Question: You have just been assigned as a

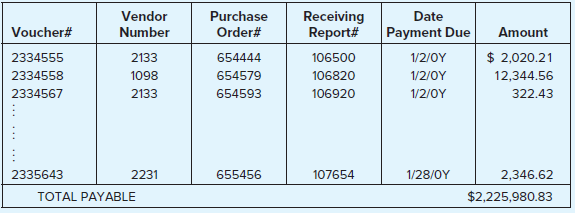

You have just been assigned as a member of the audit team of Bozarkana Company (a new client) and are considering accounts payable. Bozarkana Company uses a computerized voucher system for payables. As a starting point, you asked Bill Bozarkana, the controller, for a summary of payables and received the following schedule of more than 1,000 unpaid vouchers at year-end:

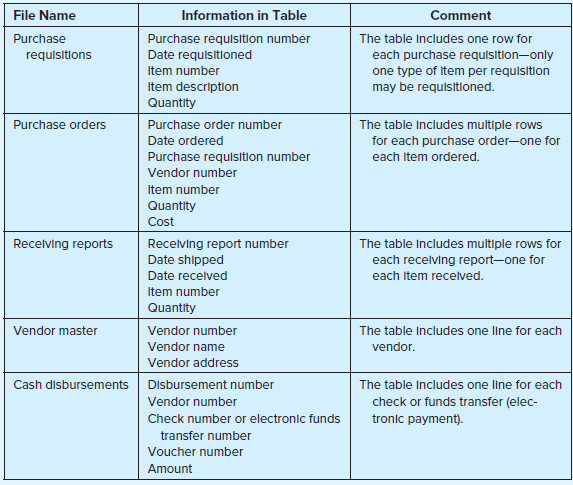

Bill Bozarkana has indicated that the schedule is a listing of the vouchers payable file as of year-end and that the total is the result of a separate question (query) of that file asking for total payables. You have the schedule in electronic and hard-copy form. Vouchers are issued sequentially, and voucher number 2335643 was the last one issued prior to year-end. You also have obtained the information relating to the following other computer files, which are available to you in electronic form, as shown above.

The client has made copies of these files available so that you and the assistant can perform the necessary steps on the files. Furthermore, you have compared these copies to the client’s copies and find that they are identical. Finally, you may assume that tests of controls have been performed on the controls related to the dates on the files. The controls were found to be effective.

Required:

a. Discuss how you would establish samples in the following situations:

(1) Randomly select 30 vouchers as of year-end and obtain the necessary information to send confirmations.

(2) Randomly select 30 accounts with balances payable (per vendor) as of December 31.

(3) Select all accounts (per vendor) with which the company has disbursed more than $500,000 during the year, but whose balance at year-end is zero.

b. Provide detailed guidance on the following:

(1) All purchases are sent to Bozarkana Company “FOB shipping point.†Identify a procedure for testing whether any items shipped to the client prior to year-end have been omitted from vouchers payable as of year-end.

(2) Select all disbursements over $300,000 in the first two weeks of January, and, for those not included as liabilities as of December 31, determine whether title to the goods had passed as of year-end, resulting in an unrecorded liability.

Transcribed Image Text:

Vendor Purchase Receiving Report# Date Voucher# Payment Due Number Order# Amount 2334555 2133 654444 106500 1/2/OY $ 2,020.21 2334558 1098 654579 106820 1/2/0Y 12,344.56 2334567 2133 654593 106920 1/2/OY 322.43 2335643 2231 655456 107654 1/28/OY 2,346.62 TOTAL PAYABLE $2,225,980.83 File Name Information in Table Comment Purchase The table Includes one row for Purchase requlsition number Date requisitioned requisitions each purchase requisition-only one type of Item per requisition may be requisitioned. Item number Item description Quantity Purchase orders Purchase order number The table Includes multiple rows for each purchase order-one for Date ordered Purchase requisition number each Item ordered. Vendor number Item number Quantity Cost Recelving reports Recelving report number Date shipped The table Includes multiple rows for each recelving report-one for Date recelved each Item recelved. Item number Quantity Vendor master Vendor number The table Includes one line for each Vendor name vendor. Vendor address Cash disbursements Disbursement number Vendor number The table Includes one llne for each check or funds transfer (elec- tronic payment). Check number or electronic funds transfer number Voucher number Amount

