Inc. technician arrived at 2:00 P.M. to begin work. By 4:00 P.M., the

> From the choices presented in the parentheses, choose the appropriate term for completing each of the following sentences: a. Advertising expenses are usually viewed as (period, product) costs. b. An example of factory overhead is (plant depreciation, sa

> From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons’ commission

> Which of the following items are properly classified as part of factory overhead for Caterpillar? a. Amortization of patents on new assembly process b. Consultant fees for a study of production line employee productivity c. Depreciation on Peoria, Illinoi

> Indicate whether the following costs of Colgate-Palmolive Company would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Bottles in which mouthwashes are sold b. Depreciation on production machinery c. Depreciation o

> Name the following graph and identify the items represented by the letters (a)Â through (f). Operating Profit (Loss) $300,000 $200,000 $100,000 b $(100,000) $(200,000) $(300,000) 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,00

> Name the following graph, and identify the items represented by the letters (a) through (f). Sales and Costs $100,000 $75,000 $50,000 a $25,000 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Units of Sales

> The internal rate of return method is used by Leach Construction Co. in analyzing a capital expenditure proposal that involves an investment of $400,125 and annual net cash flows of $75,000 for each of the eight years of its useful life.

> Currently, the unit selling price of a product is $1,350, the unit variable cost is $900, and the total fixed costs are $810,000. A proposal is being evaluated to increase the unit selling price to $1,400. a. Compute the current break-even sales (units).

> One item is omitted from each of the following computations of the return on investment: Determine the missing items, identifying each by the appropriate letter. Return on Investment Profit Margin x Investment Turnover 12% 8% (a) (b) 16% 1.25 24% (

> For the current year ending December 31, McAdams Industries expects fixed costs of $1,860,000, a unit variable cost of $105, and a unit selling price of $125. a. Compute the anticipated break-even sales (units). b. Compute the sales (units) required to re

> Erin Haywood was recently hired as a cost analyst by Wind River Medical Supplies Inc. One of Erin’s first assignments was to perform a net present value analysis for a new warehouse. Erin performed the analysis and calculated a present value index of 0.8.

> For each of the following service departments, select the activity base listed that is most appropriate for charging service expenses to responsible units. Service Department Activity Base a. Accounts Receivable 1. Number of computers b. Central Pur

> Indicate whether each of the following costs of an airplane manufacturer would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Aircraft engines b. Controls for flight deck c. Depreciation of equipment d. Landing gea

> St. Paul Lumber Company incurs a cost of $280 per hundred board feet in processing certain “rough-cut” lumber, which it sells for $320 per hundred board feet. An alternative is to produce a “finished cut” at a total processing cost of $350 per hundred boa

> Which of the following graphs best illustrates fixed costs per unit as the activity base changes? (a) (ь) Activity Base Activity Base Costs per Unit Costs per Unit

> Which of the following graphs illustrates how total fixed costs behave with changes in total units produced? (a) (Ь), Total Units Produced Total Units Produced Total Cost Total Cost

> In cost analyses, how are mixed costs treated?

> Describe the behavior of (a) total fixed costs and (b) unit fixed costs as the level of activity increases.

> How would each of the following costs be classified if units produced is the activity base? a. Direct materials costs b. Direct labor costs c. Electricity costs of $0.09 per kilowatt-hour

> A chemical company has a commodity-grade and a premium-grade product. Why might the company elect to process the commodity-grade product further to the premium-grade product?

> Under what circumstances is it appropriate to use the target cost concept?

> Modern Living Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Patio Division for the past year, assuming no service department c

> An examination of the accounting records of Larredo Company disclosed a high contribution margin ratio and production at a level below maximum capacity. Based on this information, suggest a likely means of improving operating income.

> Differentiate between a cost center and a profit center.

> A net present value analysis used to evaluate a proposed equipment acquisition indicated a $115,000 net present value. What is the meaning of the $115,000 as it relates to the desirability of the proposal?

> Why would the cash payback method understate the value of a project with a large residual value?

> What information does the cash payback period ignore that is included by the net present value method?

> What method can be used to place two capital investment proposals with unequal useful lives on a comparable basis?

> What provision of the Internal Revenue Code is especially important to consider in analyzing capital investment proposals?

> In a decentralized company in which the divisions are organized as investment centers, how could a division be considered the least profitable, even though it earned the largest amount of operating income?

> Why should the factors under the control of the investment center manager (revenues, expenses, and invested assets) be considered in computing the return on investment?

> Weyerhaeuser developed a system that assigns service department expenses to user divisions on the basis of actual services consumed by the division. Here are a number of Weyerhaeuser’s activities in its central Financial Services Department: • Payroll •

> For what decisions is the manager of a cost center not responsible?

> In what major respect would budget performance reports prepared for the use of plant managers of a manufacturing business with cost centers differ from those prepared for the use of the various department supervisors who report to the plant managers?

> Differentiate between a profit center and an investment center.

> Why would standard cost be a more appropriate transfer cost between cost centers than actual cost?

