Question: You have been asked by a client

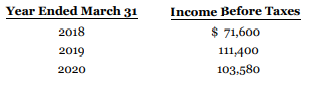

You have been asked by a client to review the records of Inteq Corporation, a small manufacturer of precision tools and machines that follows ASPE. Your client is interested in buying the business, and arrangements were made for you to review the accounting records. Your examination reveals the following. 1. Inteq Corporation started business on April 1, 2017, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income tax:

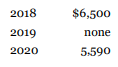

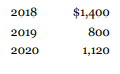

2. A relatively small number of machines have been shipped on consignment. These transactions were recorded as ordinary sales and billed in this way, with the gross profit on each sale recognized when the machine was shipped. On March 31 of each year, the amounts for machines billed and in the hands of consignees were as follows:

The sales price was determined by adding 30% to cost. Assume that the consigned machines are sold the following year.

3. On March 30, 2019, two machines were shipped to a customer on a C.O.D. basis. The sale was not entered until April 5, 2019, when $6,100 cash was received. The machines were not included in the inventory at March 31, 2019. (Title passed on March 30, 2019.)

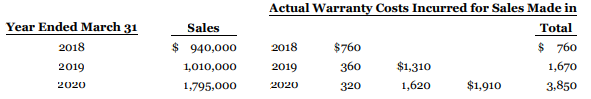

4. All machines are sold subject to a five-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to 0.5% of sales. The company has charged an expense account for actual warranty costs incurred. Sales per books and warranty costs were as follows:

5. A review of the corporate minutes reveals that the manager is entitled to a bonus of 0.5% of the income before deducting income tax and the bonus. The bonuses have never been recorded or paid.

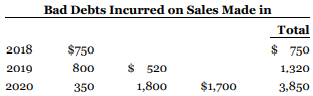

6. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 0.25% of sales. Bad debts written off and expensed were as follows:

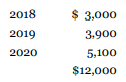

7. The bank deducts 6% on all contracts that it finances. Of this amount, 0.5% is placed in a reserve to the credit of Inteq Corporation and is refunded to Inteq as financed contracts are paid in full. The reserve established by the bank has not been reflected in Inteq's books. On the books of the bank for each fiscal year, the excess of credits over debits (the net increase) to the reserve account for Inteq was as follows:

8. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows:

Instructions

a. Present a schedule showing the revised income before income tax for each of the years ended March 31, 2018, 2019, and 2020. Make calculations to the nearest dollar.

b. Prepare the journal entry or entries that you would give the bookkeeper to correct the books. Assume that the books have not yet been closed for the fiscal year ended March 31, 2020. Disregard corrections of income tax.

Transcribed Image Text:

Year Ended March 31 Income Before Taxes $ 71,600 2018 2019 111,400 2020 103,580 2018 $6,500 2019 none 2020 5:590 Actual Warranty Costs Incurred for Sales Made in Year Ended March 31 Sales Total 2018 $ 940,000 2018 $760 $ 760 2019 1,010,000 2019 360 $1,310 1,670 2020 1,795,000 2020 320 1,620 $1,910 3,850 Bad Debts Incurred on Sales Made in Total 2018 $750 $ 750 2019 800 $ 520 1,320 2020 350 1,800 $1,700 3,850 2018 $ 3,000 2019 3.900 2020 5,100 $12,000 2018 $1,400 2019 800 2020 1,120

> Tseng Corporation Ltd. has the following capital structure at the following fiscal years ended December 31: The following additional information is available. 1. On July 31, 2020, Tseng Corporation exchanged common shares for a large piece of equipment

> Use the same information for Audrey Inc. as in P17.3, but also assume the following. 1. On September 30, 200,000 convertible preferred shares were redeemed. If they had been converted, these shares would have resulted in an additional 100,000 common sha

> Audrey Inc. has 1 million common shares outstanding as at January 1, 2020. On June 30, 2020, 4% convertible bonds were converted into 100,000 additional shares. Up to that point, the bonds had paid interest of $250,000 after tax. Net income for the year

