Question: Cash payback period for a service company

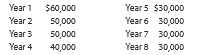

Cash payback period for a service company OBJ. 2 Prime Financial Inc. is evaluating two capital investment proposals for a drive-up ATM kiosk, each requiring an investment of $200,000 and each with an eight-year life and expected total net cash flows of $320,000. Location 1 is expected to provide equal annual net cash flows of $40,000, and Location 2 is expected to have the following unequal annual net cash flows:

Determine the cash payback period for both location proposals.

Transcribed Image Text:

Year 5 $30,000 Year 6 30,000 Year 7 30,000 Year 8 30,000 Year 1 $60,000 Year 2 50,000 Year 3 50,000 Year 4 40,000

> Differentiate between centralized and decentralized operations.

> When using the negotiated price approach to transfer pricing, within what range should the transfer price be established?

> On July 1, Coastal Distribution Company is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $740,000 of 5% U.S. Treasury bonds that mature in 14 y

> Would the use of standards be appropriate in a nonmanufacturing setting such as a fast-food restaurant?

> A new assistant controller recently was heard to re- mark: “All the assembly workers in this plant are covered by union contracts, so there should be no labor variances.” Was the controller’s remark correct? Discuss.

> What are the two variances between the actual cost and the standard cost for direct materials?

> What are the basic objectives in the use of standard costs?

> a. Describe the two variances between the actual costs and the standard costs for factory overhead. b. What is a factory overhead cost variance report?

> Wiki Wiki Company has determined that the variable overhead rate is $4.50 per direct labor hour in the Fabrication Department. The normal production capacity for the Fabrication Department is 10,000 hours for the month. Fixed costs are budgeted at $60,00

> Two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement. Determine the amounts of the missing items, identifying them by letter Finished goods inventory, June 1 Cost of go

> Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows: The compa

> The following information is available for Ethtridge Manufacturing Company for the month ending July 31: Cost of direct materials used in production……………………. $1,150,000 Direct labor……………………………………………………………………. 966,000 Work in process inventory, July 1………

> Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter $ 41,650 Work in process inventory, August1 Total manufacturing costs

> The budget director of Birds of a Feather Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January: a. Estimated sales

> Partial balance sheet data for Diesel Additives Company at August 31 are as follows: Prepare the Current assets section of Diesel Additives Company’s balance sheet at August 31. Finished goods inventory $ 89,400 9,000 348,200 Suppl

> Four types of eco-efficiency measures are identified below. Match the following descriptions to the proper eco-efficiency measures: 1. Energy erficiency 2. Fuel efficiency 3. Material use efficiency a. Cost savings from recycling and reusing waste an

> A partial list of the costs for Wisconsin and Minnesota Railroad, a short hauler of freight, follows. Classify each cost as either indirect or direct. For purposes of classifying each cost, use the train as the cost object. a. Cost to lease (rent) railro

> From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: a. The phase of the management process that uses process information to eliminate the source of problems in a process so that the proc

> From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: a. Advertising costs are usually viewed as (period, product) costs. b. Feedback is often used to (improve, direct) operations. c. Payme

> Which of the following items are properly classified as part of factory overhead for Ford Motor Company, a maker of heavy automobiles and trucks? a. Plant manager’s salary at Buffalo, New York, stamping plant, which manufactures auto and truck subassemb

> Indicate whether the following costs of Procter & Gamble , a maker of consumer products, would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Resins for body wash products b. Scents and fragrances used in making

> Leno Manufacturing Company prepared the following factory overhead cost budget for the Press Department for October of the current year, during which it expected to require 20,000 hours of productive capacity in the department: Assuming that the estima

> How does the sales mix affect the calculation of the break-even point?

> The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for March is summarized as follows: a.

> Indicate whether each of the following costs of an automobile manufacturer would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Wheels b. Glass used in the vehicle’s windshield c. Wages of assembly line worker

> TAC Industries sells heavy equipment to large corporations and to federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the gove

> Todd Lay just began working as a cost accountant for Enteron Industries Inc., which manufactures gift items. Todd is preparing to record summary journal entries for the month. Todd begins by recording the factory wages as follows: Wages Expense ……………….

> RIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the job cost sheets to learn more about the

> Carol Creedence, the plant manager of the Clearwater Company’s Revival plant, has prepared the following graph of the unit costs from the job cost reports for the plant’s highest volume product, Product CCR: Carol is

> As an assistant cost accountant for Mississippi Industries, you have been assigned to re­ view the activity base for the predetermined factory overhead rate. The president, Tony Favre, has expressed concern that the over ­

> Prepare a cost of goods sold budget for Daybook Inc. using the information in Practice Exercises 22-3A and 22-4A. Assume the estimated inventories on January 1, 20Y6, for finished goods and work in process were $28,000 and $16,500, respectively. Also ass

> Magnolia Candle Inc. budgeted production of 74,200 candles in 20Y4. Each candle requires molding. Assume that 12 minutes are required to mold each candle. If molding labor costs $14.00 per hour, determine the direct labor cost budget for 20Y4.

> Daybook Inc. budgeted production of 403,500 personal journals in 20Y6. Each journal requires assembly. Assume that eight minutes are required to assemble each journal. If assembly labor costs $13.00 per hour, determine the direct labor cost budget for 20

> Magnolia Candle Inc. budgeted production of 74,200 candles in 20Y4. Wax is required to produce a candle. Assume that eight ounces (one-half of a pound) of wax is required for each candle. The estimated January 1, 20Y4, wax inventory is 2,500 pounds. The

> Which of the three methods of inventory costing—FIFO, LIFO, or weighted average cost—will in general yield an inventory cost most nearly approximating current replacement cost?

> Midwest Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $132,000 with a $16,000 residual value and a 10-year life. The equipment will replace one employee who has an average wage of $

> Both Austin Company and Hill Company had the same unit sales, total costs, and income from operations for the current fiscal year; yet, Austin Company had a lower break-even point than Hill Company. Explain the reason for this difference in break-even po

> Daybook Inc. budgeted production of 403,500 personal journals in 20Y6. Paper is required to produce a journal. Assume six square yards of paper are required for each journal. The estimated January 1, 20Y6, paper inventory is 40,400 square yards. The desi

> Magnolia Candle Inc. projected sales of 75,000 candles for 20Y4. The estimated January 1, 20Y4, inventory is 3,500 units, and the desired December 31, 20Y4, inventory is 2,700 units. What is the budgeted production (in units) for 20Y4?

> Daybook Inc. projected sales of 400,000 personal journals for 20Y6. The estimated January 1, 20Y6, inventory is 20,000 units, and the desired December 31, 20Y6, inventory is 23,500 units. What is the budgeted production (in units) for 20Y6?

> The director of marketing for Starr Computer Co., Megan Hewitt, had the following discussion with the company controller, Cam Morley, on July 26 of the current year: Megan: Cam, it looks like I’m going to spend much less than indicated on my July budget

> Domino’s Pizza L.L.C. operates pizza delivery and carry-out restaurants. The annual report describes its business as follows: We offer a focused menu of high-quality, value-priced pizza with three types of crust (Hand- Tossed, Thin Crust, and Deep Dish)

> A bank manager of City Savings Bank Inc. uses the managerial accounting system to track the costs of operating the various departments within the bank. The departments include Cash Management, Trust, Commercial Loans, Mortgage Loans, Operations, Credit C

> Children’s Hospital of the King’s Daughters Health System in Norfolk, Virginia, introduced a new budgeting method that allowed the hospital’s annual plan to be updated for changes in operating plans. For example, if the budget was based on 400 patient-da

> Timbuk 3 Company has the following information for March: Cost of direct materials used in production…………$21,000 Direct labor…………………………………………………….... 54,250 Factory overhead…………………………………………….…35,000 Work in process inventory, March 18……………………. 7,500 Wor

> The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each depart- ment. The annual budget is divided by 12 months to pr

> If the unit cost of direct materials is decreased, what effect will this change have on the break-even point?

