Question: In January, Harry and Belinda Johnson had $

In January, Harry and Belinda Johnson had $10,660 in monetary assets (see page 109): $1,100 in cash on hand; $1,200 in a statement savings account at First Credit Union earning 1.0 percent interest; $4,000 in a statement savings account at the Far West Savings Bank earning 1.1 percent interest; $2,260 in Homestead Credit Union earning a dividend of 1.3 percent; and $2,100 in their regular checking account at First Credit Union earning 1 percent.

Required:

(a) What specific recommendations would you give the Johnsons for selecting checking and savings accounts that will enable them to effectively use the first and second tools of monetary asset management?

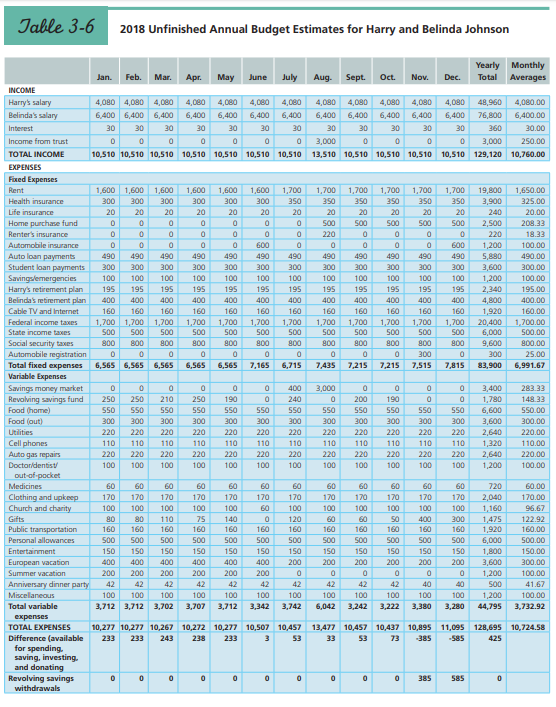

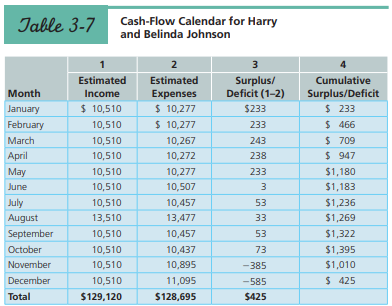

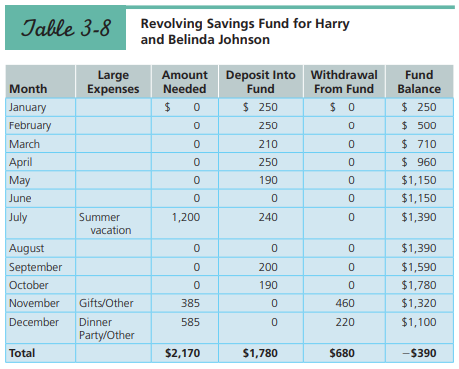

(b) Their annual budget, cash-flow calendar, and revolving savings fund (see Tables 3-6, 3-7, and 3-8 on pages 97, 98 and 99) indicate that the Johnsons will have additional amounts to deposit in the coming year. What are your recommendations for the Johnsons regarding use of a money market account? Why?

Tables 3-6:

Tables 3-7:

Tables 3-8:

(c) What savings instrument would you recommend for their savings, given their objective of saving enough to purchase a new home? Support your answer.

(d) If the Johnsons could put most of their monetary assets ($10,660) into a money market account earning 1.4 percent, how much would they have in the account after one year?

(e) Recall from Chapter 3 that Harry and Belinda had some disagreements regarding their anniversary dinner and holiday gift spending and ended up not having a balanced budget for the year. Provide some advice for the couple about how to resolve or, better, prevent such disagreements in the future.

