Question: The following information was extracted from

The following information was extracted from Citigroup, Inc.’s 2009 annual report.

From letter to shareholders:

Financial Strength

While Citi started the year as a TARP institution receiving “exceptional financial assistance,†by the end of the year our capital and liquidity positions were among the strongest in the banking world. We repaid TARP and exited the loss-sharing agreement with the U.S. government. Tier 1 Common rose by nearly $82 billion to more than $104 billion, with a ratio of 9.6%, and we had a Tier 1 Capital Ratio39 of 11.7%—one of the highest in the industry. Structural liquidity, at 73%, was in excellent shape. The allowance for loan loss reserves stood at $36 billion or 6.1% of loans. Worldwide, deposits grew by 8% to $836 billion. The other essential component of Citi’s revived financial strength has been a large reduction in our risk exposure. By year end, we had reduced assets on our balance sheet by half a trillion dollars, or 21%, from peak levels in the third quarter of 2007. This includes a substantial decline in our riskiest assets over those years. The actions we took restored Citi’s financial strength and therefore were essential. I deeply regret that they also resulted in significant dilution for our shareholders. Citi remains committed to preserving our considerable financial strength and remaining one of the strongest banks in the world.

From management’s discussion and analysis:

Allowance for Loan Losses:

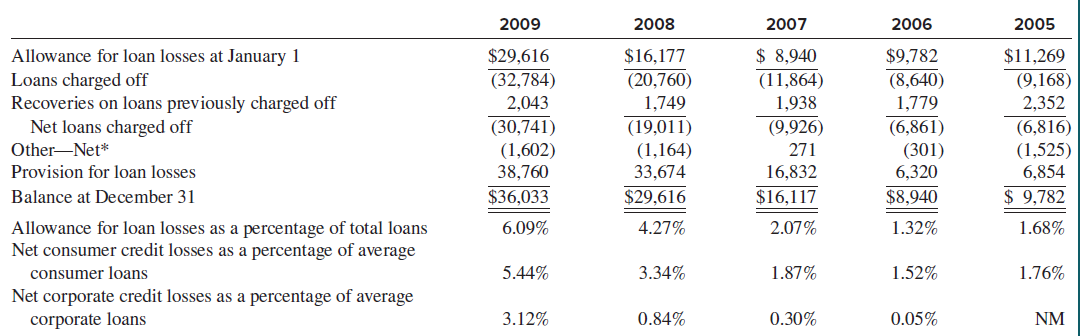

Allowance for loan losses represents management’s best estimate of probable losses inherent in

the portfolio, as well as probable losses related to large individually evaluated impaired loans and troubled debt restructurings.

Citigroup increased its allowance for loan losses.

During 2009, Citi added a net build of $8.0 billion to its allowance for loan losses. The allowance

for loan losses was $36 billion at December 31, 2009, or 6.1% of loans, compared to $29.6 billion, or 4.3% of loans, at year-end 2008. With the adoption of SFAS 166 and 167 in the first quarter of 2010, loan loss reserves would have been $49.4 billion, or 6.6% of loans, each as of December 31, 2009, and based on current estimates.

Selected details of Citigroup’s credit loss experience follow:

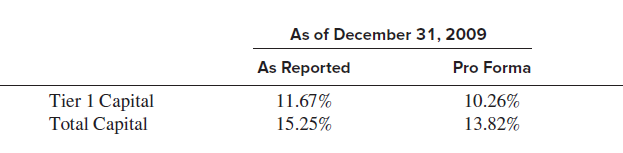

In June 2009, the FASB issued SFAS No. 166, “Accounting for Transfers of Financial assets, an amendment of FASB Statement No. 140,†that will eliminate qualifying special purpose entities (QSPEs). This change will have a significant impact on Citigroup’s Consolidated Financial Statements. Beginning January 1, 2010, the Company will lose sales treatment for certain future asset transfers that would have been considered sales under SFAS 140, and for certain transfers of portions of assets that do not meet the definition of participating interests. Simultaneously, the FASB issued SFAS No. 167, “Amendments to FASB Interpretation No. 46(R),†which details three key changes to the consolidation model. First, former QSPEs will now be included in the scope of SFAS 167. In addition, the FASB has changed the method of analyzing which party to a variable interest entity (VIE) should consolidate the VIE (known as the primary beneficiary) to a qualitative determination of which party to the VIE has “power†combined with potentially significant benefits or losses, instead of the current quantitative risks and rewards model.

