Question: Megan Berry, a freshman horticulture major at

Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Answers to these questions can be obtained by using Appendix A or the Garman/Forgue companion website.

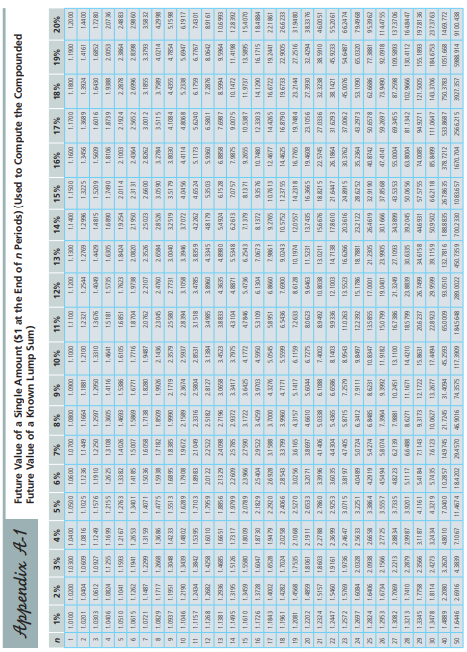

(a) If Megan’s tuition, fees, and expenditures for books this year total $22,000, what will they be during her senior year (three years from now), assuming costs rise 4 percent annually?

(Hint: Use Appendix A.1 or the Garman/Forgue companion website.)

Appendix A.1:

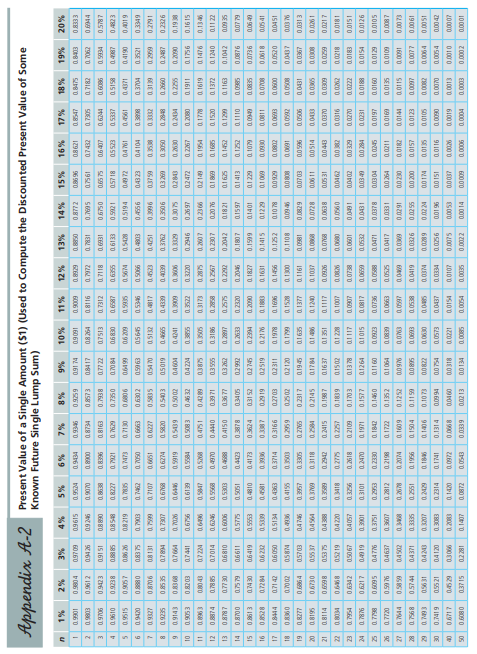

(b) Megan is applying for a scholarship currently valued at $5,000. If she is awarded it at the end of next year, how much is the scholarship worth in today’s dollars, assuming inflation of 3 percent?

(Hint: Use Appendix A.2 or the Garman/Forgue companion website.)

Appendix A.2:

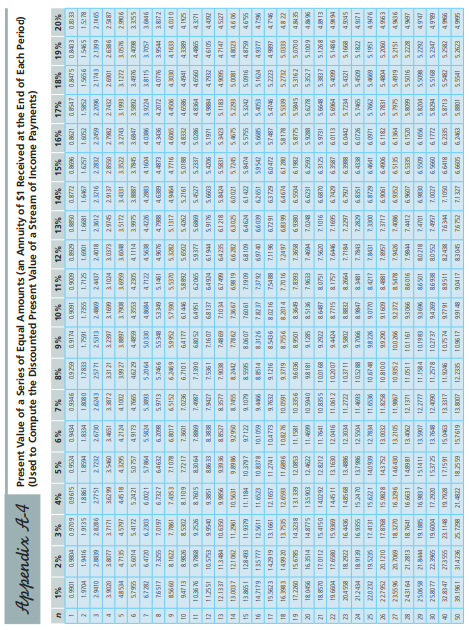

(c) Megan is already looking ahead to graduation and a job, and she wants to buy a new car not long after her graduation. If after graduation she begins an investment program of $2,400 per year in an investment yielding 4 percent, what will be the value of the fund after three years?

(Hint: Use Appendix A.3 or the Garman/Forgue companion website.)

Appendix A.3:

(d) Megan’s Aunt Karroll told her that she would give Megan $1,000 at the end of each year for the next three years to help with her college expenses. Assuming an annual interest rate of 2 percent, what is the present value of that stream of payments?

(Hint: Use Appendix A.4 or the Garman/Forgue companion website.)

