Question: The trial balances before and after adjustment

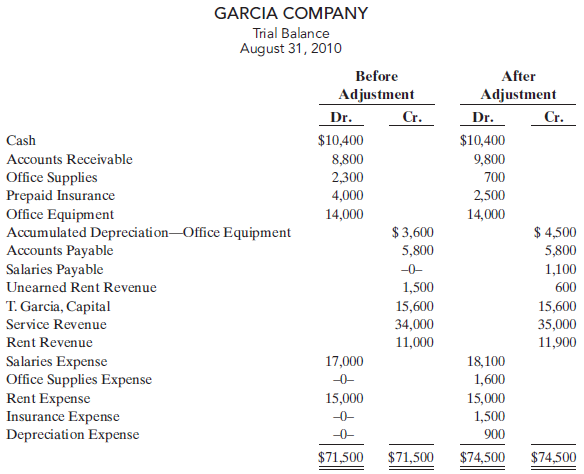

The trial balances before and after adjustment for Garcia Company at the end of its fiscal year is presented below.

Instructions

Prepare the adjusting entries that were made.

Transcribed Image Text:

GARCIA COMPANY Trial Balance August 31, 2010 Before After Adjustment Adjustment Dr. Cr. Dr. Cr. Cash $10,400 $10,400 Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Salaries Payable 8,800 2,300 9,800 700 4,000 2,500 14,000 14,000 $ 3,600 $ 4,500 5,800 5,800 -0- 1,100 Unearned Rent Revenue 1,500 600 T. Garcia, Capital 15,600 15,600 Service Revenue 34,000 11,000 35,000 11,900 Rent Revenue Salaries Expense Office Supplies Expense Rent Expense Insurance Expense Depreciation Expense 17,000 18,100 1,600 15,000 -0- 15,000 -0- 1,500 -0- 900 $71,500 $71,500 $74,500 $74,500

> Smart Company identifies the following items for possible inclusion in the taking of a physical inventory. Indicate whether each item should be included or excluded from the inventory taking. (a) Goods shipped on consignment by Smart to another company.

> Premier Bank and Trust is considering giving Lima Company a loan. Before doing so, they decide that further discussions with Lima’s accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of $297

> Karen Sommers Travel Agency purchased land for $90,000 cash on December 10, 2010. At December 31, 2010, the land’s value has increased to $93,000. What amount should be reported for land on Karen Sommers’s balance sheet at December 31, 2010? Explain.

> An analysis of the transactions made by S. Moses & Co., a certified public accounting firm, for the month of August is shown below. The expenses were $650 for rent, $4,900 for salaries, and $500 for utilities. Instructions (a) Describe each transact

> In its income statement for the year ended December 31, 2010, Pele Company reported the following condensed data. Operating expenses $ 925,000 Interest revenue $ 28,000 Cost of goods sold 1,289,000 Loss on sale of equipment 10,000 Interest expense

> Assume that Alshare Company uses a periodic inventory system and has these account balances: Purchases $450,000; Purchase Returns and Allowances $11,000; Purchase Discounts $8,000; and Freight-in $16,000. Determine net purchases and cost of goods purchas

> Presented below is information for Obley Company for the month of March 2010. Instructions (a) Prepare a multiple-step income statement. (b) Compute the gross profit rate. $212,000 $ 32,000 Cost of goods sold Freight-out Insurance expense Salary exp

> Assume Baja Company has the following reported amounts: Sales $510,000, Sales returns and allowances $15,000, Cost of goods sold $350,000, Operating expenses $110,000. Compute the following: (a) net sales, (b) gross profit, (c) income from operations,

> Explain where each of the following items would appear on (1) a multiple step income statement, and on (2) a single-step income statement: (a) gain on sale of equipment, (b) interest expense, (c) casualty loss from vandalism, and (d) cost of goods sold

> Presented is information related to Rogers Co. for the month of January 2010. Instructions (a) Prepare the necessary adjusting entry for inventory. (b) Prepare the necessary closing entries. $ 12,000 Ending inventory per perpetual records Ending inv

> Peter Kalle Company had the following account balances at year-end: cost of goods sold $60,000; merchandise inventory $15,000; operating expenses $29,000; sales $108,000; sales discounts $1,200; and sales returns and allowances $1,700. A physical count o

> Maulder Company provides the following information for the month ended October 31, 2010: Sales on credit $280,000, cash sales $100,000, sales discounts $13,000, sales returns and allowances $11,000. Prepare the sales revenues section of the income statem

> The adjusted trial balance of Zambrana Company shows the following data pertaining to sales at the end of its fiscal year October 31, 2010: Sales $800,000, Freight-out $16,000, Sales Returns and Allowances $25,000, and Sales Discounts $15,000. Instructi

> Bleeker Company has the following merchandise account balances: Sales $195,000, Sales Discounts $2,000, Cost of Goods Sold $105,000, and Merchandise Inventory $40,000. Prepare the entries to record the closing of these items to Income Summary.

