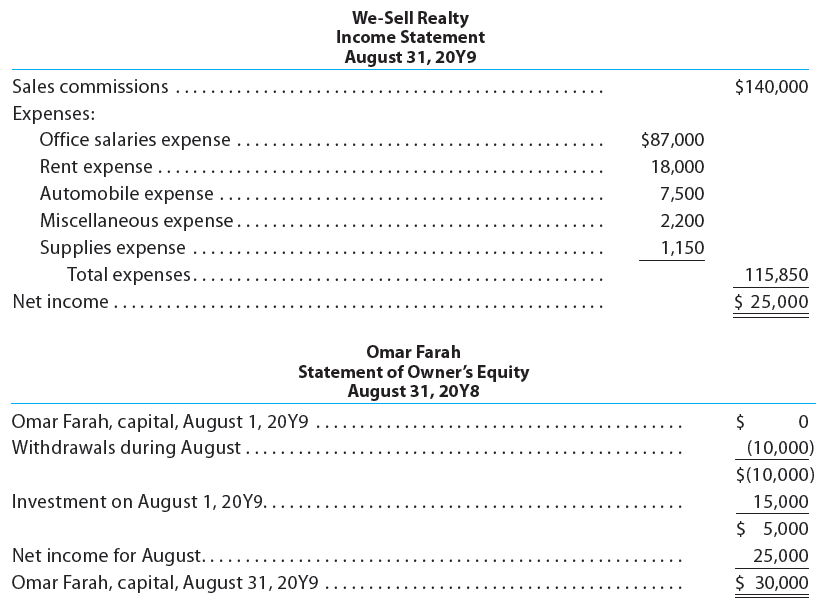

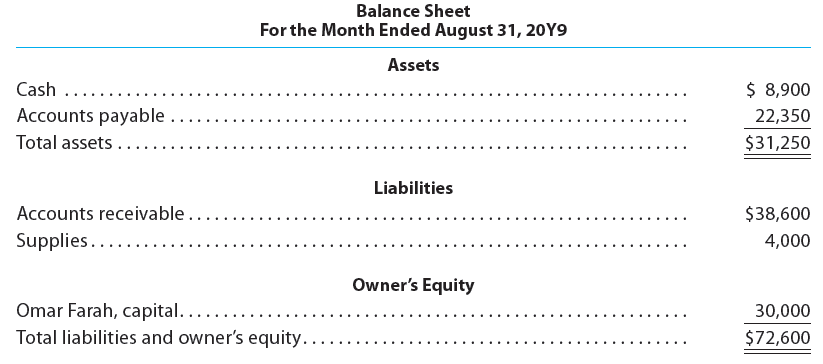

Question: We-Sell Realty, organized August 1, 20Y9,

We-Sell Realty, organized August 1, 20Y9, is owned and operated by Omar Farah. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations?

> Paragon Tire Co.’s perpetual inventory records indicate that $2,780,000 of merchandise should be on hand on March 31, 20Y9. The physical inventory indicates that $2,734,800 of merchandise is actually on hand. Journalize the adjusting entry for the invent

> Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

> The debits and credits for four related entries for a sale of $15,000, terms 1/10, n/30, are presented in the following T accounts. Describe each transaction.

> During the current year, merchandise is sold for $45,870,000. The cost of the merchandise sold is $33,026,400. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement

> Transactions related to revenue and cash receipts completed by Augusta Inc. during the month of March 20Y8 are as follows: Mar. 2. Issued Invoice No. 512 to Santorini Co., $2,135. 4. Received cash from CMI Inc., on account, for $475. 8. Issued Invoice No

> The revenue and cash receipts journals for Birmingham Productions Inc. follow. The accounts receivable control account has a January 1, 20Y4, balance of $4,720 consisting of an amount due from Clear Pointe Studios Inc. Prepare a listing of the accounts

> The following data were taken from McClean Company’s balance sheet: a. Compute the ratio of liabilities to owner’s equity. b. Has the creditor’s risk increased or decreased from December 31, 20Y5, to

> Shannon Consulting Company had the following transactions during the month of October: Oct. 2. Issued Invoice No. 321 to Pryor Corp. for services rendered on account, $1,625. 3. Issued Invoice No. 322 to Armor Inc. for services rendered on account, $850.