Appendix A.4:

Transcribed Image Text:

期网| BE DO 16 PI6 B8S ISE ZZE SIZ992 259EBOI DEE Z00L 6SEL DS SISEN 9106 FERE 11 A674 184202 DI O8 19012 DS EBLE DSL J BOR SES ZIZL BLE SE 98L SEB888I 918L ZEI DISO E6 600 O59 1469.772 BI I299 205 60S 6SII 6656 6 290 DI SENS ERE SE 18L61 155. 1893 9996 201 S800 IE69 BS19 LEZ 902 IE98 SI 12. 1722 ELIE 6 EI 12 541 84 1911' 281IE 99SEZ 1.3345 1 ZI DEI 9590 OS 66 SRI 1026E 1.7410 EIZE I 90LELEI E5 K0I SSIE H000 SS E 'IE 001I EI ISE DI 18862 GEIZ9 482 23 SEEL'E 43.53 53 2.2213 SSPII B160 26 26 65 47.4141 06 16 E SO66 Z 66LOSI 2016'11 NOBS 296E56 188E L 9899 29 619 21.2305 1000'21 S58 SEI UEB DI IE9 8 54274 616 9EE 85 997 BEGOZ 9091 I 89 664 OZED 59 232122 188L BI 9929 91 9BLI SI II162 6.3412 LOS I SZZE BZED Z 2.56 33 53. 1090 35.2364 122392 9L00 S 2LE DE SI 919EZ SILBS 26 18E SILOE 13.5523 8.9543 2647 1.2572 190ZSS EEZ6 S IZI BE E629 IE L9 IZ 01982I BEIL DI 12. 1003 SEE 66 SE 09E ESZ6Z 669EZ 19161 8.1403 I5009 D165 BE BEZE ZE 9EED LE S IZ8 BI 19951 1I20 EI BEDB DI Z 68 BEED'S 90 I 96 6EE 2.2788 E0981 ISISI ZEZ'ı 3833 76 6Z ZE DEGE IZ 950I EZ B0 61 599E 91 SELEI EZ908 D199 L69BE EES9 Z I161'Z 19081 11.5231 1.2202 5.1417 SIE 0966 E 61 266233 S006 ZZ 19.6733 064891 55LEZ I ZSIS DI SES9 66LEE 990Z 1961'I BI 198 IZZ 1962 000E S IE 184884 SILI 91 EDEE ZI AL SEG HOEI 9 60I ES EDL6E 2.1829 DE L8I & 1372 OVSI 906 60 0I 0191'1 SI S200 6 E1929 2.9372 SBL S7 6092 666 S6IEI 5.5348 3.3417 1.7317 E66 90 I 19656 8.5994 B588 9 BZS19 SESE B590 E 96127 6ZEIZ 9588 I 15991 I BEI'I EI 38833 3.4523 19 168 I 0859 ED SES SHEE 0968 E S86VE EIE 25182 ELIIS 6SEBE SBLFE BISIE IESBZ 18983 EDIL'I 56 ESI ZE'I 1.2434 LSIII 2.3316 L1619 890 44114 DEOBE 2961 0612'1 86SIS SSE 6L ISE 6ISZE O00E IELL Z 08S SZ 6SE Z 5BE BI 56 891 E ISSI 1561'1 1.0937 6 142 33 SISE 60'I |的 ZE BSE E6LE E S58IE Z100E 00 99Z SSE Z L0IZZ BEIL'I B5091 SE OSI I ZZO'I 25023 65 IEI 200SI 1301 ES I 29 IT I 211 S1901 24883 ED0I7 IS891 S0191 9BES'I ELT I 1.1041 D 150'I 2.1924 13382 1.1993 9018'1 06891 SO9 SELS'I SSIZ'I 6691'I 9001 15181 Z5891 9 10I 6095'I 60ZSI SIBI 01 61'1 EDED'I Z1901 1.3310 1.1249 1916'I 6 SZZE I 6LZ'I 188I'I 1991'1 SEZI'I 91 80I 60901 2. 