Question: Assume you work as a staff member

Assume you work as a staff member in a large accounting department for a multinational public company. Your job requires you to review documents relating to the company’s equipment purchases. Upon verifying that purchases are properly approved, you prepare journal entries to record the equipment purchases in the accounting system. Typically, you handle equipment purchases costing $100,000 or less.

This morning, you were contacted by the executive assistant to the chief financial officer (CFO). She says that the CFO has asked to see you immediately in his office. Although your boss’s boss has attended a few meetings where the CFO was present, you have never met the CFO during your three years with the company. Needless to say, you are anxious about the meeting.

Upon entering the CFO’s office, you are warmly greeted with a smile and friendly handshake. The CFO compliments you on the great work that you’ve been doing for the company. You soon feel a little more comfortable, particularly when the CFO mentions that he has a special project for you. He states that he and the CEO have negotiated significant new arrangements with the company’s equipment suppliers, which require the company to make advance payments for equipment to be purchased in the future. The CFO says that, for various reasons that he didn’t want to discuss, he will be processing the payments through the operating division of the company rather than the equipment accounting group. Given that the payments will be made through the operating division, they will initially be classified as operating expenses of the company. He indicates that clearly these advance payments for property and equipment should be recorded as assets, so he will be contacting you at the end of every quarter to make an adjusting journal entry to capitalize the amounts inappropriately classified as operating expenses. He advises you that a new account, called Prepaid Equipment, has been established for this purpose. He quickly wraps up the meeting by telling you that it is important that you not talk about the special project with anyone. You assume he doesn’t want others to become jealous of your new important responsibility.

A few weeks later, at the end of the first quarter, you receive a voicemail from the CFO stating, “The adjustment that we discussed is $771,000,000 for this quarter.†Before deleting the message, you replay it to make sure you heard it right. Your company generates over $8 billion in revenues and incurs $6 billion in operating expenses every quarter, but you’ve never made a journal entry for that much money. So, just to be sure there’s not a mistake, you send an e-mail to the CFO confirming the amount. He phones you back immediately to abruptly inform you, “There’s no mistake. That’s the number.†Feeling embarrassed that you may have annoyed the CFO, you quietly make the adjusting journal entry.

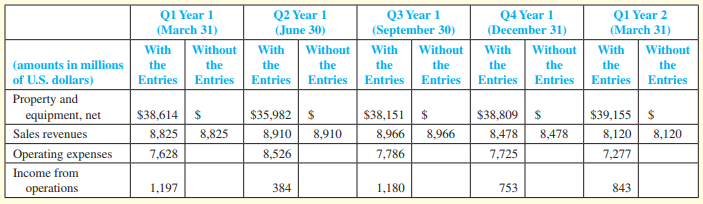

For each of the remaining three quarters in that year and for the first quarter in the following year, you continue to make these end-of-quarter adjustments. The “magic number,†as the CFO liked to call it, was $560,000,000 for Q2, $742,745,000 for Q3, $941,000,000 for Q4, and $818,204,000 for Q1 of the following year. During this time, you’ve had several meetings and lunches with the CFO where he provides you the magic number, sometimes supported with nothing more than a Post-it note with the number written on it. He frequently compliments you on your good work and promises that you’ll soon be in line for a big promotion.

Despite the CFO’s compliments and promises, you are growing increasingly uncomfortable with the journal entries that you’ve been making. Typically, whenever an ordinary equipment purchase involves an advance payment, the purchase is completed a few weeks later. At that time, the amount of the advance is removed from an Equipment Deposit account and transferred to the appropriate equipment account. This hasn’t been the case with the CFO’s special project. Instead, the Prepaid Equipment account has continued to grow, now standing at over $3.8 billion. There’s been no discussion about how or when this balance will be reduced, and no depreciation has been recorded for it.