> Loretta Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Loretta's fiscal year ends May 31. The following information is available. 1. Income from operations b

> The IFRS Foundation publishes the “Pocket Guide to IFRS Standards: The Global Financial Reporting Language.” The guide shows continuing progress toward further enhancing the quality of IFRS and increasing adoption around the world. The IFRS Foundation t

> Rocky Mountain Corp. currently has an issued debenture outstanding with Abbra Bank. The note has a principal of $2 million, was issued at face value, and interest is payable at 7%. The term of the debenture was 10 years, and was issued on December 31, 20

> Gateway Corporation has outstanding 200,000 common shares that were issued at $10 per share. The balances at January 1, 2020, were $21 million in its Retained Earnings account; $4.3 million in its Contributed Surplus account; and $1.1 million in its Accu

> The following information is available for Dylan Inc., a company whose shares are traded on the Toronto Stock Exchange: Other information: 1. For all of the fiscal year 2020, $100,000 of 6% cumulative convertible bonds have been outstanding. The bonds

> Jackie Enterprises Ltd. has a tax rate of 30% and reported net income of $8.5 million in 2020. The following details are from Jackie's statement of financial position as at December 31, 2020, the end of its fiscal year: Other information: 1. Quarterly

> The following information is for Polo Limited for 2020: There were no changes during 2020 in the number of common shares, preferred shares, or convertible bonds outstanding. For simplicity, ignore the requirement to book the convertible bonds' equity po

> On December 31, 2020, Master Corp. had a $10-million, 8% fixed-rate note outstanding that was payable in two years. It decided to enter into a two-year swap with First Bank to convert the fixed-rate debt to floating-rate debt. The terms of the swap speci

> Treeton Inc. had net income for the fiscal year ended June 30, 2020, of $5 million. There were 500,000 common shares outstanding throughout 2020. The average market price of the common shares for the entire fiscal year was $50. Treeton's tax rate was 25%

> On September 30, 2020, Gargiola Inc. issued $4 million of 10-year, 8% convertible bonds for $4.6 million. The bonds pay interest on March 31 and September 30 and mature on September 30, 2030. Each $1,000 bond can be converted into 80 no par value common

> On January 1, 2020, Salem Corp. issued $1.1 million of five-year, zero-interest-bearing notes along with warrants to buy 1 million common shares at $22 per share. On January 1, 2020, Salem had 9.3 million common shares outstanding and the market price wa

> Floral Gardens Incorporated is a nationwide chain of garden centres that operates as a private company. In 2020, it issued three new financial instruments. All three of these instruments are new to you (in your role as controller), and you are working on

> Locate the 2018 audited annual financial statements of a company that may be experiencing financial difficulties, such as Sears Holding Corporation, an American company traded on the NASDAQ. Instructions a. Identify the name of the company, the busine

> Oregano Inc. was formed on July 1, 2017. It was authorized to issue an unlimited number of common shares and 100,000 cumulative and non-participating preferred shares carrying a $2 dividend. The company has a July 1 to June 30 fiscal year. The following

> Some of the account balances of Vos Limited at December 31, 2019, are as follows: The price of the company's common shares has been increasing steadily on the market; it was $21 on January 1, 2020, and advanced to $24 by July 1 and to $27 at the end of

> On April 1, 2020, Taylor Corp. sold 12,000 of its $1,000 face value, 15-year, 11% bonds at 97. Interest payment dates are April 1 and October 1. The company follows ASPE and uses the straight-line method of bond discount amortization. On March 1, 2021, T

> In the following two independent cases, the company closes its books on December 31: 1. Armstrong Inc. sells $2 million of 10% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds

> Lasson Corp. has 5,000 preferred shares outstanding ($2 dividend), which were issued for $150,000, and 30,000 common shares, which were issued for $550,000. Instructions The following schedule shows the amount of dividends paid out over the past four

> Adventureland Incorporated purchased metal to build a new roller coaster on December 31, 2020. Adventureland provided a $500,000 down payment and agreed to pay the balance in equal instalments of $200,000 every December 31 for five years. Adventureland c

