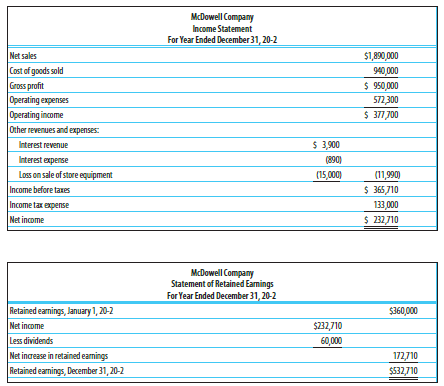

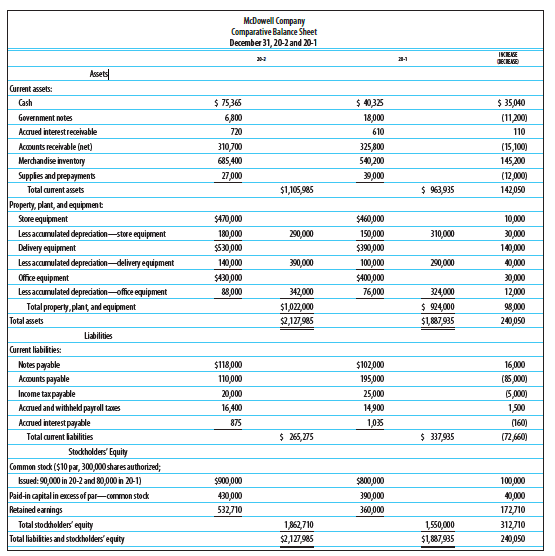

Question: Financial statements for McDowell Company as well

Financial Statements for McDowell Company as well as additional information relevant to cash flows during the period are given on pages 926–927.

Additional information:

1. Store equipment was sold in 20-2 for $25,000. Additional information on the store equipment sold is provided below.

Cost ………………………………………………………………… $ 70,000

Accumulated depreciation ………………………………….. (30,000)

Book value………………………………………………………… $ 40,000

Market value ………………………………………………………..25,000

Loss on sale………………………………………………………. $ 15,000

2. Depreciation expense for the year was $112,000.

3. The following purchases were made for cash:

Store equipment ……………………………………………. $ 64,000

Delivery equipment ………………………………………….140, 000

Office equipment ……………………………………………..30,000

$234,000

4. Declared and paid cash dividends of $60,000.

5. Issued 10,000 shares of $10 par common stock for $14 per share.

6. Acquired additional store equipment by issuing a note payable for $16,000.

REQUIRED

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

Transcribed Image Text:

McDowell Company Income Statement For Year Ended December 31, 20-2 Net sales Cost of goods sold Gross profit $1,890,000 940,000 $ 950,000 Operating expenses 572,300 Operating income $ 371 J00 Other revenues and expenses: Interest revenue $ 3,900 Interest expense Loss on sale of store equipment Income before taxes Income tax expense Net income (890) (11,9900 $ 365,710 133,000 $ 232710 (15,000) McDowell Company Statement of Retained Earmings For Year Ended December 31, 20-2 Retained eamings, lanuary 1, 20-2 Net income Less dividends Net increase in retained earnings Retained eamings, December 31, 20-2 $360,000 $232,710 60,000 172,710 $532,710 McDowell Company Comparative Balance Sheet December 31, 20-2 and 20-1 IKEE DECIEVE 20-2 2-1 Assets urrent assets: $ 75,365 $ 4035 $ 35,040 Cash Government notes 6,800 18,000 (11,200) Accrued interestreceivable 720 610 110 Acounts receivable (net) 310,700 325,800 (15,100) 145,200 Merchandise inventory 685,400 540,200 Suppies and prepayments 27,000 9,000 (12,000) Total curent assets $1,105,985 $ 963,935 142,050 Property, plant, and equipment Store equipment $470,000 SA60,000 10,000 Lessaccumulated depredation-store equipment 180,000 $530,000 30,000 140,000 20,000 150,000 $390,000 310,000 Delivery equipment Lessaccumulated deprediation-delivery equipment Office equipment Lessaccumulated deprediation-office equipment Total property, plant and equipment Total assets 140,000 390,000 100,000 20,000 40,000 30,000 12,000 98,000 $430,000 S400,000 88,000 342,000 76,000 324,000 $ 24,000 $1,87,935 $1,022000 $2,127985 240,050 Liabilities Current liabilities: Notes payable Acounts payatle Income taxpayable Accrued and withhekd payroll taes Accrued interestpayable $118,000 $102,000 16,000 (8S 00) 110,000 195,000 20,000 16,400 25,000 14,900 (5,000) 1,500 875 1,035 (160) Total curent iabilities $ 265,275 $ 337,935 (72,60) Stockholders' Equity Common stock ($10 pa, 300,000 shares authorized; ksued: 90,000 in 20-2 and 80,000 in 20-1) $900,000 $800,000 390,000 360,000 100,000 Paid-in capital in excessof par-common stock Retained earrings Total stodholders equity Total liabilties and Stockholders' Equity 430,000 40,000 532,710 1,862,710 $2,127,985 1,550,000 $1,87,935 172,710 312710 240,050

