Question: At the end of January 2011, the

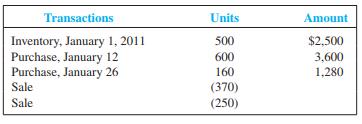

At the end of January 2011, the records of Donner Company showed the following for a particular item that sold at $16 per unit:

Required:

1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for the month of January under each method of inventory:

(a) average cost,

(b) FIFO,

(c) LIFO, and

(d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Round the average cost per unit to the nearest cent. Show the inventory computations in detail.

2. Of FIFO and LIFO, which method would result in the higher pretax income? Which would result in the higher EPS?

3. Of FIFO and LIFO, which method would result in the lower income tax expense? Explain, assuming a 30 percent average tax rate.

4. Of FIFO and LIFO, which method would produce the more favorable cash flow? Explain.

Transcribed Image Text:

Transactions Units Amount Inventory, January 1, 2011 Purchase, January 12 Purchase, January 26 Sale 500 $2,500 600 3,600 1,280 160 (370) Sale (250)

> K-Delta Company bought a building for $71,000 cash and the land on which it was located for $107,000 cash. The company paid transfer costs of $9,000 ($3,000 for the building and $6,000 for the land). Renovation costs on the building were $23,000. Requir

> The following data were included in a recent Apple Inc. annual report ($ in millions): Required: 1. Compute Apple’s fixed asset turnover ratio for 2007, 2008, and 2009. 2. How might a financial analyst interpret the results? In

> Complete the requirements for each of the following independent cases: Case A. Dr Pepper Snapple Group, Inc., is a leading integrated brand owner, bottler, and distributor of nonalcoholic beverages in the United States, Canada, and Mexico. Key brands in

> Reuters provides lists of industries and the competitors in each at www.reuters.com. Click on “Sectors and Industries,” then “All Industries,” then one of the industries listed, then “Company Ranks.” When you skim down the page, you will find an alphabet

> A recent annual report for Eastman Kodak reported that the cost of property, plant, and equipment at the end of the current year was $6,805 million. At the end of the previous year, it had been $7,327 million. During the current year, the company bought

> Total liabilities on a balance sheet at the end of the year are $150,000, retained earnings at the end of the year is $80,000, net income for the year is $60,000, and contributed capital is $35,000. What amount of total assets would be reported on the ba

> Cain Company operates in both the beverage and entertainment industries. In June 2006, Cain purchased Good Time, Inc., which produces and distributes motion picture, television, and home video products and recorded music; publishes books; and operates th

> In its recent annual report, Sysco Corporation noted it “is the largest North American distributor of food and related products primarily to the foodservice ‘food-away-from-home’ industry. We provide products and related services to approximately 400,000

> Hess Corporation is a global energy company that explores, produces, refines, and markets crude oil and natural gas. The capitalization of interest associated with self-constructed assets was discussed in this chapter. A recent annual report for Hess Cor

> Following are account balances (in millions of dollars) from a recent FedEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31, 2011: These accounts are not necessarily in good order and ha

> You are a financial analyst charged with evaluating the asset efficiency of companies in the hotel industry. Recent financial statements for Marriott include the following note: 8. Property and Equipment We record property and equipment at cost, includ

> Assume you work as a staff member in a large accounting department for a multinational public company. Your job requires you to review documents relating to the company’s equipment purchases. Upon verifying that purchases are properly a

> Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the percentage of net fixed assets to total assets fo

> Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. Required: For each question, answer it and indicate where you located the information to answer the question. 1. What method of depreciation does the co

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Required: For each question, answer it and indicate where you located the information to answer the question. 1. How much did the company spend on pro

> On June 1, 2012, the Wallace Corp. bought a machine for use in operations. The machine has an estimated useful life of six years and an estimated residual value of $2,000. The company provided the following expenditures: a. Invoice price of the machine,

> Carey Corporation has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Pate

> Which of the following is not an asset? a. Investments b. Land c. Prepaid Expense d. Contributed Capital

> During the 2012 annual accounting period, Nguyen Corporation completed the following transactions: a. On January 1, 2012, purchased a license for $7,200 cash (estimated useful life, four years). b. On January 1, 2012, repaved the parking lot of the bui

> During 2011, Rank Company disposed of three different assets. On January 1, 2011, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 1, 2011, for $6,750 cas