> Hit-n-Run Food Trucks, Inc. owns and operates food trucks (mobile kitchens) throughout the West Coast. The company’s employees have varying wage levels depending on their experience and length of time with the company. Employees work eight-hour shifts an

> Welcome Inn Hotels is considering the construction of a new hotel for $90 million. The expected life of the hotel is 30 years, with no residual value. The hotel is expected to earn revenues of $26 million per year. Total expenses, including depreciation,

> Dip N’ Dunk Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: a. Determine the present value index for each proposal. b. Which location does your analysis sup

> Target Corp. sells merchandise primarily through its retail stores. On the other hand, Amazon .com uses its e-commerce services, features, and technologies to sell its products through the Internet. Recent balance sheet inventory disclosures for Target a

> Dash Riprock is a cost analyst with Safe Insurance Company. Safe is applying standards to its claims payment operation. Claims payment is a repetitive operation that could be evaluated with standards. Dash used time and motion studies to identify an idea

> How does using the return on investment facilitate comparability between divisions of decentralized companies?

> Vanadium Audio Inc. is a small manufacturer of electronic musical instruments. The plant manager received the following variable factory overhead report for the period: The plant manager is not pleased with the $12,320 unfavorable variable factory overh

> You have been asked to investigate some cost problems in the Assembly Department of Ruthenium Electronics Co., a consumer electronics company. To begin your investigation, you have obtained the following budget performance report for the department for t

> If fixed costs increase, what would be the impact on the (a) contribution margin? (b) income from operations?

> The senior management of Tungston Company has proposed the following three performance measures for the company: 1. Net income as a percent of stockholders’ equity 2. Revenue growth 3. Employee satisfaction Management believes that these three measure

> One of the operations in the United States Postal Service is a mechanical mail sorting operation. In this operation, letter mail is sorted at a rate of 1.5 letters per second. The letter is mechanically sorted from a three-digit code input by an operator

> The following items were selected from among the transactions completed by O’Donnel Co. during the current year: Jan. 10. Purchased merchandise on account from Laine Co., $240,000, terms n/30. Feb. 9. Issued a 30-day, 4% note for $240,000 to Laine Co.,

> The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Ch

> The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9, 20Y8: Employees Mantle and Williams are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1Â&frac1

> Glenville Company has the following information for April: Cost of direct materials used in production ………. $280,000 Direct labor ………………………………………………………. 324,000 Factory overhead ………………………………………………. 188,900 Work in process inventory, April 1 …………………………7

> The following information about the payroll for the week ended December 30 was obtained from the records of Pharrell Co.: Instructions 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following en

> In a payroll system, what types of input data are referred to as (a) constants and (b) variables?

> Indicate with a Yes or No whether or not each of the following accounts normally re- quires an adjusting entry: e. Nancy Palmer, Capital f. Prepaid Insurance a. Building c Wages Expense d. Miscellaneous Expense b. Cash

> Describe how total fixed costs and unit fixed costs behave with changes in the level of activity.

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or cre

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate wh

> For the year ending August 31, Mammalia Medical Co. mistakenly omitted adjusting entries for (1) depreciation of $5,800, (2) fees earned that were not billed of $44,500, and (3) accrued wages of $7,300. Indicate the effect of the errors on (a) revenu

> For the year ending April 30, Urology Medical Services Co. mistakenly omitted adjusting entries for (1) $1,400 of supplies that were used, (2) unearned revenue of $6,600 that was earned, and (3) insurance of $9,000 that expired. Indicate the effect of

> The estimated amount of depreciation on equipment for the current year is $6,880. Journalize the adjusting entry (include an explanation) to record the depreciation.

> AutoSource Inc. designs and manufactures tires for automobiles. The company’s strategy is to design products that incorporate the full environmental impact of the product over its life cycle. This includes designing tires for fuel effic

> The estimated amount of depreciation on equipment for the current year is $7,700. Journalize the adjusting entry (include an explanation) to record the depreciation

> The supplies account had a beginning balance of $3,375 and was debited for $6,450 for supplies purchased during the year. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is

> The prepaid insurance account had a beginning balance of $4,500 and was debited for $16,600 of premiums paid during the year. Journalize the adjusting entry (include an ex- planation) required at the end of the year, assuming the amount of unexpired ins

> The balance in the unearned fees account, before adjustment at the end of the year, is $272,500. Journalize the adjusting entry (include an explanation) required if the amount of unearned fees at the end of the year is $189,750

> How would the following costs be classified (variable or fixed) if units produced was the activity base? a. Direct materials costs b. Electricity costs of $0.35 per kilowatt-hour

> On June 1, 2019, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry (include an explanation) required for unearned rent on December 31, 2019.

