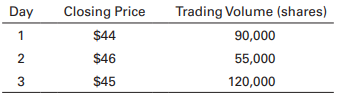

Question: Compute the level of on-balance volume (

Compute the level of on-balance volume (OBV) for the following three-day period for a stock if the beginning level of OBV is 50,000 and the stock closed yesterday at $42.

Does the movement in OBV appear to confirm the rising trend in prices? Explain.

> A 20-year, zero-coupon bond was recently being quoted at 10.625% of par. Find the current yield and the promised yield of this issue, given that the bond has a par value of $1,000. Using semiannual compounding, determine how much an investor would have t

> What is the price of a zero-coupon ($1,000 par value) bond that matures in 20 years and has a promised yield of 9.5%?

> Calculate the profit or loss per share realized on each of the following short-sale Transactions.

> A zero-coupon bond that matures in 20 years is currently selling for $156 per $1,000 par value. What is the promised yield on this bond?

> Assume that an investor is looking at two bonds: Bond A is a 25-year, 9.5% (semiannual pay) bond that is priced to yield 10%. Bond B is a 25-year, 9% (annual pay) bond that is priced to yield 8%. Both bonds carry five-year call deferments and call prices

> An 8.5%, 20-year bond has a par value of $1,000 and a call price of $1,050. (The bond’s first call date is in five years.) Coupon payments are made semiannually (so use semiannual compounding where appropriate). a. Find the current yield, YTM, and YTC on

> You are evaluating an outstanding issue of $1,000 par value bonds with an 8.75% coupon rate that mature in 25 years and make quarterly interest payments. If the current market price for the bonds is $865, what is the quoted annual yield to maturity for t

> You are considering the purchase of a $1,000 par value bond with a 6.5% coupon rate (with interest paid semiannually) that matures in 12 years. If the bond is priced to provide a required return of 8%, what is the bond’s current price?

> Compute the current yield of an 8%, 20-year bond that is currently priced in the market at $1,150. Use annual compounding to find the promised yield on this bond. Repeat the promised yield calculation, but this time use semiannual compounding to find yie

> CSM Corporation has a bond issue outstanding that has 15 years remaining to maturity and carries a coupon interest rate of 6%. Interest on the bond is paid on a semiannual basis. The par value of the CSM bond is $1,000, and it is currently selling for $

> A bond is currently selling in the market for $1,085.96. It has a coupon of 8% and a 15-year maturity. Using annual compounding, calculate the yield to maturity on this bond.

> Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 11% coupon interest rates and pay annual interest. Bond A has exactly 5 years to maturity, and bond B has 15 years to maturity. a. Calcula

> You notice in the WSJ a bond that is currently selling in the market for $1,070 with a coupon of 11% and a 20-year maturity. Using annual compounding, calculate the promised yield on this bond.

> An investor short sells 75 shares of a stock for $69 per share. The initial margin is 60%, and the maintenance margin is 40%. The price of the stock rises to $82 per share. What is the margin, and will there be a margin call?

> An investor is considering the purchase of an 6%, 15-year corporate bond that’s being priced to yield 8%. She thinks that in a year, this bond will be priced in the market to yield 7%. Using annual compounding, find the price of the bond today and in one

> What is the current yield for a $1,000 par value bond that pays interest semiannually, has nine years to maturity, and is currently selling for $937 with a bond equivalent yield of 12%?

> A $1,000 par value bond with a 7.25% coupon rate (semiannual interest) matures in seven years and currently sells for $987. What is the bond’s yield to maturity and bond equivalent yield?

> A bond is priced in the market at $1,185 and has a coupon of 7%. Calculate the bond’s current yield.

> Three years ago you purchased a 10% coupon bond that pays semiannual coupon payments for $975. What would be your bond equivalent yield if you sold the bond for its current market price of $1,050?

> A firm wishing to evaluate interest rate behavior has gathered yield data on five U.S. Treasury securities, each having a different maturity and all measured at the same point in time. The summarized data follow. a. Draw the yield curve associated with t

> Assume that you pay $825 for a long-term bond that carries a 8% coupon. Over the course of the next 12 months, interest rates drop sharply. As a result, you sell the bond at a price of $952.25. a. Find the current yield that existed on this bond at the b

> Which of the following bonds offers the highest current yield? a. A 12%, 19-year bond quoted at 135 b. A 5.6%, 28-year bond quoted at 63 c. An 8%, 23-year bond quoted at 90

> Jake Baldwin is looking for a fixed-income investment. He is considering two bond issues: a. A Treasury with a yield of 5.5% b. An in-state municipal bond with a yield of 3.8% Jake is in the 32% federal tax bracket and the 6% state tax bracket. Which bon

> Janice Wilcox is a wealthy investor who’s looking for a tax shelter. Janice is in the maximum (37%) federal tax bracket and lives in a state with a very high state income tax. (She pays the maximum of 12.3% in state income tax.) Janice is currently looki

> An investor short sells 75 shares of a stock for $69 per share. The initial margin is 60%, and the maintenance margin is 40%. The price of the stock falls to $57 per share. What is the margin, and will there be a margin call?