Just as you begin to reflect on the effect the adjustments have had on your company’s fixed assets, operating expenses, and operating income, you receive a call from the vice president for internal audit. She needs to talk with you this afternoon about “a peculiar trend in the company’s fixed asset turnover ratio and some suspicious journal entries that you’ve been making.â€

Required:

1. Complete the following table to determine what the company’s accounting records would have looked like had you not made the journal entries as part of the CFO’s special project. Comment on how the decision to capitalize amounts, which were initially recorded as operating expenses, has affected the level of income from operations in each quarter.

2. Using the publicly reported numbers (which include the special journal entries that you recorded), compute the fixed asset turnover ratio (rounded to two decimal places) for the periods ended Q2–Q4 of year 1 and Q1 of year 2. What does the trend in this ratio suggest to you? Is this consistent with the changes in operating income reported by the company?

3. Before your meeting with the vice president for internal audit, you think about the above computations and the variety of peculiar circumstances surrounding the “special project†for the CFO. What in particular might have raised your suspicion about the real nature of your work?

4. Your meeting with internal audit was short and unpleasant. The vice president indicated that she had discussed her findings with the CFO before meeting with you. The CFO claimed that he too had noticed the peculiar trend in the fixed asset turnover ratio, but that he hadn’t had a chance to investigate it further. He urged internal audit to get to the bottom of things, suggesting that perhaps someone might be making unapproved journal entries. Internal audit had identified you as the source of the journal entries and had been unable to find any documents that approved or substantiated the entries. She ended the meeting by advising you to find a good lawyer. Given your current circumstances, describe how you would have acted earlier had you been able to foresee where it might lead you.

5. In the real case on which this one is based, the internal auditors agonized over the question of whether they had actually uncovered a fraud or whether they were jumping to the wrong conclusion. The Wall Street Journal mentioned this on October 30, 2002, by stating, “It was clear. . . that their findings would be devastating for the company. They worried about whether their revelations would result in layoffs. Plus, they feared that they would somehow end up being blamed for the mess.†Beyond the personal consequences mentioned in this quote, describe other potential ways in which the findings of the internal auditors would likely be devastating for the publicly traded company and those associated with it.

Epilogue: This case is based on a fraud committed at WorldCom (now called Verizon). The case draws its numbers, the nature of the unsupported journal entries, and the CFO’s role in carrying out the fraud from a report issued by WorldCom’s bankruptcy examiner. Year 1 in this case was actually 2001 and year 2 was 2002. This case excludes other fraudulent activities that contributed to WorldCom’s $11 billion fraud. The 63-year-old CEO was sentenced to 25 years in prison for planning and executing the biggest fraud in the history of American business. The CFO, who cooperated in the investigation of the CEO, was sentenced to five years in prison.

Transcribed Image Text:

Q2 Year 1 (June 30) Q3 Year 1 (September 30) Q1 Year 1 Q4 Year 1 (December 31) Q1 Year 2 (March 31) (March 31) With Without With Without With Without With Without With Without (amounts in millions the the the the the the the the the the of U.S. dollars) Entries Entries Entries Entries Entries Entries Entries Entries Entries Entries Property and equipment, net $38,614 2$ $35,982 $38,151 $ $38,809 $ $39,155 Sales revenues 8,825 8,825 8,910 8,910 8,966 8,966 8,478 8,478 8,120 8,120 Operating expenses 7,628 8,526 7,786 7,725 7,277 Income from operations 1,197 384 1,180 753 843

> Wexler Company had the following activities for the year ended December 31, 2012: Sold land that cost $18,000 for $18,000 cash; purchased $181,000 of equipment, paying $156,000 in cash and signing a note payable for the rest; and recorded $5,500 in depre

> Elizabeth Pie Company has been in business for 50 years and has developed a large group of loyal restaurant customers. Giant Bakery Inc. has made an offer to buy Elizabeth Pie Company for $5,000,000. The book value of Elizabeth Pie’s recorded assets and

> As part of a major renovation at the beginning of the year, Scheffer’s Pharmacy, Inc., sold shelving units (store fixtures) that were 10 years old for $1,800 cash. The original cost of the shelves was $6,000 and they had been depreciated on a straight-li

> Refer to E2-13. Zeber Company has been operating for one year (2011). You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. At the start of 2012, Zeber’s T-account balances

