Question: VolWorld Communications Inc., a large

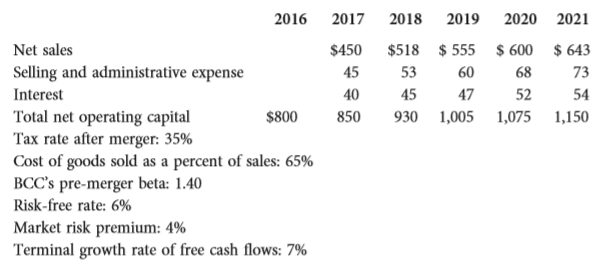

VolWorld Communications Inc., a large telecommunications company, is evaluating the possible acquisition of Bulldog Cable Company (BCC), a regional cable company. VolWorld’s analysts project the following post-merger data for BCC (in thousands of dollars, with a year-end of December 31):

If the acquisition is made ,it will occur on January 1, 2017. All cash flows shown in the income statements are assumed to occur at the end of the year. BCC currently has a capital structure of 40% debt, which costs 10% ,but over the next 4 years Vol World would increase that to 50%, and the target capital structure would be reached by the start of 2021. BCC, if independent, would pay taxes at 20 %,but its income would be taxed at 35% if it were consolidated. BCC’s current market-determined beta is 1.4. The cost of goods sold is expected to be 65% of sales. Use the compressed APV approach to answer the following questions.

a. What is the unlevered cost of equity for BCC?

b. What are the free cash flows and interest tax shields for the first 5 years?

c. What is BCC’s horizon value of interest tax shields and unlevered horizon value?

d. What is the value of BCC’s equity to Vol World’s share holders if BCC has $300,000 in debt outstanding now?

Transcribed Image Text:

2016 2017 2018 2019 2020 2021 Net sales $450 $518 $ 555 $ 600 $ 643 Selling and administrative expense 45 53 60 68 73 Interest 40 45 47 52 54 Total net operating capital Tax rate after merger: 35% Cost of goods sold as a percent of sales: 65% BCC's pre-merger beta: 1.40 $800 850 930 1,005 1,075 1,150 Risk-free rate: 6% Market risk premium: 4% Terminal growth rate of free cash flows: 7%

> You are considering two independent projects, Project A and Project B. The initial cash outlay associated with Project A is $50,000, and the initial cash outlay associated with Project B is $70,000. The discount rate on both projects is 12 percent. The

> CL Marshall Liquors owns and operates a chain of beer and wine shops throughout the Dallas–Fort Worth metro plex. As a result of the rapidly expanding population of the area, the firm requires a growing amount of funds. Historically, it

> Harrison Electronics, Inc., operates a chain of electrical lighting and fixture distribution centers throughout northern Arizona. The firm is anticipating expansion of its sales in the coming year as a result of recent population growth trends. The firm

> Bates Fabricators, Inc., estimates that it invests $0.25 in assets for each $1 of new sales. However, $0.05 in profits is produced by each $1 of additional sales, of which $0.01 can be reinvested in the firm. If sales rise by $750,000 next year from thei

> The most recent balance sheet for the ADB Distribution Company is shown in the following table. The company is about to embark on an advertising campaign that is expected to raise sales from the current level of $5 million to $7 million by the end of nex

> The current balance sheet Murphy Forklifts, Inc., is as follows: Murphy Forklifts, Inc. Balance Sheet, December 31, 2016 ($ millions) Murphy had sales for the year ended December 31, 2016, of $50 million. The firm follows a policy of paying all net ear

> Which of the following accounts will most likely vary directly with the level of firm sales? Discuss each briefly. Yes No Cash Notes payable Marketable securities Plant and equipment Accounts payable Inventories || | | | |||

> Use the following industry average ratios to construct a pro forma balance sheet for Mendoza Distributors, Inc. Total asset turnover 2 times Average collection period (assume a 365-day year) 9 days Fixed asset turnover 5 times Inventory turnover (ba

> Tulley Appliances, Inc., projects next year’s sales to be $20 million. Current sales are at $15 million, based on current assets of $7 million and fixed assets of $8 million. The firm’s net profit margin is 5 percent after taxes. Tulley forecasts that cu

> Beason Manufacturing forecasts its sales next year to be $6 million and expects to earn 5 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • C