> Jeremiah Limited issued 10-year, 7% debentures with a face value of $2 million on January 1, 2013. The proceeds received were $1.7 million. The discount was amortized on the straight-line basis over the 10-year term. The terms of the debentures stated th

> Thompson Limited, a private company with no published credit rating, completed several transactions during 2020. In January, the company bought under contract a machine at a total price of $1.2 million. It is payable over five years with instalments of $

> On December 31, 2020, Faital Limited acquired a machine from Plato Corporation by issuing a $600,000, non–interest-bearing note that is payable in full on December 31, 2024. The company's credit rating permits it to borrow funds from its several lines of

> Selected transactions on the books of Pfaff Corporation follow: Instructions a. Assume that Pfaff follows ASPE. Prepare the journal entries for the transactions above. Round to the nearest dollar. b. How would your answers to the above change if Pfaff

> Healy Corp., a leader in the commercial cleaning industry, acquired and installed, at a total cost of $110,000 plus 15% HST, three underground tanks to store hazardous liquid solutions needed in the cleaning process. The tanks were ready for use on Febru

> On June 1, 2020, MacDougall Corporation approached Silverman Corporation about buying a parcel of undeveloped land. Silverman was asking $240,000 for the land and MacDougall saw that there was some flexibility in the asking price. MacDougall did not have

> Mullen Music Limited (MML) carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. MML uses two sales promotion techniques—warranties and premiums—to attract custom

> On January 1, 2020, Batonica Limited issued a $1.2-million, five-year, zero-interest-bearing note to Northern Savings Bank. The note was issued to yield 8% annual interest. Unfortunately, during 2020 Batonica fell into financial trouble due to increased

> Manitoba Deck System Corporation (MDSC) is a public company whose shares are actively traded on the Toronto Stock Exchange. The following transactions occurred in 2020: Instructions a. Prepare the general journal entries to record the transactions. b.

> To increase the sales of its Sugar Kids breakfast cereal, KW Foods Limited (KW) places one coupon in each cereal box. Five coupons are redeemable for a premium consisting of a child's hand puppet. In 2020, KW purchases 40,000 puppets at $1.50 each and se

> Refer to P14.11 and Taylor Corp. Instructions Repeat the instructions of P14.11 assuming that Taylor Corp. uses the effective interest method. Provide an effective interest table for the bonds for two interest payment periods. (Hint: Using (1) a finan

> Four independent situations follow: 1. On March 1, 2020, Wilkie Inc. issued $4 million of 9% bonds at 103 plus accrued interest. The bonds are dated January 1, 2020, and pay interest semi-annually on July 1 and January 1. In addition, Wilkie incurred $2

> Ramirez Inc., a publishing company, is preparing its December 31, 2020 financial statements and must determine the proper accounting treatment for the following situations. Ramirez has retained your firm to help with this task. 1. Ramirez sells subscrip

> In preparing Sahoto Corporation's December 31, 2020 financial statements under ASPE, the vicepresident, finance, is trying to determine the proper accounting treatment for each of the following situations. 1. As a result of uninsured accidents during th

> Huang Inc., a private business following ASPE, has a contract with its president, Ms. Shen, to pay her a bonus during each of the years 2020, 2021, and 2022. Huang has the practice of paying Ms. Shen her bonus in quarterly payments at the end of March, J

> The following is a payroll sheet for Bayview Golf Corporation for the first week of November 2020. The EI rate is 1.66% and the maximum annual deduction per employee is $858.22. The employer's obligation for EI is 1.4 times the amount of the employee ded

> Hrudka Corp. has manufactured a broad range of quality products since 1991. The operating cycle of the business is less than one year. The following information is available for the company's fiscal year ended February 29, 2020. Hrudka follows ASPE. 1.

> Hamilton Airlines is faced with two situations that need to be resolved before the financial statements for the company's year ended December 31, 2020, can be issued. 1. The airline is being sued for $4 million for an injury caused to a child as a resul

> On October 30, 2020, Truttman Corp. sold a five-year-old building with a carrying value of $10 million at its fair value of $13 million and leased it back. There was a gain on the sale. Truttman pays all insurance, maintenance, and taxes on the building.

