Question: Exhibit 13.7 presents selected hypothetical data

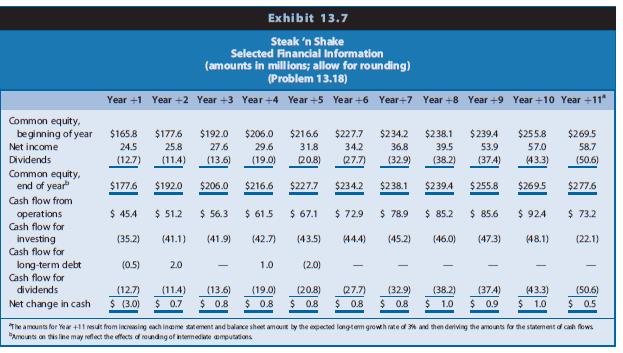

Exhibit 13.7 presents selected hypothetical data from projected financial statements for Steak ‘n Shake for Year +1 to Year +11. The amounts for Year +11 reflect a long-term growth assumption of 3%. The cost of equity capital is 9.34%. Assume net income and comprehensive income will be identical.

REQUIRED

a. Compute the value of Steak ‘n Shake as of January 1, Year þ1, using the residual income model.

b. Repeat Requirement a using the present value of expected free cash flows to the common equity shareholders.

c. Repeat Requirement a using the dividend discount model.

d. Identify the reasons for any differences in the valuations in Requirements a–c.

e. Suppose the market value of Steak ‘n Shake on January 1, Year +1, is $309.98 million. Based on your valuations in Requirements a–c, what is your assessment of the market value of this firm?

Transcribed Image Text:

Exhibit 13.7 Steak 'n Shake Selected Financial Information (amounts in millions; allow for rounding) (Problem 13.18) Year +1 Year +2 Year +3 Year +4 Year +5 Year +6 Year+7 Year +8 Year +9 Year +10 Year +11" Common equity, beginning of year $165.8 $177.6 $192.0 $206.0 $216.6 $227.7 $234.2 $238.1 $239.4 $255.8 $269.5 Net income 24.5 25.8 27.6 29.6 31.8 34.2 36.8 39.5 53.9 57.0 58.7 Dividends (12.7) (11.4) (13.6) (19.0) 20.8) (27.7) (32.9) (38.2) (374) (43.3) (50.6) Common equity, end of year $177.6 $192.0 $206.0 $216.6 $227.7 $234.2 $238.1 $2394 $255.8 $269.5 $277.6 Cash flow from operations Cash flow for $ 45.4 $ 51.2 $ 56.3 $ 61.5 $ 67.1 $ 72.9 $ 78.9 $ 85.2 $ 85.6 $ 924 $ 73.2 investing (35.2) (41.1) (41.9) (42.7) (43.5) (44.4) (45.2) (46.0) (47.3) (48.1) (22.1) Cash flow for long-term debt Cash flow for dividends (05) 2.0 1.0 (2.0) (32.9) $ 0.8 (12.7) (11.4) (13.6) (19.0) $ 0.8 (20.8) (27.7) (38.2) (37.4) (43.3) (50.6) Net change in cash $ (3.0) $ 0.7 $ 0.8 $ 0.8 $ 0.8 $ 1.0 $ 0.9 $ 1.0 $ 0.5 The amaunts for Year +11 resut from increasing each iname tatement and balance sheet amoIE by the opected langtem growh rate d 34 and then deiving the amounts fa the statement d cah fows "Ameunts an this line may reflect the effects of roundng of normedine amputations

> What are an organization’s basic duties under the Occupational Safety and Health Act?

> Given that the “reasonable woman” standard is based on women’s ideas of what is appropriate, how might an organization with mostly male employees identify and avoid behavior that could be found to be sexual harassment?