> For each of the following scenarios, indicate whether an asset has been impaired (Y for yes and N for no) and, if so, the amount of loss that should be recorded. Is Asset Impaired? Book Estimated Fair Amount Value Future Cash Flows Value of Loss $ 1

> Calculate the book value of a three-year-old machine that has a cost of $21,000, has an estimated residual value of $1,000 and an estimated useful life of 40,000 machine hours. The company uses units-of production depreciation and ran the machine 3,200 h

> Which of the following describes how assets are listed on the balance sheet? a. In alphabetical order b. In order of magnitude, lowest value to highest value c. From most liquid to least liquid d. From least liquid to most liquid

> Calculate the book value of a three-year-old machine that has a cost of $45,000, an estimated residual value of $5,000, and an estimated useful life of four years. The company uses double-declining-balance depreciation. Round to the nearest dollar.

> Calculate the book value of a three-year-old machine that has a cost of $31,000, an estimated residual value of $1,000, and an estimated useful life of five years. The company uses straight-line depreciation.

> For each of the following items, enter the correct letter to the left to show the type of expenditure. Use the following: Type of Expenditure Transactions Capital expenditure Revenue expenditure (1) Purchased a patent, $4,300 cash. (2) Paid $10,000

> The following information was reported by Kramer’s Air Cargo Service for 2008: Net fixed assets (beginning of year)......................$1,900,000 Net fixed assets (end of year)..................................2,300,000 Net sales for the year.........

> The following is a list of account titles and amounts (dollars in millions) from a recent annual report of Hasbro, Inc., a leading manufacturer of games, toys, and interactive entertainment software for children and families: Required: Prepare the ass

> Burbank Company owns the building occupied by its administrative office. The office building was reflected in the accounts at the end of last year as follows: Cost when acquired............................................................................

> At the end of the annual accounting period, December 31, 2012, O’Connor Company’s records reflected the following for Machine A: Cost when acquired............................$30,000 Accumulated depreciation....................10,200 During January 201

> Explain what the time period assumption means.

> Refer to E8-5. Information from E8-5: Nasoff Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2011, an asset account for the company showed the following balances: Manufacturing equ

> You are considering investing the cash gifts you received for graduation in various stocks. You have received several annual reports of major companies. Required: For each of the following, indicate where you would locate the information in an annual r

> Starbucks Corporation is the leading roaster and retailer of specialty coffee, with nearly 17,000 company-operated and licensed stores worldwide. Assume that Starbucks planned to open a new store on Commonwealth Avenue near Boston University and obtained

> The T-account is a tool commonly used for analyzing which of the following? a. Increases and decreases to a single account in the accounting system. b. Debits and credits to a single account in the accounting system. c. Changes in specific account bal

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Required: 1. Is the company a corporation, a partnership, or a sole proprietorship? How do you know? 2. The company shows on the balance sheet that inv

> Cheshire Company had three intangible assets at the end of 2011 (end of the accounting year): a. A copyright purchased on January 1, 2011, for a cash cost of $12,300. The copyright is expected to have a 10-year useful life to Cheshire. b. Goodwill of $

> Trotman Company had three intangible assets at the end of 2012 (end of the accounting year): a. Computer software and Web development technology purchased on January 1, 2011, for $70,000. The technology is expected to have a four-year useful life to the

> Freeport-McMoRan Copper & Gold Inc., headquartered in Phoenix, Arizona, is one of the world’s largest copper, gold, and molybdenum mining and production companies, with its principal asset in natural resource reserves (approximately 102.0 billion pounds

> On January 1, 2012, the records of Seward Corporation showed the following regarding a truck: Equipment (estimated residual value, $8,000).......................$18,000 Accumulated depreciation (straight-line, three years)................6,000 On Decem

> Marriott International is a worldwide operator and franchisor of hotels and related lodging facilities totaling over $1.4 billion in property and equipment. It also develops, operates, and markets time-share properties totaling nearly $2 billion. Assume

> Describe a typical business operating cycle.