> Brandon Computer Timeshare Company entered into the following transactions during May 2010. 1. Purchased computer terminals for $20,000 from Digital Equipment on account. 2. Paid $4,000 cash for May rent on storage space. 3. Received $15,000 cash from cu

> Presented below are transactions related to Wheeler Company. 1. On December 3, Wheeler Company sold $500,000 of merchandise to Hashmi Co., terms 2/10, n/30, FOB shipping point. The cost of the merchandise sold was $350,000. 2. On December 8, Hashmi Co. w

> At year-end the perpetual inventory records of Garbo Company showed merchandise inventory of $98,000. The company determined, however, that its actual inventory on hand was $96,500. Record the necessary adjusting entry.

> On June 10, Meredith Company purchased $8,000 of merchandise from Leinert Company, FOB shipping point, terms 2/10, n/30. Meredith pays the freight costs of $400 on June 11. Damaged goods totaling $300 are returned to Leinert for credit on June 12.The scr

> From the information in BE5-3, prepare the journal entries to record these transactions on Churchill Company’s books under a perpetual inventory system. Exercise 5-3: (a) On March 2, Monroe Company sold $900,000 of merchandise to Churchill Company, term

> Prepare the journal entries to record the following transactions on Monroe Company’s books using a perpetual inventory system. (a) On March 2, Monroe Company sold $900,000 of merchandise to Churchill Company, terms 2/10, n/30.The cost of the merchandise

> On September 1, Howe Office Supply had an inventory of 30 calculators at a cost of $18 each. The company uses a perpetual inventory system. During September, the following transactions occurred. Sept. 6 Purchased 80 calculators at $20 each from DeVito C

> Information related to Steffens Co. is presented below. 1. On April 5, purchased merchandise from Bryant Company for $25,000 terms 2/10, net/30, FOB shipping point. 2. On April 6 paid freight costs of $900 on merchandise purchased from Bryant. 3. On Apri

> Hollins Company buys merchandise on account from Gordon Company. The selling price of the goods is $780, and the cost of the goods is $520. Both companies use perpetual inventory systems. Journalize the transaction on the books of both companies.

> Mr. Wellington has prepared the following list of statements about service companies and merchandisers. 1. Measuring net income for a merchandiser is conceptually the same as for a service company. 2. For a merchandiser, sales less operating expenses is

> Presented below are the components in Waegelain Company’s income statement. Determine the missing amounts. Cost of Operating Expenses Gross Net Sales Goods Sold Profit Income (a) $75,000 ? $30,000 ? $10,800 (b) $108,000 $70,000 ? ?

> Selected transactions for Evergreen Lawn Care Company are listed below. 1. Made cash investment to start business. 2. Paid monthly rent. 3. Purchased equipment on account. 4. Billed customers for services performed. 5. Withdrew cash for owner’s personal

> (a) How do the components of revenues and expenses differ between merchandising and service companies? (b) Explain the income measurement process in a merchandising company.

> Josh Borke has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do no

> The adjusted trial balance for Apachi Company is presented in E4-8. Instructions (a) Prepare an income statement and an owner’s equity statement for the year. Apachi did not make any capital investments during the year. (b) Prepare a c

> The steps in the accounting cycle are listed in random order below. List the steps in proper sequence, assuming no worksheet is prepared, by placing numbers 1–9 in the blank spaces. (a) _____ Prepare a trial balance. (b) _____ Journalize the transactions

> Apachi Company ended its fiscal year on July 31, 2010. The company’s adjusted trial balance as of the end of its fiscal year is as shown at the top of page 182. Instructions (a) Prepare the closing entries using page J15. (b) Post to B.

