Question: Following your retirement as senior vice president

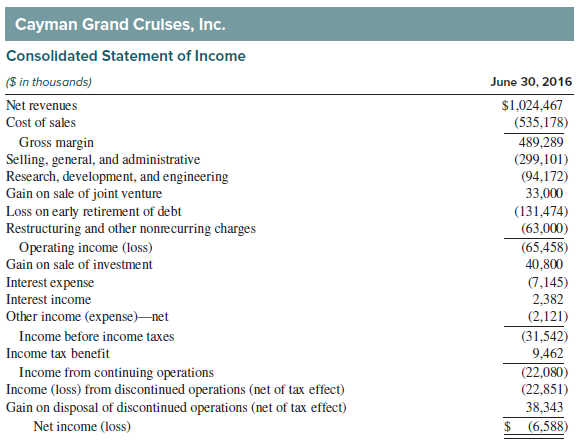

Following your retirement as senior vice president of finance for a large company, you joined the board of Cayman Grand Cruises, Inc. You serve on the compensation committee and help set the bonuses paid to the company’s top five executives. According to the annual bonus plan, each executive can earn a bonus of 1% of annual net income. No bonuses were paid in 2016 because the company reported a net loss of $6,588,000. Shortly after the end of the year, the compensation committee received a letter signed by all five executives, indicating that they felt the company had performed well in 2016. The letter identified the following items from the 2016 income statement that the executives felt painted a less favorable view of performance than was actually the case:

Required:

1. As a member of the compensation committee, how would you respond to each suggested

adjustment? Why?

2. What 2016 net income figure do you suggest be used to determine bonuses for the year?

Transcribed Image Text:

Proposed Adjustments to 2016 Earnings (S in thousands) Loss on early retirement of debt Restructuring and other nonrecurring charges Loss from discontinued operations $131,474 63,000 22,851 The letter asked the compensation committee to add these items back to the reported net loss and to then recalculate the bonus awards for 2016. The fiscal year 2016 income statement follows. Assume the tax rate is 30%. Cayman Grand Cruises, Inc. Consolidated Statement of Income (S in thousands) June 30, 2016 $1,024,467 (535,178) 489,289 (299,101) (94,172) Net revenues Cost of sales Gross margin Selling, general, and administrative Research, development, and engineering Gain on sale of joint venture Loss on early retirement of debt Restructuring and other nonrecurring charges 33,000 (131,474) (63,000) Operating income (loss) (65,458) Gain on sale of investment 40,800 Interest expense Interest income (7,145) 2,382 (2,121) Other income (expense)-net Income before income taxes (31,542) 9,462 (22,080) (22,851) 38,343 Income tax benefit Income from continuing operations Income (loss) from discontinued operations (net of tax effect) Gain on disposal of discontinued operations (net of tax effect) Net income (loss) $ (6,588)

> Smith, Inc., produces and sells clothing to department stores. Its supply arrangement with Leftwich Department Stores calls for Smith to purchase from Leftwich each month in-store advertising at a cost equal to 5% of the month’s sales to Leftwich. The in

> Barnard Bike Shop sells a bicycle to a customer for $600. Barnard offers to sell three tune-ups over the next three years for a total price of $150. The customer decides to purchase the tune ups and pays a total of $750. Barnard uses the adjusted market

> Barnard Bike Shop sells a bicycle to a customer for $750. The bicycle comes with free annual tune-ups for three years. The charge for tune-ups sold separately is $60. Barnard uses the residual approach. Allocate the transaction price to the performance o

> Jerry’s Jellies sells one- and two-year mail-order subscriptions for its jelly-of-the-month business. Subscriptions are collected in advance and credited to sales. An analysis of the recorded sales activity revealed the following: Wha

> On December 31, 2017, Vale Company had an unadjusted credit balance of $1,000 in its Allowance for uncollectible accounts. An analysis of Vale’s trade accounts receivable at that date revealed the following: What amount should Vale repo

> Todd Corporation wrote off $100,000 of obsolete inventory at December 31, 2017. What effect did this write-off have on the company’s December 31, 2017, current and quick ratios?