> In performing an audit in accordance with both generally accepted auditing standards and Generally Accepted Government Auditing Standards, the auditors are required to communicate information about weaknesses in the organization’s internal control. Howev

> In performing an audit in accordance with Generally Accepted Government Auditing Standards, the auditors are required to issue an additional combined report on compliance with laws and regulations and on internal control. Required: a. Describe the natur

> Devry Corporation has established an independent foundation for the purposes of community improvement. The foundation employs an executive director and eight staff people. The internal auditors of the company were requested to do an audit of the foundati

> You are the chief audit executive for the internal auditing function of a large municipal hospital. You receive monthly financial reports prepared by the accounting department, and your review of them has shown that total accounts receivable from patient

> a. A material departure from generally accepted accounting principles will result in auditor consideration of: (1) Whether to issue an adverse opinion rather than a disclaimer of opinion. (2) Whether to issue a disclaimer of opinion rather than a qualifi

> Assume that you are a partner with the firm of Slater & Lowe LLP. You have been asked by Grayson, Inc., an industrial supply company, to provide assurance about the change in existing customer satisfaction over the last three years. Grayson’s management

> SysTrust and WebTrust are Trust Services developed by the AICPA and the CICA. Required: a. Present and describe the Trust Services principles. b. Present and describe the “criteria” related to Trust Services. c. What is the relationship between the prin

> Loman, CPA, who has audited the financial statements of the Broadwall Corporation, a publicly held company, for the year ended December 31, 20X6, was asked to perform a review of the financial statements of Broadwall Corporation for the period ending Mar

> Jiffy Clerical Services is a company that furnishes temporary office help to its customers. The company maintains its accounting records on a basis of cash receipts and cash disbursements. You have audited the company for the year ended December 31, 20X4

> Your working papers for an integrated audit being performed under PCAOB AS 2201 include the narrative description below of the cash receipts and billing portions of internal control of Slingsdale Building Supplies, Inc. Slingsdale is a single-store retai

> Assume that during the audit of the public Chandler Corporation the following critical audit matter was identified and summarized for purposes of inclusion in the audit report. Critique presentation and details of the matter. Critical Audit Matter

> Roscoe & Jones, Ltd., a CPA firm in Silver Bell, Arizona, has completed the audit of the financial statements of Excelsior Corporation as of, and for, the year ended December 31, 20X1. Findings related to the financial statements and the audit include ∙

> Sturdy Corporation (a nonpublic company) owns and operates a large office building in a desirable section of New York City’s financial center. For many years, management of Sturdy Corporation has modified the presentation of its financial statement by 1.

> The auditors’ report that follows was drafted by a staff accountant of Smith & Co., CPAs, at the completion of the audit of the financial statements of Lenses Co. (a public company) for the year ended December 31, 20X7. Required:

> Robertson Company had accounts receivable of $200,000 at December 31, 20X0, and had provided an allowance for uncollectible accounts of $6,000. After performing all normal auditing procedures relating to the receivables and to the valuation allowance, th

> During your observation of the November 30, 20X0, physical inventory of Jay Company, you note the following unusual items: a. Electric motors in finished goods storeroom not tagged. Upon inquiry, you are informed that the motors are on consignment to Jay

> Rowe Manufacturing Company has about 50 production employees and uses the following payroll procedures. The factory supervisor interviews applicants and on the basis of the interview either hires or rejects the applicants. After being employed, the appli

> In connection with an audit of the financial statements of Olympia Company, the auditors are reviewing procedures for accumulating direct labor-hours. They learn that all production is by job order and that all employees are paid hourly wages, with time

