Question: Use the information on pages 185, 186

Use the information on pages 185, 186 and 187 to discuss how best to deal with student loan debt

Page No. 185, 186,187:

Transcribed Image Text:

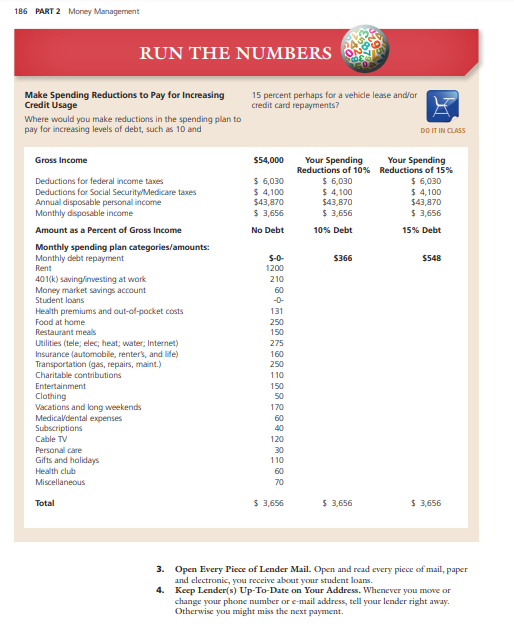

CHAPTER 6 Building and Maintaining Good Credit 185 6.2a Method 1: Continuous-Debt Method A useful approach for determining your debt limit is the continuous-debt method. If you are unable to get completely out of debt every four years (except for a mortgage loan), you probably lean on debt too heavily. Using debt for more than four ycars is not short-term consumer debt. You probably are developing a credit lifestyle in which you will never elim- inate debt and will continuously pay out substantial amounts for finance charges. DID YOU KNOW Are You Worried About Your Debts? If you are worried about your debts, then you should be. Your own gut feeling is often the best indicator of carrying too 6.2b Method 2: Debt Payments-to-Disposable Income Method much debt. The debt payments-to-disposable income method uses the debt- payments-to-disposable income ratio introduced in Chapter 3 on page 87. Recall that this ratio excludes the first mortgage loan on a home and credit card charges that are paid in full cach month. Disposable income is the amount of #you are unable to get completely your income remaining after taxes and withholding for such purposes as insurance and aut of debt every four years (except flexible benefits programs. Note that the debt payments-to-disposable income method for a martgage loan, you probably focuses on the amount of monthly debt repaymentnot one's total debt. continuous-debt method lean on debt too heavily. 6.2c Method 3: Debt-to-Income Method The debt-to-income method also was introduced in Chapter 3 on page 87. Using the debt-to-income method your monthly debt repayments (including your prospective mortgage and any other loan or alimony payments you must make) are divided by your gross monthly income (your income before taxes) and multiplied by 100. A ratio of 36 percent or less is desirable. Try out examining the impact of credit on your spending plan by looking at the debt-to-income method "Run the Numbers" box on the next page. Look at the impact of credit on your spend- Your manthly debt repayments (in- ing plan. After deductions for taxes and the like, disposable personal income amounts and any other loan or alimory pay to $3,656 per month and budgeted expenses consume the entire $3,656. Lite with no ments you must make) are divided debt is good as this person has enough money for everything including saving for retire- by your gross monthly income and ment. Think carefully. Where would you make reductions in the spending plan to pay multiplied by 100. for increasing levels of debt? DO IT IN CLASS cuding your prospective martgage, 6.2d Keep Student Loan Debt Under Control To succeed in keeping your student loan debt under control in the first place, you should not borrow at all to pay for college or borrow as little as possible. To begin your schooling, consider a community college or other less expensive institution. Also, do not borrow to pay for your living expenses. This includes meals at restaurants, clothing, vehicle payments, vacations, alcohol, drugs, and monthly bills, such as mobile phones. Instead work and save, perhaps move in with your parents or another relative. Then debt payments-to-disposable work part-time during college to lower the amount you borrow. Seven out of 10 students do borrow for college and their average debt is S38,000. Percentage of disposable personal Forty-three million people have repayment terms for education debt that typically income available for regular debt extend to 10 years, and one in six are at least nine months behind on payments. Because repayments aside from set abligations. of student loan debt, 1 in 4 borrowers put off marriage and delay starting a family. Upon graduation avoid fees and extra interest costs, keep your payments affordable, Amount of income remaining after and repay on time. Follow these suggestions to keep student debt under control. income method disposable income taxes and withholding for such purposes as insurance and union dues 1. Know Your Loans. Keep track of the lender, balance, and repayment status for cach of your student loans to determine your options for loan repayment and forgiveness. 2. Limit Student Debt. Do not borrow more than 50 percent of your first-year salary, 100 percent at the most. Rather than borrow, get a part-time job to cover living ex- penses. Choose a school that costs less than the big-name college or university. 