Question: Global Pipes produces longitudinal submerged arc

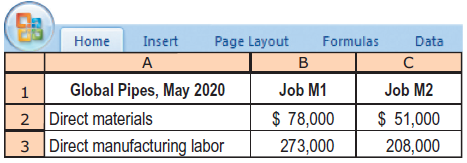

Global Pipes produces longitudinal submerged arc welded (LSAW) pipes for the oil, gas, and petrochemical industries. Each job is unique. In April 2020, it completed all outstanding orders, and then, in May 2020, it worked on only two jobs, M1 and M2:

Direct manufacturing labor is paid at the rate of $26 per hour. Manufacturing overhead costs are allocated at a budgeted rate of $20 per direct manufacturing labor-hour. Only Job M1 was completed in May.

Required

1. Calculate the total cost for Job M1.

2. 1,000 pipes were produced for Job M1. Calculate the cost per pipe.

3. Prepare the journal entry transferring Job M1 to finished goods.

4. What is the ending balance in the Work-in-Process Control account?

> The Alpha Company manufactures designer jewelry for jewelry stores. A new accountant intern at Alpha Company has accidentally deleted the calculations on the company’s variance analysis calculations for the year ended December 31, 2020.

> Dartford Enterprises Ltd manufactures just one product line of scientific calculators for engineers. The current standard cost of one unit of the product is as follows: During last month, due to an unexpected fall in demand for the product, only 15,000 u

> L’Accessorio, an Italian manufacturer of leather belts, budgeted prices for direct materials, direct manufacturing labor, and direct marketing (distribution) labor per luxury belt—€41, â‚&no

> Daytona Wheels is a Japanese tire manufacturer. For August 2021, it budgeted to manufacture and sell 3,000 tires at a variable cost of $74 per tire and total fixed costs of $54,000. The budgeted selling price was $110 per tire. Actual results in August 2

> Abeka Bakery Company had opening inventory of 14,800 units and closing inventory of 17,500 units. Profits based on marginal costing were £315,250 while overhead absorption rate was £5.20 unit. What is the profit using absorption costing? a. £224,250 b

> Amira Ltd is a trading company that sells mobile phones. The opening cash balance on January 1 was expected to be £30,000. The sales budgeted were as follows: Analysis of records shows that trade debtors settle their accounts as follow: &aci

> Jiffy Mart has a Kaizen (continuous improvement) approach to budgeting monthly activity costs for each month of 2021. Each successive month, the budgeted cost-driver rate decreases by 0.4% relative to the preceding month. So, for example, February’s budg

> The Jerico store of Jiffy Mart, a chain of small neighborhood convenience stores, is preparing its activity-based budget for January 2021. Jiffy Mart has three product categories: soft drinks (35% of cost of goods sold [COGS]), fresh produce (25% of COGS

> Roletter Company makes and sells artistic frames for pictures of weddings, graduations, and other special events. Bob Anderson, the controller, is responsible for preparing Roletter’s master budget and has accumulated the following info

> Xander Manufacturing Company manufactures blue rugs using wool and dye as direct materials. One rug is budgeted to use 36 skeins of wool at a cost of $2 per skein and 0.8 gallons of dye at a cost of $6 per gallon. All other materials are indirect. At the

> Price, Inc., bottles and distributes mineral water from the company’s natural springs in northern Oregon. Price markets two products: 12-ounce disposable plastic bottles and 1-gallon reusable plastic containers. Required 1. For 2020, Price marketing man

> The Deluxe Motorcar in northern California manufactures motor cars of all categories. Its budgeted sales volume for the most popular sedan model XE8 in 2020 is 4,000 units. Deluxe Motorcar has a beginning finished inventory of 600 units. Its ending inven

> Augustine Company sells a product for £50. Budgeted sales for the first quarter of 2020 are as follows: The company collects 60% in the month of sale, 20% in the following month, and 10% two months after the sale. Ten percentage of all sales

> Nova Plastics produces 10-liter plastic buckets. The company expects to produce 825,000 buckets in 2020. Nova Plastics purchases high-density polyethylene (HDPE) to produce the buckets. Each pound of HDPE produces two 10-liter buckets. Nova’s target endi

> Sandra Martins, a confectionery based in Austria, decides to produce peanut packs for supermarkets in Salzburg. The projected sales units and selling price per pack for 2021 for its three brands of peanut packs are: Required Compute the budgeted sales.

