Question: Helen Morgan, CFA, has been asked to

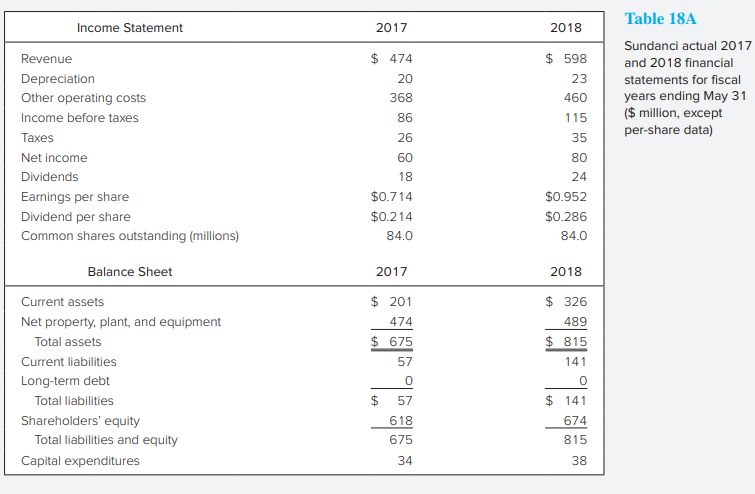

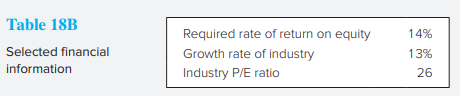

Helen Morgan, CFA, has been asked to use the DDM to determine the value of Sundanci, Inc. Morgan anticipates that Sundanci’s earnings and dividends will grow at 32% for two years and 13% thereafter. Calculate the current value of a share of Sundanci stock by using a two-stage dividend discount model and the data from Tables 18A and 18B.

> a. Pamela Itsuji, a currency trader for a Japanese bank, is evaluating the price of a 6-month Japanese yen/U.S. dollar currency futures contract. She gathers the following currency and interest rate data: Japanese yen/U.S. dollar spot currency exchange r

> The Windsor Foundation, a U.S.-based, not-for-profit charitable organization, has a diversified investment portfolio of $100 million. Windsor’s board of directors is considering an initial investment in emerging market equities. Robert Houston, treasurer

> A global manager plans to invest $1 million in U.S. government cash equivalents for the next 90 days. However, she is also authorized to use non–U.S. government cash equivalents, as long as the currency risk is hedged to U.S. dollars us

> You are a U.S. investor considering purchase of one of the following securities. Assume that the currency risk of the Canadian government bond will be hedged, and the 6-month discount on Canadian dollar forward contracts is −.75% versus

> John Irish, CFA, is an independent investment adviser who is assisting Alfred Darwin, the head of the Investment Committee of General Technology Corporation, to establish a new pension fund. Darwin asks Irish about international equities and whether the

> An analyst wants to evaluate portfolio X, consisting entirely of U.S. common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for portfolio X, the market portfolio

> The Retired Fund is an open-ended mutual fund composed of $500 million in U.S. bonds and U.S. Treasury bills. This fund has had a portfolio duration (including T-bills) of between 3 and 9 years. Retired has shown first-quartile performance over the past

> Carl Karl, a portfolio manager for the Alpine Trust Company, has been responsible since 2023 for the City of Alpine’s Employee Retirement Plan, a municipal pension fund. Alpine is a growing community, and city services and employee payr

> James Chan is reviewing the performance of the global equity managers of the Jarvis University endowment fund. Williamson Capital is currently the endowment fund’s only large-capitalization global equity manager. Performance data for Wi

> Trustees of the Pallor Corp. pension plan ask consultant Donald Millip to comment on the following statements. What should his response be? a. Median manager benchmarks are statistically unbiased measures of performance over long periods of time. b. Medi

> During the annual review of Acme’s pension plan, several trustees questioned their investment consultant about various aspects of performance measurement and risk assessment. a. Comment on the appropriateness of using each of the following benchmarks for

> a. Footnote 7 presents the formula for the convexity of a bond. Build a spreadsheet to calculate the convexity of a 5-year, 8% coupon bond making annual payments at the initial yield to maturity of 10%. b. What is the convexity of a 5-year zero-coupon bo