> Emil Skoda Company had the following adjusted trial balance. Instructions (a) Prepare closing entries at June 30, 2010. (b) Prepare a post-closing trial balance. EMIL SKODA COMPANY Adjusted Trial Balance for the Month Ended June 30, 2010 Adjusted Tri

> Using the data in BE4-3, identify the accounts that would be included in a post-closing trial balance. Reference Data from BE 4-3: The following selected accounts appear in the adjusted trial balance columns of the worksheet for Batan Company: Accumulat

> The income statement for Crestwood Golf Club for the month ending July 31 shows Green Fee Revenue $13,600, Salaries Expense $8,200, Maintenance Expense $2,500, and Net Income $2,900. Prepare the entries to close the revenue and expense accounts. Post the

> Selected worksheet data for Nicholson Company are presented below. Instructions (a) Fill in the missing amounts. (b) Prepare the adjusting entries that were made. Adjusted Trial Balance Account Titles Trial Balance Dr. Cr. Dr. Cr. Accounts Receivab

> Using the data in BE4-4, enter the balances in T accounts, post the closing entries, and rule and balance the accounts. Reference from Data BE 4-4: The ledger of Swann Company contains the following balances: D. Swann, Capital $30,000; D. Swann, Drawing

> Meredith Cleaners has the following balance sheet items. Accounts payable……………….Accounts receivable Cash………………………………………….Notes payable Cleaning equipment…………………Salaries payable Cleaning supplies…………Karin Meredith, Capital Instructions Classify each item

> The adjustments columns of the worksheet for Mears Company are shown below. Instructions (a) Prepare the adjusting entries. (b) Assuming the adjusted trial balance amount for each account is normal, indicate the financial statement column to which each

> Worksheet data for Goode Company are presented in E4-2. Data for E 4-2: Instructions (a) Journalize the closing entries at April 30. (b) Post the closing entries to Income Summary and T. Goode, Capital. Use T accounts. (c) Prepare a post-closing trial

> Worksheet data for Goode Company are presented in E4-2.The owner did not make any additional investments in the business in April. Instructions Prepare an income statement, an owner’s equity statement, and a classified balance sheet.

> The following selected accounts appear in the adjusted trial balance columns of the worksheet for Batan Company: Accumulated Depreciation; Depreciation Expense; N. Batan, Capital; N. Batan, Drawing; Service Revenue; Supplies; and Accounts Payable. Indica

> The adjusted trial balance columns of the worksheet for Goode Company are as follows. Instructions Complete the worksheet. GOODE COMPANY Worksheet (partial) for the Month Ended April 30, 2010 Adjusted Trial Balance Income Statement Balance Sheet Acco

> The steps in using a worksheet are presented in random order below. List the steps in the proper order by placing numbers 1–5 in the blank spaces. (a) _____ Prepare a trial balance on the worksheet. (b) _____ Enter adjusted balances. (c) _____ Extend adj

> The trial balance columns of the worksheet for Briscoe Company at June 30, 2010, are as follows. Other data: 1. A physical count reveals $300 of supplies on hand. 2. $100 of the unearned revenue is still unearned at month-end. 3. Accrued salaries are $28

> Why do accrual-basis financial statements provide more useful information than cash-basis statements?

> At Natasha Company, prepayments are debited to expense when paid, and unearned revenues are credited to revenue when received. During January of the current year, the following transactions occurred. Jan. 2 Paid $1,800 for fire insurance protection for t

> The following data are taken from the comparative balance sheets of Girard Billiards Club, which prepares its financial statements using the accrual basis of accounting. Fees are billed to members based upon their use of the club’s fa

> The following situations involve accounting principles and assumptions. 1. Grossman Company owns buildings that are worth substantially more than they originally cost. In an effort to provide more relevant information, Grossman reports the buildings at m

> The adjusted trial balance for Garcia Company is given in E3-13. Instructions Prepare the income and owner’s equity statements for the year and the balance sheet at August 31. GARCIA COMPANY Trial Balance August 31, 2010 Before Aft

> Selected accounts of Tabor Company are shown below. Instructions After analyzing the accounts, journalize (a) the July transactions and (b) the adjusting entries that were made on July 31. (Hint: July transactions were for cash.) Supplies Expense

> A partial adjusted trial balance of Sila Company at January 31, 2010, shows the following. Instructions Answer the following questions, assuming the year begins January 1. (a) If the amount in Supplies Expense is the January 31 adjusting entry, and $500

> The trial balance for Pioneer Advertising Agency is shown in Illustration 3-3, p. 100. In lieu of the adjusting entries shown in the text at October 31, assume the following adjustment data. 1. Advertising supplies on hand at October 31 total $500. 2. Ex

