Question: Use the same set of facts as

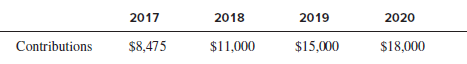

Use the same set of facts as in P14-7. In addition, assume that based on ERISA rules, Magee

Corporation must contribute the following amounts to the pension fund:

Magee intends to fund the pension plan only to the extent required by ERISA rules. Assume that the contributions to the pension fund earn exactly a 10% rate of return annually.

Required:

1. The CEO of the company, Reece Magee, is considering three possible discount rates (8%, 10%, and 12%) for calculating the annual pension expense. Provide schedules showing how much pension expense will be reported under each of the three scenarios during the 2017–2021 period.

2. Provide schedules showing the funded status of the pension plan during the 2017–2020 period.

3. Magee is wondering which of the three discount rate assumptions would be considered the most and least conservative for the purposes of determining net income. Prepare a schedule that shows how total pension expense compares across the three discount rate assumptions. Explain your results.

Transcribed Image Text:

> Suppose Japan has a GDP of $5 trillion, and that its national savings rate is 25%. a) Calculate Japan’s national saving. b) Calculate Japan’s government saving if private saving is $800 billion.

> What is the consumer price index, who calculates it, and how is it calculated and used to measure the inflation rate?

> Describe the GDP deflator and the personal consumption expenditure deflator.

> Consider the following diagram of a small open economy: a) Calculate net exports and the capital outflow when the world real interest rate is 7%. b). Calculate net exports and the capital outflow when the world real interest rate is 5%.

> How do macroeconomists distinguish between nominal and real values of variables? Does nominal GDP or real GDP provide a better picture of changes in economic activity and economic well-being? Why?

> What are the main types of income included in national income? Why doesn’t national income equal GDP?

> Identify the four major expenditure components in the national income identity and discuss the major subcategories of each component.

> Why are capital goods and inventories treated differently from intermediate goods in the production approach to measuring GDP?

> Distinguish between a flow measure and a stock measure. Which type of measure is GDP?

> How is GDP defined in the production approach to measuring economic activity? Explain how economists at the U.S. Department of Commerce’s Bureau of Economic Analysis account for the production of goods and services that are not sold in markets, the produ

> Explain the differences between nominal and real interest rates and between ex ante and ex post real interest rates.

> What does the unemployment rate measure, who calculates it, and how is it calculated?

> What is the fundamental identity of national income accounting? What is its significance?

> What is hyperinflation? What has been the main cause of hyperinflation episodes?

> Go to the St. Louis Federal Reserve FRED database, find data on Gross Private Saving (GPSAVE) and Gross Saving (GSAVE), and download the data. a) How have these variables changed from 5 years earlier to the latest available data? b) Calculate Gross Gover

> Go to the St. Louis Federal Reserve FRED database, and find data on the M1 Money Stock (M1SL), M1 Money Velocity (M1V), and Real GDP (GDPC1). Convert the M1SL data series to “quarterly” using the frequency setting, and for all three series, use the “Perc

> Second National Insurance Company provided this information for its trading securities portfolio: Required: 1. Provide the journal entries to record the fair value adjustment on December 31, 2016. Assume that Second National uses an account entitled Fa

> Goff Corporation acquired stock of Spiegel, Inc., on March 1, 2016, at a cost of $500,000. The stock had a fair value of $550,000 at December 31, 2016, $610,000 at December 31, 2017, and $590,000 at December 31, 2018. Goff sold the stock for $640,000 on

> In its 2005 annual report, Waste Management Inc. provided the following note to the financial statements: Financial Interest in Surety Bonding Company—During the third quarter of 2003, we issued a letter of credit to support the debt of a surety bonding

> On January 1, 2018, Wilson Corporation acquired mortgage-backed securities (MBS) from National Financial for $10,000 and classified the investment in its available-for-sale (AFS) portfolio. On December 31, 2018, the MBS’s fair value had declined to $7,00

> AutoParts Heaven is a U.S. company whose operations include a large, 100% owned foreign subsidiary. The subsidiary’s functional currency is the U.S. dollar. The local currency in the country where the foreign subsidiary operates is appreciating against t

