Question: Victor is somewhat satisfied with his sales

Victor is somewhat satisfied with his sales career and has always wondered about a career as a teacher in a public school. He would have to take a year off work to go back to college to obtain his teaching certificate, and that would mean giving up his $53,000 salary for a year. Victor expects that he could earn about the same income as a teacher.

Required:

(a) What would his annual income be after 10 years as a teacher if he received an average 3 percent raise every year?

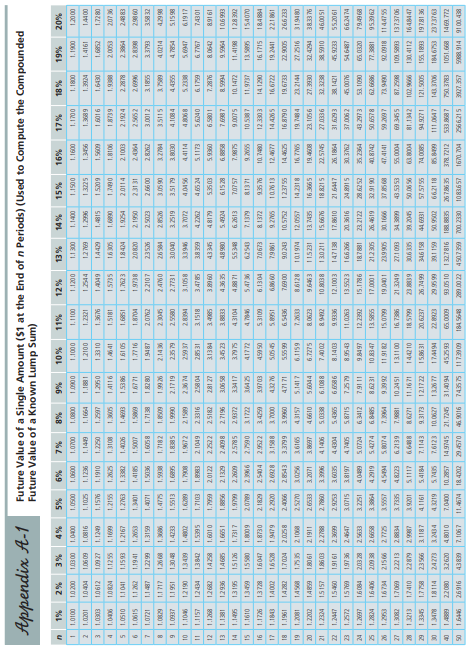

(Hint: Use Appendix A.1.)

Appendix A.1:

(b) Victor also could earn $4,000 each year teaching during the summers. What is the accumulated future value of earning those annual amounts over 10 years assuming a 5 percent raise every year?

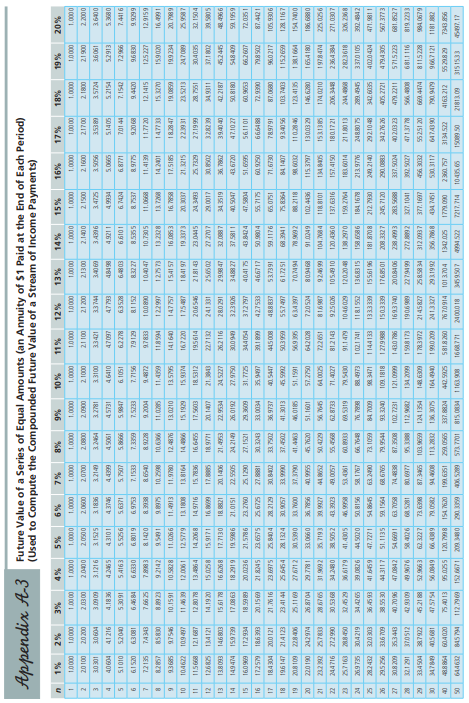

(Hint: Use Appendix A.3.)

Appendix A.3:

Transcribed Image Text:

BE DO0 16 PI6 S ISE ZZE 159EBOI 60 6EL II SLSEL 9106 OLSY ZO BI I DEEZ DOL 6SE LOS z00 68 29012 GEBE 91692 DS EBLE DSL 4B9E EES ZIZL BLE SE 98L Z SEBB B8I 918/ZEI 01S0 E6 6000 59 14.9745 21.7245 SONS LSBZ DI D 108 029ZE 68E 66 BI I299 206 OS 66 6 62 REI 290 0I EZ192 612E 155. 1893 19781 36 S00S IZI I Z26 6 S800 W IE69 851 9E LEZ9 DZ IE98SI 5.4184 1911 LBIIT 995 EZ 26.7499 121722 9.3173 96 201 ZEI 18 66S BI 90LELEI E685 601 1.7410 SSE 69 FO00 55 21.3249 9BEL 91 00 1IEI 10.2451 18862 43.5353 6.2139 48223 3.7335 SSDI BI60 26 9991 D S0662 660 SI 28 16 11 2666 29E56 188E 22 9899 29 06 16 ZE 619 W SDE ZIE 1 000 LI S585 EI ER OI IE298 S889 19BE E 85997 BE 607 9091 5.4274 89 664 OZED 59 23.2122 188LBI 98LI'SI II 162 6.3412 ZOS BZ EDZ 53. 1090 ISZZE EE9S Z 43.2973 35.2364 12.2392 9L00 S 2900 LE 2LE DE S168 919E D2 驱991 EZSS EI SILBS 2618E SILOE 190ZSS IZI BE 019821 BEILI SEE6 6 98599 45.9233 SED9 E ESZ6Z 66DE Z 19 161 8.1403 I5009 D165 BE BEZE ZE 9EED LE SS Z2 S IZN BI 9L99 SI 130211 BEOB OI 20 OL 880I'9 BEEDS 966E E ED 98I ISISI LEEBE DEGE IZ 950I EZ B0 61 599E 91 IEZSII 13.7435 EZ90 B 0199 5.6044 LEE EES9Z 9.6463 1161Z 1908I 658I 23.2144 6S19 ZIPI'S SIE S19 920 001Z SESI 61 S006 ZZ 19.6733 0648 91 55LEZI ZSLS DI 00 69L SES9 6655S 0966E 66LEE 266 233 ES8Z 990Z 1961'I 9.0243 198 IZZ Z991 SAZ 6 19862 0999 200VI SILI 91 08 DI L SEG E2902 HOEI'9 60IES 05 65 12.3303 SLII 91 8 1372 BLEI 39703 2.9522 1.8730 996Z 60081 0191'1 SI 10. 1472 S2006 EIS9 ESS HOIE SLLE L IEL'I SISI 56IEI 33417 2.9372 E66 90I 1965 6 BZS19 086 8 EEBB E EZ SPE 4.36 35 85 90E 9612Z 6ZEI Z 9588'I I 599'1 1BEI'I EI 19 168 I 0859 SHEEF 09 68 E SBE BEIE LZ 187 Z8ISZ 53503 2.2522 2.0122 ELIIS 6SE BE BISI E IE S8Z 1.8983 EDIL'I SGES'I ZBEI 12434 SII'I 3.4785 2.3316 2.1049 1619 6291 061ZI 86SIS DEDB E 6L ISE 6ISZE I ELL'Z 6SEZ 1.9990 5BEB'I SE89'I EISS'I 156 I'I LEGO'I 1.4233 SIISE 661 ZE BSE EEE 3. 1855 Z100E 00 99Z EZOS Z SSEZ BEIL'I 65IEI IZZO'I L S190'1 EB ED0I Z IS89'1 S0 19 I 2.1924 ZBEE'I 29121 1.5386 1.1593 90181 SEIS I 18ISI 14116 056 I 6691'1 Z589'1 DE191 9 109 I 6095'I 60SI SIBI 0I EE I 0161'1 Z1901 1 4049 1.0303 191b'1 689E'I SZZE I ELTI IZEZ'I I 88I'I SEZI'I 9180I 60 901 00 0I 0091'1 0DE I'I 0011'1 000'I 0060 I 0080'I 0090'I 00 EDI 0010'1 %07 %61 % 81 %91 %SI % EL %0L %6 %8 %9 %S % %E Future Value of a Known Lump Sum) Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the Compounded Appendix A-1 EESI SIE 60YIRIZ OS EROGI 06 191I O SI8 10 IS 6E 06 oE 602 199 25I 696Z11 16 S 958 EEL ZIZ E9I USEIE SZU EI |区g185 ISE9 6I O9LISI 86 Eı ssU 56 ISL DREZ POLE 101 PI6029 K88 ZEE EI OF SL 606 0 0619 266IT6 602 066I O 191 6800 189SO 1181882 690 10 区I5て55 ZEDE 95 LEGO ZIE GOE9 I ISEI KI SE 28 |ছে 6596 EDI 8GE9 EL E996 25 88 IZ S HOSVEE 911 l'I89 666L22 6069061 6602 I 206 ZII 920 S 9/96 6 60 06 2 ZISOE 1区12E 2び819 479.2211 EZ EDZ O OS ZEE 8895 EBE EG BEZ OLE691 恩OE」 6660 IZI IEZL Z01 80SE 28 BEB W 850L E9 1 699S E中ES 60Z DE ELLE 295 SDE VEL EB8O D6Z OZIL SE 208 3327 1058941 BIBI 0I 1503339 8866LZI EEI PII OZE E6 195I 5 SEIL'IS L1IE DE SS 60L 9EE 952 S 405. 