> You and a prospective client are considering the measurement of investment performance, particularly with respect to international portfolios for the past five years. The data you discussed are presented in the following table: a. Assume that the data fo

> You ran a regression of the yield of KC Company’s 10-year bond on the 10-year U.S. Treasury benchmark’s yield using month-end data for the past year. You found the following result: YieldKC = 0.54 + 1.22 YieldTreasury where YieldKC is the yield on the K

> You are provided the information outlined as follows to be used in solving this problem. Situation A A fixed-income manager holding a $20 million market value position of U.S. Treasury 11¾% bonds maturing November 15, 2035, expects the econ

> Janice Delsing, a U.S.-based portfolio manager, manages an $800 million portfolio ($600 million in stocks and $200 million in bonds). In reaction to anticipated short-term market events, Delsing wishes to adjust the allocation to 50% stock and 50% bonds

> After studying Iris Hamson’s credit analysis, George Davies is considering whether he can increase the holding-period return on Yucatan Resort’s excess cash holdings (which are held in pesos) by investing those cash ho

> René Michaels, CFA, plans to invest $1 million in U.S. government cash equivalents for the next 90 days. Michaels’s client has authorized her to use non–U.S. government cash equivalents, but only if the cu

> Suppose your client says, “I am invested in Japanese stocks but want to eliminate my exposure to this market for a period of time. Can I accomplish this without the cost and inconvenience of selling out and buying back in again if my expectations change?

> Donna Doni, CFA, wants to explore potential inefficiencies in the futures market. The TOBEC stock index has a spot value of 185. TOBEC futures contracts are settled in cash and underlying contract values are determined by multiplying $100 times the index

> Ken Webster manages a $400 million equity portfolio benchmarked to the S&P 500 index. Webster believes the market is overvalued when measured by several traditional fundamental/ economic indicators. He is concerned about potential losses but recogniz

> A stock index is currently trading at 50. Paul Tripp, CFA, wants to value 2-year index options using the binomial model. The stock will either increase in value by 20% or fall in value by 20%. The annual risk-free interest rate is 6%. No dividends are pa

> The aspect least likely to be included in the portfolio management process is a. Identifying an investor’s objectives, constraints, and preferences. b. Organizing the management process itself. c. Implementing strategies regarding the choice of assets to

> Joel Franklin is a portfolio manager responsible for derivatives. Franklin observes an Americanstyle option and a European-style option with the same strike price, expiration, and underlying stock. Franklin believes that the European-style option will ha

> Michael Weber, CFA, is analyzing several aspects of option valuation, including the determinants of the value of an option, the characteristics of various models used to value options, and the potential for divergence of calculated option values from obs

> The board of directors of Abco Company is concerned about the downside risk of a $100 million equity portfolio in its pension plan. The board’s consultant has proposed temporarily (for 1 month) hedging the portfolio with either futures or options. Referr

> a. Consider a bullish spread option strategy using a call option with a $25 exercise price priced at $4 and a call option with a $40 exercise price priced at $2.50. If the price of the stock increases to $50 at expiration and each option is exercised on

> Rich McDonald, CFA, is evaluating his investment alternatives in Ytel Incorporated by analyzing a Ytel convertible bond and Ytel common equity. Characteristics of the two securities are given in the following exhibit: a. Calculate, based on the exhibit,

> Suresh Singh, CFA, is analyzing a convertible bond. The characteristics of the bond and the underlying common stock are given in the following exhibit: Convertible Bond Characteristics Par value………………………………………………………$1,000 Annual coupon rate (annual pay)…

> Martin Bowman is preparing a report distinguishing traditional debt securities from structured note securities. Discuss how the following structured note securities differ from a traditional debt security with respect to coupon and principal payments: a.