> On January 1, 2017, Figland Company purchased for cash 40% of Irene Company’s 300,000 shares of voting common stock for $1,800,000. At the time, 40% of the book value of the underlying equity in Irene’s net assets was $1,400,000; $50,000 of the excess wa

> Central Sprinkler Corporation manufactures and sells automatic fire sprinkler heads and valves, and it distributes components for automatic sprinkler systems. Selected information from the company’s 2017 financial statements show: In

> Tredegar Industries Inc. makes plastic films and molded plastic products and soft alloy aluminum extrusions, distributes business applications software, and provides proprietary chemistry services. A note to the company’s annual report states: While cert

> The Shareholders’ Equity section of Holiday Roads Company’s balance sheet shows: Net income for 2017 was $1,700,000, preferred stock dividends were $200,000, and common stock dividends were $500,000. The company issu

> Avnext Industries issues 10-year convertible notes at par for $10,000 on December 31, 2017. The notes mature in 10 years and are convertible into 400 shares of Avnext common stock at any time after January 1, 2022. Interest is paid annually at the end of

> Statements of cash flows are provided for three companies: Telstra Corporation Limited is an Australian telecommunications and media company, formerly owned by the Australian government and privatized in stages from the late 1990s. Telstra is the larges

> On January 1, 2012, when its $30 par-value common stock was selling for $80 per share, Gierach Corporation issued $10 million of 4% convertible debentures due in 10 years. The conversion option allowed the holder of each $1,000 bond to convert the bond i

> It’s July 1, 2018, and the market price of Warm Ways’ common stock is $175 per share. There are 1.1 million common shares outstanding, and the Retained earnings account shows a balance of $45,000,000. Management wants to declare and pay a 20% common stoc

> The stockholders’ equity section of Warm Ways Inc.’s balance sheet at January 1, 2017, shows: Preferred stock, $100 par value, 10% dividend, 50,000 shares issued and outstanding ………………….. $ 5,000,000 Common stock, $6 par value, 1 million shares issued

> Massey Coal just issued $50 million of convertible notes. Each note has a $1,000 face value, a stated interest rate of 2%, and matures in five years from the issue date. Investors have the option of holding each note to maturity or converting the note in

> Kadri Corporation reported basic EPS of $3.00 and diluted EPS of $2.40 for 2017. Its EPS calculations follow: Required: Kadri issued the convertible preferred stock at the beginning of 2017 and the Series A and Series B convertible debt at par in late

> Hanigan Manufacturing had 1,800,000 shares of common stock outstanding as of January 1, 2017, and 900,000 shares of 10% noncumulative (nonconvertible) preferred stock outstanding. Required: The following events occurred during 2017: On February 28, Han

> AT&T Wireless Services was once one of the largest wireless communication—think “cell phones”—service providers in the United States. Information from its annual report to shareh

> Keystone Enterprises just announced record 2017 EPS of $5.00, up $0.25 from last year. This is the tenth consecutive year that the company has increased its EPS, an enviable record. Unfortunately, management fears that this string of EPS increases is abo

> The following excerpts are taken from the annual report of J. Crew Group, Inc. At January 29, 2005 and January 28, 2006, 92,800 shares of Series A preferred stock and 32,500 shares of Series B preferred stock were issued and outstanding. Dividends compou

> The following excerpt is from Ball Corporation’s 2006 annual report. Effective January 1, 2006, the company adopted SFAS No. 123 (revised 2004), “Share-Based Payment,” and elected to use the . . . Black–Scholes valuation model. Tax benefits associated wi

> Excerpts from the Year 2 annual report of Air Products and Chemicals, Inc., follow. The income statement and balance sheet are condensed but the note entitled “Summarized Financial Information of Equity Affiliates” is

> On January 2, 2017, Dwyer Corporation granted 10,000 nonqualified stock options each to four of its key executives (40,000 options in total). Under the terms of the option plan, upon exercise, each executive will pay the exercise price of $10 per share o

> On January 1, 2017, Darth Corp. granted nonqualified stock options to certain key employees as additional compensation. The options were for 100,000 shares of Darth’s $1 par value common stock at an exercise price of $24 per share. The market price of th

> Riggs Corporation has the following balance sheet information at December 31, 2016. Current liabilities …………………...…………………...…………………...$ 800,000 Convertible bonds ($1,000 par, 5%) …………………...…………………...2,000,000 Common stock ($1 par, 300,000 shares issued

