Question: The revenue and cash receipts journals for

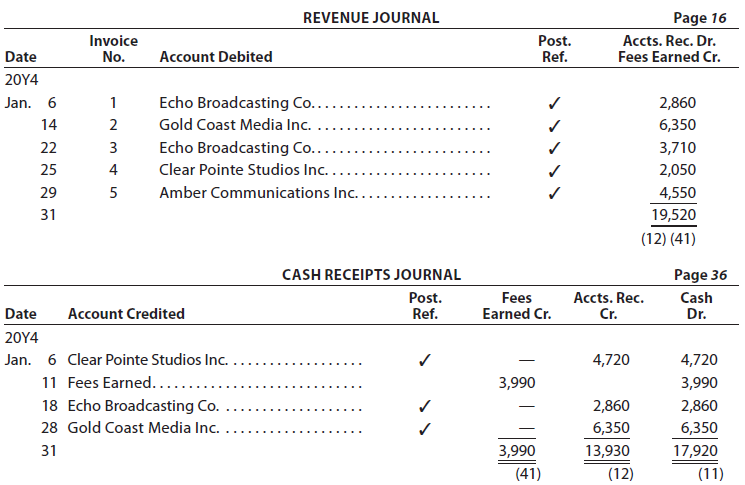

The revenue and cash receipts journals for Birmingham Productions Inc. follow. The accounts receivable control account has a January 1, 20Y4, balance of $4,720 consisting of an amount due from Clear Pointe Studios Inc.

Prepare a listing of the accounts receivable customer balances and verify that the total agrees with the ending balance of the accounts receivable controlling account.

> Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: • Fees earn

> On December 31, the following data were accumulated for preparing the adjusting entries for Flagship Realty: • The supplies account balance on December 31 is $1,585. The supplies on hand on December 31 are $320. • The unearned rent account balance on Dec

> Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y7, follows: The following business transactions were completed by Elite Realty during April 20Y7: Apr. 1. Paid rent on offi

> On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: a. Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $53,000. b. Paid rent on off

> Connie Young, an architect, opened an office on October 1, 20Y4. During the month, she completed the following transactions connected with her professional practice: a. Transferred cash from a personal bank account to an account to be used for the busine

> The following errors took place in journalizing and posting transactions: a. Rent expense of $3,220 paid for the current month was recorded as a debit to Miscellaneous Expense and a credit to Rent Expense. b. The payment of $5,080 from a customer on acco

> The following revenue transactions occurred during April: Apr. 6. Issued Invoice No. 78 to BlueBird Co. for services provided on account, $1,710. 11. Issued Invoice No. 79 to Hitchcock Inc. for services provided on account, $3,320. 19. Issued Invoice No.

> The financial statements at the end of Wolverine Realty’s first month of operations are as follows: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (q

> The Colby Group has the following unadjusted trial balance as of August 31, 20Y8: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was understated by $6,000. b. A cash receipt of $5,

> On July 1, 20Y7, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: a. Opened a business bank account with a deposit of $25,000 from personal funds. b. Purchased office supplies on account, $1,850.

> The total assets and total liabilities (in millions) of Dunkin Brands Group and Starbucks Corporation follow: Determine the stockholders’ equity of each company.

> Bamboo Consulting is a consulting firm owned and operated by Lisa Gooch. The following end-of-period spreadsheet was prepared for the year ended July 31, 20Y5: Based on the preceding spreadsheet, prepare an income statement, statement of ownerâ

> Based on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Jordan Inc., which had a $1,080 beginning balance. In addition, there were no collections during the period. a. Set up a T acc

> The following accounts appeared in recent financial statements of Delta Air Lines: Identify each account as either a balance sheet account or an income statement account. For each balance sheet account, identify it as an asset, a liability, or owner&aci

> Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form ill

> Beginning inventory, purchases, and sales data for portable game players are as follows: / The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of the merchandise sold for each sale and t

> Kroger, Sprouts Farmers Market, Inc., and Ingles are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for these three companies indicated the following merchandis

> For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is highe

> The following data (in millions) were taken from recent annual reports of Apple Inc., a manufacturer of personal computers and related products, and Mattel Inc., a manufacturer of toys, including Barbie®, Hot Wheels®, and Disney Cla

> Based on the data in Exercise 7-15 and assuming that cost was determined by the FIFO method and lower of cost or market was determined on an individual item-by-item basis, show how the merchandise inventory would appear on the balance sheet. Data from E

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9.