> Refer to P3-4. Brianna Webb, a connoisseur of fine chocolate, opened Bri’s Sweets in Collegetown on February 1, 2011. The shop specializes in a selection of gourmet chocolate candies and a line of gourmet ice cream. You have been hired as manager. Your

> The Gap, Inc., is a global specialty retailer of casual wear and personal products for women, men, children, and babies under the Gap, Banana Republic, Old Navy, Athleta, and Piperlime brands. As of January 31, 2009, the Company operated 3,149 stores acr

> At the beginning of the year, Ramos Inc. bought three used machines from Santaro Corporation. The machines immediately were overhauled, installed, and started operating. The machines were different; therefore, each had to be recorded separately in the ac

> A recent annual report for AMERCO, the holding company for U-Haul International, Inc., included the following note: AMERCO subsidiaries own property, plant, and equipment that are utilized in the manufacture, repair, and rental of U-Haul equipment and

> Define goods available for sale. How does it differ from cost of goods sold?

> What are the general guidelines for deciding which items should be included in inventory?

> Explain briefly the application of the LCM concept to the ending inventory and its effect on the income statement and balance sheet when market is lower than cost.

> Contrast the effects of LIFO versus FIFO on cash outflow and inflow.

> Contrast the income statement effect of LIFO versus FIFO (i.e., on pretax income) when (a) prices are rising and (b) prices are falling.

> If a publicly traded company is trying to maximize its perceived value to decision makers external to the corporation, the company is most likely to understate which of the following on its balance sheet? a. Assets b. Liabilities c. Retained Earning

> Contrast the effects of LIFO versus FIFO on reported assets (i.e., the ending inventory) when (a) prices are rising and (b) prices are falling.

> Brianna Webb, a connoisseur of fine chocolate, opened Bri’s Sweets in Collegetown on February 1, 2011. The shop specializes in a selection of gourmet chocolate candies and a line of gourmet ice cream. You have been hired as manager. You

> Refer to E3-10 . Stacey’s Piano Rebuilding Company has been operating for one year (2010). At the start of 2011, its income statement accounts had zero balances and its balance sheet account balances were as follows: Required: Use

> Explain how income can be manipulated when the specific identification inventory costing method is used.

> The chapter discussed four inventory costing methods. List the four methods and briefly explain each.

> Define beginning inventory and ending inventory.

> Explain the application of the cost principle to an item in the ending inventory.

> Why is inventory an important item to both internal (management) and external users of financial statements?

> When a perpetual inventory system is used, unit costs of the items sold are known at the date of each sale. In contrast, when a periodic inventory system is used, unit costs are known only at the end of the accounting period. Why these statements are cor

> Walker Company has just completed a physical inventory count at year-end, December 31, 2011. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $65,000. During the audit

> In a recent annual report, General Electric reported the following in its inventory note: It also reported a $23 million change in cost of goods sold due to “lower inventory levels.” Required: 1. Compute the increa

> The income statement for Pruitt Company summarized for a four-year period shows the following: An audit revealed that in determining these amounts, the ending inventory for 2012 was overstated by $18,000. The company uses a periodic inventory system.

> Starting with the beginning balances in M2-9 and given the transactions in M2-5 (including the sample), prepare a balance sheet for Pitt Inc. as of January 31, 2012, classified into current and noncurrent assets and liabilities. In M2-9, For each trans

> According to its annual report, Wendy’s International serves “the best hamburgers in the business” and other fresh food including salads, chicken sandwiches, and baked potatoes in more than 6,600 rest

> An annual report for General Motors Corporation included the following note: Inventories are stated generally at cost, which is not in excess of market. The cost of substantially all domestic inventories was determined by the last-in, first-out (LIFO) me

> Carter and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Carter and his associates

> Harvey Company prepared its annual financial statements dated December 31, 2011. The company applies the FIFO inventory costing method; however, the company neglected to apply LCM to the ending inventory. The preliminary 2011 income statement follows:

> Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basi

> Atlantic Company sells electronic test equipment that it acquires from a foreign source. During the year 2011, the inventory records reflected the following: Inventory is valued at cost using the LIFO inventory method. Required: 1. Complete the follo

> Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records for the most popular item in inventory showed the following: Required: Compute the amount of (a) goods availa

> Which of the following is false regarding a perpetual inventory system? a. Physical counts are not needed since records are maintained on a transaction-by-transaction basis. b. The balance in the inventory account is updated with each inventory purchas

> Which inventory method provides a better matching of current costs with sales revenue on the income statement and outdated values for inventory on the balance sheet? a. FIFO b. Average cost c. LIFO d. Specific identification

