Question: Diversified Products, Inc., has recently acquired a

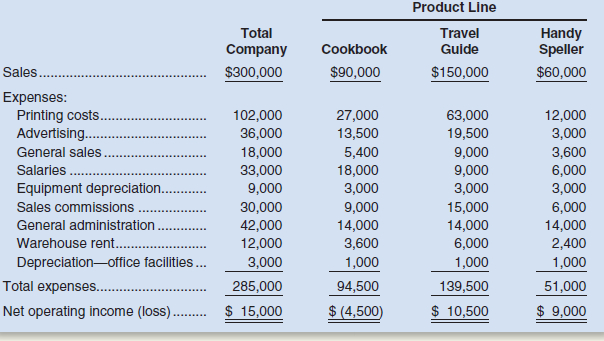

Diversified Products, Inc., has recently acquired a small publishing company that Diversified Products intends to operate as one of its investment centers. The newly acquired company has three books that it offers for sale—a cookbook, a travel guide, and a handy speller. Each book sells for $10. The publishing company’s most recent monthly income statement is given below:

The following additional information is available about the company:

a. Only printing costs and sales commissions are variable; all other costs are fixed. The printing costs (which include materials, labor, and variable overhead) are traceable to the three product lines as shown in the statement above. Sales commissions are 10% of sales for any product.

b. The same equipment is used to produce all three books, so the equipment depreciation cost has been allocated equally among the three product lines. An analysis of the company’s activities indicates that the equipment is used 30% of the time to produce cookbooks, 50% of the time to produce travel guides, and 20% of the time to produce handy spellers.

c. The warehouse is used to store finished units of product, so the rental cost has been allocated to the product lines on the basis of sales dollars. The warehouse rental cost is $3 per square foot per year. The warehouse contains 48,000 square feet of space, of which 7,200 square feet is used by the cookbook line, 24,000 square feet by the travel guide line, and 16,800 square feet by the handy speller line.

d. The general sales cost on the prior page includes the salary of the sales manager and other sales costs not traceable to any specific product line. This cost has been allocated to the product lines on the basis of sales dollars.

e. The general administration cost and depreciation of office facilities both relate to administration of the company as a whole. These costs have been allocated equally to the three product lines.

f. All other costs are traceable to the three product lines in the amounts shown on the statement on the prior page.

The management of Diversified Products, Inc., is anxious to improve the new investment center’s 5% return on sales.

Required:

1. Prepare a new contribution format segmented income statement for the month. Adjust allocations of equipment depreciation and of warehouse rent as indicated by the additional information provided.

2. After seeing the income statement in the main body of the problem, management has decided to eliminate the cookbook because it is not returning a profit, and to focus all available resources on promoting the travel guide.

a. Based on the statement you have prepared, do you agree with the decision to eliminate the cookbook? Explain.

b. Based on the statement you have prepared, do you agree with the decision to focus all available resources on promoting the travel guide? Assume that an ample market is available for all three product lines.

Transcribed Image Text:

Product Line Total Travel Handy Speller Company Cookbook Guide Sales. $300,000 $90,000 $150,000 $60,000 Expenses: Printing costs. Advertising. 102,000 27,000 13,500 5,400 63,000 12,000 3,000 3,600 36,000 19,500 General sales 18,000 33,000 9,000 30,000 9,000 9,000 3,000 Salaries. 18,000 3,000 6,000 3,000 Equipment depreciation.. Sales commissions General administration. Warehouse rent. 9,000 14,000 3,600 1,000 15,000 14,000 6,000 6,000 14,000 2,400 42,000 12,000 depreciation-office facilities... 3,000 1,000 1,000 Total expenses.. 285,000 94,500 139,500 51,000 Net operating income (loss).. $ 15,000 $ (4,500) $ 10,500 $ 9,000

> Singleton Supplies Corporation (SSC) manufactures medical products for hospitals, clinics, and nursing homes. SSC may introduce a new type of X-ray scanner designed to identify certain types of cancers in their early stages. There are a number of uncerta

> The Bartram-Pulley Company (BPC) must decide between two mutually exclusive investment projects. Each project costs $6,750 and has an expected life of 3 years. Annual net cash flows from each project begin 1 year after the initial investment is made and

> DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $450,000 and a remaining useful life of 5 years. The current