> a. Sold merchandise for cash, $116,300. The cost of the merchandise sold was $72,000. b. Sold merchandise on account, $755,000. The cost of the merchandise sold was $400,000. c. Sold merchandise to customers who used MasterCard and VISA, $1,950,000. The

> Journalize entries for the following related transactions of Greenville Heating & Air Company: a. Purchased $57,000 of merchandise from Foster Co. on account, terms 2/10, n/30. b. Paid the amount owed on the invoice within the discount period. c. Discove

> Poff’s Co., a women’s clothing store, purchased $53,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Poff’s returned $7,000 of the merchandise, receiving a credit memo, and then paid the amount due within the discount per

> Identify the errors in the following schedule of the cost of merchandise sold for the year ended May 31, 20Y4:

> Based on the following data, determine the cost of merchandise sold for July: Merchandise inventory, July 1 ………………… $ 190,850 Merchandise inventory, July 31 …………………. 195,350 Purchases …………………………………………….. 1,126,000 Purchases returns and allowances ………………

> Based on the following data, determine the cost of merchandise sold for November: Merchandise inventory, November 1 ………….. $ 28,000 Merchandise inventory, November 30 ………….. 46,000 Purchases …………………………………………………. 475,000 Purchases returns and allowances …

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 20Y7: Merchandise inventory, May 1, 20Y6 ………………………….. $ 380,000 Merchandise inventory, April 30, 20Y7 …………………………. 426,600 Purchases ………………………………

> For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is highe

> Sinclair Company had sales of $12,000,000 and related cost of merchandise sold of $7,200,000 for its first year of operations ending December 31, 20Y1. Sinclair Company provides customers a refund for any returned or damaged merchandise. At the end of 20

> Swartz Company had sales of $7,800,000 and related cost of goods sold of $4,500,000 for its first year of operations ending December 31, 20Y3. Swartz Company provides customers a refund for any returned or damaged merchandise. At the end of 20Y3, Swartz

> Simons Company had sales of $24,000,000 and related cost of goods sold of $13,300,000 for its first year of operations ending December 31, 20Y6. Simons Company provides customers a refund for any returned or damaged merchandise. At the end of 20Y6, Simon

> Oppenheimer Company purchased merchandise on account from a supplier for $84,000, terms 1/10, n/30. Oppenheimer Company returned $16,000 of the merchandise and received full credit. a. What is the amount of cash required for the payment within the discou

> On April 23, Stilwell Inc. sold $15,000 of merchandise to Bosch Inc. with terms 2/10, n/30. The cost of the merchandise sold was $9,000. On May 2, Bosch Inc. paid Stilwell for the April 23 purchase less the discount. On May 11, Bosch Inc. returned mercha

> On February 18, Silverman Enterprises sold $24,000 of merchandise to Brewster Co. with terms 2/10, n/30. The cost of the merchandise sold was $12,200. On February 23, Silverman Enterprises issued Brewster Co. a credit memo for returned merchandise. The i

> Kroger Co., a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: Total revenue …………………………. $121,162 Total assets at end of year …………… 38,118 Total assets at beginning of year ….. 37,197 a.

> The Home Depot reported the following data (in millions) in its recent financial statements: a. Determine the asset turnover for The Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn concerning the trend in

> On July 31, 20Y7, the balances of the accounts appearing in the ledger of Yang Interiors Company, a furniture wholesaler, are as follows: Prepare the July 31, 20Y7, closing entries for Yang Interiors Company.

> Identify the errors in the following income statement:

> On August 1, the supplies account balance was $1,240. During August, supplies of $3,760 were purchased, and $1,600 of supplies were on hand as of August 31. Determine supplies expense for August.

> On March 31, 20Y4, the balances of the accounts appearing in the ledger of Danns Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 20Y4. b. Compare the major advantages

> Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 20Y3. Zell Company provides customers refunds and allowances for any damaged merchandise. At the end of the year,

> Assume the following data for Oshkosh Company before its year-end adjustments: Sales …………………………………………………………………………………….. $51,600,000 Estimated percent of refunds and allowances for current year sales ……….. 1.2% Journalize the adjusting entry for customer

> For a recent year, Best Buy reported sales of $42,879 million. Its gross profit was $9,961 million. What was the amount of Best Buy’s cost of merchandise sold?

> Paragon Tire Co.’s perpetual inventory records indicate that $2,780,000 of merchandise should be on hand on March 31, 20Y9. The physical inventory indicates that $2,734,800 of merchandise is actually on hand. Journalize the adjusting entry for the invent

> Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

> The debits and credits for four related entries for a sale of $15,000, terms 1/10, n/30, are presented in the following T accounts. Describe each transaction.