> To identify instances of sexual harassment, the courts may use a “reasonable woman” standard of what constitutes offensive behavior. This standard is based on the idea that women and men have different ideas of what behavior is appropriate. What are the

> How does each of the following labor force trends affect HRM? a. Aging of the labor force b. Diversity of the labor force c. Skill deficiencies of the labor force

> How is the employment relationship typical of modern organizations different from the relationship of a generation ago?

> What HRM functions could an organization provide through self-service? What are some of advantages and disadvantages of using self-service for these functions?

> Why do multinational organizations hire host-country nationals to fill most of their foreign positions, rather than sending expatriates for most jobs?

> Suppose an organization decides to improve collaboration and knowledge sharing by developing an intranet to link its global workforce. It needs to train employees in several different countries to use this system. List the possible cultural issues you ca

> In recent years, many U.S. companies have invested in Russia and sent U.S. managers there in an attempt to transplant U.S.-style management. According to Hofstede (see Figure 15.3), U.S. culture has low power distance, uncertainty avoidance, and long-ter

> What are some HRM challenges that arise when a U.S. company expands from domestic markets by exporting? When it changes from simply exporting to operating as an international company? When an international company becomes a global company?

> Why do organizations outsource HRM functions? How does outsourcing affect the role of human resource professionals? Would you be more attracted to the role of HR professional in an organization that outsources many HR activities or in the outside firm th

> Identify the parent country, host country or countries, and third country or countries in the following example: A global soft-drink company called Cold Cola is headquartered in Atlanta, Georgia. It operates production facilities in Athens, Greece and in

> In the past, a large share of expatriate managers from the United States have returned home before successfully completing their foreign assignments. Suggest some possible reasons for the high failure rate. What can HR departments do to increase the succ

> What abilities make a candidate more likely to succeed in an assignment as an expatriate? Which of these abilities do you have? How might a person acquire these abilities?

> For an organization with operations in three different countries, what are some advantages and disadvantages of setting compensation according to the labor markets in the countries where the employees live and work? What are some advantages and disadvant

> Suppose you work in the HR department of a company that is expanding into a country where the law and culture make it difficult to lay off employees. How should your knowledge of that difficulty affect human resource planning for the overseas operations?

> Besides cultural differences, what other factors affect human resource management in an organization with international operations?

> How do HRM practices such as performance management and work design encourage employee empowerment?

> If the parties negotiating a labor contract are unable to reach an agreement, what actions can resolve the situation?

> Suppose you are the HR manager for a chain of clothing stores. You learn that union representatives have been encouraging the stores’ employees to sign authorization cards. What events can follow in this process of organizing? Suggest some ways that you

> What legal responsibilities do employers have regarding unions? What are the legal requirements affecting unions?

> When an organization decides to operate facilities in other countries, how can HRM practices support this change?

> How has union membership in the United States changed over the past few decades? How does union membership in the United States compare with union membership in other countries? How might these patterns in union membership affect the HR decisions of an i

> Why do managers at most companies prefer that unions not represent their employees? Can unions provide benefits to an employer? Explain.

> Why do employees join labor unions? Did you ever belong to a labor union? If you did, do you think the union membership benefited you? If not, do you think a union would have benefited you? Why or why not?

> What are the legal restrictions on labor-management cooperation?

> What can a company gain from union-management cooperation? What can workers gain?

> What are the usual steps in a grievance procedure? What are the advantages of resolving a grievance in the first step? What skills would a supervisor need so grievances can be resolved in the first step?

> Why are strikes uncommon? Under what conditions might management choose to accept a strike?

> Imagine that you are the human resource manager of a small architectural firm. You learn that the monthly premiums for the company’s existing health insurance policy will rise by 15 percent next year. What can you suggest to help your company manage this

> What are some advantages of offering a generous package of insurance benefits? What are some drawbacks of generous insurance benefits?

> How do tax laws and accounting regulations affect benefits packages?

