Question: Use the California Company data in Exercise

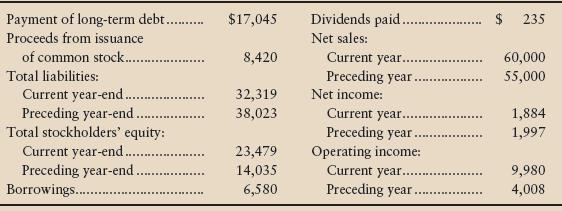

Use the California Company data in Exercise E10-34A to show how the company reported cash flows from financing activities during 2012 (the current year). List items in descending order from largest to smallest dollar amount.

In Exercise E10-34A

California Company included the following items in its financial statements for 2012, the current year (amounts in millions):

Transcribed Image Text:

Payment of long-term debt.. $17,045 Dividends paid. $ 235 Proceeds from issuance Net sales: of common stock. 8,420 Current year.. 60,000 Total liabilities: Preceding year. 55,000 Current year-end.. Preceding year-end. Total stockholders' equity: Current year-end. Preceding year-end. Borrowings.. 32,319 Net income: 38,023 Current year... 1,884 Preceding year. 1,997 23,479 Operating income: 14,035 Current year.. 9,980 6,580 Preceding year. 4,008

> On an indirect method statement of cash flows, an increase in accounts payable would be a. Added to net income in the operating activities section. b. Reported in the financing activities section. c. Deducted from net income in the operating activities s

> Amazon.com’s consolidated financial statements appear in Appendix A at the end of this book. 1. Refer to the Consolidated Balance Sheets and Note 7 (Stockholders’ Equity). Describe the classes of stock that Amazon.com, Inc., has authorized. How many shar

> This case is based on a real situation. George Campbell paid $50,000 for a franchise that entitled him to market Success Associates software programs in the countries of the European Union. Campbell intended to sell individual franchises for the major la

> Nate Smith and Darla Jones have written a computer program for a video game that may rival PlayStation and Xbox. They need additional capital to market the product, and they plan to incorporate their business. Smith and Jones are considering alternative

> Which of the following is a characteristic of a corporation? a. No income tax b. Mutual agency c. Limited liability of stockholders d. Both a and b

> Smiley Site, Inc., ended 2012 with 10 million shares of $1 par common stock issued and outstanding. Beginning additional paid-in capital was $9 million, and retained earnings totaled $44 million. â–¶ In April 2013, Smiley Site issued 9 mi

> Orbit Corporation reported the following stockholders’ equity data (all dollars in millions except par value per share): Orbit earned net income of $2,920 during 2012. For each account except Retained Earnings, one transaction explain

> Use the I-9 Networking Solutions data in Exercise 10-88 to show how the company reported cash flows from financing activities during 2012. In Exercise 10-88 I-9 Networking Solutions began operations on January 1, 2012, and immediately issued its stock,

> I-9 Networking Solutions began operations on January 1, 2012, and immediately issued its stock, receiving cash. I-9’s balance sheet at December 31, 2012, reported the following stockholders’ equity: Common stock, $1 pa

> The statement of cash flows of Cooper, Inc., reported the following for the year ended December 31, 2012: Cash flows from financing activities (amounts in millions) Cash dividends paid ............................................................... $(1,7

> Consider the authority structure in a corporation, as diagrammed in Exhibit 10-2. 1. What group holds the ultimate power in a corporation? 2. Who is the most powerful person in the corporation? What’s the abbreviation of this person&aci

> The following accounts and related balances of Dove Designers, Inc., as of December 31, 2012, are arranged in no particular order. Requirements 1. Prepare Dove’s classified balance sheet in the account format at December 31, 2012. 2.

> On an indirect method statement of cash flows, an increase in a prepaid insurance would be a. Deducted from net income. b. Added to increases in current assets. c. Added to net income. d. Included in payments to suppliers.

> Assume ABC Cupcakes of Montana, Inc., completed the following transactions during 2012, the company’s 10th year of operations: Feb 3 Issued 10,000 shares of common stock ($3.00 par) for cash of $280,000. Mar 19 Purchased 2,700 shares of the company’s own

> Madrid Jewelry Company reported the following summarized balance sheet at December 31, 2012: Assets Current assets............................................................................................. $ 34,500 Property and equipment, net….........