> During the current year, merchandise is sold for $45,870,000. The cost of the merchandise sold is $33,026,400. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement

> Transactions related to revenue and cash receipts completed by Augusta Inc. during the month of March 20Y8 are as follows: Mar. 2. Issued Invoice No. 512 to Santorini Co., $2,135. 4. Received cash from CMI Inc., on account, for $475. 8. Issued Invoice No

> The following data were taken from McClean Company’s balance sheet: a. Compute the ratio of liabilities to owner’s equity. b. Has the creditor’s risk increased or decreased from December 31, 20Y5, to

> Shannon Consulting Company had the following transactions during the month of October: Oct. 2. Issued Invoice No. 321 to Pryor Corp. for services rendered on account, $1,625. 3. Issued Invoice No. 322 to Armor Inc. for services rendered on account, $850.

> Assuming the use of a two-column (all-purpose) general journal, a purchases journal, and a cash payments journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded: a. Payment of six months

> The comparative segment revenues for Yum! Brands, a global quick-serve restaurant company, are as follows: a. Provide a horizontal analysis of the segment revenues using the prior year as the base year. Round whole percents to one decimal place. b. Prov

> Twenty-First Century Fox, Inc. is one of the world’s largest entertainment companies that includes Twentieth Century Fox films, Fox Broadcasting, Fox News, the FX, and various satellite properties. The company provided revenue disclosur

> Starbucks Corporation reported the following geographical segment revenues for a recent and a prior fiscal year: a. Prepare a horizontal analysis of the segment data using the prior year as the base year. Round whole percents to one decimal place. b. Pr

> Fernandez Services Inc. had the following transactions during the month of April: Apr. 4. Purchased office supplies from Officemate Inc. on account, $825. 9. Purchased office equipment on account from Tek Village Inc., $4,890. 16. Purchased office suppli

> Using the following revenue journal for Westside Cleaners Inc., identify each of the posting references, indicated by a letter, as representing (1) Posting to general ledger accounts or (2) Posting to subsidiary ledger accounts:

> Selected accounts from the ledger of Masterpiece Arts for the fiscal year ended April 30, 20Y2, are as follows: Prepare a statement of owner’s equity for the year.

> Serenity Systems Co. offers its services to residents in the Minneapolis area. Selected accounts from the ledger of Serenity Systems Co. for the fiscal year ended December 31, 20Y1, are as follows: Prepare a statement of owner’s equity

> FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: Prepare an income statement.

> The following data were taken from Nakajima Company’s balance sheet: a. Compute the ratio of liabilities to owner’s equity. b. Has the creditor’s risk increased or decreased from December 31, 20Y5, t

> The following revenue and expense account balances were taken from the ledger of Guardian Health Services Co. after the accounts had been adjusted on February 28, 20Y0, the end of the fiscal year: Prepare an income statement.

> The following account balances were taken from the adjusted trial balance for Capstone Messenger Service, a delivery service firm, for the fiscal year ended April 30, 20Y7: Prepare an income statement.

> Elliptical Consulting is a consulting firm owned and operated by Jayson Neese. The following end-of-period spreadsheet was prepared for the year ended June 30, 20Y6: Based on the preceding spreadsheet, prepare an income statement, statement of owner&aci

> Based on the data in Exercise 4-25, prepare the two closing entries for Alert Security Services Co. Data in Exercise 25:

> Based on the data in Exercise 4-24, prepare the adjusting entries for Alert Security Services Co. Data in Exercise 24:

> Based on the data in Exercise 4-25, prepare an income statement, statement of owner’s equity, and balance sheet for Alert Security Services Co. Data in Exercise 25:

> Alert Security Services Co. offers security services to business clients. Complete the following end-of-period spreadsheet for Alert Security Services Co.:

> Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepared on the following end-of-period spreadsheet for the year ended October 31, 20Y5: The data for year-end adjustmen

> The following data (in thousands) were taken from recent financial statements of Starbucks Corporation: a. Compute the working capital and the current ratio for Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning the company&a

> The following data (in thousands) were taken from recent financial statements of Under Armour, Inc.: a. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning t

> A summary of cash flows for Zenith Travel Service for the year ended August 31, 20Y4, follows: Cash receipts: Cash received from customers ……………………………… $881,000 Cash received from additional investment of owner …… 43,200 Cash payments: Cash paid for oper

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.

