Question: Under various registered brand names, Saucony,

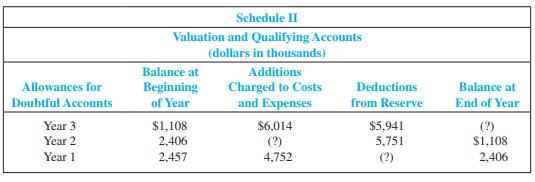

Under various registered brand names, Saucony, Inc., and its subsidiaries develop, manufacture, and market bicycles and component parts, athletic apparel, and athletic shoes. It recently disclosed the following information concerning the allowance for doubtful accounts on its Form 10-K Annual Report submitted to the Securities and Exchange Commission.

Required:

1. Record summary journal entries related to bad debts for year 3.

2. Supply the missing dollar amounts noted by (?) for year 1, year 2, and year 3.

Transcribed Image Text:

Schedule II Valuation and Qualifying Accounts (dollars in thousands) Balance at Additions Beginning of Year Charged to Costs and Expenses Allowances for Deductions Balance at Doubtful Accounts from Reserve End of Year $5,941 5,751 Year 3 $1,108 $6,014 (?) $1,108 Year 2 2,406 (?) Year 1 2,457 4,752 (?) 2,406

> Merchandise invoiced at $8,500 is sold on terms 1/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales?

> Indicate whether the following items would be added (+) or subtracted (−) from the company’s books or the bank statement during the construction of a bank reconciliation. Reconciling Item Company's Books Bank Stat

> Indicate the most likely effect of the following changes in credit policy on the receivables turnover ratio (+ for increase, − for decrease, and NE for no effect). a. Granted credit with shorter payment deadlines. b. Increased effectiveness of collection

> Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts. a. At the end of the period, bad debt expense is estimated to

> Net sales for the period was $45,000 and cost of sales was $28,000. Compute the gross profit percentage for the current year. What does this ratio measure?

> Total gross sales for the period include the following: Credit card sales (discount 3%).............................$ 9,400 Sales on account (2/15, n/60)...............................$10,500 Sales returns related to sales on account were $500. All ret

> Which of the following is the entry to be recorded by a law firm when it receives a $2,000 retainer from a new client at the initial client meeting? a. Debit to Cash, $2,000; credit to Legal Fees Revenue, $2,000. b. Debit to Accounts Receivable, $2,000

> For the transactions in M2-5, identify each as an investing (I) activity or financing (F) activity on the statement of cash flows. In M2-5, For each of the following transactions of Pitt Inc. for the month of January 2012, indicate the accounts, amount

> Indicate the most likely time you expect sales revenue to be recorded for each of the listed transactions. Indicate the most likely time you expect sales revenue to be recorded for each of the listed transactions. Transaction Point A Point B a. Sale

> A sale is made for $8,000; terms are 2/10, n/30. At what amount should the sale be recorded under the gross method of recording sales discounts? Give the required entry. Also give the collection entry, assuming that it is during the discount period.

> Microsoft develops, produces, and markets a wide range of computer software, including the Windows operating system. On its recent financial statements, Microsoft reported the following information about net sales revenue and accounts receivable (amounts

> Siemens is one of the world’s largest electrical engineering and electronics companies. Headquartered in Germany, the company has been in business for over 160 years and operates in 190 countries. In a recent annual report, it disclosed

> Frederick Company uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $275,000, (2) up to 120 days past due, $50,000, and (3) more than 12

> Casilda Company uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $50,000, (2) up to 180 days past due, $14,000, and (3) more than 180 d

> Gary’s Dairy uses the aging approach to estimate bad debt expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $16,000, (2) up to 120 days past due, $5,500, and (3) more than 120 days pas

> During 2012, Giatras Electronics recorded credit sales of $680,000. Based on prior experience, it estimates a 3.5 percent bad debt rate on credit sales. Required: 1. Prepare journal entries for each of the following transactions. a. The appropriate ba

> Using the following categories, indicate the effects of the transactions listed in E6-9. Use + for increase and − for decrease and indicate the accounts affected and the amounts. Assets Liabilities Stockholders' Equity

> During 2011, CliffCo Inc. incurred operating expenses of $200,000, of which $150,000 was paid in cash; the balance will be paid in January 2012. Transaction analysis of operating expenses for 2011 should reflect only the following: a. Decrease stockholde

> The following summarized data were provided by the records of Slate, Incorporated, for the year ended December 31, 2012: Sales of merchandise for cash............................................................$233,000 Sales of merchandise on credit....