> Bentley Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at February 28, 2013: Stockholders’ Equity Preferred stock, 6.0% cumulative—par value $25 per share authorized 140,000 shares in each class Class

> Healthy Living Foods, Inc., is authorized to issue 4,250,000 shares of $1.00 par common stock. In its initial public offering during 2012, Healthy Living issued 390,000 shares of its $1.00 par common stock for $5.50 per share. Over the next year, Healthy

> Callman Corp. has the following stockholders’ equity information: Callman’s charter authorizes the company to issue 10,000 shares of 6% preferred stock with par value of $90 and 750,000 shares of no-par common stock. The company issued 2,000 shares of th

> The partners who own Ameen Canoes Co. wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Ameen Canoes, Inc. The charter from the state of Mississippi authorizes the corporation to issue 150,000 s

> The statement of cash flows of Spirit, Inc., reported the following for the year ended December 31, 2012: Cash flows from financing activities (amounts in millions) Cash dividends paid ............................................................... $(1,8

> The following accounts and related balances of Bluebird Designers, Inc., as of December 31, 2012, are arranged in no particular order. Requirements 1. Prepare Bluebird’s classified balance sheet in the account format at December 31, 2

> What are two main advantages that a corporation has over a proprietorship and a partnership? What are two main disadvantages of a corporation?

> Assume Frozen Foods of Maine, Inc., completed the following transactions during 2012, the company’s 10th year of operations: Feb 3 Issued 11,000 shares of common stock ($3.00 par) for cash of $275,000. Mar 19 Purchased 2,400 shares of the company’s own c

> Paris Jewelry Company reported the following summarized balance sheet at December 31, 2012: Assets Current assets................................................................................. $ 33,700 Property and equipment, net.......................

> Which of the following terms appears on a statement of cash flows—indirect method? a. Collections from customers b. Depreciation expense c. Payments to suppliers d. Cash receipt of interest revenue

> Reliable Outdoor Furniture Company included the following stockholders’ equity on its year-end balance sheet at February 28, 2013: Stockholders’ Equity Preferred stock, 7.5% cumulative—par value $15 per share; authorized 110,000 shares in each class Clas

> Fresh Produce Foods, Inc., is authorized to issue 3,750,000 shares of $5.00 par common stock. In its initial public offering during 2012, Fresh Produce issued 360,000 shares of its $5.00 par common stock for $5.50 per share. Over the next year, Fresh Pro

> Doorman Corp. has the following stockholders’ equity information: Doorman’s charter authorizes the company to issue 7,000 shares of 10% preferred stock with par value of $140 and 750,000 shares of no-par common stock. The company issued 1,400 shares of t

> The partners who own Jefferson Canoes Co. wished to avoid the unlimited personal liability of the partnership form of business, so they incorporated as Jefferson Canoes, Inc. The charter from the state of Nevada authorizes the corporation to issue 110,00

> Use the Easton data in Exercise E10-50B to show how the company reported cash flows from financing activities during 2012 (the current year). List items in descending order from largest to smallest dollar amount. Data from Exercise E10-50B Easton Compan

> Easton Company included the following items in its financial statements for 2012, the current year (amounts in millions): Requirements 1. Use DuPont analysis to compute Easton’s return on assets and return on common equity during 2012

> Lexington Inns reported these figures for 2013 and 2012 (in millions): Requirements 1. Use DuPont analysis to compute Lexington’s return on assets and return on common stockholders’ equity for 2013. 2. Do these rates

> Microsoft Corporation is the defendant in numerous lawsuits claiming unfair trade practices. Microsoft has strong incentives not to disclose these contingent liabilities. However, GAAP requires that companies report their contingent liabilities. Require

> The balance sheet of Beecham Rug Company reported the following: Redeemable preferred stock, 6%, $90 par value, redemption value $25,000; outstanding 200 shares..............................................................................................

> Solartech Corp. had the following stockholders’ equity at May 31 (dollars in millions, except par value per share): Stockholders’ Equity Common stock, $1.20 par, 900 million shares authorized, 400 million shares issued ….. $ 480 Additional paid-in capita

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Triton Corporation. Each transaction is independent. a. Declaration of cash dividends of $75 million. b. Payment of the cash

> Selling equipment is reported on the statement of cash flows under a. Financing activities. b. Non-cash investing and financing activities. c. Operating activities. d. Investing activities.