186 PART 2 Money Management RUN THE NUMBERS Make Spending Reductions to Pay for Increasing Credit Usage 15 percent perhaps for a vehicle lease and/or credit card repayments? Where would you make reductions in the spending plan to pay for increasing levels of debt, such as 10 and DO IT IN CLASS Gross Income 554,000 Your Spending Your Spending Reductions of 10% Reductions of 15% Deductions for federal income taxes Deductions for Social SecurityMedicare taxes Annual disposable personal income Monthly dispasable income $ 6,030 $ 4,100 $43,870 $ 6,030 $ 4,100 $43,870 $ 6,030 $ 4,100 $43,870 $ 3,656 $ 3,656 $ 3,656 Amount as a Percent of Gross Income No Debt 10% Debt 15% Debt Monthly spending plan categories/amounts: Monthly debt repayment Rent S0- 1200 S366 $548 401(k) savinginvesting at work Money market savings account Student loans 210 60 -0- Health premiums and out-of-pocket costs 131 Food at home 250 Restaurant meals 150 Utilities (tele; elec; heat; water; Internet) Insurance (automobile, renters, and life) Transportation (gas, repairs, maint.) Charitable contributions 275 160 250 110 Entertainment 150 Clothing Vacations and long weekends Medicaldental expenses Subscriptions 50 170 60 40 Cable TV 120 Personal care 30 Gifts and holidays Health club 110 60 Miscellaneous 70 $ 3,656 $ 3,656 $ 3,656 Total 3. Open Every Piece of Lender Mail. Open and read every piece of mail, paper and electronic, you receive about your student loans. 4. Keep Lender(s) Up-To-Date on Your Address. Whenever you move or change your phone number or e-mail address, tell your lender right away. Otherwise you might miss the next payment. CHAPTER 6 Building and Maintaining Good Credit 187 Prepay the Loan If You Can. If you can afford to pay more than your required monthly payment toward the "loan balance," you can lower the amount of interest you have to pay over the life of the loan. 6. Pay Off the Most Expensive Loan First. If you're considering paying off one of your loans ahead of schedule, experts say to start with the one that has the highest interest rate. Others say to first pay off the one with the smalest balance because you will do so more quickly, providing the gratification and momentum to pay off all your debts. 7. Pick the Right Repayment Option. When your federal koans come duc, your loan payments will automatically be based on a standard 10-ycar repayment plan. If there are other options, you can change plans down the line if you want or need to. 8. Know Your Student Loan Grace Period. A student loan grace period is the period of time a lender gives you to make your repayments without having to pay interest or late fees. 9. Forgiveness May Be Available. For those employed in government, nonprofit, and other public service jobs relicf may be possible. The lender may offer some type of forbearance, often for a fee, or you may be able to make interest-only payments for some period of time. You also may get deferments, forbearance, and/or an income-based repayment schedule. 10. Do Not Extend the Loan(s). Extending your repayment period beyond 10 years can lower your monthly payments, but you'll end up paying more interest. debts into a single, new loan that is 11. To Consolidate or Not. A consolidation loan is the combining of several unsecured debts into a single, new loan that is more favorable. It may result in a lower interest rate or a lower monthly payment, or both. 5. BIAS TOWARD- OVERCONFIDENCE People tend to being overconfident in credit matters. For example, some people take on large student loan debt and then want to purchase an expensive new vehicle. What to do? Calculate your current debt ratios before taking on any new debt and then calculate what they will be with the new debt. If appropriate, either adjust the borrowed amount down or do not borrow at all. consolidation Loan The combining of several unsecured more favorable, and it may result in a lower interest rate, lower monthly payment ar both. CONCEPT CHECK 6.2 1. Distinguish among the continuous debt method, debt-to-income, debt payments-to-disposable income, and debt-to-income methods for setting your debt limit. 2. What are the borrower's feelings when heshe has a limit of debt of 11 to 14 percent of disposable personal income compared to a debt limit of 15 to 18 percent? (Hint: See Table 6-1.) 3. Summarize the effects of increasing debt payments from 10 percent to 15 percent on a budget. (Hint: See the Run the Numbers worksheet on page 186.) 4. What is the best thought on the list of keeping student loan debt under contral? 6.3 OBTAINING CREDIT AND BUILDING A GOOD CREDIT REPUTATION Learning Objective 3 Obtain credit and build a good credit reputation. Credit is widcly and readily available to most of us today. It is not unusual for a customer to walk into a retail store, such as Target or Home Depot, and be offered a credit card that can be used immediately. Your success in obtaining credit at a low interest rate depends on an understanding of the credit application, credit report, and your credit reputation. credit application A form andlor an interview that requests information that sheds light 6.3a The Credit Application and Credit Report A credit application is a request for an extension of credit, either orally or in written an your ability and willingness to form. It demands information that sheds light on your ability and willingness to repay repay debts, such as your income, debts, such as your income, assets, and debts. The lender will investigate your credit assets, and debts.