> In its December 31, 2016, balance sheet, Castle, Inc., reported 400,000 issued shares of common stock and 50,000 shares of treasury stock. The 2016 annual report also reported 100,000 exercisable incentive stock options. Each option allows the holder to

> Nike Inc. is one of the world’s largest sellers of athletic footwear and athletic apparel. The following information is from Nike’s annual report. Note 7: Redeemable Preferred Stock NIAC is the sole owner of the Compan

> Trask Corporation, a public company whose shares are traded in the over-the-counter market, had the following shareholders’ equity account balances at December 31, 2016: Common stock …………………..…………………..…………………..$ 7,875,000 Additional paid-in capital (incl

> Berle Corp. has a defined benefit pension plan that features the following data: January 1, 2016 (beginning of fiscal year): Fair value of plan assets ……………….……………….………………. $4,000 Projected benefit obligation ……………….……………….………………. $6,200 Accumulated be

> Selected pension information extracted from the retirement benefits note that appeared in Green’s 2017 annual report follows. (These numbers have been modified but are based on the activities of a real company whose name has been disgui

> The following information pertains to the pension plan of Beatty Business Group: Note that the information in Columns (2) and (3) are as of the beginning of the year, whereas the information in Column (4) is measured over the year. The AOCIâ€

> The following information is based on an actual annual report. Different names and years are being used. Bond and some of its subsidiaries provide certain postretirement medical, dental, and vision care and life insurance for retirees and their dependent

> On December 31, 2009, Internet Capital Group (ICG) acquired 89% of the equity of GovDelivery for $19,670,000. This acquisition was accounted for under the acquisition method. In its 10-K filing with the SEC, ICG disclosed the following purchase price all

> On January 1, 2017, Magee Corporation started doing business by hiring R. Walker as an employee at an annual salary of $50,000, with an annual salary increment of $10,000. Based on his current age and the company’s retirement program, Walker is required

> Assume the same facts for ABC Corporation as in P14-5 with the following exceptions: Assume both that ABC fully funds the estimated PBO on January 1, 2017, and that invested funds earn an actual return of 12% in 2017. Suppose that in addition to fundin

> Assume that the pension benefit formula of ABC Corporation calls for paying a pension benefit of $250 per year for each year of service with the company plus 50% of the projected last year’s salary at retirement. Payments begin one year after the employe

> Required: You have the following information related to Chalmers Corporation’s pension plan: 1. Defined benefit, noncontributory pension plan. 2. Plan initiation, January 1, 2017 (no credit given for prior service). 3. Retirement benefits paid at year-en

> Puhlman Inc. provides a defined benefit pension plan to its employees. It smooths recognition of its gains and losses when computing its market-related value to compute expected return. Additional information follows: During 2017, the PBO increased by

> Turner Inc. provides a defined benefit pension plan to its employees. The company has 150 employees. The remaining amortization period at December 31, 2016, for prior service cost is 5 years. The average remaining service life of employees is 11 years at

> The following information pertains to Sparta Company’s defined benefit pension plan for 2017: Discount rate ……………….………………. 8% Expected rate of return on plan assets ……………….………………. 10% Remaining amortization period at 1/1 for prior service cost ……………….

> ForeEver Yours, Inc., a manufacturer of wedding rings, issued two financial instruments at the beginning of 2017: a $10 million, 40-year bond that pays interest at the rate of 11% annually and 10,000 shares of $100 preferred stock that pays a dividend of

> The Retained earnings account for Nathan Corporation had a credit balance of $800,000 at the end of 2016. Selected transactions during 2017 follow: a. Net income was $130,000. b. Cash dividends declared were $60,000. c. Repurchased 100 shares of Nathan C

> The disclosure rules for business combinations complicate financial analysis. Trend analysis becomes difficult because comparative financial statements are not retroactively adjusted to include data for the acquired company for periods prior to the acqui

> Nome Company sponsors a defined benefit plan covering all employees. Benefits are based on years of service and compensation levels at the time of retirement. Nome has a September 30 fiscal year-ends. It determined that as of September 30, 2017, its ABO

> On January 1, 2017, East Corporation adopted a defined benefit pension plan. At plan inception, the prior service cost was $60,000. In 2017, East incurred service cost of $150,000 and amortized $12,000 of prior service cost. On December 31, 2017, East co

