Question: Walmart Stores, Inc. (Walmart) is the largest

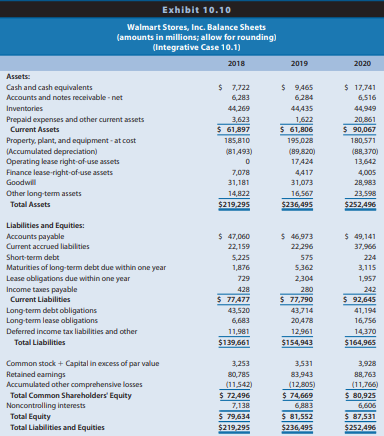

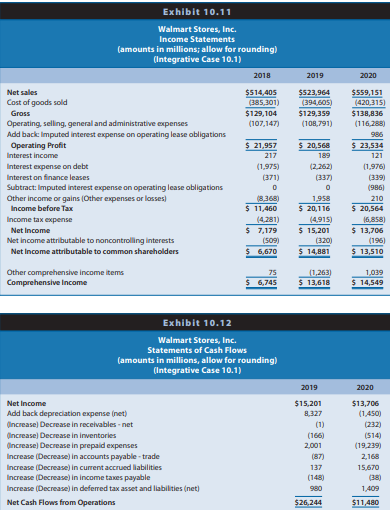

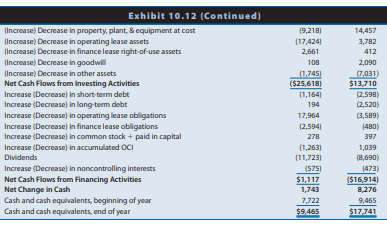

Walmart Stores, Inc. (Walmart) is the largest retailing firm in the world. Building on a base of discount stores, Walmart has expanded into warehouse clubs and Supercenters, which sell traditional discount store items and grocery products. Exhibits 10.10, 10.11, and 10.12 present the financial statements of Walmart for fiscal years 2018–2020. In these exhibits we provide modified Walmart financial statements to facilitate forecasting. Specifically, in Exhibit 10.11 we include on the income statement the adjustment for imputed interest expense on operating lease obligations. In addition, in Exhibit 10.12, we provide the implied statements of cash flows for fiscal 2019 and 2020, including implied cash flows for changes in operating lease assets and obligations.19 For your reference, Exhibits 4.50, 4.51, and 4.52 (Case 4.2 in Chapter 4) present summary financial statements for Walmart based on U.S. GAAP, and Exhibit 4.53 presents selected financial statement ratios for Years 2018–2020. (Note: A few of the amounts presented in Chapter 4 for Walmart differ slightly from the amounts provided here because, for purposes of computing financial analysis ratios, the Chapter 4 data have been adjusted slightly to remove the effects of nonrecurring items such as discontinued operations.)

REQUIRED;

(additional requirements follow on page 632)

a. Design a spreadsheet and prepare a set of financial statement forecasts for Walmart for Year 11 to Year 15 using the assumptions that follow. Project the amounts in the order presented (unless indicated otherwise) beginning with the income statement, then the balance sheet, and then the statement of cash flows. For this portion of the case, assume that Walmart will exercise its financial flexibility with the cash and cash equivalents account to balance the balance sheet.

Income Statement Forecast Assumptions Sales Sales grew by 6.7% in fiscal 2020 due to a surge in demand for Walmart products during the pandemic. However, sales grew by only 2.4% in fiscal 2019 and 3.2% in fiscal 2018. The compound annual sales growth rate during the last five years was only 3.0%. However, the compound rate of sales growth during the prior 4 years (excluding the effects of the pandemic in fiscal 2020) was only 2.1%. Walmart generates sales growth primarily through increasing same-store sales, opening new stores,