> FedEx is the world’s leading express-distribution company. In addition to the world’s largest fleet of allcargo aircraft, the company has more than 654 aircraft and 51,000 vehicles and trailers that pick up and deliver packages. Assume that FedEx sold a

> In a recent 10-K report, United Parcel Service states it “is the world’s largest package delivery company, a leader in the U.S. less-than-truckload industry, and a global leader in supply chain management.â€

> Schrade Company bought a machine for $96,000 cash. The estimated useful life was four years, and the estimated residual value was $6,000. Assume that the estimated useful life in productive units is 120,000. Units actually produced were 43,000 in year 1

> A recent annual report for FedEx includes the following information: Required: Explain why FedEx uses different methods of depreciation for financial reporting and tax purposes. For financial reporting purposes, we record depreciation and amortizat

> A recent annual report for General Motors Corporation contained the following note: Required: Why do you think the company changed its depreciation method for real estate, facilities, and equipment placed in service after January 1, 2001, and subseque

> The dual effects concept can best be described as follows: a. When one records a transaction in the accounting system, at least two effects on the basic accounting equation will result. b. When an exchange takes place between two parties, both parties

> Sterling Steel Inc. purchased a new stamping machine at the beginning of the year at a cost of $580,000. The estimated residual value was $60,000. Assume that the estimated useful life was five years, and the estimated productive life of the machine was

> Purity Ice Cream Company bought a new ice cream maker at the beginning of the year at a cost of $10,000. The estimated useful life was four years, and the residual value was $1,000. Assume that the estimated productive life of the machine was 9,000 hours

> Refer to the information in E8-5. Information from E8-5: Nasoff Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2011, an asset account for the company showed the following balances:

> Nasoff Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2011, an asset account for the company showed the following balances: Manufacturing equipment..................................

> Cedar Fair, L.P. (Limited Partnership) is one of the largest regional amusement park operators in the world, owning 12 amusement parks, five outdoor water parks, one indoor water park, and six hotels. The parks include Cedar Point in Ohio, Valleyfair nea

> Ashkar Company ordered a machine on January 1, 2012, at an invoice price of $21,000. On the date of delivery, January 2, 2012, the company paid $6,000 on the machine, with the balance on credit at 10 percent interest. On January 3, 2012, it paid $1,000 f

> K-Delta Company bought a building for $71,000 cash and the land on which it was located for $107,000 cash. The company paid transfer costs of $9,000 ($3,000 for the building and $6,000 for the land). Renovation costs on the building were $23,000. Requir

> The following data were included in a recent Apple Inc. annual report ($ in millions): Required: 1. Compute Apple’s fixed asset turnover ratio for 2007, 2008, and 2009. 2. How might a financial analyst interpret the results? In

> Complete the requirements for each of the following independent cases: Case A. Dr Pepper Snapple Group, Inc., is a leading integrated brand owner, bottler, and distributor of nonalcoholic beverages in the United States, Canada, and Mexico. Key brands in

> Reuters provides lists of industries and the competitors in each at www.reuters.com. Click on “Sectors and Industries,” then “All Industries,” then one of the industries listed, then “Company Ranks.” When you skim down the page, you will find an alphabet

> A recent annual report for Eastman Kodak reported that the cost of property, plant, and equipment at the end of the current year was $6,805 million. At the end of the previous year, it had been $7,327 million. During the current year, the company bought

> Total liabilities on a balance sheet at the end of the year are $150,000, retained earnings at the end of the year is $80,000, net income for the year is $60,000, and contributed capital is $35,000. What amount of total assets would be reported on the ba

> Cain Company operates in both the beverage and entertainment industries. In June 2006, Cain purchased Good Time, Inc., which produces and distributes motion picture, television, and home video products and recorded music; publishes books; and operates th

> In its recent annual report, Sysco Corporation noted it “is the largest North American distributor of food and related products primarily to the foodservice ‘food-away-from-home’ industry. We provide products and related services to approximately 400,000