> Assuming the use of a two-column (all-purpose) general journal, a purchases journal, and a cash payments journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded: a. Payment of six months

> The comparative segment revenues for Yum! Brands, a global quick-serve restaurant company, are as follows: a. Provide a horizontal analysis of the segment revenues using the prior year as the base year. Round whole percents to one decimal place. b. Prov

> Twenty-First Century Fox, Inc. is one of the world’s largest entertainment companies that includes Twentieth Century Fox films, Fox Broadcasting, Fox News, the FX, and various satellite properties. The company provided revenue disclosur

> Starbucks Corporation reported the following geographical segment revenues for a recent and a prior fiscal year: a. Prepare a horizontal analysis of the segment data using the prior year as the base year. Round whole percents to one decimal place. b. Pr

> Fernandez Services Inc. had the following transactions during the month of April: Apr. 4. Purchased office supplies from Officemate Inc. on account, $825. 9. Purchased office equipment on account from Tek Village Inc., $4,890. 16. Purchased office suppli

> Using the following revenue journal for Westside Cleaners Inc., identify each of the posting references, indicated by a letter, as representing (1) Posting to general ledger accounts or (2) Posting to subsidiary ledger accounts:

> Selected accounts from the ledger of Masterpiece Arts for the fiscal year ended April 30, 20Y2, are as follows: Prepare a statement of owner’s equity for the year.

> Serenity Systems Co. offers its services to residents in the Minneapolis area. Selected accounts from the ledger of Serenity Systems Co. for the fiscal year ended December 31, 20Y1, are as follows: Prepare a statement of owner’s equity

> FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: Prepare an income statement.

> The following data were taken from Nakajima Company’s balance sheet: a. Compute the ratio of liabilities to owner’s equity. b. Has the creditor’s risk increased or decreased from December 31, 20Y5, t

> The following revenue and expense account balances were taken from the ledger of Guardian Health Services Co. after the accounts had been adjusted on February 28, 20Y0, the end of the fiscal year: Prepare an income statement.

> The following account balances were taken from the adjusted trial balance for Capstone Messenger Service, a delivery service firm, for the fiscal year ended April 30, 20Y7: Prepare an income statement.

> Elliptical Consulting is a consulting firm owned and operated by Jayson Neese. The following end-of-period spreadsheet was prepared for the year ended June 30, 20Y6: Based on the preceding spreadsheet, prepare an income statement, statement of owner&aci

> Based on the data in Exercise 4-25, prepare the two closing entries for Alert Security Services Co. Data in Exercise 25:

> Based on the data in Exercise 4-24, prepare the adjusting entries for Alert Security Services Co. Data in Exercise 24:

> Based on the data in Exercise 4-25, prepare an income statement, statement of owner’s equity, and balance sheet for Alert Security Services Co. Data in Exercise 25:

> Alert Security Services Co. offers security services to business clients. Complete the following end-of-period spreadsheet for Alert Security Services Co.:

> Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepared on the following end-of-period spreadsheet for the year ended October 31, 20Y5: The data for year-end adjustmen

> The following data (in thousands) were taken from recent financial statements of Starbucks Corporation: a. Compute the working capital and the current ratio for Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning the company&a

> The following data (in thousands) were taken from recent financial statements of Under Armour, Inc.: a. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning t

> A summary of cash flows for Zenith Travel Service for the year ended August 31, 20Y4, follows: Cash receipts: Cash received from customers ……………………………… $881,000 Cash received from additional investment of owner …… 43,200 Cash payments: Cash paid for oper

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.