and acquiring other retailers. In the future, Walmart will likely continue to grow in international markets by opening stores and acquiring other firms and in domestic U.S. markets by converting discount stores to Supercenters. In addition, despite vigorous competition, Walmart will likely continue to generate steady increases in same-store sales, consistent with its performance in prior years. Assume that the elevated demand for Walmart products during the pandemic in fiscal 2020 will return to normal levels, so sales will grow 2.0% each year from Year 11 through Year 15. For a company with the scale of Walmart, achieving even a 2.0% rate of sales growth will require adding over $10 billion per year to top line sales. Cost of Goods Sold The percentage of costs of goods sold relative to sales decreased slightly from 75.3% of sales in 2019 to 75.2% in 2020. Walmart’s everyday low-price strategy, its movement into grocery products, and competition will likely prevent Walmart from achieving significant reductions in this expense percentage. Assume that the cost of goods sold to sales percentage will continue to be 75.2% of sales for Year 11 to Year 15. Operating, Selling, General and Administrative Expenses The operating, selling, general and administrative expense percentage has been remarkably steady at 20.8% of sales during 2018–2020. Walmart has exhibited strong cost control over the years, and is likely to continue to exhibit such control. Assume that operating, selling, general and administrative expenses will continue to average 20.8% of sales for Year 11 to Year 15. Interest Income Walmart earns interest income on its cash and cash equivalents accounts. The average interest rate earned on average cash balances was approximately 0.9% during 2020, a bit lower than the rates earned in 2018 and 2019 (3.0% and 2.2%, respectively). Assume that Walmart will earn interest income based on a 1.5% interest rate on average cash balances (that is, the sum of beginning and end-of-year cash balances divided by 2) for Year 11 through Year 15.

(Note: Projecting the amount of interest income must await projection of cash on the balance sheet.)

