Question: You just started a summer internship with

You just started a summer internship with the successful management consulting firm of Kirk, Spock, and McCoy. Your first day on the job was a busy one, as the following problems were presented to you.

Required:

Supply the requested comments in each of the following independent situations.

1. Alderon Enterprises is evaluating a special order it has received for a ceramic fixture to be used in aircraft engines. Alderon has recently been operating at less than full capacity, so the firm’s management will accept the order if the price offered exceeds the costs that will be incurred in producing it. You have been asked for advice on how to determine the cost of two raw materials that would be required to produce the order.

a. The special order will require 900 gallons of endor, a highly perishable material that is purchased as needed. Alderon currently has 1,300 gallons of endor on hand, since the material is used in virtually all of the company’s products. The last time endor was purchased, Alderon paid $10.00 per gallon. However, the average price paid for the endor in stock was only $9.50. The market price for endor is quite volatile, with the current price at $11.00. If the special order is accepted, Alderon will have to place a new order next week to replace the 900 gallons of endor used. By then the price is expected to reach $11.50 per gallon.

Using the cost terminology introduced in Chapter 2, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of endor if the special order is produced?

b. The special order would also require 1,400 kilograms of tatooine, a material not normally required in any of Alderon’s regular products. The company does happen to have 1,900 kilograms of tatooine on hand, since it formerly manufactured a ceramic product that used the material. Alderon recently received an offer of $28,000 from Solo Industries for its entire supply of tatooine. However, Solo Industries is not interested in buying any quantity less than Alderon’s entire 1,900-kilogram stock. Alderon’s management is unenthusiastic about Solo’s offer, since Alderon paid $40,000 for the tatooine. Moreover, if the tatooine were purchased at today’s market price, it would cost $22.00 per kilogram. Due to the volatility of the tatooine, Alderon will need to get rid of its entire supply one way or another. If the material is not used in production or sold, Alderon will have to pay $2,000 for each 500 kilograms that is transported away and disposed of in a hazardous waste disposal site.

Using the cost terminology introduced in Chapter 2, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of tatooine to be used in the special order?

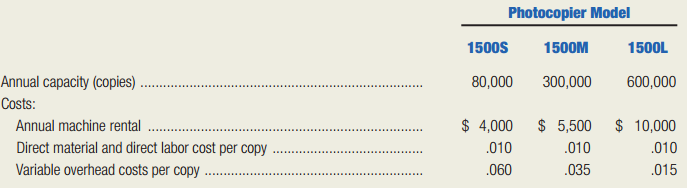

2. CopyFast Company, a specialist in printing, has established 500 convenience photo copying centers throughout the country. In order to upgrade its services, the company is considering three new models of laser copying machines for use in producing high-quality copies. These high-quality copies would be added to the growing list of products offered in the CopyFast shops. The selling price to the customer for each laser copy would be the same, no matter which machine is installed in the shop. The three models of laser copying machines under consideration are: 1500S, a smallvolume model; 1500M, a medium-volume model; and 1500L, a large-volume model. The annual rental costs and the operating costs vary with the size of each machine. The machine capacities and costs are as follows:

a. Calculate the volume level in copies where CopyFast Company would be indifferent to acquiring either the small-volume model laser copier, 1500S, or the medium-volume model laser copier, 1500M.

b. The management of CopyFast Company is able to estimate the number of copies to be sold at each establishment. Present a decision rule that would enable management to select the most profitable machine without having to make a separate cost calculation for each establishment.

(Hint: To specify a decision rule, determine the volume at which CopyFast Company would be indifferent between the small and medium copiers. Then determine the volume at which the company would be indifferent between the medium and large copiers.)

3. A local PBS station has decided to produce a TV series on state-of-the-art manufacturing. The director of the TV series, Justin Tyme, is currently attempting to analyze some of the projected costs for the series. Tyme intends to take a TV production crew on location to shoot various high-tech manufacturing scenes as they occur. If the four-week series is shown in the 8:00–9:00 p.m. prime-time slot, the station will have to cancel a wildlife show that is currently scheduled. Management projects a 10 percent viewing audience for the wildlife show, and each 1 percent is expected to bring in donations of $20,000. In contrast, the manufacturing show is expected to be watched by 15 percent of the viewing audience. However, each 1 percent of the viewership will likely generate only $10,000 in donations. If the wildlife show is canceled, it can be sold to network television for $50,000.

