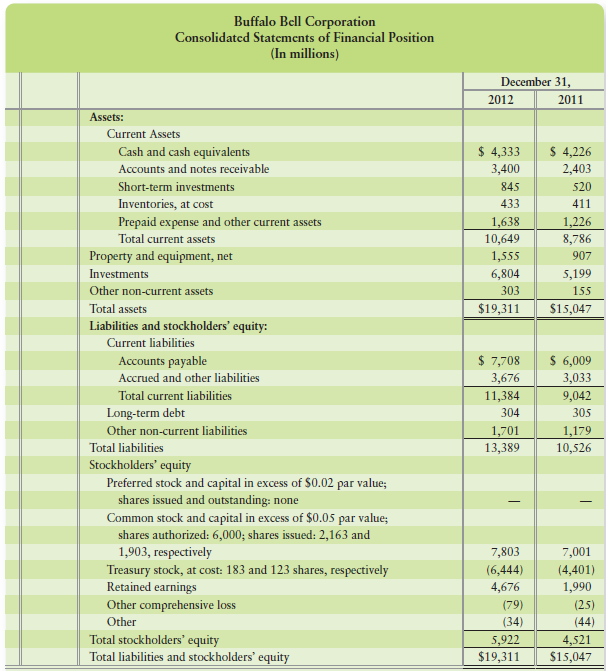

Question: Buffalo Bell’s quick (acid-test) ratio

Buffalo Bell’s quick (acid-test) ratio at year-end 2012 is closest to

a. 0.75.

b. $8,578 million.

c. 0.45.

d. 0.68.

Transcribed Image Text:

Buffalo Bell Corporation Consolidatcd Statements of Financial Position (In millions) December 31, 2012 2011 Assets: Current Assets $ 4,333 3,400 Cash and cash equivalents $ 4,226 Accounts and notes receivable 2,403 Short-term investments 845 520 Inventories, at cost 433 411 Prepaid expense and other current assets 1,638 1,226 Total current assets 10,649 8,786 Property and equipment, net 1,555 907 Investments 6,804 5,199 Other non-current assets 303 155 Total assets $19,311 $15,047 Liabilities and stockholders' equity: Current liabilities $ 6,009 3,033 9,042 Accounts payable $ 7,708 Accrued and other liabilities 3,676 Total current liabilities 11,384 Long-term debt 304 305 Other non-current liabilities 1,701 13,389 1,179 Total liabilities 10,526 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively Retained earnings Other comprehensive loss Other 7,803 7,001 (6,444) (4,401) 4,676 1,990 (79) (25) (34) (44) Total stockholders' equity Total liabilities and stockholders' equity 5,922 4,521 $19,311 $15,047 Buffalo Bell Corporation Consolidated Statements of Income (In millions, except per share amounts) Year ended December 31, 2012 $42,666 2011 2010 Net Revenue Cost of goods sold $35,220 $31,111 35,147 29,255 25,492 Gross profit Operating expenses: Selling, general, and administrative Research, development, and engineering Special charges Total operating expenses Operating income 7,519 5,965 5,619 3,341 3,250 2,985 544 53 536 512 3,885 3,803 4,033 3,634 2,162 1,586 Investment and other income (loss), net Income before income taxes 153 196 (30) 3,787 2,358 1,556 Income tax expense 1,136 940 472 Net income $ 2,651 $ 1,418 $ 1,084 Earnings per common share: Basic $ 1.41 $ 0.95 $ 0.37

> Use the Northern Corporation data in Exercise 10-41B to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2013. In Exercise 10-41B At December 31, 2012, Northern Corporation reported the stockholders’ equity account

> At December 31, 2012, Northern Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $4.00 par value per share, 2,300 million shares issued................ $ 9,200 Paid

> Journalize the following assumed transactions of Ambient Productions: Feb 22 Issued 1,800 shares of $1.75 par common stock at $5 per share. Jun 25 Purchased 400 shares of treasury stock at $14 per share. Jul 9 Sold 300 shares of treasury stock at $22 per

