Question: Zeno Inc. sold two capital assets in

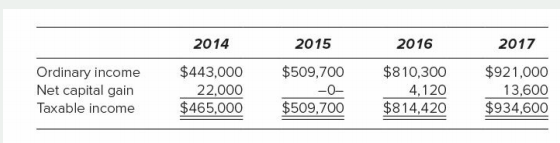

Zeno Inc. sold two capital assets in 2018. The first sale resulted in a $53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zeno was incorporated in 2014, and its tax records provide the following information.

Transcribed Image Text:

2014 2015 2016 2017 $443,000 $509,700 $810,300 4,120 $814,420 $921,000 Ordinary income Net capital gain Taxable income 22,000 $465,000 -0- $509,700 13,600 $934,600

> Ten years ago, Ms. Dee purchased 1,000 shares of Fox common stock for $124 per share. On June 2 of the current year she sold 500 shares for $92 per share. Compute Ms. Dee’s recognized loss on sale assuming that: a. She purchased 600 shares of Fox common

> Corporation A and Corporation Z go into partnership to develop, produce, and market a new product. The two corporations contribute the following properties in exchange for equal interests in AZ Partnership. Corporation A’s tax basis i

> Firm W has the opportunity to invest $150,000 in a new venture. The projected cash flows from the venture are as follows: Determine if Firm W should make the investment, assuming that: a. It uses a 6 percent discount rate to compute NPV. b. It uses a 3

> Lydia and Oliver want to form a partnership to conduct a new business. They each contribute the following assets in exchange for equal interests in LO Partnership. Lydia’s tax basis in the contributed equipment is $22,000, and Oliver&ac

> Refer to the facts in the preceding problem. Assume that Mrs. L, who is Mr. ZJ’s business colleague, transfers $200,000 cash to ZJL Corporation in exchange for 500 shares of ZJL stock. Mr. ZJ and Mrs. L’s transfers occur on the same day, and after the ex

> Mr. ZJ owns a sole proprietorship. The business assets have a $246,000 aggregate adjusted basis. According to an independent appraisal, the business is worth $400,000. Mr. ZJ transfers his business to ZJL Corporation in exchange for 1,000 shares of ZJL s

> PV Inc. transferred the operating assets of one of its business divisions into newly incorporated SV Inc. in exchange for 100 percent of SV’s stock. PV’s adjusted basis in the operating assets was $4 million, and their FMV was $10 million. a. Discuss the

> Mr. Boyd and Ms. Tuck decide to form a new corporation named BT Inc. Mr. Boyd transfers $10,000 cash and business inventory ($20,000 FMV; adjusted tax basis $3,200), and Ms. Tuck transfers business equipment (FMV $60,000; adjusted tax basis $41,500) to B

> Calvin Corporation’s office was burglarized. The thieves stole 10 laptop computers and other electronic equipment. The lost assets had an original cost of $35,000 and accumulated tax depreciation of $19,400. Calvin received an insurance reimbursement of

> On October 18 of last year, a flood washed away heavy construction equipment owned by Company K. The adjusted tax basis in the equipment was $416,000. On December 8 of last year, Company K received a $480,000 reimbursement from its insurance company. On

> Business K exchanged an old asset (FMV $95,000) for a new asset (FMV $95,000). Business K’s tax basis in the old asset was $107,000. a. Compute Business K’s realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxabl

> RP owned residential real estate with a $680,000 adjusted basis that was condemned by City Q because it needed the land for a new convention center. RP received $975,000 condemnation proceeds for the real estate. Assume that RP would elect to defer gain

> On January 10, 2016, a fire destroyed a warehouse owned by NP Company. NP’s adjusted basis in the warehouse was $530,000. On March 12, 2016, NP received a $650,000 reimbursement from its insurance company. In each of the following cases, determine NP’s r

> Company W produces circuit boards in a foreign country that imposes a 15 percent VAT. This year, Company W manufactured 8.3 million boards at a $5 material cost per unit. Company W’s labor and overhead added $1 to the cost per unit. Company W sold the bo

> On June 2, 2018, a tornado destroyed the building in which FF operated a fast-food franchise. FF’s adjusted basis in the building was $214,700. In each of the following cases, determine FF’s recognized gain or loss on this property disposition and FF’s b

> Company B and Firm W exchanged the following business real estate. a. If B’s adjusted basis in Black acre was $240,000, compute B’s realized gain, recognized gain, and basis in White acre. b. If W’s

> Firm PO and Corporation QR exchanged the following business real estate. a. If PO’s adjusted basis in Marvin Gardens was $403,000, compute PO’s realized gain, recognized gain, and basis in Boardwalk. b. If QRâ&