> Which of the following regarding the lower of cost or market rule for inventory are true? (1) The lower of cost or market rule is an example of the historical cost principle. (2) When the replacement cost of inventory drops below the cost shown in the

> Ryan Terlecki organized a new Internet company, CapUniverse, Inc. The company specializes in baseball-type caps with logos printed on them. Ryan, who is never without a cap, believes that his target market is college and high school students. You have be

> For each transaction in M2-5 (including the sample), post the effects to the appropriate T-accounts and determine ending account balances. Beginning balances are provided. In M2-5, For each of the following transactions of Pitt Inc. for the month of J

> If the ending balance in accounts payable decreases from one period to the next, which of the following is true? a. Cash payments to suppliers exceeded current period purchases. b. Cash payments to suppliers were less than current period purchases. c.

> An increasing inventory turnover ratio a. Indicates a longer time span between the ordering and receiving of inventory. b. Indicates a shorter time span between the ordering and receiving of inventory. c. Indicates a shorter time span between the purc

> Consider the following information: beginning inventory 20 units @ $20 per unit; first purchase 35 units @ $22 per unit; second purchase 40 units @ $24 per unit; 50 units were sold. What is cost of goods sold using the LIFO method of inventory costing?

> Consider the following information: beginning inventory 20 units @ $20 per unit; first purchase 35 units @ $22 per unit; second purchase 40 units @ $24 per unit; 50 units were sold. What is cost of goods sold using the FIFO method of inventory costing?

> Which of the following is not a component of the cost of inventory? a. Administrative overhead b. Direct labor c. Raw materials d. Factory overhead

> The inventory costing method selected by a company will affect a. The balance sheet. b. The income statement. c. The statement of retained earnings. d. All of the above.

> Consider the following information: ending inventory, $24,000; sales, $250,000; beginning inventory, $20,000; selling and administrative expenses, $70,000; and purchases, $90,000. What is cost of goods sold? a. $86,000 b. $94,000 c. $16,000 d. $84,

> Indicate whether the FIFO or LIFO inventory costing method would normally be selected when inventory costs are rising. Explain why.

> JCPenney Company, Inc., is a major retailer with department stores in all 50 states. The dominant portion of the company’s business consists of providing merchandise and services to consumers through department stores that include catalog departments. In

> The following list includes a series of accounts for Sanjeev Corporation, which has been operating for three years. These accounts are listed and numbered for identification. Following the accounts is a series of transactions. For each transaction, indic

> Match the type of inventory with the type of business in the following matrix: TYPE OF BUSINESS Type of Inventory Merchandising Manufacturing Work in process Finished goods Merchandise Raw materials

> For each transaction in M2-5 (including the sample), write the journal entry in the proper form. For each of the following transactions of Pitt Inc. for the month of January 2012, indicate the accounts, amounts, and direction of the effects on the accou

> Indicate the most likely effect of the following changes in inventory management on the inventory turnover ratio (use + for increase, − for decrease, and NE for no effect). ___ a. Have parts inventory delivered daily by suppliers instead of weekly. ___ b

> Knight Company had the following inventory items on hand at the end of the year. Computing the lower of cost or market on an item-by-item basis, determine what amount would be reported on the balance sheet for inventory. Cost Replacement Cost Quant

> Indicate whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. a. Declining costs Highest net income ______ Highest inventory ______ b. Rising costs Highest net income _____

> Operating costs incurred by a manufacturing company become either (1) part of the cost of inventory to be expensed as cost of goods sold at the time the finished goods are sold or (2) expenses at the time they are incurred. Indicate whether each of the

> Elite Apparel purchased 90 new shirts and recorded a total cost of $2,735 determined as follows: Invoice cost.....................................................................................................$2,250 Shipping charges....................

> Assume the 2011 ending inventory was understated by $100,000. Explain how this error would affect the 2011 and 2012 pretax income amounts. What would be the effects if the 2011 ending inventory were overstated by $100,000 instead of understated?

> Based on its physical count of inventory in its warehouse at year-end, December 31, 2011, Madison Company planned to report inventory of $34,500. During the audit, the independent CPA developed the following additional information: a. Goods from a suppl

> Misty Company reported beginning inventory of 100 units at a unit cost of $20. It engaged in the following purchase and sale transactions during 2011: Jan. 14 Sold 20 units at unit sales price of $47.50 on open account. April 9 Purchased 15 additional

> When expenses exceed revenues in a given period, a. Retained earnings are not impacted. b. Retained earnings are decreased. c. Retained earnings are increased. d. One cannot determine the impact on retained earnings without additional information.

