Question: Evaluate the market timing and security selection

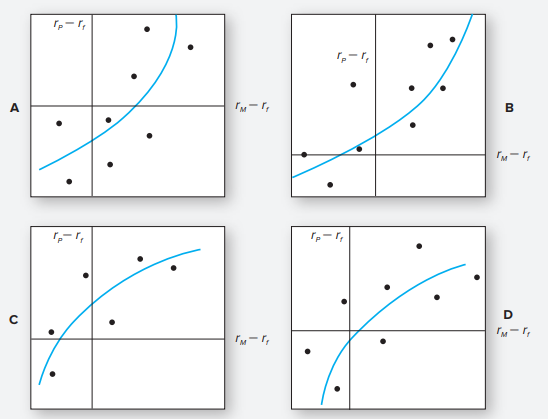

Evaluate the market timing and security selection abilities of four managers whose performances are plotted in the accompanying diagrams.

> Repeat Problem 4, but now assume the coupons are paid semiannually. Problem 4: a. Find the duration of a 6% coupon bond making annual coupon payments if it has three years until maturity and has a yield to maturity of 6%. b. What is the duration if the

> What are the differences between bottom-up and top-down approaches to security valuation? What are the advantages of a top-down approach?

> If a security is underpriced (i.e., intrinsic value > price), then what is the relationship between its market capitalization rate and its expected rate of return?

> The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contributed, but the withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your taxable income, b

> George More is a participant in a defined contribution pension plan that offers a fixed-income fund and a common stock fund as investment choices. He is 40 years old and has an accumulation of $100,000 in each of the funds. He currently contributes $1,50

> What is the least-risky asset for each of the following investors? a. A person investing for her 3-year-old child’s college tuition. b. A defined benefit pension fund with benefit obligations that have an average duration of 10 years. The benefits are no

> Your neighbor has heard that you successfully completed a course in investments and has come to seek your advice. She and her husband are both 50 years old. They just finished making their last payments for their condominium and their children’s college

> Suppose that sending an analyst to an executive education program will raise the precision of the analyst’s forecasts as measured by R-square by .01. How might you put a dollar value on this improvement? Provide a numerical example.

> Figure 27.3 includes a box for the econometrics unit. Item (3) is to “help other units.” What sorts of specific tasks might this entail?

> Jand, Inc., currently pays a dividend of $1.22, which is expected to grow indefinitely at 5%. If the current value of Jand’s shares based on the constant-growth dividend discount model is $32.03, what is the required rate of return?

> How would the application of the BL model to a stock and bond portfolio (per the example in the text) affect security analysis? What does this suggest about the hierarchy of use of the BL and TB models?

> Is statistical arbitrage true arbitrage? Explain.

> With respect to hedge fund investing, the net return to an investor in a fund of funds would be lower than that earned from an individual hedge fund because of: a. Both the extra layer of fees and the higher liquidity offered. b. No reason; funds of fund

> Which of the following would be the most appropriate benchmark to use for hedge fund evaluation? a. A multifactor model. b. The S&P 500. c. The risk-free rate.

> Which of the following is most accurate in describing the problems of survivorship bias and backfill bias in the performance evaluation of hedge funds? a. Survivorship bias and backfill bias both result in upwardly biased hedge fund index returns. b. Sur

> Why is it harder to assess the performance of a hedge fund portfolio manager than that of a typical mutual fund manager?

> How might the incentive fee of a hedge fund affect the manager’s proclivity to take on high-risk assets in the portfolio?

> Here are data on three hedge funds. Each fund charges its investors an incentive fee of 20% of total returns. Suppose initially that a fund of funds (FF) manager buys equal amounts of each of these funds, and also charges its investors a 20% incentive fe

> Return again to Problem 14. Now suppose that the manager misestimates the beta of Waterworks stock, believing it to be .50 instead of .75. The standard deviation of the monthly market rate of return is 5%. a. What is the standard deviation of the (now im

> Return to Problem 14. a. Suppose you hold an equally weighted portfolio of 100 stocks with the same alpha, beta, and residual standard deviation as Waterworks. Assume the residual returns (the e terms in Equations 26.1 and 26.2) on each of these stocks a

> Deployment Specialists pays a current (annual) dividend of $1.00 and is expected to grow at 20% for 2 years and then at 4% thereafter. If the required return for Deployment Specialists is 8.5%, what is the intrinsic value of its stock?

