Question: Maryville Inc. incurred the following costs during

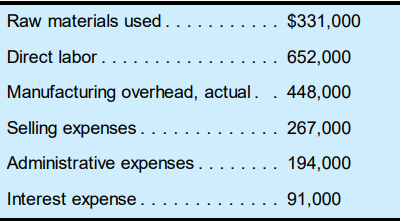

Maryville Inc. incurred the following costs during June:

Required:

During the month, 53,000 units of product were manufactured and 48,000 units of product were sold. On June 1, Maryville carried no inventories. On June 30, there were no inventories other than finished goods.

a. Calculate the cost of goods manufactured during June and the average cost per unit of product manufactured.

b. Calculate the cost of goods sold during June.

c. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in the financial statements?

d. (Optional) Prepare a traditional (absorption) income statement for Maryville for the month of June. Assume that sales for the month was $2,448,000 and the company’s effective income tax rate was 30%.

> Using a present value table, your calculator, or a computer program present value function, calculate the present value of a. A car down payment of $16,000 that will be required in two years, assuming an interest rate of 10%. b. A lottery prize of $28 mi

> Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $117,000 and has an estimated useful life of four years and an estimated salvage value of $18,000. Required: a. Calculate depreciation expense f

> Millco Inc. acquired a machine that cost $1,800,000 early in 2022. The machine is expected to last for eight years, and its estimated salvage value at the end of its life is $180,000. Required: a. Using straight-line depreciation, calculate the depreciat

> Net income for the year was $62,000. During the year, net cash provided by operating activities was $145,000; net cash used for investing activities was $96,000; net increase in cash for the year was $38,000. Required: Calculate net cash provided by (or

> The following data have been collected by capital budgeting analysts at Sunset Beach Inc. concerning an investment in an expansion of the company’s product line. Analysts estimate that an investment of $500,000 will be required to initi

> The Consortium for Advanced Manufacturing—International (CAM-I) is an international consortium of companies, consultancies, and academics that have elected to work cooperatively in a precompetitive environment to solve problems common to the group. Its s

> York Co. uses a standard cost system. When raw materials are purchased, the standard cost of the raw materials purchased is recorded as an increase in the Raw Materials Inventory account. When raw materials are used, the standard cost of the materials al

> During the year ended May 31, 2021, Teller Register Co. reported favorable raw material usage and direct labor and variable overhead efficiency variances that totaled $285,800. Price and rate variances were negligible. Total standard cost of goods manufa

> Williamson Inc. manufactures quality replacement parts for the auto industry. The company uses a standard costing system and isolates variances as soon as possible. The purchasing manager is responsible for controlling the direct material price variances

> Assume that you are the production manager of a small branch plant of a large manufacturing firm. The central accounting control department sends you monthly performance reports showing the flexed budget amount, actual cost and variances for raw material

> If a company uses a standard cost system, should all variances be calculated with the same frequency (e.g., monthly), and should they always be expressed in dollar amounts? Explain your answer and include in it the reason for calculating variances.

> One of the significant costs for a nonpublic college or university is student aid in the form of gifts and grants awarded to students because of academic potential or performance, and/or financial need. Gifts and grants are only a part of a financial aid

> Campbell Soup Company provides access to its annual reports online at campbellsoup.com. The annual reports are found in the “Investor Center/Financial Information/Annual Reports” area of its website. Locate the following information in the annual reports

> Custom Granite Inc. uses an absorption cost system for accumulating product cost. The following data are available for the past year: - Raw materials purchases totaled $240,000. - Direct labor costs incurred for the year totaled $480,000. - Variable manu

> Jim Sandrolini is an accountant for a local manufacturing company. Jim’s good friend, Dan Carruthers, has been operating a retail sporting goods store for about a year. The store has been moderately successful, and Dan needs a bank loan to help finance t

> Determine each of the following missing amounts:

> You have recently been engaged by Dominic’s Italian Cafe to evaluate the financial impact of adding gourmet pizza items to the menu. A survey of the clientele indicates that demand for the product exists at an average selling price of $18 per pizza. Fixe

> Tommy Appleton is in charge of arranging the “social hour” period and dinner for the monthly meetings of the local chapter of the Management Accountants Association. Tommy is negotiating with a new restaurant that would like to have the group’s business,

> Assume you are a sales representative for Sweet Tooth Candy Company. One of your customers is interested in buying some candy that will be given to the members of a high school Student Government Association. The association members will be marching in a

> Following are comparative statements of cash flows, as reported by The Coca-Cola Company in its 2020 annual report: Required: a. Briefly review the consolidated statements of cash flows, and then provide an overall evaluation of the “bi

> Your conversation with Mr. Gerrard, which took place in February 2023 (see Case 6.37), continued as follows: Mr. Gerrard: I’ve been talking with my accountant about our capital expansion needs, which will be considerable during the next couple of years.

> Assume that the current ratio for Arch Company is 2.0, its acid-test ratio is 1.5, and its working capital is $900,000. Answer each of the following questions independently, always referring to the original information. a. How much does the firm have in

> Solve the requirements of Problem 11.13 for the year ended August 2, 2020. Data from Problem 11.13: Refer to the consolidated balance sheets of the Campbell Soup Company annual report in the appendix. Required: Prepare a common size balance sheet at Jul

> Refer to the consolidated balance sheets of the Campbell Soup Company annual report in the appendix. Required: Prepare a common size balance sheet at July 28, 2019, using the following captions: Total current assets Plant assets, net of depreciation Good

> This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (also known as the Five-Year Review), or calculate, the following data: a. Dividends per share declared in 2020. b. Capital expenditur

> This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (also known as the Five-Year Review), or calculate, the following data: a. Net sales in 2017. b. Operating income (earnings before int

> Tablerock Corp. is interested in reviewing its method of evaluating capital expenditure proposals using the accounting rate of return method. A recent proposal involved a $100,000 investment in a machine that had an estimated useful life of five years an

> TopCap Co. is evaluating the purchase of another sewing machine that will be used to manufacture sport caps. The invoice price of the machine is $98,000. In addition, delivery and installation costs will total $5,000. The machine has the capacity to prod

> The transactions affecting the stockholders’ equity accounts of DeZurik Corp. for the year ended June 30, 2023, are summarized here: 1. 160,000 shares of common stock were issued at $21.25 per share. 2. 40,000 shares of treasury (common) stock were sold

> Cowboy Recording Studio is considering the investment of $140,000 in a new recording equipment. It is estimated that the new equipment will generate additional cash flow of $21,000 per year for each year of its 12-year life and will have a salvage value

> The segmented income statement for XYZ Company for the year ended December 31, 2022, follows: The company is concerned about the performance of product A, and you have been asked to analyze the situation and recommend to the president whether to continue

> Petro Motors Inc. (PMI) produces small gasoline-powered motors for use in lawn mowers. The company has been growing steadily over the past five years and is operating at full capacity. PMI recently completed the addition of new plant and equipment at a c

> Presented here are the original overhead budget and the actual costs incurred during April for Piccolo Inc. Piccolo’s managers relate overhead to direct labor hours for planning, control, and product costing purposes. The original budge

> Graystone’s production budget for September called for making 60,000 units of a single product. The firm’s production standards allow one-half of a machine hour per unit produced. The fixed overhead budget for Septembe

> Founders State Bank developed a standard for teller staffing that provided for one teller to handle 15 customers per hour. During June, the bank averaged 50 customers per hour and had five tellers on duty at all times. (Relief tellers filled in during lu

> The Flynn Insurance Company developed standard times for processing claims. When a claim was received at the processing center, it was first reviewed and classified as simple or complex. The standard time for processing was: Employees were expected to be