> Merging, downsizing, and reengineering all can radically change the structure of an organization. Choose one of these changes and describe HRM’s role in making the change succeed. If possible, apply your discussion to an actual merger, downsizing, or ree

> In principle, health insurance would be the most attractive to employees with large medical expenses, and retirement benefits would be most attractive to older employees. What else might a company include in its benefits package to appeal to young, healt

> Define the types of benefits required by law. How can organizations minimize the cost of these benefits while complying with the relevant laws?

> Why do employers provide employee benefits, rather than providing all compensation in the form of pay and letting employees buy the services they want?

> Why is it important to communicate information about employee benefits? Suppose you work in the HR department of a company that has decided to add new benefits—dental and vision insurance plus an additional two days of paid time off for “personal days.”

> What legal requirements might apply to a family leave policy? Suggest how this type of policy should be set up to meet those requirements.

> What issues should an organization consider in selecting a package of employee benefits? How should an employer manage the trade-offs among these considerations?

> Why do some organizations link the use of incentive pay to the organization’s overall performance? Is it appropriate to use stock performance as an incentive for employees at all levels? Why or why not?

> Suppose you are a human resource professional at a company that is setting up work teams for production and sales. What group incentives would you recommend to support this new work arrangement?

> What are the pros and cons of linking incentive pay to individual performance? How can organizations address the negatives?

> In a typical large corporation, the majority of the chief executive’s pay is tied to the company’s stock price. What are some benefits of this pay strategy? Some risks? How can organizations address the risks?

> At many organizations, goals include improving people’s performance by relying on knowledge workers, empowering employees, and assigning work to teams. How can HRM support these efforts?

> How can human resource management contribute to a company’s success?

> Suppose you are applying the residual income valuation model to value a firm with extremely conservative accounting. Suppose, for example, the firm is following U.S. GAAP or IFRS, but the firm does not recognize a substantial intangible asset on the bala

> Identify conditions that would lead an analyst to expect that management might attempt to manage earnings upward.

> In Problem 10.16, we projected financial statements for Walmart Stores, Inc. (Walmart) for Years +1 through +5. The data in Chapter 12’s Exhibits 12.17, 12.18, and 12.19 include the actual amounts for 2012 and the projected amounts for

> The Coca-Cola Company is a global soft drink beverage company (ticker: KO) that is a primary and direct competitor with PepsiCo. The data in Chapter 12’s Exhibits 12.14, 12.15, and 12.16 (pages 943–946) include the act

> Priority Contractors provides maintenance and cleaning services to various corporate clients in New York City. The firm has provided the following forecasts of comprehensive income for Year +1 to Year +5: Year +1:........................................

> Starwood Hotels (Starwood) owns and operates many hotel properties under well-known brand names, including Sheraton, W, Westin, and St. Regis. Starwood focuses on the upper end of the lodging industry. Choice Hotels (Choice) is primarily a franchisor of

> A firm has experienced a decrease in its current ratio but an increase in its quick ratio during the last three years. What is the likely explanation for these results?

> Northrop Grumman Corporation is a leading global security company that provides innovative systems products and solutions in aerospace, electronics, information systems, shipbuilding, and technical services to government and commercial customers worldwid

> Assume American Airlines acquires a regional airline in the mid-western United States for $450 million. American Airlines allocates $150 million of the purchase price to landing rights at various airports. The landing rights expire in five years. What ty

> Morrissey Tool Company manufactures machine tools for other manufacturing firms. The firm is wholly owned by Kelsey Morrissey. The firm’s accountant developed the following long-term forecasts of comprehensive income: Year +1:............................