> Donna Donie, CFA, has a client who believes the common stock price of TRT Materials (currently $58 per share) could move substantially in either direction in reaction to an expected court decision involving the company. The client currently owns no TRT s

> In reviewing the financial statements of the Graceland Rock Company, you note that net income increased while cash flow from operations decreased from 2020 to 2021. a. Explain how net income could increase for Graceland Rock Company while cash flow from

> Eastover Company (EO) is a large, diversified forest products company. Approximately 75% of its sales are from paper and forest products, with the remainder from financial services and real estate. The company owns 5.6 million acres of timberland, which

> Your client says, “With the unrealized gains in my portfolio, I have almost saved enough money for my daughter to go to college in 8 years, but educational costs keep going up.” On the basis of this statement alone, which one of the following appears to

> Eastover Company (EO) is a large, diversified forest products company. Approximately 75% of its sales are from paper and forest products, with the remainder from financial services and real estate. The company owns 5.6 million acres of timberland, which

> Eastover Company (EO) is a large, diversified forest products company. Approximately 75% of its sales are from paper and forest products, with the remainder from financial services and real estate. The company owns 5.6 million acres of timberland, which

> Eastover Company (EO) is a large, diversified forest products company. Approximately 75% of its sales are from paper and forest products, with the remainder from financial services and real estate. The company owns 5.6 million acres of timberland, which

> Janet Ludlow is a recently hired analyst. After describing the electric toothbrush industry, her first report focuses on two companies, QuickBrush Company and SmileWhite Corporation, and concludes: QuickBrush is a more profitable company than SmileWhite,

> The DuPont formula defines the net return on shareholders’ equity as a function of the following components: ∙ Operating margin ∙ Asset turnover ∙ Interest burden ∙

> Jones Group has been generating stable after-tax return on equity (ROE) despite declining operating income. Explain how it might be able to maintain its stable after-tax ROE.

> The information in the following exhibit comes from the notes to the financial statements of QuickBrush Company and SmileWhite Corporation: Determine which company has the higher quality of earnings by discussing each of the three notes.

> Rio National Corp. is a U.S.-based company and the largest competitor in its industry. Tables 18F through 18I present financial statements and related information for the company. Table 18J presents relevant industry and market data. The portfolio manag

> Janet Ludlow’s firm requires all its analysts to use a two-stage dividend discount model (DDM) and the capital asset pricing model (CAPM) to value stocks. Using the CAPM and DDM, Ludlow has valued QuickBrush Company at $63 per share. Sh

> Peninsular Research is initiating coverage of a mature manufacturing industry. John Jones, CFA, head of the research department, gathered the following fundamental industry and market data to help in his analysis: Forecast industry earnings retention rat

> An investor in the common stock of companies in a foreign country may wish to hedge against the _____ of the investor’s home currency and can do so by _____ the foreign currency in the forward market. a. depreciation; selling. b. appreciation; purchasing

> Mike Brandreth, an analyst who specializes in the electronics industry, is preparing a research report on Dynamic Communication. A colleague suggests to Brandreth that he may be able to determine Dynamic’s implied dividend growth rate from Dynamic’s curr

> Dynamic Communication is a U.S. industrial company with several electronics divisions. The company has just released its 2020 annual report. Tables 18C and 18D present a summary of Dynamic’s financial statements for the years 2019 and 2

> Christie Johnson, CFA, has been assigned to analyze Sundanci using the constant dividend growth price/earnings (P/E) ratio model. Johnson assumes that Sundanci’s earnings and dividends will grow at a constant rate of 13%. a. Calculate t

> Abbey Naylor, CFA, has been directed to determine the value of Sundanci’s stock using the Free Cash Flow to Equity (FCFE) model. Naylor believes that Sundanci’s FCFE will grow at 27% for two years and 13% thereafter. C

> Shaar (see CFA Problem 10) has revised slightly her estimated earnings growth rate for Rio National and, using normalized (underlying trend) EPS, which is adjusted for temporary impacts on earnings, now wants to compare the current value of Rio National&

> While valuing the equity of Rio National Corp. (see CFA Problem 9), Katrina Shaar is considering the use of either cash flow from operations (CFO) or free cash flow to equity (FCFE) in her valuation process. a. State two adjustments that Shaar should mak

> At Litchfield Chemical Corp. (LCC), a director of the company said that the use of dividend discount models by investors is “proof ” that the higher the dividend, the higher the stock price. a. Using a constant-growth dividend discount model as a basis o

> As a securities analyst, you have been asked to review a valuation of a closely held business, Wigwam Autoparts Heaven, Inc. (WAH), prepared by the Red Rocks Group (RRG). You are to give an opinion on the valuation and to support your opinion by analyzin