> In 2002, Enron Corporation fi led for Chapter 11 bankruptcy protection, shocking the business community: How could a company this large and this successful go bankrupt? This case explores the causes and the effects of Enron’s bankruptcy

> Sagebrush Software had the following selected account balances at December 31, 2012 (in thousands, except par value per share): Requirements 1. Prepare the stockholders’ equity section of Sagebrush Software’s balance

> Time Travel Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $25,000 to help organize the corporation. Time Travel also issued common stock to an inventor in exchange for his patent with

> Captain Sporting Goods is authorized to issue 13,000 shares of common stock. During a two-month period, Captain completed these stock-issuance transactions: Jul 23 Issued 3,200 shares of $1.00 par common stock for cash of $13.00 per share. 12 Received in

> Pryor Sales, Inc., is authorized to issue 190,000 shares of common stock and 10,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Jul 19 Issued 12,000 shares of $4.00 par common stock

> The sale of inventory for cash is reported on the statement of cash flows under a. Investing activities. b. Non-cash investing and financing activities. c. Operating activities. d. Financing activities.

> Use the California Company data in Exercise E10-34A to show how the company reported cash flows from financing activities during 2012 (the current year). List items in descending order from largest to smallest dollar amount. In Exercise E10-34A Californ

> California Company included the following items in its financial statements for 2012, the current year (amounts in millions): Requirements 1. Use DuPont analysis to compute California’s return on assets and return on common equity dur

> Lofty Inns reported these figures for 2013 and 2012 (in millions): Requirements 1. Use DuPont analysis to compute Lofty’s return on assets and return on common stockholders’ equity for 2013. 2. Do these rates of retu

> The balance sheet of Basket Rug Company reported the following: Redeemable preferred stock, 5%, $70 par value, redemption value $35,000; outstanding 400 shares...............................................................................................

> Ace Corp. had the following stockholders’ equity at January 31 (dollars in millions, except par value per share): Stockholders’ Equity Common stock, $1.80 par, 500 million shares authorized, 425 million shares issued ….. $ 765 Additional paid-in capital…

> Determine whether the following bonds payable will be issued at par value, at a premium, or at a discount: a. The market interest rate is 7%. Horton Corp. issues bonds payable with a stated rate of 6 1/2%. b. Sharp, Inc., issued 6% bonds payable when the

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Townsend Corporation. Each transaction is independent. a. Declaration of cash dividends of $76 million. b. Payment of the cas

> The stockholders’ equity for Dairy Place Drive-Ins (DP) on December 31, 2012, follows: Stockholders’ Equity Common stock, $0.30 par, 2,600,000 shares authorized, 600,000 shares issued ……. $ 180,000 Paid-in capital in excess of par—common ……………………………………….

> Superb Manufacturing, Inc., reported the following: Stockholders’ Equity Preferred stock, cumulative, $1.00 par, 6%, 90,000 shares issued …………. $ 90,000 Common stock, $0.30 par, 9,130,000 shares issued ………………..…………… 2,739,000 Superb Manufacturing has pa

> Omicron Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Omicron’s preferred stock to decrease during 2013? Cite all possible causes. 2. What caused Omicr

> Use the Blumenthal Corporation data in Exercise 10-25A to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2013. In Exercise 10-25A At December 31, 2012, Blumenthal Corporation reported the stockholders’ equity acc

> Paying off bonds payable is reported on the statement of cash flows under a. Financing activities. b. Non-cash investing and financing activities. c. Operating activities. d. Investing activities.