> Select data for Avis and Hertz for 2012 follow. Based only on this information and ratios that you construct, speculate on similarities and differences in the operations and financing decisions of the two companies based on similarities and differences i

> If the firm is in a very competitive, mature industry, what effect will the competitive conditions have on residual income for the firm and others in the industry? Now suppose the firm holds a competitive advantage in its industry, but the advantage is n

> Vulcan Materials Company, a member of the S&P 500 Index, is the nation’s largest producer of construction aggregates, a major producer of asphalt mix and concrete, and a leading producer of cement in Florida. Exhibit 6.19 presents V

> The chapter describes free cash flows for common equity shareholders. Suppose a firm has no debt and uses marketable securities to manage operating liquidity. If the firm uses cash to purchase marketable securities, how does that transaction affect free

> Gap Inc. operates chains of retail clothing stores under the names of Gap, Banana Republic, and Old Navy. Exhibit 3.21 presents the statement of cash flows for Gap for Year 0 to Year 4. REQUIRED Discuss the relations between net income and cash flow fro

> Tesla Motors manufactures high performance electric vehicles that are extremely slick looking. Exhibit 3.20 presents the statement of cash flows for Tesla Motors for 2010–2012. REQUIRED Discuss the relations among net income, cash flow

> Texas Instruments primarily develops and manufactures semiconductors for use in technology-based products for various industries. The manufacturing process is capital-intensive and subject to cyclical swings in the economy. Because of overcapacity in the

> Refer to the websites and the Form 10-K reports of Home Depot (www.homedepot.com) and Lowe’s (www.lowes.com). Compare and contrast their business strategies.

> Assume that the firm’s cost of equity capital is 10% and that the firm’s existing assets and operations generate a 10% return on common equity. If the firm raises additional equity capital and invests in assets that will generate a return less than 10%,

> Microsoft Corporation (Microsoft) and Oracle Corporation (Oracle) engage in the design, manufacture, and sale of computer software. Microsoft sells and licenses a wide range of systems and application software to businesses, computer hardware manufacture

> The Coca-Cola Company (Coca-Cola), like PepsiCo, manufactures and markets a variety of beverages. Exhibit 3.18 presents a statement of cash flows for Coca-Cola for three years. REQUIRED Discuss the relations between net income and cash flow from operat

> BTB Electronics Inc. manufactures parts, components, and processing equipment for electronics and semiconductor applications in the communications, computer, automotive, and appliance industries. Its sales tend to vary with changes in the business cycle

> United Van Lines purchased a truck with a list price of $250,000 subject to a 6% discount if paid within 30 days. United Van Lines paid within the discount period. It paid $4,000 to obtain title to the truck with the state and an $800 license fee for the

> Flight Training Corporation is a privately held firm that provides fighter pilot training under contracts with the U.S. Air Force and the U.S. Navy. The firm owns approximately 100 Lear jets that it equips with radar jammers and other sophisticated elect

> Nojiri Pharmaceutical Industries develops, manufactures, and markets pharmaceutical products in Japan. The Japanese economy experienced recessionary conditions in recent years. In response to these conditions, the Japanese government increased the propor

> Eli Lilly and Company produces pharmaceutical products for humans and animals. Exhibit 7.18 includes a footnote excerpt from the annual report of Lilly for the period ending December 31, 2004. REQUIRED Review Exhibit 7.18 and answer the following questi

> Exhibit 3.27 presents common-size statements of cash flows for eight firms in various industries. All amounts in the common-size statements of cash flows are expressed as a percentage of cash flow from operations. In constructing the common-size percenta

> Aer Lingus is an international airline based in Ireland. Exhibit 3.26 provides the statement of cash flows for Year 1 and Year 2, which includes a footnote from the financial statements. Year 2 was characterized by weakening consumer demand for air trave

> Exhibit 6.22 presents selected financial statement data for Enron Corporation as originally reported for 1997, 1998, 1999, and 2000. In 2001, Enron restated its financial statements for earlier years because it reported several items beyond the limits of

> If a firm’s residual income for a particular year is positive, does that mean the firm was profitable? Explain. If a firm’s residual income for a particular year is negative, does that mean the firm necessarily reported a loss on the income statement? Ex

> The text states, ‘‘Over sufficiently long time periods, net income equals cash inflows minus cash outflows, other than cash flows with owners.’’ Demonstrate the accuracy of this statement in the following scenario: Two friends contributed $50,000 each to

> Firms value inventory under a variety of assumptions, including two common methods: last-in first out (LIFO) and first-in first-out (FIFO). Ignore taxes, assume that prices increase over time, and assume that a firm’s inventory balance is stable or grows

> ‘‘Asset valuation and recognition of net income closely relate.’’ Explain, including conditions when they do not.

