Question: This exercise relates to the Double Diamond

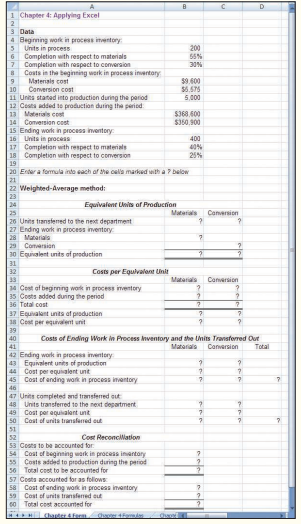

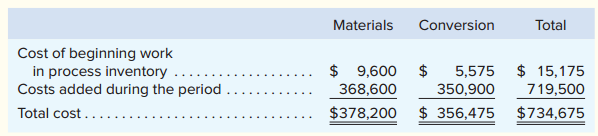

This exercise relates to the Double Diamond Skis’ Shaping and Milling Department that was discussed earlier in the chapter.The Excel worksheet form that appears below consolidates data from Exhibits 4–5 and 4–8.Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Exhibits 4–5:

Exhibits 4–5:

Required:

1. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. If you do not get these answers, find the errors in your worksheet and correct them. How much is the total cost of the units transferred out? Did it change? Why or why not?

2. Enter the following data from a different company into your worksheet:

Beginning work in process inventory:

Units in process ..........................................................................................200

Completion with respect to materials .....................................................100%

Completion with respect to conversion .....................................................20%

Costs in the beginning work in process inventory:

Materials cost ………………………………....................................................$2,000

Conversion cost ........................................................................................$800

Units started into production during the period ……..............................1,800

Costs added during the period:

Materials cost ......................................................................................$18,400

Conversion cost ……………………………...................................................$38,765

Ending work in process inventory:

Units in process ...........................................................................................100

Completion with respect to materials ....................................................100%

Completion with respect to conversion ....................................................30%

What is the cost of the units transferred out?

3. What happens to the cost of the units transferred out in part (2) above if the percentage completion with respect to conversion for the beginning inventory is changed from 20% to 40% and everything else remains the same? What happens to the cost per equivalent unit for conversion? Explain.

Transcribed Image Text:

D Chapter 4: Applying Excel Data 4 Begirning work in process imentory Unts in process Completion with respect to materials 7 Completion with respact to conversion 8 Costs in the beginning werk in process inventory Materiais 200 55% 30% 59.600 $6.575 cost 10 Conversion cost Unta stanad into production during the pariod 12 Costa added te production during the peried 13 Materials cost 14 Comersion cost 15 Ending work in process inventory 16 Units in process 17 Completion with respect to materials 18 Completion with respect to comversion 19 20 Ender a formula indo each of the cella marked wth a ? below 21 22 Weighted-Average method: 5,000 $368.600 $350,900 400 40% 25% Equivalent Uwis of Production Materials Canversion 26 Units tianstered to the next department 27 Endng work in process inventory 28 Matarials 29 Comersion 30 Equialent units of production Costs per Equivalant Unit Matarials Conversion 34 Cest of begirning wok in process imentory 35 Cosets added dunng the period 36 Total cost 37 Equivalant units af production 18 Cost per equivalent unit 40 41 42 Ending work in process imentory 43 Equivalent units of production 44 Cost per equialent unt 45 Cost of ending wark in process inentory Costs of Ending work in process inventory and she Units Transferred Out Total Materials Canvarsion 47 Units completed and transfered out 48 Units transferred to the next department 49 Cost per aquialent unt 50 Cost of units transferred out 51 Cost Reconcilation 53 Costs to be accourted for 54 Cost of beginning wark in process inertory s Costs added to production during the period 50 Total cost to be accounted for 57 Costs accounted for as follows 58 Cost of anding work in process imentory 59 Cost of units transferred out 60 Total cost accouted for H Chanter Ferm0hate ad Percent Complete Shaping and Milling Department Units Materials Conversion 200 30% Beginning work in process inventory. Units started into production during May ...... 55% 5,000 Units completed during May and transferred to the next department. Ending work in process inventory.... 4,800 100%* 100%* 400 40% 25% *We always assume that units transferred out of a department are 100% complete with respect to the processing done in that department. Materials Conversion Total Cost of beginning work in process inventory Costs added during the period. $ 9,600 $ 350,900 $ 356,475 $ 15,175 719,500 5,575 368,600 Total cost...... $378,200 $734,675

