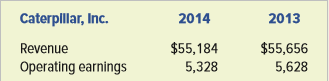

Question: With 2014 sales and revenues of $55.

With 2014 sales and revenues of $55.184 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel electric locomotives. The company principally operates through its three product segments— Resource Industries, Construction Industries, and Energy & Transportation (formerly Power Systems)—and also provides financing and related services through its Financial Products segment. Caterpillar is also a leading U.S. exporter.Â

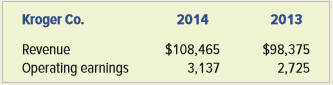

Description of business for the Kroger Company from its Form 10-K:

The Kroger Co. was founded in 1883 and incorporated in 1902.

As of January 31, 2015, we are one of the largest retailers in the nation based on annual sales. . . . As of January 31, 2015, Kroger operated, either directly or through its subsidiaries, 2,625 supermarkets and multi-department stores, 1,330 of which had fuel centers. Approximately 48% of these supermarkets were operated in Company-owned facilities, including some Company-owned buildings on leased land. Our current strategy emphasizes self-development and ownership of store real estate. Our stores operate under several banners that have strong local ties and brand recognition. Supermarkets are generally operated under one of the following formats: combination food and drug stores (“combo storesâ€); multi-department stores; marketplace stores; or price impact warehouses.

Required:

a. Determine which company appears to have the higher operating leverage.

b. Write a paragraph or two explaining why the company you identified in Requirement a might be expected to have the higher operating leverage.

c. If revenues for both companies increased by 5 percent, which company do you think would likely experience the greater percentage increase in operating earnings? Explain your answer.

Transcribed Image Text:

Caterpllar, Inc. 2014 2013 Revenue $55,184 $55,656 Operating earnings 5,328 5,628 Kroger Co. 2014 2013 Revenue $108,465 $98,375 Operating earnings 3,137 2,725

> Kilgore Company makes and sells a single product. Kilgore incurred the following costs in its most recent fiscal year. Kilgore could purchase the products that it currently makes. If it purchased the items, the company would continue to sell them using

> Gayla Ojeda is trying to decide which of two different kinds of candy to sell in her retail candy store. One type is a name-brand candy that will practically sell itself. The other candy is cheaper to purchase but does not carry an identifiable brand nam

> Because of rapidly advancing technology, Chicago Publications Corporation is considering replacing its existing typesetting machine with leased equipment. The old machine, purchased two years ago, has an expected useful life of six years and is in good c

> Kahn Company paid $240,000 to purchase a machine on January 1, 2017. During 2019, a technological breakthrough resulted in the development of a new machine that costs $300,000. The old machine costs $100,000 per year to operate, but the new machine could

> Mead Company is considering the replacement of some of its manufacturing equipment. Information regarding the existing equipment and the potential replacement equipment follows: Required: Based on this information, recommend whether to replace the equi

> The following events apply to Paradise Vacations’ first year of operations: 1. Acquired $20,000 cash from the issue of common stock on January 1, 2018. 2. Purchased $800 of supplies on account. 3. Paid $4,200 cash in advance for a one-year lease on offic

> A machine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000; its operating expenses are $60,000 per year. A replacement machine would cost $480,000, have a useful life of nine years, and would re

> Roadrunner Freight Company owns a truck that cost $42,000. Currently, the truck’s book value is $24,000, and its expected remaining useful life is four years. Roadrunner has the opportunity to purchase for $31,200 a replacement truck that is extremely fu

> Lake Corporation is considering the elimination of one of its segments. The segment incurs the following fixed costs. If the segment is eliminated, the building it uses will be sold. Advertising expense……………………………………………………….$140,000 Supervisory salaries

> Dudley Transport Company divides its operations into four divisions. A recent income statement for its West Division follows. DUDLEY TRANSPORT COMPANY West Division Income Statement for the Year 2019 Revenue………………………………………………………………….$300,000 Salaries fo

> Buckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Required: a. Explain the effect on profitability if Segment A is eliminated. b. Prepare comparative inc

> Omron Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 10,000 containers follows: Unit-level materials………………………………………………………….$ 7,500 Unit-level labor……………………………………

> The annual budget of the United States is very complex, but this case requires that you analyze only a small portion of the historical tables that are presented as a part of each year’s budget. The fiscal year of the federal government ends on September

> The following account balances were drawn from the records of Havel Company as of October 1, 2018:. Cash…………………&a

> Maria Gutierrez and Devin Duzan recently graduated from the same university. After graduation they decided not to seek jobs at established organizations but, rather, to start their own small business hoping they could have more flexibility in their perso

> Clarence Cleaver is the budget director for the Harris County School District. Mr. Cleaver recently sent an urgent e-mail message to Sally Simmons, principal of West Harris County High. The message severely reprimanded Ms. Simmons for failing to spend th

> The following events apply to Complete Business Service in 2018, its first year of operations: 1. Received $30,000 cash from the issue of common stock. 2. Earned $25,000 of service revenue on account. 3. Incurred $10,000 of operating expenses on account.