Using the cost terminology introduced in Chapter 2, comment on each of the financial amounts mentioned in the preceding discussion. What are the relative merits of the two shows regarding the projected revenue to the station?

Transcribed Image Text:

Photocopier Model 1500S 1500M 1500L Annual capacity (copies) 80,000 300,000 600,000 Costs: Annual machine rental $ 4,000 $ 5,500 $ 10,000 Direct material and direct labor cost per copy Variable overhead costs per copy .010 .010 .010 .060 .035 .015

> Since you have always wanted to be an industrial baron, invent your own product and describe at least five steps used in its production. Required: Explain how you would go about identifying non-value-added costs in the production process.

> Visit the website of a city, state, or Canadian province of your choosing (e.g., the City of Charlotte, www.charmeck.org ). Required: Read about the services offered to the public by this governmental unit. Then discuss how activity-based costing could

> Refer to the information given in the preceding exercise. For each of the activity cost pools identified, indicate whether it represents a unit-level, batch-level, product-sustaining-level, or facility-level activity. Information from previous exercise:

> Windy City Design Company specializes in designing commercial office space in Chicago. The firm’s president recently reviewed the following income statement and noticed that operating profits were below her expectations. She had a hunch

> Give an example of managerial accounting information that could help a manager make each of the following decisions. 1. The production manager in an automobile plant is deciding whether to have routine maintenance performed on a machine weekly or biweekl

> The customer-profitability analysis for Patio Grill Company, which is displayed in Exhibit 5–14 , ranks customers by operating income. An alternative, often-used approach is to rank customers by sales revenue. Exhibit 5-14: Exhibit

> Visit a restaurant for a meal or think carefully about a recent visit to a restaurant. List as many a activities as you can think of that would be performed by the restaurant’s employees for its customers. Required: For each activity on your list, indi

> List five activities performed by the employees of an airline on the ground. Required: For each of these activities, suggest a performance measure that could be used in activitybased management.

> Non-value-added costs occur in nonmanufacturing organizations, just as they do in manufacturing firms. Required: Identify four potential non-value-added costs in (1) an airline, (2) a bank, and (3) a hotel.

> United Technologies Corporation is using activity-based costing in two of its subsidiaries: Otis Elevator Company and Carrier Corporation. The following table shows 27 activities and eight accounts identified at Carrier, along with the classification det

> Zodiac Model Rocketry Company sells model rocketry kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by Zodiac, while others are purchased for resale. For the products it manufactures, the company currently b

> Seneca Falls Winery is a small, family-run operation in upstate New York. The winery produces two varieties of wine: riesling and chardonnay. Among the activities engaged in by the winery are the following: 1. Trimming: At the end of a growing seas

> Refer to the description given for Wheelco, Inc., in the preceding exercise. Suppose the firm’s president has decided to implement an activity-based costing system. Description for Wheelco, Inc.: Wheelco, Inc. manufactures automobile and truck wheels.

> Wheelco, Inc. manufactures automobile and truck wheels. The company produces four basic, h ighvolume wheels used by each of the large automobile and pickup truck manufacturers. Wheelco also has two specialty wheel lines. These are fancy, complicated whee

> Rainbow Spray Paints, Inc. has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 16 percent of direct-labor cost. Monthly direct-labor cost for the enamel paint line is $98,000. In an attempt

> SofTech, Inc., a developer and distributor of business applications software, has been in business for five years. SofTech’s sales have increased steadily to the current level of $25 million per year. The company has 250 employees. Jennifer Nolan joined

> What will happen to a company’s break-even point if the sales price and unit variable cost of its only product increase by the same dollar amount?

