Question: Using the following information, calculate the

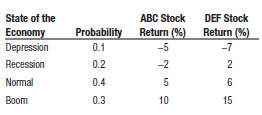

Using the following information, calculate the expected return and standard deviation of a portfolio with 50 percent in ABC and 50 percent in DEF. Then calculate the expected return and standard deviation of a portfolio where you invest 40 percent in ABC, 40 percent in DEF, and the rest in Tâ€bills with a return of 3.5 percent.

Transcribed Image Text:

State of the ABC Stock DEF Stock Return (%) Return (%) Economy Depression Probability 0.1 -5 -7 Recession 0.2 -2 2 Normal 0.4 5 6 Boom 0.3 10 15

> Calculate the F1, F 2, F 3 given the following interest rates on zero coupon bonds: One year 2.1% Four year 3.75% Two year 2.65% Five year 4.05% Three year 3.25%

> You are in the process of developing forecasts of short‐term interest rates. In order to determine a bond trading strategy, you want to determine the market’ s short‐term (one‐year)

> David says, “CDS is essentially the same as buying default insurance on the risky corporate bond, where the buyer pays for the default protection and the seller sells the protection.” Thus he concludes that CDS is the same as other insurance. Comment on

> Aqua Boat Company recently issued floating rate debt. The rate is L IBOR 3percent, reset semi‐annually. Compost Earth Company has recently issued fixed rate debt. The rate is 5 percent per year. Aqua and Compost have entered into a two&

> Ethel decided to invest in the futures market. She entered a long position in 1,000 futures contracts that require a $30,000 initial margin. The maintenance margin is $22,500. Assume that Ethel deposits the minimum amount of cash required to satisfy any

> You have observed the following monthly returns for ABC and DEF. a. Graph the relationship between the weight in ABC and the portfolio returns (restrict all weights to be greater than or equal to zero). b. Graph the relationship between the weight in ABC

> An investor enters into a short position in 50,000 futures contracts that require a $50,000 initial margin and have a maintenance margin that is 75 percent of this amount. The futures price associated with the contracts is $20. Assume the spot price of t

> An investor enters into a long position in 50,000 futures contracts that require a $50,000 initial margin and have a maintenance margin that is 75 percent of this amount. The futures price associated with the contracts is $20. Assume the spot price of th

> Ethel and Egbert have decided to invest in the futures market. Both entered into 1,000 futures contracts, which required a $30,000 initial margin. The maintenance margin for each investor is $22,500. Ethel and Egbert disagree about the future so Ethel we

> Explain basis risk and the advantage of forward contracts over future contracts in minimizing basis risk.

> Explain the difference between forwards and futures.

> CanComp has a contract to deliver a large computer system to a South African company in one year and would like to hedge the currency risk. CanComp will receive payment of R3.5 million (the currency of South Africa is the rand) in one year for the comput

> The spot exchange rate is C$1.4665 per euro, while the six‐month forward rate is C$1.50 per euro. Suppose a firm expects to receive €100,000 in six months from a foreign customer and decides to eliminate its foreign exchange exposure by entering into a s

> The spot exchange rate is C$1.4665 per euro, while the six‐month forward rate is C$1.50 per euro. Suppose a firm has to pay a foreign supplier €100,000 in six months and decides to eliminate its foreign exchange exposure by entering into a six‐month forw

> Assume an investor takes a €100,000 short position in the six‐month euro forward contract with forward rate of C$1.50 per euro. Determine the investor ’ s profit (loss) if the spot rate in six months equals the following amounts: a. C$1.40 per euro b. C$

> Suppose the spot exchange rate is C$1.4665 per euro, while the six‐month forward rate is C$1.50 per euro. What will be the profit for an investor who assumes a €100,000 long position in the forward contract if the spot rate in six months equals the follo

> FinCorp Inc. wishes to examine the effect of correlation on the efficient frontier that can be created by investing in ABC and FGI. The expected return of ABC is 6 percent, with a standard deviation of 10 percent. The expected return of FGI is 10 percent

> The Health Bracelet Company will need 1 ,000 kilograms of copper in one year and is trying to decide between buying the copper on the spot market or using a forward contract. The spot price of copper is $15 per kilogram. The forward price is $19 per kilo

> Complete the following table. The underlying asset is ounces of gold. Assume no arbitrage. 1-Year 1-Year Annual Cost of Forward Interest Storage Cost Spot Carry Price Rate A $200 8% 4% of spot B $235 $285 2% of spot $300 7% 3% of spot $350 $400 4% $2

> Why would making CDSs an exchange-listed product have avoided the collapse of AIG and averted the 2008–9 financial crisis?