> Alice and Brendan exchanged the following business real estate. a. If Alice’s adjusted basis in the undeveloped land was $360,000, compute Alice’s realized gain, recognized gain, and basis in the commercial building

> Company Z exchanged an asset (FMV $16,000) for a new asset (FMV $16,000). Company Z’s tax basis in the old asset was $9,300. a. Compute Company Z’s realized gain, recognized gain, and tax basis in the new asset assuming the exchange was a taxable transac

> Refer to the facts in problem 7. In the first year after the year of sale, TPW received payments totaling $106,900 from the purchaser. The total consisted of $67,500 principal payments and $39,400 interest payments. a. Compute TPW’s gain recognized under

> Refer to the facts in the preceding problem and assume that TPW uses the installment sale method of accounting. a. Compute the difference between TPW’s book and tax income resulting from the installment sale method. b. Is this difference favorable or unf

> TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from

> Firm UT sold realty to an unrelated buyer for $40,000 cash plus the buyer’s assumption of a $166,700 mortgage on the property. UT’s initial cost basis in the realty was $235,000, and accumulated tax depreciation through date of sale was $184,200. a. Comp

> KNB sold real property to Firm P for $15,000 cash and Firm P’s assumption of the $85,000 mortgage on the property. a. What is KNB’s amount realized on sale? b. Compute KNB’s after-tax cash flow from the sale if its adjusted basis in the real property is

> Firm Q is about to engage in a transaction with the following cash flows over a three-year period: If the firm’s marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the NPV of the tra

> Twelve years ago, Mr. and Mrs. Chang purchased a business. This year, they sold the business for $750,000. On date of sale, the business balance sheet showed the following assets. The sales contract allocated $40,000 of the purchase price to accounts r

> Ms. D sold a business that she had operated as a sole proprietorship for 18 years. On date of sale, the business balance sheet showed the following assets. The purchaser paid a lump-sum price of $300,000 cash for the business. The sales contract stipul

> St. George Inc. reported $711,800 net income before tax on this year’s financial statement prepared in accordance with GAAP. The corporation’s records reveal the following information: Four years ago, St. George realized a $283,400 gain on sale of invest

> Bali Inc. reported $605,800 net income before tax on this year’s financial statements prepared in accordance with GAAP. The corporation’s records reveal the following information: Depreciation expense per books was $53,000, and MACRS 495 depreciation was

> Calvin Corporation’s office was burglarized. The thieves stole 10 laptop computers and other electronic equipment. The lost assets had an original cost of $35,000 and accumulated tax depreciation of $19,400. Calvin received an insurance reimbursement of

> Firm R owned depreciable real property subject to a $300,000 nonrecourse mortgage. The property’s FMV is only $250,000. Consequently, the firm surrendered the property to the creditor rather than continuing to service the mortgage. At date of surrender,

> Five years ago, Firm SJ purchased land for $100,000 with $10,000 of its own funds and $90,000 borrowed from a commercial bank. The bank holds a recourse mortgage on the land. For each of the following independent transactions, compute SJ’s positive or ne

> Company L sold an inventory item to Firm M for $40,000. Company L’s marginal tax rate is 21 percent. In each of the following cases, compute Company L’s after-tax cash flow from the sale: a. Firm M’s payment consisted of $10,000 cash and its note for $30

> A taxpayer owned 1,000 shares of common stock in Barlo Corporation, which manufactures automobile parts. The taxpayer’s cost basis in the stock was $82,700. Last week, Barlo declared bankruptcy, and its board of directors issued a news release that Barlo

> Six years ago, Corporation CN purchased a business and capitalized $200,000 of the purchase price as goodwill. Through this year, CN has deducted $74,000 amortization with respect to this goodwill. At the end of the year, CN sold the business for $2 mill

> Company J must choose between two alternate business expenditures. Expenditure 1 would require a $80,000 cash outlay, and Expenditure 2 requires a $60,000 cash outlay. Determine the marginal tax rate at which the after-tax cash flows from the two expendi

> Firm P, a non corporate taxpayer, purchased residential realty in 1985 for $1 million. This year it sold the realty for $450,000. Through date of sale, Firm P deducted $814,000 accelerated depreciation on the realty. Straight-line depreciation would have

> Eleven years ago, Lynn Inc. purchased a warehouse for $315,000. This year, the corporation sold the warehouse to Firm D for $80,000 cash and D’s assumption of a $225,000 mortgage. Through date of sale, Lynn deducted $92,300 straight-line depreciation on

