Question: For each of the investments shown in

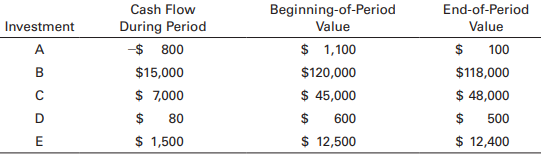

For each of the investments shown in the following table, calculate the rate of return earned over the period.

> Search online to find forecasts of the U.S. inflation rate for next year. Also find the current interest rate paid by one-year Treasury bills (this will be the nominal rate of interest for that type of security). Use the data to estimate the current real

> Two investments offer a series of cash payments over the next four years, as shown in the following table. a. What is the total amount of money paid by each investment over the four years? b. From a time value of money perspective, which of these investm

> Choose a publicly traded company that has been listed on a major exchange or in the over-the-counter market for at least five years. Use any data source of your choice to find the annual cash dividend, if any, paid by the company in each of the past five

> Describe how, if at all, a conservative and an aggressive investor might use each of the following types of orders as part of their investment programs. Contrast these two types of investors in view of these preferences. a. Market b. Limit c. Stop-loss

> Differentiate between the financial advice you would receive from a traditional investment advisor and one of the new robo-advisors. Which would you prefer to use, and why? How could membership in an investment club serve as an alternative to a paid inve

> Tyra loves to shop at her favorite store, Dollar Barrel, where she can find hundreds of items priced at exactly $1. Tyra has $200 to spend and is thinking of going on a shopping spree at Dollar Barrel, but she is also thinking of investing her money. a.

> Thomas Weisel, chief executive of a securities firm that bears his name, believes that individual investors already have too much information. “Many lose money by trading excessively on stray data,” he says. Other industry professionals oppose the SEC’s

> Why do you think some large, well-known companies such as Cisco Systems, Intel, and Microsoft prefer to trade on the Nasdaq OMX markets rather than on an organized securities exchange such as the NYSE (for which they easily meet the listing requirements)

> From 1999 to 2017, the average IPO rose by 18.4% in its first day of trading. In 1999, 117 deals doubled in price on the first day. What factors might contribute to the huge first-day returns on IPOs? Some critics of the current IPO system claim that und

> In most developed countries, prices of goods and services tend to rise over time, an economic phenomenon known as inflation. Of course, prices of some goods, such as consumer electronics, tend to fall as time passes, but from one year to the next, the ov

> In March 2018 a federal jury convicted San Diego stockbroker Paul Rampoldi of insider trading because he used information he obtained from a director at Ardea Biosciences about that firm’s upcoming (and unannounced) acquisition by AstraZeneca. Rampoldi m

> In recent years, business headlines were full of allegations of massive financial fraud committed by prominent business leaders. These allegations shocked the investment community and resulted in spectacular bankruptcies of large corporations. Civil and

> Before it was known for its financial problems, Enron, a utility firm operating pipelines and shipping natural gas, was a business pioneer, blazing new trails in the market for trading risk. In the 1980s the price of natural gas was deregulated, which me

> Buy, sell, or hold? Should investors trust and act on the investment recommendations of professional securities analysts? The evidence is somewhat mixed. Consider that from 1993 to 2015, about 55% of all analyst recommendations were to buy a stock rather

> Scandals involving fraudulent accounting practices resulted in public outrage, not only in the United States but around the world as well. In December 2013, the SEC charged Fifth Third Bank of Cincinnati and its former chief financial officer, Daniel Po

> Describe the structure of the overall investment process. Explain the role played by financial institutions and financial markets.

> The risk-free rate is 3%, and expected inflation is 2.5%. If inflation expectations change such that future expected inflation falls to 1.5%, what will the new risk-free rate be?

> What are foreign investments, and what role do they play for the individual investor?

> Define the term risk, and explain how risk is used to differentiate among investments.

> What is the relation between an investment’s risk and its return?

> Differentiate among the following types of investments, and cite an example of each: (a) securities and property investments; (b) direct and indirect investments; (c) debt, equity, and derivative securities; and (d) short-term and long-term investments.

> Define the term investment, and explain why individuals invest.

> Discuss each of the following as they are related to assessing bond market behavior. a. Bond yields b. Bond indexes

> Briefly describe the composition and general thrust of each of the following indexes. a. NYSE Composite Index b. NYSE MKT Composite Index c. Nasdaq Stock Market indexes d. Value Line Composite Index

> List each of the major averages or indexes prepared by (a) Dow Jones & Company and (b) Standard & Poor’s Corporation. Indicate the number and type of securities used in calculating each average or index.

> Discuss the impact of the Internet on the individual investor and summarize the types of resources it provides.

> Describe the risks of investing internationally, particularly currency exchange risk.