Interest Expense on Debt Walmart uses long-term mortgages to finance new stores and warehouses and short- and long-term debt to finance corporate acquisitions. The average interest rate on all interest-bearing debt was approximately 5.6% and 7.1% during 2020 and 2019, respectively. Assume a 5.5% interest rate for all outstanding borrowing (short-term and long-term debt, including the current portion of long-term debt) for Walmart for Year 11 through Year 15. Compute interest expense on the average amount of interest-bearing debt outstanding each year. (Note: Projecting the amount of interest expense must await projection of the interest-bearing debt accounts on the balance sheet.) Interest and Financing Costs on Leases Walmart also uses long-term finance leases and operating leases to finance new stores and warehouses. In Note 11, Leases, Walmart discloses that during fiscal 2020 the weighted average discount rate was 6.1% on operating leases and 6.8% on finance leases. Assume that the 6.1% interest rate will continue to apply to all outstanding operating lease obligations and the 6.8% interest rate will continue to apply to all outstanding finance lease obligations (current and long-term lease obligations) for Walmart for Year 11 through Year 15. Compute interest expense amounts on the average amount of operating and finance lease obligations outstanding each year. (Note: Projecting the amounts of interest expenses must await projections of the lease obligations on the balance sheet.) Income Tax Expense Walmart’s average income tax rate as a percentage of income before taxes has been roughly 31.7% during the last three years. Assume that Walmart’s effective income tax rate will be 31.0% of income before taxes for Year 11 through Year 15. (Note: Projecting the amount of income tax expense must await computation of income before taxes.) Net Income Attributable to Noncontrolling Interests Noncontrolling interest shareholders in Walmart subsidiaries were entitled to a $196 million share in Walmart’s 2020 net income, which amounted to roughly a 2.9% rate of return on investment. This rate of return is unusually low compared to average returns of 4.6% and 10.1% in 2019 and 2018, respectively. Assume that the portion of net income attributable to noncontrolling interests in the future will continue to yield a 5.0% rate of return in Year 11 through Year 15. Balance Sheet Forecast Assumptions Cash We will adjust cash as the flexible financial account to equate total assets with total liabilities plus shareholders’ equity. Projecting the amount of cash must await projections of all other balance sheet amounts. Accounts Receivable As a retailer, a large portion of Walmart’s sales are in cash or for third-party credit card charges, which Walmart can convert into cash within a day or two. Walmart also has its own credit card that customers can use for purchases at its stores, but the total amount of receivables outstanding is relatively minor compared to Walmart’s total sales. As a consequence, Walmart’s receivables turnover is very steady and fast, averaging roughly four days during each of the past five years. Assume that accounts receivable will continue to turn over at the same rate and the ending accounts receivable balance will grow with sales growth. Inventories Walmart’s overall inventory efficiency has increasing slightly over the past five years. Inventory turnover has improved from an average of 44 days in fiscal 2016 to an average of only 39 days in fiscal 2020. Assume that ending inventory will be equal to 40 days of cost of goods sold, in Year 11 to Year 15. Prepaid Expenses and Other Current Assets These assets include prepayments for ongoing operating costs such as rent and insurance. Assume that prepayments will grow at the growth rate in sales in Year 12 through Year 15. However, at fiscal year end 2020, Walmart includes $19,200 million in this account for assets associated with a business being held for sale. We will assume that the sale of the business will be completed in Year 11. Therefore, subtract $19,200 from the ending balance in 2020 to project the ending balance for Year 11. Property, Plant, and Equipment—At Cost With regard to property, plant, and equipment, Walmart’s net capital expenditures (capital expenditures net of proceeds from selling property, plant, and equipment) have been roughly $10.0 billion per year in fiscal years 2018–2020. Assume that capital spending on new property, plant, and equipment will continue to be $10.0 billion each year from Year 11 through Year 15. Accumulated Depreciation In 2019 and 2020, Walmart depreciated property, plant, and equipment using an average useful life of approximately 17.0 years. For Year 11 through Year 15, assume that accumulated depreciation will increase each year by depreciation expense. For simplicity, compute straightline depreciation expense based on an average 17-year useful life and zero salvage value. In computing depreciation expense each year, make sure you depreciate the beginning balance in the existing property, plant, and equipment—at cost. Also add a new layer of depreciation expense for the new property, plant, and equipment acquired through $10.0 billion each year in capital expenditures. Assume that Walmart recognizes a full year of depreciation on new property, plant, and equipment in the first year of service Lease Right-of-Use Assets Walmart recognizes long-term assets for lease rights in the Operating Lease Right-of-Use Assets and the Finance Lease Right-of-Use Assets accounts. Walmart leases assets that are similar to the types of assets purchased with capital expenditures and included in Property, Plant, and Equipment. Assume that the Operating and Finance lease asset accounts will grow at the same rate of growth in Property, Plant, and Equipment during Year 11 through Year 15. Goodwill and Other Long-Term Assets Goodwill and other long-term assets include primarily goodwill arising from corporate acquisitions outside the United States. Such acquisitions increase Walmart sales. Other long-term assets include various types of noncurrent assets including indefinite-lived intangibles Walmart has acquired, including trade names. Assume that goodwill and other long-term assets will grow at the same rate as sales. Also assume that goodwill and other assets are not amortizable, and that no impairment charges will be needed. Accounts Payable Walmart has maintained a steady accounts payable turnover, with payment periods averaging roughly 42 days during the last 5 years. Assume that ending accounts payable will continue to approximate 42 days of inventory purchases in Years 11 to 15. To compute the ending accounts payable balance using a 42-day turnover period, remember to add the change in inventory to the cost of goods sold to obtain the total amount of credit purchases of inventory during the year. Accrued Liabilities Accrued liabilities relate to accrued expenses for ongoing operating activities and are expected to grow at the growth rate in operating, selling, general and administrative expenses, which are expected to grow with sales. Income Taxes Payable and Deferred Tax Liabilities—Noncurrent For simplicity, assume that income taxes payable and deferred tax liabilities—noncurrent grow at 2.0% per year in Year 11 through Year 15. Short-Term Debt, Current Maturities of Long-Term Debt, and Long-Term Debt Walmart uses shortterm debt, current maturities of long-term debt, and long-term debt to augment cash from operations to finance capital expenditures on property, plant, and equipment and acquisitions of existing retail chains outside the United States. Over the past two years, individual amounts of debt financing (shortterm debt, current maturities of long-term debt, and long-term debt) have fluctuated from year to year. For simplicity, assume that Walmart’s short-term debt, current maturities of long-term debt, and long-term debt will grow at 3.0% per year in Year 11 through Year 15. Operating and Finance Lease Obligations Due Within One Year and Long-Term When Walmart executes new operating or finance leases, they recognize the right-of-use assets and the associated short-term and long-term lease obligations. We will assume that the short-term and long-term obligations under operating leases and finance leases will grow at the same rate as the lease right-of-use assets will grow during Year 11 through Year 15, which will be equal to the rate of growth in property, plant, and equipment. Common Stock and Additional Paid-in Capital Over the past five years, Walmart’s common stock and additional paid-in capital have grown at a compound annual rate of 13% per year. Assume that Walmart’s common stock and additional paid-in capital will continue to grow at 13.0% per year in Year 11 through Year 15. Retained Earnings The increase in retained earnings equals net income minus dividends and share repurchases. In fiscal 2020, Walmart paid total dividends of $6,116 million to common shareholders, which amounted to roughly 45% of net income attributable to Walmart shareholders. Assume that Walmart will maintain a policy to pay dividends equivalent to 45% of net income attributable to Walmart shareholders in Year 11 through Year 15. In addition, Walmart has used on average roughly $6,000 of cash to repurchase common shares in each of the past five fiscal years. Assume that Walmart will continue to use $6,000 million per year to repurchase common shares in Year 11 through Year 15. Accumulated Other Comprehensive Income Assume that accumulated other comprehensive income will not change. Equivalently, assume that other comprehensive income items will be zero (comprehensive income will equal net income), on average, in Year 11 through Year 15. Noncontrolling Interests Noncontrolling interests amount to equity investments made by thirdparty investors in subsidiaries that Walmart controls and consolidates. Noncontrolling interests grow each year by their proportionate share of the subsidiary’s income, and these interests decrease by any dividends paid to the noncontrolling shareholders. We assumed, for purposes of projecting the income statement, that net income attributable to noncontrolling interests would generate a 5.0% rate of return for those investors. For simplicity, assume that the dividends Walmart will pay to the noncontrolling interest shareholders will equal the amount of net income attributable to these noncontrolling interests in Year 11 to Year 15. Therefore, the amount of noncontrolling interests in equity will remain constant. Cash At this point, you can project the amount of cash on Walmart’s balance sheet at each year-end from Year 11 to Year 15. Assume that Walmart uses cash as the flexible financial account to balance the balance sheet. The resulting cash balance each year should be the total amount of liabilities and shareholders’ equity minus the projected ending balances in all noncash asset accounts. Statement of Cash Flows Forecast Assumptions Forecast the implied statements of cash flows for Walmart for Years 11 through 15. For each year, include the changes in each of the asset and liability accounts on the balance sheet (except cash) in either the operating activities, investing activities, or financing activities sections, as appropriate. Recall from the discussion in the chapter that increases (decreases) in assets imply uses (sources) of cash. Increases (decreases) in liability and equity accounts imply sources (uses) of cash. Depreciation Addback Include depreciation expense, which should equal the change in accumulated depreciation. Other Addbacks Assume that changes in deferred tax liabilities on the balance sheet are operating activities. Other Investing Transactions Assume that changes in goodwill and other long-term assets on the balance sheet are investing activities.