> Corporation Q, a calendar year taxpayer, has incurred the following Section 1231 net gains and losses since its formation in 2015. a. In 2018, Corporation Q sold only one asset and recognized a $4,000 Section 1231 gain. How much of this gain is treated

> Since its formation, Roof Corporation has incurred the following net Section 1231 gains and losses. a. In year 4, Roof sold only one asset and recognized a $7,500 net Section 1231 gain. How much of this gain is treated as capital gain, and how much is

> EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the following assets, all of which were held for more than 12 months. EzTech used the straight-line method to calculate depr

> This year, Sigma Inc. generated $612,000 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months. a. Compute Sigma’s taxable income assuming t

> Firm CS performed consulting services for Company P. The two parties agreed that Company P would pay for the services by transferring investment securities to Firm CS. At date of transfer, the securities had a $38,500 FMV. Company P’s tax basis in the se

> This year, QIO Company generated $192,400 income from its routine business operations. In addition, it sold the following assets, all of which were held for more than 12 months. Compute QIO’s taxable income. Initial Acc. Sale Basi

> This year, Zeron Company generated $87,200 income from the performance of services for its clients. It also sold several assets during the year. Compute Zeron’s taxable income under each of the following alternative assumptions about the tax consequences

> Lemon Corporation generated $324,600 of income from ordinary business operations. It also sold several assets during the year. Compute Lemon’s taxable income under each of the following alternative assumptions about the tax consequences of the asset sale

> Firm E must choose between two alternative transactions. Transaction 1 requires a $9,000 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $13,500 cash outlay that would be a deductible expense. Determ

> In its first year, Firm KZ recognized $427,300 ordinary business income and a $13,590 loss on the sale of an investment asset. In its second year, Firm KZ recognized $500,800 ordinary business income, a $19,300 Section 1231 gain, and a $7,400 Section 123

> In its first taxable year, Band Corporation recognized $957,500 ordinary business income and a $5,500 capital loss. In its second taxable year, Band recognized $1,220,000 ordinary business income, a $12,500 Section 1231 loss, and a $2,000 capital gain. a

> Alto Corporation sold two capital assets this year. The first sale resulted in a $13,000 capital gain, and the second sale resulted in a $41,000 capital loss. Alto was incorporated five years ago. Four years ago, Alto recognized $5,000 of net capital gai

> This year, PRS Corporation generated $300,000 income from the performance of consulting services for its clients. It sold two assets during the year, recognizing a $36,000 gain on the first sale and a $49,000 loss on the second sale. Compute PRS’s taxabl

> Koil Corporation generated $718,400 ordinary income from the sale of inventory to its customers. It also sold three non inventory assets during the year. Compute Koil’s taxable income assuming that: a. The first sale resulted in a $45,000 capital gain, t

> Several years ago, PTR purchased business equipment for $50,000. PTR’s accumulated book depreciation with respect to the equipment is $37,200, and its accumulated tax depreciation is $41,000. a. Compute PTR’s book and tax basis in the equipment. b. Using

> Shenandoah Skies is the name of an oil painting by artist Kara Lee. In each of the following cases, determine the amount and character of the taxpayer’s gain or loss on sale of the painting. a. The taxpayer is Kara Lee, who sold her painting to the Relle

> Four years ago, Firm RD paid $468,000 for 12 acres of undeveloped land. This year, the firm sold the land for $1 million. What is the character of RD’s $532,000 recognized gain under each of the following assumptions? a. RD improved the land by adding ro

> Firm J, an accrual basis taxpayer, recorded a $40,000 account receivable on the sale of an asset on credit. Its basis in the asset was $33,000. Two months after the asset sale, Firm J sold the receivable to a local bank for $38,000. a. Assuming that the

> Investor B has $100,000 in an investment paying 9 percent taxable interest per annum. Each year B incurs $825 of expenses relating to this investment. Compute B’s annual net cash flow assuming the following: a. B’s marginal tax rate is 10 percent, and th

> Silo Inc. sold investment land to PPR Inc. for $110,000 cash. Silo’s basis in the land was $145,000. Mr. and Mrs. J own 100 percent of the stock of both corporations. a. What is PPR’s tax basis in the land purchased from Silo? b. PPR holds the land as an

> Firm J sold marketable securities to Company B. Firm J’s tax basis in the securities was $45,250. Compute Firm J’s recognized gain or loss if: a. The selling price was $60,000, and Firm J and Company B are unrelated parties. b. The selling price was $60,

> Refer to the facts in the preceding problem but assume that Aldo’s basis in the investment land was $100,000 rather than $61,000. a. Compute Aldo’s recognized loss in year 1. b. In year 4, Aldo pledged the note received from the purchaser as partial coll