> Hawaiian Telephone Company entered into a contract with Microform Data Systems, Inc. (Microform), for Microform to provide a computerized assistance system that would handle 15,000 calls per hour with a one-second response time and with a “nonstop” featu

> California and Hawaiian Sugar Company (C&H), a California corporation, is an agricultural cooperative owned by 14 sugar plantations in Hawaii. It transports raw sugar to its refinery in Crockett, California. Sugar is a seasonal crop, with about 70 percen

> The Trump World Tower is a 72-story luxury condominium building constructed at 845 United Nations Plaza in Manhattan, New York. Before the building was constructed, 845 UN Limited Partnership (845 UN) began selling condominiums at the building. The condo

> Shumann Investments, Inc. (Shumann) hired Pace Construction Corporation (Pace), a general contractor, to build Outlet World of Pasco Country. In turn, Pace hired OBS Company, Inc. (OBS), a subcontractor, to perform the framing, drywall, insulation, and s

> C.W. Milford owned a registered quarter horse named Hired Chico. Milford sold the horse to Norman Stewart. Recognizing that Hired Chico was a good stud, Milford included the following provision in the written contract that was signed by both parties: “I,

> William John Cunningham, a professional basketball player, entered into a contract with Southern Sports Corporation, which owned the Carolina Cougars, a professional basketball team. The contract provided that Cunningham was to play basketball for the Co

> Eugene H. Emmick hired L. S. Hamm, an attorney, to draft his will. The will named Robert Lucas and others (Lucas) as beneficiaries. When Emmick died, it was discovered that the will was improperly drafted, violated state law, and was therefore ineffectiv

> The Phillies, L.P., the owner of the Philadelphia Phillies professional baseball team (Phillies), decided to build a new baseball stadium called Citizens Bank Park (the Project). The Phillies entered into a contract (Agreement) with Driscoll/Hunt Joint V

> Irving Levin and Harold Lipton owned the San Diego Clippers Basketball Club, a professional basketball franchise. Levin and Lipton met with Philip Knight to discuss the sale of the Clippers to Knight. After the meeting, they all initialed a 3-page handwr

> David Brown met with Stan Steele, a loan officer with the Bank of Idaho (now First Interstate Bank), to discuss borrowing money from the bank to start a new business. After learning that he did not qualify for the loan on the basis of his own financial s

> Harun Fountain, a minor, was shot in the back of the head at point-blank range by a playmate. Fountain required extensive lifesaving medical services from a variety of medical service providers, including Yale Diagnostic Radiology. The expense of the ser

> Define the cash-flow statement and explain what it does.