> The following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 500 index. A hedge fund manager believes that Waterworks is underpriced, with an alpha of 2% over the coming month. a. If he holds a

> Suppose a hedge fund follows the following strategy. Each month it holds $100 million of an S&P 500 index fund and writes out-of-the-money put options on $100 million of the index with exercise price 5% lower than the current value of the index. Suppose

> Log in to Connect and link to Chapter 26 to find a spreadsheet containing monthly values of the S&P 500 index. Suppose that in each month you had written an out-of-the-money put option on one unit of the index with an exercise price 5% lower than the cur

> Reconsider the hedge fund in Problem 10. Suppose it is January 1, the standard deviation of the fund’s annual returns is 50%, and the risk-free rate is 4%. The fund has an incentive fee of 20%, but its current high water mark is $66, and net asset value

> A hedge fund with net asset value of $62 per share currently has a high water mark of $66. Is the value of its incentive fee more or less than it would be if the high water mark were $67?

> Would a market-neutral hedge fund be a good candidate for an investor’s entire retirement portfolio? If not, would there be a role for the hedge fund in the overall portfolio of such an investor?

> Much of this chapter was written from the perspective of a U.S. investor. But suppose you are advising an investor living in a small country (choose one to be concrete). How might the lessons of this chapter need to be modified for such an investor?

> Calculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar.

> Now suppose the investor in Problem 3 also sells forward £5,000 at a forward exchange rate of $2.10/£. a. Recalculate the dollar-denominated returns for each scenario. b. What happens to the standard deviation of the dollar-denominated return? Compare it

> In Figure 25.2, we provide stock market returns in both local and dollar-denominated terms. Which of these is more relevant? What does this have to do with whether the foreign exchange risk of an investment has been hedged?

> The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $5, all of which was reinvested in the company. The firm’s expected ROE for the next four years is 20% per year, duri

> Do you agree with the following claim? “U.S. companies with global operations can give you international diversification.” Think about both business risk and foreign exchange risk.

> Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market’s average return was 14%. Performance is measured using an index model regression on excess re

> Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 12% and 16%, respectively. The beta of A is .7, while that of B is 1.4. The T-bill rate is currently 5%, whereas the expected rate of retu

> A manager buys three shares of stock today and then sells one of those shares each year for the next three years. His actions and the price history of the stock are summarized below. The stock pays no dividends. a. Calculate the time-weighted geometric a

> XYZ’s stock price and dividend history are as follows: An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaini

> Consider the rate of return of stocks ABC and XYZ. a. Calculate the arithmetic average return on these stocks over the sample period. b. Which stock has greater dispersion around the mean return? c. Calculate the geometric average returns of each stock.

> We have seen that market timing has tremendous potential value. Would it therefore be wise to shift resources to timing at the expense of security selection?

> We know that the geometric average (time-weighted return) on a risky investment is always lower than the corresponding arithmetic average. Can the IRR (the dollar-weighted return) similarly be ranked relative to these other two averages?

> Kelli Blakely is a portfolio manager for the Miranda Fund, a core large-cap equity fund. The market proxy and benchmark for performance measurement purposes is the S&P 500. Although the Miranda portfolio generally mirrors the asset class and sector w

> Primo Management Co. is looking at how best to evaluate the performance of its managers. Primo has been hearing more and more about benchmark portfolios and is interested in trying this approach. As such, the company hired Sally Jones, CFA, as a consulta

> Recalculate the intrinsic value of Rio Tinto shares using the free cash flow model of Spreadsheet 18.2 (available in Connect; link to Chapter 18 material) under each of the following assumptions. Treat each scenario independently. a. Rio Tinto’s P/E rati

> Is it possible for a positive alpha to be associated with inferior performance? Explain.

> Primo Management Co. is looking at how best to evaluate the performance of its managers. Primo has been hearing more and more about benchmark portfolios and is interested in trying this approach. As such, the company hired Sally Jones, CFA, as a consulta

> Bill Smith is evaluating the performance of four large-cap equity portfolios: Funds A, B, C, and D. As part of his analysis, Smith computed the Sharpe ratio and the Treynor measure for all four funds. Based on his finding, the ranks assigned to the four

> During a particular year, the T-bill rate was 6%, the market return was 14%, and a portfolio manager with beta of .5 realized a return of 10%. a. Evaluate the manager based on the portfolio alpha. b. Reconsider your answer to part (a) in view of the empi

> Conventional wisdom says that one should measure a manager’s investment performance over an entire market cycle. What arguments support this convention? What arguments contradict it?

> A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from variou

> A household savings-account spreadsheet shows the following entries: Use the Excel function XIRR to calculate the dollar-weighted average return between the first and final dates.