> Digitech, Ltd. manufactures various computer components in its Tokyo plant. The following costs are budgeted for January. (Yen is the Japanese monetary unit.) Insurance, plant ................................................................. 780,000 yen

> Precision Lens Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

> Service-industry firms can make effective use of ABC systems as well as manufacturers. For each of the following businesses, list five key activities that are important in the provision of the firm’s service. For each activity cost pool, suggest an appro

> Madison Electric Pump Corporation’s controller, Erin Jackson, developed new product costs for the three pump models using activity-based costing. It was apparent that the firm’s traditional product costing system had been under costing the advanced model

> Refer to the product costs developed in requirement (2) of the preceding problem. Prepare a table showing how Madison Electric Pump Corporation’s traditional, volume-based product-costing system distorts the product costs of the three p

> Madison Electric Pump Corporation manufactures electric pumps for commercial use. The company produces three models, designated as regular, advanced, and deluxe. The company uses a job-order cost accounting system with manufacturing overhead applied on t

> Cincinnati Cycle Company produces two subassemblies, JY-63 and RX-67, used in manufacturing motorcycles. The company is currently using an absorption costing system that applies overhead based on direct-labor hours. The budget for the current year ending

> Define the term equivalent unit and explain how the concept is used in process costing.

> List three nonmanufacturing businesses in which process costing could be used. For example, a public accounting firm could use process costing to accumulate the costs of processing clients' tax returns

> Distinguish between product costs and period costs.

> List five types of manufacturing in which process costing would be an appropriate product-costing system. What is the key characteristic of these products that makes process costing a good choice?

> Explain the concept of operation costing. How does it differ from process or job-order costing? Why is operation costing well suited for batch manufacturing processes?

> How would the process-costing computations differ from those illustrated in the chapter if overhead were applied on some activity base other than direct labor?

> How does process costing differ under normal or actual costing?

> Explain the reasoning underlying the name of the weighted-average method.

> A food processing company has two sequential production departments: mixing and cooking. The cost of the January 1 work in process in the cooking department is detailed as follows: Direct material .........................................................

> List and briefly describe the purpose of each of the four process-costing steps.

> What are the purposes of a product-costing system?

> Explain the primary differences between job-order and process costing.

> What is the purpose of a departmental production report prepared using process costing?

> The following cost data for the year just ended pertain to Heartstrings, Inc., a greeting card manufacturer: Required: 1. Compute each of the following costs for the year just ended: (a) total prime costs, (b) total manufacturing overhead costs, (c) to

> Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process. Work in process, April 1—10,000 units: Direct material: 100% comple

> Toronto Titanium Corporation manufactures a highly specialized titanium sheathing material that is used extensively in the aircraft industry. The following data have been compiled for the month of June. Conversion activity occurs uniformly throughout the

> Orbital Industries of Canada, Ltd. manufactures a variety of materials and equipment for the aerospace industry. A team of R&D engineers in the firm's Winnipeg plant has developed a new material that will be useful for a variety of purposes in orbiti

> Plattsburg Plastics Corporation manufactures a variety of plastic products, including a series of molded chairs. The three models of molded chairs, which are all variations of the same design, are Standard (can be stacked), Deluxe (with arms), and Execut

> (Based on a problem contributed by Roland Minch.) Celestial Glass Company manufactures a variety of glass windows in its Charleston plant. In department I clear glass sheets are produced, and some of these sheets are sold as finished goods. Other sheets

> SolarTech Company manufactures a special lacquer, which is used in the aeronautical and space industries. Two departments are involved in the production process. In the Mixing Department, various chemicals are entered into production. After processing, t

> The following data pertain to the Canandaigua Carpet Company for January. Work in process, January 1 (in units) ........................... 25,000 Units started during January .................................................. ? Total units to account fo

> Beowulf and Grendel, a public accounting firm in London, is engaged in the preparation of income tax returns for individuals. The firm uses the weighted-average method of process costing for internal reporting. The following information pertains to Febru

> Lawncraft, Inc. manufactures wooden lawn furniture using an assembly-line process. All direct materials are introduced at the start of the process, and conversion cost is incurred evenly throughout manufacturing. An examination of the company's Work-in-P

> The following data pertain to the Fantasia Flour Milling Company for the month of October. Work in process, October 1 (in units) ..................................... ? Units started during October ........................................ 70,000 Total un

> Texarkana Corporation assembles various components used in the computer industry. The company's major product, a disk drive, is the result of assembling three parts: JR1163, JY1065, and DC0766. The following information relates to activities of April: •