> Harrison Printing has projected its sales for the first eight months of 2017 as follows: Harrison collects 20 percent of its sales in the month of the sale, 50 percent in the month following the sale, and the remaining 30 percent two months following t

> You have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows: If the appropriate discount rate on these projects is 10 percent, which would be chosen and why? Year Project A Cash Flow Project

> The Sharpe Corporation’s projected sales for the first eight months of 2017 are as follows: Of Sharpe’s sales, 10 percent are for cash, another 60 percent are collected in the month following the sale, and 30 percent

> In the spring of 2016, the Caswell Publishing Company established a custom publishing business for its business clients. These clients consisted principally of small- to medium-size companies in Round Rock, Texas. However, the company’s

> Zapatera Enterprises is evaluating its financing requirements for 2017. The firm has been in business for only one year, but its CFO predicts that the firm’s operating expenses, current assets, net fixed assets, and current liabilities

> Marshall Pottery Barn is a privately owned importer of Mexican pottery and garden supplies. The firm plans on paying a $1.50 per share dividend on each of its 5,000 shares of common stock. The firm’s most recent balance sheet just befo

> Chaney’s Fatburner Gyms, Inc., operates a chain of exercise facilities throughout the Midwest. The firm appeals to middle-aged men who suffer from obesity problems and want to improve their health by entering an exercise program. The firm has 8,000,000 s

> Reconsider the problem faced by Templeton Care Facilities, Inc., from Study Problem 16–6. If the firm’s board of directors decides to use a stock split rather than a stock dividend, how many new shares should the firm issue for each outstanding share? D

> Templeton Care Facilities, Inc., is contemplating a stock dividend. The firm’s stock price had risen over the last three years and is trading at $150 per share. The firm’s board of directors feels that the trading range should be around $50 to $100, so t

> The stock price of Perkiman Go Inc. is currently $40 a share. If the firm announces a 10 percent stock dividend, what do you expect the ex-dividend stock price to be? What about a 20 percent stock dividend?

> Kingwood Corporation has a stock price of $120 per share and is contemplating the payment of a large, one-time cash dividend of $40 per share. The underlying motivation for the large payout comes from management’s belief that the firm has more cash than

> Dimmick Skate Boarding Enterprises has declared a $3 dividend for its common stock. On the day before the ex-dividend date, the firm’s shares are trading for $40 a share. What do you expect the price of Dimmick’s shares to be on the day following the ex

> You are considering a project with an initial cash outlay of $80,000 and expected cash flows of $20,000 at the end of each year for six years. The discount rate for this project is 10 percent. a. What are the project’s payback and discounted payback peri

> The Welmar Corporation operates membership warehouses that offer a wide variety of branded and private-label products in no-frills, self-service warehouse facilities. In 2016, the company paid total cash dividends of $265,029,000 and had net income of $1

> After more than 40 years of operation, the Tyler Brick Manufacturing Company has decided it is time to shut down the business. The firm has $125,000 available for distribution as a cash dividend immediately and plans to shut down its business at the end

> (The Caraway Seed Company sells specialty gardening seeds and products primarily to mail-order and internet customers. The firm has $200,000 available for distribution as a cash dividend immediately and plans to shut down its business at the end of one y

> The Barry man Drilling Company from Study Problem 16–10 is reconsidering its plan to repurchase $1 million of its common stock and instead plans to pay a $1 million cash dividend, which amounts to $2 per share of common stock. If dividends are taxed at 1

> The Barry man Drilling Company is planning on repurchasing $1 million worth of the company’s 500,000 shares of stock, which is currently trading at a price of $10 per share. Stan Barry man is the founder of the company and still holds 10,000 shares of co

> Calculate the cash dividend paid per share for each of the firms in the following table using their earnings per share and dividend payout ratio: Company Dividend Payout Ratio Earnings per Share Emerson Electric Co (EMR) 85% $2.23 Intel Corporation

> The income statements for Home Depot, Inc. (HD), spanning the period 2014–2016 (just before the housing crash, so these are representative years) are as follows: a. Calculate the times interest earned ratio for each of the years for w

> Presently, H. Swank, Inc., does not use any financial leverage and has total financing equal to $1 million. It is considering refinancing and issuing $500,000 of debt that pays 5 percent interest and using that money to buy back half the firmâ€