> Define the balance sheet and give two examples of how to increase one’s net worth.

> Give some examples of legal employment rights.

> How does one put a market value on an employee benefit?

> Is college worth the cost? Why or why not?

> Give an example of how inflation affects income and consumption.

> Describe two statistics that help predict the future direction of the economy

> Summarize the phases of the business cycle.

> What is identity theft?

> Distinguish between the APR (annual percentage rate) and the finance charge on a debt.

> The Financial Statements of Harry and Belinda Johnson Suggest Budgeting Problems Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a t

> Summarize how financial goals follow from one’s values.

> What is the biggest financial worry of most individuals, and what can they do about it?

> Summarize the content in Figure 3-1, the overview of effective personal financial planning. Figure 3-1: Figure 3-1 Overview of Effective Financial Planning Economic Data Living Еxpenses Advertising Standards of Comparison Earnings Values MANAGERIAL

> What are the building blocks to achieving financial success?

> Summarize what you will accomplish studying personal finance.

> Distinguish among financial success, financial security, and financial happiness

> Explain the five fundamental steps in the financial planning process.

> Summarize your insurance protections when you have funds on deposit in a depository institution as opposed to other financial services providers.

> Give three examples of depository institutions where one could open a checking account.

> Explain the circumstances when it would be appropriate to have funds in a checking account.

> After completing his associate of arts degree four months ago from a community college in Oklahoma City, Oklahoma, Juan Ramirez has answered more than three dozen advertisements and interviewed three times in his effort to get a sales job, but he has had

> Identify the primary goals of monetary asset management.

> Explain why some taxpayers have an effective marginal tax rate as high as 40 percent.

> What is a marginal tax bracket, and how does it impact taxpayers making tax advantaged contributions to their retirement plans?

> Distinguish between a progressive and a regressive tax.

> Is the gig economy, freelancing, or entrepreneurship for you? Why or why not?

> What can be done to enhance your abilities, experiences and education without working in a job situation?

> How do your values and interests impact your life-style trade-offs in career planning?

> What is career planning and why is it important?

> Now that you have read this chapter on building and maintaining good credit, what would you recommend to Julia Grace regarding: 1. How might Julia go about establishing a debt limit? 2. What two or three things can she do help keep her student debt under

> Now that you have read the chapter on the importance of career planning, what do you recommend to Nicole Linkletter in the case at the beginning of the chapter regarding: 1. Clarifying her values and lifestyle trade-offs in career planning? 2. Enhancing

> Victor is somewhat satisfied with his sales career and has always wondered about a career as a teacher in a public school. He would have to take a year off work to go back to college to obtain his teaching certificate, and that would mean giving up his $

> Now that you have read the chapter on managing checking and savings accounts, what would you recommend to Nathan Rosenberg and Avigai Abramovitz in the case at the beginning of the chapter regarding: 1. Where they can obtain the monetary asset managemen

> Now that you have read the chapter on managing income taxes, what advice can you offer Ace and Florence in the case at the beginning of the chapter regarding: 1. Using tax credits to help pay for Ace’s college expenses? 2. Determining how much money Flor

> Now that you have read the chapter on financial planning, what do you recommend to Austin Patterson for his talk with Emily on the subject of financial planning regarding: 1. Setting financial goals? 2. Determining what they own and owe? 3. Using the inf

> Now that you have read the chapter on the importance of personal finance, what do you recommend to Jing Wáng in the case at the beginning of the chapter regarding: Participating in her employer’s 401(k) retirement plan? Understanding the effects of her

> Is it too easy for college students to get credit cards? Who do you know who has gotten into financial difficulty because of overuse of credit cards, and what happened?