> At December 31, 2012, Blumenthal Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $3.00 par value per share, 2,400 million shares issued................ $ 7,200 Ca

> Journalize the following transactions of Alameda Productions: Jan 21 Issued 1,800 shares of $1.25 par common stock at $13 per share. Jun 23 Purchased 500 shares of treasury stock at $15 per share. Jul 12 Sold 400 shares of treasury stock at $22 per share

> Casey Software had the following selected account balances at December 31, 2012 (in thousands, except par value per share). Requirements 1. Prepare the stockholders’ equity section of Casey’s balance sheet (in thousa

> Excursion Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $20,000 to help organize the corporation. Excursion also issued common stock to an inventor in exchange for his patent with a ma

> The Coca-Cola Company reported the following comparative information at December 31, 2010, and December 31, 2009 (amounts in millions and adapted): Requirements 1. Calculate the following ratios for 2010 and 2009: a. Current ratio b. Debt ratio 2. Duri

> St. Genevieve Petroleum Company is an independent oil producer in Baton Parish, Louisiana. In February, company geologists discovered a pool of oil that tripled the company’s proven reserves. Prior to disclosing the new oil to the public, St. Genevieve q

> This case is based on the consolidated financial statements of RadioShack Corporation given in Appendix B at the end of this book. In particular, this case uses RadioShack Corporation’s consolidated statement of shareholders’ equity for the year 2010. 1.

> The global economic recession that started in 2007, and that persists in certain sectors, has impacted every business, but it was especially hard on banks, automobile manufacturing, and retail companies. Banks were largely responsible for the recession.

> Colonel Sporting Goods is authorized to issue 18,000 shares of common stock. During a two-month period, Colonel completed these stock-issuance transactions: Apr 23 Issued 3,000 shares of $1.00 par common stock for cash of $14.50 per share. 12 Received in

> Aerostar, Inc., operates as a retailer of casual apparel. A recent, condensed income statement for Aerostar follows: Requirements 1. Assume that the following transactions were inadvertently omitted at the end of the year. Using the categories in the t

> Brown-Box Retail Corporation reported shareholders’ equity on its balance sheet at December 31, 2013 as follows: Requirements 1. Identify the two components that typically make up accumulated other comprehensive income. 2. For each co

> Fall River Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2012: Requirements Answer these questions about Fall River Specialties’ stockholdersâ€&

> The accounting (not the income tax) records of Johnson Publications, Inc., provide the income statement for 2012. ___________________________2012 Total revenue........................................... $850,000 Expenses: Cost of goods sold..............

> Jackson Hallstead, accountant for Confection Pies, was injured in an auto accident. While he was recuperating, another inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2012: The individual amounts listed

> Better Experts Ltd. (BEL) specializes in taking underperforming companies to a higher level of performance. BEL’s capital structure at December 31, 2011, included 10,000 shares of $2.25 preferred stock and 120,000 shares of common stock. During 2012, BEL

> Suppose Blanco Corporation completed the following international transactions: May 1 Sold inventory on account to Aromando, the Italian automaker, for €70,000. The exchange rate of the euro was $1.33, and Aromando demands to pay in euros. 10 Purchased su

> What is the largest single item included in Buffalo Bell’s debt ratio at December 31, 2012? a. Cash and cash equivalents b. Common Stock c. Accounts payable d. Investments Buffalo Bell Corporation Consolidatcd Statements of Financ

> Shaw Cosmetics in Problem P11-56B holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Shaw’s stock is currently se

> Use the data in Problem P11-56B to prepare the Shaw Cosmetics statement of retained earnings for the year ended December 31, 2012. Use the Statement of Retained Earnings for Maxim, Inc., in the End-of-Chapter Summary Problem as a model. Data in Problem

> Hambrick Sales, Inc., is authorized to issue 170,000 shares of common stock and 5,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Aug 19 Issued 10,000 shares of $5.00 par common stoc

> The following information was taken from the records of Shaw Cosmetics, Inc., at December 31, 2012: Requirements 1. Prepare Shaw Cosmetics’ single-step income statement, which lists all revenues together and all expenses together, for

> Fabulous Food Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2012: Requirements Answer these questions about Fabulous Food Specialties’ stockholdersâ&

> The accounting (not the income tax) records of Mahoney Publications, Inc., provide the income statement for 2012. ____________________________2012 Total revenue........................................... $900,000 Expenses: Cost of goods sold.............