> Dharma Supply has earnings before interest and taxes (EBIT) of $500,000, interest expenses of $300,000, and a corporate tax rate of 35 percent. a. What is Dharma Supply’s net income? b. What would Dharma’s net income be if it didn’t have any debt (and, c

> Lowe’s Companies, Inc. (LOW), and its subsidiaries operate as a home improvement retailer in the United States and Canada. As of February 1, 2008, they operated 1,534 stores in 50 states and Canada. The company’s balan

> Plato Energy is an oil-and-gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering two different drilling opportunities that

> Home Depot, Inc. (HD), operates as a home improvement retailer primarily in the United States, Canada, and Mexico. The balance sheet for Home Depot for February 3, 2008, included the following liabilities and owners’ equity: a. What a

> Curley’s Fried Chicken Kitchen operates two southern-cooking restaurants in St. Louis, Missouri, and has the following financial structure: The firm is considering an expansion that would involve raising an additional $2 million. a. W

> Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai’s balance sheet indicates that the firm has $50 million in total liabilities. Ojai has only $40 million in short- and long-term debt on its balance sheet. However, becau

> The common stock of Moe’s Restaurant is currently selling for $80 per share and has a book value of $60 per share; there are 1 million shares of common stock outstanding. In addition, the firm has 100,000 bonds outstanding that have a par value of $1,00

> Home Depot, Inc. (HD), had 1,244 million shares of common stock outstanding in 2016 whereas Lowe’s Companies, Inc. (LOW), had 929 million shares outstanding. Given the 2016 earnings levels found in Study Problems 15–9 and 15–10 and a 35 percent tax rate

> Three recent graduates of the computer science program at the University of Tennessee are forming a company that will write and distribute new application software for the iPhone. Initially, the corporation will operate in the southern region of Tennesse

> Abe Forrester and three of his friends from college have interested a group of venture capitalists in backing their business idea. The proposed operation would consist of a series of retail outlets to distribute and service a full line of vacuum cleaners

> You have developed the following pro forma income statement for your corporation. It represents the most recent year’s operations, which ended yesterday. Your supervisor in the controller’s office has just handed you

> The income statements for Lowe’s Companies, Inc. (LOW), spanning the period 2014–2016 (just before the housing crash, so these are representative years) are as follows: a. Calculate the times interest earned ratio fo

> Webb Solutions, Inc., has the following financial structure: a. Compute Webb’s debt ratio and interest-bearing debt ratio. b. If the market value of Webb’s equity is $2,000,000 and the value of the firmâ€&

> The Bar-None Manufacturing Company manufactures fence panels used in cattle feedlots throughout the Midwest. Bar-None’s management is considering three investment projects for next year but doesn’t want to make any inv

> The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with th

> Current and projected free cash flows for Radell Global Operations are shown here. Growth is expected to be constant after 2018, and the weighted average cost of capital is 11%. What is the horizon (continuing) value at 2019 if growth from 2018 remains c

> The following balance sheet represents Boles Electronics Corporation’s position at the time it filed for bankruptcy (in thousands of dollars): The mortgage bonds are secured by the plant but not by the equipment. The sub ordinated deb

> The Verbrugge Publishing Company’s 2016 balance sheet and income statement are as follows (in millions of dollars): Verbrugge and its creditors have agreed upon a voluntary reorganization plan. In this plan, each share of the $6 pref

> Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.5 million, $2.9 million, $3.4 million, and $3.57 million at Years 1 through 4, respectively, after which the free cash flows w

> Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.5 million, $2.9 million, $3.4 million, and $3.57 million at Years 1 through 4, respectively, after which the free cash flows w

> Hastings Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares outstanding and a target capital structure consisting of 30% debt ; its beta is 1.4 (given its target capital structure).Vandell has $10.82 million in debt

> Schwarzentraub Corporation’s expected free cash flow for the year is $500,000; in the future, free cash flow is expected to grow at a rate of 9%. The company currently has no debt, and its cost of equity is 13%. Its tax rate is 40%. Use the compressed ad

> Companies U and L are identical in every respect except that U is unlevered while L has $10 million of 5% bonds outstanding. Assume that: (1) All of the MM assumptions are met. (2) Both firms are subject to a 40% federal-plus-state corporate tax rate. (3

> Breuer Investment’s convertible bonds have a $1,000 par value and a conversion price of $50 a share. What is the convertible issue’s conversion ratio?