0091'1 001 I'I 0001'1 0080'I 00 901 0010'1 %61 % 81 %91 %EL % 01 %6 %8 Future Value of a Known Lump Sum) Future Value of a Single Amount (S1 at the End of n Periods) (Used to Compute the Compounded Appendix A-1 10000 Z000 ED00 D 9000 D 600 00 SEDO D 5800 D EI ZO0 SI LED 0S 0.0 134 0.0339 20000 O 100 0 61000 000 ES000 S000 20100 ISIOD IZZO D BIE 00 0900 8900 Z000 S000 91100 ISI 00 96 100 LEPOD ELSOO SL00 6600 IEI'O ILID 0.55 21 6 I'O DE 0.0090 0.0334 0.2314 0.3083 04120 IS00 0 9000 Z000 SEIOD NI00 19000 LL00 0 2600 D EZIOD SIOD 55 20 0 BESO D S6800 OSID 95610 0.0326 SEEE D 0.5744 1600 D 中100 0Z 00 1620 0 6000 9600 6091 0 L800 0 SEIOD 69100 I EED O LIHOD SZSO D E990 0 GEBO O 190 I0 0.0211 0.1352 0.1722 0.2812 SOI00 6ZIOD 09100 OEDO BLED O SELO D 09 1ID 09年0 ESEZD ISLE D 56090 0.0923 0.2330 IEZO O E00 ZESOD 6590 0 LI800 SIO ID 10IED 0.0126 01264 ERIOD 6ZE 00 1090 D BELOD LOGOD BLEID 0.2109 BIZD 19050 0.1703 0.6342 BIZO O 29200 Z 00 29100 0900 20010 20SID 0.3418 68SE D 22 L IZO O 60ED D DLED D IE SOD BE90O ISE ID SIND BBE VO SLESO 86590 IZ 0.1637 PIS00 I1 900 9 10 02145 0.3118 E IED O 9050 D 96500 ED L00 6Z800 1B60 D 19110 LLEID SE9 ID LIEZO SDEE D LSEE D ED LS0 61 0.0431 16000 600 EOSE D SSIPO 2000 09 O ISPO0 0090 0 Z080 D 62600 BLOID 99IE0 PILE D ESEO EISO O50 90 0.1252 02311 0.2703 08414 81900 600 10 SIPIO 6ISZO Z 90 91 900 9ELOO SEBO D 6651'0 LZBI D 25 IED ESSSO 6I90 DED E 1980 01401 0.4173 9/800 ZSZI D LOBI'O DZEZ D 0.2633 Z66Z0 29ED BLEO 11990 01413 0.4423 SE 600 0.1042 E911D 0.1821 EDES D 9009 0 01890 DE LLD El 0.2042 04I50 0.1240 OZSI D S89I D 68 ID LDEZ D SBIED 55S ED ILGED O付ヤ0 895S D 58BLD 0.1372 a11 22 0.8874 6191 D LIED SOSEO S191'0 1161 D OZZE D 0.4632 EBOS D 6E190 0.8203 ES06 D 61'0 20050 61650 19920 0.9143 OSDE D 6Z ED 90SE O 2LE D GEEPD 61050 EOSO LOEL D 0.8535 SEZG O 1620 9660 SES O 1990 660 0.3349 IZSE D HOLE D 95SYO 9905 D ES O S950 E9650 0.6302 E9990 OSOLO 04104 EDGL D SLEBO 043 23 190 19 VO 602 90 66190 900 SIS60 0 M73 85ISD LEES D EZS S0 BI L50 SSE9D DEB 90 0.5921 S80 58 880 0.9238 01960 0.6133 0.7350 0.5934 9809 0 LO90 EISLO 0.7938 E918D IS 160 0.7118 068 80 0.7312 0.8396 0.9423 07182 SOEL D ZELO 1920 IEBLD 91180 08417 2 160 ELS80 Z1960 2. 0.8333 12980 96980 O8772 OS880 60060 16060 6S260 S1960 60 L60 10660 0.9434 %07 %61 % 8L %91 14% %EL %0L %6 %8 %9 %E 12% Known Future Single Lump Sum) Present Value of a Single Amount ($1) (Used to Compute the Discounted Present Value of Some Appendix A-2 EESI SIE 60 TIBIZ OS 6OSI 06 191I E0 SI8 10 TAS 958 EEL SZU DEI POLE I01 PI60/ 区EI85 SZS Z 5950 Z ISE9 6I EIOS MRR 4163.212 606 06 06019 HE DES 266IT6 602 O66 I SLOE EI ZE EII O 16 189SO K 6290 86 |0E 15て55 ZEDE 9S LEG0 ZIE 6OE9 I 124. 1354 6596 EDI 8GE9 EL 62. 