Question: The Walt Disney Company is a diversified

The Walt Disney Company is a diversified worldwide entertainment company with operations in four business segments: media networks, parks and resorts, studio entertainment and consumer products. The media networks segment consists of the company's television (ABC, ESPN, and Discovery) and radio networks, cable/satellite and international broadcast operations, production and distribution of television programming, and Internet operations. The studio entertainment segment produces live-action and animated motion pictures, television animation programs, musical recordings and live stage plays. The consumer products segment licenses the company's characters and other intellectual property to manufacturers, retailers, show promoters and publishers. Disney parks and resorts are at the cornerstone of a carefully integrated entertainment marketing strategy. Through the parks and resorts segment, Walt Disney owns and operates four destination resorts in the United States, Japan and France. In the United States, kids flock to Disneyland, California, and Walt Disney World, Florida--an immense entertainment center that includes the Animal Kingdom, Magic Kingdom, Epcot Center, and Disney-MGM Studios. During recent years, the company has extended its amusement park business to foreign soil with Tokyo Disneyland and Euro Disneyland, located just outside of Paris, France. Work is underway on a fifth resort, Hong Kong Disneyland, scheduled to open in late 2005 or early 2006. Disney's foreign operations provide an interesting example of the company's shrewd combination of marketing and financial skills. To conserve scarce capital resources, Disney was able to entice foreign investors to put up 100% of the financing required for both the Tokyo and Paris facilities. In turn, Disney is responsible for the design and management of both operations, retains an important equity interest, and enjoys significant royalties on all gross revenues. Disney is also a major force in the movie picture production business with Buena Vista, Touchstone, and Hollywood Pictures, in addition to the renowned Walt Disney Studios. The company is famous for recent hit movies such as Finding Nemo, The Lion King, Pirates of the Caribbean: The Curse of the Black Pearl, and The Sixth Sense, in addition to a film library including hundreds of movie classics like Fantasia, Snow White, and Mary Poppins, among others. Disney employs an aggressive and highly successful video marketing strategy for new films and re- releases from the company's extensive film library. The Disney Store, a chain of retail specialty shops, profits from the sale of movie tie-in merchandise, books, and recorded music. Also making a significant contribution to the bottom line are earnings from Disney’s television operations which include ABC, The Disney Channel, the Discovery Channel, and sports juggernaut ESPN, the Entertainment and Sports Programming Network. The company's family entertainment marketing strategy is so broad in its reach that Disney characters such as Mickey Mouse, Donald Duck, and Goofy have become an integral part of the American culture. Given its ability to turn whimsy into outstanding operating performance, the Walt Disney Company is one firm that doesn't mind being called a “Mickey Mouse Organization.†Table 6.7 shows a variety of accounting operating statistics, including revenues, cash flow, capital spending, dividends, earnings, book value, and year-end share prices for the Walt Disney Company during the 1980-2003 period. All data are expressed in dollars per share to illustrate how individual shareholders have benefitted from the company's growth. During this time frame, revenue per share grew at an annual rate of 14.5% per year, and earnings per share grew by 9.0% per year. These performance measures exceed industry and economy-wide norms. Disney employees, CEO Michael D. Eisner, and all stockholders profited greatly from the company's outstanding stock-price performance during the 1980's and 1990's, but have grown frustrated by stagnant results during recent years. Over the 1980-2003 period, Disney common stock exploded in price from $1.07 per share to $23.33, after adjusting for stock splits. This represents a 14.3% annual rate of return, and illustrates how Disney has been an above-average stock-market performer. However, the stock price has grown stagnant since 1996, and stockholders are getting restless. Given the many uncertainties faced by Disney and most major corporations, forecasts of operating performance are usually restricted to a fairly short time perspective. The Value Line Investment Survey, one of the most widely respected forecast services, focuses on a three- to five- year time horizon. For the 2007-09 period, Value Line forecasts Disney revenues of $18.10, cash flow of $2.25, earnings of $1.65, dividends of $0.21, capital spending of $0.45, and book value per share of $17.55. Actual results will vary, but these assumptions offer a fruitful basis for measuring the relative growth potential of Disney.