> The following are typical questions that might appear on an internal control questionnaire for payroll activities: 1. Is there adequate separation of duties between employees who maintain human resources records and employees who approve payroll disburse

> Your client is a company that owns a shopping center with 30 store tenants. All leases with the store tenants provide for a fixed rent plus a percentage of sales, net of sales taxes, in excess of a fixed dollar amount computed on an annual basis. Each le

> Rita King, your staff assistant on the April 30, 20X2, audit of Maxwell Company, was transferred to another assignment before she could prepare a proposed adjusting journal entry for Maxwell’s Miscellaneous Revenue account, which she ha

> You are engaged in the audit of Phoenix Corp., a new client, at the close of its first fiscal year, April 30, 20X1. The accounts had been closed before the time you began your year-end fieldwork. You review the following stockholders’ e

> You have received confirmations from the transfer agent and the registrar of Lowe Company as to the number of authorized and outstanding shares as of December 31, 20X1, Lowe’s year-end. a. Which financial statement assertions do these confirmations most

> Robert Hopkins was the senior office employee at the Griffin Equipment Company. He enjoyed the complete confidence of the owner, William Barton, who devoted most of his attention to sales, engineering, and production problems. All financial and accountin

> Your client, Software and Stuff (Software), has developed a new electronic game. One part of the game uses software developed by another company, Component of Yuma (Component). Software signed an agreement with Component that provides that Software will

> Marshall and Wyatt, CPAs, has been the independent auditor of Interstate Land Development Corporation for several years. During these years, Interstate prepared and filed its own annual income tax returns. During 20X4, Interstate requested Marshall and W

> The observation of a client’s physical inventory is a mandatory auditing procedure when possible for the auditors to carry out and when inventories are material. Required: a. Why is the observation of physical inventory a mandatory auditing procedure? E

> The audit staff of Adams, Barnes & Co. (ABC), CPAs, reported the following audit findings in their 20X5 audit of Keystone Computers & Networks (KCN), Inc.: 1. Unrecorded liabilities in the amount of $6,440 for purchases of inventory. These inventory item

> As part of your first audit of the financial statements of Marina del Rey, Inc., you have decided to confirm some of the accounts payable. You are now in the process of selecting the individual companies to whom you will send accounts payable confirmatio

> The following are typical questions that might appear on an internal control questionnaire for accounts payable. 1. Are monthly statements from vendors reconciled with the accounts payable listing? 2. Are vendors’ invoices matched with receiving reports

> You are the senior accountant in the audit of Granger Grain Corporation, whose business primarily involves the purchase, storage, and sale of grain products. The corporation owns several elevators located along navigable water routes and transports its g

> Western Trading Company is a sole proprietorship engaged in the grain brokerage business. On December 31, 20X0, the entire grain inventory of the company was stored in outside bonded warehouses. The company’s procedure of pricing inventories in these war

> You have been with Zaird & Associates for approximately three months and are completing your work on the BizCaz audit. BizCaz produces pullover knit shirts to address the business casual market for both men and women. Although your experience has been li

> Hovington, CPA, knows that while audit objectives relating to inventories may be stated in terms of the assertions as presented in this chapter, they also may be subdivided and stated more specifically. He has chosen to do so and has prepared the second

> Smith is the partner in charge of the audit of Blue Distributing Corporation, a wholesaler that owns one warehouse containing 80 percent of its inventory. Smith is reviewing the working papers that were prepared to support the firm’s opinion on Blue’s fi

> For each of the following independent cases, state the highest level of deficiency that you believe the circumstances represent: a control deficiency, a significant deficiency, or a material weakness. Explain your decision in each case. Case 1: The comp

> Your firm audits Metropolitan Power Supply (MPS). The issue under consideration is the treatment in the company’s financial statements of $700 million in capitalized construction costs relating to Eagle Mountain, a partially completed nuclear power plant

> Many companies employ outside service companies that specialize in counting, pricing, extending, and footing inventories. These service companies usually furnish a certificate attesting to the value of the physical inventory. Required: Assuming that the