> Creative Images Co. offers its services to individuals desiring to improve their personal images. After the accounts have been adjusted at July 31, the end of the fiscal year, the following balances were taken from the ledger of Creative Images Co.: Jou

> Prior to closing, total revenues were $8,315,000 and total expenses were $6,460,000. During the year, the owner made no additional investments and withdrew $408,000. After the closing entries, how much did the owner’s capital account change?

> From the list that follows, identify the accounts that should be closed to the owner’s capital account at the end of the fiscal year: a. Accounts Receivable b. Accumulated Depreciation c. Building d. Depreciation Expense e. Fees Earned f. Jackie Lindsay,

> List the errors you find in the following balance sheet. Prepare a corrected balance sheet.

> MaxFit Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 20Y4, the end of the fiscal year, the balances of selected accounts from the ledger of MaxFit Weight Loss

> Identify each of the following as (a) A current asset or (b) Property, plant, and equipment: 1. Accounts Receivable 2. Building 3. Cash 4. Land 5. Prepaid Insurance 6. Supplies

> The balance in the unearned fees account, before adjustment at the end of the year, is $23,100. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $4,620.

> The following data are taken from recent financial statements of Nike, Inc. (in millions): a. Determine the amount of change (in millions) and percent of change in net income from Year 1 to Year 2. Round to one decimal place. b. Determine the percentage

> Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon’s income statements through operating income for two recent years are as follows (in millions): a. Prepare a vertical analysis of the two operating income s

> A summary of cash flows for Up-in-the-Air Travel Service for the year ended April 30, 20Y7, follows: Cash receipts: Cash received from customers ………………………………….. $1,803,000 Cash received from additional investment of owner …………. 52,000 Cash payments: Cash

> The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accounta

> For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $676 million. The income before taxes for Campbell for the year was $272 million. a. Assume the adjusting entry for $676 million of accrued expenses was not r

> For a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $5,675 million. For the same period, Costco reported income before income taxes of $4,442 million. Assume that the adjusting entry for $5,675 million of

> In a recent balance sheet, Microsoft Corporation reported property, plant, and equipment of $58,683 million and accumulated depreciation of $29,223 million. a. What was the book value of the fixed assets? b. Would the book value of Microsoft’s fixed asse

> The balance in the equipment account is $3,240,000, and the balance in the accumulated depreciation — equipment account is $2,134,000. a. What is the book value of the equipment? b. Does the balance in the accumulated depreciation account mean that the e

> The following data (in millions) were taken from the financial statements of Costco Wholesale Corporation: a. For Costco, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent

> The following errors took place in journalizing and posting transactions: a. Insurance of $18,000 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance. b. A withdrawal of $10,000 by Brian Phillips, owne

> Lowe’s Companies Inc., a major competitor of The Home Depot in the home improvement business, operates over 1,800 stores. Lowe’s recently reported the following balance sheet data (in millions): a. Determine the total

> The Home Depot is the world’s largest home improvement retailer and one of the largest retailers in the United States based on net sales volume. The Home Depot operates over 2,200 Home Depot® stores that sell a wide assortmen

> We-Sell Realty, organized August 1, 20Y9, is owned and operated by Omar Farah. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations?

> Using the following data for Zenith Travel Service as well as the statement of owner’s equity shown in Practice Exercise 1-5B, prepare a report form balance sheet as of August 31, 20Y4: Accounts payable …â€

> A summary of cash flows for Ethos Consulting Group for the year ended May 31, 20Y6, follows: Cash receipts: Cash received from customers ……………………………………… $637,500 Cash received from additional investment of owner ………….. 62,500 Cash payments: Cash paid for

> The following data (in millions) were taken from the financial statements of Target Corporation: a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the rece

> The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance: When the ledger and other records are reviewed, you discover the following: (1) The debits and credits in the cash account total $77,600 and $62,

> Financial information related to the proprietorship of Rockwell Interiors for February and March 20Y0 is as follows: a. Prepare balance sheets for Rockwell Interiors as of February 29 and March 31, 20Y0. b. Determine the amount of net income for March,

> Identify the errors in the following trial balance. All accounts have normal balances.

> Hermes Services was organized on August 1, 20Y2. A summary of the revenue and expense transactions for August follows: Fees earned …………….……. $627,600 Wages expense ……………….. 440,800 Rent expense ………….………… 28,100 Supplies expense ……………….. 6,800 Miscellaneo