> The Everly Equipment Company’s flange-lipping machine was purchased 5 years ago for $55,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $5,500 per year for each year of its remaining life. As older flange-lip

> Madison Manufacturing is considering a new machine that costs $350,000 and would reduce pre-tax manufacturing costs by $110,000 annually. Madison would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a

> Shao Industries is considering a proposed project for its capital budget. The company estimates the project’s NPV is $12 million. This estimate assumes that the economy and market conditions will be average over the next few years. The

> Define each of the following terms: a. Capital budgeting; regular payback period; discounted payback period b. Independent projects; mutually exclusive projects c. DCF techniques; net present value (NPV) method; internal rate of return (IRR) method; prof

> St. Johns River Shipyard’s welding machine is 15 years old, fully depreciated, and has no salvage value. However, even though it is old, it is still functional as originally designed and can be used for quite a while longer. A new welder will cost $182,5

> Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 40%. a. W

> Davis Industries must choose between a gas-powered and an electric powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The

> Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100 and that for the pulley s

> Your division is considering two investment projects, each of which requires an up-front expenditure of $15 million. You estimate that the investments will produce the following net cash flows: a. What are the two projects’ net present

> Refer to Problem 12-1. What is the project’s discounted payback period? Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> Refer to Problem 12-1. What is the project’s payback period? Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> Refer to Problem 12-1. What is the project’s PI? Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $10 million but realizes after-tax inflows of $4 million per year for 4 years.

> Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce net cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and wil

> Suppose a firm estimates its overall cost of capital for the coming year to be 10%. What might be reasonable costs of capital for average-risk, high-risk, and low-risk projects?

> Define each of the following terms: a. Operating plan; financial plan b. Spontaneous liabilities; profit margin; payout ratio c. Additional funds needed (AFN); AFN equation; capital intensity ratio; self-supporting growth rate d. Forecasted financial

> Amfac Company manufactures a single product. The company keeps careful records of manufacturing activities from which the following information has been extracted: The company’s manufacturing overhead cost consists of both variable an

> Sawaya Co., Ltd., of Japan is a manufacturing company whose total factory overhead costs fluctuate considerably from year to year according to increases and decreases in the number of direct labor-hours worked in the factory. Total factory overhead costs

> Pleasant View Hospital of British Columbia has just hired a new chief administrator who is anxious to employ sound management and planning techniques in the business affairs of the hospital. Accordingly, she has directed her assistant to summarize the co

> A number of graphs displaying cost behavior patterns are shown below. The vertical axis on each graph represents total cost, and the horizontal axis represents level of activity (volume). Required: 1. For each of the following situations, identify the g

> Morrisey & Brown, Ltd., of Sydney is a merchandising company that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company’s income statements for the three most recent months fol

> Marwick’s Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, $2,450 each from the manufacturer. Marwick’s Pianos, Inc., sells the pianos to its customers at an average price of $3

> St. Mark’s Hospital contains 450 beds. The average occupancy rate is 80% per month. In other words, on average, 80% of the hospital’s beds are occupied by patients. At this level of occupancy, the hospital’s operating costs are $32 per occupied bed per d

> Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $1,200 and the variable cost per cup of coffee served is $0.22. Required: 1. Fill in the following table with your estimat

> Lubricants, Inc., produces a special kind of grease that is widely used by race car drivers. The grease is produced in two processing departments: Refining and Blending. Raw materials are introduced at various points in the Refining Department. The follo

> Weston Products manufactures an industrial cleaning compound that goes through three processing departments—Grinding, Mixing, and Cooking. All raw materials are introduced at the start of work in the Grinding Department. The Work in Pro

> Birch Company normally produces and sells 30,000 units of RG-6 each month. RG-6 is a small electrical relay used as a component part in the automotive industry. The selling price is $22 per unit, variable costs are $14 per unit, fixed manufacturing overh

> Cooperative San José of southern Sonora state in Mexico makes a unique syrup using cane sugar and local herbs. The syrup is sold in small bottles and is prized as a flavoring for drinks and for use in desserts. The bottles are sold for $12 each. (The Mex

> Old Country Links Inc. produces sausages in three production departments—Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then trans

> Builder Products, Inc., manufactures a caulking compound that goes through three processing stages prior to completion. Information on work in the first department, Cooking, for May follows: Production data: Pounds in process, May 1; materials 100% compl

> Sunspot Beverages, Ltd., of Fiji makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are then bottled and packed for shipping in the Bottling Depa

