Question: The Town of Weston has a Water

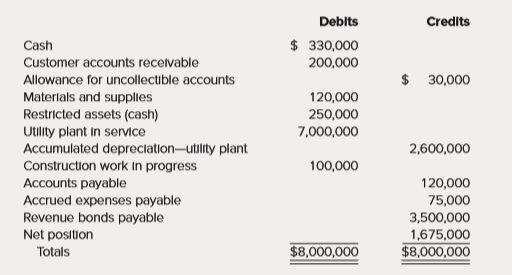

The Town of Weston has a Water Utility Fund with the following trial balance as of July 1, 2016, the first day of the fiscal year:

During the year ended June 30, 2017, the following transactions and events occurred in the Town of Weston Water Utility Fund:

1. Accrued expenses at July 1 were paid in cash.

2. Billings to nongovernmental customers for water usage for the year amounted to $1,380,000; billings to the General Fund amounted to $107,000.

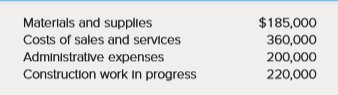

3. Liabilities for the following were recorded during the year:

4. Materials and supplies were used in the amount of $275,000, all for costs of sales and services. 5. $14,000 of old accounts receivable were written off.

6. Accounts receivable collections totaled $1,462,000 from nongovernmental customers and $48,400 from the General Fund.

7. $1,035,000 of accounts payable were paid in cash.

8. One year’s interest in the amount of $175,000 was paid.

9. Construction was completed on plant assets costing $250,000; that amount was transferred to Utility Plant in Service.

10. Depreciation was recorded in the amount of $260,000.

11. Interest in the amount of $25,000 was reclassified to Construction Work in Progress. (This was previously paid in item 8.)

12. The Allowance for Uncollectible Accounts was increased by $9,900.

13. As required by the loan agreement, cash in the amount of $100,000 was transferred to Restricted Assets for eventual redemption of the bonds.

14. Accrued expenses, all related to costs of sales and services, amounted to $89,000.

15. Nominal accounts for the year were closed.

Required:

a. Record the transactions for the year in general journal form.

b. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position.

c. Prepare a Statement of Net Position as of June 30, 2017.

d. Prepare a Statement of Cash Flows for the year ended June 30, 2017. Assume all debt and interest are related to capital outlay. Assume the entire construction work in progress liability (see item 3) was paid in entry 7. Include restricted assets as cash and cash equivalents.

Transcribed Image Text:

Deblts Credits Cash $ 330,000 Customer accounts recelvable 200,000 Allowance for uncollectible accounts $ 30,000 Materlals and supplles Restricted assets (cash) Utility plant in service Accumulated depreciation-utility plant 120,000 250,000 7,000,000 2,600,000 Construction work in progress 100,000 Accounts payable Accrued expenses payable Revenue bonds payable Net position 120,000 75,000 3,500,000 1,675,000 $8,000,000 Totals $8,000,000 Materials and supples $185,000 Costs of sales and services 360,000 Administrative expenses Construction work In progress 200,000 220,000

> What capabilities can local suppliers in high-cost countries develop if they are to effectively compete against overseas suppliers in low-cost countries? Discuss how each capability impacts the level of inventory in the supply chain.

> For each of the five levers—capacity, inventory, time, information, and price—identify an example where a supply chain has focused on this lever to deal with uncertainty. In each case, identify reasons why you think it is or is not an appropriate choice.

> Consider the purchase of a can of soda at a convenience store. Describe the various stages in the supply chain and the different flows involved.

