Question: Use Worksheets 3.1 and 3.2.

Use Worksheets 3.1 and 3.2. Qiang Gao graduated from college in 2014 and began work as a systems analyst in July 2014. He is preparing to file his income tax return for 2014 and has collected the following financial information for calendar year 2014:

Tuition, scholarships, and grants……….$ 5,750

Scholarship, room, and board……………….1,850

Salary………………………………………………..30,250

Interest income ………………………………………185

Deductible expenses, total ……………………3,000

Income taxes withheld ………………………. 2,600

a. Prepare Qiang’s 2014 tax return, using a $6,200 standard deduction, a personal exemption of $3,950, and the tax rates given in Exhibit 3.3. Which tax form should Qiang use, and why?

b. Prepare Qiang’s 2014 tax return using the data in part a, along with the following information:

IRA contribution………………………………..$5,000

Cash dividends received …………………………..150

Which tax form should he use in this case? Why?

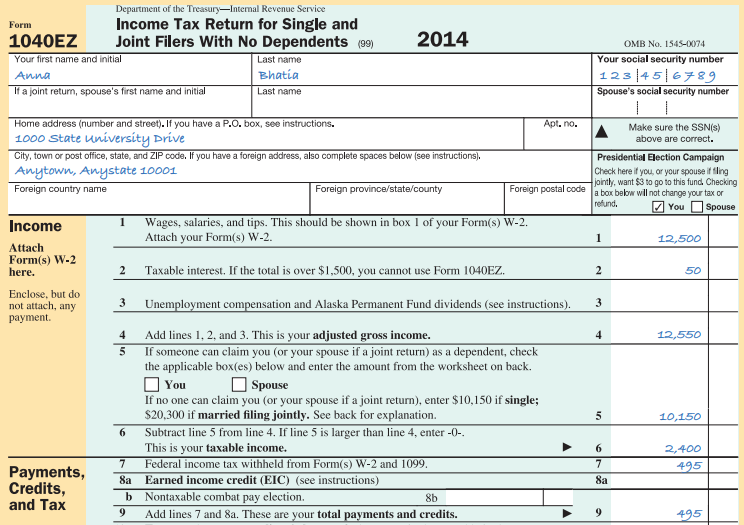

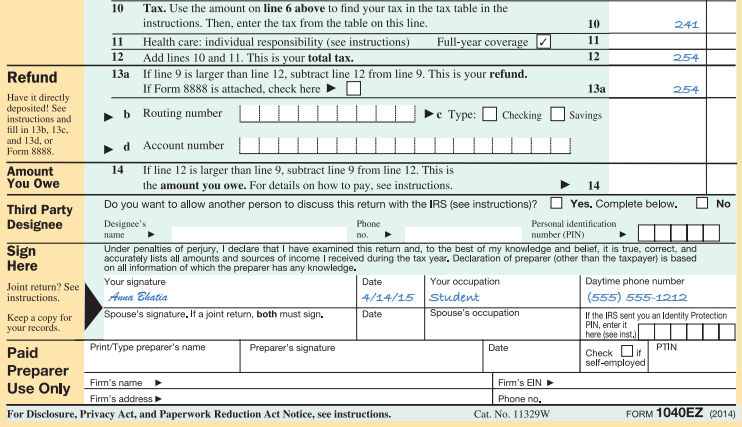

Worksheets 3.1:

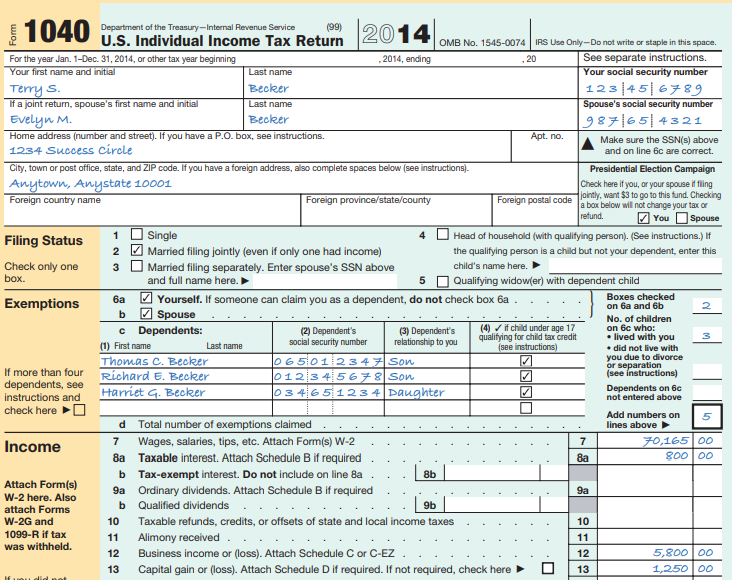

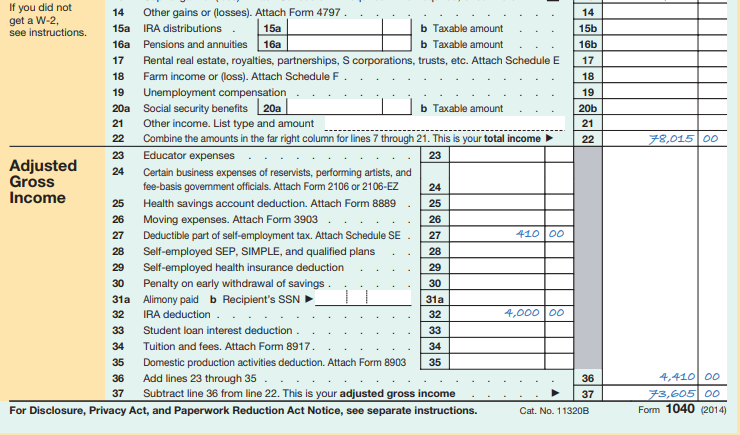

Worksheets 3.2:

Transcribed Image Text:

Department of the Treasury-Intemal Revenue Service Income Tax Return for Single and Joint Filers With No Dependents (99) Form 1040EZ 2014 OMB No. 1545-0074 Your first name and initial Last name Your social security number 123|4 5|678 Spouse's social security number Anna Bhatia If a joint return, spouse's first name and initial Last name Home address (number and street). If you have a P.O. box, see instructions. 1000 State university Drive Apt. no. Make sure the SSN(s) above are correct. City, town or post office, state, and ZIIP code. If you have a foreign address, also complete spaces below (see instructions). Presidential Election Campaign Anytown, Anystate 10001 Check here if you, or your spouse if fling jointly, want $3 to go to this fund Checking a box below will not change your tax or refund. Foreign country name Foreign province/state/county Foreign postal code Z You OSpouse Wages, salaries, and tips. This should be shown in box 1 of your Form(s) W-2. Attach your Form(s) W-2. 1 Income 1 12,500 Attach Form(s) W-2 here. 2 Taxable interest. If the total is over $1,500, you cannot use Form 1040EZ. 2 50 Enclose, but do not attach, any payment. 3 Unemployment compensation and Alaska Permanent Fund dividends (see instructions). 3 Add lines 1, 2, and 3. This is your adjusted gross income. 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. O You If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. Subtract line 5 from line 4. If line 5 is larger than line 4, enter -0-. This is your taxable income. Federal income tax withheld from Form(s) W-2 and 1099. Earned income credit (EIC) (see instructions) b Nontaxable combat pay election. 4 4 12,550 O Spouse 5 10,150 6. 6 2,400 7 7 495 Payments, Credits, 8a 8a 8b and Tax 9 Add lines 7 and 8a. These are your total payments and credits. 9. 495 10 Tax. Use the amount on line 6 above to find your tax in the tax table in the instructions. Then, enter the tax from the table on this line. 10 241 Health care: individual responsibility (see instructions) 12 11 Full-year coverage 11 Add lines 10 and 11. This is your total tax. If line 9 is larger than line 12, subtract line 12 from line 9. This is your refund. If Form 8888 is attached, check here 12 254 Refund 13а 13a 254 Have it directly deposited! See instructions and fill in 13b, 13c, and 13d, or b Routing number Рс Туре: Checking Savings >d Account number Form 8888. 14 If line 12 is larger than line 9, subtract line 9 from line 12. This is Amount You Owe the amount you owe. For details on how to pay, see instructions. 14 Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete below. No Third Party Designee Designee's Phone Personal identification патe number (PIN) no. Sign Here Under penalties of perjury, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct, and accurately lists all amounts and sources of income I received during the tax year. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge. Your signature Date Your occupation Daytime phone number Joint return? See instructions. (555) 555-1212 Anna Bhatia 4/14/15 Student Spouse's signature, If a joint return, both must sign. Date Spouse's occupation Кеер а сopy for your records. If the IRS sent you an Identity Protection PIN, enter it here (see inst.) Paid Print/Type preparer's name Preparer's signature Date PTIN if Check self-employed Preparer Use Only Firm's EIN Firm's name Fim's address Phone no. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. Cat. No. 11329w FORM 1040EZ (2014) | 1040 2014 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. See separate instructions. Your social security number 123|45|6789 Spouse's social security number 987|65|4321 For the year Jan. 1-Dec. 31, 2014, or other tax year beginning 2014, ending 20 Your first name and initial Last name Terry s. If a joint return, spouse's first name and initial Becker Last name Evelyn M. Home address (number and street). If you have a P.O. box, see instructions. Becker Apt. no. Make sure the SSN(s) above and on line 6c are correct. 1234 Success circle City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Presidential Election Campaign Anytown, Anystate 10001 Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. Foreign country name Foreign province/state/county Foreign postal code Z You OSpouse 1 Single Head of household (with qualifying person). (See instructions.) If Filing Status 2 2 Married filing jointly (even if only one had income) the qualifying person is a child but not your dependent, enter this Check only one box. 3 child's name here. Married filing separately. Enter spouse's SSN above and full name here. I 5 O Qualifying widow(er) with dependent child 6a O Yourself. If someone can claim you as a dependent, do not check box 6a . b 7 Spouse c Dependents: Boxes checked Exemptions on 6a and 6b No. of children (4) / if child under age 17 qualifying for child tax credit (see instructions) on 6c who: • lived with you • did not live with you due to divorce or separation (see instructions) Dependents on 6c not entered above (2) Dependent's social security number (3) Dependent's relationship to you (1) First name Last name Thomas C. Becker Ríchard E. Becker Harriet G. Becker 065:01 2347 Son 012 34 5678 Son 03 46 51234 Daughter If more than four dependents, see instructions and check here Total number of exemptions claimed Add numbers on lines above 70,165 00 800 00 Income 7 Wages, salaries, tips, etc. Attach Form(s) W-2 7 8a Taxable interest. Attach Schedule B if required b Tax-exempt interest. Do not include on line 8a 8a 8b Attach Form(s) W-2 here. Also attach Forms W-2G and 9a Ordinary dividends. Attach Schedule B if required 9a b Qualified dividends. 96 Taxable refunds, credits, or offsets of state and local income taxes 10 10 1099-R if tax was withheld. Alimony received ... 11 11 12 Business income or (loss). Attach Schedule C or C-EZ . 12 5,800 00 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 13 1,250 |00 If you did not get a W-2, see instructions. 14 Other gains or (losses). Attach Form 4797 . 14 15a IRA distributions . 15a b Taxable amount 15b 16a Pensions and annuities 16a b Taxable amount 16b 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 18 Farm income or (loss). Attach Schedule F 18 Unemployment compensation 20a Social security benefits 20a Other income. List type and amount Combine the amounts in the far right column for lines 7 through 21. This is your total income 19 19 b Taxable amount 20b 21 21 22 22 78,015 00 23 Educator expenses 23 Adjusted gross income 24 Certain business expenses of reservists, performing artists, and fee-basis govemment officials. Attach Form 2106 or 2106-EZ 24 25 Health savings account deduction. Attach Form 8889 25 26 Moving expenses. Attach Form 3903 26 27 Deductible part of self-employment tax. Attach Schedule SE . 27 410 00 28 Self-employed SEP, SIMPLE, and qualified plans 28 29 Self-employed health insurance deduction 29 30 Penalty on early withdrawal of savings . 30 31a Alimony paid b Recipient's SSN . 32 31a IRA deduction . 32 4,000 00 33 Student loan interest deduction . 33 34 Tuition and fees. Attach Form 8917. 34 35 Domestic production activities deduction. Attach Form 8903 35 36 Add lines 23 through 35 . 36 4,410 00 37 Subtract line 36 from line 22. This is your adjusted gross income 73,605| OO Form 1040 (2014) 37 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B

> Find the finance charges on a 6.5 percent, 18-month, single-payment loan when interest is computed using the simple interest method. Find the finance charges on the same loan when interest is computed using the discount method. Determine the APR in each

> Using the simple interest method, find the monthly payments on a $3,000 installment loan if the funds are borrowed for 24 months at an annual interest rate of 6 percent. How much interest will be paid during the first year of this loan?