> From the following trial balance taken after one month of operation, prepare an income statement, a statement of owner’s equity, and a balance sheet. TJ's Paint Service Trial Balance July 31, 20-- ACOUNT ACCDUNT DET BALANE CREDIT BA

> From the information in Exercises 4-4A and 4-5A, Exercises 4-4A and 4-5A: Diane Bernick has opened Bernick’s Consulting. Journalize the following transactions that occurred during January of the current year. Use the following journa

> Set up general ledger accounts using the chart of accounts provided in Exercise 4-4A. Exercise 4-4A: Diane Bernick has opened Bernick’s Consulting. Journalize the following transactions that occurred during January of the current year

> List the four steps for closing the temporary accounts.

> Diane Bernick has opened Bernick’s Consulting. Journalize the following transactions that occurred during January of the current year. Use the following journal pages: January 1–10, page 1, and January 11â€&

> Set up T accounts for each of the general ledger accounts needed for Exercise 4-2A and post debits and credits to the accounts. Exercise 4-2A: For each of the following transactions, list the account to be debited and the account to be credited in the

> For each of the following transactions, list the account to be debited and the account to be credited in the general journal. 1. Invested cash in the business, $5,000. 2. Paid office rent, $500. 3. Purchased office supplies on account, $300. 4. Received

> Prepare an income statement for Jay Pembroke for the month of April 20--.

> Label each of the following accounts as an asset (A), a liability (L), or owner’s equity (OE), using the following format: Item Account Classification Money in bank Office supplies Money owed Office chairs Net worth of owner Cash Su

> Refer to the trial balance in Problem 3-13A and to the analysis of the change in owner’s equity in Problem 3-14A. REQUIRED 1. Prepare an income statement for Kohl’s Home Repair for the month ended May 31, 20--. 2. Prepare a statement of owner’s equity f

> To determine the following information. Use the format provided below. 1. a. Total revenue for the month b. Total expenses for the month c. Net income for the month 2. a. Wilhclm Kohl's original investment in the business + Net income for the month

> Wilhelm Kohl started a business in May 20-- called Kohl’s Home Repair. Kohl hired a part-time college student as an assistant. Kohl has decided to use the following accounts for recording transactions: The following transactions occurre

> From the information in the trial balance presented for Juanita’s Delivery Service on page 76, prepare a balance sheet for Juanita’s Delivery Service as of September 30, 20--.

> Assuming that all entries have been posted, prepare correcting entries for each of the following errors. 1. The following entry was made to record the purchase of $700 in supplies on account: Supplies 142 700 Cash 101 700 2. The following entry was m

> Why is it important to total and verify the totals of the payroll register after the data for each employee have been entered?

> Jim Andrews opened a delivery business in March. He rented a small office and has a part-time assistant. His trial balance shows accounts for the first three months of business. Andrews’ transactions for the month of June are as follow

> Source documents trigger the analysis of events requiring an accounting entry. Match the following source documents with the type of information they provide. 1. Check stubs or check register 2. Purchase invoice from suppliers (vendors) a. A good or

> The following accounts have normal balances. Prepare a trial balance for Kenny’s Lawn Service as of September 30, 20--. Cash …………………………………………………………... $10,000 Accounts Receivable ……………………………………… 6,000 Supplies ………………………………………………………... 1,600 Prepaid Insu

> Prepare a trial balance for Charlie’s Detective Service as of January 31, 20--.