> For each of the following events, which ones result in an exchange transaction for Dittman Company (Y for yes and N for no)? (1) Dittman Company purchased a machine that it paid for by signing a note payable. (2) The founding owner, Megan Dittman,

> Wolverine World Wide Inc. prides itself as being the “world’s leading marketer of U.S. branded nonathletic footwear.” It competes in many markets with Deckers, often offering products at a lower price point. Its brands include Wolverine, Bates, Sebago, a

> Brazen Shoe Company records Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts as contra-revenues. Complete the following tabulation, indicating the effect (+ for increase, − for decrease, and NE for no effect) and

> The following transactions were selected from among those completed by Hailey Retailers in 2010: Nov. 20 Sold two items of merchandise to Customer B, who charged the $450 sales price on her Visa credit card. Visa charges Hailey a 2 percent cr

> The September 30, 2011, bank statement for Bennett Company and the September ledger accounts for cash are summarized here: No outstanding checks and no deposits in transit were carried over from August; however, there are deposits in transit and checks

> Jackson Company’s June 30, 2011, bank statement and June ledger accounts for cash are summarized below: Required: 1. Reconcile the bank account. A comparison of the checks written with the checks that have cleared the bank shows out

> Stride Rite Corporation manufactures and markets shoes under the brand names Stride Rite, Keds, and Sperry Top-Sider. Three recent years produced a combination of declining sales revenue and net income culminating in a net loss of $8,430,000. Each year,

> A recent annual report for Dell, Inc., contained the following data: Required: 1. Determine the receivables turnover ratio and average day’s sales in receivables for the current year. 2. Explain the meaning of each number. (dol

> A recent annual report for FedEx contained the following data: Required: 1. Determine the receivables turnover ratio and average day’s sales in receivables for the current year. 2. Explain the meaning of each number. (dollars in

> On January 1, 2011, Anson Company started the year with a $250,000 credit balance in Retained Earnings and a $300,000 balance in Contributed Capital. During 2011, the company earned net income of $50,000, declared a dividend of $15,000, and issued more s

> During 2011, Dorothy’s Ceramics Shop had sales revenue of $70,000, of which $25,000 was on credit. At the start of 2011, Accounts Receivable showed a $4,000 debit balance, and the Allowance for Doubtful Accounts showed a $300 credit balance. Collections

> During 2012, Robby’s Camera Shop had sales revenue of $170,000, of which $75,000 was on credit. At the start of 2012, Accounts Receivable showed a $16,000 debit balance, and the Allowance for Doubtful Accounts showed a $900 credit balance. Collections of

> Zeber Company has been operating for one year (2011). You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. At the start of 2012, Zeber’s T-account balances were as follows:

> A recent annual report for Target contained the following information (dollars in thousands) at the end of its fiscal year: A footnote to the financial statements disclosed that uncollectible accounts amounting to $811,000 and $428,000 were written off

> During the months of January and February, Silver Corporation sold goods to three customers. The sequence of events was as follows: Jan. 6 Sold goods for $850 to S. Green and billed that amount subject to terms 2/10, n/30. 6 Sold good

> During 2011, Soto Electronics, Incorporated, recorded credit sales of $790,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. The appropriate bad debt expe

> During 2011, Crandell Productions, Inc., recorded credit sales of $800,000. Based on prior experience, it estimates a 1 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. The appropriate bad debt expense

> The following transactions were selected from among those completed by Cadence Retailers in 2011: Nov. 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,500 (total); terms 3/10, n/30. 25 Sold two items of merchandi

> The following transactions were selected from the records of OceanView Company: July 12 Sold merchandise to Customer R, who charged the $3,000 purchase on his Visa credit card. Visa charges OceanView a 2 percent credit card fee. 15 Sold me

> When companies involved in long-term construction projects can estimate the percentage of work completed and the total expected costs with reasonable accuracy, GAAP allows them to recognize revenues based on the incurred contract costs to date divided by

> The following data are from annual reports of Jen’s Jewelry Company: Compute Jen’s total asset turnover ratio for 2012 and 2011. What do these results suggest to you about Jen’s Jewelry Company?