> How might students judge whether they are taking on too high a level of student loan debt?

> What aspects of your financial life make you creditworthy? What aspects might make it difficult for you to obtain credit?

> Have you ever had a disagreement with a friend or family member over a money issue? How might you communicate differently now?

> Lost/Stolen Debit Cards. What should you do if your ATM or debit card is lost or stolen? Why?

> Harry has started out fine in his career as his responsibilities have increased since he began working there about five years ago. Belinda recently attended a conference for those in her stock brokerage field and by chance she dropped in at the “career s

> When might it be appropriate for you to save via a certificate of deposit versus a money market account?

> Many people desire protection from the possibility of overdrawing their checking account. Banks make it easy by allowing you to opt into overdraft protection. Explain how this and other overdraft protections work and why the true cost of opting in may ex

> When would you recommend using an individual account, a joint tenancy with right of survivorship account, and a tenancy by the entirety account for your monetary assets?

> You know someone who recently had $90 in overdraft fees for two small debit card transactions. Explain to him why such high fees resulted from such small transactions and the relative benefits of having an automatic funds transfer agreement versus an aut

> List two examples of checking account transactions that result in assessment of fees that are avoidable?

> Identify three strategies to reduce income tax liability that you may take advantage of in the future.

> Name three tax credits that a college student might take advantage of while still in school or during the first few years after graduation.

> Some college students earn money that is paid to them in cash and then do not include this as income when they file their tax returns. What are the pros and cons of this practice?

> Many college students choose not to file a federal income tax return, assuming that the income taxes withheld by employers “probably” will cover their tax liability. Is such an assumption correct? What are the negatives of this practice if the employers

> What can a person try to do to genuinely control spending to better achieve financial success?

> You have been asked to give a brief speech on how to achieve financial success and financial security. Use the five steps in the financial planning process and the building blocks to achieving financial success in your speech. Outline your speech.

> Do you have a budget or spending plan? Why or why not? What do you think are the two major reasons why people do not make formal written budgets?

> Of the financial ratios described in this chapter, which two might be most revealing for the typical college student?

> College students often have little income and many expenses. Does this reduce or increase the importance of completing a cash-flow statement on a monthly basis? Why or why not?

> What are two of your most important personal values? Give an example of how each of those values might influence your financial plans.

> What is the biggest budget-related mistake that you have made? What would you do differently now?

> During slow economic times, the federal government’s budgeting priority often is to borrow so it can spend more money than it takes in. What happens to families that try that, and why?

> People regularly make decisions in career planning that have trade-offs. Identify some benefits and costs people are faced with as well as two lifestyle trade-offs.

> What would you do if you inherited $3,000 from an aunt? Identify three options.

> Thinking about some common mistakes that people make in job interviews, which three are the worst? Make a short list of things people should do to improve success in an interview.

> What are some common mistakes that people make in personal finance? Name two that might be the worst, and why?

> Samantha Beliveau of Ames, Iowa, is a senior in college, majoring in nutrition. She anticipates getting married a year or so after graduation. Samantha has only one elective course remaining and is going to choose between an advanced class in sociology a

> Where is the United States in the economic cycle now, and where does it seem to be heading? List some indicators that suggest in which direction it may move.

> List three interviewing tips for new college graduates looking for employment when in many parts of the country a growing job market exists.