> You manage a $23 million portfolio, currently all invested in equities, and believe that the market is on the verge of a big but short-lived downturn. You would move your portfolio temporarily into T-bills, but you do not want to incur the transaction co

> Suppose that the value of the S&P 500 stock index is 2,000. a. If each E-mini futures contract (with a contract multiplier of $50) costs $25 to trade with a discount broker, how much is the transaction cost per dollar of stock controlled by the futures c

> The risk-free rate of return is 8%, the expected rate of return on the market portfolio is 15%, and the stock of Xyrong Corporation has a beta coefficient of 1.2. Xyrong pays out 40% of its earnings in dividends, and the latest earnings announced were $1

> Consider the futures contract written on the S&P 500 index and maturing in one year. The interest rate is 3%, and the future value of dividends expected to be paid over the next year is $35. The current index level is 2,000. Assume that you can short sel

> You believe that the spread between municipal bond yields and U.S. Treasury bond yields is going to narrow in the coming month. How can you profit from such a change using the municipal bond and T-bond futures contracts?

> Both gold-mining firms and oil-producing firms might choose to use futures to hedge uncertainty in future revenues due to price fluctuations. But trading activity sharply tails off for maturities beyond one year. Suppose a firm wishes to use available (s

> Consider these futures market data for the June delivery S&P 500 contract, exactly one year from today. The S&P 500 index is at 2,145, and the June maturity contract is at F0 = 2,146. a. If the current interest rate is 2.5%, and the average dividend rate

> Suppose the 1-year futures price on a stock-index portfolio is 1,914, the stock index currently is 1,900, the 1-year risk-free interest rate is 3%, and the year-end dividend that will be paid on a $1,900 investment in the market index portfolio is $40. a

> Suppose that at the present time, one can enter 5-year swaps that exchange LIBOR for 5%. An off-market swap would then be defined as a swap of LIBOR for a fixed rate other than 5%. For example, a firm with 7% coupon debt outstanding might like to convert

> Firm ABC enters a 5-year swap with firm XYZ to pay LIBOR in return for a fixed 6% rate on notional principal of $10 million. Two years from now, the market rate on 3-year swaps is LIBOR for 5%; at this time, firm XYZ goes bankrupt and defaults on its swa

> Suppose the U.S. yield curve is flat at 4% and the euro yield curve is flat at 3%. The current exchange rate is $1.20 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap calls for the exchange of 1 mil

> Suppose that the price of corn is risky, with a beta of .5. The monthly storage cost is $.03 per bushel, and the current spot price is $5.50, with an expected spot price in three months of $5.88. If the expected rate of return on the market is 0.9% per m

> A U.S. exporting firm may use foreign exchange futures to hedge its exposure to exchange rate risk. Its position in futures will depend in part on anticipated payments from its customers denominated in foreign currency. a. In general, however, should its

> FinCorp’s free cash flow to the firm is reported as $205 million. The firm’s interest expense is $22 million. Assume the corporate tax rate is 21% and the net debt of the firm increases by $3 million. What is the market value of equity if the FCFE is pro

> If the corn harvest today is poor, would you expect this fact to have any effect on today’s futures prices for corn to be delivered (post-harvest) two years from today? Under what circumstances will there be no effect?

> a. If the spot price of gold is $1,500 per troy ounce, the risk-free interest rate is 2%, and storage and insurance costs are zero, what should be the forward price of gold for delivery in one year? Use an arbitrage argument to prove your answer. b. Show

> A corporation plans to issue $10 million of 10-year bonds in three months. At current yields the bonds would have modified duration of 8 years. The T-note futures contract is selling at F0 = 100 and has modified duration of 6 years. How can the firm use

> Yields on short-term bonds tend to be more volatile than yields on long-term bonds. Suppose that you have estimated that the yield on 20-year bonds changes by 10 basis points for every 15-basis-point move in the yield on 5-year bonds. You hold a $1 milli

> Return to Figure 23.7. Suppose the LIBOR rate when the first listed Eurodollar contract matures in January is 3.0%. What will be the profit or loss to each side of the Eurodollar contract?

> Consider the following information: rUS = 4%; rUK = 7% E0 = 2.00 dollars per pound F0 = 1.98 (1-year delivery) where the interest rates are annual yields on U.S. or U.K. bills. Given this information: a. Where would you lend? b. Where would you borrow? c

> A stock’s beta is a key input to hedging in the equity market. A bond’s duration is key in fixed income hedging. How are they used similarly? Are there any differences in the calculations necessary to formulate a hedge position in each market?

> Determine how a portfolio manager might use financial futures to hedge risk in each of the following circumstances: a. You own a large position in a relatively illiquid bond that you want to sell. b. You have a large gain on one of your Treasuries and wa

> a. Turn to the Mini-S&P 500 contract in Figure 22.1. If the margin requirement is 10% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the June maturity contract? b. If the June futures price

> Evaluate the criticism that futures markets siphon off capital from more productive uses.

> Atech has fixed costs of $7 million and profits of $4 million. Its competitor, ZTech, is roughly the same size and this year earned the same profits, $4 million. However, ZTech operates with fixed costs of only $5 million but higher variable costs. a. Wh

> What is the difference between the futures price and the value of the futures contract?