> Given a real rate of interest of 2%, an expected inflation premium of 3%, and risk premiums for investments A and B of 4% and 6%, respectively, find the following. a. The risk-free rate of return, rf b. The required returns for investments A and B

> Describe how foreign security investments can be made, both indirectly and directly.

> Why is globalization of securities markets an important issue today? How have international investments performed in recent years?

> Differentiate between a bull market and a bear market.

> What are electronic communication networks?

> Explain how the dealer market works. Be sure to mention market makers, bid and ask prices, the Nasdaq market, and the OTC market. What role does the dealer market play in initial public offerings (IPOs) and secondary distributions?

> For each of the items in the left-hand column, select the most appropriate item in the right-hand column. a. Prospectus b. Underwriting c. NYSE d. Nasdaq BX e. Listing requirements f. OTC 1. Trades unlisted securities 2. Buying securities from firms and

> Briefly describe the IPO process and the role of the investment bank in underwriting a public offering. Differentiate among the terms public offering, rights offering, and private placement.

> Describe the key advantages and disadvantages of short selling. How are short sales used to earn speculative profits?

> What relevance do margin requirements have in the short-selling process? What would have to happen to experience a margin call on a short-sale transaction? What two actions could be used to remedy such a call?

> What is the primary motive for short selling? Describe the basic short-sale procedure. Why must the short seller make an initial equity deposit?

> Below are the prices on the first and last day of the year for Netflix common stock for several recent years. Netflix paid no dividends over this period. Calculate the return that an investor would have earned in each calendar year. What is the average o

> Describe the procedures and regulations associated with margin trading. Be sure to explain restricted accounts, the maintenance margin, and the margin call. Define the term debit balance, and describe the common uses of margin trading.

> How does margin trading magnify profits and losses? What are the key advantages and disadvantages of margin trading?

> What is a long purchase? What expectation underlies such a purchase? What is margin trading, and what is the key reason why investors sometimes use it as part of a long purchase?

> Briefly describe the key requirements of the following federal securities laws: a. Securities Act of 1933 b. Investment Company Act of 1940 c. Investment Advisors Act of 1940 d. Insider Trading and Fraud Act of 1988 e. Regulation Fair Disclosure (2000) f

> How are after-hours trades typically handled? What is the outlook for after-hours trading?

> Differentiate between each of the following pairs of terms. a. Money market and capital market b. Primary market and secondary market c. Broker market and dealer market

> Why do insurance companies need employees with advanced training in investments?

> Why is an understanding of investment principles important to a senior manager working in corporate finance?

> Define, compare, and contrast the following short-term investments. a. I bonds b. U.S. Treasury bills c. Certificates of deposit d. Commercial paper e. Banker’s acceptances f. Money market mutual funds (money funds)

> Briefly describe the key features and differences among the following deposit accounts. a. Passbook savings account b. NOW account c. Money market deposit account d. Asset management account

> Explain the characteristics of short-term investments with respect to purchasing power and default risk.

> What makes an asset liquid? Why hold liquid assets? Would 100 shares of IBM stock be considered a liquid investment? Explain.

> Discuss the relation between stock prices and the business cycle.

> Describe the differing investment philosophies typically applied during each of the following stages of an investor’s life cycle. a. Youth (ages 20 to 45) b. Middle age (ages 46 to 60) c. Retirement years (age 61 and older)

> Define and differentiate among the following. Explain how each is related to federal income taxes. a. Active income b. Portfolio and passive income c. Capital gain d. Capital loss e. Tax planning f. Tax-advantaged retirement investments

> What should an investor establish before developing and executing an investment program? Briefly describe the elements of an investment policy statement.

> Briefly define and differentiate among the following investments. Which offer fixed returns? Which are derivative securities? Which offer professional investment management? a. Bonds b. Convertible securities c. Preferred stock d. Mutual funds e. Hedge f

> What is common stock, and what are its two sources of potential return?

> What are short-term investments? How do they provide liquidity?

> Differentiate between individual investors and institutional investors.

> Assume you purchased a bond for $9,700. The bond pays $100 interest every six months. You sell the bond after 18 months for $10,100. Calculate the following. a. Income b. Capital gain or loss c. Total return in dollars and as a percentage of the original

> Classify the roles of (a) government, (b) business, and (c) individuals as net suppliers or net demanders of funds.

> Briefly describe each of the following approaches to real estate market value: a. Cost approach b. Comparative sales approach c. Income approac

> What is the market value of a property? What is real estate appraisal? Comment on the following statement: “Market value is always the price at which a property sells.”

> Are real estate markets efficient? Why or why not? How does the efficiency or in efficiency of these markets affect both promotion and negotiation as parts of the property transfer process?