Transcribed Image Text:

Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Yearly Monthly Jan. Feb. Mar. Apr. Мay June July Aug. Sept. Oc. Nov. Dec. Total Averages INCOME 4,080 4,080 4,080 Harry's salary Belinda's salary 4,080 4,080 4,080 4,080 4,080 4,080 4,080 4,080 4,080 48,960 4,080.00 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 6,400 76,800 6,400.00 Interest 30 30 30 30 30 30 30 30 30 30 30 30 360 30.00 Income from trust 3,000 3,000 250.00 TOTAL INCOME 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13,510 10,51o 10,510 10,510 10,510 129,120 10,760.00 ЕXPENSES Fixed Expenses Rent 1,600 1,600 1,600 1,600 1,600 1,600 1,700 1,700 1,700 1,700 1,700 1,700 19,800 1,650.00 Health insurance 300 300 300 300 300 300 350 350 350 350 350 350 3,900 325.00 Life insurance 20 20 20 20 20 20 20 20 20 20 20 20 240 20.00 Home purchase fund 500 500 500 500 500 2,500 208.33 Renter's insurance 220 220 18.33 Automobile insurance 600 600 1,200 100.00 Auto loan payments Student loan payments 490 490 490 490 490 490 490 490 490 490 490 490 5,880 490.00 300 300 300 300 300 300 300 300 300 300 300 300 3,600 300.00 Savingslemergencies Harry's retirement plan Belinda's retirement plan 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 195 195 195 195 195 195 195 195 195 195 195 195 2,340 195.00 400 400 400 400 400 400 400 400 400 400 400 400 4,800 400.00 160.00 1,700.00 500.00 Cable TV and Internet 160 160 160 160 160 160 160 160 160 160 160 160 1,920 20,400 6,000 Federal income taxes 1,700 1,700 1,700 1,700 500 1,700 S00 1,700 1,700 1,700 1,700 500 1,700 500 1,700 500 1,700 State income taxes S00 500 500 500 500 500 S00 Social security taxes Automobile registration Total fixed expenses Variable Expenses 800 800 800 800 800 800 800 800 800 800 800 800 9,600 800.00 300 300 25.00 6,565 6,565 6,565 6,565 6,565 7,165 6,715 7,435 7,215 7,215 7,515 7,815 83,900 6,991.67 Savings money market Revolving savings fund Food (home) 400 3,000 3,400 283.33 250 250 210 250 190 240 200 190 1,780 148 33 550 550 550 550 550 550 550 550 550 550 550 550 6,600 550.00 Food (out) 300 300 300 300 300 300 300 300 300 300 300 300 3,600 300.00 Utilities 220 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Cell phones Auto gas repairs 110 110 110 110 110 110 110 110 110 110 110 110 1,320 110.00 220 220 220 220 220 220 220 220 220 220 220 220 2,640 220.00 Doctoridentist 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 out-of-pocket Medicines 60 60 60 60 60 60 60 60 60 60 60 60 720 60.00 Clothing and upkeep Church and charity 170.00 96.67 170 170 170 170 170 170 170 170 170 170 170 170 2,040 100 100 100 100 100 60 100 100 100 100 100 100 1,160 1,475 1,920 Gifts 80 80 110 75 140 120 60 60 400 300 122.92 Public transportation Personal allowances 160 160 160 160 160 160 160 160 160 160 160 160 160.00 S00 500 500 500 500 500 500 S00 S00 S00 S00 S00 6,000 500.00 Entertainment 150 150 150 150 150 150 150 150 150 150 150 150 1,800 150.00 European vacation 400 400 400 400 400 400 200 200 200 200 200 200 3,600 300.00 Summer vacation 200 200 200 200 200 200 1,200 100.00 Anniversary dinner party 42 42 42 42 42 42 42 42 42 42 40 40 500 41.67 Miscellaneous 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 Total variable 3,712 3,712 3,702 3,707 3,712 3,342 3,742 6,042 3,242 3,222 3,380 3,280 44,795 3,732.92 expenses TOTAL EXPENSES 10,277 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 128,695 10,724.58 Difference (available 233 233 243 238 233 53 33 53 73 -385 -585 425 for spending. saving, investing. and donating Revolving savings 385 585 withdrawals Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson 2 3 Estimated Estimated Surplus/ Deficit (1-2) Cumulative Month Surplus/Deficit $ 233 Income Expenses $ 10,510 $ 10,277 $ 10,277 January $233 February 10,510 233 $ 466 243 $ 709 $ 947 March 10,510 10,267 April 10,510 10,272 238 May 10,510 10,277 233 $1,180 June 10,510 10,507 3 $1,183 July 10,510 10,457 53 $1,236 August 13,510 13,477 33 $1,269 September 10,510 10,457 53 $1,322 October 10,510 10,437 73 $1,395 November 10,510 10,895 -385 $1,010 December 10,510 11,095 -585 $ 425 Total $129,120 $128,695 $425 Table 3-8 Revolving Savings Fund for Harry and Belinda Johnson Large Expenses Amount Deposit Into Withdrawal Fund Fund Month Needed From Fund Balance January $ 250 $ 250 February 250 $ 500 March 210 $ 710 April 250 $ 960 May 190 $1,150 June $1,150 July Summer 1,200 240 $1,390 vacation August $1,390 September 200 $1,590 October 190 $1,780 November Gifts/Other 385 460 $1,320 December Dinner 585 220 $1,100 Party/Other Total $2,170 $1,780 $680 -$390