Required:

(Continued from page 626)

b. If you have programmed your spreadsheet correctly, the projected amount of cash grows steadily from $26,880 million at the end of Year 11 to a whopping $52,534 million at the end of Year 15 (allow for rounding), which is 19.2% of total assets. Identify one problem that so much cash could create for the financial management of Walmart.

c. Suppose that Walmart announces that it will augment its dividend policy by paying out 45% of net income plus the amount of excess cash each year (if any). Assume that during Year 11 to Year 15, Walmart will maintain a constant cash balance of $17,741 million (the cash balance at fiscal year-end 2020). Revise your forecast model spreadsheets to change the financial flexibility account from cash to dividends. Determine the total amount of dividends that Walmart could pay each year under this scenario. Identify one potential benefit that increased dividends could create for the financial management of Walmart.

d. Calculate and compare the return on common equity for Walmart using the forecast amounts determined in Requirements a and c for Year 11 to Year 15. Why the two sets of returns are different? Which results will Walmart’s common shareholders prefer? Why?

> Walmart Stores (Walmart) is the world’s largest retailer. It employs an “everyday low price” strategy and operates stores as three business segments: Walmart U.S., International, and Samâ€&

> The Coca-Cola Company is a global soft drink beverage company (ticker: KO). The following data for Coca-Cola include the actual amounts for Year 0 and the projected amounts for Years 11 through 15 for comprehensive income and common shareholdersâ&#

> Barnes & Noble sells books, magazines, music, and videos through retail stores and online. For a retailer like Barnes & Noble, inventory is a critical element of the business, and it is necessary to carry a wide array of titles. Inventories constitute th

> Hasbro designs, manufactures, and markets toys and games for children and adults in the United States and in international markets. Hasbro’s portfolio of brands and products contains some of the most well-known toys and games under famous brands such as

> The following is an excerpt from Note 13 (Pensions and Other Post-Employment Benefits) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola): REQUIRED: a. Write a memorandum explaining the change in the net pension liability in

> The following are excerpts from Note 14 (Income Taxes) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola): A reconciliation of the statutory U.S. federal tax rate and our effective tax rate is as follows: REQUIRED: a. Does Co

> Kentucky Gold (KG) holds 10,000 gallons of whis key in inventory on October 31, Year 1, that costs $225 per gallon. KG contemplates selling the whiskey on March 31, Year 2, when it completes the aging process. Uncertainty about the selling price of whisk