The most interesting economic statistic for Disney stockholders is the stock price during some future period, say 2007-09. In economic terms, stock prices represent the net present value of future cash flows, discounted at an appropriate risk-adjusted rate of return. To forecast Disney's stock price during the 2007-09 period, one might use any or all of the data in Table 6.7. Historical numbers for a recent period, like 1980-2003, represent a useful context for projecting future stock prices. For example, Fidelity's legendary mutual fund investor Peter Lynch argues that stock prices are largely determined by future earnings per share. Stock prices rise following an increase in earnings per share and plunge when earnings per share plummet. Sir John Templeton, the father of global stock market investing, focuses on book value per share. Templeton contends that future earnings are closely related to the book value of the firm, or accounting net worth. “Bargains†can be found when stock can be purchased in companies that sell in the marketplace at a significant discount to book value, or when book value per share is expected to rise dramatically. Both Lynch and Templeton have built a large following among investors who have profited mightily using their stock-market selection techniques. As an experiment, it will prove interesting to employ the data provided in Table 6.7 to estimate regression models that can be used to forecast the average common stock price for The Walt Disney Company over the 2007-09 period. A simple regression model over the 1980-2003 period where the Y-variable is the Disney year-end stock price and the X-variable is Disney’s earnings per share reads as follows (t-statistics in parentheses):

Pt = -$1.661 + $31.388EPSt, R2 = 86.8% (-1.13) (12.03)

Use this model to forecast Disney’s average stock price for the 2007-09 period using the Value Line estimate of Disney’s average earnings per share for 2007-09. Discuss this share-price forecast.

a. A simple regression model over the 1980-2003 period where the Y-variable is the Disney year-end stock price and the X-variable is Disney’s book value per share reads as follows (t-statistics in parentheses):

Pt = -$1.661 + $31.388EPSt, R2 = 6.8%

(-1.13) (12.03)

Use this model to forecast Disney’s average stock price for the 2007-09 period using the Value Line estimate of Disney’s average book value per share for 2007-09. Discuss this share-price forecast.

b. A multiple regression model over the 1980-2003 period where the Y-variable is the Disney year-end stock price and the X-variables are Disney’s earnings per share and book value per share reads as follows (t-statistics in parentheses):

Pt = $3.161 + $2.182BVt, R2 = 76.9%

(1.99) (8.57)

Use this model to forecast Disney’s average stock price for the 2007-09 period using the Value Line estimate of Disney’s average earnings per share and book value per share for 2007-09. Discuss this share-price forecast.

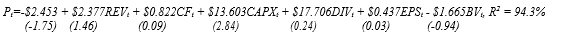

c. A multiple regression model over the 1980-2003 period where the y-variable is the Disney year-end stock price and x-variables include the accounting operating statistics shown in Table 6.7 reads as follows (t-statistics in parentheses):

Pt = -$1.112 + $21.777EPSt + $0.869BVt, R2 = 90.9% (-0.88) (5.66) (3.06)

Use this model and Value Line estimates to forecast Disney’s average stock price for the 2007-09 period using the Value Line estimate of Disney’s average earnings per share and book value per share for 2007-09. Discuss this share-price forecast.

d. A multiple regression model over the 1980-2003 period where the y-variable is the Disney year-end stock price and x-variables include the accounting operating statistics shown in Table 6.7 reads as follows (t-statistics in parentheses):

Use this model and Value Line estimates to forecast Disney’s average stock price for the 2007-09 period. Check The Value Line Investment Survey at www.valueline.com. How did these regression-based forecasts perform?

Transcribed Image Text:

P=-$2.453 + $2.377REV. + $0.822CF, + $13.603CAPX, + $17.706DIV, + $0.437EPS, - $1.665BV, R = 94.3% (-1.75) (1.46) (0.09) (2.84) (0.24) (0.03) (-0.94)

> In 1990, Congress adopted a luxury tax to be paid by buyers of high-price cars, yachts, private airplanes, and jewellery. Proponents saw the levy as an effective means of taxing the rich. Critics pointed out that those bearing the hardship of a tax may o

> The demand for basic foodstuffs, like feed grains, tends to be inelastic with respect to price. Use this fact to explain why highly fertile farmland will fetch a relatively high price at any point in time, but that rising farm productivity over time has

> In 2004, OPEC reduced the quantity of oil it was willing to supply to world markets. Explain why the resulting price increase was much larger in the short run than in the long run.