> Creative Images Co. offers its services to individuals desiring to improve their personal images. After the accounts have been adjusted at July 31, the end of the fiscal year, the following balances were taken from the ledger of Creative Images Co.: Jou

> Prior to closing, total revenues were $8,315,000 and total expenses were $6,460,000. During the year, the owner made no additional investments and withdrew $408,000. After the closing entries, how much did the owner’s capital account change?

> From the list that follows, identify the accounts that should be closed to the owner’s capital account at the end of the fiscal year: a. Accounts Receivable b. Accumulated Depreciation c. Building d. Depreciation Expense e. Fees Earned f. Jackie Lindsay,

> List the errors you find in the following balance sheet. Prepare a corrected balance sheet.

> MaxFit Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 20Y4, the end of the fiscal year, the balances of selected accounts from the ledger of MaxFit Weight Loss

> Identify each of the following as (a) A current asset or (b) Property, plant, and equipment: 1. Accounts Receivable 2. Building 3. Cash 4. Land 5. Prepaid Insurance 6. Supplies

> The balance in the unearned fees account, before adjustment at the end of the year, is $23,100. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $4,620.

> The following data are taken from recent financial statements of Nike, Inc. (in millions): a. Determine the amount of change (in millions) and percent of change in net income from Year 1 to Year 2. Round to one decimal place. b. Determine the percentage

> Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon’s income statements through operating income for two recent years are as follows (in millions): a. Prepare a vertical analysis of the two operating income s

> A summary of cash flows for Up-in-the-Air Travel Service for the year ended April 30, 20Y7, follows: Cash receipts: Cash received from customers ………………………………….. $1,803,000 Cash received from additional investment of owner …………. 52,000 Cash payments: Cash

> The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accounta

> For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $676 million. The income before taxes for Campbell for the year was $272 million. a. Assume the adjusting entry for $676 million of accrued expenses was not r

> For a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $5,675 million. For the same period, Costco reported income before income taxes of $4,442 million. Assume that the adjusting entry for $5,675 million of

> In a recent balance sheet, Microsoft Corporation reported property, plant, and equipment of $58,683 million and accumulated depreciation of $29,223 million. a. What was the book value of the fixed assets? b. Would the book value of Microsoft’s fixed asse

> The balance in the equipment account is $3,240,000, and the balance in the accumulated depreciation — equipment account is $2,134,000. a. What is the book value of the equipment? b. Does the balance in the accumulated depreciation account mean that the e

> The following data (in millions) were taken from the financial statements of Costco Wholesale Corporation: a. For Costco, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent

> The following errors took place in journalizing and posting transactions: a. Insurance of $18,000 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance. b. A withdrawal of $10,000 by Brian Phillips, owne

> Lowe’s Companies Inc., a major competitor of The Home Depot in the home improvement business, operates over 1,800 stores. Lowe’s recently reported the following balance sheet data (in millions): a. Determine the total

> The Home Depot is the world’s largest home improvement retailer and one of the largest retailers in the United States based on net sales volume. The Home Depot operates over 2,200 Home Depot® stores that sell a wide assortmen

> Using the following data for Zenith Travel Service as well as the statement of owner’s equity shown in Practice Exercise 1-5B, prepare a report form balance sheet as of August 31, 20Y4: Accounts payable …â€

> A summary of cash flows for Ethos Consulting Group for the year ended May 31, 20Y6, follows: Cash receipts: Cash received from customers ……………………………………… $637,500 Cash received from additional investment of owner ………….. 62,500 Cash payments: Cash paid for

> The following data (in millions) were taken from the financial statements of Target Corporation: a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the rece

> The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance: When the ledger and other records are reviewed, you discover the following: (1) The debits and credits in the cash account total $77,600 and $62,

> Financial information related to the proprietorship of Rockwell Interiors for February and March 20Y0 is as follows: a. Prepare balance sheets for Rockwell Interiors as of February 29 and March 31, 20Y0. b. Determine the amount of net income for March,

> Identify the errors in the following trial balance. All accounts have normal balances.