> Lynn Construction enters into a firm purchase commitment for equipment to be delivered on June 30, Year 1, for a price of £10,000. It simultaneously signs a forward foreign exchange contract for £10,000. The forward rate on June 30, Year 1, for settlemen

> Following information relates to a firm’s pension plan. REQUIRED: a. Compute the December 31, Year 1, PBO and FMV of pension assets. b. Compute Year 1 pension expense. c. Use the financial statements effects template to show the eff

> A large manufacturer of truck and car tires recently changed its cost-flow assumption method for inventories at the beginning of Year 2. The manufacturer has been in operation for almost 40 years, and for the last decade it has reported moderate growth i

> Deere & Company manufactures agricultural and industrial equipment and provides financing services for its independent dealers and their retail customers. In Note 2 to its October 31, Year 12, Form 10-K, Deere discloses the following revenue recognition

> Prime Contractors (Prime) is a privately owned company that contracts with the U.S. government to provide various services under multiyear (usually five-year) contracts. Its principal services are as follows: Refuse: Picks up and disposes of refuse from

> On January 1, Year 1, assume that Turner Construction Company agreed to construct an observatory for Dartmouth College for $120 million. Dartmouth College must pay $60 million upon signing and $30 million in Year 2 and Year 3. Expected construction costs

> Foreign Sub is a wholly owned subsidiary of U.S. Domestic Corporation. U.S. Domestic Corporation acquired the subsidiary several years ago. The financial statements for Foreign Sub for Year 2 in its own currency appear in Exhibit 8.31. LO 8-6 December 31

> Exhibit 8.28 presents the separate financial statements at December 31, Year 2, of Prestige Resorts and its 80%-owned subsidiary Booking, Inc. Two years earlier on January 1, Year 1, Prestige acquired 80% of the common shares of B

> On December 31, Year 1, Pace Co. paid $3,000,000 to Sanders Corp. shareholders to acquire 100% of the net assets of Sanders Corp. Pace Co. also agreed to pay former Sanders shareholders $200,000 in cash if certain earnings projections were achieved over

> Ormond Co. acquired all of the outstanding common stock of Daytona Co. on January 1, Year 1. Ormond Co. gave shares of its common stock with a fair value of $312 million in exchange for 100% of the Daytona Co. common stock. Daytona Co. will remain a lega

> Lexington Corporation acquired all of the outstanding common stock of Chalfont, Inc., on January 1, Year 1. Lexington gave shares of its no par common stock with a market value of $504 million in exchange for the Chalfont common stock. Chalfont will rema

> Bed and Breakfast (B&B), an Italian company operating in the Tuscany region, follows IFRS and has made the choice to premeasure long-lived assets at fair value. B&B purchased land in Year 1 for €150,000. At December 31 of the next four years, the land is

> Floral Delivery, Inc. (FD) acquired a fleet of vans on January 1, 2021, by issuing a $500,000, four-year, 4% fixed rate note, with interest payable annually on December 3. FD has the option to repay the note prior to maturity at the note’s fair value. FD

> Exhibits 7.14 and 7.15 provide footnote excerpts to the financial reports of The Coca-Cola Company and Eli Lilly and Company that discuss the stock option grants given to the employees of the two firms. Each firm uses options extensively to reward employ

> Eli Lilly and Company Produces pharmaceutical products for humans and animals. Exhibit 7.15 includes a footnote excerpt from the annual report of Lilly for the period ending December 31, Year 4. REQUIRED: Review Exhibits 7.15 and answer the following qu

> Refer to financial statements for Walmart in Exhibit 1.19 (Balance Sheets), Exhibit 1.20 (Statements of Income), and Exhibit 1.22 (Statement of Cash Flows). Exhibit 1.19: Exhibit 1.20: Exhibit 1.22: REQUIRED a. Explain why depreciation and amortiza

> Exhibit 7.14 includes a footnote excerpt from the annual report of The Coca-Cola Company for Year 4. The beverage company offers stock options to key employees under plans approved by stockholders. REQUIRED: Review Exhibit 7.14 and answer the followin

> On January 1 of Year 1, Baylor Company needs to acquire an industrial drilling machine that has a five-year life. Baylor could borrow funds and buy the machine outright for $50,000 or it could lease it from Gonzaga Financial by making annual end-of-the-y

> Exhibits 6.17–6.19 present the December 31, 2019, Consolidated Statements of Income, Statements of Comprehensive Income, Consolidated Statements of Cash Flows for Chipotle Mexican Grill, Inc. Notes 5 and 6 to the financial statements pr