> Brondon Corp. purchased a put option on Mykia common shares on July 7, 2020, for $480. The put option is for 350 shares, and the strike price is $50. The option expires on January 31, 2021. The following data are available with respect to the put option:

> The head office of North Central Ltd. has operated in the western provinces for almost 50 years. North Central uses ASPE. In 2004, new offices were constructed on the same site at a cost of $9.5 million. The new building was opened on January 4, 2005, an

> Use the information for P20.21. Instructions Answer the following questions, rounding all numbers to the nearest cent. Under Option 2: a. Assume that, at the signing of the original lease, Sanderson Inc. has no intention of exercising the lease rene

> Sanderson Inc., a pharmaceutical distribution firm, is providing a BMW car for its chief executive officer as part of a remuneration package. Sanderson has a calendar year end, issues financial statements annually, and follows ASPE. You have been assigne

> Mulholland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special-purpose equipment for a period of seven years. Mulholland follows IFRS 16 and Galt follows ASPE. The following information

> Fram Fibreglass Corp. (FFC) is a private New Brunswick company, using ASPE, that manufactures a variety of fibreglass products for the fishing and food services industry. With the traditional fishery in decline over the past few years, FFC found itself i

> Ali Reiners, the new controller of Luftsa Corp., is preparing the financial statements for the year ended December 31, 2020. Luftsa is a publicly traded entity and therefore follows IFRS. Ali has found the following information. 1. Luftsa has been offer

> Bayberry Corporation performs year-end planning in November each year before its fiscal year ends in December. The preliminary estimated net income following IFRS is $4.2 million. The CFO, Rita Warren, meets with the company president, Jim Bayberry, to r

> Kitchener Corporation has followed IFRS and used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced b

> Jacobsen Corporation is negotiating a loan for expansion purposes. Jacobsen's books and records have never been audited and the bank has requested that an audit be performed and that IFRS be followed. Jacobsen has prepared the following comparative finan

> Refer to P16.1, but assume that Hing Wa wrote (sold) the call option for a premium of $480 (instead of buying it). Assume that the market price of the shares and the fair value of the option are otherwise the same. Instructions Prepare the journal ent

> Seneca Corporation, which uses IFRS, has contracted with you to prepare a statement of cash flows. The controller has provided the following information: Additional information related to 2020 is as follows: 1. Equipment that cost $10,500 and was 50%

> The unclassified SFP accounts for Sorkin Corporation, which is a public company using IFRS, for the year ended December 31, 2019, and its statement of comprehensive income and statement of cash flows for the year ended December 31, 2020, are as follows:

> Bradburn Corporation was formed five years ago through an initial public offering (IPO) of common shares. Daniel Brown, who owns 15% of the common shares, was one of the organizers of Bradburn and is its current president. The company has been successful

> The following accounts appear in the ledger of Samson Inc. Samson's shares trade on the Toronto and New York stock exchanges and so the company uses IFRS. Samson has chosen to account for shares held in Anderson Corp. as FV-OCI and to reclassify out of O

> You are compiling the consolidated financial statements for Vu Corporation International (VCI), a public company. The corporation's accountant, Timothy Chow, has provided you with the following segment information. Note 7: Major Segments of Business V

> Leopard Corporation is currently preparing its annual financial statements for the fiscal year ended April 30, 2020, following IFRS. The company manufactures plastic, glass, and paper containers for sale to food and drink manufacturers and distributors.