> In November and December 2017, Gee Company, a newly organized magazine publisher, received $36,000 for 1,000 three-year subscriptions at $12 per year, starting with the January 2018 issue of the magazine. Required: How much should Gee report in its 2017

> The following information was extracted from Citigroup, Inc.’s 2009 annual report. From letter to shareholders: Financial Strength While Citi started the year as a TARP institution receiving “exceptional financial ass

> During your audit of Patti Company’s ending inventory at December 31, 2017, you find the following inventory accounting errors: a. Goods in Patti’s warehouse on consignment from Valley, Inc., were included in Patti’s ending inventory. b. On December 31,

> In 2018, Ginzel Corporation agreed to provide a client with 20 detailed marketing analyses of its client’s key products for a total fee of $110,000. The fee was computed as $5,000 per report x 20 reports = $100,000, plus $10,000 to extract the necessary

> Packard, Inc., adopted the dollar-value LIFO inventory method on June 30, 2016, the end of its fiscal year. Packard’s inventory records provide the following information: Calculate the ending inventory for Packard, Inc., for 2017, 201

> Princess Retail Stores started doing business on January 1, 2017. The following data reflect its inventory purchases and sales during the year: Required: 1. Compute gross margin and cost of ending inventory using the periodic FIFO cost flow assumption.

> Jeanette Corporation’s president is in a dilemma regarding which inventory method (LIFO or FIFO) to use. The controller provides the following list of factors that should be considered before making a choice. a. Jeanette has borrowed money during the cur

> Mastrolia Manufacturing produces pacifiers. The company uses absorption costing for external reporting, but management prefers variable costing for evaluating the profitability of each model. Bonuses, which make up a significant portion of each manager&a

> Bravo Wholesalers, Inc., began its business on January 1, 2017. Information on its inventory purchases and sales during 2017 follows: Required: Assume a tax rate of 40%. 1. Compute the cost of ending inventory and cost of goods sold under each of the f

> The following information pertains to Yuji Corporation: Costs incurred during the year 2017 were as follows: Raw material purchased ……………â€&b

> 1. Refer to the facts in Problem 9-16. Repeat the requirements assuming that Jake uses the FIFO cost flow assumption. 2. Explain how the financial statements are affected when a company decides that NRV should be used for the inventory value. 3. Repeat p

> Ramps by Jake, Inc., manufactures skateboard ramps. The company uses independent sales representatives to market its products and pays a commission of 8% on each sale. Data regarding the five styles of ramps in the company’s inventory a

> Caldwell Corporation operates an ice cream processing plant and uses the FIFO inventory cost flow assumption. A partial income statement for the year ended December 31, 2017, follows: Caldwell’s physical inventory levels were virtuall

> Appearing next is information pertaining to Garrels Company’s Allowance for doubtful accounts. Examine this information and answer the following questions. Required: 1. Solve for the unknowns in the preceding schedule. (Hint: Use T-acc

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells technical support for $30,000. It does not sell the software separately. Gerakos uses the residual method to alloca

> Sirotka Retail Company began doing business in 2015. The following information pertains to its first three years of operation: Assume the following: The income tax rate is 40%. Purchase and sale prices change only at the beginning of the year. Sirotk

> Don Facundo Bacardy Maso founded the original Bacardi® rum business in Cuba in 1862. The following information is excerpted from Bacardi Corporation’s annual report for the year ended December 31, Year 2. Bacardiâ€

> JKW Corporation has been selling plumbing supplies since 1981. In 2003, the company adopted the LIFO method of valuing its inventory. The company has grown steadily over the years and a layer has been added to its LIFO inventory in each of the years the

> The following is an excerpt from the financial statements of Talbot Industries: Effective September 30, 2016, the Company changed its method of accounting for inventories from the LIFO method principally to the Specific Identification method, because,

> Parque Corporation applied to Fairview Bank early in 2017 for a $400,000 five-year loan to finance plant modernization. The company proposes that the loan be unsecured and repaid from future operating cash flows. In support of the loan application, Parqu

> Keefer, Inc., began business on January 1, 2016. Information on its inventory purchases and sales during 2016 and 2017 follow: Required: 1. Calculate ending inventory, cost of goods sold, and gross margin for 2016 and 2017 under the periodic FIFO inv

> On January 1, 2017, Hillock Brewing Company sold 50,000 bottles of beer to various customers for $45,000 using credit terms of 3/10, n/30. These credit terms mean that customers receive a cash discount of 3% of invoice price for payments made within 10 d

> On January 2, 2017, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a cash selling price of $109,837. As payment, Criswell gave Mifflinburg Farm Supply $25,000 in cash and a $100,000, five-year note that provided for annual i

> On December 31, 2017, Roker, Inc. reported notes receivable of $63,930,000. This amount represents the present value of future cash flows (both principal and interest) discounted at a rate of 11.12% per annum. The schedule of collections of the receivabl

> The following information pertains to the financial statements of Buffalo Supply Company, a provider of plumbing fixtures to contractors in central Pennsylvania. Reconstruct all journal entries pertaining to Gross accounts receivable and Allowance for

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It does not sell technical support separately. Gerakos use