> Andy Wright, D.D.S., opened a dental practice on January 1, 2010. During the first month of operations the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $875 of such services was earned

> The trial balance of Bair Company includes the following balance sheet accounts. Identify the accounts that may require adjustment. For each account that requires adjustment, indicate (a) the type of adjusting entry (prepaid expenses, unearned revenues,

> The ledger of Piper Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. An analysis of the accounts shows the following. 1. The equipment depreciates $400 per month. 2. One-t

> Affleck Company accumulates the following adjustment data at December 31. 1. Services provided but not recorded total $750. 2. Store supplies of $300 have been used. 3. Utility expenses of $225 are unpaid. 4. Unearned revenue of $260 has been earned. 5.

> Drew Carey Company has the following balances in selected accounts on December 31, 2010. Accounts Receivable ………………………………….…………………. $ -0- Accumulated Depreciation—Equipment ….…….……………………-0- Equipment …………………………………………………………………. 7,000 Interest Payable …………

> Larry Smith, president of Smith Company, has instructed Ron Rivera, the head of the accounting department for Smith Company, to report the company’s land in the company’s accounting reports at its market value of $170,000 instead of its cost of $100,000.

> Emeril Corporation encounters the following situations: 1. Emeril collects $1,000 from a customer in 2010 for services to be performed in 2011. 2. Emeril incurs utility expense which is not yet paid in cash or recorded. 3. Emeril’s employees worked 3 day

> On numerous occasions, proposals have surfaced to put the federal government on the accrual basis of accounting. This is no small issue. If this basis were used, it would mean that billions in unrecorded liabilities would have to be booked, and the feder

> Nunez Company accumulates the following adjustment data at December 31. Indicate (a) the type of adjustment (prepaid expense, accrued revenues and so on), and (b) the status of accounts before adjustment (overstated or understated). 1. Supplies of $100

> Jo Seacat has prepared the following list of statements about the time period assumption. 1. Adjusting entries would not be necessary if a company’s life were not divided into artificial time periods. 2. The IRS requires companies to file annual tax retu

> The ledger of Dey Company includes the following accounts. Explain why each account may require adjustment. (a) Prepaid Insurance (c) Unearned Revenue (b) Depreciation Expense (d) Interest Payable

> (a) Who are internal users of accounting data? (b) How does accounting provide relevant data to these users?

> The accounts in the ledger of Sanford Delivery Service contain the following balances on July 31, 2010. Accounts Receivable $ 7,642 Prepaid Insurance $1,968 Accounts Payable 8,396 Repair Expense 961 Cash? Service Revenue 10,610 Delivery Equipment 49,360

> The bookkeeper for Sam Kaplin Equipment Repair made a number of errors in journalizing and posting, as described below. 1. A credit posting of $400 to Accounts Receivable was omitted. 2. A debit posting of $750 for Prepaid Insurance was debited to Insura

> Selected transactions for Tina Cordero Company during its first month in business are presented below. Sept. 1 Invested $10,000 cash in the business. 5 Purchased equipment for $12,000 paying $5,000 in cash and the balance on account. 25 Paid $3,000 cash

> Presented below and on the next page is the ledger for Heerey Co. Instructions (a) Reproduce the journal entries for the transactions that occurred on October 1, 10, and 20, and provide explanations for each. (b) Determine the October 31 balance for eac

> (a) The following are users of financial statements. ______Customers ______Securities and Exchange Commission ______Internal Revenue Service ______Store manager ______Labor unions ______Suppliers ______Marketing manager ______Vice-president of f

> The T accounts below summarize the ledger of Simon Landscaping Company at the end of the first month of operations. Instructions (a) Prepare the complete general journal (including explanations) from which the postings to Cash were made. (b) Prepare a t

> In alphabetical order below are balance sheet items for Lopez Company at December 31, 2010. Kim Lopez is the owner of Lopez Company. Prepare a balance sheet, following the format of Illustration 1-9. Accounts payable…………………..$90,000 Accounts receivable…

> Presented below are three transactions. Mark each transaction as affecting owner’s investment (I), owner’s drawings (D), revenue (R), expense (E), or not affecting owner’s equity (NOE). _______ (a) Received cash for services performed _______ (b) Paid ca

> Classify each of the following items as owner’s drawing (D), revenue (R), or expense (E). _______ (a) Advertising expense _______ (e) Bergman, Drawing _______ (b) Commission revenue _______ (f) Rent revenue _______ (c) Insurance expense _______ (g)