> How and why did AIG fail?

> Explain the difference between an insurance contract and a credit default swap.

> 1. Which of the following statements about strong form EMH is false? a. It encompasses both the weak and semi-strong EMH. b. It is the most flexible form of market efficiency. c. It states that prices reflect both public and private information. d. It im

> 1. Which of the following statements about an efficient market is false ? a. Prices fully and accurately reflect all available information. b. Prices reflect information about a firm’s future plans. c. Prices are always correct. d. Price changes are inde

> State four important implications of the EMH for investors and two implications for corporate officers.

> Summarize the empirical conclusions regarding the three forms of the EMH.

> Which type of analyst, buy side or sell side, is more likely to “sell” their recommendation to the public?

> You are interested in two stocks: Alcon and Beldon. Both stocks have a standard deviation of 8 percent. The expected return of Alcon is 10 percent, and the expected return of Beldon is 20 percent. You want the weights to be greater than or equal to zero.

> Parker Investments Inc. has just completed an investigation of strong form efficiency in the Canadian stock market and has concluded that its evidence is statistically significant but not economically significant. Explain to your client how this is possi

> Explain whether each of the following is an example of informational efficiency. a. Every time my broker tells me to buy, the stock price subsequently goes down. Every time my broker tells me to sell, the stock price subsequently goes up. b. Three months

> Identify the types of inefficiency (allocational, operational, or informational) described below: a. The Lower Red River stock market is characterized by very high transaction costs, and due to frequent flooding, transaction orders are often lost. b. In

> What are the main implications of the EMH for investors? For corporate officers?

> Explain why behavioural traits can cause asset price bubbles.

> Explain why behavioural flaws could result in investors holding portfolios that are not as predicted by modern portfolio theory.

> Contrast behavioural finance with the traditional view.

> Is the strong form EMH well supported by empirical evidence? Discuss any exceptions.

> Is the semi-strong form EMH well supported by empirical evidence? Discuss any exceptions.

> Is the weak form EMH well supported by empirical evidence? Discuss any exceptions.

> You are interested in two stocks: Alcon and Beldon. Both stocks have an expected return of 8 percent. The standard deviation of Alcon is 3 percent, and the standard deviation of Beldon is 5 percent. You want the weights to be greater than or equal to zer

> How would you expect increasing access to the Internet to affect investor behaviour?

> Would you expect investors to be more overconfident during a boom or a recession? Why?

> A news story about United Airline’s decision to seek protection from creditors was originally published December 10, 2002 by the Chicago Tribune. The story was recirculated by a Florida news service in 2008. Following the recirculated story there was a s

> On Monday evening, Codina Model Steam Engine Company announced that it would be restating its financial statements for the past five years, and its CFO was arrested for fraud. Interpret the following Tuesday’s stock reactions: a. Stock price drops b. Sto

> On the morning of March 15, Decker Marketing Inc. announced that it would pay its first dividend of $5 this year. The ex-dividend date will be July 3. a. If the announcement is a complete surprise to the market, what do you expect will happen to the stoc

> Distinguish between loss aversion and risk aversion.

> Assume that the information system is so advanced that the market, as confirmed by numerous unbiased studies, is efficient. Investment firms therefore decide to retire all portfolio managers and financial analysts and let random choice govern the securit

> On Monday, the stock of Wicker Company was trading at $25. The CEO was satisfied with this price as it reflected the prospects of the firm (future dividend growth and required rate of return). The firm’s scientists worked all Monday night to complete a t

> You are on the board of directors of Marlin Company. The stock price of Marlin has suddenly increased by 20 percent, and the CEO has come to the board asking for a substantial pay increase. The CEO argues that the company’s prospects have dramatically im

> Elvira, the CEO of AT Pharmaceutical Ltd., has hired Dome Financial Inc. to advise her on issuing new stock. Her company will need to issue more stock soon to finance the development of a new product—Hair Growth formula. Elvira has noticed that, on avera

> What is the momentum effect? What form of the EMH does it contradict?