> We-Sell Realty Co. pays weekly salaries of $11,800 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry (include an explanation) assuming that the accounting period ends on Wednesday.

> Prospect Realty Co. pays weekly salaries of $27,600 for a six-day workweek (Monday thru Saturday). Journalize the necessary adjusting entry (include an explanation) assuming that the accounting period ends on Friday.

> At the end of the current year, $23,570 of fees have been earned but have not been billed to clients. Journalize the adjusting entry (include an explanation) to record the accrued fees.

> Greeson Clothes Company produced 25,000 units during June of the current year. The Cutting Department used 6,380 direct labor hours at an actual rate of $10.90 per hour. The Sewing Department used 9,875 direct labor hours at an actual rate of $11.12 per

> Central Plains Power Company is considering an investment in wind farm technology to replace natural gas-generating capacity. Initial installation cost of a wind turbine is expected to be $1,200 per kilowatt-hour of capacity. The wind turbine has a capac

> At the end of the current year, $17,555 of fees have been earned but have not been billed to clients. Journalize the adjusting entry (include an explanation) to record the accrued fees

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense: a. Cash received for services not yet rendered. b. Insurance paid for the next year. c. Interest revenue eamed but not receiv

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense: a. Cash received for use of land next month. c. Wages owed but not yet paid. d. Supplies on hand. b. Fees earned but not rece

> Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry: a. Accumulated Depreciation b. Frank Kent, Drawing C Land d. Salaries Payable e. Supplies f. Unearned Rent

> During August, Rothchild Company accumulated 3,500 hours of direct labor costs on Job 40 and 4,200 hours on Job 42. The total direct labor was incurred at a rate of $25.00 per direct labor hour for Job 40 and $23.50 per direct labor hour f

> Beck Inc. and Bryant Inc. have the following operating data: a. Compute the operating leverage for Beck Inc. and Bryant Inc. b. How much would income from operations increase for each company if the sales of each increased by 20%? c. Why is there a di

> a. If Canace Company, with a break-even point at $960,000 of sales, has actual sales of $1,200,000, what is the margin of safety expressed (1) in dollars and (2) as a percentage of sales? b. If the margin of safety for Canace Company was 20%, fixed co

> Zero Turbulence Airline provides air transportation services between Los Angeles, California; and Kona, Hawaii. A single Los Angeles to Kona round-trip flight has the following operating statistics: Fuel ……………………………………………………………………. $7,000 Flight crew sal

> Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows: a.

> Daisy’s Creamery Inc. is considering one of two investment options. Option 1 is a $75,000 investment in new blending equipment that is expected to produce equal annual cash flows of $19,000 for each of seven years. Option 2 is a $90,000

> Name the following chart and identify the items represented by the letters (a) through (f): $200,000 $150,000 $100,000 $50,000 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Units of Sales Sales and Costs

> La Barte Company manufactures commuter bicycles from recycled materials. The following data for July of the current year are available: Quantity of direct labor used ………………………………5,050 hrs. Actual rate for direct labor ……………………………$16.80 per hr. Bicycles

> Identify the following costs as direct materials (DM), direct labor (DL), or factory overhead (FO) for a magazine publisher: a. Staples used to bind magazines b. Wages of printing machine employees c. Maintenance on printing machines d. Paper used i

> Using the data for Loudermilk Inc. in Exercise 21-17, Data from Exercise 21-17: For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the releva

> For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the relevant range are $2,500,000. a. Construct a cost-volume-profit chart. b. Estimate th

> Sprint Nextel is one of the largest digital wireless service providers in the United States. In a recent year, it had approximately 32.5 million direct subscribers (accounts) that generated revenue of $35,345 million. Costs and expenses for the year were

> Describe how total variable costs and unit variable costs behave with changes in the level of activity.