> Consider FASB standards for accounting for contributions and answer the following: a. Outline revenue recognition criteria for resources restricted for (1) time and (2) purpose. b. Describe the difference in accounting for contributions with a condit

> Consider FASB standards for reporting by private not-for-profit organizations and answer the following: a. What are the financial reports required of all not-for-profits? What additional report is required for voluntary health and welfare organizations

> The Grant Wood Arts Association had the following trial balance as of January 1, 2017, the first day of the year: During the year ended December 31, the following transactions occurred: 1. Cash contributions during the year included (a) unrestricted,

> The Blair Museum Association, a nonprofit organization, had the following transactions for the year ended December 31, 2017. 1. Cash contributions to the Association for the year included (a) Unrestricted, $970,000; (b) Restricted for traveling displ

> The Ombudsman Foundation is a private not-for-profit organization providing training in dispute resolution and conflict management. The Foundation had the following pre closing trial balance at December 31, 2017, the end of its fiscal year: a. Prepar

> With regard to current GASB standards for pension reporting: 1. Distinguish between (1) Defined contribution plans. (2) Defined benefit plans. 2. Distinguish between defined benefit pension reporting for (1) Governmental fund statements. (2) For ent

> On July 1, 2016, a five-year agreement is signed between the City of Genoa and the Computer Leasing Corporation for the use of computer equipment not associated with proprietary funds activity. The cost of the lease, excluding executory costs, is $15,000

> On January 1, 2017, the Mount Rogers city water department leases a truck under a non-cancelable lease agreement meeting the requirements for classification as a capital lease. The present value (8 percent interest) of the minimum lease payments is $45,0

> Assume a government leases equipment to be used in governmental activities under a noncancelable lease, meeting the requirements for classification as a capital lease. Where the capital lease and the payments on the lease would be reported in the governm

> Beachfront property owners of the Town of Eden Beach requested a seawall be constructed to protect their beach. The seawall was financed through a note payable, which was to be repaid from taxes raised through a special assessment on their properties. Th

> The Great Lakes Maritime Institute is a public institution preparing cadets for careers in commercial shipping and includes instruction in piloting, navigation, maritime law, and other fields. 1. The Institute began the year with the following account

> Residents of a neighborhood financed the installation of sidewalks through a note payable. The note was to be repaid through a special assessment tax on their properties. When is it appropriate to account for special assessment activities in an agency fu

> Presented below is the Governmental Funds Statement of Revenues, Expenditures, and Changes in Fund Balances for the Trinity Parish Fire District, a special-purpose entity engaged in a single governmental activity. Prepare a combined Governmental Funds

> Presented below is the Governmental Funds Balance Sheet for the Warrenton Library District, a special-purpose entity engaged in a single governmental activity. Prepare a combined Governmental Funds Balance Sheet/Statement of Net Position in the format pr

> With regard to current GASB standards for other postemployment benefit reporting: 1. What are other postemployment benefits? 2. What are the reporting requirements of OPEB obligations for financial statements prepared using the economic resources measure

> Amherst City provides a defined benefit pension plan for employees of the city electric utility, an enterprise fund. Assume that the projected level of earnings on plan investments is $190,000, the service cost component is $250,000, and interest on the

> The City of Grinders Switch maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments fo

> The following information is available for the preparation of the government wide financial statements for the City of Northern Pines for the year ended June 30, 2017: / From the previous information, prepare, in good form, a Statement of Activities fo

> The following information is available for the preparation of the government wide financial statements for the City of Southern Springs as of April 30, 2017: From the preceding information, prepare (in good form) a Statement of Net Position for the Cit

> List some of the major adjustments required when converting from fund financial statements to government-wide statements.

> Under the reporting model required by GASB Statement 34, fund statements are required for governmental, proprietary, and fiduciary funds. Government wide statements include the Statement of Net Position and Statement of Activities. Answer the following q

> Go to the GASB website (www.gasb.org). What is the mission of GASB?

> Answer the following questions with regard to infrastructure: a. What is infrastructure? b. What are the two methods that might be used to record infrastructure expense from year to year? How is the accounting different under the two methods? c. What

> The government-wide Statement of Net Position separately displays governmental activities and business activities. Why are internal service funds most commonly displayed as governmental activities?

> Identify the types of nonexchange revenues that are most likely to result in differences in the timing of recognition between the accrual and modified accrual bases of accounting.