> For each of the following brief scenarios, assume that you are reporting on a client’s current-year financial statements. Reply as to the type or types of opinion possible in the circumstance. S Unmodified—standard U Unmodified with emphasis-of-matter or

> You are a young CPA just starting your own practice in Hollywood, California, after five years’ experience with a “Big 4” firm. You have several connections in the entertainment industry and hope to develop a practice rendering income tax, auditing, and

> The auditors’ working paper that relates control strengths and weaknesses to the assertions about purchases and accounts payable is presented in Appendix 14A. This working paper also presents the auditors’ planned assessed level of control risk for each

> As indicated on the control risk assessment working paper in Appendix 14A, the auditors identified two weaknesses in internal control over the acquisition cycle of KCN. Describe the implications of each of the two weaknesses in terms of the type of error

> A summary of the controls for the acquisition cycle of Keystone Computers & Networks, Inc., appears in Appendix 14A. Required: a. For the following three controls over the acquisition cycle, indicate one type of error or fraud that the control serve

> Chem-Lite, Inc., maintains its accounts on the basis of a fiscal year ending March 31. At March 31, 20X1, the Equipment account in the general ledger appeared as shown below. The company uses straight-line depreciation, a 10-year life, and 10 percent sal

> Robert Myers, CPA, has been engaged to audit the City of Mystic in accordance with the Single Audit Act. Robert is aware that the Single Audit Act requires additional tests of major federal financial assistance programs, and he is trying to identify thos

> You are reviewing the property, plant, and equipment working papers of Mandville Corporation, a company that publishes travel guides. The lead schedule for the account is included in the chapter as Figure 13.1. The following are among the findings relati

> For each of the following brief scenarios, assume that you are the CPA reporting on the financial statements of a nonpublic company. Using the form included with this problem, describe the reporting circumstance involved, the type or types of opinion pos

> Assume that you are a CPA interested in expanding your services to provide System and Organization Controls Control (SOC) reports. Access the AICPA store website (aicpastore. com) and find guidance that will help you achieve your goal. Skim through the a

> Webstar, a nonpublic company, is owned by Ben Williams and three of his friends. Previously, the company’s financing has been internally generated, with limited equity contributions by the owners. The company has not been audited in the past, and William

> Nancy Howe, your staff assistant on the April 30, 20X2, audit of Wilcox Company, was transferred to another audit engagement before she could complete the audit of unrecorded accounts payable. Her working paper, which you have reviewed and are satisfied

> Taylor, CPA, is engaged in the audit of Rex Wholesaling for the year ended December 31. Taylor obtained an understanding of internal control relating to the purchasing, receiving, trade accounts payable, and cash disbursement cycles and has decided not t

> You are engaged in the audit of the financial statements of Holman Corporation for the year ended December 31, 20X6. The accompanying analyses of the Property, Plant, and Equipment and related accumulated depreciation accounts have been prepared by the c

> Assume that you are auditing the financial statements of Agee Corporation. During the course of the audit, you discover the following circumstances. 1. Management of Agee has decided to discontinue the production of consumer electronics, which represents

> You are an audit manager of the rapidly growing CPA firm of Raye and Coye. You have been placed in charge of three new audit clients, which have the following inventory features: 1. Canyon Cattle Co., which maintains 15,000 head of cattle on a 1,000-squa

> You are involved in your CPA firm’s first audit of Zorostria, a retailer of artwork, primarily paintings and photographs purchased from artists in Southeast Asia (particularly Vietnam, Cambodia, and Laos). Zorostria has stores in seven cities throughout

> The following are typical questions that might appear on an internal control questionnaire for inventory: 1. Are written procedures prepared by the client for the taking of the physical inventory? 2. Do the client’s inventory-taking procedures include a

> Described below are potential financial statement misstatements that are encountered by auditors in the audit of inventory and cost of goods sold. a. Management of a chain of discount department stores systematically overstates inventory quantities at se