> Which of the following is indicated by an unfavorable fixed overhead spending variance? a. There was more excess capacity than planned b. The price of fixed overhead items cost more than budgeted c. The fixed overhead cost-allocation base was not used ef

> Coronavirus disease 2019 (COVID-19) was first identified in December 2019 and resulted in an ongoing pandemic. There are currently few effective treatments for coronavirus with doctors relying on patients’ immune systems. In 2020, a UK-based bio-tech com

> Legion Bank (LB) is examining the profitability of its Star Account, a combined savings and checking account. Depositors receive a 6% annual interest rate on their average deposit. LB earns an interest rate spread of 3% (the difference between the rate a

> The job-costing system at Sheri’s Custom Framing has five indirect-cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 215, an ord

> Ramirez Wholesalers operates at capacity and sells furniture items to four department-store chains (customers). Mr. Ramirez commented, “We apply ABC to deter- mine product-line profitability. The same ideas apply to customer profitabili

> Caleb Enterprises Ltd. manufactures electrical cables for households and industries. The company has identified the following overheads activities, costs, and activity drivers for the coming year. The company’s normal activity requires

> Aniline Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Aniline classifies its various printing jobs as standard jobs or special jobs. Aniline’s simple job-costing system has two direc

> CKM is an architectural firm that designs and builds build- ings. It prices each job on a cost plus 20% basis. Overhead costs in 2020 are $4,011,780. CKM’s simple cost- ing system allocates overhead costs to its jobs based on number of

> John Bradshaw & Bros Ltd. manufactures different plastic toys for kindergartens in Lagos, Nigeria. Details of the toy production budget for the next accounting year are as follows. Note all costs are presented using the currency of Nigeria i.e., Nige

> Triumph Trophies makes trophies and plaques and operates at capacity. Triumph does large custom orders, such as the participant trophies for the Minnetonka Little League. The controller has asked you to compare plant-wide, department, and activity- based

> Automotive Products (AP) designs and pro- duces automotive parts. In 2020, actual variable manufacturing overhead is $308,600. AP’s simple costing system allocates variable manufacturing overhead to its three customers based on machine-

> The following data relate to the budget and actual results of Oscar Enterprises, which produces and sells net balls in France. Use the information above to answer questions 7-16–7-20 The standard cost of €15.00 per a n

> The Walliston Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in WG and thei

> CoreTech Laboratories does heat testing (HT) and stress testing (ST) on materials and operates at capacity. Under its current simple costing system, CoreTech aggregates all operating costs of $1,800,000 into a single overhead cost pool. CoreTech calculat

> SharpPitch, Inc., manufactures karaoke machines for several well-known companies. The machines differ significantly in their complexity and their manufacturing batch sizes. The following costs were incurred in 2019: a. Indirect manufacturing labor costs

> The Row-On-Watershed Company (ROW) produces a line of non-motorized boats. ROW uses a normal-costing system and allocates manufacturing overhead using direct manufacturing labor cost. The following data are for 2020: Inventory balances on December 31, 20

> Clayton Solutions de- signs Web pages for clients in the education sector. The company’s job-costing system has a single direct cost category (Web-designing labor) and a single indirect cost pool composed of all overhead costs. Overhead

> Discuss the role of management accounting in decision-making activities in an organization.

> Differentiate between variable costs and fixed costs. Give some examples.

> How does cost accounting help organizations assess their competitive advantage in value chain analysis?

> Why might an advertising agency use job costing for an advertising campaign by PepsiCo, whereas a bank might use process costing to determine the cost of checking account deposits?

> What are the strategic consequences of product undercosting and overcosting?

> Explain the concept of cost–volume–profit (CVP) analysis.

> Chico & Partners, a Quebec-based public accounting partnership, specializes in audit services. Its job-costing system has a single direct-cost category (professional labor) and a single indirect-cost pool (audit support, which contains all costs of t

> What is conceptually the most defensible method for allocating multiple support-department costs? Why?

> Distinguish between revenue allocation and bundled product or service.

> What are some common clauses that are often included in contracts based on cost accounting information?