> Hess Corporation is a global energy company that explores, produces, refines, and markets crude oil and natural gas. The capitalization of interest associated with self-constructed assets was discussed in this chapter. A recent annual report for Hess Cor

> Following are account balances (in millions of dollars) from a recent FedEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31, 2011: These accounts are not necessarily in good order and ha

> You are a financial analyst charged with evaluating the asset efficiency of companies in the hotel industry. Recent financial statements for Marriott include the following note: 8. Property and Equipment We record property and equipment at cost, includ

> Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the percentage of net fixed assets to total assets fo

> Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. Required: For each question, answer it and indicate where you located the information to answer the question. 1. What method of depreciation does the co

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Required: For each question, answer it and indicate where you located the information to answer the question. 1. How much did the company spend on pro

> On June 1, 2012, the Wallace Corp. bought a machine for use in operations. The machine has an estimated useful life of six years and an estimated residual value of $2,000. The company provided the following expenditures: a. Invoice price of the machine,

> Carey Corporation has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Pate

> Which of the following is not an asset? a. Investments b. Land c. Prepaid Expense d. Contributed Capital

> During the 2012 annual accounting period, Nguyen Corporation completed the following transactions: a. On January 1, 2012, purchased a license for $7,200 cash (estimated useful life, four years). b. On January 1, 2012, repaved the parking lot of the bui

> During 2011, Rank Company disposed of three different assets. On January 1, 2011, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 1, 2011, for $6,750 cas

> Refer to P3-4. Brianna Webb, a connoisseur of fine chocolate, opened Bri’s Sweets in Collegetown on February 1, 2011. The shop specializes in a selection of gourmet chocolate candies and a line of gourmet ice cream. You have been hired as manager. Your

> The Gap, Inc., is a global specialty retailer of casual wear and personal products for women, men, children, and babies under the Gap, Banana Republic, Old Navy, Athleta, and Piperlime brands. As of January 31, 2009, the Company operated 3,149 stores acr

> At the beginning of the year, Ramos Inc. bought three used machines from Santaro Corporation. The machines immediately were overhauled, installed, and started operating. The machines were different; therefore, each had to be recorded separately in the ac

> A recent annual report for AMERCO, the holding company for U-Haul International, Inc., included the following note: AMERCO subsidiaries own property, plant, and equipment that are utilized in the manufacture, repair, and rental of U-Haul equipment and

> Define goods available for sale. How does it differ from cost of goods sold?

> What are the general guidelines for deciding which items should be included in inventory?

> Explain briefly the application of the LCM concept to the ending inventory and its effect on the income statement and balance sheet when market is lower than cost.

> Contrast the effects of LIFO versus FIFO on cash outflow and inflow.

> Contrast the income statement effect of LIFO versus FIFO (i.e., on pretax income) when (a) prices are rising and (b) prices are falling.

> If a publicly traded company is trying to maximize its perceived value to decision makers external to the corporation, the company is most likely to understate which of the following on its balance sheet? a. Assets b. Liabilities c. Retained Earning

> Contrast the effects of LIFO versus FIFO on reported assets (i.e., the ending inventory) when (a) prices are rising and (b) prices are falling.

> Brianna Webb, a connoisseur of fine chocolate, opened Bri’s Sweets in Collegetown on February 1, 2011. The shop specializes in a selection of gourmet chocolate candies and a line of gourmet ice cream. You have been hired as manager. You

> Refer to E3-10 . Stacey’s Piano Rebuilding Company has been operating for one year (2010). At the start of 2011, its income statement accounts had zero balances and its balance sheet account balances were as follows: Required: Use

> Explain how income can be manipulated when the specific identification inventory costing method is used.

> The chapter discussed four inventory costing methods. List the four methods and briefly explain each.

> Define beginning inventory and ending inventory.

> Explain the application of the cost principle to an item in the ending inventory.

> Why is inventory an important item to both internal (management) and external users of financial statements?