> Every six months, Larry Sun takes an inventory of the consumer debts that he has outstanding. His latest tally shows that he still owes $4,000 on a home improvement loan (monthly payments of $125); he is making $85 monthly payments on a personal loan wit

> Assume that you’ve been shopping for a new car and intend to finance part of it through an installment loan. The car you’re looking for has a sticker price of $18,000. The local dealership has offered to sell it to you for $3,000 down and finance the bal

> What types of assistance and tax preparation services does the IRS provide?

> Because of a job change, Ben Hardesty has just relocated to the southeastern United States. He sold his furniture before he moved, so he’s now shopping for new furnishings. At a local furniture store, he’s found an assortment of couches, chairs, tables,

> Use Worksheet 7.2. Elizabeth Erlich wants to buy a home entertainment center. Complete with a big-screen TV, DVD, and sound system, the unit would cost $4,500. Elizabeth has over $15,000 in a money fund, so she can easily afford to pay cash for the whole

> Sherman Jacobs plans to borrow $5,000 and to repay it in 36 monthly installments. This loan is being made at an annual add-on interest rate of 7.5 percent. a. Calculate the finance charge on this loan, assuming that the only component of the finance cha

> Lina Martinez wants to buy a new high-end audio system for her car. The system is being sold by two dealers in town, both of whom sell the equipment for the same price of $2,000. Lina can buy the equipment from Dealer A, with no money down, by making pay

> After careful comparison shopping, Bill Withers decides to buy a new Toyota Camry. With some options added, the car has a price of $23,558—including plates and taxes. Because he can’t afford to pay cash for the car, he will use some savings and his old c

> Marilyn Seacrest is a sophomore at State College and is running out of money. Wanting to continue her education, Marilyn is considering a student loan. Explain her options. How can she minimize her borrowing costs and maximize her flexibility?

> Wyatt Collins recently graduated from college and is evaluating two credit cards. Card A has an annual fee of $75 and an interest rate of 9 percent. Card B has no annual fee and an interest rate of 16 percent. Assuming that Wyatt intends to carry no bala

> Ryan Gray, a student at State College, has a balance of $380 on his retail charge card; if the store levies a finance charge of 21 percent per year, how much monthly interest will be added to his account?

> Sean and Amy Anderson have a home with an appraised value of $180,000 and a mortgage balance of only $90,000. Given that an S&L is willing to lend money at a loan-to-value ratio of 75 percent, how big a home equity credit line can Sean and Amy obtain? Ho

> What are the main features and implications of the Credit Card Act of 2009?

> What is the purpose of a tax audit? Describe some things you can do to be prepared if your return is audited.

> Use Worksheet 6.1. Alyssa Clark is evaluating her debt safety ratio. Her monthly take- home pay is $3,320. Each month, she pays $380 for an auto loan, $120 on a personal line of credit, $60 on a department store charge card, and $85 on her bank credit ca

> Isaac Wright has a monthly take-home pay of $1,685; he makes payments of $410 a month on his outstanding consumer credit (excluding the mortgage on his home). How would you characterize Isaac’s debt burden? What if his take-home pay were $850 a month and

> Carter Hall recently graduated from college and wants to borrow $50,000 to start a business, which he believes will produce a cash flow of at least $10,000 per year. As a student, Carter was active in clubs, held many leadership positions, and did a lot

> Christine Lin was reviewing her credit card statement and noticed several charges that didn’t look familiar to her. Christine is unsure whether she should pay the bill in full and forget about the unfamiliar charges, or “make some noise.” If some of thes

> Henry Stewart is trying to decide whether to apply for a credit card or a debit card. He has $8,500 in a savings account at the bank and spends his money frugally. What advice would you have for Henry? Describe the benefits and drawbacks of each type of