> You plan to retire in 40 years. To provide for your retirement, you initiate a savings program of $4,000 per year yielding 7 percent. What will be the value of the retirement fund after 40 years? (Hint: Use Appendix A.3 or visit the Garman/Forgue compan

> You want to create a college fund for a child who is now 3 years old. The fund should grow to $60,000 in 15 years. If an investment available to you will yield 6 percent per year, how much must you invest in a lump sum now to realize the $60,000 when nee

> Isabel Lopez, from Lewiston, Idaho, is age 19, and she recently received an inheritance of $50,000 from her grandmother’s estate. She plans to use the money for the down payment on a home in ten years when she finishes her education. Ri

> Invest Now or Later? Twins Natalie and Kaitlyn are both age 27. They both live in Warren, Ohio. Beginning at age 27, Natalie invests $2,000 per year for ten years and then never sets aside another penny. Kaitlyn waits ten years and then invests $2,000 pe

> What would be the marginal tax rate for a single person who has a taxable income of (a) $31 ,560, (b) $58,150, (c) $66,450, and (d) $100,580? (Hint: Use Table 4-2.) Table 4-2: Table 4-2 Tax Rate Schedules DO IT IN CLASS Single Individuals If taxable

> What would be the tax liability for a single taxpayer who has a gross income of $50,050?

> Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the “young married couple”). Leyia thinks that she can go on half-s

> Cody Sebastian, of Lubbock, Texas, earns $60,000 a year. He pays 30 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,800 per month and variable expenses that average $1,400 per month. What i

> Survey two relatives or friends and ask about their decision-making process when they most recently bought a vehicle. Find out if they thought about the opportunity costs when making the purchase. Also ask if they used marginal costs in their thinking. M

> Review the financial statements of Victor and Maria Hernandez (Table 3-2 and Table 3-3) and the financial ratios on page 87 and respond to the following questions: (a) How would you interpret their investment assets to total assets ratio? The Hernandez

> Tyler Winkle’s employer in Pittsburgh makes a matching contribution of $2,000 a year to his 401(k) retirement account at work. If the dollar amount of the employer’s contribution increases 4 percent annually, how much will the employer contribute to the

> Using the Rule of 72, calculate how quickly $1,000 will double to $2,000 at interest rates of 2 percent, 4 percent, 6 percent, 8 percent, and 10 percent.

> Using the present and future value tables in Appendix A, the appropriate calculations on the Garman/Forgue companion website, or a financial calculator, calculate the following: (a) The amount a person would need to deposit today to be able to withdraw $

> Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Answers to these questions can be obtained by using Appendix A or the Garman/Forgue companion website.

> Julia has recently undergone a severe career crisis. After nearly ten years as a professional engineer, her position was phased out by her company due to a loss of government contracts, and she has been offered a position in the marketing department. The

> Jacob Marchese of Vancouver, Washington, is the credit manager for a regional chain of department stores. He has been asked to join a panel of community members and make a ten-minute speech to graduating high school seniors on the topic “Using Credit Wis

> Julia has been thinking about the purchase of a boat. As a teenager, she was an avid water skier at her parents’ summer home. Now that she has moved away, she wants to renew her hobby at a lake nearby. Julia recently received a raise of $200 per month an

> Victor and Maria have always enjoyed a close relationship with Maria’s niece Teresa, who graduated from college with a pharmacy degree. Teresa recently asked Maria for some assistance with her finances now that her education debts are coming due. She owe

> Harry and Belinda have a substantial annual joint income—more than $125,000, in fact. Nevertheless, they expect to experience some cash-flow deficits during the months of November and December of the upcoming year (see Tables 3-6 and 3-

> Throughout this book, we will present a continuing narrative about Victor and Maria Hernandez. Following is a brief description of the lives of this couple. Victor and Maria, both in their late 30s, have two children: Jacob, age 13, and Nicholas, age 15.

> Asset Management Kwaku Addo, a licensed physical therapist from Topeka, Kansas, earns $4,200 per month take-home pay and has the funds directly deposited in his checking account. He spends only about $3,500 per month, and the excess funds have been build

> Julia’s six-figure salary has allowed her to build up a considerable cash reserve of over $20,000. She initially had basic checking and savings accounts. She also has a credit card with her bank that she uses to make most of her purchases, thereby earnin