Question: Custom Granite Inc. uses an absorption cost

Custom Granite Inc. uses an absorption cost system for accumulating product cost. The following data are available for the past year:

- Raw materials purchases totaled $240,000.

- Direct labor costs incurred for the year totaled $480,000.

- Variable manufacturing overhead is applied on the basis of $6 per direct labor hour.

- Fixed manufacturing overhead is applied on the basis of machine hours used.

- When plans for the year were being made, it was estimated that total fixed overhead costs would be $312,000 and that 96,000 machine hours would be used during the year.

- The direct labor rate is $16 per hour.

- Actual machine hours used during the year totaled 88,000 hours.

- Actual general and administrative expenses for the year totaled $320,000.

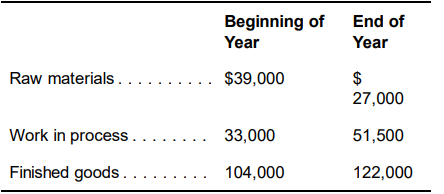

Inventory balances at the beginning and end of the year were as follows:

Required:

a. Calculate the predetermined fixed manufacturing overhead rate and explain how it will be used during the year.

b. Draw a graph for fixed manufacturing overhead showing two lines. The first line should illustrate cost behavior and how Custom Granite’s management expects total fixed costs to be incurred for the year. The second line should illustrate product costing and how fixed costs are to be assigned to Custom Granite’s production. Comment on your graph.

c. Repeat requirement b for variable manufacturing overhead.

d. Prepare a T-account for Raw Materials to calculate the cost of raw materials used. Explain the relationship between raw material purchased and raw material used.

e. Calculate the variable manufacturing overhead applied to work in process. Could the applied amount of variable overhead differ from the actual amount of variable overhead incurred by Custom Granite for the year? If so, why might this occur?

f. Calculate the fixed manufacturing overhead applied to work in process. Could the applied amount of fixed overhead differ from the actual amount of fixed overhead incurred by Custom Granite for the year? Why or why not?

g. Prepare a T-account for Work in Process to calculate the cost of goods manufactured.

h. Prepare a T-account for Finished Goods to calculate the cost of goods sold. Identify the cost of goods manufactured and not sold.

i. Custom Granite estimated that it would use 96,000 machine hours during the year, but actual machine hours used totaled 88,000. Refer to the graph you prepared in requirement b and explain the implications for the product costing system of the 8,000 machine hours that Custom Granite failed to generate during the year. What are the implications for Custom Granite’s balance sheet and income statement?

> Anglin Inc. expects to incur a loss for the current year. The chairperson of the board of directors wants to have a cash dividend so that the company’s record of having paid a dividend during every year of its existence will continue. What factors will d

> O’Garro Inc. has paid a regular quarterly cash dividend of $0.60 per share for several years. The common stock is publicly traded. On February 27 of the current year, O’Garro’s board of directors declared the regular first-quarter dividend of $0.60 per s

> Dedrick Inc. did not pay dividends in 2021 or 2022, even though 60,000 shares of its 7.5%, $50 par value cumulative preferred stock were outstanding during those years. The company has 900,000 shares of $2 par value common stock outstanding. Required: a.

> Rosie Inc. did not pay dividends on its $3.50, $50 par value, cumulative preferred stock during 2021 or 2022, but had met its preferred dividend requirement in all prior years. Since 2017, 38,000 shares of this stock have been outstanding. Rosie Inc. has

> Calculate the cash dividends required to be paid for each of the following preferred stock issues: Required: a. The semiannual dividend on 7% cumulative preferred, $60 par value, 40,000 shares authorized, issued, and outstanding. b. The annual dividend o

> Calculate the annual cash dividends required to be paid for each of the following preferred stock issues: Required: a. $2.25 cumulative preferred, no par value; 600,000 shares authorized, 525,000 shares issued. (The treasury stock caption of the stockhol

> A number of financial statement captions are listed in the following table. Indicate in the spaces to the right of each caption the category of each item and the financial statement(s) on which the item can usually be found. Use the following abbreviatio

> The balance sheet caption for common stock is the following: Required: a. Calculate the average price at which the shares were issued. b. If these shares had been assigned a stated value of $1 each, show how the caption here would be different. c. If a c

> The balance sheet caption for common stock is the following: Required: a. Calculate the dollar amount that will be presented opposite this caption. b. Calculate the total amount of a cash dividend of $0.40 per share. c. What accounts for the difference b