> After having declined during the 1970s and 1980s, the proportion of teenage smokers in the United States has risen sharply since the early-1990s. To reverse this trend, advertising programs have been launched to discourage teenage smoking, penalties for

> People of many different age groups and circumstances take advantage of part-time employment opportunities provided by the fast-food industry. Given the wide variety of different fast-food vendors, the industry is fiercely competitive, as is the unskill

> Assume that you are willing to pay $1,100 for a new personal computer that has all the “bells and whistles.” On the Internet, you buy one for the bargain price of $900. Unbeknownst to you, the Internet retailer’s marginal cost was only $750. How much con

> Wal-Mart founder Sam Walton amassed an enormous fortune in discount retailing, one of the most viciously competitive markets imaginable. How is this possible?

> Your best income-earning opportunity appears to be an offer to work for a local developer during the month of June and earn $2,000. However, before taking the job, you accept a surprise offer from a competitor. If you earn $2,600 during the month, how mu

> Will firms in industries in which high levels of output are necessary for minimum efficient scale tend to have substantial degrees of operating leverage?

> With traditional medical insurance plans, workers pay a premium that is taken out of each pay check and must meet an annual deductible of a few hundred dollars. After that, insurance picks up most of their health-care costs. Companies complain that this

> The president of a small firm has been complaining to the controller about rising labour and material costs. However, the controller notes that average costs have not increased during the past year. Is this possible?

> The definition of point output elasticity is εQ = ∂Q/Q ÷ ∂X/X (X represents all inputs), whereas the definition of point cost elasticity is εC = ∂C/C ÷ ∂Q/Q. Explain why εQ > 1 indicates increasing returns to scale, whereas εC < 1 indicates economies of

> What is the relation between production functions and cost functions? Be sure to include in your discussion the effect of competitive conditions in input factor markets.

> Suppose the Big Enchilada restaurant has been offered a binding one-year lease agreement on an attractive site for $5,200 per month. Before the lease agreement has been signed, what is the incremental cost per month of site rental? After the lease agreem

> Southwest Airlines offers four flights per weekday from Cleveland, Ohio to Tucson, Arizona. If adding a fifth flight per weekday would cost $15,000 per flight, or $110 per available seat, calculate the incremental costs borne by Southwest following a dec

> The Federal Trade Commission seeks to ensure that the process of bringing new low-cost generic alternatives to the marketplace and into the hands of consumers is not impeded in ways that are anti-competitive. To illustrate the potential for economic

> Simpson Flanders, Inc., is a Motor City-based manufacturer and distributor of valves used in nuclear power plants. Currently, all output is sold to North American customers. Demand and marginal revenue curves for the firm are as follows: P= $1,000 - $0.

> Assume that two years ago, you purchased a new Jeep Wrangler SE 4WD with a soft top for $16,500 using five-year interest-free financing. Today, the remaining loan balance is $9,900 and your Jeep has a trade-in value of $9,500. What is your opportunity co

> Do operating strategies of average cost minimization and profit maximization always lead to identical levels of output?

> What advantages or disadvantages do you see in using current costs for tax and stockholder reporting purposes?

> Explain why company productivity is important to managers, employees, and investors. Is superior worker productivity a necessary and sufficient condition for above-average compensation?

> Cite some ways for increasing productivity growth in the United States.

> Powerful unions like the AFL-CIO are staunch advocates for increasing the federal minimum wage despite the fact that highly-trained and experienced AFL-CIO workers tend to earn far more than the minimum wage. Can you give an economic rationale for the AF

> “Oregon’s minimum wage increased from $4.75 in 1996 to $5.50 in 1997, to $6 in 1998, and to $6.50 in 1999. According to a study by the Oregon Center for Public Policy, the minimum wage increases in Oregon did not harm welfare recipients’ opportunities to

> Clarify how profits are maximized and the optimal level of employment is achieved in a competitive labor market when the price of labor PL = MRPL.