> Follow the same format as BE1-6 on the previous page. Determine the effect on assets, liabilities, and owner’s equity of the following three transactions. (a) Invested cash in the business. (b) Withdrawal of cash by owner. (c) Received cash from a custom

> Presented below are three business transactions. On a sheet of paper, list the letters (a), (b), (c) with columns for assets, liabilities and owner’s equity. For each column, indicate whether the transactions increased (+), decreased (-), or had no effec

> Indicate whether each of the following items is an asset (A), liability (L), or part of owner’s equity (OE). _______ (a) Accounts receivable _______ (d) Office supplies _______ (b) Salaries payable _______ (e) Owner’s investment _______(c) Equipment

> Use the expanded accounting equation to answer each of the following questions: (a) The liabilities of Cai Company are $90,000. Meiyu Cai’s capital account is $150,000; drawings are $40,000; revenues, $450,000; and expenses, $320,000. What is the amount

> Rick Marsh, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If Marsh’s law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why?

> Selected transactions from the journal of Teresa Gonzalez, investment broker, are presented below. Instructions (a) Post the transactions to T accounts. (b) Prepare a trial balance at August 31, 2010. Date Account Titles and Explanation Ref. Debit C

> Why is it possible to prepare financial statements directly from an adjusted trial balance?

> “An adjusting entry may affect more than one balance sheet or income statement account.” Do you agree? Why or why not?

> State two generally accepted accounting principles that relate to adjusting the accounts.

> One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a) Salaries Expense is debited. (b) Depreciation Expense is debited. (c) Interest Payable is credited. (d) Supplies is credited. (e) Accounts Rec

> For each of the following items before adjustment, indicate the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, and accrued expense) that is needed to correct the misstatement. If an item could result in more than one type of

> On January 9, a company pays $5,000 for salaries, of which $2,000 was reported as Salaries Payable on December 31. Give the entry to record the payment.

> A company makes an accrued revenue adjusting entry for $900 and an accrued expense adjusting entry for $700. How much was net income understated prior to these entries? Explain.

> A company fails to recognize an expense incurred but not paid. Indicate which of the following accounts is debited and which is credited in the adjusting entry: (a) asset, (b) liability, (c) revenue, or (d) expense.

> A company fails to recognize revenue earned but not yet received. Which of the following accounts are involved in the adjusting entry: (a) asset, (b) liability, (c) revenue, or (d) expense? For the accounts selected, indicate whether they would be de

> What is the debit/credit effect of an unearned revenue adjusting entry?

> Selected journal entries for the Finney Company are presented in BE2-7. Post the transactions using the standard form of account. Reference Data BE 2-8: J1 Account Titles and Explanation Ref. Debit Credit Date May 5 Accounts Receivable 5,000 Service

> Shinn Company purchased equipment for $18,000. By the current balance sheet date, $6,000 had been depreciated. Indicate the balance sheet presentation of the data.

> “Depreciation is a valuation process that results in the reporting of the fair market value of the asset.” Do you agree? Explain.

> Indicate whether the following accounts generally will have (a) debit entries only, (b) credit entries only, or (c) both debit and credit entries. (1) Cash. (4) Accounts Payable. (2) Accounts Receivable. (5) Salaries Expense. (3) Owner’s Drawing. (6)

> For the following transactions, indicate the account debited and the account credited. (a) Supplies are purchased on account. (b) Cash is received on signing a note payable. (c) Employees are paid salaries in cash.

> Indicate whether each of the following accounts is an asset, a liability, or an owner’s equity account and whether it has a normal debit or credit balance: (a) Accounts Receivable, (b) Accounts Payable, (c) Equipment, (d) Owner’s Drawing, (e) Supplies.

> State the rules of debit and credit as applied to (a) asset accounts, (b) liability accounts, and (c) the owner’s equity accounts (revenue, expenses, owner’s drawing, and owner’s capital).

> Maria Alvarez, a beginning accounting student, believes debit balances are favorable and credit balances are unfavorable. Is Maria correct? Discuss.

> Describe a compound entry, and provide an example.

> What are the normal balances for PepsiCo’s Cash, Accounts Payable, and Interest Expense accounts?

> Two students are discussing the use of a trial balance. They wonder whether the following errors, each considered separately, would prevent the trial balance from balancing. (a) The bookkeeper debited Cash for $600 and credited Wages Expense for $600 for