> Hermes Services was organized on August 1, 20Y2. A summary of the revenue and expense transactions for August follows: Fees earned …………….……. $627,600 Wages expense ……………….. 440,800 Rent expense ………….………… 28,100 Supplies expense ……………….. 6,800 Miscellaneo

> Financial information related to Pegasus Products Company, a proprietorship, for the month ended April 30, 20Y7, is as follows: Net income for April …………………………………………….. $161,000 Brian Walinsky’s withdrawals during April ……………….. 24,000 Brian Walinsky’s c

> When preparing the financial statements for the year ended October 31, accrued salaries owed to employees for October 30 and 31 were omitted. The accrued salaries were included in the first salary payment in November. Indicate which items will be erroneo

> The accounts in the ledger of Hickory Furniture Company as of December 31, 20Y6, are listed in alphabetical order below. All accounts have normal balances. The balance of the cash account has been intentionally omitted. Prepare an unadjusted trial balan

> Four different proprietorships, Dakota, Jersey, Carolina, and Iowa, show the same balance sheet data at the beginning and end of a year. These data, exclusive of the amount of owner’s equity, are summarized as follows: On the basis of

> Using the following data for Up-in-the-Air Travel Service as well as the statement of owner’s equity shown in Practice Exercise 1-5A, prepare a report form balance sheet as of April 30, 20Y7: Accounts payable …â

> Perimeter Realty Co. pays weekly salaries of $14,800 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (a) On Wednesday and (b) On Thursday.

> Emerald Tours Co. is a travel agency. The nine transactions recorded by Emerald Tours during May 20Y5, its first month of operations, are indicated in the following T accounts: Indicate for each debit and each credit (a) Whether an asset, liability, own

> The balance in the supplies account, before adjustment at the end of the year, is $10,680. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $1,940.

> a. During February, $194,500 was paid to creditors on account, and purchases on account were $210,400. Assuming that the February 28 balance of Accounts Payable was $62,500, determine the account balance on February 1. b. On October 1, the accounts recei

> On September 18, 20Y4, Carbon Company purchased $8,710 of supplies on account. In Carbon Company’s chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. a. Journalize the September 18, 20Y4, transaction on Page 87

> Simmons Consulting Co. has the following accounts in its ledger: Cash; Accounts Receivable; Supplies; Office Equipment; Accounts Payable; Michael Short, Capital; Michael Short, Drawing; Fees Earned; Rent Expense; Advertising Expense; Utilities Expense; M

> Indicate whether each of the following is identified with (1) an asset, (2) a liability, or (3) owner’s equity: a. accounts receivable b. accounts payable c. cash d. fees earned e. land f. rent expense g. supplies

> Penny Lyman is the owner and operator of Go 109, a motivational consulting business. At the end of its accounting period, December 31, 20Y1, Go 109 has assets of $659,000 and liabilities of $165,000. Using the accounting equation and considering each cas

> Determine the missing amount for each of the following:

> The total assets and total liabilities (in millions) of Dollar Tree Inc. and Target Corporation follow: Determine the stockholders’ equity of each company.

> Using the income statement for Zenith Travel Service shown in Practice Exercise 1-4B, prepare a statement of owner’s equity for the year ended August 31, 20Y4. Megan Cox, the owner, invested an additional $43,200 in the business during

> The following revenue transactions occurred during August: Aug. 4. Issued Invoice No. 162 to Oasis Enterprises Co. for services provided on account, $320. 15. Issued Invoice No. 163 to City Electric Inc. for services provided on account, $535. 25. Issued

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> Equations (7.13) and (7.14) show two formulas for the homoskedasticity-only F-statistic. Show that the two formulas are equivalent. Data from Equation 7.13: Data from Equation 7.14:

> Refer to the table of estimated regressions, computed using data on employees in a developing country. The data set consists of information on over 10,000 full-time, full-year workers. The highest educational achievement for each worker is either a high

> (Yi, X1i, X2i) satisfy the assumptions. You are interested in b1, the causal effect of X1 on Y. Suppose X1 and X2 are uncorrelated. You estimate 1 by regressing Y onto X1 (so that X2 is not included in the regression). Does this estimator suffer from om