3227 E996 25 88 IT S HOSVEE 681.1116 IZZ 920 S 9/6 606 2 ZISOE 1区12E LZ58 189 EZSILS EZ EDZ O 0S ZEE 8895 EB ६८ 2008406 OLE691 IEZL Z01 80SE 28 原 850L E9 1699 15 47.0842 960L' DE SS BE E中ESE 60Z BDE ELLE 195 SOE VEL IZZZ SO OZIL S 208 3327 105892I 1503339 88662I BIBI 601 OZE E6 195I 65 51.1135 L1IE 60L 9EE 95Z S6 186 I SED9 ZE DEGL ZIE 96 195SI 181 8708 GEE EEEI 1144133 ELE B8 6501 EL S98 S 47.7271 44.5020 9280 6E 619 E6 S EDE OZE 28.2432 3924842 S0I 0ZEE 9859 851 B68L 118I 552 I IZ01 6I'16 29LI BS 9518 DS 13683 15 30.4219 26.9 735 EI OI I2 Z SI 620901 61ES 69 19ES 2DED Z 157.4150 9IE9 ZEI 120 A360 6626 EIZI8 895 S5 62.8733 500 43.3923 ZSOS BE 89 ES DE 2364384 180.1721 244716 SBEIESI 1018 BII 296918 200 19 35.7193 2606 IE 197844 0889 981 ZEDDEI 26LE SII SEH Z01 620 16 89608 1091 IS S566 D 95 0990 EE 061 022 199 I 123.4135 95 0E6 209 6 88.2118 2606 1651'IS SIO W 06E2E 00 E 06ES DE 601 02 61 659ZSII EON EDI 1SEB SL IE 89 656 EDS EIOE'I ZOS ZE 0666 E 2506 DE ZEI R EZIVIZ I961 81 61.7251 23 A1 44 90E6 S0I LIZ096 0890 28 1626BL ISLO 59 16ELES 800 S 36.9737 ZOSL EE ZO8 DE 6ZIZ B 919L IZ 488837 20.0 121 OS26 09 SLIL 55 LI 299 EESZ 668 IBE 26 SE PEDO EE ECE DE 1888 22 SZ9 S 6951'02 EGE 981 91 666488 ES96 09 101195 HORS 2 43.8424 I 185 LE S659 IS 16LELE SOE SZLL'IE 609E IZSI ZZ 06ZIZ 09LZ EZ 98LS'IZ 20.0236 68 65 BI E980 LI 72.0351 PE 696 091 SI 2610 24.2149 SOS5 Z2 ISIO'IZ 9865 61 6 16781 GEL 6SI 50.8180 996 298L E 6ISE E LB80 ZE 16ZOBZ 9112 ESE IZ 17.7130 899 91 116 SI 42.2187 IZ88 BI BL 19 SI E0B 9 138093 EI 208 2E L100 20.1407 SS9 91 6691 134121 L89 IZI 9SII OSIZE 304035 15 R 6661'2Z SHOEZ 243493 6ZEL SZ 2181 43 26 II E095 2I SERL SI 9126 890Z I BL 08 ZI 18.5312 EIZS 1Z 6261 SI 65 ZI 1900 Z1 6580 61 17.5185 85 91 ES80 91 25 IPSI SS EI OIZO EI 9U即て 990'11 8285 01 1651'01 589 E6 199234 166 91 0E SI 99 01 9.2142 6S162I 899011 SOEL'OI 068 00 I EEBL6 BEGE B 74343 SEITL 125227 12. 1415 81420 66266 DEB 96 LESI SSES B ZZEB ZSI IB 6Z16L EEZS2 6SEE'2 ES69 6 I089 OEEY 9 orS 19 180E9 7.1533 9 IHL 9967L 10199 ED 9 8SE9 1S019 9998S LOSLS 160ES 010 IS 089ES E1625 SIZS I IZ6 45731 1905 44399 SLE 9EBI' IOIE 9IZ I 1909E ISE 68 ESE 9505 E 3.4725 96EVE 69 OVE HLEE 00IEE 18LZE SZSIE 00507 00001 SEBI E 9IZI'E 60 60 E 10E DE 000 006 IZ 008IZ 00LIZ 00EIZ 001 IZ 0001Z 0060 Z 0080 Z 0090Z 00 ED Z 001 0Z 2. 