> Several executives of Computer Associates International, including former CEO Sanjay Kumar, pleaded guilty to providing fraudulent financial statements. The scheme was built around the backdating of sales contracts to affect the results of quarterly repo

> On December 1, 2017, Eva Corporation, a mortgage bank, has the following amounts on its balance sheet (in millions): Also on December 1, 2017, Eva transfers mortgage receivables with a book value of $20,000,000 to a securitization entity (SE). The ave

> At December 31, 2016, Oettinger Corporation, a premium kitchen cabinetmaker for the home remodeling industry, reported the following accounts receivable information on its year-end balance sheet: Gross accounts receivable …â

> Avillion Corporation had a $45,000 debit balance in Accounts receivable and a $3,500 credit balance in Allowance for uncollectibles on December 31, 2017. The company prepared the following aging schedule to record the adjusting entry for bad debts on Dec

> Baer Enterprises’s balance sheet at October 31, 2017 (fiscal year-end), includes the following: Accounts receivable …………………………………………$379,000 Less: Allowance for uncollectible …………………… (33,000) Accounts receivable (net) …………………………………………$346,000 Transact

> Moto-Lite Company is an original equipment manufacturer of high-quality aircraft engines that it traditionally has sold directly to aero clubs building their own aircraft. The engine’s selling price depends on its size and horsepower; Moto-Lite’s average

> The following notes are excerpted from the financial statements of three companies: The Company and certain of its domestic subsidiaries regularly discount trade notes receivable on a full recourse basis with banks. These trade notes receivable discounte

> Mikeska Companies purchased equipment for $108,000 from Power-line Manufacturing on January 1, 2015. Mikeska paid $18,000 in cash and signed a five-year, 5% installment note for the remaining $90,000 of the purchase price. The note calls for annual payme

> Fish Spotters, Inc., purchased a single-engine aircraft from National Aviation on January 1, 2014. Fish Spotters paid $55,000 cash and signed a three-year, 8% note for the remaining $45,000. Terms of the note require Fish Spotters to pay accrued interest

> The following information is taken from the financial statements of Ramsay Health Care Inc.: Required: 1. Reconstruct all journal entries relating to Gross accounts receivable and Allowance for doubtful accounts (that is, Allowance for uncollectibles)

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It sells technical support for $30,000. Gerakos allocates

> Atherton Manufacturing Company sold $200,000 of accounts receivable to a factor. Pertinent facts about this transaction include the following: 1. The factored receivables had a corresponding $4,000 balance in Allowance for uncollectibles. 2. The receiva

> Regulated utilities such as Duke Power Co. (a subsidiary of Duke Energy Corporation) are authorized to earn a specific rate of return on their capital investments. Energy regulators set a rate the utility can charge its customers for the electricity. If

> Needham Corporation has a $200,000 balloon mortgage payment due in early August. To meet its obligation, it decided on August 1 to accelerate collection of accounts receivable by assigning $260,000 of specified accounts to a commercial lender as collater

> Aardvark, Inc., began 2017 with the following receivables-related account balances: Aardvark’s transactions during 2017 include the following: Accounts receivable ………………….…………………. $575,000 Allowance for ………………….………………….…………………. 43,250 1. On April 1, 20

> Duke Energy Corporation’s 2014 annual report to shareholders contains the following note disclosure (edited for brevity): Regulatory Accounting: A substantial majority of Duke Energy’s regulated operations meet the criteria for regulatory accounting trea

> Food Lion, Inc., operates a chain of retail supermarkets principally in the southeastern United States. The supermarket business is highly competitive, and it is characterized by low profit margins. Food Lion competes with national, regional, and local s

> John Brincat was the president and chief executive of Mercury Finance, an auto lender pecializing in high credit-risk customers. The company’s 1995 proxy statement contained the following description of Brincat’s pay package. Mr. Brincat is eligible for

> In late 2002, Frisby Technologies received a default notice from two of its creditors notifying the company that it was in default of the tangible net worth covenant in its loan agreements. Although the company had a period of time to cure the default, i

> Foot Locker, Inc., reported an $18 million loss on sales of $1,283 million for the quarter ended August 4, 2007. The quarterly financial filing (10-Q) also contained this warning for investors and creditors. Required: 1. What is a minimum fixed charge c

> Kleymenova Consulting, Inc., enters into a contract to provide consulting services. In each of the following independent scenarios, determine whether revenue should be recognized at a point in time or over time. 1. The consulting services are the provisi

> Explain the potential conflict of interest that arises when doctors own the hospitals in which they work.