> Socket Mobile develops and deploys bar-code-enabled mobile apps, cordless bar-code scanners, and contactless reading and writing devices to enable data capture. Its primary revenue source is the servicing of firms in the specialty retailer, field service

> Exhibit 6.16 presents the Consolidated Statements for Income of Harley-Davidson, Inc., and Note 3 describes restructuring expenses. NOTE: 3 Accompanying HARLEY-DAVIDSON, INC. December 31, 2019, Consolidated Financial Statements 3. Restructuring Expense

> Diviney Company wants to raise $50 million cash but for various reasons does not want to do so in a way that results in a newly recorded liability. The firm is sufficiently solvent and profitable, so its bank is willing to lend up to $50 million at the p

> Delta Air Lines, Inc., is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for several years. Exhibit 5.17 presents selected financial data for Delta Air Lines for each of the five years ending December 31, 200

> Exhibit 5.16 presents risk ratios for Coca-Cola for Year 1 through Year 3. REQUIRED a. Assess the changes in the short-term liquidity risk of Coca-Cola between Year 1 and Year 3. b. Assess the changes in the long-term solvency risk of Coca-Cola betwe

> Abercrombie & Fitch sells casual apparel and personal care products for men, women, and children through retail stores located primarily in shopping malls. Its fiscal year ends January 31 of each year. Financial statements for Abercrombie & Fitch

> The following are summary financial data for three well-known companies—American Airlines, Amazon, and The Home Depot. Based on your awareness of these companies and the economic events surrounding the COVID-19 pandemic that

> Exhibits 1.19–1.22 of Integrative Case 1.1 (Chapter 1) present the financial statements for Walmart for 2019–2021. In addition, the website for this text contains Walmart’s January 31, 2021, Form 10-K

> Analyzing the profitability of restaurants requires consideration of their strategies with respect to ownership of restaurants versus franchising. Firms that own and operate their restaurants report the assets and financing of those restaurants on their

> Selected data for General Mills for Year 1, Year 2, and Year 3 appear below (amounts in millions). REQUIRED a. Compute the rate of ROCE for Year 1, Year 2, and Year 3. b. Compute basic EPS for Year 1, Year 2, and Year 3. c. Interpret the changes in RO

> Sirius XM Radio Inc. is a satellite radio company, formed from the merger of Sirius and XM in 2008. Exhibit 3.20 presents a statement of cash flows for Sirius XM Radio for 2006, 2007, and 2008. Sirius XM and its predecessor, Sirius, realized revenue grow

> Aer Lingus is an international airline based in Ireland. Exhibit 3.24 provides the statement of cash flows for Year 1 and Year 2, which includes a footnote from the financial statements. Year 2 was characterized by weakening consumer demand for air trave

> The Apollo Group is one of the largest providers of private education and runs numerous programs and services, including the University of Phoenix. Exhibit 3.23 provides statements of cash flows for Year 1 through Year 3. REQUIRED Discuss the relation

> Montgomery Ward operates a retail department store chain. It filed for bankruptcy during the first quarter of Year 12. Exhibit 3.22 presents a statement of cash flows for Montgomery Ward for Year 7 to Year 11. The firm acquired Lechmere, a discount reta

> Sunbeam Corporation manufactures and sells a variety of small household appliances, including toasters, food processors, and waffle grills. Exhibit 3.21 presents a statement of cash flows for Sunbeam for Year 5, Year 6, and Year 7. After experiencing de

> Using the analytical framework, indicate the effect of each of the three independent sets of transactions described next. (1) a. January 15, 2018: Purchased marketable debt securities for $100,000. b. December 31, 2018: Revalued the marketable securiti

> In Integrative Case 10.1, we projected financial statements for Walmart Stores for Years 11 through 15. The data in Chapter 12, Exhibits 12.17 through 12.19, include the actual amounts for 2020 and the projected amounts for Year 11 to Year 16 for the inc

> Residual Income Valuation of Walmart’s Common Equity In Integrative Case 10.1, we projected financial statements for Walmart Stores, Inc. (Walmart), for Years 11 through 15. The data in Chapter 12’s Exhibits 12.17, 12.