As a result of implementing these new accounting standards, Citigroup will consolidate certain of the VIEs and former QSPEs with which it currently has involvement. The pro forma impact on certain of Citigroup’s regulatory capital ratios of adopting these new accounting standards (based on financial information as of December 31, 2009), reflecting immediate implementation of the recently issued final risk-based capital rules regarding SFAS 166 and SFAS 167, would be as follows:

Examine the selected details of Citigroup’s credit loss experience.

a. How does the dollar amount of loans charged off in 2009 compare with that of 2008?

b. How much was added to the Provision for loan losses in 2009?

c. What is the trend in the allowance for loan losses as a percentage of total loans over the period 2005–2009?

2. As a consequence of your findings in requirement 1, how (if at all) does this new information

affect your expectation regarding the future performance of Citigroup’s existing loans? To answer this question, it will be helpful to read Citigroup’s Management Discussion and Analysis (available at http://www.citi.com/citi/fin/data/ar09c_en.pdf.), particularly pages 10 and 11.

3. What is the effect of having to comply with SFAS 166 and SFAS 167 on Citigroup’s capital

ratios? Briefly explain why this effect occurs. Refer to the Doyle National Bank discussion earlier in the book.

Transcribed Image Text:

2009 2008 2007 2006 2005 $29,616 (32,784) 2,043 (30,741) (1,602) 38,760 $ 8,940 (11,864) 1,938 $9,782 $11,269 Allowance for loan losses at January 1 Loans charged off Recoveries on loans previously charged off Net loans charged off Other-Net* $16,177 (20,760) (8,640) 1,779 (9,168) 2,352 1,749 (19,011) (1,164) (9,926) (6,861) (301) 6,320 (6,816) (1,525) 6,854 271 Provision for loan losses 33,674 16,832 Balance at December 31 $36,033 $29,616 $16,117 $8,940 $ 9,782 Allowance for loan losses as a percentage of total loans Net consumer credit losses as a percentage of average 6.09% 4.27% 2.07% 1.32% 1.68% consumer loans 5.44% 3.34% 1.87% 1.52% 1.76% Net corporate credit losses as a percentage of average corporate loans 3.12% 0.84% 0.30% 0.05% NM As of December 31, 2009 As Reported Pro Forma Tier 1 Capital Total Capital 11.67% 10.26% 15.25% 13.82%

> In October 2010, Moody’s Investors Services reduced the credit rating assigned to Greece’s government bonds from investment grade to a speculative (junk-level) rating. At the time, Greece was considered by many to be the epicenter of the European debt cr

> Halifax Products has a $1 million bank loan that comes due next year. Management has prepared cash flow forecasts for each of the next six quarters as shown in the table below. Planned capital expenditures are intended to replace failing manufacturing eq

> 1. Define the term quality of earnings. 2. List the techniques that management can use to improve a company’s reported earnings performance in the short run. 3. Give examples of low-quality earnings components.