> Alaskan Fisheries, Inc., processes salmon for various distributors. Two departments are involved— Cleaning and Packing. Data relating to pounds of salmon processed in the Cleaning Department during July are presented below: A total of

> Superior Micro Products uses the weighted-average method in its process costing system. During January, the Delta Assembly Department completed its processing of 25,000 units and transferred them to the next department. The cost of beginning inventory an

> Scribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate th

> Helix Corporation produces prefabricated flooring in a series of steps carried out in production departments. All of the material that is used in the first production department is added at the beginning of processing in that department. Data for May for

> Pureform, Inc., manufactures a product that passes through two departments. Data for a recent month for the first department follow: The beginning work in process inventory was 80% complete with respect to materials and 60% complete with respect to lab

> Hielta Oy, a Finnish company, processes wood pulp for various manufacturers of paper products. Data relating to tons of pulp processed during June are provided below: Required: 1. Compute the number of tons of pulp completed and transferred out during

> Distinguish between discretionary fixed costs and committed fixed costs.

> Chocolaterie de Geneve, SA, is located in a French-speaking canton in Switzerland. The company makes chocolate truffles that are sold in popular embossed tins. The company has two processing departments—Cooking and Molding. In the Cooki

> Maria Am Corporation uses a process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process inventory was $3,570, the cost o

> Data concerning a recent period’s activity in the Prep Department, the first processing department in a company that uses process costing, appear below: A total of 20,100 units were completed and transferred to the next processing dep

> Superior Micro Products uses the weighted-average method in its process costing system. Data for the Assembly Department for May appear below: Required: 1. Compute the cost per equivalent unit for materials, for labor, and for overhead. 2. Compute the

> Clonex Labs, Inc., uses a process costing system. The following data are available for one department for October: The department started 175,000 units into production during the month and transferred 190,000 completed units to the next department. Re

> Quality Brick Company produces bricks in two processing departments—Molding and Firing. Information relating to the company’s operations in March follows: a. Raw materials were issued for use in production: Molding Department, $23,000; and Firing Departm

> Losses have been incurred at Millard Corporation for some time. In an effort to isolate the problem and improve the company’s performance, management has requested that the monthly income statement be segmented by sales region. The comp

> The Midwest Consulting Group (MCG) helps companies build balanced scorecards. As part of its marketing efforts, MCG conducts an annual balanced scorecard workshop for prospective clients. As MCG’s newest employee, your boss has asked you to participate i

> Vulcan Company’s contribution format income statement for June is given below: Vulcan Company Income Statement For the Month Ended June 30 Sales ................................................. $750,000 Variable expenses ............................. 3

> What is the difference between a contribution approach income statement and a traditional approach income statement?

> Lost Peak ski resort was for many years a small, family-owned resort serving day skiers from nearby towns. Lost Peak was recently acquired by Western Resorts, a major ski resort operator. The new owners have plans to upgrade the resort into a destination

> The contribution format income statement for Huerra Company for last year is given below: The company had average operating assets of $2,000,000 during the year. Required: 1. Compute the company’s return on investment (ROI) for the p

> Financial data for Joel de Paris, Inc., for last year follow: The company paid dividends of $15,000 last year. The “Investment in Buisson, S.A.” on the balance sheet represents an investment in the stock of another

> Comparative data on three companies in the same service industry are given below: Required: 1. What advantages are there to breaking down the ROI computation into two separate elements, margin and turnover? 2. Fill in the missing information above, and

> “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company fo

> Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $3,00

> Wingate Company, a wholesale distributor of videotapes, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement, which follows: Sales ..........................................................

> Raner, Harris, & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices—one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jo

> A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: Company A B C $9,000,000 $ ? $3,000,000 $7,000,000 $ 280,000 $ 14

> Ariel Tax Services prepares tax returns for individual and corporate clients. As the company has gradually expanded to 10 offices, the founder Max Jacobs has begun to feel as though he is losing control of operations. In response to this concern, he has

> Refer to the data in Exercise 10–13. Assume that Minneapolis’ sales by major market are: The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. T

> CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales .................................................................................. $3,000,000 Net operati

> Pecs Alley is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The Springfield Club reported the following results for the past year:

> Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Com

> Provide the missing data in the following table for a distributor of martial arts products: Divislon Alpha Bravo Charlie $ ? $ ? $800,000 $11,500,000 $ 920,000 $ $ ? $210,000 $ ? Sales.. Net operating income Average operating assets. Margin... ? 4%

> Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below (the currency is the Australian dollar, denoted here as $): Required: 1. Compute the rate of return for each division using the return on investment (ROI)

> Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow (in millions of yen, denoted by ¥): Required: 1. For each division, compute the return on investment (R

> Juniper Design Ltd. of Manchester, England, is a company specializing in providing design services to residential developers. Last year the company had net operating income of £600,000 on sales of £3,000,000. The company’s average operating assets for th

> Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales .....................................................