> When would a company use zero-based budgeting?

> What behavioral problems are associated with establishing conflicting goals within the budget?

> What behavioral problems are associated with setting a budget too loosely?

> Give an example of budgetary slack.

> What is the manager’s role in a responsibility center?

> How can standards be used by management to help control costs?

> The three divisions of Dixie Foods are Cereal, Produce, and Snacks. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: 1. Which division is making the best

> How does a schedule of collections from sales assist in preparing the cash budget?

> In preparing the budget for the cost of goods sold, what are the three budgets from which data on relevant estimates of quantities and costs are combined with data on estimated inventories?

> What is the first step in preparing a master budget?

> How are standards used in budgetary performance evaluation?

> How often should standards be revised?

> What is meant by reporting by the “principle of exceptions,” as the term is used in reference to cost control?

> Why might the use of ideal standards in applying the cost-plus approach to product pricing lead to setting product prices that are too low?

> What does operating leverage measure, and how is it computed?

> How can activity-based costing be used in service companies?

> It was reported that Exabyte Corporation, a fast- growing Colorado marketer of computer devices has decided to purchase key components of its product from other suppliers. A former chief executive officer of Exabyte stated, “If we’d tried to build our ow

> The Customer Service Department of Bragg Inc. asked the Publications Department to prepare a brochure for its training program. The Publications Department delivered the brochures and charged the Customer Service Department a rate that was 15% higher tha

> Both Gouda Company and Cheddar Company had the same sales, total costs, and operating income for the current fiscal year; yet Gouda Company had a lower break-even point than Cheddar Company. Explain the reason for this difference in break-even points.

> If insurance rates are increased, what effect will this change in fixed costs have on the break-even point?

> At the end of the fiscal year, there was a relatively minor balance in the factory overhead account. What procedure can be used for disposing of the balance in the account?

> a. What is (1) over applied factory overhead and (2) under applied factory overhead b. If the factory overhead account has a positive balance, was factory overhead under applied or over applied?

> If fixed costs increase, what would be the impact on the (a) contribution margin and (b) operating income?

> In applying the high-low method of cost estimation, how is the total fixed cost estimated?

> Describe the source of the data for increasing Work in Process for (a) direct materials, (b) direct labor, and (c) factory overhead.

> Which of the following graphs illustrates how unit variable costs behave with changes in total units produced? (a), (Ь) 0 Total Units Produced 0 Total Units Produced Unit Cost Unit Cost

> How does the use of the materials requisition help control the issuance of materials from the storeroom?

> What kind of firm would use a job order cost system?

> Sisel Company has two divisions, the Optic Lens Division and the Camera Division. The Camera Division may purchase lenses from the Optic Lens Division or from outside suppliers. The Optic Lens Division sells products both internally and externally. The m

> How would each of the following costs be classified if units produced is the activity base? a. Salary of factory supervisor ($120,000 per year) b. Straight-line depreciation of plant and equipment c. Property rent of $11,500 per month on plant and equipm

> How is product cost information used by managers?

> For a company that produces desktop computers, would memory chips be considered a direct or an indirect materials cost of each computer produced?

> Bev Frazier is a cost accountant for Ocean Atlantic Apparel Inc. Jeff Rangel, vice president of marketing, has asked Bev to meet with representatives of Ocean Atlantic Apparel’s major competitor to discuss product cost data. Jeff indicates that the shari

> Kopecky Industries Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows:

> The investment committee of Iron Skillet Restaurants Inc. is evaluating two restaurant sites. The sites have different useful lives, but each requires an investment of $1,000,000. The estimated net cash flows from each site are as follows:

> The management of Heckel Communications Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: The radio station requires an investment of $1,598,800, while the TV station requ

> Donahue Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instructions: 1. Assuming that the desired rate of return is 20%, prepa

> McMorris Publications Inc. is considering two new magazine products. The estimated net cash flows from each product are as follows: Each product requires an investment of $400,000. A rate of 10% has been selected for the net present valu

> The capital investment committee of Overnight Express Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows: Each project requires an investment of $800,0

> Harmony Industries Inc. is a small manufacturer of electronic musical instruments. The plant manager received the following variable factory overhead report for the period: The plant manager is not pleased with the $29,800 unfavorable variable factory

> Birrell Scientific Inc. manufactures electronic products, with two operating divisions, GPS Systems and Communication Systems. Condensed divisional income statements, which involve no intra company transfers and which include a breakdown o

> The vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as

> A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31, 20Y2, is as follows: Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated

> High Country Foods Inc. is a diversified food products company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y7, are as follows:

> A-One Freight Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance using operating income as a percent of revenues. The following quarterly income

> Sneed Industries Company sells vehicle parts to manufacturers of heavy construction equipment. The Crane Division is organized as a cost center. The budget for the Crane Division for the month ended August 31, 20Y6, is as follows (in thousands): During

> Seabury, Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October. The company expected to operate the department at 100% of normal capacity of 25,000 hours. During