> John Holland, accountant for Sunny Pie Foods, was injured in an auto accident. While he was recuperating, another inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2012: The individual amounts listed on t

> Capital Experts, Ltd., (CEL) specializes in taking underperforming companies to a higher level of performance. CEL’s capital structure at December 31, 2011, included 14,000 shares of $2.25 preferred stock and 115,000 shares of common stock. During 2012,

> Suppose Gray Corporation completed the following international transactions: May 1 Sold inventory on account to Giorgio, the Italian automaker, for €80,000. The exchange rate of the euro was $1.35, and Giorgio demands to pay in euros. 10 Purchased suppli

> Crowley Cosmetics in Problem P11-48A holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Crowley’s stock is curren

> Use the data in Problem P11-48A to prepare the Crowley Cosmetics statement of retained earnings for the year ended December 31, 2012. Use the Statement of Retained Earnings for Maxim, Inc., in the End-of-Chapter Summary Problem as a model. In Problem P1

> The following information was taken from the records of Crowley Cosmetics, Inc., at December 31, 2012: Requirements 1. Prepare Crowley Cosmetics’ single-step income statement, which lists all revenues together and all expenses togethe

> During 2012, Granite Corporation earned net income of $5.1 billion and paid off $2.9 billion of long-term notes payable. Granite raised $1.6 billion by issuing common stock, paid $3.9 billion to purchase treasury stock, and paid cash dividends of $1.9 bi

> Which statement is true? a. The Public Company Oversight Board evaluates internal controls. b. GAAP governs the form and content of the financial statements. c. Management audits the financial statements. d. Independent auditors prepare the financial sta

> Examine the statement of stockholders’ equity of Wellington Electronics Corporation. What was the market value of each share of the stock that Wellington gave its stockholders in the stock dividend? a. $26 b. $39,000 c. $3,000 d. $52

> Which of the following items is most closely related to prior-period adjustments? a. Retained earnings b. Earnings per share c. Preferred stock dividends d. Accounting changes

> Use the Copycat Corporation data in question 43. At the end of its first year of operations, Copycat’s deferred tax liability is a. $27,000. b. $11,000. c. $3,000. d. $19,000.

> Copycat Corporation in the preceding question must immediately pay income tax of a. $77,000. b. $30,000. c. $33,000. d. $70,000.

> Copycat Corporation has income before income tax of $110,000 and taxable income of $100,000. The income tax rate is 30%. Copycat’s income statement will report net income of a. $30,000. b. $33,000. c. $77,000. d. $107,000.

> Earnings per share is not reported for a. Discontinued operations. b. Extraordinary items. c. Comprehensive income. d. Continuing operations.

> Foreign-currency transaction gains and losses are reported on the a. Balance sheet. b. Income statement. c. Statement of cash flows. d. Consolidation work sheet.

> One way to hedge a foreign-currency transaction loss is to a. Pay debts as late as possible. b. Pay in the foreign currency. c. Off set foreign-currency inventory and plant assets. d. Collect in your own currency.

> Buffalo Bell’s current ratio at year end 2012 is closest to a. $1,420. b. 0.9. c. 22.1. d. 1.2. Buffalo Bell Corporation Consolidatcd Statements of Financial Position (In millions) December 31, 2012 2011 Assets: Current Assets $ 4

> Graham Corporation is conducting a special meeting of its board of directors to address some concerns raised by the stockholders. Stockholders have submitted the following questions. Answer each question. 1. Why are common stock and retained earnings sho

> Boston Systems purchased inventory on account from Megaplex. The price was ¥140,000, and a yen was quoted at $0.0091. Boston paid the debt in yen a month later when the price of a yen was $0.0092. Boston a. Recorded a Foreign-Currency Transaction Gain of

> Return to the preceding question. Suppose you are evaluating Leslie’s Lotion Company stock as an investment. You require an 8% rate of return on investments, so you capitalize Leslie’s earnings at 8%. How much are you willing to pay for all of Leslie’s s

> Leslie’s Lotion Company reports several earnings numbers on its current-year income statement (parentheses indicate a loss): How much net income would most investment analysts predict for Leslie’s to earn next year?