> Katherine Whipple of Food Queen Grocery, In., has asked you and your team to meet with her concerning a possible attest engagement relating to the assertion that Food Queen has the lowest overall prices of all grocery stores in the Salt Lake City area. F

> Williams Pharmaceutical Company produces a number of drugs that are regulated by various agencies, including, in the United States, the federal Food and Drug Administration (FDA). These agencies issue licenses that approve drugs for sale and establish sp

> Described below are potential financial statement misstatements that are encountered by auditors. a. Inventory is understated because warehouse personnel overlooked several racks of parts in taking the physical inventory. b. Inventory is overstated becau

> Under the Single Audit Act, auditors must test for compliance with the specific requirements of all major programs. State whether each of the following is required under that act: Is it Statement required? a. Determine that the organization complles

> Select the best answer for each of the following questions. Explain the reasons for your selection. a. Internal auditing can best be described as: (1) An accounting function. (2) A compliance function. (3) An activity primarily to detect fraud. (4) A con

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partlal Definition) Term a. A service developed by the AICPA and CICA to provide assurance 1. CBIZ 2. Financl

> For each of the situations (a) through (e), select the CPA engagement that is most likely to be appropriate from the list of services below: 1. Compliance 2. Continuous auditing 3. Forecast 4. Internal control over financial reporting 5. MD&A 6. Prim

> Indicate whether a CPA may provide each of the following services, and whether independence is required, by placing a check in the appropriate box. May Provide; Independence Independence May Not Is Required May Provide; Service Is Not Required Prov

> Following are descriptions of potential needs of clients for various services. For each need, identify the type of service that would best meet the client’s need using the following: ∙ Attestation of prospective financ

> Select the best answer for each of the following and explain fully the reason for your selection. a. A report on an attestation engagement should: (1) State the nature of the client’s control system. (2) State the practitionerâ

> Auditors who audit public and nonpublic companies must be familiar with professional standards developed by a variety of sources. For each of the types of services, indicate the proper source of professional requirements. Each source may be used once, mo

> The following are typical questions that might appear on an internal control questionnaire relating to plant and equipment: 1. Has a dollar minimum been established for expenditures to be capitalized? 2. Are subsidiary ledgers for plant and equipment reg

> Indicate whether a CPA may provide each of the following services, and whether independence is required, by placing a check in the appropriate box. May Provide; Independence Independence Is Required May Provide; Service Is Not Required May Not Provi

> State whether you agree or disagree with each of the following relating to the topic of special-purpose financial reporting frameworks. a. International Financial Reporting Standards are considered a special-purpose financial reporting framework. b. Cash

> Bill Jones, the president of AMTO, a nonpublic audit client of your firm, has come to you and indicated that his company established a subsidiary in the country of Laos this year and that he wants your firm to issue an audit report on that subsidiary for

> The following statements relate to auditor reporting on financial statements prepared using special-purpose financial reporting frameworks. For each, indicate whether the statement is correct or incorrect. Statement Correct Incorrect 1. A speclal-p

> Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is not typically performed when the auditors are performing a review of client financial statements? (1) Analytical procedures app

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partial Definition) Term a. A control deficlency, or a combination of control deficlencles, In Internal contr

> During audits of internal control over financial reporting of various issuers, the auditors encountered the independent situations below. For each situation a through e select from the following list the appropriate audit responses. Each reply may be use

> Bill Jensen, a staff member of Zhan & Co., CPAs, has given you the following list of what he refers to as “internal control deficiencies” for the Zabling Co. audit and has asked you to review each point and make certain that you agree that each is an int

> While performing an internal control audit in conformity with PCAOB AS 2201, the auditors must be able to identify both control strengths and control weaknesses. Items (1) through (11) present various control strengths and deficiencies. For each item, se

> Select the best answer for each of the following questions. Explain the reasons for your selection: a. In an integrated audit, which of the following must the auditors communicate to the audit committee? b. In an integrated audit, which of the followi