> Consider the data in Problem 19-1. Assume that RC’s tax rate is 40% and that the equipment’s depreciation would be $100 per year. If the company leased the asset on a 2-year lease, the payment would be $110 at the beginning of each year. If RC borrowed a

> Reynolds Construction (RC) needs a piece of equipment that costs $200. RC can either lease the equipment or borrow $200 from a local bank and buy the equipment. If the equipment is leased, the lease would not have to be capitalized. RC’

> Bynum and Crumpton ,as mall jewelry manufacturer, has been successful and has enjoyed a positive growth trend. Now B&C is planning to go public with an issue of common stock, andit faces the problem of setting an appropriate price for the stock. The

> In 1983,the Japanese yen-U.S. dollarexchangeratewas245yenperdollar,andthedollar cost ofa compact Japanese-manufactured car was $8,000.Supposethat now the exchange rate is 80 yen per dollar. Assume there has been no inflation in the yen cost of an automob

> (a) If a firm buys under terms of 3 15, net 45, but actually pays on the 20th day and still takes the discount, what is the nominal cost of its non free trade credit? (b) Does it receive more or less credit than it would if it paid within 15 days?

> Calculate the nominal annual cost of non free trade credit under each of the following terms. Assume that payment is made either on the discount date or on the due date. a. 1 10, net 20 b. 2 10, net 60 c. 3 10, net 45 d. 2 10, net 45 e. 2 10, net 40

> Snider Industries sells on terms of 2 10, net 45. Total sales for the year are $1,500,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 50 days after their purchases. a. What is the days sales outstan

> What are the nominal and effective costs of trade credit under the credit terms of 3 15, net 30?

> Williams & Sons last year reported sales of $12 million, cost of goods sold (COGS) of $10 million, and an inventory turnover ratio of 2. The company is now adopting a new inventory system. If the new system is able to reduce the firm’s inventory level an

> Boehm Corporation has had stable earnings growth of 8% a year for the past 10 years and in 2016 Boehm paid dividends of $2.6 million on net income of $9.8 million. However, in 2017 earnings are expected to jump to $12.6 million, and Boehm plans to invest

> An annuity is defined as a series of payments of a fixed amount for a specific number of periods. Thus, $100 a year for 10 years is an annuity, but $100 in Year 1, $200 in Year 2, and$400inYears 3through10 does not constitute an annuity. However the enti

> Garlington Technologies Inc.’s 2016 financial statements are shown below: Suppose that in 2017 sales increase by 10% over 2016 sales and that 2017 dividends will increase to $112,000. Forecast the financial statements using the foreca

> Stevens Textile Corporation’s 2016 financial statements are shown below: a. Suppose 2017 sales are projected to increase by 15 % over 2016 sales. Use the forecasted financial statement method to forecast a balance sheet and income st

> Upton Computers makes bulk purchases of small computers, stocks the min conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton’s bal

> The Booth Company’s sales are forecasted to double from $1,000 in 2016 to $2,000 in 2017. Here is the December 31, 2016, balance sheet: Booth’s fixed assets were used to only 50% of capacity during 2016, but its curr

> At year-end 2016, Wallace Landscaping’s total assets were $2.17 million, and its accounts payable were $560,000. Sales, which in 2016 were $3.5 million, are expected to increase by 35% in 2017. Total assets and accounts payable are proportional to sales,

> Maggie’s Muffins Bakery generated$5,000,000 in sales during 2016, and its year-end total assets were $2,500,000. Also, at year-end 2016, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,

> Refer to Problem 12-1. Return to the assumption that the company had $5 million in assets at the end of 2016, but now assume that the company pays no dividends. Under these assumptions, what would be the additional funds needed for the coming year? Why i

> Refer to Problem 12-1. What would be the additional funds needed if the company’s year end 2016 assets had been $7 million? Assume that all other numbers, including sales, are the same as in Problem 12-1 and that the company is operating at full capacity

> The following table gives the current balance sheet for Travellers Inn Inc. (TII), a company that was formed by merging a number of regional motel chains. The following facts also apply to TII. (1) Short-term debt consists of bank loans that currently

> EMC Corporation has never paid a dividend. Its current free cash flow of $400,000 is expected to grow at a constant rate of 5%. The weighted average cost of capital is WACC 12%. Calculate EMC’s estimated value of operations.

