Question: Use the table in the text to

Use the table in the text to prove your answers for Exercise 14A-2.

Exercise 14A-2:

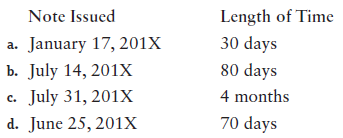

Determine the maturity date for each of the following without the use of tables:

Transcribed Image Text:

Note Issued Length of Time a. January 17, 201X 30 days b. July 14, 201x c. July 31, 201X 80 days 4 months d. June 25, 201X 70 days

> At the end of the day the clerk for Harold’s Variety Shop noticed an error in the amount of cash he should have. Total cash sales from the sales tape were $1,196, whereas the total cash in the register was $1,156. Harold keeps a $29 change fund in his sh

> From the following information, construct a bank reconciliation for Zoom Co. as of October 31, 201X. Then prepare journal entries if needed. Checkbook balance $1,580 Outstanding checks $638 Bank statement balance 1,000 Bank service charge 70 Deposit

> From the following posted T accounts, reconstruct the closing journal entries for March 31, 201X. M. Faulks, Capital Insurance Expense Withdrawals 1,700 8,000 (Mar. 1) 300 Closing 300 4,200 Net Income M. Faulks, Withdrawals Wage Expense 1,700 Closin

> From the following T accounts, journalize the four closing entries on July 31, 201X. J. Kohl, Capital Rent Expense 10,000 7,500 J. Kohl, Withdrawals Wage Expense 3,000 8,200 Income Summary Insurance Expense 3,100 Fees Earned Depr. Expense, Office Eq

> From the adjustments section of a worksheet presented in Figure 5.22, prepare adjusting journal entries for the end of October. Figure 5.22: Adjustments Dr. Cr. (A) 1200 00 40000 Prepaid Rent Office Supplies (B) |2|이이100 (D) 2|0|이000 Accumulated De

> Risch Company each year prepares an income statement and balance sheet. Tom Martin, the controller, issued a memo to Debbie Kreiger, vice president, that the company should prepare a statement of cash flows. Debbie called the controller and told him that

> Complete the following table. Which Financial Account Category Normal Balance Statement(s) Found Accounts Payable Prepaid Insurance Computer Equipment Depreciation Expense, Computer Equipment B. Free, Capital B. Free, Withdrawals Salaries Payable Ac

> You have been hired to correct the trial balance in Figure 3.35 that has been recorded improperly from the ledger to the trial balance. Figure 3.35: SUNG CO. TRIAL BALANCE August 31, 201x Dr. Cr. Accounts Payable A. Sung, Capital 520000 4750 00 550

> From the following trial balance of Helm’s Cleaners in Figure 2.6, prepare the following for May: • Income statement • Statement of owner’s equity • Balance sheet

> Complete the following table. For each account listed on the left, fill in what category it belongs to, whether increases and decreases in the account are marked on the debit or credit sides, and on which financial statement the account appears. A sample

> From the following account balances, prepare in proper form for September (a) an income statement, (b) a statement of owner’s equity, and (c) a balance sheet for French Realty. Cash $ 2,900 S. French, Withdrawals $ 200 Accounts Rec

> Record the following transactions in the expanded accounting equation. Do not calculate a running balance. a. Bell invested $45,000 in a computer company. b. Bought computer equipment on account, $9,500. c. Bell paid personal telephone bill from compan

> From the following, prepare a balance sheet for Rolland Co. Cleaners at the end of June 201X: Cash, $52,000; Equipment, $36,000; Accounts Payable, $11,000; B. Rolland, Capital.

> Explain how a creditor might analyze a statement of cash flows.

> Record the following into the general journal of Rick’s Auto Shop. 201X Apr. 1 Rick Savareses invested $80,000 cash in the auto shop. Paid $15,000 for auto equipment. 8 Bought auto equipment from Laverty Co. for $5,000 on account.

> Prepare journal entries for the following transactions that occurred during April: 201X Apr. 1 Jan Dimon invested $100,000 cash and $18,000 of equipment into her new business. 3 Purchased building for $40,000 on account. 12 Purchased a truck from Le

> a. In which columns of the worksheet would the following additional data be placed? b. In which columns would the beginning-of-year figures be placed? Inventories Year-End Figures Column Raw materials $30,000 Work-in-process 15,500 Finished goods 2

> From the following transactions, prepare the appropriate general journal entries for the month of May: a. Raw materials costing $78,000 were issued from the storeroom. b. Direct labor of $85,000 was charged to production. c. Supplies costing $6,000 were

> Calculate the contribution margin for each department and income before taxes, based on the following: Dept. A 11,000 square feet Dept. B 19,000 square feet Net Sales $57,000 $96,000 Cost of Goods Sold 24,000 46,000 Sales Salaries 9,000 (40% directl

> From the following, calculate departmental income before tax. Assume a tax rate of 30%. Dept. A Dept. B Net Sales $270,000 $300,000 Cost of Goods Sold 106,000 126,000 Delivery Expense 24,700 28,500 Advertising Expense 23,350 22,150 Depreciation Expe

> Marvin Company records invoices at gross in its voucher system. From the following transactions, (a) record in general journal form the appropriate entries at gross and (b) record the entries as if Marvin Company recorded invoices at net. 201X Sept.