> Parker Young recently received his monthly MasterCard bill for the period June 1–30, 2015, and wants to verify the monthly finance charge calculation, which is assessed at a rate of 15 percent per year and based on ADBs, including new purchases. His outs

> Martina Lopez has several credit cards, on which she is carrying a total current balance of $14,500. She is considering transferring this balance to a new card issued by a local bank. The bank advertises that, for a 2 percent fee, she can transfer her ba

> Establish a credit history. After graduating from college last fall, Nicole butler took a job as a consumer credit analyst at a local bank. From her work reviewing credit applications, she realizes that she should begin establishing her own credit histor

> Denise Green is currently renting an apartment for $725 per month and paying $275 annually for renter’s insurance. She just found a small townhouse that she can buy for $185,000. She has enough cash for a $10,000 down payment and $4,000

> How much might a home buyer expect to pay in closing costs on a $220,000 house with a 10 percent down payment? How much would the home buyer have to pay at the time of closing, taking into account closing costs, down payment, and a loan fee of 3 points?

> Define estimated taxes, and explain under what conditions such tax payments are required.

> Using the maximum ratios for a conventional mortgage, how big a monthly payment could the Danforth family afford if their gross (before-tax) monthly income amounted to $4,000? Would it make any difference if they were already making monthly installment l

> Calculating required down payment on home purchase. How much would you have to put down on a house costing $100,000 if the house had an appraised value of $105,000 and the lender required an 80 percent loan-to-value ratio?

> Use Worksheet 5.3. Selma and Rodney Jackson need to calculate the amount that they can afford to spend on their first home. They have a combined annual income of $47,500 and have $27,000 available for a down payment and closing costs. The Jacksons estima

> Art Patton has equally attractive job offers in Miami and Los Angeles. The rent ratios in the cities are 8 and 20, respectively. Art would really like to buy rather than rent a home after the moves. Explain how to interpret the rent ratio and what it tel

> Lease vs purchase car decision: Use Worksheet 5.1. Chris Svenson is trying to decide whether to lease or purchase a new car costing $18,000. If he leases, he’ll have to pay a $600 security deposit and monthly payments of $425 over the 36-month term of th

> Use Worksheet 5.4. Latha Yang purchased a condominium four years ago for $180,000, paying $1,250 per month on her $162,000, 8 percent, 25-year mortgage. The current loan balance is $152,401. Recently, interest rates have dropped sharply, causing Latha to

> What are the pros and cons of adding $100 a month to your fixed-rate mortgage payment?

> What would the monthly payments be on a $150,000 loan if the mortgage were set up as: a. A 15-year, 6 percent fixed-rate loan? b. A 30-year ARM in which the lender adds a margin of 2.5 to the index rate, which now stands at 4.5 percent? Find the monthly

> Find the monthly mortgage payments on the following mortgage loans using either your calculator or the table in Exhibit 5.8: a. $80,000 at 6.5 percent for 30 years b. $105,000 at 5.5 percent for 20 years c. $95,000 at 5 percent for 15 years Exhibit 5.8:

> Janet Wilhite has just graduated from college and needs to buy a car to commute to work. She estimates that she can afford to pay about $450 per month for a loan or lease and has about $2,000 in savings to use for a down payment. Develop a plan to guide

> Explain how the following are used in filing a tax return: (a) Form 1040, (b) various schedules that accompany Form 1040, and (c) tax rate schedules.

> Owen and Audrey Nelson together earn approximately $82,000 a year after taxes. Through an inheritance and some wise investing, they also have an investment portfolio with a value of almost $150,000. a. How much of their annual income do you recommend the

> Describe some of the short-term investment vehicles that can be used to manage your cash resources. What would you focus on if you were concerned that the financial crisis inflation will increase significantly in the future?