> Brett’s Cycles sells merchandise on credit terms of 2/15, n/30. A sale invoiced at $900 (cost of sales $600) was made to Shannon Allen on February 1, 2011. The company uses the gross method of recording sales discounts. Required: 1. Give the journal en

> An annual report of ConocoPhillips contained the following note: During 2008, certain international inventory quantity reductions caused a liquidation of LIFO inventory values resulting in a $39 million benefit to our R&M segment net income. In 2007, a l

> Complete the following table by entering either the word debit or credit in each column. Increase Decrease Assets Liabilities Stockholder's equity

> Grants Corporation prepared the following two income statements (simplified for illustrative purposes): During the third quarter, it was discovered that the ending inventory for the first quarter should have been $4,400. Required: 1. What effect did

> Several years ago, the financial statements of Gibson Greeting Cards, now part of American Greetings, contained the following note: On July 1, the Company announced that it had determined that the inventory. . . had been overstated. . . . The overstatem

> Zocco Ski Company mistakenly recorded purchases of inventory on account received during the last week of December 2011 as purchases during January of 2012 (this is called a purchases cutoff error). Zocco uses a periodic inventory system, and ending inven

> The following note was contained in a recent Ford Motor Company annual report: Required: 1. What amount of ending inventory would have been reported in the current year if Ford had used only FIFO? 2. The cost of goods sold reported by Ford for the cu

> First Team Sports, Inc., is engaged in the manufacture (through independent contractors) and distribution of in-line roller skates, ice skates, street hockey equipment, and related accessory products. Its recent annual report included the following on it

> The records at the end of January 2012 for Captain Company showed the following for a particular kind of merchandise: Inventory, December 31, 2011, at FIFO: 19 Units @ $16 = $304 Inventory, December 31, 2011, at LIFO: 19 Units @ $12 = $228 Required:

> Dell Inc. is the leading manufacturer of personal computers. In a recent year, it reported the following in dollars in millions: Net sales revenue......................................$61,101 Cost of sales................................................

> As a team, select an industry to analyze. Reuters provides lists of industries under Sectors and Industries at www.reuters.com. (Click on an industry and then select Company Rankings for a list of members of that industry.) Each team member should acquir

> Parson Company was formed on January 1, 2012, and is preparing the annual financial statements dated December 31, 2012. Ending inventory information about the four major items stocked for regular sale follows: Required: 1. Compute the valuation that s

> Jones Company is preparing the annual financial statements dated December 31, 2012. Ending inventory information about the five major items stocked for regular sale follows: Required: Compute the valuation that should be used for the 2012 ending inven

> Following is partial information for the income statement of Lumber Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cos

> Complete the following table by entering either the word increases or decreases in each column. Debit Credit Assets Liabilities Stockholders' equity

> Daniel Company uses a periodic inventory system. Data for 2012: beginning merchandise inventory (December 31, 2011), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $194,500; ending inventory per physical count at De

> Beck Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement through pretax income

> Element Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement through pretax i

> Hamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2012, the accounting records provided the following information for product 1: Required: Compute ending inventory and cost of goods sold under

> Abercrombie and Fitch is a leading retailer of casual apparel for men, women, and children. Assume that you are employed as a stock analyst and your boss has just completed a review of the new Abercrombie annual report. She provided you with her notes, b

> Supply the missing dollar amounts for the income statement for each of the following independent cases: Pretax Sales Beginning Total Ending Inventory Goods Sold Profit Expenses Cost of Gross Income Cases Revenue Inventory $ 650 Purchases Available (

> The matching principle controls a. Where on the income statement expenses should be presented. b. When costs are recognized as expenses on the income statement. c. The ordering of current assets and current liabilities on the balance sheet. d. How co

> Supply the missing dollar amounts for the income statement for each of the following independent cases. Case A Case B Case C Net sales revenue $7.500 2$ $6,000 Beginning inventory $11,200 $ 6,500 $ 4,000 Purchases 5,000 9,500 Goods available for sal

> In its annual report, Caterpillar, Inc., a major manufacturer of farm and construction equipment, reported the following information concerning its inventories: Inventories are stated at the lower of cost or market. Cost is principally determined using t