> An investor lives in a state with a 3% income tax rate. Her federal income tax bracket is 35%. She wants to invest in one of two bonds that are similar in terms of risk (and both bonds currently sell at par value). The first bond is fully taxable and off

> An investor is in the 24% tax bracket and lives in a state with no income tax. He is trying to decide which of two bonds to purchase. One is a 7% corporate bond that is selling at par. The other is a municipal bond with a 5% coupon that is also selling a

> Buck buys a 7.5% corporate bond with a current yield of 4.8%. How much did he pay for the bond?

> Find the conversion value of a convertible preferred stock that carries a conversion ratio of 1.6, given that the market price of the underlying common stock is $35 a share. Would there be any conversion premium if the convertible preferred were selling

> Assume you just paid $1,200 for a convertible bond that carries a 7% coupon and has 20 years to maturity. The bond can be converted into 24 shares of stock, which are now trading at $50 a share. Find the bond investment value of this issue, given that co

> A certain bond has a current yield of 6.5% and a market price of $846.15. What is the bond’s coupon rate?

> An 8% convertible bond carries a par value of $1,000 and a conversion ratio of 20. Assume that an investor has $5,000 to invest and that the convertible sells at a price of $1,000 (which includes a 25% conversion premium). How much total income (coupon p

> A certain 6% annual coupon rate convertible bond ($1,000 par value, maturing in 20 years) is convertible at the holder’s option into 20 shares of common stock. The bond is currently trading at $800. The stock (which pays 75¢ a share in annual dividends)

> You are considering investing $800 in Higgs B. Technology Inc. You can buy common stock at $25 per share; this stock pays no dividends. You can also buy a convertible bond ($1,000 par value) that is currently trading at $790 and has a conversion ratio of

> A certain convertible bond has a conversion ratio of 19 and a conversion premium of 15%. The current market price of the underlying common stock is $30. What is the bond’s conversion equivalent?

> An investor short sells 250 shares of a stock for $43 per share. The initial margin is 60%. Ignoring transaction costs, how much will be in the investor’s account after this transaction if this is the only transaction the investor has undertaken and the

> Kim and Kanye have been dating for years and are now thinking about getting married. As a financially sophisticated couple, they want to think through the tax implications of their potential union. a. Suppose Kim and Kanye both earn $70,000 (so their com

> Red Eléctrica de España SA is refinancing its bank loans by issuing 6.5% euro denominated bonds to investors. You are considering buying €15,000 of these bonds at par value. You could also invest $15,000 in a 5.5% U.S. bond (also at par value) with simil

> Letticia Garcia, an aggressive bond investor, is currently thinking about investing in a foreign (non-dollar-denominated) government bond. In particular, she’s looking at a Swiss government bond that matures in 15 years and carries a 9.5% coupon. The bon

> Burt purchased an interest-bearing security last year, planning to hold it until maturity. He received interest payments and, to his surprise, a sizable amount of the principal was paid back in the first year. This happened again in year two. What type o

> Rhonda purchased a 12%, zero-coupon bond with a 20-year maturity and a $15,000 par value 20 years ago. The bond matures tomorrow. How much will Rhonda receive in total from this investment, assuming all payments were made on these bonds as expected?

> In early January 2014, you purchased $100,000 worth of some high-grade corporate bonds. The bonds carried a coupon of 6% and mature in 2027. You paid a price of 102.625 when you bought the bonds. Over the five years from 2014 through 2018, the bonds were

> Caleb buys an 8.75% corporate bond with a current yield of 5.6%. When he sells the bond one year later, the current yield on the bond is 6.6%. How much did Caleb make on this investment?

> A 9%, 20-year bond is callable in 12 years at a call price of $1,090. The bond is currently priced in the market at $923.68. What is the issue’s current yield?

> You are given the following information for the number of stocks making new highs and new lows for each day: a. Calculate the 10-day moving-average NH-NL indicator. b. If there are 120 new highs and 20 new lows today, what is the new 10-day moving-avera

> At the end of a trading day you find that on the NYSE 1,200 stocks advanced and 2,000 stocks declined. What is the value of the advance-decline line for that day?

> You hear a market analyst on television say that the advance/decline ratio for the session was 2.2. What does that mean?

> An investor short sells 500 shares of a stock for $35 per share. The initial margin is 45%. How much equity will be required in the account to complete this transaction?

> Following are figures representing the number of stocks making new highs and new lows for each month over a six-month period: Would a technical analyst consider the trend to be bullish or bearish over this period? Explain.