> Exhibit 4.22 presents selected operating data for three retailers for a recent year. Macy’s operates several department store chains selling consumer products such as brand-name clothing, china, cosmetics, and bedding and has a large pr

> The chapter describes free cash flows for common equity shareholders. If the firm borrows cash by issuing debt, how does that transaction affect free cash flows for common equity shareholders in that period? If the firm uses cash to repay debt, how does

> ‘‘Some asset valuations using historical costs are highly relevant and very representationally faithful, whereas others may be representationally faithful but lack relevance. Some asset valuations based on fair values are highly relevant and very represe

> A recent article in Fortune magazine listed the following firms among the top ten most admired companies in the United States: Dell, Southwest Airlines, Microsoft, and Johnson & Johnson. Access the websites of these four companies or read the Business se

> A firm’s income tax return shows income taxes for 2009 of $35,000. The firm reports deferred tax assets before any valuation allowance of $24,600 at the beginning of 2009 and $27,200 at the end of 2009. It reports deferred tax liabilities of $18,900 at t

> Describe how the statement of cash flows is linked to each of the other financial statements (income statement and balance sheet). Also review how the other financial statements are linked with each other.

> Explain residual ROCE (return on common shareholders’ equity). What does residual ROCE represent? What does residual ROCE measure?

> Suppose the following hypothetical data represent total assets, book value, and market value of common shareholders’ equity (dollar amounts in millions) for Microsoft, Intel, and Dell, three firms involved in different aspects of the co

> What are the fundamental determinants of share value, and how do they affect market-based valuation multiples, such as market-to-book and price earnings ratios?

> A firm’s income tax return shows $50,000 of income taxes owed for 2009. For financial reporting, the firm reports deferred tax assets of $42,900 at the beginning of 2009 and $38,700 at the end of 2009. It reports deferred tax liabilities of $28,600 at th

> Explain the implications of a value to- book ratio that is exactly equal to 1. Compare the implications of a value-to-book ratio that is greater than 1 to those of a value-to-book ratio that is less than 1.

> Sunbeam Corporation manufactures and sells a variety of small household appliances, including toasters, food processors, and waffle grills. Exhibit 6.21 presents a statement of cash flows for Sunbeam for Year 5, Year 6, and Year 7. After experiencing dec

> Effective financial statement analysis requires an understanding of a firm’s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.22 pres

> Dick’s Sporting Goods is a chain of full-line sporting goods retail stores offering a broad assortment of brand name sporting goods equipment, apparel, and footwear. Dick’s Sporting Goods had its initial public offerin

> In conceptual terms, explain the value-to-book valuation approach. Explain how the value-to-book approach described and demonstrated in this chapter relates to the residual income valuation approach described and demonstrated in Chapter 13.

> Analyzing the profitability of restaurants requires consideration of their strategies with respect to ownership of restaurants versus franchising. Firms that own and operate their restaurants report the assets and financing of those restaurants on their

> If the firm borrows capital from a bank and invests it in assets that earn a return greater than the interest rate charged by the bank, what effect will that have on residual income for the firm? How does that effect compare with the effects of capital s

> Why is it appropriate to use the required rate of return on equity capital (rather than the weighted-average cost of capital) as the discount rate when using the residual income valuation approach?

> The Coca-Cola Company is a global soft drink beverage company (ticker symbol ¼ KO) that is a primary and direct competitor with PepsiCo. The data in Exhibits 12.14–12.16 include the actual amounts for 2010, 2011, and 2012

> Identify conditions that would lead an analyst to expect that management might attempt to manage earnings downward.

> Explain the two roles of book value of common shareholders’ equity in the residual income valuation approach.

> Explain the theory behind the residual income valuation approach. Why is residual income value-relevant to common equity shareholders?