> Explain why the MP/P relation is deficient as the sole mechanism for determining the optimal level of resource employment.

> “Hourly wage rates are an anachronism. Efficiency requires incentive-based pay tied to performance.” Discuss this statement.

> Indicate whether each of the following statements is true or false and explain why. a. In competitive market equilibrium, social welfare is measured by the net benefits derived from consumption and production as measured by the difference between consum

> Commission-based and piece-rate-based compensation plans are commonly employed by businesses. Use the concepts developed in the chapter to explain these phenomena.

> “Output per worker is expected to increase by 10 percent during the next year. Therefore, wages can also increase by 10 percent with no harmful effects on employment, output prices, or employer profits.” Discuss this statement.

> Is use of least-cost input combinations a necessary condition for profit maximization? Is it a sufficient condition? Explain.

> Discuss important differences between centralized and decentralized allocations of decision authority within an organization. Are these methods of decision authority allocation mutually exclusive?

> Describe three basic needs that must be met in the design of any organization.

> Executive stock options are often seen as a simple and effective solution to the “other people’s money” problem that can occur when managers with little ownership interest mismanage firm investment opportunities. Can you foresee any advantages and/or pot

> In a typical corporation, who are the “principals” and who are the “agents”? What is the firm’s agency problem?

> What is the Coase Theorem, and why is it important in managerial economics?

> Cite three important categories of transactions costs encountered within the firm, and give some examples.

> The personal computer has evolved from a tool for computation to an Internet-cantered communications device. Is this likely to change corporate structures by increasing the efficiency of smaller, more nimble corporations?

> Power Brokers, Inc. (PBI), a discount brokerage firm, is contemplating opening a new regional office in Providence, Rhode Island. An accounting cost analysis of monthly operating costs at a dozen of its regional outlets reveals average fixed costs of $4,

> Describe four essential components of an effective decision management and control system.

> Describe the difference between vertical and horizontal business relationships.

> Describe the difference between limit pricing and predatory pricing strategies.

> The typical CEO of a major U. S. corporation is 56-58 years old and gets paid $3-5 million per year. From a game-theory perspective, explain why corporate governance experts advise that such executives be required to hold common stock worth 7-10 years of

> Instructors sometimes use quizzes to motivate students to adequately prepare for class. However, preparing and grading quizzes can become time-consuming and tedious. Moreover, if students prepare adequately for class, there is no need for quizzes. What d

> Define the Nash equilibrium concept.

> Does game theory offer a strategy appropriate for situations in which no strategy results in the highest payoff to a player regardless of the opposing player=s decision?

> Explain how the Prisoner’s Dilemma example shows that rational self-interested play does not always result in the best solution for all parties.

> Would a linear regression model of the advertising/sales relation be appropriate for forecasting the advertising levels at which threshold or saturation effects become prevalent? Explain.

> In prepared remarks before Congress in mid-2007, Federal Reserve Chairman Ben Bernanke testified: "The principal source of the slowdown in economic growth … has been the substantial correction in the housing market. [and] The near-term prospects for the

> Explain why revenue and profit data reported by shippers such as FedEx Corp. and United Parcel Service Inc. can provide useful information about trends in the overall economy.

> "Interest rates were expected to increase by 85% of all consumers in the May 2004 survey, more than ever before," said Richard Curtin, the Director of the University of Michigan’s Surveys of Consumers. "More consumers in the May 2004 survey cited the adv

> Blue Chip Financial Forecasts gives the latest prevailing opinion about the future direction of the economy. Survey participants include 50 business economists from Deutsche Banc Alex Brown, Banc of America Securities, Fannie Mae, and other prominent cor

> Forecasting the success of new product introductions is notoriously difficult. Describe some of the macroeconomic and microeconomic factors that a firm might consider in forecasting sales for a new teeth whitening product.

> Discuss some of the microeconomic and macroeconomic factors a firm must consider in its own sales and profit forecasting.