> Karl Company uses a voucher system along with a petty cash fund. Record each of the following entries in general journal form. Assume that Karl Company records all vouchers at gross. 201X July Purchased $750 of merchandise on account from Grace Comp

> Diaz Company, which is a medium-sized firm, uses a voucher system. Record each of the following entries in general journal form. Assume that Diaz Company records all vouchers at gross. 201X July Voucher no. 50 was prepared for the purchase of $6,600

> From the given income statement and additional information of Cunningham Co., compute the following: a. Asset turnover for 2016 b. Inventory turnover for 2016 c. Accounts receivable turnover for 2016 2016 2015 Net Sales $820,000 $700,000 Cost of Goo

> Explain how a gain or loss on retirement of bonds before the maturity date is recorded.

> Balance this four-column account. What function does the PR column serve? When will Account 111 be used in the journalizing and posting process? Cash Acct. 111 Balance Date Explanation PR Dr. Cr. Dr. Cr. 201X Mar. 6 GJ 1 29 10 GJ 1 90 15 GJ 2 7 18 G

> From the following comparative balance sheet of Haynes Co., prepare a common-size comparative balance sheet. (Round all percentages to the nearest tenth of a percent.) 2016 2015 Current Assets $105,000 $64,000 Plant and Equipment 451,000 $556,000 31

> From the following, prepare a common-size income statement for Timothy Co. by converting the dollar amounts into percentages. (Round to the nearest hundredth of a percent.) Use net sales as 100%. 2016 2015 Net Sales $450,000 $400,000 Cost of Goods S

> Prepare a horizontal analysis of the comparative income statement for Auster Co. for the years ending December 31, 2015, and December 31, 2016. (Round to the nearest hundredth of a percent as needed.) 2016 2015 Net Sales $150,000 $70,000 Cost of Goo

> From the following, calculate the net cash flows from operating activities (use the indirect method): 2013 2014 Accounts Receivable $ 5,100 $7,600 Prepaid Insurance 904 850 Accounts Payable 3,997 4,604 Salaries Payable 1,050 1,950 For the year ended

> On January 1 Boxer Corporation sold $340,000 of 10-year sinking fund bonds. The corporation expects to earn 5% on the sinking fund balance and is required to deposit $23,608 at the end of each year with the trustee. Record the following entries: a. The

> On July 1, Henry Corporation issued 10%, 10-year bonds with a face value of $109,000 for $96,520 because the current market rate is 12%. Record the following entries, assuming that the interest method is used to amortize the discount on bonds. Round disc

> Redo the journal entries for Exercise 20A-3, assuming that bonds sold at 102. Exercise 20A-3: Hathaway Corporation issued $320,000 of 12%, 25-year bonds at 93 on May 1, 201X, with semiannual interest payable on May 1 and November 1. Amortization of dis

> Hathaway Corporation issued $320,000 of 12%, 25-year bonds at 93 on May 1, 201X, with semiannual interest payable on May 1 and November 1. Amortization of discount is by the straight-line method. Record the journal entries for the following: a. Issuance

> On July 1, 201X, Good now Corporation issued $700,000 of 6%, 30-year bonds to lenders at par (100). Interest is to be paid semiannually on January 1 and July 1. Journalize the following entries: a. Issued the bonds. b. Paid semiannual interest payment.

> From the following, prepare in proper form a statement of retained earnings for Thomas Company for the year ended December 31, 2015. Prior period adjustment: increase in recording expense for Land in Retained Earnings, January 2015 $36,000 2013 (dis

> Explain the difference between a stock dividend and a stock split.