> When a perpetual inventory system is used, unit costs of the items sold are known at the date of each sale. In contrast, when a periodic inventory system is used, unit costs are known only at the end of the accounting period. Why these statements are cor

> Walker Company has just completed a physical inventory count at year-end, December 31, 2011. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,000. During the audit

> In a recent annual report, General Electric reported the following in its inventory note: It also reported a $23 million change in cost of goods sold due to “lower inventory levels.” Required: 1. Compute the increa

> The income statement for Pruitt Company summarized for a four-year period shows the following: An audit revealed that in determining these amounts, the ending inventory for 2012 was overstated by $18,000. The company uses a periodic inventory system.

> Starting with the beginning balances in M2-9 and given the transactions in M2-5 (including the sample), prepare a balance sheet for Pitt Inc. as of January 31, 2012, classified into current and noncurrent assets and liabilities. In M2-9, For each trans

> According to its annual report, Wendy’s International serves “the best hamburgers in the business” and other fresh food including salads, chicken sandwiches, and baked potatoes in more than 6,600 rest

> An annual report for General Motors Corporation included the following note: Inventories are stated generally at cost, which is not in excess of market. The cost of substantially all domestic inventories was determined by the last-in, first-out (LIFO) me

> Carter and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Carter and his associates

> Harvey Company prepared its annual financial statements dated December 31, 2011. The company applies the FIFO inventory costing method; however, the company neglected to apply LCM to the ending inventory. The preliminary 2011 income statement follows:

> Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basi

> Atlantic Company sells electronic test equipment that it acquires from a foreign source. During the year 2011, the inventory records reflected the following: Inventory is valued at cost using the LIFO inventory method. Required: 1. Complete the follo

> At the end of January 2011, the records of Donner Company showed the following for a particular item that sold at $16 per unit: Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit fo

> Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records for the most popular item in inventory showed the following: Required: Compute the amount of (a) goods availa

> Which of the following is false regarding a perpetual inventory system? a. Physical counts are not needed since records are maintained on a transaction-by-transaction basis. b. The balance in the inventory account is updated with each inventory purchas

> Which inventory method provides a better matching of current costs with sales revenue on the income statement and outdated values for inventory on the balance sheet? a. FIFO b. Average cost c. LIFO d. Specific identification

> Which of the following regarding the lower of cost or market rule for inventory are true? (1) The lower of cost or market rule is an example of the historical cost principle. (2) When the replacement cost of inventory drops below the cost shown in the

> Ryan Terlecki organized a new Internet company, CapUniverse, Inc. The company specializes in baseball-type caps with logos printed on them. Ryan, who is never without a cap, believes that his target market is college and high school students. You have be

> For each transaction in M2-5 (including the sample), post the effects to the appropriate T-accounts and determine ending account balances. Beginning balances are provided. In M2-5, For each of the following transactions of Pitt Inc. for the month of J

> If the ending balance in accounts payable decreases from one period to the next, which of the following is true? a. Cash payments to suppliers exceeded current period purchases. b. Cash payments to suppliers were less than current period purchases. c.

> An increasing inventory turnover ratio a. Indicates a longer time span between the ordering and receiving of inventory. b. Indicates a shorter time span between the ordering and receiving of inventory. c. Indicates a shorter time span between the purc

> Consider the following information: beginning inventory 20 units @ $20 per unit; first purchase 35 units @ $22 per unit; second purchase 40 units @ $24 per unit; 50 units were sold. What is cost of goods sold using the LIFO method of inventory costing?

> Consider the following information: beginning inventory 20 units @ $20 per unit; first purchase 35 units @ $22 per unit; second purchase 40 units @ $24 per unit; 50 units were sold. What is cost of goods sold using the FIFO method of inventory costing?

> Which of the following is not a component of the cost of inventory? a. Administrative overhead b. Direct labor c. Raw materials d. Factory overhead

> The inventory costing method selected by a company will affect a. The balance sheet. b. The income statement. c. The statement of retained earnings. d. All of the above.

> Consider the following information: ending inventory, $24,000; sales, $250,000; beginning inventory, $20,000; selling and administrative expenses, $70,000; and purchases, $90,000. What is cost of goods sold? a. $86,000 b. $94,000 c. $16,000 d. $84,