> Nike, Inc.’s principal business activity involves the design, development, and worldwide marketing of athletic footwear, apparel, equipment, accessories, and services for serious and recreational athletes. Nike boasts that it is the lar

> Holmes Corporation is a leading designer and manufacturer of material handling and processing equipment for heavy industry in the United States and abroad. Its sales have more than doubled, and its earnings have increased more than sixfold in the past fi

> In Integrative Case 10.1, we projected financial statements for Walmart Stores, Inc. (Walmart), for Years +1 through +5. In this portion of the Walmart Integrative Case, we use the projected financial statements from Integrative Case 10.1 and apply the t

> Integrative Case 10.1 involves projecting financial statements for Walmart for Years 11 through 15. The following data for Walmart include the actual amounts for fiscal 2020 and the projected amounts for Years 11 through 15 for comprehensive income and c

> Since the early 1990s, woodstove sales have declined from 1,200,000 units per year to approximately 100,000 units per year. The decline has occurred because of (1) stringent new federal EPA regulations, which set maximum limits on stove emissions beginni

> The website for this text contains Walmart’s January 31, 2021, Form 10-K. You should read the management discussion and analysis (MD&A), financial statements, and notes to the financial statements, especially Note 1, “Summary of Significant Accounting Po

> Walmart makes significant investments in operating capacity, primarily via investments in property, plant, and equipment, but also via investments in wholly and partially owned subsidiaries. Walmart also has significant non-U.S. operations in its Walmart

> As you learned in the first two steps of the six-step financial statement analysis and valuation process, a firm’s financing activity is greatly influenced by industry economics and strategy, especially its stage within its life cycle. Early-stage firms

> Arbortech, a designer, manufacturer, and marketer of PC cards for computers, printers, telecommunications equipment, and equipment diagnostic systems, was the darling of Wall Street during Year 6. Its common stock price was the leading gainer for the yea

> Citigroup Inc. (Citi) is a leading global financial services company with more than 200 million customer accounts and operations in more than 140 countries. Its operating units Citicorp and Citi Holdings provide a broad range of financial products and se

> The first case at the end of this chapter and numerous subsequent chapters is a series of integrative cases involving Walmart, Inc. (Walmart). The series of cases applies the concepts and analytical tools discussed in each chapter to Walmartâ€

> Diamond Bank expects that the Singapore dollar will depreciate against the U.S. dollar from its spot rate of $0.43 to $0.42 in 60 days. The following interbank lending and borrowing rates exist: Diamond Bank considers borrowing 10 million Singapore doll

> Blue Demon Bank expects that the Mexican peso will depreciate against the dollar from its spot rate of $0.15 to $0.14 in 10 days. The following interbank lending and borrowing rates exist: Assume that Blue Demon Bank has a borrowing capacity of either $

> Assume that the U.S. inflation rate becomes high relative to Canadian inflation. Other things being equal, how should this affect (a) the U.S. demand for Canadian dollars, (b) the supply of Canadian dollars for sale, and (c) the equilibrium value of t

> Assume that the United States invests heavily in government and corporate securities of Country K. In addition, residents of Country K invest heavily in the United States. Approximately $10 billion worth of investment transactions occur between these two

> Mexico tends to have much higher inflation than the United States as well as much higher interest rates than the United States. Inflation and interest rates are much more volatile in Mexico than in industrialized countries. The value of the Mexican peso

> Tarheel Co. plans to determine how changes in U.S. and Mexican real interest rates will affect the value of the U.S. dollar. (See Appendix C for the basics of regression analysis.) a. Describe a regression model that could be used to achieve this purpos

> How do you think weaker U.S. economic conditions could affect capital flows? If capital flows are affected, how would this influence the value of the dollar (holding other factors constant)?

> Why do you think most crises in countries cause the local currency to weaken abruptly? Is it because of trade flows or capital flows

> If Asian countries experience a decline in economic growth (and experience a decline in inflation and interest rates as a result), how will their currency values (relative to the U.S. dollar) be affected?

> Analysts commonly attribute the appreciation of a currency to expectations that economic conditions will strengthen. Yet, this chapter suggests that when other factors are held constant, increased national income could increase imports and cause the loca

> On August 26, 1998, the day that Russia decided to let the ruble float freely, the ruble declined by about 50 percent. N the following day, called bloody Thursday, stock markets around the world (including the U.S.) declined by more than 4 percent. Why d

> In some historical periods, Brazil’s inflation rate has been very high. Explain why this places pressure on the Brazilian currency

> Explain why the value of the British pound against the dollar will not always move in tandem with the value of the euro against the dollar.