2721 I 186'I2 SE09 ZE DEGL ZIZ 8OL8 18I 96 1955I GEE EEEI IE 86 600L 18 E6 S 6S9 I 47.7271 44.5020 9280 6E 6/19 6501 EL EDE OZE IZ Z6E S0I 0ZEE LL6 EIZ BL91 181 9859 85I SI E89EI Z5S IBII I I201 ELE B8 9518 OS 6IZVOE SEL 6 620901 6 I'16 6IES 69 2DED'ILZ BEEZ 180.1721 SOEI 120 A360 6626 10549 10 296918 EEL8 79 500 89 ES DE 206. 3448 137.6316 43.3923 38.505 2 0I20 WI REIESI 1018 BII 200 19 2000 266 6 2606 IE 12 0889 81 08I59I 26LE SII SEH 201 60 16 89608 1091'IS SS66 958L E 00 0990 EE I BL' 199 II SEIPZI BIZ 2606 1651'IS 06ES DE 61 2911 BI 659TSI I EON EDI 950VE6 LOI 1 IE 89 ISZL19 656 EDS E1DE 'I 0666 EE 2506 DE ZEI R ZOS ZE 196 147 21A123 9006 S01 LIZ096 0890 28 16268L ISLO 59 53.7391 EESL7 488837 800 S 36.9737 ZOSL EE ZO8 DE 6ZIZ E S269 EZ 919L IZ IZI OOZ HOE 81 881999 OS26 09 086 05 2I 299 668 IBE LO6 SE PEDO EE ECE DE 1888 27 SZ9 S EGE 981 91 21 8245 72.035 I 6561 5 L09799 ES96 09 101195 S659 IS 43.8424 SL IPO 26LZLE SOE SZLL'IE 60E IZSI 22 06ZI SZ 09LZ EZ 98LS'IZ 20.0236 E980 LI 616 81 696091 SI 18.59 89 60 8S 0BI8 DS OS D I 185 LE 2610 24.2149 SOSS Z2 ISIO'IZ 9865 61 GEL 65I 996 298L DE 61SE E L880 ZE 162OBZ 9112 PESS ZZ ESE IZ IZ88 BI DEIL'2I 8929 91 BL 19 SI E0B 9I 138093 EI 42.2187 SORS E Z0R IE 66 91 116 SI 134121 L89 IZI FOSI ZE SEDVOE 666122 24.3493 SHOEZ E印て 18.5312 ED 21 6261 S 6ZEL Z 590z D19561 SS9 91 SEBL SI 9126 I 890Z I BL 08 ZI EIZS 1Z 1918TI 1900 ZI 68 D 6580 61 E S80 91 25 ISI 13.0210 9U即て 9920'11 1651'01 589 E6 6 17.5185 166 91 ZE SI 118594 EEBL6 9.2142] 8 1420 E B68 L DEE9 9 9 01 125227 0R中6 12. 1415 89 0Z6 10.4047 068 00 I ZSI IB BEGE B 9.4872 74343 72135 66266 DEB 96 LESL B SSES B Z ZEB 6Z16L 95122 6SEE2 EESI 2 ESL69 6 1089 180E9 0ZS 19 9 7.5233 9967L 10199 ED 89 8SE9 1S01 9 9998S 952SS E9IVS 160ES 010 IS 08ES 46410 00IEE E1625 SIZS SOPIS I I26 1905 SLE 4.4399 SEBI E IOIE 4.1836 41 216 3.5724 008IZ 1909E 68 ESE 96EYE 3.4725 00SIZ 9505E HLEE 18LZE IZE S2SIE 3.1216 60 60E 00 ED Z 10E DE 006 IZ 00LIZ 0DEIZ 001 I2 0001Z 2.0900 0080 0090Z 001 02 0000'1 00001 0000' 00 001 00001 00001 0000 I 00001 00001 00001 00001 00001 0000'1 0000' 0000' 0000'1 0000 00 00 00001 00001 %0Z %6L %81 %91 %SI %EL % 0L %6 %8 %9 % %E (Used to Compute the Compounded Future Value of a Stream of Income Payments) Appendix A-3 Future Value of a Series of Equal Amounts (an Annuity of $1 Paid at the End of Each Period)