> A feature of top executive pays at Krispy Kreme Doughnuts, Inc., is its compensation recovery policy. The policy allows Krispy Kreme to take back annual or long-term incentive compensation paid to executive officers and certain other management team memb

> Whole Foods Market’s Compensation Committee determines a portion of executive bonuses qualitatively. For the quantitative portion, the Committee selects from 13 performance metrics. For the fiscal year 2014, the Compensation Committee selected the follow

> Alliant Energy just received regulatory approval for its 2017 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation foll

> A brief description of Krispy Kreme’s annual cash bonus plan for top executives follows. The disclosure further indicates that eligible recipients would receive 70%, 100%, or 140% of the portion of the target bonus for performance attri

> As discussed in the chapter, abnormal earnings (AE) are where Xt is the firm’s net income, re is the cost of equity capital, and BVt−1 is the book value of equity at t − 1. Following are Xt, BVt&aci

> Exhibit 6.5 describes the key financial ratios Standard & Poor’s analysts use to assess credit risk and assign credit ratings to industrial companies. The same financial ratios for three firms follow. Required: 1. What credit rati

> As discussed in the chapter, abnormal earnings (AE) are equity at time t − 1. Solve the following problems: 1. If Xt is $5,000, re = 15%, and BVt−1 is $50,000, what is AEt? 2. If Xt is $25,000, re = 18%, and BVt&acir

> Sonic Solutions develops digital media products, services, and technologies for consumers and content development professionals. In June 2010, a team of analysts at J.P. Morgan issued a research report that valued Sonic’s stock at $13 p

> Tail O’ the Dog operates a chain of seven gourmet hot dog stands in southern California. The firm’s first stand, built in 1948, was shaped like (what else?) a giant hot dog, in a giant hot dog bun, and with mustard, of course. Over the years, this humble

> Glick Corporation offers a 10% volume discount to customers who purchase more than 10,000 units of its yoga mats in a calendar year. The volume discount applies to all units purchased in the year, not just the units above 10,000. Once a customer exceeds

> Tack, Inc., reported a Retained earnings balance of $150,000 at December 31, 2016. In June 2017, Tack’s internal audit staff discovered two errors that were made in preparing the 2016 financial statements that are considered material: a. Merchandise cos

> Assume that inventory purchases were recorded correctly and that no correcting entries were made at December 31, 2015, or December 31, 2016. The errors were discovered in 2017, after the 2016 financial statements were issued. Required: 1. Ignoring incom

> Hentzel Landscaping commenced its business on January 1, 2017. 1. During the first year of its operations, Hentzel purchased supplies in the amount of $12,000 (debited to Supplies inventory), and of this amount, $3,000 were unused as of December 31, 201

> Jones Corporation switched from the LIFO method of costing inventories to the FIFO method at the beginning of 2017. The LIFO inventory at the end of 2016 would have been $80,000 higher using FIFO. Reported retained earnings at the end of 2016 were $1,750

> Required: Classify the following costs as period or traceable costs. Depreciation on office building………………. Depreciation on factory Insurance expense for factory building………………. Bonus to factory workers Product liability insurance premium ………………. Salary

> A recent balance sheet for Pittards, PLC, a British company, follows. The company’s principal activities are the design, production, and procurement of technically advanced leather. The Group financial statements consolidate the account

> On September 1, 2017, Revsine Co. approved a plan to dispose of a segment of its business. Revsine expected that the sale would occur on March 31, 2017, at an estimated gain of $375,000. The segment had actual and estimated operating profits (losses) as

> Munnster Corporation’s income statements for the years ended December 31, 2017, and 2016 included the following information before adjustments: 2017 2016 ______________________________________________________________ Operating income $

> Krewatch, Inc., is a vertically integrated manufacturer and retailer of golf clubs and accessories (gloves, shoes, bags, etc.). Krewatch maintains separate financial reporting systems for each of its facilities. The company experienced the following even

> Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 2017. Statement of Income and Retained Earnings for the Year Ended December 31, 2017 ($ in 000) Net sales ……………….……………….……………….……………….………………. $5,

> The following information is provided for Kelly Plumbing Supply. Cash received from customers during December 2017 ………………. $387,000 Cash paid to suppliers for inventory during December 2017 ……………….131,000 Cash received from customers includes all $139,

> Under Hart Company’s accounting system, all insurance premiums paid are debited to Prepaid insurance. For interim financial reports, Hart makes monthly estimated charges to Insurance expense with credits to Prepaid insurance. Additional information for t

> Joel Hamilton, D.D.S., keeps his accounting records on the cash basis. During 2017, he collected $200,000 in fees from his patients. At December 31, 2016, Dr. Hamilton had accounts receivable of $18,000 and no liability for deferred fee revenue. At Decem