> 1. Why is fair value accounting so important to companies such as News Corporation that have substantial investments in goodwill recorded on their balance sheets? 2. News Corporation uses a discounted free cash flow valuation approach when assessing good

> The price/earnings ratios of four companies from the same industry are: What factors might explain the difference in the P/E ratios of these companies? Company P/E Ratio 16.3 19.7 33.7 Fresh Market Kroger Sprouts Farmers Market Whole Foods Market 2

> The price/earnings ratios of four companies from different industries are: What factors might explain the difference in the P/E ratios of these companies? Company P/E Ratio Amazon.com 882.7 Microsoft 35.2 Toyota Motors 9.3 Whole Foods Market 21.3

> Shelter Products sells portable livestock shelters to hog producers in the Central and Midwest regions of the United States. The terms of sale require cash payment within 30 days, and most customers take full advantage of this payment option. Sales are s

> Lemon Corporation and Morley, Inc., have entered into an arrangement whereby Lemon will supply materials and 1,000 hours of its scientists’ time for a project to be undertaken at Morley’s research facility in Austin, TX. Morley will also contribute its s

> 1. What does the phrase sustainable earnings mean? What types of earnings are not sustainable? 2. What are abnormal earnings? 3. Briefly describe the key features of the abnormal earnings approach to valuation.

> The quarterly cash flows from operations for two software companies are Required: 1. Explain why Firm B has more credit risk than Firm A. 2. Suppose that Firm B’s cash flow was $200 higher each quarter (e.g., $336.7 in Q1 of 2016). Ex

> 1. What are free cash flows? 2. Explain the difference between a company’s operating cash flow and its free cash flow. 3. Briefly describe the key features of the free cash flow approach to valuation.

> On January 1, 2019, LeMoyne Construction Company signs a contract to build an office building for Franklin Corporation for $10 million. Franklin remits $1 million to LeMoyne upon signing the contract, $5 million when the foundation and all outside compon

> Selected information taken from the accounting records of Vigor Company follows: Net accounts receivable at December 31, 2016 ……………………………………$ 900,000 Net accounts receivable at December 31, 2017 ……………………………………$1,000,000 Accounts receivable turnover ………

> A comparison of 2017 to 2016 performance shows that Neir Company’s inventory turnover increased substantially although sales and inventory amounts were essentially unchanged. Which of the following statements best explains the increased inventory turnove

> Gil Corporation has current assets of $90,000 and current liabilities of $180,000. Required: Compute the effect of each of the following independent transactions on Gil’s current ratio: 1. Refinancing a $30,000 long-term mortgage with a short-term note.

> Following are income statements for Hossa Corporation for 2017 and 2016. Percentage of sales amounts are also shown for each operating expense item. Hossa’s income tax rate was 38% in 2016 and 40% in 2017. Hossa’s ma

> This exercise is built around Whole Foods Market’s financial statements from the chapter. Average common shareholders’ equity for 2012 was $3.397 billion, and a 40% income tax rate should be used as needed. Required: 1. Whole Foods earned an ROA of 9.7%

> Mentor Graphics Corporation, a supplier of electronic design automation systems, just announced its second quarter results. According to the earnings press release, the company reported “revenues of $182.6 million, non-GAAP earnings per share of $0.02, a

> Following is Crash Zone Corporation’s balance sheet at the end of 2016 and its cash flow statement for 2017. Crash zone manufactures safety equipment for race cars. Additional Information: a. During 2017, 500 shares of common stock wer

> The Hershey Co. is famous worldwide for its chocolate confections—the Hershey bar and those delightful Hershey Kisses. Tootsie Roll Industries is equally famous for its chewy Tootsie Roll and those flavorful Tootsie Roll Pops. Selected

> Serven Corporation has estimated its accrual-basis revenue and expenses for June 2017 and would like your help in estimating cash disbursements. Selected data from these estimated amounts are as follows: Sales ………………………………………………………………………………………………………$700

> The following information is available from Sand Corporation’s accounting records for the year ended December 31, 2017: Cash received from customers…………………………………… $870,000 Rent received ………………………………………………………10,000 Cash paid to suppliers and employees ……

> During 2017, Kew Company, a service organization, had $200,000 in cash sales and $3,000,000 in credit sales. The accounts receivable balances were $400,000 and $485,000 at December 31, 2016 and 2017, respectively. Required: What was Kew Company’s cash re