> The standards for one case of liquid weed killer are as follows: During the week ended May 6, the following activity took place: 4,360 machine hours were worked. 22,800 lb of raw material were purchased for inventory at a total cost of $174,420. 3,800 ca

> The standards for one case of Springfever Tonic are as follows: During the week ended March 13, the following activity took place: 14,800 lb of raw materials were purchased for inventory at a cost of $2.97 per pound. 2,000 cases of finished product were

> Freese Inc. is in the process of preparing the fourth quarter budget for 2022, and the following data have been assembled: - The company sells a single product at a price of $50 per unit. The estimated sales volume for the next six months is as follows:

> DeZurik Corp. had the following stockholders’ equity section in its June 30, 2022, balance sheet (in thousands, except share and per share amounts): Required: a. Calculate the par value per share of preferred stock and determine the pre

> Soprano Co. is in the process of preparing the second quarter budget for 2022, and the following data have been assembled: - The company sells a single product at a selling price of $50 per unit. The estimated sales volume for the next six months is as f

> Following are the budgeted income statements for the second quarter of 2022 for SeaTech Inc.: The company expects about 40% of sales to be cash transactions. Of sales on account, 65% are expected to be collected in the first month after the sale is made,

> The monthly cash budgets for the second quarter of 2022 follow ($000 omitted) for Tuscano Mfg. Co. A minimum cash balance of $15,000 is required to start each month, and a $50,000 line of credit has been arranged with a local bank at a 16% interest rate.

> Refer to the PrimeTime Sportswear data. Required: a. Prepare a cash budget for August and September. What are the prospects for this company if its sales growth continues at a similar rate? b. Assume now that PrimeTime Sportswear is a mature firm and tha

> Precious Stones Ltd. is a retail jeweler. Most of the firm’s business is in jewelry and watches. The firm’s average gross profit ratio for jewelry and watches is 70% and 40%, respectively. The sales forecast for the ne

> D&J Furniture, a retail store, has an average gross profit ratio of 48%. The sales forecast for the next four months follows: Management’s inventory policy is to have ending inventory equal to 200% of the cost of sales for the subse

> Morrison & Company incurred the following costs during August: Manufacturing overhead is applied on the basis of $25 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the y

> The following table summarizes the beginning and ending inventories of Springfield Manufacturing Inc. for the month of September: Raw materials purchased during the month of September totaled $247,800. Direct labor costs incurred totaled $624,400 for the

> GrandSlam Inc. incurred the following costs during March: Required: During the month, 3,900 units of product were manufactured and 2,200 units of product were sold. On March 1, GrandSlam carried no inventories. On March 31, there were no inventories for

> You were asked to obtain the most recent annual report of a company that you were interested in reviewing throughout this term. Required: Please review the note disclosures provided in your focus company’s annual report and identify at least three items

> Williamson Inc. manufactures digital voice recorders. During 2022, total costs associated with manufacturing 52,000 of the new EZ 9900 model (introduced this year) were as follows: Required: a. Calculate the cost per recorder under both variable costing

> TopBass Inc. manufactures fishing equipment. During 2022, total costs associated with manufacturing 30,000 fly-cast fishing rods (a new product introduced this year) were as follows: Required: a. Calculate the cost per fishing rod under both variable cos

> Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manu

> HealthTech Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with infor

> Austin Inc. produces small-scale replicas of vintage automobiles for collectors and museums. Finished products are built on a 1/20 scale of originals. The firm’s income statement showed the following: An automated stamping machine has b

> Gonzales Inc. makes and sells a single product. The current selling price is $16 per unit. Variable expenses are $10 per unit, and fixed expenses total $21,600 per month. Sales volume for March totaled 4,100 units. Required: a. Calculate operating income

> Muscle Beach Inc. makes three models of high-performance weight-training benches. Current operating data are summarized here: Required: a. Calculate the contribution margin ratio of each product. b. Calculate the firm’s overall contribu