> Presented on the following pages are partial financial statements for the City of Shenandoah, including: / Additional Information: 1. $856,700 of the capital assets purchased in fiscal year 2017 was equipment. All remaining capital acqui

> The City of Southern Pines maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. As such, the City’s internal service fund, a motor pool fund, is included in the

> The City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the foll

> Baird County maintains an investment trust fund for the School District and the Town of Bairdville (separate governments). Presented below is the pre closing trial balance for the investment trust fund, a private-purpose trust fund. Prepare

> Describe GASB requirements for accounting for investment trust funds. Include (a) A discussion of when the use of investment trust funds is appropriate. (b) The investments to be included and excluded. (c) The basis at which investments are to be report

> On July 1, 2016, the Morgan County School District received a $50,000 gift from a local civic organization with the stipulation that, on June 30 of each year, $3,500 plus any interest earnings on the unspent principal be awarded as a college scholarship

> On July 1, 2016, the City of Belvedere accepted a gift of cash in the amount of $3,200,000 from a number of individuals and foundations and signed an agreement to establish a private-purpose trust. The $3,200,000 and any additional gifts are to be invest

> The following information is available for the preparation of the governmentwide financial statements for the city of Southern Springs as of April 30, 2017: Cash and cash equivalents, governmental activities….……………………....$ 3,850,000 Cash and cash equiva

> Presented below is the pre closing trial balance for the Scholarship Fund, a private-purpose trust fund of the Algonquin School District. Prepare the year-end closing entries and a Statement of Changes in Fiduciary Net Position for the year ended Decem

> A concerned citizen provides resources and establishes a trust with the local government. What factors should be considered in determining which fund to report the trust activities?

> Benton County maintains a tax agency fund for use by the County Treasurer to record receivables, collections, and disbursements of all property tax collections to all other units of government in the county. For FY 2016–2017, the follow

> Describe how the fiduciary fund categories could change under the GASB exposure draft for fiduciary funds? What current fund type would be discontinued, and where would those activities be reported in the future?

> Presented below is the pre closing trial balance for the Retiree Health Benefit Plan of the Alger County School District. Prepare (1) The year-end closing entries. (2) A Statement of Changes in Fiduciary Net Position. (3) A Statement of Fiduciary Net

> The City of Sweetwater maintains an Employees’ Retirement Fund, a single employer defined benefit plan that provides annuity and disability benefits. The fund is financed by actuarially determined contributions from the cityâ€

> Assume that a local government is the trustee for the pension assets for its police and fire department employees and participates in a statewide plan for all of its other employees. Individual accounts are maintained for all local governments in the sta

> With regard to current GASB standards for pension reporting, do the following: a. Distinguish between (1) Defined contribution plans. (2) Defined benefit plans. b. Distinguish between (1) Agent (2) Cost-sharing multiemployer plans. c. Define the f

> What are the required financial statements for a pension trust fund? What are the required supplementary information schedules?

> The following is a Statement of Cash Flows for the risk management internal service fund of the City of Wrightville. An inexperienced accountant prepared the statement using the FASB format rather than the format required by GASB. All long-term debt was

> Accounting and financial reporting for state and local governments use, in different places, either the economic resources measurement focus and the accrual basis of accounting or the current financial resources measurement focus and the modified accrual

> The Village of Parry reported the following for its Print Shop Fund for the year ended April 30, 2017. The Print Shop Fund records also revealed the following: The following balances were observed in current asset and current liability accounts. ( ) d

> The City of Sandwich purchased a swimming pool from a private operator as of April 1, 2017, for $400,000, of which $200,000 was provided by a onetime contribution from the General Fund, and $200,000 was provided by a loan from the First National Bank, se

> Using the information provided in exercise 6–4, prepare the reconciliation of operating income to net cash provided by operating activities that would appear at the bottom of the December 31 Statement of Cash Flows. Recall that the beginning balance of a

> The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2017, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. a. Prepare the closing e

> Why might it be desirable to operate enterprise funds at a profit?

> What accounting problem arises if an internal service fund is operated at a significant profit? What accounting problem arises if an internal service fund is operated at a significant loss?