> Every month, the U.S. trade deficit figures are announced. Foreign exchange traders often react to this announcement and even attempt to forecast the figures before they are announced. a. Why do you think the trade deficit announcement sometimes has suc

> Assume the spot rate of the British pound is $1.73. The expected spot rate one year from now is assumed to be $1.66. What percentage depreciation does this reflect?

> Explain the foreign exchange situation for countries that use the euro when they engage in international trade among themselves.

> The Wolfpack Corp. is a U.S. exporter that invoices its exports to the United Kingdom in British pounds. If it expects that the pound will appreciate against the dollar in the future, should it hedge its exports with a forward contract? Explain.

> Compute the bid/ask percentage spread for Mexican peso retail transactions in which the ask rate is $0.11 and the bid rate is $0.10.

> Utah Bank’s bid price for Canadian dollars is $0.7938 and its ask price is $0.8100. What is the bid/ask percentage spread?

> List some of the important characteristics of bank foreign exchange services that MNCs should consider.

> Explain how the appreciation of the Japanese yen against the U.S. dollar would affect the return to a U.S. firm that borrowed Japanese yen and used the proceeds for a U.S. project.

> During the Hong Kong crisis, the Hong Kong stock market declined substantially over a four-day period due to concerns in the foreign exchange market. Why would stock prices decline due to such concerns in the foreign exchange market? Why would some count

> In July 2015, Greece was negotiating to obtain its third bailout from several European governments over a five-year period. Greece argued that austerity measures should not be imposed. Offer some reasoning for this argument. The European governments insi

> As of today, the interest rates in Countries X, Y, and Z are similar. In the next month, Country X is expected to have a weak economy, while Countries Y and Z are expected to experience a 6 percent increase in their economic growth. However, conditions t

> Bloomington Co. is a large U.S.-based MNC with large subsidiaries in Germany. It has issued stock in Germany to establish its business. As an alternative financing mechanism, it could have issued stock in the United States and then used the proceeds to s

> Explain how the international integration of financial markets caused the credit crisis of 2008–2009 to spread across many countries

> Explain how the appreciation of the Australian dollar against the U.S. dollar would affect the return to a U.S. firm that invested in an Australian money market security.

> Identify some of the key factors that can allow for stronger governance, thereby increasing participation and trading activity in a stock market

> a. What factors cause some firms to become more internationalized than others? b. Why might the Internet have resulted in more international business?

> a. Do you think the acquisition of a foreign firm or licensing will result in greater growth for an MNC? Which alternative is likely to have more risk? b. Describe a scenario in which the size of a corporation is not affected by access to international

> a. Explain how the existence of imperfect markets has led to the establishment of subsidiaries in foreign markets. b. If perfect markets existed, would wages, prices, and interest rates among countries be more similar or less similar than under conditio

> a. Explain how the theory of comparative advantage relates to the need for international business. b. Explain how the product cycle theory relates to the growth of an MNC.

> Explain the relationship between transparency of firms and investor participation (or trading activity) in stock markets. Based on this relationship, how can governments of countries increase the amount of trading activity (and therefore liquidity) of th

> a. Explain the agency problem of MNCs. b. Why might agency costs be larger for an MNC than for a purely domestic firm?

> Briefly describe the historical developments that led to floating exchange rates as of 1973.

> What is the function of the international money markets? Briefly describe the reasons for the development and growth of the European money market. Explain how the international money, credit, and bond markets differ from one another.

> Explain the process used by banks in the Eurocredit market to determine the rate to charge on loans.

> Explain how syndicated loans are used in international markets

> Assume Poland’s currency (the zloty) is worth $0.17 and the Japanese yen is worth $0.008. What is the cross exchange rate of the zloty with respect to yen? That is, how many yen equal one zloty?

> If the direct exchange rate of the euro is $1.25, what is the euro’s indirect exchange rate? That is, what is the value of a dollar in euros?

> Explain why an MNC may invest funds in a financial market outside its own country

> When South Korea’s export growth stalled, some South Korean firms suggested that South Korea’s primary export problem was the weakness in the Japanese yen. How would you interpret this statement?

> Explain how the existence of the euro may affect U.S. international trade

> Assume that during this semester, the euro appreciated against the dollar. Did the direct exchange rate of the euro increase or decrease? Did the indirect exchange rate of the euro increase or decrease?

> Why do you think international trade volume has increased over time? In general, how are inefficient firms affected by the reduction in trade restrictions among countries and the continuous increase in international trade?