> HighTide Canvas Co. currently makes and sells two model sizes of a boat cover. Data applicable to the current operation are summarized in the following columns labeled Current Operation. Management is considering adding a Medium model to its current Larg

> Ozark Metal Co. makes a single product that sells for $42 per unit. Variable costs are $27.30 per unit, and fixed costs total $65,415 per month. Required: a. Calculate the number of units that must be sold each month for the firm to break even. b. Assume

> Marathon Co. makes and sells a single product. The current selling price is $18 per unit. Variable expenses are $12 per unit, and fixed expenses total $36,000 per month. Required: a. Calculate the breakeven point expressed in terms of total sales dollars

> Assume that Home and Office City Inc. provided the following comparative data concerning long-term debt in the notes to its 2023 annual report (amounts in millions): Required: a. As indicated, Home and Office City’s 3¼% Co

> Refer to the Campbell Soup Company annual report for 2020 in the appendix or to the most recent full annual report that you have downloaded from Campbell’s website. Find and scan the notes to consolidated financial statements. Read the independent audito

> Presented here is the income statement for Fairchild Co. for March: Based on an analysis of cost behavior patterns, it has been determined that the company’s contribution margin ratio is 30%. Required: a. Rearrange the preceding income

> Presented here is the income statement for Big Sky Inc. for the month of February: Based on an analysis of cost behavior patterns, it has been determined that the company’s contribution margin ratio is 25%. Required: a. Rearrange the pr

> Shown here is an income statement in the traditional format for a firm with a sales volume of 18,000 units: Required: a. Prepare an income statement in the contribution margin format b. Calculate the contribution margin per unit and the contribution marg

> Shown here is an income statement in the traditional format for a firm with a sales volume of 10,000 units. Cost formulas also are shown: Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per

> The following data have been extracted from the records of Puzzle Inc.: Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high–low method. c. Calculate the total cost that would be incurred

> A department of Delta Co. incurred the following costs for the month of June. Variable costs, and the variable portion of mixed costs, are a function of the number of units of activity: During July, the activity level was 16,000 units, and the total cost

> This problem is based on the 2020 annual report of Campbell Soup Company in the appendix. Required: a. Compute the following profitability measures for the year ended August 2, 2020: (1) Return on investment, based on net earnings (perform a DuPont analy

> Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: Required: a. Calculate return on investment, based on net income and average total assets, for 2023 and 2022. Show both margin and turnover in your calculatio

> Following are comparative balance sheets for Millco Inc. at January 31 and February 28, 2023: Required: Prepare a statement of cash flows that explains the change that occurred in cash during the month. You may assume that the change in each balance shee

> Following are a statement of cash flows (indirect method) for Harris Inc. for the year ended December 31, 2023, and the firm’s balance sheet at December 31, 2022: Required: a. Using the preceding information, prepare the balance sheet f

> You were asked to obtain the most recent annual report of a company that you were interested in reviewing throughout this term. Required: Review the note disclosures provided in your focus company’s annual report and discuss what you’ve learned about how

> Following is a statement of cash flows (indirect method) for Hartford Inc. for the year ended December 31, 2023. Also shown is a partially completed comparative balance sheet as of December 31, 2023 and 2022: Required: a. Complete the December 31, 2023 a

> Following is a partially completed balance sheet for Hoeman Inc. at December 31, 2023, together with comparative data for the year ended December 31, 2022. From the statement of cash flows for the year ended December 31, 2023, you determine the following

> The following information is available from Gray Co.’s accounting records for the year ended December 31, 2022 (amounts in millions): Required: a. The net cash provided by operating activities for Gray Co. for the year ended December 31

> The following information is available from Bromfield Co.’s accounting records for the year ended December 31, 2022 (amounts in millions): Required: a. Calculate the net cash provided (used) by operating activities for Bromfield Co. for

> The financial statements of Pouchie Co. included the following information for the year ended December 31, 2022 (amounts in millions): Required: Complete the following statement of cash flows, using the indirect method:

> The financial statements of Simon Co. include the following items (amounts in thousands): Required: a. Calculate the net cash flow provided by operations for Simon Co. for the year ended December 31, 2023. b. Explain why net income is different from the

> On April 8, 2022, a flood destroyed the warehouse of Marmaron Distributing Co. From the waterlogged records of the company, management was able to determine that the firm’s gross profit ratio had averaged 45% for the past several years and that the inven

> Franklin Co. has experienced gross profit ratios for 2022, 2021, and 2020 of 41%, 38%, and 40%, respectively. On April 6, 2023, the firm’s plant and all its inventory were destroyed by a tornado. Accounting records for 2023, which were

> The following information is available from the accounting records of Spenser Co. for the year ended December 31, 2022: Required: a. Calculate the operating income for Spenser Co. for the year ended December 31, 2022. b. Calculate the companyâ€

> The following information is available from the accounting records of Manahan Co. for the year ended December 31, 2022: Required: a. Calculate the operating income for Manahan Co. for the year ended December 31, 2022. b. Calculate the companyâ€

> A review of the accounting records at Corless Co. revealed the following information concerning the company’s liabilities that were outstanding at December 31, 2023 and 2022, respectively: Required: a. Corless Co. has not yet made an ad

> Bacon Inc. has the following stockholders’ equity section in its May 31, 2022, comparative balance sheets: Required: a. Calculate the amount that should be shown on the balance sheet for common stock at May 31, 2022. b. The only transac

> Francis Inc. has the following stockholders’ equity section in its November 30, 2022, balance sheet: Required: a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be s

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or min

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or mi

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or mi

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or min

> On January 1, 2022, Metco Inc. reported 411,050 shares of $5 par value common stock as being issued and outstanding. On March 24, 2022, Metco Inc. purchased for its treasury 3,600 shares of its common stock at a price of $37 per share. On August 19, 2022

> On March 3, 2022, Docker Inc. purchased 800 shares of its own common stock in the market at a price of $10.75 per share. On August 29, 2022, 500 of these shares were sold in the open market at a price of $11.50 per share. There were 33,600 shares of Dock

> Permabilt Corp. was incorporated on January 1, 2022, and issued the following stock for cash: 2,000,000 shares of no-par common stock were authorized; 750,000 shares were issued on January 1, 2022, at $35 per share. 800,000 shares of $100 par value, 7.5

> Homestead Oil Corp. was incorporated on January 1, 2022, and issued the following stock for cash: - 600,000 shares of no-par common stock were authorized; 120,000 shares were issued on January 1, 2022, at $26 per share. - 100,000 shares of $100 par value

> You have been approached by Gary Gerrard, president and CEO of Gerrard Construction Co., who would like your advice on a number of business and accounting related matters. Your conversation with Mr. Gerrard, which took place in February 2023, proceeded a

> On January 1, 2022, Learned, Inc., issued $105 million face amount of 20- year, 14% stated rate bonds when market interest rates were 16%. The bonds pay interest semiannually each June 30 and December 31 and mature on December 31, 2041. Required: a. Usin

> On January 1, 2022, Drennen, Inc., issued $6 million face amount of 10-year, 14% stated rate bonds when market interest rates were 12%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2031. Required: a. Using the

> Hurley Co. has outstanding $420 million face amount of 9% bonds that were issued on January 1, 2010, for $409,500,000. The 20-year bonds mature on December 31, 2029, and are callable at 102 (i.e., they can be paid off at any time by paying the bondholder

> Hayden Co. has outstanding $50 million face amount of 6% bonds that were issued on January 1, 2015, for $50,750,000. The 20-year bonds mature on December 31, 2034, and are callable at 102 (that is, they can be paid off at any time by paying the bondholde

> The following summary data for the payroll period ended December 27, 2021, are available for Cayman Coating Co.: Additional information - For employees, FICA tax rates for 2021 were 7.65% on the first $142,800 of each employee’s annual