> Do the U.S. antitrust statutes protect competition or competitors? What is the difference?

> Explain why state tax rates on personal income vary more on a state-by-state basis than do corresponding tax rates on corporate income.

> When will an increase in the minimum wage increase employment income for unskilled laborers? When will it cause this income to fall? Based on your experience, which is more likely?

> Antitrust statutes in the United States have been used to attack monopolization by big business. Does labor monopolization by giant unions have the same potential for the misallocation of economic resources?

> Given the difficulties encountered with utility regulation, it has been suggested that nationalization might lead to a more socially optimal allocation of resources. Do you agree? Why or why not?

> Oh, Lord, Won’t You Buy Me a Mercedes-Benz (Factory)?1 In 1993, Alabama emerged victorious as the site of Mercedes-Benz AG’s first U.S. car plant. States like Alabama are vying more desperately than ever to lure new industrial jobs and hold on to those

> Give an example of monopoly in the labor market. Discuss such a monopoly's effect on wage rates and on inflation.

> Why are both industry and firm demand curves downward sloping in monopoly markets?

> From a social standpoint, what is the problem with monopoly?

> Describe the economic effects of countervailing power, and cite examples of markets in which countervailing power is observed.

> Describe the monopoly market structure and provide some examples.

> What are the main characteristics of accurate forecasts?

> Cite some examples of forecasting problems that might be addressed using regression analysis of complex multiple-equation systems of economic relations.

> Perhaps the most famous early econometric forecasting firm was Wharton Economic Forecasting Associates (WEFA), founded by Nobel Prize winner Lawrence Klein. A spin-off of the Wharton School of the University of Pennsylvania, where Klein taught, WEFA was

> In the 1880s, cattlemen in the American West crowded more and more animals onto common grazing land to feed a growing nation. Cattlemen contended, “None of us knows anything about grass outside of the fact that there is lots of it, and we aim to get it w

> What is the essential difference between public and private goods? Give some examples of each and some examples of goods and services that involve elements of both.

> Is the large publicly traded corporation in eclipse? Some say yes. Harvard financial economist Michael Jensen, for example, argues that the experience of the past 2 decades indicates that corporate internal control systems have failed to deal effectively

> What role does the price elasticity of demand play in determining the short-run effects of regulations that increase fixed costs? What if they lead to increased variable costs?

> Air pollution costs the U.S. billions of dollars per year in worker absenteeism, healthcare, pain and suffering, and loss of life. Discuss some of the costs and benefits of a Pigou tax on air pollution.

> “Regulation is often proposed on the basis of equity considerations and opposed on the basis of efficiency considerations. As a result, the regulation versus deregulation controversy is not easily resolved.” Discuss this statement.

> The former chairman of the Federal Communications Commission heralded Voice over Internet Protocol, or VoIP, as “the most important shift in the entire history of modern communications since the invention of the telephone.” Using cheap computer software

> To measure public project desirability, positive and negative aspects of the project must be expressed in terms of a common monetary unit. Explain the importance of the present value concept in benefit/cost ratio calculations using a 5 percent interest r

> In 1848, the idea of cost-benefit analysis originated with a French engineer by the name of Jules Dupuit. Economists argue that underlying calculations of costs and benefits must be based upon actual market behavior and not based upon consumer and produc

> A pipeline break reduced the supply of gasoline to the Phoenix, Arizona, area in August, 2003. Press reports indicated that some stations ran out of gasoline, consumers waited in line for hours, and some drivers started following gasoline tankers as they

> Does the fact that public decisions are sometimes made by self-interested politicians and bureaucrats undermine the efficiency of public-sector decision making?