> Symbol Technologies, Inc., was a fast-growing maker of bar-code scanners. According to the federal charges, Tomo Razmilovic, the CEO at Symbol, was obsessed with meeting the stock market’s expectation for continued growth. His executive team responded by

> Cripple Creek Company has one trusted employee who, as the owner said, “handles all of the bookkeeping and paperwork for the company.” This employee is responsible for counting, verifying, and recording cash receipts and payments, making the weekly bank

> Refer to the financial statements of American Eagle Outfitters given in Appendix B at the end of this book. Required: 1. What does the company include in its category of cash and cash equivalents? How close do you think the disclosed amount is to actual

> BMW Group, headquartered in Munich, Germany, manufactures several automotive brands including BMW Group, MINI, and Rolls-Royce. Financial information is reported in the euro (€) monetary unit using International Financial Reporting Standards (IFRS) as ap

> Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the gross profit percentage for both companies for the

> Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. Required: 1. How much cash and cash equivalents does the company report at the end of the current year? 2. What was the change in accounts receivable and

> Star Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 1: Required: Compute ending inventory and cost of goods sold under FIFO

> Perry Corporation is a local grocery store organized seven years ago as a corporation. At that time, a total of 10,000 shares of common stock were issued to the three organizers. The store is in an excellent location, and sales have increased each year.

> Briggs & Stratton Engines Inc. uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/45. The balance of each account receivable is aged on the basis of four time periods as f

> Recent balance sheets of Dell, Inc., a leading producer and marketer of a broad range of personal computers, mobility products, software, and related tools and services, are provided. Required: 1. Is Dell a corporation, sole proprietorship, or partners

> The following data were selected from the records of Sharkim Company for the year ended December 31, 2012. Balances January 1, 2012: Accounts receivable (various customers).......................$116,000 Allowance for doubtful accounts..................

> What is the distinction between sales allowances and sales discounts?

> What is a sales discount? Use 1/10, n/30 in your explanation.

> What is a credit card discount? How does it affect amounts reported on the income statement?

> Jefferson Corporation was organized on May 1, 2011. The following events occurred during the first month. a. Received $65,000 cash from the five investors who organized Jefferson Corporation. b. Ordered store fixtures costing $20,000. c. Borrowed $10,

> What is gross profit or gross margin on sales? How is the gross profit ratio computed? In your explanation, assume that net sales revenue was $100,000 and cost of goods sold was $60,000.

> Define cash and cash equivalents in the context of accounting. Indicate the types of items that should be included and excluded.

> Does an increase in the receivables turnover ratio generally indicate faster or slower collection of receivables? Explain.

> What is the effect of the write-off of bad debts (using the allowance method) on (a) net income and (b) accounts receivable, net?

> Using the allowance method, is bad debt expense recognized in (a) the period in which sales related to the uncollectible account are made or (b) the period in which the seller learns that the customer is unable to pay?

> Given the transactions in M3-7 and M3-8 (including the examples), prepare the Operating Activities section of the statement of cash flows for Craig’s Bowling, Inc., for the month of July 2011. The following transactions are July 2011 a

> Which basic accounting principle is the allowance method of accounting for bad debts designed to satisfy?

> Differentiate accounts receivable from notes receivable.

> Explain the difference between sales revenue and net sales.

> What are the three major categories of notes or footnotes presented in annual reports? Cite an example of each.

> Briefly explain the major classifications of stockholders’ equity for a corporation.

> During its first month of operations in March 2011, Volz Cleaning, Inc., completed six transactions with the dollar effects indicated in the following schedule: Required: 1. Write a brief explanation of transactions (1) through (6). Explain any assump

> Ethan Allen Interiors, Inc., is a leading manufacturer and retailer of home furnishings in the United States and abroad. The following is adapted from Ethan Allen’s June 30, 2008, annual financial report. Dollars are in thousands. Ass

> For property, plant, and equipment, as reported on the balance sheet, explain ( a ) cost, ( b ) accumulated depreciation, and ( c ) net book value.

> Define extraordinary items. Why should they be reported separately on the income statement?

> Briefly explain the normal sequence and form of financial reports produced by public companies in a typical year.