> Refer to the Amazon.com, Inc. , consolidated financial statements in Appendix A at the end of this book. 1. Amazon.com, Inc.’s consolidated statements of operations do not mention income from continuing operations. Why not? Focus your attention on the co

> This case is based on the RadioShack Corporation consolidated financial statements in Appendix B at the end of this book. 1. Focus on the company’s Consolidated Statements of Income for the three years ended December 31, 2010, as well as Note 2 summarizi

> The December 31, 2011, Balance Sheet and the 2012 Statement of Cash Flows for Snow, Inc., follow: Requirement Prepare the December 31, 2012, balance sheet for Snow, Inc. Snow, Inc. Balance Sheet December 31, 2011 Assets: Cash $ 11,000 Accounts rec

> Craftsman Specialties reported the following at December 31, 2012 (in thousands): Requirement Determine the following items for Craftsman Specialties during 2012: a. Gain or loss on the sale of property and equipment b. Amount of long-term debt issued

> Rodeo Drive, Inc., reported the following in its financial statements for the year ended May 31, 2012 (in thousands): Requirement 1. Determine the following cash receipts and payments for Rodeo Drive, Inc., during 2012: (Enter all amounts in thousands.

> The comparative balance sheets of Lesley Leary Design Studio, Inc., at June 30, 2012 and 2011, and transaction data for fiscal 2012, are as follows: Transaction data for the year ended June 30, 2012, follows: a. Net income, $60,500 b. Depreciation expe

> To prepare the statement of cash flows, accountants for Rosie Electric Company have summarized 2012 activity in two accounts as follows: Rosie’s 2012 income statement and balance sheet data follow: Requirements 1. Prepare the statem

> POLA Corporation’s 2012 financial statements reported the following items, with 2011 figures given for comparison (adapted and in millions). Use the DuPont model to compute POLA’s return on assets and return on commo

> During 2012, Buffalo Bell’s total assets a. Increased by 28.3%. b. Increased by $1,420 million. c. Both a and b. d. Increased by 22.1%. Buffalo Bell Corporation Consolidatcd Statements of Financial Position (In millions) December

> Fashion Furniture Gallery, Inc., provided the following data from the company’s records for the year ended December 31, 2012: a. Credit sales, $522,000 b. Loan to another company, $8,900 c. Cash payments to purchase plant assets, $77,000 d. Cost of goods

> Use the Perfect Supply Corp. data from Problem P12-71B. Data in Problem P12-71B The 2012 and 2011 comparative balance sheets and 2012 income statement of Perfect Supply Corp. follow: Requirements 1. Prepare the 2012 statement of cash fl ows by using

> The 2012 and 2011 comparative balance sheets and 2012 income statement of Perfect Supply Corp. follow: Perfect Supply had no non-cash investing and fi nancing transactions during 2012. During the year, there were no sales of land or equipment, no paym

> The comparative balance sheets of Moynihan Movie Theater Company at September 30, 2012 and 2011, reported the following: Moynihan’s transactions during the year ended September 30, 2012, included the following: Requirements 1. Prepa

> Galvin Software Corp. has assembled the following data for the year ended December 31, 2012: Requirement Prepare Galvin Software Corp.’s statement of cash flows using the indirect method to report operating activities. Include an acco

> Use the Classic Automobiles of Cedar Grove, Inc., data from Problem 12-67B. Data in Problem 12-67B Classic Automobiles of Cedar Grove, Inc., was formed on January 1, 2012. The following transactions occurred during 2012: On January 1, 2012, Classic issu

> Classic Automobiles of Cedar Grove, Inc., was formed on January 1, 2012. The following transactions occurred during 2012: On January 1, 2012, Classic issued its common stock for $430,000. Early in January, Classic made the following cash payments: a. $16