> The “fairness or equity” criterion is most applicable to the government rather than the private sector. Explain.

> What factors should be considered by managers when allocating resources among customers?

> Describe peak-load pricing and give an example.

> Define price discrimination and give an example.

> What are the key components of the financial perspective and customer perspective of a balanced scorecard?

> Differentiate between a strategy map and a balanced scorecard.

> What are ways that a company can achieve cost leadership?

> State the importance of cost information in decision making.

> What is a one-time-only special order?

> What is the likelihood value? Why do prediction models attempt to maximize it?

> How do data scientists use cross-validation and holdout samples?

> What is pruning? Why is it helpful?

> Why does overfitting occur?

> What is Gini impurity?

> Describe the decision tree technique of predictive modeling.

> Define target leakage.

> What is the seven-step decision-making process for applying machine-learning techniques in business situations?

> Docks Transport assembles prestige manufactured homes. Its job- costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead allocated at a budgeted $21 per machine-hou

> How do management accountants help managers to operationalize data science models?

> How does the management accountant use the payoff matrix to make decisions using data science models?

> Explain false positives (FP) and false negatives (FN).

> What is the receiver operating characteristic (ROC) curve?

> Explain the bias–variance tradeoff.

> How do management accountants work with data scientists to create value for an organization?

> When using the high-low method, should you base the high and low observations on the dependent variable or on the cost driver?

> Differentiate between the industrial engineering method of cost estimation and the quantitative method.

> What criteria are used by managers in the classification of costs into variable and fixed components?

> Why is a linear cost function useful?

> Virtual Company produces gadgets for the coveted small appliance market. The following data reflect activity for the year 2020: Virtual Co. uses a normal-costing system and allocates overhead to work in process at a rate of $2.50 per direct manufacturing

> Explain linear cost function and give an example.

> Do companies in either the service sector or the merchandising sector make choices about absorption costing versus variable costing?

> How does the treatment of fixed production overhead differ under variable costing and absorption costing?

> What needs to be calculated to explain a variable flexible-budget variance? Explain what an €8,000 unfavorable flexible-budget variance indicates.

> Assume variable manufacturing overhead is allocated using machine-hours. Give three possible reasons for a favorable variable overhead efficiency variance.

> Describe some of the characteristics of a flexible budget.

> Explain why standard costing should not be used to report results in year-end financial statements. Why would managers use standard costing?

> What are the main features to be considered in planning variable overhead costs and fixed over- head costs?

> How can flexible-budget variance analysis be used to control costs of activity areas?

> How are the main components of materials variances interrelated in a flexible budget?

> Olga Ltd produces stapling machines for most businesses operating in New Orleans. The production process involves three stages: cutting department, assembly department and painting and finishing department. Required Each department is treated as a cost

> Which of the following statements is true about a master budget? I. It is a summary of all other budgets. It is expressed as a budgeted income and is mentioned in the balance sheet. II. The master budget comprises of the operating budget and the financia

> Describe why standard costs are used in variance analysis.

> When is a flexible budget similar to a static budget? Why?

> What are the impacts of variances on an operating income?

> Why are standard costs often used in variance analysis?

> Benchmarking is about comparing your firm’s performance against the best levels of performance in the market and has nothing to do with variance analyses.” Do you agree?

> When inputs are substitutable, how can the direct materials efficiency variance be decomposed further to obtain useful information?

> Comment on the following statement made by a management accountant: “The plant manager has little knowledge of the individual impacts of the purchase department, the sales department, and the production department on the total unfavorable variance in our

> What is the purpose of variance analysis to management?

> What is the usual starting point for an operating budget?

> Budgets meet the cost–benefit test by pushing managers to act differently.” Do you agree? Explain.

> Holland Builders uses normal costing and allocates manufacturing overhead to jobs based on a budgeted labor-hour rate and actual direct labor-hours. Under- or over allocated overhead, if immaterial, is written off to cost of goods sold. During 2020, Holl

> Budgets can promote coordination and communication among subunits within the company.” Do you agree? Explain.

> List the key questions that a manager must consider when developing a successful strategy.

> What are the advantages of a budget?

> Define a master budget and explain its purpose. Describe its components.

> Explain why cash budgets are important.

> What are some additional considerations when budgeting in multinational companies?