> David Abacus uses the internet to place an order to license software for his computer from Inet.License, Inc. (Inet) through Inet’s electronic website ordering system. Inet’s web page order form asks David to type in his name, mailing address, telephone

> Little Steel Company is a small steel fabricator that makes steel parts for various metal machine shop clients. When Little Steel Company receives an order from a client, it must locate and purchase 10 tons of a certain grade of steel to complete the ord

> Someone secretly took video cameras into the locker room and showers of the Illinois State University football team. Video recordings showing these undressed players were displayed at the website http://univ.youngstuds.com, operated by Franco Productions

> Ernest & Julio Gallo Winery (Gallo) is a famous maker of wines located in California. The company registered the trademark “Ernest & Julio Gallo” in 1964 with the U.S. Patent and Trademark Office. The company has spent more than $500 million promoting it

> Ptarmigan Investment Company (Ptarmigan), a partnership, entered into a contract with Gundersons, Inc. (Gundersons), a South Dakota corporation in the business of golf course construction. The contract provided that Gundersons would construct a golf cour

> Andrew Parente had a criminal record. He and Mario Pirozzoli Jr., formed a partnership to open and operate the Speak Easy Café in Berlin, Connecticut, which was a bar that would serve alcohol. The owners were required to obtain a liquor license from the

> Hawaiian Telephone Company entered into a contract with Microform Data Systems, Inc. (Microform), for Microform to provide a computerized assistance system that would handle 15,000 calls per hour with a one-second response time and with a “nonstop” featu

> California and Hawaiian Sugar Company (C&H), a California corporation, is an agricultural cooperative owned by 14 sugar plantations in Hawaii. It transports raw sugar to its refinery in Crockett, California. Sugar is a seasonal crop, with about 70 percen

> The Trump World Tower is a 72-story luxury condominium building constructed at 845 United Nations Plaza in Manhattan, New York. Before the building was constructed, 845 UN Limited Partnership (845 UN) began selling condominiums at the building. The condo

> Shumann Investments, Inc. (Shumann) hired Pace Construction Corporation (Pace), a general contractor, to build Outlet World of Pasco Country. In turn, Pace hired OBS Company, Inc. (OBS), a subcontractor, to perform the framing, drywall, insulation, and s

> C.W. Milford owned a registered quarter horse named Hired Chico. Milford sold the horse to Norman Stewart. Recognizing that Hired Chico was a good stud, Milford included the following provision in the written contract that was signed by both parties: “I,

> William John Cunningham, a professional basketball player, entered into a contract with Southern Sports Corporation, which owned the Carolina Cougars, a professional basketball team. The contract provided that Cunningham was to play basketball for the Co

> Eugene H. Emmick hired L. S. Hamm, an attorney, to draft his will. The will named Robert Lucas and others (Lucas) as beneficiaries. When Emmick died, it was discovered that the will was improperly drafted, violated state law, and was therefore ineffectiv

> The Phillies, L.P., the owner of the Philadelphia Phillies professional baseball team (Phillies), decided to build a new baseball stadium called Citizens Bank Park (the Project). The Phillies entered into a contract (Agreement) with Driscoll/Hunt Joint V

> Irving Levin and Harold Lipton owned the San Diego Clippers Basketball Club, a professional basketball franchise. Levin and Lipton met with Philip Knight to discuss the sale of the Clippers to Knight. After the meeting, they all initialed a 3-page handwr

> David Brown met with Stan Steele, a loan officer with the Bank of Idaho (now First Interstate Bank), to discuss borrowing money from the bank to start a new business. After learning that he did not qualify for the loan on the basis of his own financial s

> Harun Fountain, a minor, was shot in the back of the head at point-blank range by a playmate. Fountain required extensive lifesaving medical services from a variety of medical service providers, including Yale Diagnostic Radiology. The expense of the ser

> Define the cash-flow statement and explain what it does.

> Define the balance sheet and give two examples of how to increase one’s net worth.

> Give some examples of legal employment rights.

> How does one put a market value on an employee benefit?

> Is college worth the cost? Why or why not?

> Give an example of how inflation affects income and consumption.

> Describe two statistics that help predict the future direction of the economy

> Summarize the phases of the business cycle.

> What is identity theft?

> Distinguish between the APR (annual percentage rate) and the finance charge on a debt.

> The Financial Statements of Harry and Belinda Johnson Suggest Budgeting Problems Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a t

> Summarize how financial goals follow from one’s values.

> What is the biggest financial worry of most individuals, and what can they do about it?

> Summarize the content in Figure 3-1, the overview of effective personal financial planning. Figure 3-1: Figure 3-1 Overview of Effective Financial Planning Economic Data Living Еxpenses Advertising Standards of Comparison Earnings Values MANAGERIAL

> What are the building blocks to achieving financial success?

> Summarize what you will accomplish studying personal finance.

> Distinguish among financial success, financial security, and financial happiness

> Explain the five fundamental steps in the financial planning process.