> Platinum Tracks, Inc., is a small audio recording studio located in Los Angeles. The company handles work for advertising agencies—primarily for radio ads—and has a few singers and bands as clients. Platinum Tracks han

> Speedy Auto Repairs uses a job-order costing system. The company’s direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics’ hourly wages. Speedy’s overhead costs include various items,

> Wilmington Company has two manufacturing departments—Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of

> Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production.......140,000 Machine-hours required to support estimated production.

> Milden Company is a merchandiser that plans to sell 12,000 units during the next quarter at a selling price of $100 per unit. The company also gathered the following cost estimates for the next quarter: Cost Cost Formula Cost of goods sold ………………

> Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month: Required: 1. With respect to cost classifications for preparing financial statements: a. What is the total pro

> Miller Company’s total sales are $120,000. The company’s direct labor cost is $15,000, which represents 30% of its total conversion cost and 40% of its total prime cost. Its total selling and administrative expense is $18,000 and its only variable sellin

> Madison Seniors Care Center is a nonprofit organization that provides a variety of health services to the elderly. The center is organized into a number of departments, one of which is the Meals-On-Wheels program that delivers hot meals to seniors in t

> Todrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales ..............................................................................$300,000 Beginning merchandise inventory ………………..............$20,000

> The following cost data pertain to the operations of Montgomery Department Stores, Inc., for the month of July. Corporate legal office salaries ............................................................................$56,000 Apparel Department cost of

> Whirly Corporation’s contribution format income statement for the most recent month is shown below: Required: 1. What would be the revised net operating income per month if the sales volume increases by 100 units? 2. What would be the

> Security Pension Services helps clients to set up and administer pension plans that are in compliance with tax laws and regulatory requirements. The firm uses a job-order costing system in which overhead is applied to clients’ accounts

> Pureform, Inc., uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: The beginning work in process inventory was 80% compl

> Helix Corporation uses the weighted-average method in its process costing system. It produces prefabricated flooring in a series of steps carried out in production departments. All of the material that is used in the first production department is added

> Highlands Company uses the weighted-average method in its process costing system. It processes wood pulp for various manufacturers of paper products. Data relating to tons of pulp processed during June are provided below: Required: 1. Compute the number

> Maria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process

> Clonex Labs, Inc., uses the weighted-average method in its process costing system. The following data are available for one department for October: The department started 175,000 units into production during the month and transferred 190,000 completed u

> Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of machine-hours. The company’s predetermined overhead rate of $2.40 per machine-hour was based on a cost formula that estimates $192,000 of

> The following data from the just completed year are taken from the accounting records of Mason Company Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedul

> Kingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and computes plantwide predetermined overhead rates on a quarterly basis using the number of units to b

> Taveras Corporation is currently operating at 50% of its available manufacturing capacity. It uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the followin

> Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $15 per hour. During the year, the company started and completed only two jobs—Jo

> Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a job-order costing system. The capacity of the plant is determined by the capacity of its constraint, which is time on the automated bandsaw t

> Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work a

> Braverman Company has two manufacturing departments—Finishing and Fabrication. The predetermined overhead rates in Finishing and Fabrication are $18.00 per direct labor-hour and 110% of direct materials cost, respectively. The company’s direct labor wage

> Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $16.00 per direct labor-hour and $12.00 per direct labor-hour, respectively. The company’s direct

> Mickley Company’s plantwide predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $17.00 per hour. The following information pertains to Job A-500: Direct materials...........................................$231 Di

> Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production.........

> Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 20,000 direct labor-hours would be required for the period’s estimated level of production. The

> Delph Company uses a job-order costing system and has two manufacturing departments—Molding and Fabrication. The company provided the following estimates at the beginning of the year: During the year, the company had no beginning or end

> Yancey Productions is a film studio that uses a job-order costing system. The company’s direct materials consist of items such as costumes and props. Its direct labor includes each film’s actors, directors, and extras. The company’s overhead costs includ

> Warner Corporation purchased a machine 7 years ago for $319,000 when it launched product P50. Unfortunately, this machine has broken down and cannot be repaired. The machine could be replaced by a new model 300 machine costing $313,000 or by a new model

> The.Alpine.House,.Inc.,.is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Amount Sales...................................................................................$150,000 Selling.pr

> Java Source, Inc., (JSI) buys coffee beans from around the world and roasts, blends, and packages them for resale. Some of JSI’s coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volume

> Munchak Company’s relevant range of production is 9,000–11,000 units. Last month the company produced 10,000 units. Its total manufacturing cost per unit produced was $70. At this level of activity the companyâ&#

> The Devon Motor Company produces automobiles. On April 1st the company had no beginning inventories and it purchased 8,000 batteries at a cost of $80 per battery. It withdrew 7,600 batteries from the storeroom during the month. Of these, 100 were used to

> Refer to the data given in Exercise 1–7. Answer all questions independently. Data from Exercise 1-7: The Devon Motor Company produces automobiles. On April 1st the company had no beginning inventories and it purchased 8,000 batteries at a cost of $80 pe

> Refer to the data given in Exercise 3. Answer all questions independently. Data from Exercise 3: Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows:

> Refer to the data given in Exercise 3. Answer all questions independently. Data given in Exercise 3: Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as foll

> Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials …………………………………………………………………… $7.00 Direct labor……………

> Cherokee Inc. is a merchandiser that provided the following information: Amount Number of units sold……………………………………………………………………………. 20,000 Selling price per unit…………………………………………………………………………………. $30 Variable selling expense per unit………………………………………………………………

> Miller Company’s contribution format income statement for the most recent month is shown below: Required: 1. What is the revised net operating income if unit sales increase by 15%? 2. What is the revised net operating income if the sel

> Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow: Fixed expenses total $183,750 per month. Required: 1. Prepare a

> Siegel Company manufactures a product that is available in both a deluxe model and a regular model. The company has manufactured the regular model for years. The deluxe model was introduced several years ago to tap a new segment of the market. Since intr

> Cheryl Montoya picked up the phone and called her boss, Wes Chan, the vice president of marketing at Piedmont Fasteners Corporation: “Wes, I’m not sure how to go about answering the questions that came up at the meetin

> “Blast it!” said David Wilson, president of Teledex Company. “We’ve just lost the bid on the Koopers job by $2,000. It seems we’re either too high to get the job or

> “Blast it!” said David Wilson, president of Teledex Company. “We’ve just lost the bid on the Koopers job by $2,000. It seems we’re either too high to get the job or

> The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 2,000 sets per year. Annual cost data at full capacity follow: Direct labo

> The Excel worksheet form that appears below is to be used to recreate portions of the Review Problem relating to Voltar Company. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this works

> The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that appears earlier in the chapter. Download the workbook containing this form You should proceed to the requirements below only after

> This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2–5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form. Exhibit

> This Excel worksheet form is to be used to recreate Exhibit 1–7. Download the workbook containing this form from Connect, where you will also receive instructions. Required: 1. Check your worksheet by changing the variable selling cost

> The Ramon Company is a manufacturer that is interested in developing a cost formula to estimate the variable and fixed components of its monthly manufacturing overhead costs. The company wishes to use machine-ho The company leases all of its manufacturi

> Mercury, Inc., produces cell phones at its plant in Texas. In recent years, the company’s market share has been eroded by stiff competition from overseas. Price and product quality are the two key areas in which companies compete in thi

> Milden Company is a distributor who wants to start using a contribution format income statement for planning purposes. The company has analyzed its expenses and developed the following cost formulas: Cost Cost Formula Cost of goods sold .................

> The Hard Rock Mining Company is developing cost formulas for management planning and decision-making purposes. The company’s cost analyst has concluded that utilities cost is a mixed cost, and he is attempting to find a base that correl

> Archer Company is a wholesaler of custom-built air-conditioning units for commercial buildings. It gathered the following monthly data relating to units shipped and total shipping expense: Required: 1. Prepare a scattergraph using the data given above.