> The stockholders’ equity for Perfect Desserts Drive-Ins (PD) on December 31, 2012, follows: Stockholders’ Equity Common stock, $0.75 par, 2,700,000 shares authorized, 500,000 shares issued …….. $ 375,000 Paid-in capital in excess of par—common …………………………

> Majestic Manufacturing, Inc., reported the following: Stockholders’ Equity Preferred stock, cumulative, $2.00 par, 8%, 70,000 shares issued ………….. $ 140,000 Common stock, $0.15 par, 9,070,000 shares issued ……………..…….………….. 1,360,500 Majestic Manufacturi

> Zeta Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Zeta’s preferred stock to decrease during 2013? Cite all possible causes. 2. What caused Zetaâ

> Use the Northern Corporation data in Exercise 10-41B to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2013. In Exercise 10-41B At December 31, 2012, Northern Corporation reported the stockholders’ equity account

> At December 31, 2012, Northern Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $4.00 par value per share, 2,300 million shares issued................ $ 9,200 Paid

> Journalize the following assumed transactions of Ambient Productions: Feb 22 Issued 1,800 shares of $1.75 par common stock at $5 per share. Jun 25 Purchased 400 shares of treasury stock at $14 per share. Jul 9 Sold 300 shares of treasury stock at $22 per

> In 2002, Enron Corporation fi led for Chapter 11 bankruptcy protection, shocking the business community: How could a company this large and this successful go bankrupt? This case explores the causes and the effects of Enron’s bankruptcy

> Sagebrush Software had the following selected account balances at December 31, 2012 (in thousands, except par value per share): Requirements 1. Prepare the stockholders’ equity section of Sagebrush Software’s balance

> Time Travel Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $25,000 to help organize the corporation. Time Travel also issued common stock to an inventor in exchange for his patent with

> Captain Sporting Goods is authorized to issue 13,000 shares of common stock. During a two-month period, Captain completed these stock-issuance transactions: Jul 23 Issued 3,200 shares of $1.00 par common stock for cash of $13.00 per share. 12 Received in

> Pryor Sales, Inc., is authorized to issue 190,000 shares of common stock and 10,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Jul 19 Issued 12,000 shares of $4.00 par common stock

> The sale of inventory for cash is reported on the statement of cash flows under a. Investing activities. b. Non-cash investing and financing activities. c. Operating activities. d. Financing activities.

> California Company included the following items in its financial statements for 2012, the current year (amounts in millions): Requirements 1. Use DuPont analysis to compute California’s return on assets and return on common equity dur

> Lofty Inns reported these figures for 2013 and 2012 (in millions): Requirements 1. Use DuPont analysis to compute Lofty’s return on assets and return on common stockholders’ equity for 2013. 2. Do these rates of retu

> The balance sheet of Basket Rug Company reported the following: Redeemable preferred stock, 5%, $70 par value, redemption value $35,000; outstanding 400 shares...............................................................................................

> Ace Corp. had the following stockholders’ equity at January 31 (dollars in millions, except par value per share): Stockholders’ Equity Common stock, $1.80 par, 500 million shares authorized, 425 million shares issued ….. $ 765 Additional paid-in capital…

> Determine whether the following bonds payable will be issued at par value, at a premium, or at a discount: a. The market interest rate is 7%. Horton Corp. issues bonds payable with a stated rate of 6 1/2%. b. Sharp, Inc., issued 6% bonds payable when the

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Townsend Corporation. Each transaction is independent. a. Declaration of cash dividends of $76 million. b. Payment of the cas

> The stockholders’ equity for Dairy Place Drive-Ins (DP) on December 31, 2012, follows: Stockholders’ Equity Common stock, $0.30 par, 2,600,000 shares authorized, 600,000 shares issued ……. $ 180,000 Paid-in capital in excess of par—common ……………………………………….