> The Curious Accountant in this chapter discussed some of the budgeting issues facing the United States Olympic Committee (USOC). First, to get a basic understanding of the sources of revenues and expenses of the USOC, review its Form 990, which shows its

> If the cost object is a manufactured product, what are the three major cost categories to accumulate?

> Identify the primary qualities of revenues and costs that are relevant for decision making.

> What is a cost object? Identify four different cost objects in which an accountant would be interested.

> Define the term annuity. What is one example of an annuity receipt?

> What are the advantages and disadvantages associated with the unadjusted rate of return method for evaluating capital investments?

> “The payback method cannot be used if the cash inflows occur in unequal patterns.” Do you agree or disagree? Explain.

> “I always go for the investment with the shortest payback period.” Is this a sound strategy? Why or why not?

> What typical cash inflow and outflow items are associated with capital investments?

> Does the net present value method provide a measure of the rate of return on capital investments?

> Use the 2014 Form 10-K for Snap-on Incorporated to complete the following requirements. To obtain the Form 10-K, you can use the EDGAR system or it can be found under “Corporate” and “Investor Information” on the company’s corporate website at www.snap

> What criteria determine whether a project is acceptable under the net present value method?

> Receiving $100,000 per year for five years is equivalent to investing what amount today at 14 percent? Provide a mathematical formula to solve this problem, assuming use of a present value annuity table to convert the future cash flows to their present

> When are sales and cost variances favorable and unfavorable?

> What is a responsibility center?

> What three ways can a manager increase the return on investment?

> What two factors affect the computation of return on investment?

> How do variance reports promote the management by exception doctrine?

> Pam Kelly says she has no faith in budgets. Her company, Kelly Manufacturing Corporation, spent thousands of dollars to install a sophisticated budget system. One year later the company’s expenses are still out of control. She believes budgets simply do

> What is a master budget?

> How may budgets be used as a measure of performance?

> The Parent Teacher Association (PTA) of Meadow High School is planning a fund-raising campaign. The PTA is considering the possibility of hiring Eric Logan, a world-renowned investment counselor, to address the public. Tickets would sell for $28 each. Th

> What is the advantage of using a perpetual budget instead of the traditional annual budget?

> How does the pro forma statement of cash flows differ from the cash budget?

> What is the normal starting point in developing the master budget?

> A manager is faced with deciding whether to replace machine A or machine B. The original cost of machine A was $20,000 and that of machine B was $30,000. Because the two cost figures differ, they are relevant to the manager’s decision. Do you agree? Expl

> Mary Hartwell and Jane Jamail, college roommates, are considering the joint purchase of a computer that they can share to prepare class assignments. Ms. Hartwell wants a particular model that costs $2,000; Ms. Jamail prefers a more economical model that

> What level(s) of costs is (are) relevant in special order decisions?

> Why would a company consider outsourcing products or services?

> What does the term breakeven point mean? Name the two ways it can be measured.

> What two factors should be considered in deciding how to allocate shelf space in a retail establishment?

> Which of the following would not be relevant to a make-or-buy decision? (a) Allocated portion of depreciation expense on existing facilities. (b) Variable cost of labor used to produce products currently purchased from suppliers. (c) Warehousing costs fo

> “It all comes down to the bottom line. The numbers never lie.” Do you agree with this conclusion? Explain your position.

> Are all fixed costs unavoidable?

> In a manufacturing environment, which costs are direct and which are indirect in product costing?

> How is an allocation rate determined? How is an allocation made?

> Explain the risk and rewards to a company that result from having fixed costs.

> Give an example of why the statement “All direct costs are avoidable” is incorrect.

> Explain the limitations of using operating leverage to predict profitability.

> What is the primary factor that distinguishes the three different levels of planning from each other?

> When would variable cost volume variances be expected to be unfavorable? How should unfavorable variable cost volume variances be interpreted?