> SFP accounts of Secada Inc., which follows IFRS, follow: Additional information: Secada Inc. has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. 1. Cash dividends declared during the

> The following excerpt is from the financial statements of a large Canadian manufacturer and provides segmented geographic data: The company reported that it was engaged principally in one line of business—processed food productsâ&

> You have completed your audit of Khim Inc. and its consolidated subsidiaries for the year ended December 31, 2020, and are satisfied with the results of your examination. You have examined the financial statements of Khim for the past three years. The co

> Radiohead Inc., a private company following ASPE, produces electronic components for sale to manufacturers of radios, television sets, and digital sound systems. In connection with her examination of Radiohead's financial statements for the year ended De

> Secord Limited has two classes of shares outstanding: preferred ($6 dividend) and common. At December 31, 2019, the following accounts and balances were included in shareholders' equity: The contributed surplus accounts arose from net excess of proceeds

> Your firm has been engaged to examine the financial statements of Samson Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on J

> In an examination of Daniel Corporation Ltd. as at December 31, 2020, you have learned that the following situations exist. No entries have been made in the accounting records for these items. Daniel follows IFRS. 1. The corporation erected its present

> Jeopardy Inc.'s CFO has just left the office of the company president after a meeting about the draft SFP at April 30, 2020, and income statement for the year then ended. (Both are reproduced below.) “Our liquidity position looks health

> Griseta Limited sponsors a defined benefit pension plan for its employees, which it accounts for under ASPE. The following data relate to the operation of the plan for the year 2020: 1. The actuarial present value of future benefits earned by employees

> The following information is available for Antoine Corporation's pension plan for the 2020 fiscal year: On January 1, 2020, Antoine Corp. amended its pension plan, resulting in past service costs with a present value of $140,400. Antoine follows ASPE.

> The following information is available for Huntley Corporation's pension plan for the year 2020: Instructions a. Calculate pension expense for the year 2020, and provide the entries to recognize the pension expense and funding for the year, assuming t

> Refer to E18.7 for Sayaka Tar and Gravel Ltd., and assume the same facts as in E18.8 for the fiscal year ended December 31, 2021, except that the enacted tax rate for 2022 and subsequent years was reduced to 20% on September 15, 2021. Instructions a.

> Refer to E18.7 for Sayaka Tar and Gravel Ltd., and assume the same facts for the fiscal year ended December 31, 2020. For the second year of operations, Sayaka made progress on the construction of the road for the municipality. The account balances at De

> Sayaka Tar and Gravel Ltd. operates a road construction business. In its first year of operations, the company won a contract to build a road for the municipality of Cochrane West. It is estimated that the project will be completed over a three-year peri

> Esau Inc. presented the following data: As at January 1, 2020, there were no dividends in arrears. On December 31, 2020, Esau declared and paid the preferred dividend for 2020. Instructions a. Calculate earnings per share for the year ended December

> Perfect Ponds Inc. (PPI) is a backyard pond design and installation company. PPI was incorporated during 2020, with an unlimited number of common shares, and 50,000 preferred shares with a $3 dividend rate authorized. PPI follows ASPE. The following tran

> Allen Corporation reports the following amounts in its first three years of operations. The difference between taxable income and accounting income is due to one reversing difference. The tax rate is 30% for all years and the company expects to continue

> Koala Inc., a publicly traded company, had 210,000 common shares outstanding on December 31, 2019. During 2020, the company issued 8,000 shares on May 1 and retired 14,000 shares on October 31. For 2020, the company reported net income of $229,690 after

> Zak Corp. purchased depreciable assets costing $600,000 on January 2, 2020. For tax purposes, the company uses CCA in a class that has a 40% rate. Assume these assets are considered “eligible equipment” for purposes of the Accelerated Investment Incentiv

> Use the information for Jenny Corporation in E18.16. Assume that the company reports accounting income of $155,000 in each of 2021 and 2022, and that there is no reversing difference other than the one identified in E18.16. In addition, assume now that J

> Refer to the information for Henry Limited in BE18.11. Following the year ended December 31, 2020, Henry continued to actively trade its securities investments until the end of its 2021 fiscal year, when it was forced to sell several of them at a loss, b

> Use the information for Jenny Corporation in E18.16. Assume that the company reports accounting income of $155,000 in each of 2021 and 2022 and that the warranty expenditures occurred as expected. No reversing difference exists other than the one identif

> Jenny Corporation recorded warranty accruals as at December 31, 2020, in the amount of $150,000. This reversing difference will cause deductible amounts of $50,000 in 2021, $35,000 in 2022, and $65,000 in 2023. Jenny's accounting income for 2020 is $135,