> In year 1, Aldo sold investment land with a $61,000 tax basis for $95,000. Payment consisted of $15,000 cash down and the purchaser’s note for $80,000. The note is being paid in 10 annual installments of $8,000, beginning in year 2. a. Compute Aldo’s rec

> In year 1, Maxim sold investment land with a tax basis of $77,000. Payment consisted of $10,000 cash down and the purchaser’s note for $90,000. The note is payable in equal installments of $45,000 in years 2 and 3. a. Compute Maxim’s realized gain on the

> Refer to the facts in the preceding problem. a. Compute the difference between TPW’s book and tax income resulting from the installment sale method. b. Is this difference favorable or unfavorable? c. Using a 21 percent tax rate, determine the effect of t

> Lento Inc. owned machinery with a $30,000 initial cost basis. Accumulated book depreciation with respect to the machinery was $12,000, and accumulated tax depreciation was $19,100. Lento sold the machinery for $13,000 cash. Lento’s marginal tax rate is 2

> In year 0, Jarmex paid $55,000 for an overhaul of a tangible operating asset. Jarmex has a 21 percent marginal tax rate and uses a 7 percent discount rate to compute NPV. a. Compute the after-tax cost of the overhaul if Jarmex can deduct the $55,000 paym

> Hansen Company, a cash basis taxpayer, paid $50,000 for an asset in year 0. Assume it can deduct one-half of the cost in year 0 and the remainder in year 1. Assume a 21 percent tax rate and 8 percent discount rate. a. Calculate the net present value of H

> Refer to the facts in problem 6. Now assume that Firm A borrowed $50,000 to purchase the asset. In each year, it paid $3,800 annual interest on the debt. The interest payments were deductible. a. How does this change in facts affect Firm A’s net cash flo

> Taxpayer Y, who has a 30 percent marginal tax rate, invested $65,000 in a bond that pays 8 percent annual interest. Compute Y’s annual net cash flow from this investment assuming that: a. The interest is tax-exempt income. b. The interest is taxable inco

> Mr. JK, a U.S. citizen and resident of Vermont, owns 100 percent of the stock of JK Services, which is incorporated under Vermont law and conducts business in four counties in the state. JK Services owns 100 percent of the stock of JK Realty, which is in

> What is cognitive dissonance?

> Explain the difference between a need and a want.

> How does learning new information make it more likely that we’ll forget things we’ve already learned?

> How do different types of reinforcement enhance learning? How does the strategy of frequency marketing relate to conditioning?

> Describe three types of motivational conflicts, citing an example of each from current marketing campaigns.

> Name the two basic measures of memory and describe how they differ from one another.

> What is motivation and why is this idea so important to marketers?

> If a consumer is familiar with a product, advertising for it can work both ways by either enhancing or diminishing recall. Why?

> How is associative memory like a spider web?

> What are the major differences between the positivist and interpretivist paradigms in consumer research?

> A group of psychologists argued that we need to revise Maslow’s Hierarchy of Needs. They propose we should delete “self-actualization” from the pinnacle and replace it with “parenting.” Right below this peak, they added “mate retention” and “mate acquisi

> This chapter states “people often buy products not for what they do but for what they mean. “ Explain the meaning of this statement and provide an example.

> List the three types of memory, and explain how they work together.

> What are some strategies marketers can use to increase consumers’ involvement with their products?

> Give an example of an episodic memory.

> What is popular culture, and how does this concept relate to marketing and consumer behavior?

> How can marketers use repetition to increase the likelihood that consumers will learn about their brand?

> What is the major difference between behavioral and cognitive theories of learning?

> What is the difference between classical conditioning and instrumental conditioning?

> What is role theory, and how does it help us to understand consumer behavior?

> What is market segmentation? Give three examples of market segments.

> Many college students “share” music by downloading clips from the Internet. Interview at least five people who have downloaded at least one song or movie without paying for it. Do they feel they are stealing? What explanations do they offer for this beha

> Give an example of a halo effect in marketing.

> What is the difference between an unconditioned stimulus and a conditioned stimulus?

> Describe a multi-attribute attitude model, listing its key components.

> According to balance theory, how can we tell if a triad is balanced or unbalanced? How can consumers restore balance to an unbalanced triad?

> What is the foot-in-the-door technique? How does self-perception theory relate to this effect?

> We sometimes enhance our attitude toward a product after we buy it. How does the theory of cognitive dissonance explain this change?

> List the three hierarchies of attitudes, and describe the major differences among them.

> Describe the ABC model of attitudes.

> What is an avatar, and why might an advertiser choose to use one instead of hiring a celebrity endorser?