> Joan Mason, the marketing manager for a large manufacturing company, believes her unfavorable sales volume variance is the responsibility of the production department. What production circumstances that she does not control could have been responsible fo

> Candice Sterling is a veterinarian. She has always been concerned for the pets of low-income families. These families love their pets but frequently do not have the means to provide them proper veterinary care. Dr. Sterling decides to open a part-time ve

> When the operating costs for Bill Smith’s production department were released, he was sure that he would be getting a raise. His costs were $20,000 less than the planned cost in the master budget. His supervisor informed him that the results look good bu

> What is the difference between a static budget and a flexible bud

> What are the three types of responsibility centers? Explain how each differs from the others.

> Is it true that the manager with the highest residual income is always the best performer?

> How can a residual income approach to performance evaluation reduce the likelihood of sub optimization?

> Carmen Douglas claims that her company’s performance evaluation system is unfair. Her company uses return on investment (ROI) to evaluate performance. Ms. Douglas says that even though her ROI is lower than another manager’s, her performance is far supe

> Minnie Divers, the manager of the marketing department for one of the industry’s leading retail businesses, has been notified by the accounting department that her department experienced an unfavorable sales volume variance in the preceding period but a

> How are flexible budget variances determined? What causes these variances?

> With respect to fixed costs, what are the consequences of the actual volume of activity exceeding the planned volume?

> Ken Shilov, manager of the marketing department, tells you that “budgeting simply does not work.” He says that he made budgets for his employees and when he reprimanded them for failing to accomplish budget goals, he got unfounded excuses. Suggest how M

> Gaines Company recently initiated a post audit program. To motivate employees to take the program seriously, Gaines established a bonus program. Managers receive a bonus equal to 10 percent of the amount by which actual net present value exceeds the proj

> What are the advantages of budgeting?

> What are the three levels of planning? Explain each briefly.

> Why does preparing the master budget require a committee?

> What information does the pro forma income statement provide? How does its preparation depend on the operating budgets?

> The primary reason for preparing a cash budget is to determine the amount of cash to include on the budgeted balance sheet. Do you agree or disagree with this statement? Explain.

> What are the components of the cash budget? Describe each.

> How does the level of inventory affect the production budget? Why is it important to manage the level of inventory?

> Budgets are useful only for small companies that can estimate sales with accuracy. Do you agree with this statement?

> A local bank advertises that it offers a free non interest-bearing checking account if the depositor maintains a $500 minimum balance in the account. Is the checking account truly free?

> What is an opportunity cost? How does it differ from a sunk cost?

> Webb Publishing Company is evaluating two investment opportunities. One is to purchase an Internet company with the capacity to open new marketing channels through which Webb can sell its books. This opportunity offers a high potential for growth but inv

> Carmon Company invested $300,000 in the equity securities of Mann Corporation. The current market value of Carmon’s investment in Mann is $250,000. Carmon currently needs funds for operating purposes. Although interest rates are high, Carmon’s president

> Describe the relationship between relevance and accuracy.

> Identify the four hierarchical levels used to classify costs. When can each of these levels of costs be avoided?

> Are variable costs always relevant? Explain.

> Why would a supervisor choose to continue using a more costly old machine instead of replacing it with a less costly new machine?

> The managers of Wilcox, Inc. are suggesting that the company president eliminate one of the company’s segments that is operating at a loss. Why may this be a hasty decision?

> Identify some qualitative factors that should be considered in addition to quantitative costs in deciding whether to outsource.

> Chris Sutter, the production manager of Satellite Computers, insists that the floppy drives used in the company’s upper-end computers be outsourced since they can be purchased from a supplier at a lower cost per unit than the company is presently incurri

> Identify two qualitative considerations that could be associated with special order decisions.

> What is a direct cost? What criteria are used to determine whether a cost is a direct cost?

> Obtain Shake Shack, Inc.’s Form 10-K for the fiscal year ending on December 31, 2014. To obtain the Form 10-K, you can use the EDGAR system (see Appendix A at the back of this text for instructions), or it can be found under the “Investor Relations” li

> Why is cost accumulation imprecise?

> Define the term cost pool. How are cost pools important in allocating costs?

> Respond to the following statement: “The allocation base chosen is unimportant. What is important in product costing is that overhead costs be assigned to production in a specific period by an allocation process.”

> On January 31, the managers of Integra Inc. seek to determine the cost of producing their product during January for product pricing and control purposes. The company can easily determine the costs of direct materials and direct labor used in January pro

> What is the objective of allocating indirect manufacturing overhead costs to the product?

> Why are some manufacturing costs not directly traceable to products?

> If Company A has a projected margin of safety of 22 percent while Company B has a margin of safety of 52 percent, which company is at greater risk when actual sales are less than budgeted?