> Charles Chadwick opened a business called Charlie’s Detective Service in January 20--. Set up T accounts for the following accounts: Cash; Accounts Receivable; Office Supplies; Computer Equipment; Office Furniture; Accounts Payable; Charles Chadwick, Cap

> Foot and balance the T accounts prepared in Exercise 3-5A if necessary. Exercise 3-5A: Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the t

> Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in

> Indicate the normal balance (debit or credit) for each of the following accounts: 1. Cash 2. Wages Expense 3. Accounts Payable 4. Owner's Drawing 5. Supplies 6. Owner's Capital 7. Equipment

> Richard Gibbs began a business called Richard’s Shoe Repair. 1. Create T accounts for Cash; Supplies; Richard Gibbs, Capital; and Utilities Expense. Identify the following transactions by letter and place them on the proper side of the T accounts: (a) In

> Complete the following statements using either “debit” or “credit”: (a) The cash account is increased with a _________. (b) The owner’s capital account is increased with a _________. (c) The delivery equipment account is increased with a _________. (d) T

> Identify all items that are debited or credited to Social Security Tax Payable and to Medicare Tax Payable.

> From the information in the trial balance presented above, prepare a statement of owner’s equity for Juanita’s Delivery Service for the month ended September 30, 20--.

> From the information in the trial balance presented above, prepare an income statement for Juanita’s Delivery Service for the month ended September 30, 20--.

> Foot and balance the cash T account shown below. Cash 500 100 400 200 600

> Jay Pembroke started a business. During the first month (April 20--), the following transactions occurred. (a) Invested cash in business, $18,000. (b) Bought office supplies for $4,600: $2,000 in cash and $2,600 on account. (c) Paid one-year insurance pr

> Dr. John Salvaggi is a chiropractor. As of December 31, he owned the following property that related to his professional practice. Cash……………â€

> Prepare a statement of owner’s equity assuming Ray had a net loss of $3,000.

> Ray started an accounting service on June 1, 20--, by investing $20,000. Her net income for the month was $10,000, and she withdrew $8,000. Prepare a statement of owner’s equity for the month of June.

> Label each of the following accounts as an asset (A), liability (L), owner’s equity (OE), revenue (R), or expense (E). Indicate the financial statement on which the account belongs—income statement (IS), statement of o

> Assume John Sullivan completed the following additional transactions during February. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owner’s Equity (Capital – Drawing + Revenues – Exp

> John Sullivan started a business. During the first month (February 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets = Liabilities + Owner’s Equity. After each transaction, show the new tot

> Identify the sources of the information needed to prepare the balance sheet.

> Using the accounting equation, compute the missing elements. Owner's Equity $17,000 Assets Liabilities + $27,000 $18,000 $32,000 $27,000 $20,000 IL || || |

> List the six major steps of the accounting process in order (1–6) and define each. Recording Summarizing Reporting Analyzing Interpreting Classifying

> Match the following users with the information needed. 1. Owners 2. Managers 3. Creditors 4. Government agencies a. Whether the firm can pay its bills on time b. Detailed, up-to-date information to measure business performance (and plan for future op

> Prepare a balance sheet for Jay Pembroke as of April 30, 20--.

> Prepare a statement of owner’s equity for Jay Pembroke for the month of April 20--.

> A beginning accounting student tried to complete a work sheet for Joyce Lee’s Tax Service. The following adjusting entries were to have been analyzed and entered onto the work sheet. The work sheet is shown on page 167. (a) Ending inventory of supplies a

> Refer to Problem 5-15A and the following additional information: REQUIRED 1. Journalize the adjusting entries on page 5 of the general journal. 2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany t

> Jason Armstrong started a business called Campus Delivery Service. After the first month of operations, the trial balance as of November 30, 20--, is as shown on the next page. REQUIRED 1. Analyze the following adjustments and enter them on the work she

> The following is a list of outstanding notes payable as of December 31, 20--: REQUIRED 1. Compute the accrued interest at the end of the year. 2. Prepare the adjusting entry in the general journal. Maker Date of Note No. of Days Principal $1,000 Inte

> Martin Manufacturing issued the following bonds: Date of issue and sale: …………………………………………………………………… April 1, 20-1 Principal amount: ………………………………………………………………………………. $500,000 Sale price of bonds: ……………………………………………………………………………………. 100 Denomination of bonds

> What is the relationship between the revenue and expense accounts and the owner’s equity account?