0000I 00001 00001 00 001 00001 0000' 000I 00 001 00001 00001 0000' 00001 0000'1 0000'1 0000'1 0000 00 001 00001 00001 % 61 %81 %91 %SI %EL % 0L %6 %8 %9 %S % %E (Used to Compute the Compounded Future Value of a Stream of Income Payments) Future Value of a Series of Equal Amounts (an Annuity of $1 Paid at the End of Each Period) Appendix A-3 SENG EZS ISSS 1088S LZE I'2 SHOEB 時166 41 960I 12.2335 LO08 EI 6.2463 61925I 65SZBI SEZVIE 1961'6E 05 ZSS EILBS SEEZ 9 BI99 O5012 1I568 16L6 13.3317 ESO SI 1651'21 I EZ 555ELZ 32 8347 686 LEZS 89I5S 0995 9 Z5S O8 BE698 SZLESI BISZ'II BL EI LL OBSZ DE 60SS9 BIZOR 10598 9696 15.1411 I E9991 SI 61 BZZZS 910SS 6608S DZSI 9 SEES 9 91098 990 E6 191 IDI I IS0 II 12 1371 290 EI IL BI 7.4412 EIBZ'IZ 19IEZ ISIZS 616S SEISY RIS 家00 962E 91 600L 96SSEZ E96 090ZS IEBLS 6.1182 909 1906 9 LILEZ 188 8 609 16 0018 01 ZEDO EI ZSLEDI 20.1210 1961 1609 I29 SI 17.4131 SZS 61 16.9355 GE16 BI 5. 1822 6OSS IZES SNS 6.4338 ISEB 9 HOSS ZI OLESI 212434 899IS 7.7184 S92 11.2722 PEDE ZI Z 190'11 ZEB ZOBS 6 II LEDI 96 EI 16.436 ZZ6Z BI 0859 1 5.7234 EZ 98IS EI 109 28SE 9 S6912 SILLB DE9I EI 1I SI 6SE6 SI 9.424 EI 8 82I'S 5.9731 SZIE9 91012 ISLO B 5.3837 89 100I 15.4150 ZI1021 OLS8 BI 10.8355 12.8212 968 6001'S LE5ES IE299 EE962 SEISB 181 86 EDG SE I 16.3514 9SO BI 4.8435 DOLO'S 29IES 5.5845 SLUBS Z8619 HOSS 9 0BE6 9 1056 B SED 96 10.3356 1650 0I 7.8393 ES80 ZI GEE IEI 14.3238 SBL9 SI 61 6ESS RIBS 0Z 19 6689 96 1 69 ZI EZZZS ZU09 16Z29 96112 75488 91 Z08 ZEL 6 ELLFOI L59I ZI 1991 EI 616Z 15.5623 91 8.5436 9.1216 19929 60099 PIS 60 IDI 1195 ZI SEI 6l 559 658 9160S ZES 601 89 60612 19092 20908 L6LE OI I 598 EI SI 11.1184 19621 90 9 1800S 12009 2299 61 69 292 8.242 LUSE B 第6 290 121 S606 EBIIS EZES IEBS 5 BED62 SE GE6 61 218 9586 6 OSE9 DI LEEI'ZI EI 64235 4492 S019 ZEGL E099S L165 t619 68137 20912 1 9ES2 BEBE B ISBE 6 ESIS DI ISSZII 88633 12 0959 SEB LEEZS LLE65 59079 1569 Z5 089 190EB SZI 6BEE 5.0188 19125 Z6RS I012'9 SEZOZ 109E2 6011'8 ZDES B 44941 48332 S009 2966 629 7453 192 6.7327 26102 2291 4.3436 ELE 19IS 6EES BESS 99'S EIL6S ZE99 3.8172 SSZEL 4.2072 6.2098 0 OS 19ES 1 2009 SSEE BEOE Z6BSE SLE SL66E 41114 SOEZ ESSE ELI6 S5625 5.2421 ISE 2001 44518 ILILE 98E9Z 10697 ZENZ 0S58Z LE167 3.0373 DIE 6691E 2GEZE ZLBE E 09SE 331 21 ENIZ 60 EIESZ 1.6081 OS880 9595I Z5851 Z5091 SEL'I SSEL'I EERI 1988I SEI6I 1.7833 0.8 33 0.8403 1606 D 6Z60 S1960 60L60 1066 0 0.9346 %61 %81 %91 %EL % Z1 %01 %6 %8 %9 %E (Used to Compute the Discounted Present Value of a Stream of Income Payments) Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) Appendix A-4