> Summarize your insurance protections when you have funds on deposit in a depository institution as opposed to other financial services providers.

> Give three examples of depository institutions where one could open a checking account.

> Explain the circumstances when it would be appropriate to have funds in a checking account.

> After completing his associate of arts degree four months ago from a community college in Oklahoma City, Oklahoma, Juan Ramirez has answered more than three dozen advertisements and interviewed three times in his effort to get a sales job, but he has had

> Identify the primary goals of monetary asset management.

> Explain why some taxpayers have an effective marginal tax rate as high as 40 percent.

> What is a marginal tax bracket, and how does it impact taxpayers making tax advantaged contributions to their retirement plans?

> Distinguish between a progressive and a regressive tax.

> Is the gig economy, freelancing, or entrepreneurship for you? Why or why not?

> What can be done to enhance your abilities, experiences and education without working in a job situation?

> How do your values and interests impact your life-style trade-offs in career planning?

> What is career planning and why is it important?

> Now that you have read this chapter on building and maintaining good credit, what would you recommend to Julia Grace regarding: 1. How might Julia go about establishing a debt limit? 2. What two or three things can she do help keep her student debt under

> Now that you have read the chapter on the importance of career planning, what do you recommend to Nicole Linkletter in the case at the beginning of the chapter regarding: 1. Clarifying her values and lifestyle trade-offs in career planning? 2. Enhancing

> Now that you have read the chapter on managing checking and savings accounts, what would you recommend to Nathan Rosenberg and Avigai Abramovitz in the case at the beginning of the chapter regarding: 1. Where they can obtain the monetary asset managemen

> Now that you have read the chapter on managing income taxes, what advice can you offer Ace and Florence in the case at the beginning of the chapter regarding: 1. Using tax credits to help pay for Ace’s college expenses? 2. Determining how much money Flor

> Now that you have read the chapter on financial planning, what do you recommend to Austin Patterson for his talk with Emily on the subject of financial planning regarding: 1. Setting financial goals? 2. Determining what they own and owe? 3. Using the inf

> Now that you have read the chapter on the importance of personal finance, what do you recommend to Jing Wáng in the case at the beginning of the chapter regarding: Participating in her employer’s 401(k) retirement plan? Understanding the effects of her

> Is it too easy for college students to get credit cards? Who do you know who has gotten into financial difficulty because of overuse of credit cards, and what happened?

> Use the information on pages 185, 186 and 187 to discuss how best to deal with student loan debt Page No. 185, 186,187: CHAPTER 6 Building and Maintaining Good Credit 185 6.2a Method 1: Continuous-Debt Method A useful approach for determining your d

> How might students judge whether they are taking on too high a level of student loan debt?

> What aspects of your financial life make you creditworthy? What aspects might make it difficult for you to obtain credit?

> Have you ever had a disagreement with a friend or family member over a money issue? How might you communicate differently now?

> Lost/Stolen Debit Cards. What should you do if your ATM or debit card is lost or stolen? Why?

> Harry has started out fine in his career as his responsibilities have increased since he began working there about five years ago. Belinda recently attended a conference for those in her stock brokerage field and by chance she dropped in at the “career s

> When might it be appropriate for you to save via a certificate of deposit versus a money market account?

> Many people desire protection from the possibility of overdrawing their checking account. Banks make it easy by allowing you to opt into overdraft protection. Explain how this and other overdraft protections work and why the true cost of opting in may ex

> When would you recommend using an individual account, a joint tenancy with right of survivorship account, and a tenancy by the entirety account for your monetary assets?

> You know someone who recently had $90 in overdraft fees for two small debit card transactions. Explain to him why such high fees resulted from such small transactions and the relative benefits of having an automatic funds transfer agreement versus an aut

> List two examples of checking account transactions that result in assessment of fees that are avoidable?

> Identify three strategies to reduce income tax liability that you may take advantage of in the future.

> Name three tax credits that a college student might take advantage of while still in school or during the first few years after graduation.

> Some college students earn money that is paid to them in cash and then do not include this as income when they file their tax returns. What are the pros and cons of this practice?

> Many college students choose not to file a federal income tax return, assuming that the income taxes withheld by employers “probably” will cover their tax liability. Is such an assumption correct? What are the negatives of this practice if the employers

> What can a person try to do to genuinely control spending to better achieve financial success?

> You have been asked to give a brief speech on how to achieve financial success and financial security. Use the five steps in the financial planning process and the building blocks to achieving financial success in your speech. Outline your speech.