> Royal Lawncare Company produces and sells two packaged products, Weedban and Greengrow. Revenue and cost information relating to the products follow: Common fixed expenses in the company total $33,000 annually. Last year the company produced and sold 1

> ColdKing Company is a small producer of fruit-flavored frozen desserts. For many years, ColdKing’s products have had strong regional sales on the basis of brand recognition; however, other companies have begun marketing similar products in the area, and

> What is a plantwide overhead rate? Why are multiple overhead rates, rather than a plantwide overhead rate, used in some companies?

> Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given on the following page: Overhead is applied to production on the basis of direct labor-hours. During

> Sharp Company manufactures a product for which the following standards have been set: During March, the company purchased direct materials at a cost of $55,650, all of which were used in the production of 3,200 units of product. In addition, 4,900 hour

> Danson Company is a chemical manufacturer that supplies various products to industrial users. The company plans to introduce a new chemical solution, called Nysap, for which it needs to develop a standard product cost. The following information is availa

> John Fleming, chief administrator for Valley View Hospital, is concerned about the costs for tests in the hospital’s lab. Charges for lab tests are consistently higher at Valley View than at other hospitals and have resulted in many complaints. Also, bec

> Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been experiencing problems as shown by its June contribution format income statement below: Janet Dunn, who has just been appointed general manager of the West

> Define the following terms: (a) Cost behavior and (b) Relevant range.

> If a company fully allocates all of its overhead costs to jobs, does this guarantee that a profit will be earned for the period?

> What factors should be considered in selecting a base to be used in computing the predetermined overhead rate?

> Why do companies use predetermined overhead rates rather than actual manufacturing overhead costs to apply overhead to jobs?

> Explain why some production costs must be assigned to products through an allocation process.

> Explain how a sales order, a production order, a materials requisition form, and a labor time ticket are involved in producing and costing products.

> Mason Paper Company (MPC) manufactures commodity grade papers for use in computer printers and photocopiers. MPC has reported net operating losses for the last two years due to intense price pressure from much larger competitors. The MPC management team—

> Becton Labs, Inc., produces various chemical compounds for industrial use. One compound, called Fludex, is prepared using an elaborate distilling process. The company has developed standard costs for one unit of Fludex, as follows: During November, the

> What is a predetermined overhead rate, and how is it computed?

> What is the purpose of the job cost sheet in a job-order costing system?

> What effect does an increase in volume have on— a. Unit fixed costs? b. Unit variable costs? c. Total fixed costs? d. Total variable costs?

> How do the performance measurement and compensation systems of service companies compare with those of manufacturers? Ask the manager of your local McDonald’s, Wendy’s, Burger King, or other fast-food chain if he or she could spend some time discussing t

> Distinguish between (a) A variable cost, (b) A fixed cost, and (c) A mixed cost.

> In what way can the use of ROI as a performance measure for investment centers lead to bad decisions? How does the residual income approach overcome this problem?

> How is it possible for a cost that is traceable to a segment to become a common cost if the segment is divided into further segments?

> Why aren’t common costs allocated to segments under the contribution approach?

> Explain how the segment margin differs from the contribution margin.

> Distinguish between a traceable cost and a common cost. Give several examples of each.

> The auto repair shop of Quality Motor Company uses standards to control the labor time and labor cost in the shop. The standard labor cost for a motor tune-up is given below: The record showing the time spent in the shop last week on motor tune-ups has

> What benefits result from decentralization?

> Why does the balanced scorecard include financial performance measures as well as measures of how well internal business processes are doing?

> Maple Products, Ltd., manufactures a super-strong hockey stick. The standard cost of one hockey stick is: Last year, 8,000 hockey sticks were produced and sold. Selected cost data relating to last year’s operations follow: The follo