> Mystery Technologies, Inc., a hypothetical company, is a leading manufacturer of bar code scanners and related information technology whose stock is traded on the New York Stock Exchange. In Year 3, the SEC filed allegations that during the previous five

> Following is a list of items taken from the December 31, 2017, balance sheet of Reagan Company (amounts omitted): Accounts payable ………………………………………………………Goodwill Accrued expenses ………………………………………………………Income taxes payable Accumulated depreciation—buildings

> The preliminary draft of the balance sheet at the end of the current fiscal year for Eagle Industries follows. The statement will be incorporated into the annual report to stockholders and will present the dollar amounts at the end of both the current an

> The following information was taken from the 2017 financial statements of Zurich Corporation, a maker of fine Swiss watches: Net income …………………$(200,000) Depreciation …………………50,000 Increase (decrease) in Accounts receivable ………………… (140,000) Inventories

> The following information was taken from the 2017 financial statements of Eiger Corporation, a maker of equipment for mountain and rock climbers: Net income ……………………………………$100,000 Depreciation ……………………………………30,000 Increase (decrease) in Accounts receivab

> The following classification scheme typically is used in the preparation of a balance sheet: a. Current assets b. Investments and funds c. Property, plant, and equipment d. Intangible assets e. Other assets f. Current liabilities g. Long-term liabilities

> Riff Hospital recently treated an accident victim in the emergency room. Because the patient was unconscious when he arrived, Riff treated the patient without knowing whether he had insurance or, if he did, whether it was with an insurer with which Riff

> Theo Corporation entered into a contract with Maddon Company to sell Maddon goods for $200,000. About a week later, Maddon ordered additional goods and the two companies agreed to a $50,000 price. The stand-alone price for the additional goods is typical

> Theo Corporation entered into a contract with Maddon Company to sell Maddon goods for $200,000. About a week later, Maddon ordered additional goods and the two companies agreed to a $50,000 price. Then the two companies agreed, for simplicity, to add the

> Kruger Corporation sells construction equipment to a customer for $50,000. The equipment comes with a standard 2-year warranty covering any repairs that are required during that time. It does not cover routine maintenance, and the warranty is voided if t

> The following information related to Caterpillar’s inventories is taken from its 2015 annual report. Use this information in answering the questions that follow. There were no LIFO liquidations in 2014 or 2015. Assume a 35% tax rate. D.

> For several years, the Securities and Exchange Commission (SEC) has been considering whether to transition U.S. firms to International Financial Reporting Standards (IFRS) for filing public financial reports. During 2011, Matthew J. Foehr, the vice presi

> ClearOne Communications, Inc., is a provider of end-to-end video and audio conferencing services, including the manufacture and sale of video and audio conferencing products. From its inception as a manufacturer of this equipment through 2001, ClearOne s

> Baines Corporation manufactures fireplace tools and accessories. It has been prosperous since its incorporation in 1980, largely due to a small, exceptionally skilled, and highly motivated managerial staff. Baines has been able to attract and retain its

> The following information related to ExxonMobil’s inventories is taken from its 2014 annual report. 3. Miscellaneous Financial Information In 2014, 2013, and 2012, net income included gains of $187 million, $282 million, and $328 millio

> The following inventory note appears in General Electric’s Year 3 annual report. LIFO revaluations decreased $70 million in Year 3, compared with decreases of $169 million in ear 2 and $82 million in Year 1. Included in these changes

> Presented below are excerpts from the 2015 annual report of Daimler AG, a German company that manufactures luxury automobiles. Inventories are comprised as shown in table E.41. The amount of write-down of inventories to net realizable value recognized as

> Latter Corporation received an order from Murray, Inc. for electronic components. Because Murray is struggling financially, Latter called the company and said it will get ready to fulfill the order, but it will not ship the order until payment is receive

> Dale Golf Course, Inc., operates golf courses in South Carolina. A round of golf at one of Dale’s courses costs $75. Dale also sells one-year season passes, good for unlimited rounds of golf for a single golfer, for $3,000. In 2019, Dale’s first year of