> Listed in the table are data that pertain to the corporate bond market. (Note: Each “period” covers a span of six months.) a. Compute the confidence index for each of the four periods listed in the table. b. Assume tha

> Compute the Arms index for the S&P 500 over the following three days: Which of the three days would be considered the most bullish? Explain why.

> Which of the following facts, if true, would violate the weak form of the efficient markets hypothesis? a. Stocks earn higher returns than bonds over time. b. You can earn better-than-average returns by purchasing a stock any time it reaches a 52-week hi

> Technical analysis looks at the demand and supply for securities based on trading volumes and price studies. Charting is a common method used to identify and project price trends in a security. A well-known technical indicator is the Bollinger Band. It c

> Data on a stock’s closing price and its price change for the last 14 trading days appears in the table. a. Over this 14-day period, what is the average gain on up days? (Note: To calculate the average, divide the sum of all gains by 14,

> You find the closing prices for a stock you own. You want to use a 10-day moving average to monitor the stock. Calculate the 10-day moving average for days 11 through 20. Based on the data in the following table, are there any signals you should act on?

> You are presented with the following data (dollars in trillions): Calculate the MFCR for each month. At the end of May, are you bullish or bearish?

> You have collected the following NH-NL indicator data: If you are a technician following a momentum-based strategy, are you buying or selling today?

> Not long ago, Ed Sheeran bought 400 shares of Division Signs Inc. at $47 per share; he bought the stock on margin of 60%. The stock is now trading at $60 per share, and the Federal Reserve has recently lowered initial margin requirements to 50%. Ed now w

> The High-Growth mutual fund earned a return last year of 11% and had a beta of 1.3. The Value Stock fund earned a return of 13% and had a beta of 1.5. The risk-free rate was 2%, and the market return was 9%. Did either fund earn an abnormal return? Posit

> Investors expect that Aviation Aircraft Parts will pay a dividend of $2.00 in the coming year. Investors require an 11% rate of return on the company’s shares, and they expect dividends to grow at 6% per year. Using the dividend valuation model, find the

> Melissa Cutt is thinking about buying some shares of EZLawn Equipment at $42 per share. She expects the price of the stock to rise to $50 over the next three years. During that time she also expects to receive annual dividends of $3 per share. a. What is

> From 2013 to 2018, Beer Brothers, Inc., paid dividends of $2.29, $2.36, $2.44, $2.48, $2.54, and $2.61. Use an Excel spreadsheet like the template shown to find Brother’s historical dividend growth rate.

> During the previous year, Leveraged Inc. paid $110 million of interest expense, and its average rate of interest for the year was 8%. The company’s ROE is 11%, and it pays no dividends. Estimate next year’s interest expense, assuming that interest rates

> Big Auto has an ROE of 8.6%. Its earnings per share are $0.97, and its dividends per share are $0.37. Estimate Big Auto’s growth rate.

> Jensen Inc. has total equity of $73 billion and 675 million shares outstanding. Its ROE is 12.7%. The dividend payout ratio is 21%. Calculate the company’s dividends per share (round to the nearest penny).

> Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firmâ&

> Our Space is a social media site that is growing in popularity. The firm has been around for a few years and has created a nice market niche for itself. In fact, it actually turned a profit last year, albeit a fairly small one. After doing some basic res

> Newco is a young company that has yet to make a profit. You are trying to place a value on the stock, but it pays no dividends and you obviously cannot calculate a P/E ratio. As a result, you decide to look at other stocks in the same industry as Newco t

> Sara Sanders purchased 50 shares of Apple stock at $190 per share using the minimum initial margin requirement of 50%. She held the stock for exactly six months and sold it without brokerage costs at the end of that period. During the 6-month holding per

> Next Gear Corp. has total equity of $82 million and 54 million shares outstanding. Its ROE is 13%. Calculate the company’s EPS.

> Energy Resources generated an EPS of $1.85 over the past 12 months. The company’s earnings are expected to grow by 17% next year, and because there will be no significant change in the number of shares outstanding, EPS should grow at about the same rate.

> You’re thinking about buying some stock in Affiliated Computer Corporation and want to use the P/E approach to value the shares. You’ve estimated that next year’s earnings should come in at about $3.25 a share. In addition, although the stock normally tr

> Assume you obtain the following information about Wild Amusement Park: Total assets $75,000,000 Total equity $35,000,000 Net income $4,780,000 EPS $4.65 Dividend payout ratio 37% Required return 14% Use the constant-growth DVM to place a value on this co

> Create a spreadsheet that applies the variable-growth model to predict the intrinsic value of the Rhyhorn Company common stock. Assume that dividends will grow at a variable rate for the next three years (2019, 2020, and 2021). After that, the annual rat

> You are interested in purchasing the common stock of Azure Corporation. The firm recently paid a dividend of $3.00 per share. It expects its earnings—and, hence, its dividends—to grow at a rate of 7% for the foreseeable future. Currently, similar-risk s