> Refer to the data for Highlands Company. Assume that the company uses the FIFO method in its process costing system. Required: 1. Compute the number of tons of pulp completed and transferred out during June. 2. Compute the equivalent units of production

> Refer to the data for Pureform, Inc., in Exercise 4–9. Exercise 4–9: Pureform, Inc., uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data

> Refer to the data for Alaskan Fisheries, Inc., in Exercise 4–10. Exercise 4–10: Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted-average method in its process costing system.

> MediSecure, Inc., uses the FIFO method in its process costing system. It produces clear plastic containers for pharmacies in a process that starts in the Molding Department. Data concerning that department’s operations in the most recent period appear be

> Brooks Corporation uses a job-order costing system to apply manufacturing costs to jobs. The company closes its underapplied or overapplied overhead to cost of goods sold. Its balance sheet on March 1 is as follows: During March the company completed th

> What is the meaning of margin of safety?

> Star Videos, Inc., produces short musical videos for sale to retail outlets. The company’s balance sheet accounts as of January 1 are given below. Because the videos differ in length and in complexity of production, the company uses a

> What is the meaning of break-even point?

> What is the meaning of operating leverage?

> What is the meaning of contribution margin ratio? How is this ratio useful in planning business operations?

> Assume that a company has two processing departments—Mixing followed by Firing. Explain what costs might be added to the Firing Department’s Work in Process account during a period.

> How do direct labor costs flow through a job-order costing system?

> How do you compute the unadjusted cost of goods sold?

> How do you compute the cost of goods manufactured?

> How do you compute the total manufacturing costs within a schedule of cost of goods manufactured?

> How do you compute the raw materials used in production?

> What is underapplied overhead? Overapplied overhead?

> Stillicum Corporation makes ultra-light weight backpacking tents. Data concerning the company’s two product lines appear below: The company has a traditional costing system in which manufacturing overhead is applied to units based on di

> A number of terms relating to the cost of quality and quality management are listed below: Appraisal costs ……………………………………………………………… Quality circles Quality cost report …………………………………………………………… Prevention costs Quality of conformance ………………………………………………………

> Describe the terms (a) “control premium” and (b) “illiquidity discount” when discussing possible external or outside buyers of a venture.

> What is an employee stock option plan (ESOP)? How is an ESOP used to buy out a venture?

> What is foreclosure?

> What is meant by loan default? Also, describe (a) an acceleration provision and (b) a cross-default provision.

> What is the purpose of the U.S. Bankruptcy Code? What are some of the characteristics of ventures that use instead of private liquidation?

> Describe a venture bankruptcy. Also, indicate the difference between (a) a voluntary bankruptcy petition and (b) an involuntary bankruptcy petition.

> What is bankruptcy and how is it used by ventures?

> What are the steps or stages in a “typical” execution and time line schedule used in planning and executing an IPO?

> Describe the absolute priority rule.

> What is a private liquidation? What does the process of assignment mean?

> What is a private workout? Also, describe some of the characteristics of ventures that are likely to engage in private workouts.

> What is a systematic liquidation of a venture? What are some of the advantages and disadvantages of a systematic liquidation?

> What is meant by initial public offering (IPO) underpricing?

> Describe the two following terms that may be involved in underwriting a new securities issue: (a) green shoe and (b) lockup provision.

> When an investment banking firm decides whether to underwrite or market a securities issue, what is meant by a firm commitment and best efforts?

> What is meant by due diligence? How does a traditional registration differ from a shelf registration?

> An insolvent venture is one where equity is negative and/or the cash flow of the firm is unable to meet debt obligations.

> Define asset restructuring and describe how it can be implemented to escape from financial distress.

> Define operations restructuring and describe how it can be implemented to escape financial distress.

> What do we mean when we say a venture is insolvent?

> Use the concept of cash flow insolvency over time and describe what would happen if the problem is temporary rather than permanent.

> Describe what is meant by (a) a leveraged buyout (LBO), and (b) a management buyout (MBO).

> Describe how the relative value method is used to value a firm’s equity.

> Describe an outright sale of a venture. What are the four categories of possible buyers?