> Use the information for Sorpon Corporation in E18.12. Assume that the company reports accounting income of $180,000 in each of 2021 and 2022, and that there are no reversing differences other than the one identified in E18.12. In addition, assume now tha

> Use the information for Sorpon Corporation in E18.12. Assume that the company reports accounting income of $180,000 in each of 2021 and 2022, and that there are no temporary differences other than the one identified in E18.12. Instructions a. Calculat

> On January 1, 2020, Draper Inc. issued $4 million of face value, five-year, 6% bonds at par. Each $1,000 bond is convertible into 20 common shares. Draper's net income in 2020 was $200,000, and its tax rate was 25%. The company had 100,000 common shares

> LEW Jewellery Corp. uses gold in the manufacture of its products. LEW anticipates that it will need to purchase 500 ounces of gold in October 2020 for jewellery that will be shipped for the holiday shopping season. However, if the price of gold increases

> Ottey Corporation issued $4 million of 10-year, 7% callable convertible subordinated debentures on January 2, 2020. The debentures have a face value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in two years it will

> Christina Inc. follows IFRS. Christina holds a variety of investments, some of which are accounted for at fair value through net income and some of which are accounted for at fair value through other comprehensive income. On January 1, 2020, the beginnin

> On January 1, 2020, Manfred Manufacturers had 300,000 common shares outstanding. On April 1, the corporation issued 30,000 new common shares to raise additional capital. On July 1, the corporation declared and distributed a 10% stock dividend on its comm

> In 2019, Capstone Ltd. issued $50,000 of 8% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had revenues of $75,000 and expenses of $40,000 for 2020, not including interest and tax. (Assume a tax rate of 25%.) Th

> At January 1, 2020, Ming Limited's outstanding shares included the following: Net income for 2020 was $2,130,000. No cash dividends were declared or paid during 2020. On February 15, 2021, however, all preferred dividends in arrears were paid, together

> A portion of the combined statement of income and retained earnings of Snap Ltd. for the current year ended December 31, 2020, follows: Note 1. During the year, Snap Inc. suffered a loss from discontinued operations of $400,000 after the applicable inco

> On January 1, 2020, Trigson Ltd. had 580,000 common shares outstanding. During 2020, it had the following transactions that affected the common share account: The company's year end is December 31. Instructions a. Determine the weighted average numbe

> On January 1, 2020, Logan Limited had shares outstanding as follows: To acquire the net assets of three smaller companies, the company authorized the issuance of an additional 330,000 common shares. The acquisitions were as follows: On May 14, 2020, Lo

> Mustafa Limited began operations on January 2, 2019. Mustafa employs nine individuals who work eight-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of th

> The payroll of Sumerlus Corp. for September 2020 is as follows. Total payroll was $485,000. Pensionable (CPP) and insurable (EI) earnings were $365,000. Income taxes in the amount of $85,000 were withheld, as were $8,000 in union dues. The EI rate was 1.

> Vanstone Corp., a public company, adopted a stock option plan on November 30, 2020, that designated 70,000 common shares as available for the granting of options to officers of the corporation at an exercise price of $8 a share. The market value was $12

> Financial information for Cao Inc. follows. Instructions a. Calculate the following ratios or relationships of Cao Inc. Assume that the ending account balances are representative unless the information provided indicates differently. 1. Current ratio

> At December 31, 2020, Reddy Inc. has three long-term debt issues outstanding. The first is a $2.2-million note payable that matures on June 30, 2023. The second is a $4- million bond issue that matures on September 30, 2024. The third is a $17.5-million

> Kawani Corporation has been operating for several years. On December 31, 2020, it presented the following SFP. Cost of goods sold in 2020 was $420,000, operating expenses were $51,000, and net income was $27,000. Accounts payable suppliers provided oper

> The following are various accounts: 1. Bank loans payable of a winery, due March 10, 2024 (the product requires aging for five years before it can be sold) 2. $10 million of serial bonds payable, of which $2 million is due each July 31 3. Amounts with