> Superb Manufacturing, Inc., reported the following: Stockholders’ Equity Preferred stock, cumulative, $1.00 par, 6%, 90,000 shares issued …………. $ 90,000 Common stock, $0.30 par, 9,130,000 shares issued ………………..…………… 2,739,000 Superb Manufacturing has pa

> Omicron Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Omicron’s preferred stock to decrease during 2013? Cite all possible causes. 2. What caused Omicr

> Use the Blumenthal Corporation data in Exercise 10-25A to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2013. In Exercise 10-25A At December 31, 2012, Blumenthal Corporation reported the stockholders’ equity acc

> Paying off bonds payable is reported on the statement of cash flows under a. Financing activities. b. Non-cash investing and financing activities. c. Operating activities. d. Investing activities.

> At December 31, 2012, Blumenthal Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $3.00 par value per share, 2,400 million shares issued................ $ 7,200 Ca

> Journalize the following transactions of Alameda Productions: Jan 21 Issued 1,800 shares of $1.25 par common stock at $13 per share. Jun 23 Purchased 500 shares of treasury stock at $15 per share. Jul 12 Sold 400 shares of treasury stock at $22 per share

> Casey Software had the following selected account balances at December 31, 2012 (in thousands, except par value per share). Requirements 1. Prepare the stockholders’ equity section of Casey’s balance sheet (in thousa

> Excursion Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $20,000 to help organize the corporation. Excursion also issued common stock to an inventor in exchange for his patent with a ma

> The Coca-Cola Company reported the following comparative information at December 31, 2010, and December 31, 2009 (amounts in millions and adapted): Requirements 1. Calculate the following ratios for 2010 and 2009: a. Current ratio b. Debt ratio 2. Duri

> St. Genevieve Petroleum Company is an independent oil producer in Baton Parish, Louisiana. In February, company geologists discovered a pool of oil that tripled the company’s proven reserves. Prior to disclosing the new oil to the public, St. Genevieve q

> This case is based on the consolidated financial statements of RadioShack Corporation given in Appendix B at the end of this book. In particular, this case uses RadioShack Corporation’s consolidated statement of shareholders’ equity for the year 2010. 1.

> The global economic recession that started in 2007, and that persists in certain sectors, has impacted every business, but it was especially hard on banks, automobile manufacturing, and retail companies. Banks were largely responsible for the recession.

> Colonel Sporting Goods is authorized to issue 18,000 shares of common stock. During a two-month period, Colonel completed these stock-issuance transactions: Apr 23 Issued 3,000 shares of $1.00 par common stock for cash of $14.50 per share. 12 Received in

> Aerostar, Inc., operates as a retailer of casual apparel. A recent, condensed income statement for Aerostar follows: Requirements 1. Assume that the following transactions were inadvertently omitted at the end of the year. Using the categories in the t

> Brown-Box Retail Corporation reported shareholders’ equity on its balance sheet at December 31, 2013 as follows: Requirements 1. Identify the two components that typically make up accumulated other comprehensive income. 2. For each co

> Fall River Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2012: Requirements Answer these questions about Fall River Specialties’ stockholdersâ€&

> The accounting (not the income tax) records of Johnson Publications, Inc., provide the income statement for 2012. ___________________________2012 Total revenue........................................... $850,000 Expenses: Cost of goods sold..............

> Jackson Hallstead, accountant for Confection Pies, was injured in an auto accident. While he was recuperating, another inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2012: The individual amounts listed

> Better Experts Ltd. (BEL) specializes in taking underperforming companies to a higher level of performance. BEL’s capital structure at December 31, 2011, included 10,000 shares of $2.25 preferred stock and 120,000 shares of common stock. During 2012, BEL

> Suppose Blanco Corporation completed the following international transactions: May 1 Sold inventory on account to Aromando, the Italian automaker, for €70,000. The exchange rate of the euro was $1.33, and Aromando demands to pay in euros. 10 Purchased su

> What is the largest single item included in Buffalo Bell’s debt ratio at December 31, 2012? a. Cash and cash equivalents b. Common Stock c. Accounts payable d. Investments Buffalo Bell Corporation Consolidatcd Statements of Financ

> Shaw Cosmetics in Problem P11-56B holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Shaw’s stock is currently se

> Use the data in Problem P11-56B to prepare the Shaw Cosmetics statement of retained earnings for the year ended December 31, 2012. Use the Statement of Retained Earnings for Maxim, Inc., in the End-of-Chapter Summary Problem as a model. Data in Problem