> Victor is somewhat satisfied with his sales career and has always wondered about a career as a teacher in a public school. He would have to take a year off work to go back to college to obtain his teaching certificate, and that would mean giving up his $

> Now that you have read the chapter on managing checking and savings accounts, what would you recommend to Nathan Rosenberg and Avigai Abramovitz in the case at the beginning of the chapter regarding: 1. Where they can obtain the monetary asset managemen

> Now that you have read the chapter on managing income taxes, what advice can you offer Ace and Florence in the case at the beginning of the chapter regarding: 1. Using tax credits to help pay for Ace’s college expenses? 2. Determining how much money Flor

> Now that you have read the chapter on financial planning, what do you recommend to Austin Patterson for his talk with Emily on the subject of financial planning regarding: 1. Setting financial goals? 2. Determining what they own and owe? 3. Using the inf

> Now that you have read the chapter on the importance of personal finance, what do you recommend to Jing Wáng in the case at the beginning of the chapter regarding: Participating in her employer’s 401(k) retirement plan? Understanding the effects of her

> Is it too easy for college students to get credit cards? Who do you know who has gotten into financial difficulty because of overuse of credit cards, and what happened?

> Use the information on pages 185, 186 and 187 to discuss how best to deal with student loan debt Page No. 185, 186,187: CHAPTER 6 Building and Maintaining Good Credit 185 6.2a Method 1: Continuous-Debt Method A useful approach for determining your d

> How might students judge whether they are taking on too high a level of student loan debt?

> What aspects of your financial life make you creditworthy? What aspects might make it difficult for you to obtain credit?

> Have you ever had a disagreement with a friend or family member over a money issue? How might you communicate differently now?

> Lost/Stolen Debit Cards. What should you do if your ATM or debit card is lost or stolen? Why?

> Harry has started out fine in his career as his responsibilities have increased since he began working there about five years ago. Belinda recently attended a conference for those in her stock brokerage field and by chance she dropped in at the “career s

> When might it be appropriate for you to save via a certificate of deposit versus a money market account?

> Many people desire protection from the possibility of overdrawing their checking account. Banks make it easy by allowing you to opt into overdraft protection. Explain how this and other overdraft protections work and why the true cost of opting in may ex

> When would you recommend using an individual account, a joint tenancy with right of survivorship account, and a tenancy by the entirety account for your monetary assets?

> You know someone who recently had $90 in overdraft fees for two small debit card transactions. Explain to him why such high fees resulted from such small transactions and the relative benefits of having an automatic funds transfer agreement versus an aut

> List two examples of checking account transactions that result in assessment of fees that are avoidable?

> Identify three strategies to reduce income tax liability that you may take advantage of in the future.

> Name three tax credits that a college student might take advantage of while still in school or during the first few years after graduation.

> Some college students earn money that is paid to them in cash and then do not include this as income when they file their tax returns. What are the pros and cons of this practice?

> Many college students choose not to file a federal income tax return, assuming that the income taxes withheld by employers “probably” will cover their tax liability. Is such an assumption correct? What are the negatives of this practice if the employers

> What can a person try to do to genuinely control spending to better achieve financial success?

> You have been asked to give a brief speech on how to achieve financial success and financial security. Use the five steps in the financial planning process and the building blocks to achieving financial success in your speech. Outline your speech.

> Do you have a budget or spending plan? Why or why not? What do you think are the two major reasons why people do not make formal written budgets?

> Of the financial ratios described in this chapter, which two might be most revealing for the typical college student?

> College students often have little income and many expenses. Does this reduce or increase the importance of completing a cash-flow statement on a monthly basis? Why or why not?

> What are two of your most important personal values? Give an example of how each of those values might influence your financial plans.

> What is the biggest budget-related mistake that you have made? What would you do differently now?

> During slow economic times, the federal government’s budgeting priority often is to borrow so it can spend more money than it takes in. What happens to families that try that, and why?

> People regularly make decisions in career planning that have trade-offs. Identify some benefits and costs people are faced with as well as two lifestyle trade-offs.

> What would you do if you inherited $3,000 from an aunt? Identify three options.

> Thinking about some common mistakes that people make in job interviews, which three are the worst? Make a short list of things people should do to improve success in an interview.

> What are some common mistakes that people make in personal finance? Name two that might be the worst, and why?

> Samantha Beliveau of Ames, Iowa, is a senior in college, majoring in nutrition. She anticipates getting married a year or so after graduation. Samantha has only one elective course remaining and is going to choose between an advanced class in sociology a

> Where is the United States in the economic cycle now, and where does it seem to be heading? List some indicators that suggest in which direction it may move.