> Janet Ludlow is preparing a report on U.S.-based manufacturers in the electric toothbrush industry and has gathered the information shown in Tables 17B and 17C. Ludlow’s report concludes that the electric toothbrush industry is in the m

> The correlation coefficient between the returns on a broad index of U.S. stocks and the returns on indexes of the stocks of other industrialized countries is mostly _____, while the correlation coefficient between the returns on highly diversified portfo

> Adams’s research report (see CFA Problem 3) continued as follows: “With a business recovery already under way, the expected profit surge should lead to a much higher price for Universal Auto stock. We strongly recommend purchase.” a. Discuss the business

> As part of your analysis of debt issued by Monticello Corporation, you are asked to evaluate two of its bond issues, shown in the following table. a. Using the duration and yield information in the table above, compare the price and yield behavior of the

> Universal Auto is a large multinational corporation headquartered in the United States. For segment reporting purposes, the company is engaged in two businesses: production of motor vehicles and information processing services. The motor vehicle busines

> Janet Meer is a fixed-income portfolio manager. Noting that the current shape of the yield curve is flat, she considers the purchase of a newly issued, 7% coupon, 10-year maturity, option-free corporate bond priced at par. The bond has the following feat

> Carol Harrod is the investment officer for a $100 million U.S. pension fund. The fixed-income portion of the portfolio is actively managed, and a substantial portion of the fund’s large capitalization U.S. equity portfolio is indexed and managed by Webb

> A member of a firm’s investment committee is very interested in learning about the management of fixed-income portfolios. He would like to know how fixed-income managers position portfolios to capitalize on their expectations concerning three factors tha

> You are the manager for the bond portfolio of a pension fund. The policies of the fund allow for the use of active strategies in managing the bond portfolio. It appears that the economic cycle is beginning to mature, inflation is expected to accelerate,

> Patrick Wall is considering the purchase of one of the two bonds described in the following table. Wall realizes his decision will depend primarily on effective duration, and he believes that interest rates will decline by 50 basis points at all maturiti

> One common goal among fixed-income portfolio managers is to earn high incremental returns on corporate bonds versus government bonds of comparable durations. The approach of some corporate-bond portfolio managers is to find and purchase those corporate b

> Sandra Kapple presents Maria VanHusen with a description, given in the following table, of the bond portfolio held by the Star Hospital Pension Plan. All securities in the bond portfolio are noncallable U.S. Treasury securities. a. Calculate the modified

> You are a U.S. investor who purchased British securities for £2,000 one year ago when the British pound cost U.S.$1.50. What is your total return (based on U.S. dollars) if the value of the securities is now £2,400 and the pound is worth $1.45? No divide

> Bonds of Zello Corporation with a par value of $1,000 sell for $960, mature in five years, and have a 7% annual coupon rate paid semiannually. a. Calculate each of the following yields: i. Current yield. ii. Yield to maturity to the nearest whole percent

> Identify the fundamental distinction between a futures contract and an option contract, and briefly explain the difference in the manner that futures and options modify portfolio risk.

> An unanticipated expansionary monetary policy has been implemented. Indicate the impact of this policy on each of the following four variables: a. Inflation rate. b. Real output and employment. c. Real interest rate. d. Nominal interest rate.

> a. Explain the impact on the offering yield of adding a call feature to a proposed bond issue. b. Explain the impact on both effective bond duration and convexity of adding a call feature to a proposed bond issue.

> Use the following data to solve this problem. Cash payments for interest ……………………………………….$(12) Retirement of common stock ………………………………………(32) Cash payments to merchandise suppliers ……………………..(85) Purchase of land …………………………………………………………..(8) Sale of equip

> a. A 6% coupon bond paying interest annually has a modified duration of 10 years, sells for $800, and is priced at a yield to maturity of 8%. If the YTM increases to 9%, what is the predicted change in price based on the bond’s duration? b. A 6% coupon b

> Briefly discuss what actions the U.S. Federal Reserve would likely take in pursuing an expansionary monetary policy using each of the following three monetary tools: a. Reserve requirements. b. Open market operations. c. Discount rate.