> The Town of Thomaston has a Solid Waste Landfill Enterprise Fund with the following trial balance as of January 1, 2017, the first day of the fiscal year. During the year, the following transactions and events occurred: 1. Citizens and trash companies

> The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements s

> The Town of Frostbite self-insures for some of its liability claims and purchases insurance for others. In an effort to consolidate its risk management activities, the Town recently decided to establish an internal service fund, the Risk Management Fund.

> Describe the “hierarchy of GAAP” for state and local governments.

> The Village of Burksville, which has a fiscal year July 1 to June 30, sold $2,000,000 in 5 percent tax-supported bonds at par to construct an addition to its police station. The bonds were dated and issued on July 1, 2016. Interest is payable semiannuall

> The Village of Hawksbill issued $4,000,000 in 5 percent general obligation, tax-supported bonds on July 1, 2016, at 101. A fiscal agent is not used. Resources for principal and interest payments are to come from the General Fund. Interest payment dates a

> a. Armstrong County established a County Office Building Construction Fund to account for a project that was expected to take less than one year to complete. The County’s fiscal year ends on June 30. 1. On July 1, 2016, bonds were sold at par in the amo

> A citizen group raised funds to establish an endowment for the Eastville City Library. Under the terms of the trust agreement, the principal must be maintained, but the earnings of the fund are to be used to purchase database and periodical subscriptions

> The citizens of Spencer County approved the issuance of $2,000,000 in 6 percent general obligation bonds to finance the construction of a courthouse annex. A capital projects fund was established for that purpose. The preclosing trial balance of the cour

> A government has outstanding bonds payable. Interest is payable on a date other than the fiscal year-end. What is the appropriate method of accounting for interest accruals by debt service funds?

> What are the major sources of funds for capital project and debt service funds, and how are the sources classified in the Statement of Revenues, Expenditures, and Changes in Fund Balance?

> A concerned citizen provides resources and establishes a trust with the local government. What factors should be considered in determining in which fund to report the trust activities?

> The City of Sharpesburg received a gift of $1,000,000 from a local resident on June 1, 2017, and signed an agreement that the funds would be invested permanently and that the income would be used to maintain the city wildlife preserve and nature center.

> The following transactions relate to Newport City’s special revenue fund. 1. In 2017, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones.

> What is the definition of a government as agreed upon by the FASB and GASB?

> Lincoln County’s General Fund had two interfund transactions: 1. The General Fund paid $320,000 to the Housing and Urban Development Fund, a special revenue fund that is supported by grants from the federal government on a cost reimbursement basis. The

> The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2017: 1. Beginning balances were: Cash, $90,000; Taxes Receivable, $185,000; Accounts Payable, $50,000; and Fund Balance, $225,000. 2. Th

> The following information was abstracted from the accounts of the General Fund of the City of Rome after the books had been closed for the fiscal year ended June 30, 2017. There were no transfers into the General Fund, but there was one transfer out. P

> Prepare journal entries in the General Fund of the Brownville School District. a. The District had outstanding encumbrances of $11,200 for band instruments from the previous year. It is the District’s policy to re-establish those encumbrances in the s

> The Town of Quincy’s fiscal year ends on June 30. The following data relate to the property tax levy for the fiscal year ended June 30, 2017. Prepare journal entries for each of the dates as indicated. a. The balance in Deferred Inflows—Property Taxes

> On January 1, 2017, the first day of its fiscal year, Carter City received notification that a federal grant in the amount of $560,000 was approved. The grant was restricted for the payment of wages to teenagers for summer employment. The terms of the gr

> The Village of Seaside Pines prepared the following General Fund Trial Balance as of December 31, 2017, the last day of its fiscal year. Control accounts are used for budgetary entries. 1. Prepare the closing entries for December 31. (It is not necess

> Assume at the beginning of 2017 the Village of Ashlawn Street and Highway Fund (a special revenue fund) has cash of $136,000 offset by assigned fund balance in the same amount. 1. During the year, the State notified the Village that $500,000 for the St

> The City of South Dundee budget for the fiscal year ended June 30, 2017, included an appropriation for the police department in the amount of $8,700,000. During the month of July 2016, the following transactions occurred (in summary): Purchase orders

> Distinguish between the (1) GAAP basis and (2) budgetary basis of reporting for the General Fund.