> From the following data, calculate the Retained Earnings balance as of December 31, 2022:

> At September 30, 2022, the end of the first year of operations at Lukancic Inc., the firm’s accountant neglected to accrue payroll taxes of $4,700 that were applicable to payrolls for the year then ended. Required: a. Use the horizontal model (or write t

> On August 1, 2022, Colombo Co.’s treasurer signed a note promising to pay $2,400,000 on December 31, 2022. The proceeds of the note were $2,340,000. Required: a. Calculate the discount rate used by the lender. b. Calculate the effective interest rate (AP

> On May 15, 2022, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $600,000. The interest rate charged by the bank was 7%. The bank made the loan on a discount basis. Required: a.

> Enter the following column headings across the top of a sheet of paper: Enter the transaction or adjustment letter in the first column and show the effect, if any, of each transaction or adjustment on the appropriate balance sheet category or on net inco

> Enter the following column headings across the top of a sheet of paper: Enter the transaction or adjustment letter in the first column and show the effect, if any, of each transaction or adjustment on the appropriate balance sheet category or on net inc

> Enter the following column headings across the top of a sheet of paper: Enter the transaction or adjustment letter in the first column, and show the effect, if any, of each of the transactions or adjustments on the appropriate balance sheet category or o

> Enter the following column headings across the top of a sheet of paper: Enter the transaction or adjustment letter in the first column and show the effect, if any, of each of the transactions or adjustments on the appropriate balance sheet category or on

> The following are the transactions relating to the formation of Gray Mowing Services Inc. and its first month of operations. Prepare an answer sheet with the columns shown. Record each transaction in the appropriate columns of your answer sheet. Show the

> A firm issues long-term debt with an effective interest rate of 10%, and the proceeds of this debt issue can be invested to earn an ROI of 12%. What effect will this financial leverage have on the firm’s ROE relative to having the same amount of funds in

> Atom Endeavour Co. issued $190 million face amount of 6.5% bonds when market interest rates were 6.71% for bonds of similar risk and other characteristics. Required: a. How much interest will be paid annually on these bonds? b. Were the bonds issued at a

> Reynolds Co. issued $75 million face amount of 6% bonds when market interest rates were 5.81% for bonds of similar risk and other characteristics. Required: a. How much interest will be paid annually on these bonds? b. Were the bonds issued at a premium

> On March 1, 2017, Catherine purchased $450,000 of Tyson Co.’s 10%, 20-year bonds at face value. Tyson Co. has regularly paid the annual interest due on the bonds. On March 1, 2022, market interest rates had risen to 12%, and Catherine is considering sell

> On August 1, 2014, Bonnie purchased $40,000 of Huber Co.’s 10%, 20-year bonds at face value. Huber Co. has paid the semiannual interest due on the bonds regularly. On August 1, 2022, market rates of interest had fallen to 8%, and Bonnie is considering se

> Alexi Co. issued $75 million face amount of 6%, 10-year bonds on June 1, 2022. The bonds pay interest on an annual basis on May 31 each year. Required: a. Assume that the market interest rates were slightly higher than 6% when the bonds were sold. Would

> Jessie Co. issued $3 million face amount of 9%, 20-year bonds on July 1, 2022. The bonds pay interest on an annual basis on June 30 each year. Required: a. Assume that market interest rates were slightly lower than 9% when the bonds were sold. Would the

> Kirkland Theater sells season tickets for six events at a price of $378. For the 2022 season, 1,200 season tickets were sold. Required: a. Use the horizontal model (or write the journal entry) to show the effect of the sale of the season tickets. b. Use

> NightWoundsTime Brewing Co. distributes its products in an aluminum keg. Customers are charged a deposit of $80 per keg; deposits are recorded in the Keg Deposits account. Required: a. Where on the balance sheet will the Keg Deposits account be found? Ex

> Prist Co. had not provided a warranty on its products, but competitive pressures forced management to add this feature at the beginning of 2022. Based on an analysis of customer complaints made over the past two years, the cost of a warranty program was

> Record transactions and calculate financial statement amounts. The transactions relating to the formation of Blue Co. Stores Inc. and its first month of operations follow. Prepare an answer sheet with the columns shown. Record each transaction in the app