> State the main assumptions required for the existence of efficient markets.

> Describe two common tests for the weak form and for the semi-strong form of the EMH.

> The manager of Quest Adventures Ltd. is puzzled. Analysts are saying that the future prospects for his company are poor because the stock price has dropped 5 percent. a. Explain to the manager the relationship between stock prices and market expectations

> Describe the various forms of EMH.

> Explain the efficient market hypothesis (EMH).

> How are multiples linked to a discounted cash flow valuation?

> Why do P/E ratios differ even between comparable firms?

> What drives P/E ratios?

> 1. Park Recreational Vehicles Ltd. shares are currently selling for $37.50 each. You bought 200 shares one year ago at $34 and received dividend payments of $1.50 per share. What was your total dollar capital gain this year? a. $400 b. $300 c. $700 d. No

> The expected return of ABC is 15 percent, and the expected return of DEF is 23 percent. Their standard deviations are 10 percent and 23 percent, respectively, and the correlation coefficient between them is zero. a. What is the expected return and standa

> 1. Jason bought 46,000 shares of CTB Inc. on January 12, 2015. At that time, CTB Inc. had 2 million common shares outstanding. Calculate the portion of CTB Inc. that Jason owns. a. 2.3 percent b. 1.4 percent c. 6.0 percent d. 1.5 percent 2. You bought 10

> Karlyle Inc. has just paid a dividend of $4. An analyst forecasts annual dividend growth of 9 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity. The required return is 12 percent (effective annual return, E

> Calculate the leading P/E ratio, given the following information: retention ratio = 0.4, required rate of return = 10 percent, expected growth rate = 6 percent.

> Star Corporation has issued $1 million in preferred shares to investors with a 6.75 percent annual dividend rate on a par value of $100. Assuming the firm pays dividends indefinitely and the required rate is 11.5 percent, calculate the price of the prefe

> State the relationship that the required rate of return, the expected growth rate, and expected dividends have with the market share price, according to the constant growth DDM.

> What are the two main components of the required rate of return on equity securities?

> How do equity shareholders exert their influence over a company?

> What other relative valuation multiples are useful in valuation?

> What are some of the key assumptions that must be made when applying the valuation concepts discussed in this chapter to an actual valuation situation?

> List three reasons why one firm may have a higher leading P/E ratio than a comparable firm.

> You are interested in using short selling to increase the possible returns from your portfolio. 20 You have short sold $200 of ABC and invested $1,200 in DEF. The following data are available on ABC and DEF: The correlation between ABC and DEF is 0.4. Ca

> Determine the present value of growth opportunities for a company with a leading EPS of $1.85, a required rate of return of 8 percent, and a current stock price of $50.

> FinCorp Inc. purchased a stock for $48. It expects to receive a dividend of $4 in one year and to sell the stock immediately afterwards. a. If the sale price is $65, what is the expected one‐year holding period return? b. If the sale price is $38, what i

> List the elements needed for the calculation of a share price using the constant growth DDM.

> Oak Furniture Company’s most recent earnings were $300,000. From these earnings, it paid dividends on common equity totalling $175,000. There are 50,000 common shares outstanding. The ROE for Oak Furniture is 12 percent. Determine the following: a. i) Ea

> ToolWerks Company is expected to earn $12 million next year. There are 4 million shares outstanding and the company uses a dividend payout ratio of 30 percent. The required rate of return for companies like ToolWerks is 10 percent. The current share pric

> Fill in the missing information in the following table: Common Shares in Canada Dividend Required Dividend Current Expected Company Price Retum Growth Dividend in 1 Year A 15% $4.50 $5.00 B $600 3% 1% $70 5% $8.00 D $55 $10.00 $11.00 E 14% 6% $9.50 1

> The preferred shares of Chinook Electrical Co. have a par value of $100 and a dividend rate of 8 percent. The current price is $105. If the risk‐free rate is 2.5 percent, what is the risk premium associated with these preferred shares?