> If you put $6,000 in a savings account that pays interest at the rate of 4 percent, compounded annually, how much will you have in 5 years? .How much interest will you earn during the 5 years? If you put $6,000 each year into a savings account that pays

> Determine the annual net cost of these checking accounts: a. Monthly fee $4, check-processing fee of 20 cents, average of 23 checks written per month b. Annual interest of 2.5 percent paid if balance exceeds $750, $8 monthly fee if account falls below mi

> You’re getting married and are unhappy with your present bank. Discuss your strategy for choosing a new bank and opening an account. Consider the factors that are important to you in selecting a bank—such as the type and ownership of new accounts and ban

> Suppose that someone stole your ATM card and withdrew $950 from your checking account. How much money could you lose according to federal legislation if you reported the stolen card to the bank: (a) the day the card was stolen, (b) 6 days after the theft

> What type of bank serves your needs best? Visit the Web sites of the following institutions and prepare a chart comparing the services offered, such as traditional and online banking, investment services, and personal financial advice. Which one would yo

> Your parents are retired and have expressed concern about the really low interest rates they’re earning on their savings. They’ve been approached by an advisor who says he has a “sure-fire” way to get them higher returns. What would you tell your parents

> Shauna and Conan O’Farrell have been notified that they are being audited. What should they do to prepare for the audit?

> Steve and Beth Compton are married and have one child. Steve is putting together some figures so that he can prepare the Compton’s.0 joint 2014 tax return. He can claim three personal exemptions (including himself). So far, heâ

> What is a progressive tax structure and the economic rationale for it?

> If Amy Phillips is single and in the 28 percent tax bracket, calculate the tax associated with each of the following transactions. (Use the IRS regulations for capital gains in effect in 2014.) a. She sold stock for $1,200 that she purchased for $1,000

> Debra Ferguson received the following items and amounts of income during 2014. Help her calculate (a) her gross income and (b) that portion (dollar amount) of her income that is tax exempt. Salary ……………………………………………….$33,500 Dividends …………………………………………….

> Prepare a record of your income and expenses for the last 30 days; then prepare a personal cash budget for the next three months. (Use the format in Worksheet 2.3, but fill out only three months and the Total column.) Use the cash budget to control and r

> Here is a portion of Chuck Schwartz’s budget record for April 2016. Fill in the blanks in columns 5 and 6. Note the answers are included. They may be deleted if you wish to use in classroom. Amount Item Budgeted Amount Spent (2) Be

> Richard and Elizabeth Walker are preparing their 2017 cash budget. Help the Walkers reconcile the following differences, giving reasons to support your answers. a. Their only source of income is Richard’s salary, which amounts to $5,000 a month before t

> Use Worksheet 2.2. Bill and Nancy Ballinger are about to construct their income and expense statement for the year ending December 31, 2016. They have put together the following income and expense information for 2016: Using the information provided, p

> Use Worksheet 2.1. Denise Fisher’s banker has asked her to submit a personal balance sheet as of June 30, 2016, in support of an application for a $6,000 home improvement loan. She comes to you for help in preparing it. So far, she has

> Put yourself 10 years into the future. Construct a fairly detailed and realistic balance sheet and income and expense statement reflecting what you would like to achieve by that time.

> Chad Livingston is preparing his balance sheet and income and expense statement for the year ending June 30, 2016. He is having difficulty classifying six items and asks for your help. Which, if any, of the following transactions are assets, liabilities,

> Saul Schwab’s, of Knoxville, Tennessee, was 65 when he retired in 2010. Camille, his wife of 40 years, passed away the next year. Her will left everything to Saul. Although Camille’s estate was valued at $2,250,000, th

> Jessica Wright has always been interested in stocks. She has decided to invest $2,000 once every year into an equity mutual fund that is expected to produce a return of 6 percent a year for the foreseeable future. Jessica is really curious how much money

> Dan Weaver wants to set up a fund to pay for his daughter’s education. In order to pay her expenses, he will need $23,000 in four years, $24,300 in five years, $26,000 in six years, and $28,000 in seven years. If he can put money into a fund that pays 4

> Chris Jones wishes to have $800,000 in a retirement fund 20 years from now. He can create the retirement fund by making a single lump-sum deposit today. a. If he can earn 6 percent on his investments, how much must Chris deposit today to create the retir

> Over the past several years, Catherine Lee has been able to save regularly. As a result, she has $54,188 in savings and investments today. She wants to establish her own business in five years and feels she will need $100,000 to do so. a. If she can earn

> Use future or present value techniques to solve the following problems. a. Starting with $15,000, how much will you have in 10 years if you can earn 6 percent on your money? If you can earn only 4 percent? b. If you inherited $45,000 today and invested a

> Assume that you graduated from college with a major in marketing and took a job with a large consumer products company. After three years, you are laid off when the company downsizes. Describe the steps you’d take to “repackage” yourself for another fiel

> Alice Reynolds and Tricia Bostwick, both freshman and friends at a major university, are interested in going into a health sciences career. While they're not just interested in the money they can make, they do want to have a sense of the compensation in

> Summarize current and projected trends in the economy with regard to GDP growth, unemployment, and inflation. How should you use this information to make personal financial and career planning decisions?