> Kohl Co. provides warranties for many of its products. The January 1, 2022, balance of the Estimated Warranty Liability account was $25,100. Based on an analysis of warranty claims during the past several years, this year’s warranty provision was establi

> Glennelle’s Boutique Inc. operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: a. Explain how the amount of tax ex

> Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $310,000. The appraised value of the land is $105,000, and the appraised value of the building is $245,000. Required: a. Assuming that the build

> Prepare an answer sheet with the following column headings. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on assets, liabilities, and net income by entering for each account affected the accou

> Prepare an answer sheet with the column headings that follow. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on assets, liabilities, and net income by entering for each account affected the acc

> Goodwill arises when one firm acquires the net assets of another firm and pays more for those net assets than their current fair value. Suppose that Target Co. had operating income of $1,215,000 and net assets with a fair value of $5,400,000. Takeover Co

> Assume that fast-food restaurants generally provide an ROI of 10%, but that such a restaurant near a college campus has an ROI of 16% because its relatively large volume of business generates an above-average turnover (sales/assets). The replacement valu

> Using a present value table, your calculator, or a computer program present value function, calculate the present value of a. A car down payment of $16,000 that will be required in two years, assuming an interest rate of 10%. b. A lottery prize of $28 mi

> Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $117,000 and has an estimated useful life of four years and an estimated salvage value of $18,000. Required: a. Calculate depreciation expense f

> Millco Inc. acquired a machine that cost $1,800,000 early in 2022. The machine is expected to last for eight years, and its estimated salvage value at the end of its life is $180,000. Required: a. Using straight-line depreciation, calculate the depreciat

> Net income for the year was $62,000. During the year, net cash provided by operating activities was $145,000; net cash used for investing activities was $96,000; net increase in cash for the year was $38,000. Required: Calculate net cash provided by (or

> The following data have been collected by capital budgeting analysts at Sunset Beach Inc. concerning an investment in an expansion of the company’s product line. Analysts estimate that an investment of $500,000 will be required to initi

> The Consortium for Advanced Manufacturing—International (CAM-I) is an international consortium of companies, consultancies, and academics that have elected to work cooperatively in a precompetitive environment to solve problems common to the group. Its s

> York Co. uses a standard cost system. When raw materials are purchased, the standard cost of the raw materials purchased is recorded as an increase in the Raw Materials Inventory account. When raw materials are used, the standard cost of the materials al

> During the year ended May 31, 2021, Teller Register Co. reported favorable raw material usage and direct labor and variable overhead efficiency variances that totaled $285,800. Price and rate variances were negligible. Total standard cost of goods manufa

> Williamson Inc. manufactures quality replacement parts for the auto industry. The company uses a standard costing system and isolates variances as soon as possible. The purchasing manager is responsible for controlling the direct material price variances

> Assume that you are the production manager of a small branch plant of a large manufacturing firm. The central accounting control department sends you monthly performance reports showing the flexed budget amount, actual cost and variances for raw material

> If a company uses a standard cost system, should all variances be calculated with the same frequency (e.g., monthly), and should they always be expressed in dollar amounts? Explain your answer and include in it the reason for calculating variances.

> One of the significant costs for a nonpublic college or university is student aid in the form of gifts and grants awarded to students because of academic potential or performance, and/or financial need. Gifts and grants are only a part of a financial aid

> Campbell Soup Company provides access to its annual reports online at campbellsoup.com. The annual reports are found in the “Investor Center/Financial Information/Annual Reports” area of its website. Locate the following information in the annual reports

> Jim Sandrolini is an accountant for a local manufacturing company. Jim’s good friend, Dan Carruthers, has been operating a retail sporting goods store for about a year. The store has been moderately successful, and Dan needs a bank loan to help finance t

> Determine each of the following missing amounts:

> You have recently been engaged by Dominic’s Italian Cafe to evaluate the financial impact of adding gourmet pizza items to the menu. A survey of the clientele indicates that demand for the product exists at an average selling price of $18 per pizza. Fixe

> Tommy Appleton is in charge of arranging the “social hour” period and dinner for the monthly meetings of the local chapter of the Management Accountants Association. Tommy is negotiating with a new restaurant that would like to have the group’s business,

> Assume you are a sales representative for Sweet Tooth Candy Company. One of your customers is interested in buying some candy that will be given to the members of a high school Student Government Association. The association members will be marching in a

> Following are comparative statements of cash flows, as reported by The Coca-Cola Company in its 2020 annual report: Required: a. Briefly review the consolidated statements of cash flows, and then provide an overall evaluation of the “bi

> Your conversation with Mr. Gerrard, which took place in February 2023 (see Case 6.37), continued as follows: Mr. Gerrard: I’ve been talking with my accountant about our capital expansion needs, which will be considerable during the next couple of years.