> Your client, Summerford, Inc., has a debt agreement with Valley City Bank that includes a number of restrictions and covenants. Violation of any restriction or covenant results in the entire amount of the debt becoming due immediately. For each of the fo

> This simulation, available online, presents a draft of a nonpublic company audit report document and three exhibits. To allow this DRS to stand alone without consideration of other parts of the Keystone Computers & Networks, Inc. (Keystone) case, ass

> Johnson & Barkley, CPAs, audited the consolidated financial statements of Jordan Company (a public company) for the year ended December 31, 20X7. Johnson & Barkley previously have audited and issued standard unqualified audit reports on Jordan Company’s

> For each of the following brief scenarios, assume that you are reporting on a client’s financial statements. Reply as to the type(s) of opinion (per below) possible for the scenario. In addition: ∙ Unless stated otherw

> Items 1 through 5 present various independent factual situations an auditor might encounter in conducting an audit of a nonpublic company. For each situation, assume: ∙ The auditor is independent. ∙ The auditor previou

> For each of the account balances and associated assertions below, select the audit procedure from the list provided that provides the most appropriate audit evidence for the account assertion. //

> Match the following terms to the appropriate definition (or partial definition). Each definition is used once. Term Definition (or Partial Definition) a. Commitment b. Contingent llablity c. General risk 1. A contractual obligation to carry out a tr

> In connection with her audit of the financial statements of Flowmeter, Inc., for the year ended December 31, 20X3, Joan Hirsch, CPA, is aware that certain events and transactions that have taken place after December 31, 20X3, but before she has issued he

> In connection with your audit of the financial statements of Hollis Mfg. Corporation for the year ended December 31, 20X3, your review of subsequent events disclosed the following items: a. January 7, 20X4: The mineral content of a shipment of ore en rou

> The following situations represent excerpts from the responses to audit inquiries of external legal counsel of XYZ Co. during the annual audit of year 1 (“legal response”). For each excerpt, select the most appropriate

> Select the best answer for each of the following and give reasons for your choice: a. Which of the following is least likely to be considered a substantive procedure relating to payroll? (1) Investigate fluctuations in salaries, wages, and commissions. (

> The auditors’ report that follows was drafted by a staff accountant of Williams & Co., CPAs, at the completion of the audit of the financial statements of Lenz Corporation (nonpublic company) for the year ended December 31, 20X1. As

> Match the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partial Definition) Term a. An Institutlon charged with responslblity for avolding 1. Common stock overissuanc

> Select the best answer choice for each of the following, and justify your selection in a brief statement. a. Which of the following is least likely to be an audit objective for debt? (1) Determine the existence of recorded debt. (2) Establish the complet

> This simulation, available online, presents an audit request list document for materials requested of management that has been prepared by an audit team staff member for the Keystone audit. Because this simulation addresses material presented in Chapters

> In applying audit procedures and evaluating the results of those procedures, auditors may encounter specific information that may raise a question concerning the existence of noncompliance with laws and related party transactions. Indicate whether each o

> The auditors of SSC Company, a nonpublic company, are working on both audit objectives for the various accounts and documentation requirements. Parts (a) through (d) of this question relate to objectives, while part (e) addresses documentation. The audit

> The following flowchart depicts the activities relating to the purchasing, receiving, and accounts payable departments of Model Company, Inc. Assume that you are a supervising assistant assigned to the Model Company audit. Joe Werell, a beginning assis

> Select the best answer for each of the following and explain the reason for your selection. a. Which of the following procedures is least likely to be completed before the balance sheet date? (1) Confirmation of receivables. (2) Search for unrecorded lia

> a. Analysis of which account is least likely to reveal evidence relating to recorded retirement of equipment? (1) Accumulated depreciation. (2) Insurance expense. (3) Property, plant, and equipment. (4) Purchase returns and allowances. b. Which of the f

> Hwang Corporation has engaged in a number of expenditures relating to a land acquisition for a future plant. For each of the following, indicate whether you as the auditor of Hwang Corporation would propose an adjusting entry. Assume all transactions are