> Smith, Inc., produces and sells clothing to department stores. Its supply arrangement with Leftwich Department Stores calls for Smith to purchase from Leftwich each month in-store advertising at a cost equal to 5% of the month’s sales to Leftwich. The in

> Barnard Bike Shop sells a bicycle to a customer for $600. Barnard offers to sell three tune-ups over the next three years for a total price of $150. The customer decides to purchase the tune ups and pays a total of $750. Barnard uses the adjusted market

> Barnard Bike Shop sells a bicycle to a customer for $750. The bicycle comes with free annual tune-ups for three years. The charge for tune-ups sold separately is $60. Barnard uses the residual approach. Allocate the transaction price to the performance o

> Jerry’s Jellies sells one- and two-year mail-order subscriptions for its jelly-of-the-month business. Subscriptions are collected in advance and credited to sales. An analysis of the recorded sales activity revealed the following: Wha

> On December 31, 2017, Vale Company had an unadjusted credit balance of $1,000 in its Allowance for uncollectible accounts. An analysis of Vale’s trade accounts receivable at that date revealed the following: What amount should Vale repo

> Todd Corporation wrote off $100,000 of obsolete inventory at December 31, 2017. What effect did this write-off have on the company’s December 31, 2017, current and quick ratios?

> In November and December 2017, Gee Company, a newly organized magazine publisher, received $36,000 for 1,000 three-year subscriptions at $12 per year, starting with the January 2018 issue of the magazine. Required: How much should Gee report in its 2017

> During your audit of Patti Company’s ending inventory at December 31, 2017, you find the following inventory accounting errors: a. Goods in Patti’s warehouse on consignment from Valley, Inc., were included in Patti’s ending inventory. b. On December 31,

> In 2018, Ginzel Corporation agreed to provide a client with 20 detailed marketing analyses of its client’s key products for a total fee of $110,000. The fee was computed as $5,000 per report x 20 reports = $100,000, plus $10,000 to extract the necessary

> Packard, Inc., adopted the dollar-value LIFO inventory method on June 30, 2016, the end of its fiscal year. Packard’s inventory records provide the following information: Calculate the ending inventory for Packard, Inc., for 2017, 201

> Princess Retail Stores started doing business on January 1, 2017. The following data reflect its inventory purchases and sales during the year: Required: 1. Compute gross margin and cost of ending inventory using the periodic FIFO cost flow assumption.

> Jeanette Corporation’s president is in a dilemma regarding which inventory method (LIFO or FIFO) to use. The controller provides the following list of factors that should be considered before making a choice. a. Jeanette has borrowed money during the cur

> Mastrolia Manufacturing produces pacifiers. The company uses absorption costing for external reporting, but management prefers variable costing for evaluating the profitability of each model. Bonuses, which make up a significant portion of each manager&a

> Bravo Wholesalers, Inc., began its business on January 1, 2017. Information on its inventory purchases and sales during 2017 follows: Required: Assume a tax rate of 40%. 1. Compute the cost of ending inventory and cost of goods sold under each of the f

> The following information pertains to Yuji Corporation: Costs incurred during the year 2017 were as follows: Raw material purchased ……………â€&b

> 1. Refer to the facts in Problem 9-16. Repeat the requirements assuming that Jake uses the FIFO cost flow assumption. 2. Explain how the financial statements are affected when a company decides that NRV should be used for the inventory value. 3. Repeat p

> Ramps by Jake, Inc., manufactures skateboard ramps. The company uses independent sales representatives to market its products and pays a commission of 8% on each sale. Data regarding the five styles of ramps in the company’s inventory a

> Caldwell Corporation operates an ice cream processing plant and uses the FIFO inventory cost flow assumption. A partial income statement for the year ended December 31, 2017, follows: Caldwell’s physical inventory levels were virtuall