> Assume that the current ratio for Arch Company is 2.0, its acid-test ratio is 1.5, and its working capital is $900,000. Answer each of the following questions independently, always referring to the original information. a. How much does the firm have in

> Solve the requirements of Problem 11.13 for the year ended August 2, 2020. Data from Problem 11.13: Refer to the consolidated balance sheets of the Campbell Soup Company annual report in the appendix. Required: Prepare a common size balance sheet at Jul

> Refer to the consolidated balance sheets of the Campbell Soup Company annual report in the appendix. Required: Prepare a common size balance sheet at July 28, 2019, using the following captions: Total current assets Plant assets, net of depreciation Good

> This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (also known as the Five-Year Review), or calculate, the following data: a. Dividends per share declared in 2020. b. Capital expenditur

> This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (also known as the Five-Year Review), or calculate, the following data: a. Net sales in 2017. b. Operating income (earnings before int

> Tablerock Corp. is interested in reviewing its method of evaluating capital expenditure proposals using the accounting rate of return method. A recent proposal involved a $100,000 investment in a machine that had an estimated useful life of five years an

> TopCap Co. is evaluating the purchase of another sewing machine that will be used to manufacture sport caps. The invoice price of the machine is $98,000. In addition, delivery and installation costs will total $5,000. The machine has the capacity to prod

> The transactions affecting the stockholders’ equity accounts of DeZurik Corp. for the year ended June 30, 2023, are summarized here: 1. 160,000 shares of common stock were issued at $21.25 per share. 2. 40,000 shares of treasury (common) stock were sold

> Cowboy Recording Studio is considering the investment of $140,000 in a new recording equipment. It is estimated that the new equipment will generate additional cash flow of $21,000 per year for each year of its 12-year life and will have a salvage value

> The segmented income statement for XYZ Company for the year ended December 31, 2022, follows: The company is concerned about the performance of product A, and you have been asked to analyze the situation and recommend to the president whether to continue

> Petro Motors Inc. (PMI) produces small gasoline-powered motors for use in lawn mowers. The company has been growing steadily over the past five years and is operating at full capacity. PMI recently completed the addition of new plant and equipment at a c

> Presented here are the original overhead budget and the actual costs incurred during April for Piccolo Inc. Piccolo’s managers relate overhead to direct labor hours for planning, control, and product costing purposes. The original budge

> Graystone’s production budget for September called for making 60,000 units of a single product. The firm’s production standards allow one-half of a machine hour per unit produced. The fixed overhead budget for Septembe

> Founders State Bank developed a standard for teller staffing that provided for one teller to handle 15 customers per hour. During June, the bank averaged 50 customers per hour and had five tellers on duty at all times. (Relief tellers filled in during lu

> The Flynn Insurance Company developed standard times for processing claims. When a claim was received at the processing center, it was first reviewed and classified as simple or complex. The standard time for processing was: Employees were expected to be

> The standards for one case of liquid weed killer are as follows: During the week ended May 6, the following activity took place: 4,360 machine hours were worked. 22,800 lb of raw material were purchased for inventory at a total cost of $174,420. 3,800 ca

> The standards for one case of Springfever Tonic are as follows: During the week ended March 13, the following activity took place: 14,800 lb of raw materials were purchased for inventory at a cost of $2.97 per pound. 2,000 cases of finished product were

> Freese Inc. is in the process of preparing the fourth quarter budget for 2022, and the following data have been assembled: - The company sells a single product at a price of $50 per unit. The estimated sales volume for the next six months is as follows:

> DeZurik Corp. had the following stockholders’ equity section in its June 30, 2022, balance sheet (in thousands, except share and per share amounts): Required: a. Calculate the par value per share of preferred stock and determine the pre

> Soprano Co. is in the process of preparing the second quarter budget for 2022, and the following data have been assembled: - The company sells a single product at a selling price of $50 per unit. The estimated sales volume for the next six months is as f

> Following are the budgeted income statements for the second quarter of 2022 for SeaTech Inc.: The company expects about 40% of sales to be cash transactions. Of sales on account, 65% are expected to be collected in the first month after the sale is made,

> The monthly cash budgets for the second quarter of 2022 follow ($000 omitted) for Tuscano Mfg. Co. A minimum cash balance of $15,000 is required to start each month, and a $50,000 line of credit has been arranged with a local bank at a 16% interest rate.