> Fill in the missing information in the following table: Preferred Shares in Canada Dividends Par Required Dividend Paid per Company Price Value Return Rate Share A $100 8% 5% $5.00 B $60 $50 3% $70 $75 $8.00 $50 $50 14% $150 $30 7% $100 4% $9.50 G 7%

> Describe how to estimate the present value of growth opportunities (PVGO) and what it represents.

> Describe the constant growth DDM valuation method.

> FinCorp Inc. is exploring the risk of different portfolio allocations between two stocks. Complete the following table. Case 1 Case 2 Weight in stock 1 35% 40% Weight in stock 2 Standard deviation of stock 1 3% Standard deviation of stock 2 25% 20% C

> Describe the characteristics of preferred shares.

> Larch Foods Inc.’ s current dividend is $5. Dividends are expected to decline by 4 percent per year for the next three years, and then remain constant thereafter. The required rate of return for this type of company is 12 percent. What is the current sto

> Barchuk Mining Inc.’s share is currently selling for $120. The current dividend is $5 and the required rate of return is 10 percent. What is the expected dividend growth rate?

> Global Systems Inc. has just paid $2.40 in dividends D0 $2.40 . The firm is expected to continue paying dividends in perpetuity. a. Suppose that the dividends are constant (Di = $2.40 for all i) . What will be the stock price of a share of Global System

> Apex Financial Ltd. has completed a fundamental analysis of Spark Energy Inc. Spark Energy is a young company and expects to invest heavily in facilities and research and development during the next five years. It expects to reap the benefits of its rese

> Selkirk Inc. has an expected profit margin of 10 percent, turnover ratio of 1.8, and a leverage ratio of 0.3. The leading EPS is $2.50 and the firm uses a dividend payout ratio of 35 percent. The required return on firms with Selkirk’s risk characteristi

> As part of your duties at Apex Financial Ltd. you have been asked to review the analysis carried out by a rival company—Prime Group—of the WX Media Company. WX has had a constant P/E ratio for the past five years. Prime’s analyst has made the following s

> Apex Financial Ltd. is interested in investing in Scion Systems Inc. Scion’s current dividend is $5.50 and its shares are selling for $40. The required rate of return for firms like Scion is 8 percent. Apex has conducted an extensive analysis of the comp

> Dillon Mechanical Ltd.’ s preferred shares have a par value of $50, a dividend rate of 7 percent, and trade at a price of $70. Sherwood Inc.’s preferred shares have a par value of $60, have a dividend rate of 4 percent, and trade at a price of $45. Which

> INV Design Ltd. just paid a dividend of $4 and its current earnings per share is $6. The current T‐bill rate is 3.5 percent and INV ’ s risk premium is 10 percent. The net profit margin, asset turnover, and debt‐to‐equity ( D/E) ratios are 15 percent, 1.

> In Practice Problem 40, the correlation coefficient ρ AB is 0.4 and the standard deviations of stock A and stock B are 28 percent and 15 percent, respectively. Calculate the standard deviation of the portfolio.

> TelTec Inc. has a patent that will expire in two years. The firm is expected to grow at 10 percent for the next two years and dividends will be paid at year end. It just paid a dividend of $1. After two years, the growth rate will decline to 4 percent im

> JINX Ltd. had earnings per share of $5 as of December 31, 2015, but paid no dividends. Earnings were expected to grow at 15 percent per year for the following five years. JINX Ltd. will start paying dividends for the first time on December 31, 2020, dist

> TelTec Inc. stock is expected to sell for $10 per share four years from now. TelTec has just paid a dividend of 50 cents per share. Dividends are expected to grow at a rate of 5 percent per year for the next four years. Assume that the required rate of r

> Dillon Mechanical Inc. ’ s first dividend of $2 per share is expected to be paid six years from today. From then on, dividends will grow by 10 percent per year for five years. After five years, the growth rate will slow to 5 percent per year in perpetuit

> Why can’t the expected growth rate exceed the investor’s required return in the constant growth model?

> Why does an increase in the expected dividend growth rate increase share prices?

> Why is share value based on the present value of expected future dividends?