> An insurance company must make payments to a customer of $10 million in one year and $4 million in five years. The yield curve is flat at 10%. a. If it wants to fully fund and immunize its obligation to this customer with a single issue of a zero-coupon

> Which of the following forecasts is consistent with a steeply upwardly sloping yield curve? a. Monetary policy will be expansive and fiscal policy will be expansive. b. Monetary policy will be expansive while fiscal policy will be restrictive. c. Monetar

> You predict that interest rates are about to fall. Which bond will give you the highest capital gain? a. Low coupon, long maturity. b. High coupon, short maturity. c. High coupon, long maturity. d. Zero coupon, long maturity.

> Assume you invested in an asset for two years. The first year you earned a 15% return, and the second year you earned a negative 10% return. What was your annual geometric return?

> Choose an industry and identify the factors that will determine its performance in the next three years. What is your forecast for performance in that time period?

> What monetary and fiscal policies might be prescribed for an economy in a deep recession?

> a. Find the duration of a 6% coupon bond making annual coupon payments if it has three years until maturity and has a yield to maturity of 6%. b. What is the duration if the yield to maturity is 10%?

> A 9-year bond paying coupons annually has a yield of 10% and a duration of 7.194 years. If the market yield changes by 50 basis points, what is the percentage change in the bond’s price?

> Institutional Advisors for All Inc., or IAAI, is a consulting firm that advises foundations, endowments, pension plans, and insurance companies. The members of the research department foresee an upward trend in job creation and consumer confidence and pr

> Institutional Advisors for All Inc., or IAAI, is a consulting firm that advises foundations, endowments, pension plans, and insurance companies. The members of the research department foresee an upward trend in job creation and consumer confidence and pr

> If you believe the U.S. dollar will depreciate more dramatically than other investors anticipate, what will be your stance on investments in U.S. auto producers?

> Find the duration of a bond with a settlement date of May 27, 2023, and maturity date November 15, 2034. The coupon rate of the bond is 7%, and the bond pays coupons semiannually. The bond is selling at a bond-equivalent yield to maturity of 8%. You can

> Spice asks Meyers (see Problem 17) to quantify price changes from changes in interest rates. To illustrate, Meyers computes the value change for the fixed-rate note in the table. Specifically, he assumes an increase in the level of interest rate of 100 b

> Frank Meyers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice, is very interested in learning about the management of fixed-income portfolios. Spice has approached Meyers with several qu

> The administrator of a large pension fund wants to evaluate the performance of four portfolio managers. Each portfolio manager invests only in U.S. common stocks. Assume that during the most recent 5-year period, the average annual total rate of return i

> Which of the following is not a governmental structural policy that supply-side economists believe would promote long-term growth in an economy? a. A redistributive tax system. b. A promotion of competition. c. Minimal government interference in the econ

> Here are four industries and four forecasts for the macroeconomy. Match the industry to the scenario in which it is likely to be the best performer.

> Why do you think the index of consumer expectations for business conditions is a useful leading indicator of the macroeconomy? (See Table 17.2.)

> For each pair of firms, choose the one that you think would be more sensitive to the business cycle. a. General Autos or General Pharmaceuticals. b. Friendly Airlines or Happy Cinemas.

> In which stage of the industry life cycle would you place the following industries? (Note: There is considerable room for disagreement concerning the “correct” answers to this question.) a. Oil well equipment. b. Computer hardware. c. Computer software.

> Currently, the term structure is as follows: 1-year zero-coupon bonds yield 7%; 2-year zerocoupon bonds yield 8%; 3-year and longer-maturity zero-coupon bonds all yield 9%. You are choosing between 1-, 2-, and 3-year maturity bonds all paying annual coup

> According to supply-side economists, what will be the long-run impact on prices of a reduction in income tax rates?

> Prices of long-term bonds are more volatile than prices of short-term bonds. However, yields to maturity of short-term bonds fluctuate more than yields of long-term bonds. How do you reconcile these two empirical observations?

> A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of returns over a money market rate, which currently is 5%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio

> Which of the following hedge fund types is most likely to have a return that is closest to risk free? a. A market-neutral hedge fund. b. An event-driven hedge fund. c. A long/short hedge fund.

> A pension fund portfolio begins with $500,000 and earns 15% the first year and 10% the second year. At the beginning of the second year, the sponsor contributes another $500,000. What were the time-weighted and dollar-weighted rates of return?

> If you were to invest $10,000 in the British bills of Problem 7, how would you lock in the dollar denominated return?