> Do you have a budget or spending plan? Why or why not? What do you think are the two major reasons why people do not make formal written budgets?

> Of the financial ratios described in this chapter, which two might be most revealing for the typical college student?

> College students often have little income and many expenses. Does this reduce or increase the importance of completing a cash-flow statement on a monthly basis? Why or why not?

> What are two of your most important personal values? Give an example of how each of those values might influence your financial plans.

> What is the biggest budget-related mistake that you have made? What would you do differently now?

> During slow economic times, the federal government’s budgeting priority often is to borrow so it can spend more money than it takes in. What happens to families that try that, and why?

> People regularly make decisions in career planning that have trade-offs. Identify some benefits and costs people are faced with as well as two lifestyle trade-offs.

> What would you do if you inherited $3,000 from an aunt? Identify three options.

> Thinking about some common mistakes that people make in job interviews, which three are the worst? Make a short list of things people should do to improve success in an interview.

> What are some common mistakes that people make in personal finance? Name two that might be the worst, and why?

> Samantha Beliveau of Ames, Iowa, is a senior in college, majoring in nutrition. She anticipates getting married a year or so after graduation. Samantha has only one elective course remaining and is going to choose between an advanced class in sociology a

> Where is the United States in the economic cycle now, and where does it seem to be heading? List some indicators that suggest in which direction it may move.

> List three interviewing tips for new college graduates looking for employment when in many parts of the country a growing job market exists.

> You plan to retire in 40 years. To provide for your retirement, you initiate a savings program of $4,000 per year yielding 7 percent. What will be the value of the retirement fund after 40 years? (Hint: Use Appendix A.3 or visit the Garman/Forgue compan

> You want to create a college fund for a child who is now 3 years old. The fund should grow to $60,000 in 15 years. If an investment available to you will yield 6 percent per year, how much must you invest in a lump sum now to realize the $60,000 when nee

> Isabel Lopez, from Lewiston, Idaho, is age 19, and she recently received an inheritance of $50,000 from her grandmother’s estate. She plans to use the money for the down payment on a home in ten years when she finishes her education. Ri

> Invest Now or Later? Twins Natalie and Kaitlyn are both age 27. They both live in Warren, Ohio. Beginning at age 27, Natalie invests $2,000 per year for ten years and then never sets aside another penny. Kaitlyn waits ten years and then invests $2,000 pe

> What would be the marginal tax rate for a single person who has a taxable income of (a) $31 ,560, (b) $58,150, (c) $66,450, and (d) $100,580? (Hint: Use Table 4-2.) Table 4-2: Table 4-2 Tax Rate Schedules DO IT IN CLASS Single Individuals If taxable

> What would be the tax liability for a single taxpayer who has a gross income of $50,050?

> Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the “young married couple”). Leyia thinks that she can go on half-s

> Cody Sebastian, of Lubbock, Texas, earns $60,000 a year. He pays 30 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,800 per month and variable expenses that average $1,400 per month. What i

> Survey two relatives or friends and ask about their decision-making process when they most recently bought a vehicle. Find out if they thought about the opportunity costs when making the purchase. Also ask if they used marginal costs in their thinking. M

> Review the financial statements of Victor and Maria Hernandez (Table 3-2 and Table 3-3) and the financial ratios on page 87 and respond to the following questions: (a) How would you interpret their investment assets to total assets ratio? The Hernandez

> Tyler Winkle’s employer in Pittsburgh makes a matching contribution of $2,000 a year to his 401(k) retirement account at work. If the dollar amount of the employer’s contribution increases 4 percent annually, how much will the employer contribute to the

> Using the Rule of 72, calculate how quickly $1,000 will double to $2,000 at interest rates of 2 percent, 4 percent, 6 percent, 8 percent, and 10 percent.

> Using the present and future value tables in Appendix A, the appropriate calculations on the Garman/Forgue companion website, or a financial calculator, calculate the following: (a) The amount a person would need to deposit today to be able to withdraw $

> Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Answers to these questions can be obtained by using Appendix A or the Garman/Forgue companion website.

> Julia has recently undergone a severe career crisis. After nearly ten years as a professional engineer, her position was phased out by her company due to a loss of government contracts, and she has been offered a position in the marketing department. The

> Jacob Marchese of Vancouver, Washington, is the credit manager for a regional chain of department stores. He has been asked to join a panel of community members and make a ten-minute speech to graduating high school seniors on the topic “Using Credit Wis