> Circle D Fastener Corporation accumulates costs for its single product using process costing. Direct material is added at the beginning of the production process, and conversion activity occurs uniformly throughout the process. A partially completed prod

> Atlantic City Taffy Company produces various kinds of candy, but salt-water taffy is by far its most important product. The company accumulates costs for its product using process costing. Direct material is added at the beginning of the production proce

> Jupiter Corporation manufactures home security devices. During 20x4, 1,000,000 units were completed and transferred to finished-goods inventory. On December 31, 20x4, there were 310,000 units in work in process. These units were 48 percent complete as to

> Use the Internet to access the website for Weyerhaeuser (www.weyerhaeuser.com), International Paper ( www.internationalpaper.com ), or Boise Cascade (www.boisecascade.com Required: Skim over the information presented on the website about the company's

> Raleigh Textiles Company manufactures a variety of natural fabrics for the clothing industry. The following data pertain to the Weaving Department for the month of November. Equivalent units of direct material (weighted-average method............... 62,

> The following data pertain to Tuscaloosa Paperboard Company, a manufacturer of cardboard boxes. Work in process, March 1……………………..………. 10,000 units* Direct material ............................................................. $ 10,900 Conversion ......

> Montana Lumber Company grows, harvests, and processes timber for use in construction. The following data pertain to the firm's sawmill during June. Work in process, June 1 Direct material ............................................................. $ 74

> Refer to the preceding problem regarding Bandway Company. Complete the job-cost record for Job number T79. (Assume that all of the labor hours for job T79 occurred during the week of 10/8 through 10/12.) Job number T79: BANDWAY COMPANY JOB-COST RECO

> Duluth Glass Company manufactures window glass for automobiles. The following data pertain to the Plate Glass Department. Work in process, February 1 Direct material .......................................... $ 43,200 Conversion .........................

> According to some estimates, the volume of electronic commerce transactions exceeds $3 trillion. Business to-business transactions account for almost half of this amount. What changes do you believe are in store for managerial accounting as a result of t

> Bandway Company manufactures brass musical instruments for use by high school students. The company uses a normal-costing system, in which manufacturing overhead is applied on the basis of directlabor hours. The company’s budget for the current year incl

> Andromeda Glass Company manufactures decorative glass products. The firm employs a processcosting system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly through

> Conundrum, Inc. manufactures puzzles. Due to a fire in the administrative offices, the accounting records for September of the current year were partially destroyed. You have been able to piece together the following information from the ledger. Upon ex

> PetroTech Company refines a variety of petrochemical products. The following data are from the firm's Amarillo plant. Work in process, July 1................................................... 1,900,000 liters Direct material ........

> Rochester Heating Systems, Inc. calculates its predetermined overhead rate on a quarterly basis. The following estimates were made for the current year. The firm’s main product, part number SC71, requires $600 of direct material and 20

> The Milwaukee plant of Healthy Life Styles, Inc. produces low-fat salad dressing. The following data pertain to the year just ended. During the year the company started 140,000 gallons of material in production. Required: Prepare a schedule analyzing t

> Tiana Shar, the controller for Caesar Glassware Company, is in the process of analyzing the overhead costs for the month of November. She has gathered the following data for the month. Labor Direct-labor hours: Job 57 ................................

> In each case below, fill in the missing amount. 1. Work in Process, June 1 ......................................................... 10,000 pounds Units started during June .........................................................................? Units

> Marvelous Marshmallow Company’s cost of goods sold for January was $690,000. January 31 working process inventory was 90 percent of January 1 work-in-process inventory. Manufacturing overhead applied was 50 percent of direct-labor cost. Other information

> The November production of MVP's Minnesota Division consisted of batch P25 (2,000 professional basketballs) and batch S33 (4,000 scholastic basketballs). Each batch was started and finished during November, and there was no beginning or ending work in pr

> A division manager is responsible for each of Resolute Electronics Corporation’s (REC) divisions. Each division’s controller, assigned by the corporate controller’s office, manages the division’s accounting system and provides analysis of financial infor

> Joey Dulwich has recently been hired as a cost management specialist by Offset Press Company, a privately held company that produces a line of offset printing presses and lithograph machines. During his first few months on the job, Dulwich discovered tha

> Lycoming Leather Company manufactures leather goods in central Pennsylvania. The company's profits have declined during the past nine months. In an attempt to isolate the causes of poor profit performance, management is investigating the manufacturing op

> Seaway, Inc. manufactures outboard motors and an assortment of other marine equipment. The company uses a job-order costing system. Normal costing is used, and manufacturing overhead is applied on the basis of machine hours. Estimated manufacturing overh

> Briefly describe two ways of closing out over applied or under applied overhead at the end of an accounting period.