> Captured Photographs doesn’t currently pay any dividends but is expected to start doing so in four years. That is, Captured Photographs will go three more years without paying dividends and then is expected to pay its first dividend (of $2 per share) in

> A major investment service has just given Big Lake Realty its highest investment rating along with a strong buy recommendation. As a result, you decide to take a look for yourself and to place a value on the company’s stock. Here’s what you find: This ye

> Nextbig Corp. currently has sales of $870 million; sales are expected to grow by 26% next year (year 1). For the year after next (year 2), the growth rate in sales is expected to equal 13%. Over each of the next two years, the company is expected to have

> The Millennium Company earned $2.5 million in net income last year. It took depreciation deductions of $300,000 and made new investments in working capital and fixed assets of $100,000 and $350,000, respectively. a. What was Millennium’s free cash flow l

> An investor buys 300 shares of stock selling at $65 per share using a margin of 70%. The stock pays annual dividends of $2 per share. A margin loan can be obtained at an annual interest cost of 4%. Determine what return on invested capital the investor w

> Assume there are three companies that in the past year paid exactly the same annual dividend of $1.85 a share. In addition, the future annual rate of growth in dividends for each of the three companies has been estimated as follows: Assume also that as t

> FastPaced Inc. had sales of $125 million in 2019 and is expected to have sales of $165 million for 2020. The company’s net profit margin was 3% in 2019 and is expected to increase to 7% by 2020. Estimate the company’s net profit for 2020.

> Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $4.25 per share and paid cash dividends of $2.55 per share (D0 = +2.55). Grips’ earnings and dividends are expected to grow at 25

> This year, Midland Light and Gas (ML&G) paid its stockholders an annual dividend of $1.75 a share. A major brokerage firm recently put out a report on ML&G predicting that the company’s annual dividends would grow at the rate of 5% per year for each of t

> The price of Jane’s Book Co. is now $50. The company pays no dividends. Ms. Johnson expects the price four years from now to be $75 per share. Should she buy Jane’s Book Co. stock if she desires a 9% rate of return? Explain.

> Let’s assume that you’re thinking about buying stock in West Coast Electronics. So far in your analysis, you’ve uncovered the following information: The stock pays annual dividends of $5.00 a share indefinitely. It trades at a P/E of 10 times earnings an

> Use the constant-growth dividend valuation model to find the value of each firm shown in the following table.

> Assume you’ve generated the following information about the stock of Ben’s Banana Splits: The company’s latest dividends of $2.00 a share are expected to grow to $2.27 next year, to $2.71 the year after that, and to $3.10 in three years. After that, you

> Wilbur and Orville are brothers. They’re both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As

> Kelsey Drums Inc. is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company’s class A common stock has paid a dividend of $2.80 per share per year for the past 12 years. Management expects to cont

> Allen Bagley bought 300 shares of stock at $95 per share using an initial margin of 60%. Given a maintenance margin of 35%, how far does the stock have to drop before Allen faces a margin call? (Assume that there are no other securities in the margin acc

> Jack is considering a stock purchase. The stock pays a constant annual dividend of $3.00 per share and is currently trading at $21. Jack’s required rate of return for this stock is 13%. Should he buy this stock?

> TXS Manufacturing has an outstanding preferred stock issue with a par value of $65 per share. The preferred shares pay dividends annually at a rate of 10%. a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on t

> An investor estimates that next year’s sales for Dursley’s Hotels, Inc. should amount to about $100 million. The company has five million shares outstanding, generates a net profit margin of about 10%, and has a payout ratio of 50%. All figures are expec

> Financial Learning Systems has 2.5 million shares of common stock outstanding and 100,000 shares of preferred stock. (The preferred pays annual cash dividends of $5 a share, and the common pays annual cash dividends of 25 cents a share.) Last year, the c

> The following data have been gathered from the financial statements of General Nutrition Centers (in thousands of dollars): Calculate the times interest earned ratios for 2016 and 2017. Is the company more or less able to meet its interest payments in 20

> For its fiscal year ending on June 30, 2018, Microsoft reported net income of $16.57 billion from sales of $110.36 billion. The company also reported total assets of $258.85 billion. a. Calculate Microsoft’s total asset turnover and its net profit margin

> In late 2017, Apple had a P/E ratio of 16.9, and analysts were projecting earnings growth of 17.5% per year for 2018, 2019, and 2020. What was Apple’s PEG ratio?

> ZIPBIT common stock is selling at a P/E of 10 times earnings. The stock price is $23.50. What were the firm’s earnings per share?

> The Anderson Company has net profits of $20 million, sales of $250 million, and 4.5 million shares of common stock outstanding. The company has total assets of $175 million and total stockholders’ equity of $95 million. It pays $1.50 per share in common