> In what two ways can the information necessary to compute departmental gross profit be accumulated?

> Horn Company’s condensed income statement for the year ended December 31, 20-2, was as follows: Net sales ………………&ac

> M. Evans & Sons manufactures parts for radios. For each job order, it maintains ledger sheets on which it records direct labor, direct materials, and factory overhead applied. The factory overhead control account contains postings of actual overhead cost

> Stone street Enterprises makes garage doors. During the month of February, the company had four job orders: 205, 206, 207, and 208. Overhead was applied at predetermined rates, while actual factory overhead was recorded as incurred. All four jobs were co

> Eto Manufacturing had the following transactions during the month: (a) purchased raw materials on account, $70,000. (b) Issued direct materials to Job No. 300, $25,000. (c) Issued indirect materials to production, $10,000. (d) Paid biweekly payroll and c

> The following information is provided for J. Klein Manufacturing Company. Prepare (1) a schedule of cost of goods manufactured, and (2) the related cost of goods sold section of the income statement for the company for the year ended December 31, 20--.

> Overhead applied; completed jobs sent to finished goods inventory; closing of the under- or overapplied factory overhead to the cost of goods sold account; and sale of finished goods. Apr. 1 purchased materials on account, $35,000. 10 Issued direct mater

> Millerlile Enterprises calculates a predetermined factory overhead rate so that factory overhead may be applied to production during the month. It calculates the overhead using three different methods and then decides which one to use. Total estimated fa

> Huang Company manufactures toys. It keeps a factory overhead account where actual factory overhead costs are recorded as a debit, and factory overhead applied is recorded as a credit. At the end of the month, under- or overapplied factory overhead is cal

> Hilburn Manufacturing Corporation had the following transactions for its job order costing operation. Prepare general journal entries to record these transactions. Jan. 1 Purchased materials on account, $17,000. 15 Issued direct materials to Job No. 104,

> Identify the sources of the information needed to prepare the statement of owner’s equity.

> The following information is supplied for Maupin Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 ………

> The following information is supplied for R&D Manufacturing Co. and WP West Co. (a merchandising company). Prepare the cost of goods sold sections for the income statements of both companies for the year ended 20--. R&D Manufacturing WP West Me

> Durwood Thomas operates the business Thomas Security that sells security equipment for commercial property and residential homes. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing

> Alexa Cole owns a business called Alexa’s Bakery. She has divided her business into two departments: breads and pastries. The following information is provided for the fiscal year ended June 30, 20--: REQUIRED 1. Prepare an income state

> Thomas and Hill Distributors has divided its business into two departments: commercial sales and industrial sales. The following information is provided for the year ended December 31, 20- : Net sales, commercial sales department ……………………………………………………………

> The sales, gross profit, and condensed direct and indirect operating expenses of departments A and B of Wei Zhao International are as follows: Compute the departmental direct operating margin and direct operating margin percentage for each department.

> The sales, cost of goods sold, and total operating expenses of departments A and B of Ash Company are as follows: Compute the departmental operating income for each department. Dept. B Dept. A $200,000 146,000 31,000 Sales Cost of goods sold Total op

> Mercado Lopez owns a furniture store that offers free delivery of merchandise delivered within the local area. Mileage records for the three sales departments are as follows: Department 1: …………………………………………….. 36,000 miles Department 2: ……………………………………………

> Hayley Doll owns a car stereo store. She has divided her store into three departments. Net sales for the month of July are as follows: Deluxe: ……………………………………………………… $33,600 Standard: ……………………………………………………… 38,400 Economy: ……………………………………………………… 48,000 Ad

> Weaverling Company rents 10,000 square feet of store space for $36,000 per year. The amount of square footage by department is as follows: Department A: ………...…………………………………………… 2,600 sq. ft. Department B: ………...…………………………………………… 2,400 sq. ft. Department

> Explain the difference between a blank endorsement and a restrictive endorsement.