> Ben Saunders and Ashley Tinsdale are planning to get married in six months. Both are 30 years old have been out of college for several years. Ben uses three credit cards and has a bank account balance of $7,500 while Ashely only uses one credit card and

> What is a standard of living? What factors affect the quality of life?

> In the late 1980s, Carsten Richter, from Germany, migrated to the United States, where he is now a citizen. A man of many talents and deep foresight, he has built a large fleet of oceangoing oil tankers during his stay in the United States. Now a wealthy

> Terry and Evelyn Becker are a married couple in their mid-20s. Terry has a good start as an electrical engineer and Evelyn works as a sales representative. Since their marriage four years ago, Terry and Evelyn have been living comfortably. Their income h

> Is it possible to have a cash deficit on an income and expense statement? If so, how?

> Explain what cash basis means in this statement: “An income and expense statement should be prepared on a cash basis.” How and where are credit purchases shown when statements are prepared on a cash basis?

> Explain two ways in which net worth could increase (or decrease) from one period to the next.

> When might you use future value? Present value? Give specific examples.

> What is compounding? Explain the rule of 72.

> Why is it important to use time value of money concepts in setting personal financial goals?

> Why is it important to analyze actual budget surpluses or deficits at the end of each month?

> The Gonzales family has prepared their annual cash budget for 2016. They have divided it into 12 monthly budgets. Although only 1 monthly budget balances, they have managed to balance the overall budget for the year. What remedies are available to the Go

> Describe the cash budget and its three parts. How does a budget deficit differ from a budget surplus?

> Describe some of the areas or items you would consider when evaluating your balance sheet and income and expense statement. Cite several ratios that could help in this effort.

> Maria Sepulveda is 57 years old and has been widowed for 13 years. Never remarried, she has worked full-time since her husband died 13 years ago—in addition to raising her two children, the youngest of whom is now finishing college. After being forced to

> What are the two types of personal financial statements? What is a budget, and how does it differ from personal financial statements? What role do these reports play in a financial plan?

> Discuss the need for career planning throughout the life cycle and its relationship to financial planning. What are some of your own personal career goals?

> All people who have equivalent formal education earn similar incomes.” Do you agree or disagree with this statement? Explain your position.

> What is inflation, and why should it be a concern in financial planning?

> What are the stages of an economic cycle? Explain their significance for your personal finances.

> Discuss the following statement: “The interactions among government, business, and consumers determine the environment in which personal financial plans must be made.”

> What is a professional financial planner? Does it make any difference whether the financial planner earns money from commissions made on products sold as opposed to the fees he or she charges?

> Discuss briefly how the following situations affect personal financial planning: a. Being part of a dual-income couple b. Major life changes, such as marriage or divorce c. Death of a spouse

> There’s no sense in worrying about retirement until you reach middle age.” Discuss this point of view.

> Describe employee benefit and tax planning. How do they fit into the financial planning framework?

> Linda Calloway and Meredith Perdue are neighbors in Charleston. Linda works as a software engineer for Progressive Apps Corporation, while Sherry works as an executive for Industrial Container Company. Both are married, have two children, and are well pa

> Chad Jackson’s investments over the past several years have not lived up to his full return expectations. He is not particularly concerned, however, because his return is only about 2 percentage points below his expectations. Do you have any advice for C

> Discuss the relationship of life-cycle considerations to personal financial planning. What are some factors to consider when revising financial plans to reflect changes in the life cycle?

> What types of financial planning concerns does a complete set of financial plans cover?

> Distinguish between long-term, intermediate, and short-term financial goals. Give examples of each.

> Explain why it is important to set realistically attainable financial goals. Select one of your personal financial goals and develop a brief financial plan for achieving it.

> Explain why financial plans must be psychologically as well as economically sound. What is the best way to resolve money disputes in a relationship?

> What is the role of money in setting financial goals? What is the relationship of money to utility?