> Are the following statements true or false? Why? a. All else equal, the futures price on a stock index with a high dividend yield should be higher than the futures price on an index with a low dividend yield. b. All else equal, the futures price on a hig

> a. How should the parity condition (Equation 22.2) for stocks be modified for futures contracts on Treasury bonds? What should play the role of the dividend yield in that equation? b. In an environment with an upward-sloping yield curve, should T-bond fu

> You are a corporate treasurer who will purchase $1 million of bonds for the sinking fund in 3 months. You believe rates will soon fall, and you would like to repurchase the company’s sinking fund bonds (which currently are selling below par) in advance o

> The multiplier for a futures contract on a stock market index is $50. The maturity of the contract is 1 year, the current level of the index is 2,250, and the risk-free interest rate is .5% per month. The dividend yield on the index is .2% per month. Sup

> It is now January. The current interest rate is 2%. The June futures price for gold is $1,500, whereas the December futures price is $1,510. Is there an arbitrage opportunity here? If so, how would you exploit it?

> Suppose the value of the S&P 500 stock index is currently 2,000. a. If the 1-year T-bill rate is 3% and the expected dividend yield on the S&P 500 is 2%, what should the 1-year maturity futures price be? b. What if the T-bill rate is less than the divide

> We will derive a two-state put option value in this problem. Data: S0 = 100; X = 110; 1 + r = 1.10. The two possibilities for ST are 130 and 80. a. Show that the range of S is 50, whereas that of P is 30 across the two states. What is the hedge ratio of

> In each of the following questions, you are asked to compare two options with parameters as given. The risk-free interest rate for all cases should be assumed to be 4%. Assume the stocks on which these options are written pay no dividends. Which put opti

> Return to Problem 38. a. What will be the payoff to the put, Pu, if the stock goes up? b. What will be the payoff, Pd, if the stock price falls? c. Value the put option using the risk-neutral shortcut described in the box in Section 21.3. d. Confirm that

> Eagle Products’ EBIT is $300, its tax rate is 21%, depreciation is $20, capital expenditures are $60, and the planned increase in net working capital is $30. What is the free cash flow to the firm?

> Return to Problem 36. Value the call option using the risk-neutral shortcut described in the box in Section 21.3. Confirm that your answer matches the value you get using the two-state approach. Problem 36: You are attempting to value a call option with

> Suppose that JPMorgan Chase sells call options on $1.25 million worth of a stock portfolio with beta = 1.5. The option delta is .8. It wishes to hedge its resultant exposure to a market advance by buying a market-index portfolio. a. How many dollars’ wor

> Using the data in Problem 46, suppose that 3-month put options with a strike price of $90 are selling at an implied volatility of 34%. Construct a delta-neutral portfolio comprising positions in calls and puts that will profit when the option prices come

> Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $90 are selling at an implied volatility of 30%. ExxonMobil stock price is $90 per share, and the risk-free rate is 4%. a. If you believe the true volatility

> You are a provider of portfolio insurance and are establishing a 4-year program. The portfolio you manage is worth $100 million, and you hope to provide a minimum return of 0%. The equity portfolio has a standard deviation of 25% per year, and T-bills pa

> You are holding call options on a stock. The stock’s beta is .75, and you are concerned that the stock market is about to fall. The stock is currently selling for $5 and you hold 1 million options (i.e., you hold 10,000 contracts for 100 shares each). Th

> Goldman Sachs believes that market volatility will be 20% annually for the next three years. Three-year at-the-money call and put options on the market index sell at an implied volatility of 22%. What options portfolio can Goldman establish to speculate

> “The beta of a call option on the S&P 500 index with an exercise price of 2,430 is greater than the beta of a call on the index with an exercise price of 2,440.” True or false?

> “The beta of a call option on FedEx is greater than the beta of a share of FedEx.” True or false?

> XYZ Corp. will pay a $2 per share dividend in two months. Its stock price currently is $60 per share. A European call option on XYZ has an exercise price of $55 and 3-month time to expiration. The risk-free interest rate is .5% per month, and the stock’s

> Mary Smith, a CFA candidate, was recently hired for an analyst position at a large bank in London. Her first assignment is to examine the competitive strategies employed by various French wineries. Smith’s report identifies four winerie

> Calculate the value of a put option with exercise price $100 using the data in Problem 36. Show that put-call parity is satisfied by your solution. Problem 36: You are attempting to value a call option with an exercise price of $100 and one year to expi

> A newly issued bond paying a semiannual coupon has the following characteristics: a. Calculate modified duration using the information above. b. Explain why modified duration is a better measure than maturity when calculating the bond’s

> Louise and Christopher Maclin (see Problem 8) have purchased their house and made the donation to the local charity. Now that an investment policy statement has been prepared for the Maclins, Grant Webb recommends that they consider the strategic asset a