> What is an opportunity cost rate? How is this rate used in discounted cash flow analysis, and where is it shown on a timeline? Is the opportunity rate a single number that is used to evaluate all potential investments?

> Conroy Consulting Corporation (CCC) has been growing at a rate of 30% per year inrecent years. This same non constant growth rate is expected to last for another 2 years g0,1 g1,2 30% . a. If D0 $2 50, rs 12% , and gL 7%, then what is CCC’s stock worth

> Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost o

> Kendra Enterprises has never paid a dividend. Free cash flow is projected to be $80,000 and $100,000 for the next 2 years, respectively; after the second year, FCF is expected to grow at a constant rate of 8%. The company’s weighted average cost of capit

> Investors require a 13% rate of return on Brook Corporation stock rs = 13% . a. What would the estimated value of Brook’s stock be if the previous dividend were D0 = $3 00 and if investors expect dividends to grow at a constant annual rate of (1) −5%, (

> Several years ago, Rolen Riders issued preferred stock with a stated annual dividend of 10% of its $100 par value. Preferred stock of this type currently yields 8%. Assume dividends are paid annually. a. What is the estimated value of Rolen’s preferred s

> Simpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the first dividend of $0.50 coming 3 years from today. The dividen

> Assume that the average firm in your company’s industry is expected to grow at a constant rate of 6% and that its dividend yield is 7 %. Your company is about as risky as the average firm in the industry and just paid a dividend D0 of $1. You expect that

> Brushy Mountain Mining Company’s coal reserves are being depleted, so its sales are falling. Also, environmental costs increase each year, so its costs are rising. As a result, the company’s earnings and dividends are declining at the constant rate of 4%

> Define each of the following terms: a. Proprietorship; partnership; corporation; charter; bylaws b. Limited partnership; limited liability partnership; professional corporation c. Stockholder wealth maximization d. Money market; capital market; primary m

> You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. a. What are the betas of Stocks X and Y? b. What are the required rates of return on Stocks X and Y? c. What is the required rate

> You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: a. Calculate the average rate of return for each stock during the 5-

> A 10-year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,060. The bond sells for $1,100. (Assume that the bond has just been issued.) a. What is the bond’s yield to maturity? b. What is the bond’s cu

> a. Find the present values of the following cash flow streams. The appropriate interest rate is 8%. b. What is the value of each cash flow stream at a 0% interest rate? Year Cash Stream A Cash Stream B 1 $100 $300 400 400 400 400 400 400 5 300 100 N

> Find the present value of the following ordinary annuities a. $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% c. $400 per year for 5 years at 0% d. Now rework parts a, b, and c assuming that payments are made at the beginning of each

> You want to accumulate $1 million by your retirement date, which is 25 years from now. You will make 25 deposits in your bank, with the first occurring today. The bank pays 8% interest, compounded annually. You expect to receive annual raises of 3%, whic

> Assume that your father is now 50 years old, plans to retire in 10 years, and expects to live for 25 years after he retires — that is , until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as $40,00

> Anne Lockwood, manager of Oaks Mall Jewelry, wants to sell on credit, giving customers 3 months to pay. However, Anne will have to borrow from her bank to carry the accounts receivable. The bank will charge a nominal rate of 15% and will compound monthly

> It is now January 1.You plan to make a total of 5 deposits of $100 each, one every 6 months, with the first payment being made today. The bank pays a nominal interest rate of 12% but uses semi annual compounding. You plan to leave the money in the bank f

> Your company is planning to borrow $1 million on a 5-year, 15%, annual payment, fully amortized term loan. What fraction of the payment made at the end of the second year will represent repayment of principal?

> Give two reasons why stockholders might be indifferent between owning the stock of a firm with volatile cash flows and that of a firm with stable cash flows.

> Assume that your aunt sold her house on December 31, and to help close the sales he took a second mortgage in the amount of $10,000 as part of the payment. The mortgage has a quoted (or nominal) interest rate of 10% ; it calls for payments every 6 months

> Assume that you inherited some money. A friend of yours is working as an unpaid internata local broker age firm, and her boss is selling securities that call for 4 payments of $50 (1 payment at the end of each of the next 4 years) plus an extra payment o

> Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. a. $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% c. $400 per year for 5 years at 0