> Williams and Lloyd Company is trying to decide whether to discontinue department B. Operating results for the year just ended for each of the company’s three departments and for the entire operation are as follows: REQUIRED 1. Prepare a

> Bill Walters and Alice Jennings are partners in a business called Walters and Jennings Sportswear that sells athletic footwear. They have organized the business on a departmental basis as follows: running shoes, walking shoes, and specialty shoes. At the

> Refer to the financial statements in Problem 24-8A. Problem 24-8A: Amounts from the comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are as follows: REQUIRED Prepare a vertical analysis of the inc

> Amounts from the comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are as follows: REQUIRED Prepare a horizontal analysis. Add columns to show the amount of increase (decrease) and the percentage cha

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Based on the financial statement data in Exercise 24-1A, Exercise 24-1A: Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculation

> Why must a signature card be filled out and signed to open a checking account?

> Refer to the financial statements in Problem 24-8A. Problem 24-8A: Amounts from the comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are as follows: REQUIRED Calculate the following ratios and amo

> Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow, compute the following liquidity measures for 20-2 (round all calculations to two decimal places): (a) Quick or acid-test ratio (b) Current ratio (c)

> Zowine Company’s condensed income statement for the year ended December 31, 20-2, was as follows: Net sales ………………&

> Ball Company’s income statement for 20-2 reported interest expense of $1,540. The comparative balance sheet as of December 31, 20-2 and 20-1, reported the following: Compute the amount of cash paid for interest in 20-2. 20-2 20-1

> Norton’s Sign Shop issued a $10,000, three-year note payable to acquire a new framing machine. Show how this transaction is reported on a statement of cash flows.

> Rogerson Company’s comparative balance sheet as of December 31, 20-2 and 20-1, showed the following with regard to investing and financing activities: Net income for 20-2 was $90,000, and cash dividends of $30,000 were declared and pa

> The income statement for Hubbard’s Professional Edge Tennis Camp follows. Assume that all revenues and expenses were for cash and that land was sold for $500. There were no other investing or financing activities during the year. The Ca

> After adjusting net income for changes in current assets and current liabilities, Penguin Tuxedo’s cash from operating activities is $45,000. However, Penguin reports $12,500 in depreciation expense for the year. Compute cash from operating activities af

> Brady Company reported net income of $30,000 for 20-2. The December 31 balances of the current assets and current liabilities are shown below. Compute cash provided by operating activities. 20-2 20-1 Accounts Receivable Merchandise Inventory Accounts

> Olsen Company’s balance sheets as of December 31, 20-2 and 20-1, showed the following with regard to cash and cash equivalents: Compute the amount of change in cash and cash equivalents and indicate whether it represented an increase or

> Why is it necessary to distinguish between business assets and liabilities and nonbusiness assets and liabilities of a single proprietor?

> Refer to Problem 23-9A. The following additional information was obtained from Zowine’s financial statements and auxiliary records for the year ended December 31, 20-2: Acquired a new warehouse……

> The following activities took place during the current year. Indicate whether each activity is a cash inflow (+) or cash outflow (–), and whether it is an operating activity (O), an investing activity (I), or a financing activity (F). (a) Proceeds from c

> Bunkichi Corporation issued the following bonds at a premium: Date of issue and sale: ………………………………………………………………. March 1, 20-1 Principal amount: ……………………………………………………………………………. $800,000 Sale price of bonds: ………………………………………………………………………………….. 103 Denominati

> Ito Co. issued the following bonds: Date of issue and sale: ……………………………………………………………. April 1, 20-1 Principal amount: ………………………………………………………………………. $300,000 Sale price of bonds: ……………………………………………………………………………. 100 Denomination of bonds: …………………………………………………

> M. J. Adams Corporation pays $40,000 into a bond sinking fund each year for the future redemption of bonds. At the end of the first year, earnings on the sinking fund are $3,200. When the bonds mature, there is a balance in the sinking fund of $301,800,

> Mutschelknaus Manufacturing sold bonds at a discount for $290,000 (discount of $10,000) seven years ago. (a) The corporation redeems $25,000 of this issue at 97. The unamortized discount is $350. (b) The corporation redeems $30,000 of this issue at 99. T

> Brighton Unlimited sold bonds at a premium for $630,000 (premium of $30,000) eight years ago. (a) The corporation redeems $60,000 of this issue at 98. The unamortized premium is $600. (b) The corporation redeems $90,000 of this issue at 102. The unamorti

> Levesque Lumber Co. issued $800,000 in bonds at face value 10 years ago and has paid semiannual interest payments through the years. (a) Assume the bonds are redeemed at face value. (b) Assume that $80,000 of the bonds are redeemed at 104. (c) Assume tha