> List two examples of checking account transactions that result in assessment of fees that are avoidable?

> Identify three strategies to reduce income tax liability that you may take advantage of in the future.

> Name three tax credits that a college student might take advantage of while still in school or during the first few years after graduation.

> Some college students earn money that is paid to them in cash and then do not include this as income when they file their tax returns. What are the pros and cons of this practice?

> Many college students choose not to file a federal income tax return, assuming that the income taxes withheld by employers “probably” will cover their tax liability. Is such an assumption correct? What are the negatives of this practice if the employers

> What can a person try to do to genuinely control spending to better achieve financial success?

> You have been asked to give a brief speech on how to achieve financial success and financial security. Use the five steps in the financial planning process and the building blocks to achieving financial success in your speech. Outline your speech.

> Do you have a budget or spending plan? Why or why not? What do you think are the two major reasons why people do not make formal written budgets?

> Of the financial ratios described in this chapter, which two might be most revealing for the typical college student?

> College students often have little income and many expenses. Does this reduce or increase the importance of completing a cash-flow statement on a monthly basis? Why or why not?

> What are two of your most important personal values? Give an example of how each of those values might influence your financial plans.

> What is the biggest budget-related mistake that you have made? What would you do differently now?

> During slow economic times, the federal government’s budgeting priority often is to borrow so it can spend more money than it takes in. What happens to families that try that, and why?

> People regularly make decisions in career planning that have trade-offs. Identify some benefits and costs people are faced with as well as two lifestyle trade-offs.

> What would you do if you inherited $3,000 from an aunt? Identify three options.

> Thinking about some common mistakes that people make in job interviews, which three are the worst? Make a short list of things people should do to improve success in an interview.

> What are some common mistakes that people make in personal finance? Name two that might be the worst, and why?

> Samantha Beliveau of Ames, Iowa, is a senior in college, majoring in nutrition. She anticipates getting married a year or so after graduation. Samantha has only one elective course remaining and is going to choose between an advanced class in sociology a

> Where is the United States in the economic cycle now, and where does it seem to be heading? List some indicators that suggest in which direction it may move.

> List three interviewing tips for new college graduates looking for employment when in many parts of the country a growing job market exists.

> You plan to retire in 40 years. To provide for your retirement, you initiate a savings program of $4,000 per year yielding 7 percent. What will be the value of the retirement fund after 40 years? (Hint: Use Appendix A.3 or visit the Garman/Forgue compan

> You want to create a college fund for a child who is now 3 years old. The fund should grow to $60,000 in 15 years. If an investment available to you will yield 6 percent per year, how much must you invest in a lump sum now to realize the $60,000 when nee

> Isabel Lopez, from Lewiston, Idaho, is age 19, and she recently received an inheritance of $50,000 from her grandmother’s estate. She plans to use the money for the down payment on a home in ten years when she finishes her education. Ri

> Invest Now or Later? Twins Natalie and Kaitlyn are both age 27. They both live in Warren, Ohio. Beginning at age 27, Natalie invests $2,000 per year for ten years and then never sets aside another penny. Kaitlyn waits ten years and then invests $2,000 pe

> What would be the marginal tax rate for a single person who has a taxable income of (a) $31 ,560, (b) $58,150, (c) $66,450, and (d) $100,580? (Hint: Use Table 4-2.) Table 4-2: Table 4-2 Tax Rate Schedules DO IT IN CLASS Single Individuals If taxable

> What would be the tax liability for a single taxpayer who has a gross income of $50,050?

> Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the “young married couple”). Leyia thinks that she can go on half-s

> Cody Sebastian, of Lubbock, Texas, earns $60,000 a year. He pays 30 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,800 per month and variable expenses that average $1,400 per month. What i

> Survey two relatives or friends and ask about their decision-making process when they most recently bought a vehicle. Find out if they thought about the opportunity costs when making the purchase. Also ask if they used marginal costs in their thinking. M

> Review the financial statements of Victor and Maria Hernandez (Table 3-2 and Table 3-3) and the financial ratios on page 87 and respond to the following questions: (a) How would you interpret their investment assets to total assets ratio? The Hernandez

> Tyler Winkle’s employer in Pittsburgh makes a matching contribution of $2,000 a year to his 401(k) retirement account at work. If the dollar amount of the employer’s contribution increases 4 percent annually, how much will the employer contribute to the

> Using the Rule of 72, calculate how quickly $1,000 will double to $2,000 at interest rates of 2 percent, 4 percent, 6 percent, 8 percent, and 10 percent.

> Using the present and future value tables in Appendix A, the appropriate calculations on the Garman/Forgue companion website, or a financial calculator, calculate the following: (a) The amount a person would need to deposit today to be able to withdraw $

> Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Answers to these questions can be obtained by using Appendix A or the Garman/Forgue companion website.

> Julia has recently undergone a severe career crisis. After nearly ten years as a professional engineer, her position was phased out by her company due to a loss of government contracts, and she has been offered a position in the marketing department. The

> Jacob Marchese of Vancouver, Washington, is the credit manager for a regional chain of department stores. He has been asked to join a panel of community members and make a ten-minute speech to graduating high school seniors on the topic “Using Credit Wis

> Julia has been thinking about the purchase of a boat. As a teenager, she was an avid water skier at her parents’ summer home. Now that she has moved away, she wants to renew her hobby at a lake nearby. Julia recently received a raise of $200 per month an

> Victor and Maria have always enjoyed a close relationship with Maria’s niece Teresa, who graduated from college with a pharmacy degree. Teresa recently asked Maria for some assistance with her finances now that her education debts are coming due. She owe

> Harry and Belinda have a substantial annual joint income—more than $125,000, in fact. Nevertheless, they expect to experience some cash-flow deficits during the months of November and December of the upcoming year (see Tables 3-6 and 3-

> Throughout this book, we will present a continuing narrative about Victor and Maria Hernandez. Following is a brief description of the lives of this couple. Victor and Maria, both in their late 30s, have two children: Jacob, age 13, and Nicholas, age 15.

> Asset Management Kwaku Addo, a licensed physical therapist from Topeka, Kansas, earns $4,200 per month take-home pay and has the funds directly deposited in his checking account. He spends only about $3,500 per month, and the excess funds have been build

> Julia’s six-figure salary has allowed her to build up a considerable cash reserve of over $20,000. She initially had basic checking and savings accounts. She also has a credit card with her bank that she uses to make most of her purchases, thereby earnin

> Fast The Hernandez family is experiencing some financial pressures, even though the couple has a combined income of $85,000. Also, their eldest son, Joseph, will start college in only three years. Maria is contemplating going to work full time to add abo

> Review Figure 4-1 on page 117 and comment on the logic of how different segments of Victoria Bassett’s income is taxed. Figure 4-1: Figure 4-1 How Your Income Is Really Taxed (Example: Victoria Bassett with a $60,000 gross income,

> Carson Wentz, of Philadelphia, determined the following tax information: salary, $144,000; interest earned, $2,000; qualified retirement plan contribution, $6,000; personal exemption, $4,050; itemized deductions, $10,000. Filing single, calculate Carson’

> Jared Goff, of Los Angeles, determined the following tax information: gross salary, $160,000; interest earned, $2,000; IRA contribution, $5,000; personal exemption, $4,050; and itemized deductions, $8,000. Calculate Jared’s taxable income and tax liabili

> Find the tax liabilities based on the taxable income of the following people: (a) married couple, $92,225; (b) married couple, $74,170; (c) single person, $27, 880; (d) single person, $56,060. (Hint: Use Table 4-3.)

> Describe two professional certification programs for financial planners.

> What are the four different ways financial planners may be compensated?

> How does a professional financial planner differ from a local lawyer or insurance person in your community?

> Identify three ways you might more effectively communicate about money matters.

> Explain why it is difficult for many people in relationships to talk about money matters.

> Explain what a cash-flow calendar accomplishes. Name three techniques to control spending.

> How might one go about revising budget estimates to create a balanced budget?

> What are budget estimates? Offer some suggestions on how to go about making budget estimates for various types of expenses.