> Hambrick Sales, Inc., is authorized to issue 170,000 shares of common stock and 5,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Aug 19 Issued 10,000 shares of $5.00 par common stoc

> The following information was taken from the records of Shaw Cosmetics, Inc., at December 31, 2012: Requirements 1. Prepare Shaw Cosmetics’ single-step income statement, which lists all revenues together and all expenses together, for

> Fabulous Food Specialties, Inc., reported the following statement of stockholders’ equity for the year ended October 31, 2012: Requirements Answer these questions about Fabulous Food Specialties’ stockholdersâ&

> The accounting (not the income tax) records of Mahoney Publications, Inc., provide the income statement for 2012. ____________________________2012 Total revenue........................................... $900,000 Expenses: Cost of goods sold.............

> John Holland, accountant for Sunny Pie Foods, was injured in an auto accident. While he was recuperating, another inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2012: The individual amounts listed on t

> Capital Experts, Ltd., (CEL) specializes in taking underperforming companies to a higher level of performance. CEL’s capital structure at December 31, 2011, included 14,000 shares of $2.25 preferred stock and 115,000 shares of common stock. During 2012,

> Suppose Gray Corporation completed the following international transactions: May 1 Sold inventory on account to Giorgio, the Italian automaker, for €80,000. The exchange rate of the euro was $1.35, and Giorgio demands to pay in euros. 10 Purchased suppli

> Crowley Cosmetics in Problem P11-48A holds significant promise for carving a niche in its industry. A group of Irish investors is considering purchasing the company’s outstanding common stock. Crowley’s stock is curren

> Use the data in Problem P11-48A to prepare the Crowley Cosmetics statement of retained earnings for the year ended December 31, 2012. Use the Statement of Retained Earnings for Maxim, Inc., in the End-of-Chapter Summary Problem as a model. In Problem P1

> Buffalo Bell’s quick (acid-test) ratio at year-end 2012 is closest to a. 0.75. b. $8,578 million. c. 0.45. d. 0.68. Buffalo Bell Corporation Consolidatcd Statements of Financial Position (In millions) December 31, 2012 2011 Assets

> The following information was taken from the records of Crowley Cosmetics, Inc., at December 31, 2012: Requirements 1. Prepare Crowley Cosmetics’ single-step income statement, which lists all revenues together and all expenses togethe

> During 2012, Granite Corporation earned net income of $5.1 billion and paid off $2.9 billion of long-term notes payable. Granite raised $1.6 billion by issuing common stock, paid $3.9 billion to purchase treasury stock, and paid cash dividends of $1.9 bi

> Which statement is true? a. The Public Company Oversight Board evaluates internal controls. b. GAAP governs the form and content of the financial statements. c. Management audits the financial statements. d. Independent auditors prepare the financial sta

> Examine the statement of stockholders’ equity of Wellington Electronics Corporation. What was the market value of each share of the stock that Wellington gave its stockholders in the stock dividend? a. $26 b. $39,000 c. $3,000 d. $52

> Which of the following items is most closely related to prior-period adjustments? a. Retained earnings b. Earnings per share c. Preferred stock dividends d. Accounting changes

> Use the Copycat Corporation data in question 43. At the end of its first year of operations, Copycat’s deferred tax liability is a. $27,000. b. $11,000. c. $3,000. d. $19,000.

> Copycat Corporation in the preceding question must immediately pay income tax of a. $77,000. b. $30,000. c. $33,000. d. $70,000.

> Copycat Corporation has income before income tax of $110,000 and taxable income of $100,000. The income tax rate is 30%. Copycat’s income statement will report net income of a. $30,000. b. $33,000. c. $77,000. d. $107,000.

> Earnings per share is not reported for a. Discontinued operations. b. Extraordinary items. c. Comprehensive income. d. Continuing operations.

> Foreign-currency transaction gains and losses are reported on the a. Balance sheet. b. Income statement. c. Statement of cash flows. d. Consolidation work sheet.

> One way to hedge a foreign-currency transaction loss is to a. Pay debts as late as possible. b. Pay in the foreign currency. c. Off set foreign-currency inventory and plant assets. d. Collect in your own currency.