> Dell Company adopted a defined benefit pension plan on January 1, 2017. Dell amortizes the initial prior service cost of $1,334,400 over 16 years. It assumes a 7% discount rate and an 8% expected rate of return. The following additional data are availabl

> The following information pertains to Kane Company’s defined benefit pension plan: Balance sheet asset, ……………………. 1/1/2017 $ 2,000 AOCI—prior service cost, ……………... 1/1/2017 24,000 Service cost …………………….…………... 19,000 Interest cost …………………….………… 38,000

> The following information pertains to Gali Company’s defined benefit pension plan for 2017: Fair value of plan assets, beginning of year ………… $350,000 Fair value of plan assets, end of year ………………… 525,000 Employer contributions …………………………………. 110,000

> Use the facts given in E14-4. Repeat the requirements assuming that the discount and earnings rate is 11% instead of 8%. E14-4: Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor of farm implements. Abbott plans to r

> Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor of farm implements. Abbott plans to retire on her 65th birthday, five years from January 1, 2017. Her salary at January 1, 2017 is $48,000 per year, and her projected

> The stockholders’ equity section of Peter Corporation’s balance sheet at December 31, 2017, follows: Common stock ($10 par value); authorized …………………… 1,000,000 shares, issued and outstanding 900,000 shares ………… $ 9,000,000 Additional paid-in capital ……

> The following data pertain to Tyne Company’s investments in marketable equity securities. (Assume that all securities were held throughout 2019 and 2020.) Note that the new FASB guidance on accounting for minority-passive investments is

> 1. What is the difference between preferred stock and common stock? 2. What is treasury stock? 3. Why does the SEC require companies to exclude redeemable preferred stock from shareholders’ equity even when redemption is not mandatory? 4. Describe how th

> [A] Aon Corporation’s Mezzanine Preferred Stock In its 2002 annual report to shareholders, Aon Corporation described its mandatorily redeemable preferred stock as follows: In January 1997, Aon created Aon Capital A, a wholly-owned statu

> Selected financial statements for Ralston Company, a sole proprietorship, are as follows: Additional Information: a. During 2017, equipment having accumulated depreciation of $4,500 was sold for a $3,000 gain. b. A $3,750 lease payment was made in 201

> Karr Inc. reported net income of $300,000 for 2017. Changes occurred in several balance sheet accounts as follows: Equipment ……………... $25,000 increase Accumulated depreciation ……………...40,000 increase Note payable ……………...30,000 increase Additional Inf

> During 2017, King Corporation wrote off accounts receivable totaling $25,000 and made sales, all on account, of $710,000. Other information about the company’s sales activities follows: In addition, in February 2017, King accepted a $

> An income statement for Hamilton Corporation follows: Additional Information: a. Decrease in accounts receivable, $36,000. b. The prepaid insurance account increased by $4,800 during the year. c. Included in salary expenses are salaries of $9,600 accr

> During 2017, Xan Inc. had the following activities related to its financial operations: Payment for the early retirement of long-term bonds payable (carrying value $370,000) ……………...……………...……………... $375,000 Distribution in 2017 of cash dividend declare

> Hoffman Engineering Company is a young and growing producer of pre-stressed concrete manufacturing equipment. You have been retained by the company to advise it in the preparation of a statement of cash flows. Hoffman uses the direct method in reporting

> Papa John’s International, Inc., operates and franchises pizza delivery and carryout restaurants in domestic and global markets. In its December 30, 2012, 10-K filing with the SEC, Papa John’s discloses the following relationship with a variable interest

> Sage Inc. bought 40% of Adams Corporation’s outstanding common stock on January 2, 2017, for $400,000. The carrying amount of Adams’s net assets at the purchase date totaled $900,000. Fair values and carrying amounts were the same for all items except fo

> Information related to Jones Company’s portfolio of trading securities at December 31, 2017, follows: Aggregate cost of securities ………………….. $340,000 Gross unrealized gains (cumulative) …………………..8,000 Gross unrealized losses (cumulative) …………………..52,000

> On January 1, 2017, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Deardon Corporation’s common stock. Following are the January 1, 2017, separate balance sheets of Chesapeake and Deardon

> Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2015, the price of salesforce.com stock was $56.45, and there were 650,596,000 shares of common stock outstanding. All questions relate to the ye