> Public support dropped for a Medicare prescription-drug law endorsed by President George W. Bush and passed by a Republican-controlled Congress following withering criticism from Democrats. Democrats were upset that the law prevented Medicare from neg

> Market Imperfections. Markets usually allocate resources in a manner that creates the greatest net benefit to society. An efficient allocation is one that maximizes the net benefits to society. Indicate whether each of the following statements is true or

> Level 3 Communications, LLC, provides integrated telecommunications services including voice, Internet access, and data transmission using rapidly improving optical and Internet protocol technologies (i.e., “broadband”). Level 3 is called a facilities-ba

> Keystone Manufacturing, Inc., is analyzing a new bid to supply the company with electronic control systems. Alpha Corporation has been supplying the systems and Keystone is satisfied with its performance. However, a bid has just been received from Beta C

> Tex-Mex, Inc., is a rapidly growing chain of Mexican food restaurants. The company has a limited amount of capital for expansion and must carefully weigh available alternatives. Currently, the company is considering opening restaurants in Santa Fe or Alb

> Recently, the housing market suffered the worst slump in nearly two decades. Hot housing markets like Boston, Ft. Lauderdale Florida, and Washington DC cooled as rising interest rates and tightened lending standards eliminated lots of potential buyers. W

> Firefly Products, Inc., has just completed development of a new line of skin-care products. Preliminary market research indicate two feasible marketing strategies: (1). creating general consumer acceptance through media advertising or (2). creating di

> Perry Chandler, a broker with Caveat Emptor, Ltd., offers free investment seminars to local PTA groups. On average, Chandler expects 1 percent of seminar participants to purchase $25,000 in tax-sheltered investments and 5 percent to purchase $5,000 in st

> The certainty equivalent concept can be widely employed in the analysis of personal and business decision making. Indicate whether each of the following statements is true or false and explain why: The appropriate certainty equivalent adjustment factor,

> Speedy Business Cards, Inc., supplies customized business cards to commercial and individual customers. The company is preparing a bid to supply cards to the Nationwide Realty Company, a large association of independent real estate agents. Because paper,

> Identify each of the following as being consistent with risk-averse, risk-neutral, or risk-seeking behavior in investment project selection. Explain your answers. a. Larger risk premiums for riskier projects b. Preference for smaller, as opposed to large

> Kinked Demand Curves. Assume Safety Service Products (SSP) faces the following segmented demand and marginal revenue curves for its new infant safety seat: 1. Over the range from 0 to 10,000 units of output, P1 = $60 - Q, MR1 = ∂TR1/∂Q = $60 - $

> Bertrand Equilibrium. Coke and Pepsi dominate the U. S soft-drink market. Together, they account for about 75% of industry sales. Suppose the quantity of Coke demanded depends upon the price of Coke (PC) and the price of Pepsi (PP) QC = 15 - 2.5PC + 1.25

> Statisticians use the Greek letter beta to signify the slope coefficient in a linear relation. Financial economists use this same Greek letter β to signify stock-price risk because betas are the slope coefficients in a simple linear relation that links t

> Stackelberg Model. Imagine that a two-firm duopoly dominates the market for spreadsheet application software for personal computers. Also assume that the firms face a linear market demand curve P = $1,250 - Q where P is price and Q is total output in t

> Cournot Equilibrium. VisiCalc, the first computer spreadsheet program, was released to the public in 1979. A year later, introduction of the DIF format made spreadsheets much more popular because they could now be imported into word processing and other

> Cartel Equilibrium. Assume the Hand Tool Manufacturing Industry Trade Association recently published the following estimates of demand and supply relations for hammers: QD = 60,000 - 10,000P (Demand), QS = 20,000P (Supply). a. Calculate the perfectly

> Monopolistic Competition. Gray Computer, Inc., located in Colorado Springs, Colorado, is a privately held producer of high-speed electronic computers with immense storage capacity and computing capability. Although Gray=s market is restricted to industri

> Competitive Markets v. Cartels. Suppose the City of Columbus, Ohio, is considering two proposals to privatize municipal garbage collection. First, a handful of leading waste disposal firms have offered to purchase the city's plant and equipment at an att

> Monopolistically Competitive Demand. Would the following factors increase or decrease the ability of domestic auto manufacturers to raise prices and profit margins? Why? a. Decreased import quotas b. Elimination of uniform emission standards c. Incr

> Market Structure Measurement. In 2005, Federated Department Stores, Inc. proposed to acquire The May Department Stores Co., thereby combining the two largest chains in the United States of so-called “traditional” or “conventional” department stores. Conv