> Given the transactions in M3-7 and M3-8 (including the examples), prepare an income statement for Craig’s Bowling, Inc., for the month of July 2011. The following transactions are July 2011 activities of Craig’s Bowli

> Briefly explain the normal sequence and form of financial reports produced by private companies in a typical year.

> Define the following three users of financial accounting disclosures and the relationships among them: ( a ) financial analysts, ( b ) private investors, and ( c ) institutional investors.

> Describe the roles and responsibilities of management and independent auditors in the financial reporting process.

> Briefly define return on assets and what it measures.

> What are the three major classifications on a statement of cash flows?

> List the six major classifications reported on a balance sheet.

> What are the four major subtotals or totals on the income statement?

> During its first week of operations ending January 7, 2011, FastTrack Sports Inc. completed six transactions with the dollar effects indicated in the following schedule: Required: 1. Write a brief explanation of each transaction. Explain any assumptio

> What basis of accounting does GAAP require on the ( a ) income statement, ( b ) balance sheet, and ( c ) statement of cash flows?

> Explain why information must be relevant and reliable to be useful.

> The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount

> Briefly describe the role of information services in the communication of financial information.

> Creative Technology, a computer hardware company based in Singapore, developed the modern standard for computer sound cards in the early 1990s. Recently, Creative has released a line of portable audio products to directly compete with Appleâ€&

> Jordan Sales Company (organized as a corporation on April 1, 2011) has completed the accounting cycle for the second year, ended March 31, 2013. Jordan also has completed a correct trial balance as follows: Required: Complete the financial statements a

> Aeropostale, Inc., is a mall-based specialty retailer of casual apparel and accessories. The company concept is to provide the customer with a focused selection of high-quality, active-oriented fashions at compelling values. The items reported on its inc

> At the end of the 2011 annual reporting period, Barnard Corporation’s balance sheet showed the following: During 2012, the following selected transactions (summarized) were completed: a. Sold and issued 1,000 shares of common stock a

> Exquisite Jewelers is developing its annual financial statements for 2012. The following amounts were correct at December 31, 2012: cash, $58,000; accounts receivable, $71,000; merchandise inventory, $154,000; prepaid insurance, $1,500; investment in sto

> Following are terms related to the balance sheet that were discussed in Chapters 2 through 5. Match each definition with its related term by entering the appropriate letter in the space provided. Terms Definitions (1) Capital in excess of par A. Nea

> Newell Rubbermaid Inc. manufactures and markets a broad array of office products, tools and hardware, and home products under a variety of brand names, including Sharpie, Paper Mate, Rolodex, Rubbermaid, Levolor, and others. The items reported on its inc

> Granger Service Company, Inc., was organized by Ted Granger and five other investors. The following activities occurred during the year: a. Received $63,000 cash from the investors; each was issued 1,400 shares of capital stock. b. Purchased equipment

> Following are the concepts of accounting covered in Chapters 2 through 5. Match each transaction or definition with its related concept by entering the appropriate letter in the space provided. Use one letter for each blank. Concepts Transactions/De

> The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount

> The Securities and Exchange Commission (SEC) regulates companies that issue stock on the stock market. It receives financial reports from public companies electronically under a system called EDGAR (Electronic Data Gathering and Retrieval Service). Using

> Net income was $900,000. Beginning and ending assets were $8,000,000 and $9,600,000, respectively. What was the return on assets (ROA)? a. 9.4% b. 10.23% c. 11.25% d. 10.41%

> When companies issue par value stock for cash, which accounts are normally affected? a. Common Stock; Additional Paid-In Capital; and Property, Plant, and Equipment, Net. b. Cash; and Property, Plant, and Equipment, Net. c. Common Stock; Additional Pa

> The classified balance sheet format allows one to ascertain quickly which of the following? a. The most valuable asset of the company. b. The specific due date for all liabilities of the company. c. What liabilities must be paid within the upcoming ye

> Which of the following is not a normal function of a financial analyst? a. Issue earnings forecasts. b. Examine the records underlying the financial statements to certify their conformance with GAAP. c. Make buy, hold, and sell recommendations on comp

> Which of the following would normally not be found in the notes to the financial statements? a. Accounting rules applied in the company’s financial statements. b. Additional detail supporting numbers reported in the company’s financial statements. c.