> A government study found that people who eat chocolate frequently weigh less than people who don’t. Researchers questioned 1000 individuals from Cairo between the ages of 20 and 85 about their eating habits, and measured their weight and height. On avera

> Critique each of the following proposed research plans. Your critique should explain any problems with the proposed research and describe how the research plan might be improved. Include a discussion of any additional data that need to be collected and t

> X and Y are discrete random variables with the following joint distribution: That is, Pr (X = 3, Y = 2) = 0.04, and so forth. a. Calculate the probability distribution, mean, and variance of Y. b. Calculate the probability distribution, mean, and varianc

> A researcher plans to study the causal effect of a strong legal system on the number of scandals in a country, using data from a random sample of countries in Asia. The researcher plans to regress the number of scandals on how strong a legal system is in

> Data were collected from a random sample of 200 home sales from a community in 2013. Let Price denote the selling price (in $1000s), BDR denote the number of bedrooms, Bath denote the number of bathrooms, Hsize denote the size of the house (in square fee

> Refer to the table of estimated regressions, computed using data for 2015 from the Current Population Survey. The data set consists of information on 7178 full-time, full-year workers. The highest educational achievement for each worker was either a high

> Refer to the table of estimated regressions, computed using data for 2015 from the Current Population Survey. The data set consists of information on 7178 full-time, full-year workers. The highest educational achievement for each worker was either a high

> Refer to the table of estimated regressions, computed using data for 2015 from the Current Population Survey. The data set consists of information on 7178 full-time, full-year workers. The highest educational achievement for each worker was either a high

> A school district undertakes an experiment to estimate the effect of class size on test scores in second-grade classes. The district assigns 50% of its previous year’s first graders to small second-grade classes (18 students per classroom) and 50% to reg

> Consider the regression model Yi = 1X1i + 2X2i + ui for i = 1, ……, n. Following analysis a. Specify the least squares function that is minimized by OLS. b. Compute the partial de

> (Yi, X1i, X2i) satisfy the assumption; in addition, var (ui | X1i, X2) = 4 and var (X1i) = 6. A random sample of size n = 400 is drawn from the population. a. Assume that X1 and X2 are uncorrelated. Compute the variance of ^1. b. Assume that corr (X1,

> Refer to the table of estimated regressions, computed using data for 2015 from the Current Population Survey. The data set consists of information on 7178 full-time, full-year workers. The highest educational achievement for each worker was either a high

> Consider the regression model Yi = Xi + ui, where ui and Xi satisfy the least squares assumptions. Let denote an estimator of b that is constructed as = Y>X, where Y and X are the sample means of Yi and Xi, respectively. a. Show that is a linear f

> The random variable Y has a mean of 4 and a variance of 1/9. Let Z = 3 (Y – 4). Find the mean and the variance of Z.

> Suppose (Yi, Xi) satisfy the least squares assumptions in Key Concept 4.3 and, in addition, ui is N (0, 2u) and is independent of Xi. A sample of size n = 30 yields where the numbers in parentheses are the homoskedastic-only standard er

> Suppose (Yi, Xi) satisfy the least squares assumptions. A random sample of size n = 250 is drawn and yields Y^ = 5.4 + 3.2X, R2 = 0.26, SER = 6.2. (3.1) (1.5) a. Test H0: 1 = 0 vs. H1: 1 ≠ 0 at the 5% level. b. Construct a 95% confidence interval for

> Refer to the regression described in Exercise 5.5. a. Do you think that the regression errors are plausibly homoskedastic? Explain. b. SE (^1) was computed using Equation. Suppose the regression errors were homoskedastic. Would this aff

> In the 1980s, Tennessee conducted an experiment in which kindergarten students were randomly assigned to “regular” and “small” classes and given standardized tests at the end of the

> Read the box “The Economic Value of a Year of Education: Homoskedasticity or Heteroskedasticity?”. Use the regression reported in Equation (5.23) to answer the following. a. A randomly selected 30-year-old worker repor