> Appearing next is information pertaining to Garrels Company’s Allowance for doubtful accounts. Examine this information and answer the following questions. Required: 1. Solve for the unknowns in the preceding schedule. (Hint: Use T-acc

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells technical support for $30,000. It does not sell the software separately. Gerakos uses the residual method to alloca

> Sirotka Retail Company began doing business in 2015. The following information pertains to its first three years of operation: Assume the following: The income tax rate is 40%. Purchase and sale prices change only at the beginning of the year. Sirotk

> Don Facundo Bacardy Maso founded the original Bacardi® rum business in Cuba in 1862. The following information is excerpted from Bacardi Corporation’s annual report for the year ended December 31, Year 2. Bacardiâ€

> JKW Corporation has been selling plumbing supplies since 1981. In 2003, the company adopted the LIFO method of valuing its inventory. The company has grown steadily over the years and a layer has been added to its LIFO inventory in each of the years the

> The following is an excerpt from the financial statements of Talbot Industries: Effective September 30, 2016, the Company changed its method of accounting for inventories from the LIFO method principally to the Specific Identification method, because,

> Parque Corporation applied to Fairview Bank early in 2017 for a $400,000 five-year loan to finance plant modernization. The company proposes that the loan be unsecured and repaid from future operating cash flows. In support of the loan application, Parqu

> Keefer, Inc., began business on January 1, 2016. Information on its inventory purchases and sales during 2016 and 2017 follow: Required: 1. Calculate ending inventory, cost of goods sold, and gross margin for 2016 and 2017 under the periodic FIFO inv

> On January 1, 2017, Hillock Brewing Company sold 50,000 bottles of beer to various customers for $45,000 using credit terms of 3/10, n/30. These credit terms mean that customers receive a cash discount of 3% of invoice price for payments made within 10 d

> On January 2, 2017, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a cash selling price of $109,837. As payment, Criswell gave Mifflinburg Farm Supply $25,000 in cash and a $100,000, five-year note that provided for annual i

> On December 31, 2017, Roker, Inc. reported notes receivable of $63,930,000. This amount represents the present value of future cash flows (both principal and interest) discounted at a rate of 11.12% per annum. The schedule of collections of the receivabl

> The following information pertains to the financial statements of Buffalo Supply Company, a provider of plumbing fixtures to contractors in central Pennsylvania. Reconstruct all journal entries pertaining to Gross accounts receivable and Allowance for

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It does not sell technical support separately. Gerakos use

> Several executives of Computer Associates International, including former CEO Sanjay Kumar, pleaded guilty to providing fraudulent financial statements. The scheme was built around the backdating of sales contracts to affect the results of quarterly repo

> On December 1, 2017, Eva Corporation, a mortgage bank, has the following amounts on its balance sheet (in millions): Also on December 1, 2017, Eva transfers mortgage receivables with a book value of $20,000,000 to a securitization entity (SE). The ave

> At December 31, 2016, Oettinger Corporation, a premium kitchen cabinetmaker for the home remodeling industry, reported the following accounts receivable information on its year-end balance sheet: Gross accounts receivable …â

> Avillion Corporation had a $45,000 debit balance in Accounts receivable and a $3,500 credit balance in Allowance for uncollectibles on December 31, 2017. The company prepared the following aging schedule to record the adjusting entry for bad debts on Dec

> Baer Enterprises’s balance sheet at October 31, 2017 (fiscal year-end), includes the following: Accounts receivable …………………………………………$379,000 Less: Allowance for uncollectible …………………… (33,000) Accounts receivable (net) …………………………………………$346,000 Transact

> Moto-Lite Company is an original equipment manufacturer of high-quality aircraft engines that it traditionally has sold directly to aero clubs building their own aircraft. The engine’s selling price depends on its size and horsepower; Moto-Lite’s average

> The following notes are excerpted from the financial statements of three companies: The Company and certain of its domestic subsidiaries regularly discount trade notes receivable on a full recourse basis with banks. These trade notes receivable discounte