> Given the following stockholders’ equity: Common Stock, $6 par value, authorized 106,000 shares, 82,000 shares issued and outstanding …………â€&brv

> From the following information, determine the book value per share for preferred and common stock assuming $14,800 of dividends are in arrears on the preferred stock. Stockholders’ Equity Preferred 6% Stock cumulative and nonparticipating, $17 par value

> Peterson Corporation began its business on January 1, 201X. It sold at $35 per share 5,600 shares of no-par common stock with a stated value of $15 per share. The charter of Peterson indicated that 36,000 shares were authorized. Retained earnings were $5

> On January 1, 201X, Dandy Corporation issued on a subscription basis 950 shares of $53 par-value common stock at $93 per share. Two equal installments were to be made on July 1 and December 31. Prepare the appropriate journal entries on January 1, July 1

> Paula Corporation was authorized to issue 28,000 shares of common stock. Record the journal entry for each of the following independent situations, assuming Paula issues 5,600 shares at $9 on July 20, 201X: a. Common stock has an $8 par value. b. Common

> A machine that cost $9,080 with $3,920 of accumulated depreciation was traded in for a similar machine having a $5,850 cash price. An $835 trade-in was offered by the seller. a. Calculate the book value of the old machine. b. Calculate the loss on the e

> August Co., whose accounting period ends on December 31, purchased a machine for $6,780 on January 1 with an estimated residual value of $790 and an estimated useful life of 4 years. Prepare depreciation schedules for the current as well as the following

> From the following, prepare depreciation schedules for the first 2 years for (a) straight-line, (b) units-of-production, and (c) double declining-balance at twice the straight-line rate methods. • Machine purchased on January 1, $1,470. • Residual value,

> Milton Sales uses the FIFO method with the perpetual inventory system. Enter the following information in the inventory record form for product 44BX. Be sure to keep the balance on hand up-to-date. 201X Nov. Balance on hand: 5 units at a cost of $20

> Journalize and post the preceding transactions (for Exercise 15A-2) using a two-column journal and T accounts. Exercise 15A-2: The RJM Company uses the perpetual inventory system with a subsidiary ledger for inventory. Enter the following information i

> Restrictions on retained earnings have to be updated in the ledger. Agree or disagree? Why?

> The Mark Electric Company uses the perpetual inventory system. Record these transactions in a two-column journal. 201X Feb. 3 Purchased 50 model 77DX light fixtures on account from Solar Electric at total cost of $2,000; terms n/30. 5 Sold 10 model

> Determine the maturity date for each of the following without the use of tables: Note Issued Length of Time a. January 17, 201X 30 days b. July 14, 201x c. July 31, 201X 80 days 4 months d. June 25, 201X 70 days

> Violet Company had credit sales of $210,000 during 2015. The balance in Allowance for Doubtful Accounts is a $970 debit balance. Journalize the Bad Debts Expense for December 31 using each of the following methods: a. Bad Debts Expense is estimated at 1.

> Jacob Co., which uses an Allowance for Doubtful Accounts, had the following transactions in 2015, 2016, and 2017. (Use the income statement approach.) a. Journalize the transactions. (The company uses the income statement approach in estimating bad deb

> Acres.com has requested that you prepare a partial balance sheet on December 31, 2015, from the following: Cash, $126,000; Petty Cash, $72; Accounts Receivable, $68,000; Bad Debts Expense, $49,000; Allowance for Doubtful Accounts, $10,000; Merchandise In

> On December 31, 2012, $290 of salaries has been accrued. (Salaries before the accrued amount totaled $24,500.) The next payroll to be paid will be on February 3, 2013, for $6,200. Please do the following: a. Journalize and post the adjusting entry (use

> From the worksheet in Exercise 12A-3, prepare the assets section of a classified balance sheet. Exercise 12A-3: From the partial worksheet in Figure 12.11, journalize the closing entries for December 31 for F. Henry Co. Figure 12.11: F. HENRY CO.

> From the partial worksheet in Figure 12.11, journalize the closing entries for December 31 for F. Henry Co. Figure 12.11: F. HENRY CO. WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Income Statement Balance Sheet Account Dr. Cr. Dr. Cr. 18900 449 00 56

> Give the category, the classification, and the report(s) on which each of the following appears (for example: Cash—asset, current asset, balance sheet): a. Salaries Payable b. Accounts Payable c. Mortgage Payable d. Unearned Legal Fees e. SIT Payable f.

> Distinguish among legal capital, par value, no-par value, and no-par value with a stated value.