> Explain why setting financial goals is an important step in budgeting.

> Name different ways to handle budget variances.

> List two ways you can maximize the benefits from a tax-sheltered retirement program.

> Create a math example of why many employees participate in a tax-sheltered employee benefit plan, such as an HSA or 401(k) plan

> Kate Beckett and her two children, Austin and Alexandra, moved into the home of her new husband, Richard Castle, in New York City. Kate is a novelist, and her husband is a police detective. The family income consists of the following: $60,000 from Kate&a

> Summarize the benefits of participating in a high-deductible health care plan at work.

> What is a flexible spending account and what do pretax dollars have to do with it?

> Distinguish between Chapter 7 and Chapter 13 bankruptcy, and explain who might be forced to use Chapter 13 rather than Chapter 7.

> What services are provided by a credit counseling agency, and how might a debt management plan work to provide relief for someone who is having debt problems?

> List the major provisions of the Fair Debt Collection Practices Act.

> Identify four signs of over indebtedness.

> Summarize the rules that apply if you lose your ATM or debit card and it is used without your authorization.

> List the steps you should take if you find an error in your monthly statement regarding an electronic transaction.

> Distinguish among credit cards, debit cards, and stored-value cards.

> Summarize what you know about Bitcoin.

> Julia does well financially because she earns a good salary as an engineer, is somewhat frugal, and is making the maximum contribution to her employer-sponsored retirement plan. After reading about ways to decrease her income tax liability, she has some

> Use Table 1-1 to calculate the future value of (a) $2,000 at 5 percent for four years, (b) $4,500 at 9 percent for eight years, and (c) $10,000 at 6 percent for ten years. Table 1-1: Table 1-1 Future Value of $1 After a Given Number of Periods Pe

> Explain the difference between simple interest and compound interest, and describe why that difference is critical.

> What are the two common questions about money?

> Summarize how to fix errors in your credit report, and explain why some people add a consumer statement to their report.

> Name three steps to help establish a good credit history.

> What is a credit history, and what role do credit bureaus play in the development of it?

> Distinguish among the credit terms: prescreened, invitation-to-apply, and preapproved.

> Differentiate between ownership via joint tenancy with right of survivorship and tenancy in common.

> Explain why correctly owning assets is important to the personal finances of people, especially couples.

> Identify three strategies to avoid overpayment of income taxes, and summarize the essence of each.

> Several years have gone by since Harry and Belinda graduated from college and started their working careers. They both earn good salaries. They believe that they are paying too much in federal income taxes. The Johnsons’ total income la

> Summarize the differences between a traditional individual retirement account (IRA) and a Roth IRA.

> Explain how to reduce income taxes via your employer, and name three employer sponsored plans to do so.

> Distinguish between two major types of tax-sheltered investment returns

> Name three financial records that might be best kept in a safe-deposit box or in an envelope at a safe place like at work.

> List some advantages of keeping good financial records.

> Give three suggestions on how to succeed in an interview.

> Give examples of how to identify specific job opportunities.

> Offer suggestions on correctly assembling a résumé and what style formats are available.

> Give two career advancement tips.

> Explain how to compare salary and living costs in different cities.

> A Couple Creates an Educational Savings Plan Stanley Marsh and Wendy Testaburger of South Park, Colorado, have two young children. They both work and earn a substantial income, over $100,000 annually. Their monthly budget is illustrated in Table 3-5 on p

> Describe and give an example of how your marginal income tax rate can affect financial decision making.

> Explain and give an example of how marginal utility and marginal cost makes some financial decisions easier.

> Define opportunity cost and give an example of how opportunity costs might affect your financial decision making.

> What is the best thought on the list of keeping student loan debt under control?

> Summarize the effects of increasing debt payments from 10 percent to 15 percent on a budget. (Hint: See the Run the Numbers worksheet.) Worksheet: RUN THE NUMBERS Make Spending Reductions to Pay for Increasing Credit Usage 15 percent perhaps for a v

> What are the borrower’s feelings when he/she has a limit of debt of 11 to 14 percent of disposable personal income compared to a debt limit of 15 to 18 percent? (Hint: See Table 6-1.) Table 6-1: Table 6-1 Debt-Payment Limits as a P

> Distinguish among the continuous debt method, debt-to-income, debt payments-to-disposable income, and debt-to-income methods for setting your debt limit