> Mikeska Companies purchased equipment for $108,000 from Power-line Manufacturing on January 1, 2015. Mikeska paid $18,000 in cash and signed a five-year, 5% installment note for the remaining $90,000 of the purchase price. The note calls for annual payme

> Fish Spotters, Inc., purchased a single-engine aircraft from National Aviation on January 1, 2014. Fish Spotters paid $55,000 cash and signed a three-year, 8% note for the remaining $45,000. Terms of the note require Fish Spotters to pay accrued interest

> The following information is taken from the financial statements of Ramsay Health Care Inc.: Required: 1. Reconstruct all journal entries relating to Gross accounts receivable and Allowance for doubtful accounts (that is, Allowance for uncollectibles)

> On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to a customer for $80,000. Gerakos sells the same software without technical support for $60,000. It sells technical support for $30,000. Gerakos allocates

> Atherton Manufacturing Company sold $200,000 of accounts receivable to a factor. Pertinent facts about this transaction include the following: 1. The factored receivables had a corresponding $4,000 balance in Allowance for uncollectibles. 2. The receiva

> Regulated utilities such as Duke Power Co. (a subsidiary of Duke Energy Corporation) are authorized to earn a specific rate of return on their capital investments. Energy regulators set a rate the utility can charge its customers for the electricity. If

> Needham Corporation has a $200,000 balloon mortgage payment due in early August. To meet its obligation, it decided on August 1 to accelerate collection of accounts receivable by assigning $260,000 of specified accounts to a commercial lender as collater

> Aardvark, Inc., began 2017 with the following receivables-related account balances: Aardvark’s transactions during 2017 include the following: Accounts receivable ………………….…………………. $575,000 Allowance for ………………….………………….…………………. 43,250 1. On April 1, 20

> Duke Energy Corporation’s 2014 annual report to shareholders contains the following note disclosure (edited for brevity): Regulatory Accounting: A substantial majority of Duke Energy’s regulated operations meet the criteria for regulatory accounting trea

> Food Lion, Inc., operates a chain of retail supermarkets principally in the southeastern United States. The supermarket business is highly competitive, and it is characterized by low profit margins. Food Lion competes with national, regional, and local s

> Following your retirement as senior vice president of finance for a large company, you joined the board of Cayman Grand Cruises, Inc. You serve on the compensation committee and help set the bonuses paid to the company’s top five execut

> John Brincat was the president and chief executive of Mercury Finance, an auto lender pecializing in high credit-risk customers. The company’s 1995 proxy statement contained the following description of Brincat’s pay package. Mr. Brincat is eligible for

> In late 2002, Frisby Technologies received a default notice from two of its creditors notifying the company that it was in default of the tangible net worth covenant in its loan agreements. Although the company had a period of time to cure the default, i

> Foot Locker, Inc., reported an $18 million loss on sales of $1,283 million for the quarter ended August 4, 2007. The quarterly financial filing (10-Q) also contained this warning for investors and creditors. Required: 1. What is a minimum fixed charge c

> Kleymenova Consulting, Inc., enters into a contract to provide consulting services. In each of the following independent scenarios, determine whether revenue should be recognized at a point in time or over time. 1. The consulting services are the provisi

> Explain the potential conflict of interest that arises when doctors own the hospitals in which they work.

> A feature of top executive pays at Krispy Kreme Doughnuts, Inc., is its compensation recovery policy. The policy allows Krispy Kreme to take back annual or long-term incentive compensation paid to executive officers and certain other management team memb

> Whole Foods Market’s Compensation Committee determines a portion of executive bonuses qualitatively. For the quantitative portion, the Committee selects from 13 performance metrics. For the fiscal year 2014, the Compensation Committee selected the follow

> Alliant Energy just received regulatory approval for its 2017 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation foll

> A brief description of Krispy Kreme’s annual cash bonus plan for top executives follows. The disclosure further indicates that eligible recipients would receive 70%, 100%, or 140% of the portion of the target bonus for performance attri