> On January 5, 2018, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the stock purchase, as well as fair value information regardi

> Lindy, a calendar-year U.S. corporation, bought inventory items from a supplier in Germany on November 5, 2017, for 100,000 euros, when the spot exchange rate was $1.40 per euro. At Lindy’s December 31, 2017, year-end, the spot exchange rate was $1.38. O

> A wholly owned subsidiary of Ward Inc. has certain expense accounts for the year ended December 31, 2017, stated in local currency units (LCU) as follows: The exchange rates at various dates are as follows: Required: Assume that the LCU is the subsid

> On July 1, 2017, Pushway Corporation issued 100,000 shares of common stock in exchange for all of Stroker Company’s common stock. The Pushway stock issued had a market value of $500,000 on the date of the exchange. Following are the Jul

> Pate Corp. owns 80% of Strange Inc.’s common stock. During 2017, Pate sold inventory to Strange for $600,000 on the same terms as sales made to outside customers. Strange sold the entire inventory purchased from Pate by the end of 2017.

> Founded on January 1, 2017, Gehl Company had the following short-term investments in securities at the end of 2017 and 2018 (all were held in the “trading” portfolio): Required: If the company recorded a $4,000 debit

> Stone has provided the following information on its available-for-sale securities: Aggregate cost as of 12/31/17 …………………..$170,000 Unrealized gain as of 12/31/17 …………………..4,000 Unrealized losses as of 12/31/17 …………………..26,000 Net realized gains during

> On September 1, 2017, Cano & Company, a U.S. corporation, sold merchandise to a foreign firm for 250,000 euros. Terms of the sale require payment in euros on February 1, 2018. On September 1, 2017, the spot exchange rate was $1.30 per euro. At Cano’s yea

> Sea Company purchased 60% of Island Company’s common stock for $180,000. On the acquisition date, Island’s book value of net assets totaled $250,000 and the fair value of identifiable net assets totaled $275,000. The $

> The following data pertain to Tyne Company’s investments in marketable equity securities. (Assume that all securities were held throughout 2016 and 2017.) Required: 1. What amount should Tyne report as unrealized holding gain (loss) i

> Several years ago, RJR Nabisco Holdings Corporation (Holdings) offered for sale 93 million shares of its subsidiary RN-Nabisco Group. According to the prospectus, the estimated initial public offering price for RN-Nabisco common stock would be in the ran

> On December 31, 2017, the Stockholders’ Equity section of Mercedes Corporation was as follows: Common stock, par value $5; authorized 30,000 shares; ………… $ 45,000 issued and outstanding, 9,000 shares Additional paid-in capital …………………………………………………… 58,00

> Newton Corporation was organized on January 1, 2017. On that date, it issued 200,000 shares of its $10 par-value common stock at $15 per share (400,000 shares were authorized). During the period from January 1, 2017, through December 31, 2019, Newton rep

> Weldon Wire has issued 2,500,000 shares of $2 par common stock at an average price of $10 per share. Of these, 100,000 shares were repurchased during the year for $15 each and retired. Another 200,000 shares of the shares were repurchased for $17 each an

> Munn Corporation’s records included the following stockholders’ equity accounts: Preferred stock, par value $15, authorized 20,000 shares …………………… $255,000 Additional paid-in capital—preferred stock ………………………………………… 15,000 Common stock, no par, $5 stated

> Warren Corporation was organized on January 1, 2017, with an authorization of 500,000 shares of common stock ($5 par value per share). During 2017, the company had the following capital transactions: January 5 ………… Issued 100,000 shares at $5 per share A

> On July 1, 2017, Amos Corporation granted nontransferable, nonqualified stock options to certain key employees as additional compensation. The options permit the purchase of 20,000 shares of Amos’s $1 par common stock at a price of $32 per share. On the

> Information concerning the capital structure of the Petrock Corporation is as follows: During 2017, Petrock paid dividends of $1 per share on its common stock and $2.40 per share on its preferred stock. The preferred stock is convertible into 20,000 sha

> Tam Company’s net income for the year ending December 31, 2017, was $10,000. During the year, Tam declared and paid $1,000 cash dividends on preferred stock and $1,750 cash dividends on common stock. At December 31, 2017, the company had 12,000 shares of