> Identify and briefly describe the three organizations that set standards for state and local governments, the federal government, and nongovernmental not-for-profit organizations.

> a. Outline revenue recognition criteria under modified accrual accounting. Include specific requirements for property tax revenue. b. Outline expenditure recognition criteria under modified accrual accounting.

> a. Distinguish between (1) Exchange (2) Non exchange transactions. b. Identify and describe the four eligibility requirements for a government to recognize revenue in a non-exchange transaction. c. GASB classifies non-exchange transactions into four

> Presented below are account balances for Monterey Hospital. In addition, cash transactions for the year ended December 31, 2017, are summarized in the T-account. The hospital issued $600,000 of long-term debt during the year and purchased $307,000 of

> As of January 1, 2017, the trial balance for Haven Hospital was as follows: During the fiscal year ended December 31, 2017, the following transactions occurred: 1. Patient service revenue amounted to $20,990,000, all recorded on account. Contractual a

> The Association of Women in Government established an Educational Foundation to raise money to support scholarship and other education initiatives. The Educational Foundation is a private not-for-profit. Members of the Association of Women in Government

> Jefferson Animal Rescue is a private not-for-profit clinic and shelter for abandoned domesticated animals, chiefly dogs and cats. At the end of 2016, the organization had the following account balances: The following took place during 2017: 1. Additio

> The fund-basis financial statements of Cherokee Library District (a special purpose government engaged only in governmental activities) have been completed for the year 2017 and appear in the second and third tabs of the Excel spreadsheet provided with t

> The fund-basis financial statements of the City of Cottonwood have been completed for the year 2017 and appear in the first tab of the Excel spreadsheet provided with this exercise. In addition, the government-wide Statement of Net Position from the prev

> The fund-basis financial statements of Jefferson County have been completed for the year 2017 and appear in the first tab of the Excel spreadsheet provided with this exercise. The following information is also available: a. Capital Assets Capital ass

> A successful businessman in the community has contacted the Moose County Board of Commissioners about donating income-producing securities to the County to support a particular activity. Under the agreement, the County would be required to maintain the p

> Identify and describe the five environmental differences between governments and for-profit business enterprises as identified in the Governmental Accounting Standards Board’s Why Governmental Accounting and Financial Reporting Is—and Should Be—Different

> In December 2016, the Hamilton County Board of Commissioners established the Hamilton County OPEB Trust Fund. Retired employees of Hamilton County can participate in postemployment benefits through the Trust. The Trust is a single-employer defined benefi

> Rural County is an agricultural community located hundreds of miles from any metropolitan center. The County established a Television Reception Improvement Fund to serve the public interest by constructing and operating television translator stations. TV

> Jefferson County operates a centralized motor pool to service county vehicles. At the end of 2016, the Motor Pool Internal Service Fund had the following account balances: The following events took place during 2017: 1. Additional supplies were purch

> The Town of McHenry has $10,000,000 in general obligation bonds outstanding and maintains a single debt service fund for all debt service transactions. On July 1, 2017, a current refunding took place in which $10,000,000 in new general obligation bonds w

> Using the information from Exercise 14–6, prepare a schedule showing the status of the appropriation at the end of the first quarter. Data from Exercise 14-6: Assume a federal agency has the following events: 1. Receives a warrant from the Treasury n

> Distinguish between private and public sector organization.

> What bodies are responsible for establishing accounting standards for the federal government and its agencies?

> What are the required financial statements of a federal agency?

> Jefferson County established a capital project fund in 2016 to build low income housing with the transfer of $100,000 from the General Fund. A portion of that was expended on engineering studies in 2016. The following transactions occurred during 2017:

> For each of the summarized transactions for the Village of Sycamore General Fund, prepare the general ledger journal entries. a. The budget was formally adopted, providing for estimated revenues of $1,070,000 and appropriations of $996,000. b. Revenues