> Refer to the schedule of cost of goods manufactured prepared for Superior Metals Corporation in the preceding problem. Data from preceding problem (8): Required: 1. How much of the manufacturing costs incurred during 20x4 remained associated with work-

> What is the cause of over applied or under applied overhead?

> Golden State Enterprises provides consulting services throughout California and uses a job-order costing system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by Go

> What is meant by the term cost driver? What is a volume-based cost driver?

> Juarez, Inc. uses a job-order costing system for its products, which pass from the Machining Department, to the Assembly Department, to finished-goods inventory. The Machining Department is heavily automated; in contrast, the Assembly Department performs

> Why is manufacturing overhead applied to products when product costs are used in making pricing decisions?

> For each of the following activities, explain which of the objectives of managerial accounting activity is involved. In some cases, several objectives may be involved. 1. Measuring the cost of the inventory of tablet computers on hand in a retail electro

> Southwestern Fashions, Inc. which uses a job-order costing system, had two jobs in process at the start of the year: job no. 101 ($168,000) and job no. 102 ($107,000). The following information is available: a. The company applies manufacturing overhead

> How is the concept of product costing applied in service industry firms?

> Dessert Delite Company produces frozen microwavable desserts. The following accounts appeared in the ledger as of December 31. Additional information: a. Accounts payable is used only for direct-material purchases. b. Underapplied overhead of $3,500 fo

> Explain how a Texas Instruments engineer might use bar code technology to record the time she spends on various activities.

> Birmingham Bowling Ball Company (BBBC) uses a job-order costing system to accumulate manufacturing costs. The company’s work-in-process on December 31, 20x3, consisted of one job (no. 3088), which was carried on the year-end balance sheet at $78,400. The

> Describe how a large retailer such as Lowes could use EDI.

> Vermont Clock Works manufactures fine, handcrafted clocks. The firm uses a job-order costing system, and manufacturing overhead is applied on the basis of direct-labor hours. Estimated manufacturing overhead for the year is $260,000. The firm employs 10

> Define each of the following terms, and explain the relationship among them: a. Overhead cost distribution b. Service department cost allocation c. Overhead application.

> ColorTech Corporation manufactures two different color printers for the business market. Cost estimates for the two models for the current year are as follows Each model of printer requires 20 hours of direct labor. The basic system requires 5 hours in

> When a single, volume-based cost driver (or activity base) is used to apply manufacturing overhead, what is the managerial accountant’s primary objective in selecting the cost driver?

> Suppose the fixed expenses of a travel agency increase. What will happen to its break-even point, measured in number of clients served? Why?

> Refer to the illustration of overhead application in the Midtown Advertising Agency on pp. 104–105. Suppose the firm used a single cost driver, total staff compensation, to apply overhead costs to each ad contract From pp. 104-105: To illustrate the cos

> Why are some manufacturing firms switching from direct-labor hours to machine hours or throughput time as the basis for overhead application?

> Refer to Exhibit 3–12, which portrays the three types of allocation procedures used in two-stage allocation. Give an example of each of these allocation procedures in a hospital setting. The ultimate cost object is a patient-day of hosp

> Give an example of how a hospital, such as the Mayo Clinic, might use job-order costing concepts.

> Suppose you are the controller for a company that produces handmade glassware. 1. Choose a volume-based cost driver upon which to base the application of overhead. Write a memo to the company president explaining your choice. 2. Now you have changed jobs

> Describe the flow of costs through a product-costing system. What special accounts are involved, and how are they used?

> Rocky Mountain Leatherworks, which manufactures saddles and other leather goods, has three departments. The Assembly Department manufactures various leather products, such as belts, purses, and saddlebags, using an automated production process. The Saddl

> Describe an important cost-benefit issue involving accuracy versus timeliness in accounting for overhead.