> From the following accounts, prepare a cost of goods sold section in proper form: Merchandise Inventory, 12/31/1X, $9,000; Purchases Discount, $920; Merchandise Inventory, 12/01/1X, $4,000; Purchases, $62,000; Purchases Returns and Allowances, $970; Frei

> From the following, calculate (a) net sales, (b) cost of goods sold, (c) gross profit, and (d) net income: Sales, $22,000; Sales Discount, $470; Sales Returns and Allowances, $240; Beginning Inventory, $640; Net Purchases, $13,500; Ending Inventory, $510

> Journalize the following transactions. Assume the perpetual inventory system. 201X Аpг. 5 Sold merchandise for $1,350 cash. The cost of the merchandise was $725. 16 Made refunds to cash customers for defective merchandise, $50. The cost of defective

> Journalize the following transactions. Assume the perpetual inventory system. 201X Dec. 4 Sold merchandise for $450 cash. The cost of merchandise was $350. 9 Purchased merchandise from Ree Co. on account, $3,300, F.0.B. shipping point (buyer pays fr

> Journalize the following transactions. Assume a perpetual inventory system. 201X Apr. 8 Purchased merchandise on account from Bachand Supplies, $19,000; terms 3/10, n/30. 15 Sold merchandise on account, $3,500; terms 3/10, n/30. The cost of merchand

> Journalize, record, and post when appropriate the following transactions into the general journal (p. 2) for Jacob’s Clothing. All purchases discounts are 7/10, n/30. Assume the periodic inventory system. If using working papers, be sur

> Journalize the following transactions. Assume a perpetual inventory system. 201X 8 Sold merchandise on account, $630, to Ring Co.; terms 3/10, n/30. Cost of merchandise was $390. Jul. 12 Purchased office equipment on account from MEC Co., $1,600. 13

> From the general journal in Figure 10.29, record to the accounts payable subsidiary ledger and post to general ledger accounts as appropriate. Figure 10.29: GENERAL JOURNAL Page 2 Date Account Titles and Description PR Dr. Cr. 201X Jun. Purchases

> From the following facts calculate what Mike Hall paid Lakeville Co. for the purchase of a dining room set. Sale terms are 5/10, n/30. a. Sales ticket price before tax, $11,000, dated April 5. b. Sales tax, 10%. c. Returned one defective chair for credi

> From the following transactions for Ava Co., journalize, record, post, and prepare a schedule of accounts receivable when appropriate. You will have to set up your own accounts receivable subsidiary ledger and partial general ledger as needed. All sales

> Avan Corporation just published its financial statements. The president of Avan told the accountants not to include in the annual report any information about a pending lawsuit. The president thought it would only worry the stockholders. Do you think the

> Journalize, record, and post when appropriate the following transactions in the general journal (all sales carry terms of 5/10, n/30): Use the following account numbers: Accounts Receivable, 112; Sales, 411; Sales Returns and Allowances, 412; Sales Dis

> Mocha Company has four employees, and each employee earned $50,000 for the calendar year. Using a blank Form 940, complete Part 2, lines 3–8, to answer the following questions: Total annual payroll for the year …………………………………………. ? Payments made in exces

> Using a blank form 941, complete Part 1, lines 1–6, using the following information: Total employees during the first quarter ……………………………………………………… 3 Total wages during the first quarter, none came from tips ……………. $26,050.66 Federal income tax withheld

> The total wage expense for Edgar Co. was $166,000. Of this total, $26,000 was above the OASDI wage base limit and not subject to this tax. All earnings are subject to Medicare tax, and $55,000 was above the federal and state unemployment wage base limits

> At the end of the day the clerk for Ken’s Variety Shop noticed an error in the amount of cash he should have. Total cash sales from the sales tape were $1,192, whereas the total cash in the register was $1,152. Ken keeps a $25 change fund in his shop. Pr

> From the following information, construct a bank reconciliation for Bang Co. as of February 28, 201X. Then prepare journal entries if needed. Checkbook balance $1,314 Outstanding checks $654 Bank statement balance 1,050 Bank service charge 65 NSF: T

> From the following accounts (not in order), prepare a post-closing trial balance for Wurley Co. on March 31, 201X. Note: These balances are before closing. Accounts Receivable $24,700 P. Wurley, Capital $25,320 Legal Supplies 10,400 P. Wurley, Withd

> From the following posted T accounts, reconstruct the closing journal entries for August 31, 201X. M. Fahy, Capital Withdrawals 100 7,000 (Aug. 1) Insurance Expense 275 Closing 275 375 Net Income M. Fahy, Withdrawals Wage Expense 100 Closing 100 400

> From the following T accounts, journalize the four closing entries on October 31, 201X. J. Kirsch, Capital Rent Expense 14,000 7,500 J. Kirsch, Withdrawals Wage Expense 5,000 8,100 Income Summary Insurance Expense 1,300 Fees Earned Depr. Expense, Of

> From the adjustments section of a worksheet (see Figure 5.21), prepare adjusting journal entries for the end of December. Figure 5.21: Adjust ments Dr. Cr. Prepaid Rent Office Supplies (A) 1 30000 (B) 45000 Accumulated Depreciation, Equipment (C) 3

> Jee Jones is in a partnership with Alvin Scott and Morry Flynn. Jee signed a long-term contract with a supplier without telling either partner. When Alvin heard about it, he hit the roof. He told Jee the partnership could not afford this contract and he

> From the completed worksheet in Exercise 4A-4, prepare Exercise 4A-4: From the following trial balance (Figure 4.19) and adjustment data, complete a worksheet for J. Revere as of January 31, 201X: Figure 4.19: a. an income statement for January. b.