> The time frame in each of these scenarios is after the effective date of the new revenue recognition rules in ASC Topic 606. For each of the following independent situations, determine the point at which a contract exists and is subject to application of

> Information from Jacob Perez Company’s records is available as follows for the year ended December 31, 2017: Net sales …………………………………………………………………$1,600,000 Cost of goods manufactured: Variable …………………………………………………………………$ 800,000 Fixed ………………………………………………………

> Frate Company was formed on January 1, 2017. The following information is available from Frate’s inventory records for Product Ply: A physical inventory on December 31, 2017, shows 1,600 units on hand. Required: Prepare schedules to co

> John Rigas founded Adelphia Communications Corporation with a $300 license in 1952, took the company public in 1986, and built it into the sixth largest cable television operator by acquiring other systems in the 1990s. As the company grew, it also expan

> Acme’s gross profit ratio increased by 20% over the prior year. Net sales and cost of goods sold for the prior year were $120,000 and $90,000, respectively. Cost of goods sold for the current year is $140,000. Required: Determine the amount of Acme’s sa

> Classify each of the following items according to (1) whether it belongs on the income statement (IS) or balance sheet (BS) and (2) whether it is a revenue (R), expense (E), asset (A), liability (L), or stockholders’ equity (SE) item.

> Each account has a normal balance. For the following list of accounts, indicate whether the normal balance of each is a debit or a credit. Account Nomal Balance 1. Cash 2. Prepaid Insurance 3. Retained Earnings 4. Bonds Payable 5. Investments 6. Cap

> Choose from the following list of account titles the one that most accurately fits the description of that account or is an example of that account. An account title may be used more than once or not at all. Cash Accounts Receivable Notes Receivabl

> Indicate the appropriate classification of each of the following as a current asset (CA), noncurrent asset (NCA), current liability (CL), or long-term liability (LTL). 1. Inventory 2. Accounts payable 3. Cash 4. Patents 5. Notes payable, due in six

> Havre Company would like to buy a building and equipment to produce a new product line. Information about Havre is more useful to some people involved in the project than to others. Required: Complete the following chart by identifying the information l

> Regal Entertainment Group operates the largest chain of movie theaters in the U.S. Classify each of the following items found on the company’s balance sheet included in the Form 10-K for the fiscal year ended December 31, 2015 as a curr

> Billings Inc. would like to buy a franchise to provide a specialized service. Information about Billings is more useful to some people involved in the project than to others. Required: Complete the following chart by identifying the information listed o

> Following are Butler Realty Corporation’s accounts, identified by number. The company has been in the real estate business for ten years and prepares financial statements monthly. Following the list of accounts is a series of transactio

> A list of accounts, with an identifying number for each, is provided. Following the list of accounts is a series of transactions entered into by a company during its first year of operations. Required: For each transaction, indicate the account or accou

> Following are the accounts of Dominique Inc., an interior decorator. The company has been in the decorating business for ten years and prepares quarterly financial statements. Following the list of accounts is a series of transactions entered into by Dom

> A list of accounts, with an identifying number for each, is provided. Following the list of accounts is a series of transactions entered into by a company during its first year of operations. Required: For each transaction, indicate the account or accou

> Using Y for yes and N for no, indicate whether each of the following items should be included in cash and cash equivalents on the balance sheet. If an item should not be included in cash and cash equivalents, indicate where it should appear on the balanc

> From the following list, identify each item as operating (O), investing (I), financing (F), or not separately reported on the statement of cash flows (N). Assume that the indirect method is used to determine the cash flows from operating activities. Purc

> Refer to the transactions recorded directly in T accounts for We-Go Delivery Service in Exercise 3-13. Assume that all of the transactions took place during December. Prepare a trial balance at December 31. Exercise 3-13: Record each of the following t

> During the month, services performed for customers on account amounted to $7,500 and collections from customers in payment of their accounts totaled $6,000. At the end of the month, the Accounts Receivable account had a balance of $2,500. What was the Ac

> Jessie’s Accounting Services was organized on June 1. The company received a contribution of $1,000 from each of the two principal owners. During the month, Jessie’s Accounting Services provided services for cash of $1,400 and services on account for $45

> For each of the following independent cases, fill in the blank with the appropriate dollar amount. Assets Liabilities Owners' Equity Case 1 $125,000 $ 75,000 Case 2 400,000 100,000 Case 3 320,000 95,000

> Assume that a company is preparing a bank reconciliation for the month of June. It reconciles the bank balance and the book balance to the correct balance. For each of the following items, indicate whether the item is an addition to the bank balance (A-B