> How do restrictions on use, location, site, improvements, and property management affect a property’s competitive edge?

> What role does demand and supply play in determining the value of real estate? What are demographics and psychographics, and how are they related to demand? How does the principle of substitution affect the analysis of supply?

> Briefly describe the following important features to consider when making a real estate investment. a. Physical property b. Property rights c. Time horizon d. Geographic area

> Define and differentiate between income property and speculative property. Differentiate between and give examples of residential and commercial income properties.

> What are some popular types of collectibles? What important variables should be taken into account when investing in them?

> Describe the different ways in which one can hold gold and other precious metals as a form of investing. Discuss gemstone investments in terms of quality, commissions, and liquidity

> Assume you purchased a share of stock in Verizon communications at the beginning of 2017 for $54.58. A year later the stock was worth $53.53, but during 2017 it paid a dividend of $2.32. Calculate the following. a. Income b. Capital gain (or loss) c. Tot

> How does real estate investment differ from securities investment? Why might adding real estate to your investment portfolio decrease your overall risk? Explain.

> What are the three basic forms of tangible investments? Briefly discuss the investment merits of tangibles. Be sure to note the key factors that affect the future prices of tangibles.

> What are other tangibles? Briefly describe the conditions that tend to cause tangibles to rise in price.

> Briefly describe the basic structure and investment considerations associated with a real estate investment trust (REIT). What are the three basic types of REITs?

> Explain why, despite its being acceptable on the basis of NPV or of IRR, a real estate investment still might not be acceptable to a given investor.

> Define depreciation from a tax viewpoint. Explain why it is said to offer tax shelter potential. What real estate investments provide this benefit? Explain.

> List and briefly describe the five steps in the framework for real estate investment analysis.

> What is the net present value? What is the IRR? How are the NPV and IRR used to make real estate investment decisions?

> What is net operating income (NOI)? What are after-tax cash flows? Why do real estate investors prefer to use ATCFs?

> What is leverage, and what role does it play in real estate investment? How does it affect the risk–return values of a real estate investment?

> From her Investment Analysis class, Laura has been given an assignment to evaluate several securities on a risk-return tradeoff basis. The specific securities to be researched are International Business Machines, Helmerich & Payne, Inc., and the S&am

> What is real estate investment analysis? How does it differ from the concept of market value?

> Define and differentiate between real estate and other tangibles. Give examples of each of these forms of investment.

> Describe and compare the key features of each of the following types of individual retirement arrangements. a. Traditional deductible IRA b. Roth IRA c. Nondeductible IRA d. SIMPLE IRA

> Briefly describe each of the following programs for deferring taxes to retirement. a. 401(k) plans b. Keogh plans c. Individual retirement arrangements (IRAs)

> Explain conditions that favor the following strategies for deferring tax liabilities to the next year. a. A put hedge b. Selling a deep-in-the-money call option When is it best simply to hold the stock and do nothing?

> What is tax-favored income? Briefly describe the following forms of income excluded from taxation. a. Tax-free municipal bond interest b. Treasury and government agency issues c. Sale of a personal residence

> What is a tax shelter? What is the tax advantage of organizing certain business activities as a sole proprietorship or a partnership rather than as a corporation?

> How does tax avoidance differ from tax deferral? Explain whether either of these is a form of tax evasion.

> Describe the steps involved in calculating a person’s taxable income. How do tax credits differ from tax deductions?

> What is a capital asset? Explain how capital asset transactions are taxed, and compare their treatment with that of ordinary income.

> The historical returns for two investments—A and B—are summarized in the following table for the period 2016 to 2020. Use the data to answer the questions that follow. a. On the basis of a review of the return data, wh

> In each of the following cases, calculate the price of one share of the foreign stock measured in U.S. dollars (US$). a. A Belgian stock priced at 103.2 euros (€) when the exchange rate is 1.0753$/€ (i.e., each euro is worth $1.0753). b. A Swiss stock pr

> What is a limited liability company (LLC) and why has it become a popular business entity?

> How does a limited partnership (LP) differ from a corporation and a general partnership? How did the Tax Reform Act of 1986 affect the popularity of LPs as tax shelters?

> Discuss the investment suitability of a deferred annuity, particularly its positive and negative features. Briefly describe the procedures for buying annuities.

> Explain how a deferred annuity works as a tax shelter. How does a tax-sheltered annuity work, and who is eligible to purchase one? Discuss whether a deferred annuity is a better tax shelter than an IRA.

> Define the following terms as they are related to deferred annuities. a. Current interest rate b. Minimum guaranteed interest rate c. Payout

> Define an annuity, explain the role it might play in an investment portfolio, and differentiate between a. single-premium and installment annuities. b. immediate and deferred annuities. c. fixed and variable annuities.