> List three interviewing tips for new college graduates looking for employment when in many parts of the country a growing job market exists.

> You plan to retire in 40 years. To provide for your retirement, you initiate a savings program of $4,000 per year yielding 7 percent. What will be the value of the retirement fund after 40 years? (Hint: Use Appendix A.3 or visit the Garman/Forgue compan

> You want to create a college fund for a child who is now 3 years old. The fund should grow to $60,000 in 15 years. If an investment available to you will yield 6 percent per year, how much must you invest in a lump sum now to realize the $60,000 when nee

> Isabel Lopez, from Lewiston, Idaho, is age 19, and she recently received an inheritance of $50,000 from her grandmother’s estate. She plans to use the money for the down payment on a home in ten years when she finishes her education. Ri

> Invest Now or Later? Twins Natalie and Kaitlyn are both age 27. They both live in Warren, Ohio. Beginning at age 27, Natalie invests $2,000 per year for ten years and then never sets aside another penny. Kaitlyn waits ten years and then invests $2,000 pe

> What would be the marginal tax rate for a single person who has a taxable income of (a) $31 ,560, (b) $58,150, (c) $66,450, and (d) $100,580? (Hint: Use Table 4-2.) Table 4-2: Table 4-2 Tax Rate Schedules DO IT IN CLASS Single Individuals If taxable

> What would be the tax liability for a single taxpayer who has a gross income of $50,050?

> Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the “young married couple”). Leyia thinks that she can go on half-s

> Cody Sebastian, of Lubbock, Texas, earns $60,000 a year. He pays 30 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,800 per month and variable expenses that average $1,400 per month. What i

> Survey two relatives or friends and ask about their decision-making process when they most recently bought a vehicle. Find out if they thought about the opportunity costs when making the purchase. Also ask if they used marginal costs in their thinking. M

> Review the financial statements of Victor and Maria Hernandez (Table 3-2 and Table 3-3) and the financial ratios on page 87 and respond to the following questions: (a) How would you interpret their investment assets to total assets ratio? The Hernandez

> Tyler Winkle’s employer in Pittsburgh makes a matching contribution of $2,000 a year to his 401(k) retirement account at work. If the dollar amount of the employer’s contribution increases 4 percent annually, how much will the employer contribute to the

> Using the Rule of 72, calculate how quickly $1,000 will double to $2,000 at interest rates of 2 percent, 4 percent, 6 percent, 8 percent, and 10 percent.

> Using the present and future value tables in Appendix A, the appropriate calculations on the Garman/Forgue companion website, or a financial calculator, calculate the following: (a) The amount a person would need to deposit today to be able to withdraw $

> Julia has recently undergone a severe career crisis. After nearly ten years as a professional engineer, her position was phased out by her company due to a loss of government contracts, and she has been offered a position in the marketing department. The

> Jacob Marchese of Vancouver, Washington, is the credit manager for a regional chain of department stores. He has been asked to join a panel of community members and make a ten-minute speech to graduating high school seniors on the topic “Using Credit Wis

> Julia has been thinking about the purchase of a boat. As a teenager, she was an avid water skier at her parents’ summer home. Now that she has moved away, she wants to renew her hobby at a lake nearby. Julia recently received a raise of $200 per month an

> Victor and Maria have always enjoyed a close relationship with Maria’s niece Teresa, who graduated from college with a pharmacy degree. Teresa recently asked Maria for some assistance with her finances now that her education debts are coming due. She owe

> Harry and Belinda have a substantial annual joint income—more than $125,000, in fact. Nevertheless, they expect to experience some cash-flow deficits during the months of November and December of the upcoming year (see Tables 3-6 and 3-

> Throughout this book, we will present a continuing narrative about Victor and Maria Hernandez. Following is a brief description of the lives of this couple. Victor and Maria, both in their late 30s, have two children: Jacob, age 13, and Nicholas, age 15.