> Complete the following table. Which Financial Account Category Normal Balance Statement(s) Found Accumulated Depreciation, Office Equipment Prepaid Rent Office Equipment Depreciation Expense, office Equipment B. Reel, Capital B. Reel, Withdrawals Wa

> You have been hired to correct the trial balance in Figure 3.32 that has been recorded improperly from the ledger to the trial balance. Figure 3.32: SALT LAKE CO. TRIAL BALANCE ОСТОВER 31, 201X Account Dr. Cr. Accounts Payable 390000 12 250 00 9500

> From the following transactions for Lucas Company for the month of May, (a) prepare journal entries (assume that it is page 1 of the journal), (b) post journal entries to the ledger (use a four-column account), and (c) prepare a trial balance. A partia

> Post the journal entries in Figure 3.31 to the ledger of Kramer Company. The partial ledger of Kramer Company is Cash, 111; Equipment, 121; Accounts Payable, 211; and A. Kramer, Capital, 311. Please use four column accounts in the posting process. Figur

> From the trial balance of Hugo’s Cleaners in Figure 2.5, prepare the following for July: • Income statement • Statement of owner’s equity • Balance sheet HUGO

> Complete the following table. For each account listed on the left, fill in what category it belongs to, whether increases and decreases in the account are marked on the debit or credit sides, and on which financial statement the account appears. A sample

> From the following account balances, prepare in proper form for November (a) an income statement, (b) a statement of owner’s equity, and (c) a balance sheet for Frederick Realty. Cash $4,800 S. Frederick, Withdrawals $ 120 Accounts

> Record the following transactions in the expanded accounting equation. Do not calculate a running balance. a. Black invested $60,000 in a computer company. b. Bought computer equipment on account, $7,000. c. Black paid personal telephone bill from comp

> From the following, prepare a balance sheet for Rideout Co. Cleaners at the end of November 201X: Cash, $71,000; Equipment, $12,000; Accounts Payable, $15,100; B. Rideout, Capital.

> Pete went to an auto dealer to buy a new Jeep. The salesperson told Pete that cars really appreciate in value. He cited antique cars as a perfect example. The dealer went on to tell Pete that buying a car represents some great tax savings. He told Pete t

> Record the following into the general journal of Remy’s Auto Shop. 201X May 1 Remy Tarsia invested $150,000 cash in the auto shop. 5 Paid $6,000 for auto equipment. 8 Bought auto equipment from Littleton Co. for $4,000 on account.

> Prepare journal entries for the following transactions that occurred during April: 201X April 1 Jamie Moore invested $110,000 cash and $12,000 of equipment into her new business. 3 Purchased building for $70,000 on account. 12 Purchased a truck from

> From the trial balance in Figure 25.20 and the provided year-end information, prepare a worksheet for Jenks Corporation (assume no adjustments). Figure 25.20: Year-End Figures Raw materials inventory ……â&#

> As the bookkeeper of Queen Manufacturing, you are to record the following transactions in the general journal for the month of November: a. Raw materials of $74,000 were issued from the storeroom. b. Charged $60,000 of direct labor to production. c. Supp

> An analysis of the accounts of Payson Manufacturing reveals the following data for the month ended April 30, 201X: Costs Incurred: Raw materials purchased, $120,000; direct labor, $133,000; manufacturing overhead, $49,700. These specific overheads incl

> Greer Company requested that you (1) assign indirect expenses to its jewelry and shoes departments as appropriate and (2) prepare an income statement for August 201X showing departmental contribution margins along with net income. Assume a 30% tax rate.

> From the following partial data, prepare an income statement showing departmental income before tax along with net income for Jay’s Corporation for the year ended December 31, 201X. Net Sales, TVs …â€&brv

> Given the following information about the clothing and hardware departments of Eustis Company, prepare a departmental expense allocation sheet showing expenses by department. Allocation Basis Rent and Insurance: …â€&brvb

> From the following data, prepare in proper form an income statement showing departmental gross profit (assume a 22% tax rate) for Speedy Stop for the year ended December 31, 201X. Cash ……………………………………………………………………………….. $10,000 Accounts Receivable …………………