> Refer to the PrimeTime Sportswear data. Required: a. Prepare a cash budget for August and September. What are the prospects for this company if its sales growth continues at a similar rate? b. Assume now that PrimeTime Sportswear is a mature firm and tha

> Precious Stones Ltd. is a retail jeweler. Most of the firm’s business is in jewelry and watches. The firm’s average gross profit ratio for jewelry and watches is 70% and 40%, respectively. The sales forecast for the ne

> D&J Furniture, a retail store, has an average gross profit ratio of 48%. The sales forecast for the next four months follows: Management’s inventory policy is to have ending inventory equal to 200% of the cost of sales for the subse

> Morrison & Company incurred the following costs during August: Manufacturing overhead is applied on the basis of $25 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the y

> The following table summarizes the beginning and ending inventories of Springfield Manufacturing Inc. for the month of September: Raw materials purchased during the month of September totaled $247,800. Direct labor costs incurred totaled $624,400 for the

> GrandSlam Inc. incurred the following costs during March: Required: During the month, 3,900 units of product were manufactured and 2,200 units of product were sold. On March 1, GrandSlam carried no inventories. On March 31, there were no inventories for

> Maryville Inc. incurred the following costs during June: Required: During the month, 53,000 units of product were manufactured and 48,000 units of product were sold. On June 1, Maryville carried no inventories. On June 30, there were no inventories other

> You were asked to obtain the most recent annual report of a company that you were interested in reviewing throughout this term. Required: Please review the note disclosures provided in your focus company’s annual report and identify at least three items

> Williamson Inc. manufactures digital voice recorders. During 2022, total costs associated with manufacturing 52,000 of the new EZ 9900 model (introduced this year) were as follows: Required: a. Calculate the cost per recorder under both variable costing

> TopBass Inc. manufactures fishing equipment. During 2022, total costs associated with manufacturing 30,000 fly-cast fishing rods (a new product introduced this year) were as follows: Required: a. Calculate the cost per fishing rod under both variable cos

> Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manu

> HealthTech Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with infor

> Austin Inc. produces small-scale replicas of vintage automobiles for collectors and museums. Finished products are built on a 1/20 scale of originals. The firm’s income statement showed the following: An automated stamping machine has b

> Gonzales Inc. makes and sells a single product. The current selling price is $16 per unit. Variable expenses are $10 per unit, and fixed expenses total $21,600 per month. Sales volume for March totaled 4,100 units. Required: a. Calculate operating income

> Muscle Beach Inc. makes three models of high-performance weight-training benches. Current operating data are summarized here: Required: a. Calculate the contribution margin ratio of each product. b. Calculate the firm’s overall contribu

> HighTide Canvas Co. currently makes and sells two model sizes of a boat cover. Data applicable to the current operation are summarized in the following columns labeled Current Operation. Management is considering adding a Medium model to its current Larg

> Ozark Metal Co. makes a single product that sells for $42 per unit. Variable costs are $27.30 per unit, and fixed costs total $65,415 per month. Required: a. Calculate the number of units that must be sold each month for the firm to break even. b. Assume

> Marathon Co. makes and sells a single product. The current selling price is $18 per unit. Variable expenses are $12 per unit, and fixed expenses total $36,000 per month. Required: a. Calculate the breakeven point expressed in terms of total sales dollars

> Assume that Home and Office City Inc. provided the following comparative data concerning long-term debt in the notes to its 2023 annual report (amounts in millions): Required: a. As indicated, Home and Office City’s 3¼% Co

> Refer to the Campbell Soup Company annual report for 2020 in the appendix or to the most recent full annual report that you have downloaded from Campbell’s website. Find and scan the notes to consolidated financial statements. Read the independent audito

> Presented here is the income statement for Fairchild Co. for March: Based on an analysis of cost behavior patterns, it has been determined that the company’s contribution margin ratio is 30%. Required: a. Rearrange the preceding income

> Presented here is the income statement for Big Sky Inc. for the month of February: Based on an analysis of cost behavior patterns, it has been determined that the company’s contribution margin ratio is 25%. Required: a. Rearrange the pr