> Asset Management Kwaku Addo, a licensed physical therapist from Topeka, Kansas, earns $4,200 per month take-home pay and has the funds directly deposited in his checking account. He spends only about $3,500 per month, and the excess funds have been build

> Julia’s six-figure salary has allowed her to build up a considerable cash reserve of over $20,000. She initially had basic checking and savings accounts. She also has a credit card with her bank that she uses to make most of her purchases, thereby earnin

> Fast The Hernandez family is experiencing some financial pressures, even though the couple has a combined income of $85,000. Also, their eldest son, Joseph, will start college in only three years. Maria is contemplating going to work full time to add abo

> Review Figure 4-1 on page 117 and comment on the logic of how different segments of Victoria Bassett’s income is taxed. Figure 4-1: Figure 4-1 How Your Income Is Really Taxed (Example: Victoria Bassett with a $60,000 gross income,

> Carson Wentz, of Philadelphia, determined the following tax information: salary, $144,000; interest earned, $2,000; qualified retirement plan contribution, $6,000; personal exemption, $4,050; itemized deductions, $10,000. Filing single, calculate Carson’

> Jared Goff, of Los Angeles, determined the following tax information: gross salary, $160,000; interest earned, $2,000; IRA contribution, $5,000; personal exemption, $4,050; and itemized deductions, $8,000. Calculate Jared’s taxable income and tax liabili

> Find the tax liabilities based on the taxable income of the following people: (a) married couple, $92,225; (b) married couple, $74,170; (c) single person, $27, 880; (d) single person, $56,060. (Hint: Use Table 4-3.)

> Describe two professional certification programs for financial planners.

> What are the four different ways financial planners may be compensated?

> In January, Harry and Belinda Johnson had $10,660 in monetary assets (see page 109): $1,100 in cash on hand; $1,200 in a statement savings account at First Credit Union earning 1.0 percent interest; $4,000 in a statement savings account at the Far West S

> How does a professional financial planner differ from a local lawyer or insurance person in your community?

> Identify three ways you might more effectively communicate about money matters.

> Explain why it is difficult for many people in relationships to talk about money matters.

> Explain what a cash-flow calendar accomplishes. Name three techniques to control spending.

> How might one go about revising budget estimates to create a balanced budget?

> What are budget estimates? Offer some suggestions on how to go about making budget estimates for various types of expenses.

> Explain why setting financial goals is an important step in budgeting.

> Name different ways to handle budget variances.

> List two ways you can maximize the benefits from a tax-sheltered retirement program.

> Create a math example of why many employees participate in a tax-sheltered employee benefit plan, such as an HSA or 401(k) plan

> Kate Beckett and her two children, Austin and Alexandra, moved into the home of her new husband, Richard Castle, in New York City. Kate is a novelist, and her husband is a police detective. The family income consists of the following: $60,000 from Kate&a

> Summarize the benefits of participating in a high-deductible health care plan at work.

> What is a flexible spending account and what do pretax dollars have to do with it?

> Distinguish between Chapter 7 and Chapter 13 bankruptcy, and explain who might be forced to use Chapter 13 rather than Chapter 7.

> What services are provided by a credit counseling agency, and how might a debt management plan work to provide relief for someone who is having debt problems?

> List the major provisions of the Fair Debt Collection Practices Act.

> Identify four signs of over indebtedness.

> Summarize the rules that apply if you lose your ATM or debit card and it is used without your authorization.

> List the steps you should take if you find an error in your monthly statement regarding an electronic transaction.

> Distinguish among credit cards, debit cards, and stored-value cards.

> Summarize what you know about Bitcoin.

> Julia does well financially because she earns a good salary as an engineer, is somewhat frugal, and is making the maximum contribution to her employer-sponsored retirement plan. After reading about ways to decrease her income tax liability, she has some

> Use Table 1-1 to calculate the future value of (a) $2,000 at 5 percent for four years, (b) $4,500 at 9 percent for eight years, and (c) $10,000 at 6 percent for ten years. Table 1-1: Table 1-1 Future Value of $1 After a Given Number of Periods Pe

> Explain the difference between simple interest and compound interest, and describe why that difference is critical.

> What are the two common questions about money?

> Summarize how to fix errors in your credit report, and explain why some people add a consumer statement to their report.

> Name three steps to help establish a good credit history.

> What is a credit history, and what role do credit bureaus play in the development of it?

> Distinguish among the credit terms: prescreened, invitation-to-apply, and preapproved.

> Differentiate between ownership via joint tenancy with right of survivorship and tenancy in common.

> Explain why correctly owning assets is important to the personal finances of people, especially couples.

> Identify three strategies to avoid overpayment of income taxes, and summarize the essence of each.

> Several years have gone by since Harry and Belinda graduated from college and started their working careers. They both earn good salaries. They believe that they are paying too much in federal income taxes. The Johnsons’ total income la

> Summarize the differences between a traditional individual retirement account (IRA) and a Roth IRA.

> Explain how to reduce income taxes via your employer, and name three employer sponsored plans to do so.