> The comparative balance sheets of Susan Saboda Design Studio, Inc., at June 30, 2012 and 2011, and transaction data for fiscal 2012, are as follows: Transaction data for the year ended June 30, 2012, follows: a. Net income, $70,600 b. Depreciation expe

> To prepare the statement of cash flows, accountants for Dora Electric Company have summarized 2012 activity in two accounts as follows: Dora’s 2012 income statement and balance sheet data follow: Requirements 1. Prepare the statemen

> Give the DuPont model formula for computing (a) Rate of return on total assets (ROA) and (b) Rate of return on common stockholders’ equity (ROE). Then answer these questions about the rate-of-return computations. 1. Explain the meaning of the component d

> Landry Furniture Gallery, Inc., provided the following data from the company’s records for the year ended March 31, 2012: a. Credit sales, $600,000 b. Loan to another company, $12,300 c. Cash payments to purchase plant assets, $82,100 d. Cost of goods so

> Suppose you manage Outward Bound, Inc., a Vermont sporting goods store that lost money during the past year. To turn the business around, you must analyze the company and industry data for the current year to learn what is wrong. The companyâ€

> Use the Summer Time Supply Corp. data from Problem 12-62A. Data in Problem 12-62A The 2012 and 2011 comparative balance sheets and 2012 income statement of Summer Time Supply Corp. follow: Requirements 1. Prepare the 2012 statement of cash flows by us

> The 2012 and 2011 comparative balance sheets and 2012 income statement of Summer Time Supply Corp. follow: Summer Time Supply had no non-cash investing and financing transactions during 2012. During the year, there were no sales of land or equipment, n

> The comparative balance sheets of Mystic Movie Theater Company at June 30, 2012, and 2011, reported the following: Mystic Movie Theater’s transactions during the year ended June 30, 2012, included the following: Requirements 1. Prep

> Stellar Software Corp. has assembled the following data for the years ending December 31, 2012 and 2011. Requirement Prepare Stellar Software Corp.’s statement of cash flows using the indirect method to report operating activities. In

> Use the Modern Automobiles of Denver, Inc., data from Problem 12-58A. Data in Problem 12-58A Modern Automobiles of Denver, Inc., was formed on January 1, 2012. The following transactions occurred during 2012: On January 1, 2012, Modern issued its common

> Modern Automobiles of Denver, Inc., was formed on January 1, 2012. The following transactions occurred during 2012: On January 1, 2012, Modern issued its common stock for $280,000. Early in January, Modern made the following cash payments: a. $120,000 fo

> Income Tax Payable was $5,000 at the end of the year and $2,600 at the beginning. Income tax expense for the year totaled $58,900. What amount of cash did the company pay for income tax during the year? a. $56,500 b. $58,900 c. $61,300 d. $61,500

> Credit sales totaled $750,000, accounts receivable increased by $60,000, and accounts payable decreased by $40,000. How much cash did the company collect from customers? a. $690,000 b. $810,000 c. $730,000 d. $750,000

> Compute the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable are $23,000 and $27,000, respectively. Credit sales for the period total $67,000. How much are cash collections from customers? b. Cost of goods sold

> Turnberry Golf Corporation’s long-term debt agreements make certain demands on the business. For example, Turnberry may not purchase treasury stock in excess of the balance of retained earnings. Also, long-term debt may not exceed stockholders’ equity, a

> The following data (dollar amounts in millions) are from the financial statements of Valley Corporation: Average stockholders’ equity............................... $5,400 Interest expense................................................

> The following data (dollar amounts in millions) are taken from the financial statements of Number 1 Industries, Inc.: Total liabilities.................................... $12,500 Total current assets........................... $13,500 Accumulated deprec

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to Topline.com and E-shop Stores and have assembled the following data. Selected income statement data for current year: Selected balance sheet and market p

> Comparative financial statement data of Panfield Optical Mart follow: Other information: 1. Market price of Panfield common stock: $94.38 at December 31, 2012, and $85.67 at December 31, 2011 2. Common shares outstanding: 15,000 during 2012 and 10,000